Key Insights

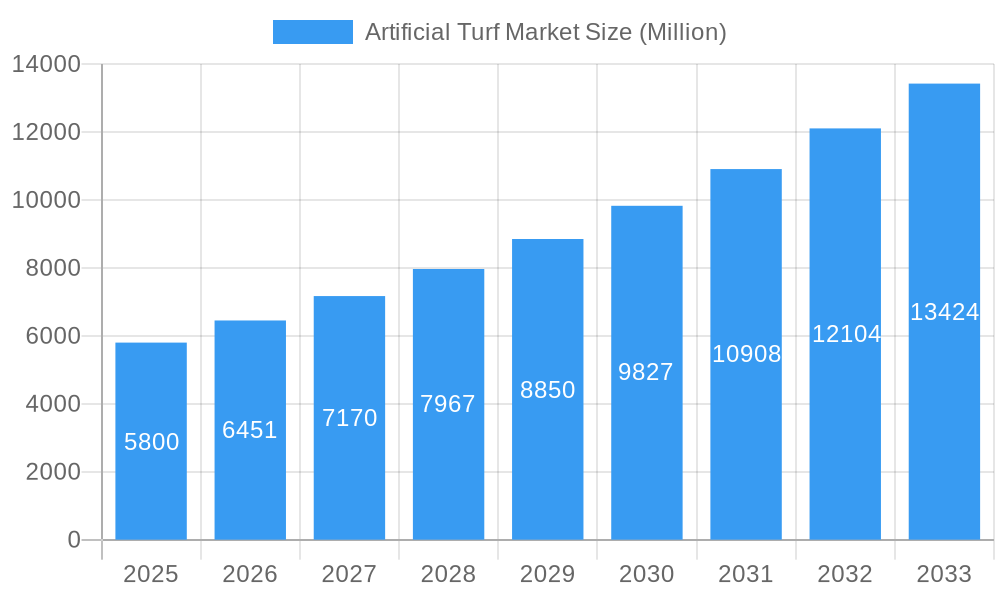

The global Artificial Turf Market is projected for significant expansion, expected to reach a market size of $6.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 12.7% through 2033. This robust growth is primarily driven by increasing demand for low-maintenance, high-performance sports surfaces. Key advantages, including all-weather usability, consistent playing conditions, and reduced water consumption compared to natural grass, are accelerating adoption in professional and amateur sports. Beyond sports, artificial turf is gaining traction in landscaping and recreational areas, meeting a growing preference for durable and aesthetically pleasing outdoor spaces in residential and commercial applications. Technological advancements in turf realism, shock absorption, and durability further fuel market penetration.

Artificial Turf Market Market Size (In Billion)

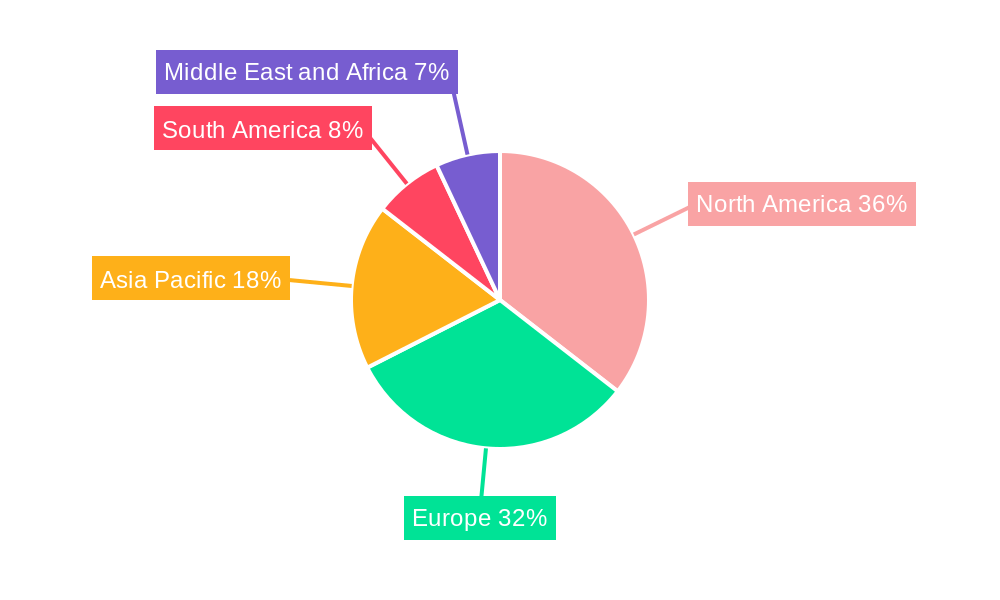

While the market demonstrates substantial growth, initial installation costs for premium systems can present a challenge, particularly in price-sensitive regions. Concerns regarding the environmental impact of manufacturing materials and end-of-life disposal are also factors. However, the development of eco-friendly materials and sustainable recycling solutions is actively mitigating these issues. Leading industry players are focused on research and development to address these challenges and capitalize on the burgeoning demand for advanced artificial turf solutions across diverse geographies, with North America and Europe currently leading adoption.

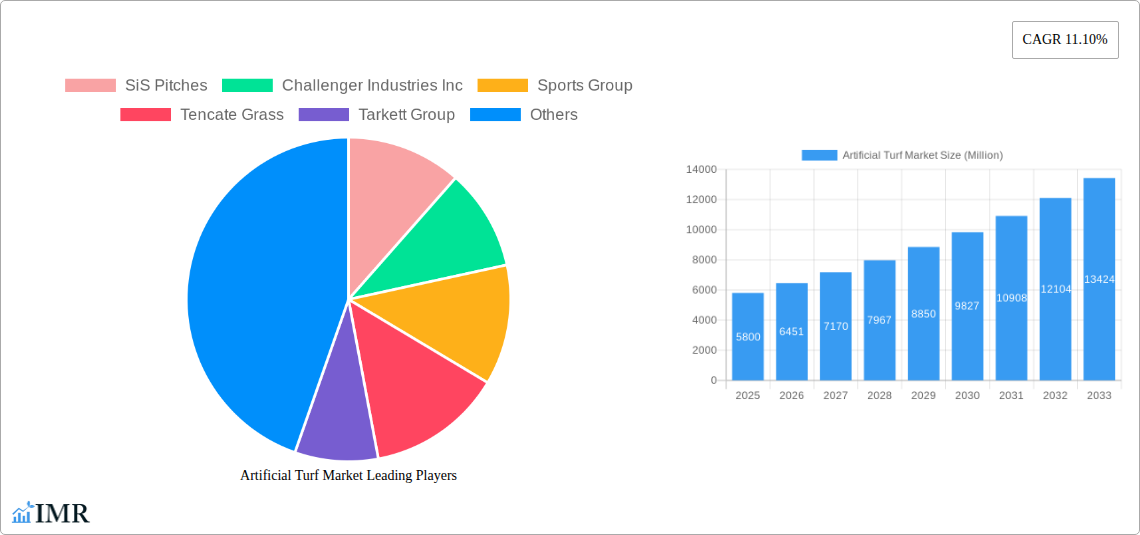

Artificial Turf Market Company Market Share

This comprehensive report provides critical insights into the global artificial turf market, detailing market dynamics, growth trajectories, and future opportunities. Spanning the historical period of 2019-2024 and a forecast period of 2025-2033, with 2025 as the base year, it is an essential resource for understanding the evolving synthetic grass market, sports surfacing solutions, and landscape turf innovations.

The report segments include contact sports turf, field hockey surfaces, tennis courts, other sports applications, leisure turf, and residential landscaping turf. It also analyzes key industry developments and strategic initiatives of major players such as SiS Pitches, Challenger Industries Inc, Sports Group, Tencate Grass, Tarkett Group, Act Global, Creative Recreation Solutions (CRS), CC Grass, ForeverLawn, and Global Syn-Turf.

Artificial Turf Market Market Dynamics & Structure

The artificial turf market exhibits a moderate level of concentration, driven by significant technological innovation and evolving regulatory frameworks that emphasize safety and performance standards. Competitive product substitutes, primarily natural grass, face increasing pressure from the durability, low maintenance, and all-weather playability of synthetic turf solutions. End-user demographics are diversifying, with a growing demand from residential landscaping, commercial spaces, and a continued strong base in sports facilities. Mergers and acquisitions (M&A) are a key feature, indicating consolidation and strategic expansion. For instance, the acquisition of The Recreational Group by Sentinel Capital Partners in January 2022 highlights the private equity interest in this growing sector. The market share of key players is influenced by their investment in R&D and their ability to cater to specific segment needs. Innovation barriers include the high initial cost of premium turf systems and the need for specialized installation expertise.

- Market Concentration: Moderate, with a few leading players and a growing number of niche manufacturers.

- Technological Innovation Drivers: Enhanced durability, improved drainage, realistic aesthetics, and sustainable material development (e.g., increased soy content).

- Regulatory Frameworks: Focus on safety standards, environmental impact assessments, and performance certifications for sports applications.

- Competitive Product Substitutes: Natural grass (for cost and environmental considerations), alternative synthetic surfacing materials.

- End-User Demographics: Sports clubs, municipalities, schools, residential homeowners, commercial property developers.

- M&A Trends: Active, with private equity firms and larger corporations acquiring smaller innovators to gain market share and technological advantages. The acquisition of TenCate Grass Holding BV by Crestview Partners in September 2021 underscores this trend.

Artificial Turf Market Growth Trends & Insights

The artificial turf market is poised for robust growth, driven by increasing adoption rates across diverse applications and significant technological advancements. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period, reaching an estimated value of USD 12,500 Million by 2033. This growth is fueled by a fundamental shift in consumer and institutional preferences towards low-maintenance, high-performance surfaces. In the sports segment, the need for consistent playability regardless of weather conditions and reduced maintenance costs for athletic fields is a primary driver. For landscaping, the appeal of a perpetually green and manicured lawn without the water usage, mowing, or pest control associated with natural grass is increasingly compelling.

Technological disruptions are at the forefront of this evolution. Innovations such as advanced yarn technologies for increased resilience and realistic texture, improved backing systems for superior drainage and longevity, and the incorporation of sustainable materials like recycled content and bio-based infills are enhancing product appeal and addressing environmental concerns. SYNLawn's product enhancements in February 2021, including more soy content and super yarn technology, exemplify this trend. Market penetration is deepening, moving beyond elite sports facilities to amateur leagues, public parks, and residential gardens. Consumer behavior is shifting towards valuing convenience and long-term cost savings over the initial investment. The demand for customizability in terms of color, pile height, and density further contributes to market expansion. The global artificial turf market is anticipated to grow from an estimated USD 5,000 Million in 2025 to USD 9,000 Million by 2033, exhibiting a CAGR of around 7.0%.

- Market Size Evolution: The global artificial turf market is projected to experience significant growth, driven by increasing demand from both sports and landscaping sectors.

- Adoption Rates: Rising adoption in residential, commercial, and recreational settings, particularly in regions with water scarcity or high maintenance costs for natural grass.

- Technological Disruptions: Continuous innovation in yarn technology, backing systems, infill materials, and sustainable manufacturing processes.

- Consumer Behavior Shifts: Growing preference for low-maintenance, durable, and aesthetically pleasing surfaces, leading to increased investment in artificial turf solutions for both functional and decorative purposes.

- Market Penetration: Expanding beyond traditional sports venues to include urban landscaping, pet areas, playgrounds, and multi-purpose recreational spaces.

Dominant Regions, Countries, or Segments in Artificial Turf Market

The landscape segment is emerging as a dominant force in the global artificial turf market, driven by a confluence of economic, environmental, and lifestyle factors. This segment's estimated market share is projected to reach 45% of the total artificial turf market by 2033, growing at a CAGR of approximately 8.0%. Key drivers include increasing urbanization, declining water availability in many regions, and a growing desire for low-maintenance, aesthetically pleasing outdoor spaces in residential and commercial properties. Countries like the United States, Australia, and parts of Europe are witnessing significant uptake in landscape turf due to drought concerns and the high cost of maintaining natural lawns.

Furthermore, the leisure segment, encompassing recreational areas, public spaces, and hospitality venues, also contributes substantially to market growth, with an estimated market share of 25% by 2033. The demand for durable, safe, and visually appealing surfaces for parks, hotels, and event spaces is on the rise. In the sports domain, contact sports continue to be a strong segment, holding an estimated 20% market share, driven by the need for high-performance, weather-resistant playing surfaces for football, soccer, and rugby. Other sports, including field hockey and tennis, represent the remaining market share, with specialized turf solutions catering to their unique performance requirements. Economic policies that promote water conservation and urban greening initiatives further bolster the landscape and leisure segments. Infrastructure development in emerging economies also plays a crucial role, facilitating the adoption of artificial turf for various applications.

- Landscape Segment Dominance: Driven by water conservation needs, low maintenance appeal, and aesthetic value in residential and commercial applications.

- Leisure Segment Growth: Fueled by demand for durable, safe, and visually appealing surfaces in public parks, hospitality, and recreational areas.

- Contact Sports Segment Strength: Continual demand for high-performance, all-weather playing surfaces for professional and amateur leagues.

- Regional Drivers: Water scarcity in arid regions, government incentives for sustainable landscaping, and increased disposable income in developing economies.

- Country-Specific Trends: Strong adoption in North America and Australia for landscaping, and in Europe for sports and landscaping applications.

Artificial Turf Market Product Landscape

The artificial turf product landscape is characterized by continuous innovation focused on enhancing realism, durability, and performance. Manufacturers are developing advanced yarn technologies, such as polyethylene and nylon blends, to mimic the feel and appearance of natural grass, offering superior resilience against foot traffic and weather elements. Product applications range from high-performance sports fields for soccer and football, designed for optimal ball roll and player safety, to aesthetically pleasing landscape solutions for residential gardens and commercial properties. Innovations in backing systems provide improved drainage capabilities, preventing waterlogging and extending the turf's lifespan. The incorporation of sustainable infill materials, including recycled rubber and bio-based options, addresses environmental concerns and contributes to a more eco-friendly product. Performance metrics such as tuft bind strength, pile height consistency, UV resistance, and shock absorption are critical for ensuring product quality and meeting diverse application requirements.

Key Drivers, Barriers & Challenges in Artificial Turf Market

The artificial turf market is propelled by several key drivers, including the increasing demand for low-maintenance and water-saving landscaping solutions, the need for consistent and durable sports surfaces, and ongoing technological advancements that enhance realism and performance. Economic factors like rising water costs and labor expenses for natural grass maintenance also contribute to the adoption of synthetic turf.

However, the market faces significant barriers and challenges. The high initial installation cost remains a primary restraint, particularly for residential consumers. Regulatory hurdles related to the disposal of end-of-life turf and concerns about the environmental impact of certain infill materials can also pose challenges. Supply chain issues and the availability of raw materials can impact production costs and lead times. Furthermore, competitive pressures from natural grass advocates and the perception of artificial turf as an inferior alternative in some segments continue to exist.

Emerging Opportunities in Artificial Turf Market

Emerging opportunities in the artificial turf market lie in the expansion of applications beyond traditional sports and landscaping. The development of specialized turf for pet-friendly areas, offering superior drainage and odor control, is gaining traction. Urban vertical gardens and green roofs are also presenting new avenues for artificial turf integration, contributing to sustainable urban development. Furthermore, the growing demand for indoor recreational facilities, such as indoor sports centers and play areas, is creating a niche for high-quality, low-maintenance artificial turf solutions. The increasing focus on sustainability is also driving innovation in biodegradable and recyclable turf materials, opening up new markets for environmentally conscious consumers.

Growth Accelerators in the Artificial Turf Market Industry

Several catalysts are accelerating the growth of the artificial turf industry. Technological breakthroughs in yarn extrusion and backing technology are leading to more durable, realistic, and cost-effective products. Strategic partnerships between turf manufacturers, sports governing bodies, and landscaping professionals are crucial for driving adoption and standardizing quality. Market expansion into developing economies, where the demand for low-maintenance and durable surfaces is growing rapidly, represents a significant growth accelerator. The increasing awareness of the benefits of artificial turf, such as water conservation and reduced maintenance, among consumers and institutions is also a key driver.

Key Players Shaping the Artificial Turf Market Market

- SiS Pitches

- Challenger Industries Inc

- Sports Group

- Tencate Grass

- Tarkett Group

- Act Global

- Creative Recreation Solutions (CRS)

- CC Grass

- ForeverLawn

- Global Syn-Turf

Notable Milestones in Artificial Turf Market Sector

- January 2022: Sentinel Capital Partners, a private equity firm that invests in promising mid-market companies, announced its acquisition of The Recreational Group, a leading manufacturer and distributor of recreational surfacing products.

- September 2021: The Netherlands Crestview Partners acquired TenCate Grass Holding BV, the leading global artificial grass solutions provider for sports and landscaping.

- February 2021: SYNLawn, the largest manufacturer and unrivaled innovator of artificial grass in North America announced its latest product enhancements and new offerings debuting. Its products include more soy content, advanced drainage, additional color options, and super yarn technology.

In-Depth Artificial Turf Market Market Outlook

The future outlook for the artificial turf market remains exceptionally positive, driven by persistent demand for sustainable, low-maintenance, and high-performance surfacing solutions. Growth accelerators, including ongoing technological innovation in material science and manufacturing, coupled with strategic market expansion into underserved regions, will continue to propel the industry forward. The increasing focus on environmental sustainability and water conservation will further solidify artificial turf's position as a preferred alternative to natural grass. Emerging opportunities in diverse sectors such as pet-friendly surfaces, urban greening initiatives, and indoor recreational spaces offer significant potential for market diversification and sustained growth. This report forecasts continued strong performance for the artificial turf market, making it an attractive sector for investment and innovation.

Artificial Turf Market Segmentation

-

1. Usage

- 1.1. Contact Sports

- 1.2. Field Hockey

- 1.3. Tennis

- 1.4. Other Sports

- 1.5. Leisure

- 1.6. Landscape

Artificial Turf Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Artificial Turf Market Regional Market Share

Geographic Coverage of Artificial Turf Market

Artificial Turf Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Product Innovation; Increasing Government Initiatives and Extensive Promotions by Market Players

- 3.3. Market Restrains

- 3.3.1. Safety Concerns Associated with the Usage of Insect Repellents

- 3.4. Market Trends

- 3.4.1. High Adoption of Artificial Grass in Various Sports Tournaments Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Usage

- 5.1.1. Contact Sports

- 5.1.2. Field Hockey

- 5.1.3. Tennis

- 5.1.4. Other Sports

- 5.1.5. Leisure

- 5.1.6. Landscape

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Usage

- 6. North America Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Usage

- 6.1.1. Contact Sports

- 6.1.2. Field Hockey

- 6.1.3. Tennis

- 6.1.4. Other Sports

- 6.1.5. Leisure

- 6.1.6. Landscape

- 6.1. Market Analysis, Insights and Forecast - by Usage

- 7. Europe Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Usage

- 7.1.1. Contact Sports

- 7.1.2. Field Hockey

- 7.1.3. Tennis

- 7.1.4. Other Sports

- 7.1.5. Leisure

- 7.1.6. Landscape

- 7.1. Market Analysis, Insights and Forecast - by Usage

- 8. Asia Pacific Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Usage

- 8.1.1. Contact Sports

- 8.1.2. Field Hockey

- 8.1.3. Tennis

- 8.1.4. Other Sports

- 8.1.5. Leisure

- 8.1.6. Landscape

- 8.1. Market Analysis, Insights and Forecast - by Usage

- 9. South America Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Usage

- 9.1.1. Contact Sports

- 9.1.2. Field Hockey

- 9.1.3. Tennis

- 9.1.4. Other Sports

- 9.1.5. Leisure

- 9.1.6. Landscape

- 9.1. Market Analysis, Insights and Forecast - by Usage

- 10. Middle East and Africa Artificial Turf Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Usage

- 10.1.1. Contact Sports

- 10.1.2. Field Hockey

- 10.1.3. Tennis

- 10.1.4. Other Sports

- 10.1.5. Leisure

- 10.1.6. Landscape

- 10.1. Market Analysis, Insights and Forecast - by Usage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SiS Pitches

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Challenger Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sports Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencate Grass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tarkett Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Act Global

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Creative Recreation Solutions (CRS)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CC Grass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ForeverLawn*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Global Syn-Turf

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SiS Pitches

List of Figures

- Figure 1: Global Artificial Turf Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Artificial Turf Market Revenue (billion), by Usage 2025 & 2033

- Figure 3: North America Artificial Turf Market Revenue Share (%), by Usage 2025 & 2033

- Figure 4: North America Artificial Turf Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Artificial Turf Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Artificial Turf Market Revenue (billion), by Usage 2025 & 2033

- Figure 7: Europe Artificial Turf Market Revenue Share (%), by Usage 2025 & 2033

- Figure 8: Europe Artificial Turf Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Artificial Turf Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Artificial Turf Market Revenue (billion), by Usage 2025 & 2033

- Figure 11: Asia Pacific Artificial Turf Market Revenue Share (%), by Usage 2025 & 2033

- Figure 12: Asia Pacific Artificial Turf Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Artificial Turf Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Artificial Turf Market Revenue (billion), by Usage 2025 & 2033

- Figure 15: South America Artificial Turf Market Revenue Share (%), by Usage 2025 & 2033

- Figure 16: South America Artificial Turf Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Artificial Turf Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Artificial Turf Market Revenue (billion), by Usage 2025 & 2033

- Figure 19: Middle East and Africa Artificial Turf Market Revenue Share (%), by Usage 2025 & 2033

- Figure 20: Middle East and Africa Artificial Turf Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Artificial Turf Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 2: Global Artificial Turf Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 4: Global Artificial Turf Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 10: Global Artificial Turf Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Spain Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 19: Global Artificial Turf Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 26: Global Artificial Turf Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Artificial Turf Market Revenue billion Forecast, by Usage 2020 & 2033

- Table 31: Global Artificial Turf Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Artificial Turf Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Turf Market?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the Artificial Turf Market?

Key companies in the market include SiS Pitches, Challenger Industries Inc, Sports Group, Tencate Grass, Tarkett Group, Act Global, Creative Recreation Solutions (CRS), CC Grass, ForeverLawn*List Not Exhaustive, Global Syn-Turf.

3. What are the main segments of the Artificial Turf Market?

The market segments include Usage.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Product Innovation; Increasing Government Initiatives and Extensive Promotions by Market Players.

6. What are the notable trends driving market growth?

High Adoption of Artificial Grass in Various Sports Tournaments Driving the Market.

7. Are there any restraints impacting market growth?

Safety Concerns Associated with the Usage of Insect Repellents.

8. Can you provide examples of recent developments in the market?

January 2022: Sentinel Capital Partners, a private equity firm that invests in promising mid-market companies, announced its acquisition of The Recreational Group, a leading manufacturer and distributor of recreational surfacing products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Turf Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Turf Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Turf Market?

To stay informed about further developments, trends, and reports in the Artificial Turf Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence