Key Insights

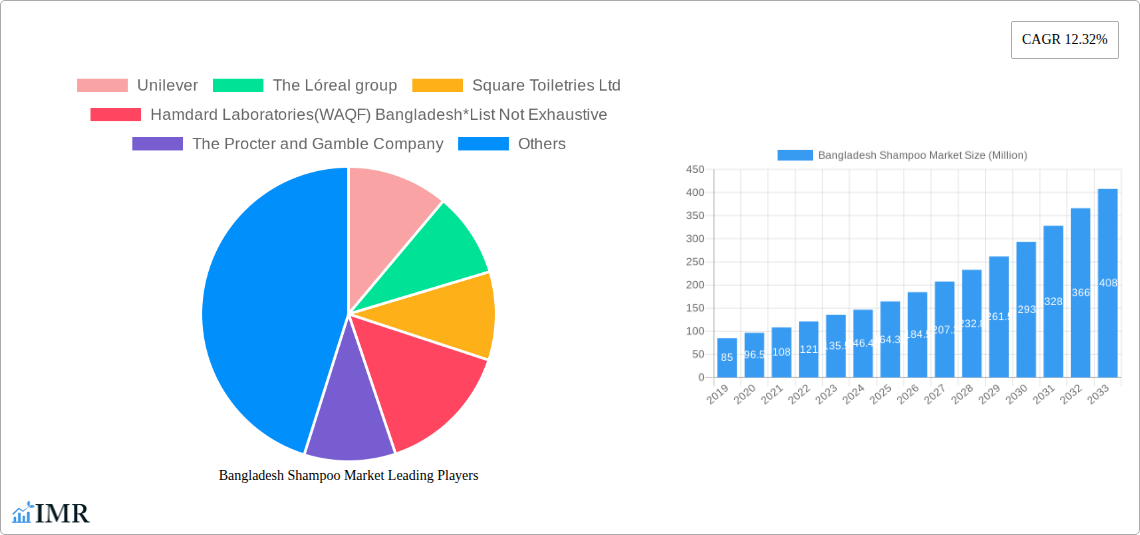

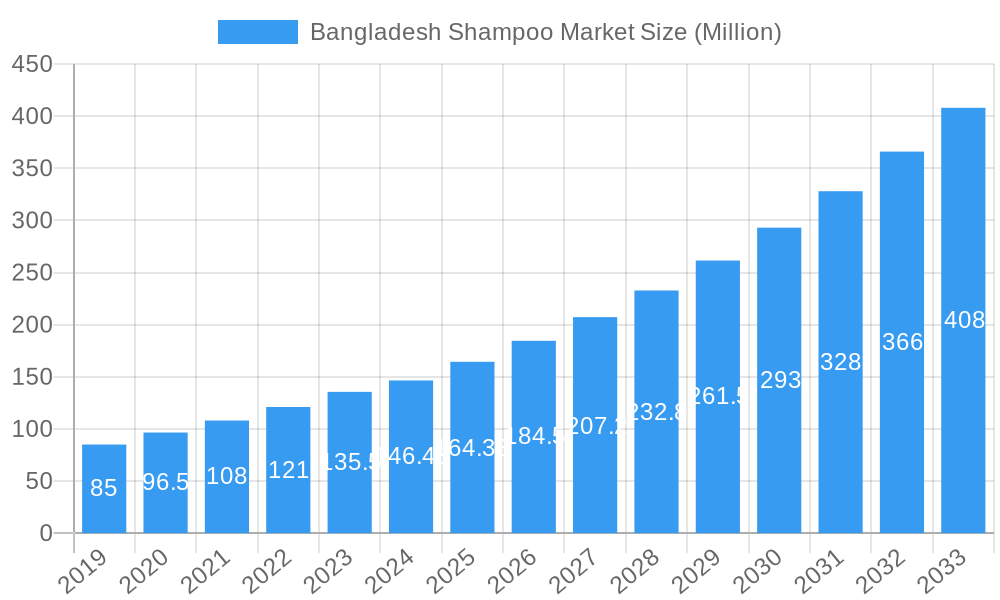

The Bangladesh Shampoo Market is poised for significant expansion, projected to reach a substantial market size by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 12.32%. This dynamic growth is fueled by a confluence of factors, including a rapidly urbanizing population, increasing disposable incomes, and a growing awareness of personal hygiene and grooming standards. The demand for both regular and natural shampoo formulations is on the rise, with consumers actively seeking products that cater to specific hair concerns and embrace natural ingredients. The penetration of modern retail channels, such as supermarkets and hypermarkets, coupled with the burgeoning online retail sector, is further accelerating market accessibility and sales. Key players like Unilever, The L'Oréal Group, and Square Toiletries Ltd are strategically investing in product innovation, marketing campaigns, and expanding their distribution networks to capture a larger market share. The shift towards premium and specialized shampoo products, alongside an increasing preference for eco-friendly and sustainable options, are prominent trends shaping the market landscape.

Bangladesh Shampoo Market Market Size (In Million)

While the market exhibits strong growth potential, certain restraints need to be addressed. Price sensitivity among a significant portion of the population, coupled with the presence of a robust unorganized sector offering lower-priced alternatives, could pose challenges to value growth. Furthermore, inconsistent product quality and efficacy from some smaller players might impact consumer trust. However, the overarching positive sentiment driven by a young demographic, increasing media influence on beauty trends, and the growing acceptance of branded personal care products are expected to outweigh these restraints. The market's trajectory indicates a sustained period of growth, presenting lucrative opportunities for both established and emerging brands to innovate and cater to the evolving needs of Bangladeshi consumers seeking effective and desirable hair care solutions.

Bangladesh Shampoo Market Company Market Share

Bangladesh Shampoo Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock deep insights into the dynamic Bangladesh shampoo market with this comprehensive report. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delves into market size, growth drivers, key players, and emerging opportunities. Navigate the competitive landscape with detailed segment analysis, including Regular Shampoo and Natural Shampoo product types, and understand the impact of distribution channels like Supermarket/Hypermarkets, Convenience Stores, and Online Retail Stores. This report is essential for industry professionals seeking to understand hair care market trends, beauty product demand, and FMCG sector growth in Bangladesh.

Bangladesh Shampoo Market Market Dynamics & Structure

The Bangladesh shampoo market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, but with a growing presence of niche and emerging brands. Technological innovation is a key driver, particularly in the development of natural shampoo formulations and advanced hair care solutions addressing specific concerns like hair fall and scalp health. Regulatory frameworks, while evolving, generally support market entry and product development, though adherence to quality and safety standards is paramount. Competitive product substitutes include traditional hair washing methods and specialized hair treatments, but the convenience and efficacy of shampoos ensure their sustained demand. End-user demographics reveal a growing middle class with increased disposable income, seeking premium and specialized hair care products. Mergers and acquisitions (M&A) trends are present, driven by the desire for market consolidation, portfolio expansion, and enhanced distribution reach.

- Market Concentration: Dominated by multinational corporations and large local manufacturers, with a gradual influx of smaller players focusing on specific product segments.

- Technological Innovation: Focus on natural ingredients, sulphate-free formulations, and efficacy-driven products for hair fall and scalp issues.

- Regulatory Frameworks: Evolving standards for product safety, ingredient disclosure, and marketing claims.

- Competitive Product Substitutes: Limited direct substitutes, with focus on differentiation within the shampoo category.

- End-User Demographics: Growing demand for specialized shampoos driven by increased awareness of hair health and beauty.

- M&A Trends: Strategic acquisitions to gain market share and expand product portfolios.

Bangladesh Shampoo Market Growth Trends & Insights

The Bangladesh shampoo market is poised for robust growth, driven by a confluence of economic development, increasing consumer awareness, and evolving lifestyle choices. The market size has witnessed a consistent upward trajectory in the historical period (2019–2024) and is projected to continue its expansion throughout the forecast period (2025–2033). This growth is fueled by rising disposable incomes, a burgeoning young population that is highly influenced by global beauty trends, and a growing emphasis on personal grooming and hygiene. The adoption rates for both regular and natural shampoo segments are on the rise. Technological disruptions, such as the development of innovative ingredient formulations and sustainable packaging solutions, are further stimulating demand. Consumer behavior is shifting towards a preference for products offering specific benefits, such as anti-hair fall, moisturizing, and volumizing shampoos, moving beyond basic cleansing. The increasing penetration of organized retail and the rapid growth of online retail stores are making a wider variety of shampoos more accessible to consumers across the country, thereby accelerating market growth. The CAGR for the forecast period is expected to be substantial, reflecting the underlying economic and demographic strengths of Bangladesh.

Dominant Regions, Countries, or Segments in Bangladesh Shampoo Market

The Regular Shampoo segment is currently the dominant force driving growth within the Bangladesh shampoo market. This dominance is attributed to its widespread availability, affordability, and established brand presence, catering to the basic cleansing needs of a large consumer base. However, the Natural Shampoo segment is experiencing accelerated growth, driven by increasing consumer consciousness regarding health, wellness, and the environmental impact of product ingredients. The preference for natural and organic ingredients, free from harsh chemicals like sulfates and parabens, is a significant trend shaping this segment.

Key Drivers of Dominance (Regular Shampoo):

- Price Sensitivity: Regular shampoos offer a more economical option for a larger segment of the population.

- Brand Loyalty: Established brands have cultivated strong consumer trust and loyalty over years of presence.

- Widespread Availability: Superior distribution networks ensure regular shampoos are accessible across urban and rural areas.

- Versatile Use: Caters to a broad spectrum of hair types and concerns with established efficacy.

Drivers of Growth (Natural Shampoo):

- Health & Wellness Trend: Growing awareness of the benefits of natural ingredients and the avoidance of synthetic chemicals.

- Influence of Social Media & Influencers: Increased exposure to global beauty trends and advocacy for natural products.

- Premiumization: Consumers are willing to pay a premium for shampoos perceived to be healthier and more sustainable.

- Innovation in Formulations: Development of effective natural shampoos addressing specific hair concerns like hair fall and scalp sensitivity.

Among distribution channels, Supermarket/Hypermarkets continue to be a significant contributor due to their one-stop-shop convenience and wider product selection. However, Online Retail Stores are rapidly emerging as a crucial growth driver, offering convenience, competitive pricing, and access to a broader range of brands and specialized products, including niche natural options.

Bangladesh Shampoo Market Product Landscape

The Bangladesh shampoo market is witnessing a wave of product innovation centered around efficacy and natural ingredients. Brands are increasingly focusing on formulations that address specific hair concerns like hair fall, dandruff, and dryness, often incorporating active ingredients derived from nature. Regular shampoo offerings continue to evolve with improved cleansing properties and enhanced fragrance profiles, while the natural shampoo segment is seeing an influx of products featuring botanical extracts, essential oils, and certifications for organic content. Performance metrics are being redefined by consumer demand for tangible results, with packaging and marketing emphasizing these benefits. Unique selling propositions often revolve around gentle formulations, scalp health benefits, and sustainability. Technological advancements are evident in the development of advanced delivery systems for active ingredients and the exploration of biodegradable packaging materials.

Key Drivers, Barriers & Challenges in Bangladesh Shampoo Market

The Bangladesh shampoo market is propelled by several key drivers including a growing young population with increasing disposable incomes, a rising awareness of personal grooming and hair health, and the expanding influence of e-commerce making a diverse range of products accessible. Technological advancements in product formulation, particularly in natural shampoo development, and effective marketing campaigns by both multinational and local players also significantly contribute to market expansion.

However, the market faces barriers such as price sensitivity among a large consumer base, intense competition leading to pricing pressures, and the challenge of ensuring consistent product quality across all distribution channels. Supply chain disruptions, particularly in rural areas, and evolving regulatory compliance can also pose challenges. Limited consumer awareness regarding the long-term benefits of specialized shampoos compared to their cost can also be a restraining factor.

Emerging Opportunities in Bangladesh Shampoo Market

Emerging opportunities in the Bangladesh shampoo market lie in the growing demand for natural shampoo and specialized hair care solutions. The increasing environmental consciousness among consumers presents an avenue for brands offering sustainable packaging and ethically sourced ingredients. Untapped markets in semi-urban and rural areas, coupled with the expansion of online retail penetration, offer significant growth potential. Innovative applications, such as shampoos with added benefits like UV protection or hair coloring, and personalized hair care solutions tailored to individual needs, are also areas ripe for exploration. Evolving consumer preferences towards premium and value-added products further create openings for niche brands and innovative product lines.

Growth Accelerators in the Bangladesh Shampoo Market Industry

Several catalysts are accelerating the long-term growth of the Bangladesh shampoo market. Technological breakthroughs in ingredient science are enabling the development of more effective and targeted hair care solutions, particularly within the natural shampoo segment. Strategic partnerships between manufacturers and online retailers are expanding market reach and improving consumer accessibility. Market expansion strategies, including aggressive product launches and targeted marketing campaigns that highlight product benefits and address specific consumer needs, are also playing a crucial role. Furthermore, increasing urbanization and a rising middle class with a greater propensity to spend on personal care products are fundamental growth accelerators.

Key Players Shaping the Bangladesh Shampoo Market Market

- Unilever

- The Lóreal group

- Square Toiletries Ltd

- Hamdard Laboratories(WAQF) Bangladesh

- The Procter and Gamble Company

- Johnson and Johnson

- Herbal Essences

- The Body Shop

- Marico Bangladesh

- Kohinoor Chemical Company

- Keya Group

Notable Milestones in Bangladesh Shampoo Market Sector

- June 2022: Sunsilk, a hair care brand of Unilever Bangladesh Limited, introduced a new range of shampoos with an active blend of natural ingredients. The new Sunsilk shampoo line provides three hair care solutions shiny black hair, thick and long hair, and hair fall prevention.

- December 2021: Kayos expanded its product line with the addition of three-step curly hair products. Among the products included in the kit are curly hair grapeseed shampoo, avocado conditioner, flaxseed hair gel, and a free curly hair brush.

- February 2021: Marico Bangladesh launched a Parachute Naturale shampoo range, Hajab Fresh Anti Hairfall Shampoo. The presence of natural ingredients such as coconut milk protein and green tea in the product helps reduce hair fall.

In-Depth Bangladesh Shampoo Market Market Outlook

The future outlook for the Bangladesh shampoo market is exceptionally promising, fueled by sustained economic growth, evolving consumer preferences towards premium and natural products, and the continued expansion of digital retail channels. Growth accelerators such as technological innovation in formulations, strategic market penetration, and increasing disposable incomes will continue to drive market expansion. The rising demand for specialized hair care, especially within the natural shampoo segment, presents significant strategic opportunities for both established players and emerging brands. The market is expected to witness increased product diversification, with a focus on sustainability and personalized solutions, further solidifying its growth trajectory in the coming years.

Bangladesh Shampoo Market Segmentation

-

1. Product Type

- 1.1. Regular Shampoo

- 1.2. Natural Shampoo

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Bangladesh Shampoo Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Shampoo Market Regional Market Share

Geographic Coverage of Bangladesh Shampoo Market

Bangladesh Shampoo Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Herbal and Medicated Shampoo

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Shampoo Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Regular Shampoo

- 5.1.2. Natural Shampoo

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unilever

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Lóreal group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Square Toiletries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hamdard Laboratories(WAQF) Bangladesh*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Procter and Gamble Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson and Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Herbal Essences

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Body Shop

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Marico Bangladesh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kohinoor Chemical Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Keya Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Unilever

List of Figures

- Figure 1: Bangladesh Shampoo Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bangladesh Shampoo Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Shampoo Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Bangladesh Shampoo Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Bangladesh Shampoo Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Bangladesh Shampoo Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Bangladesh Shampoo Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Bangladesh Shampoo Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Shampoo Market?

The projected CAGR is approximately 12.32%.

2. Which companies are prominent players in the Bangladesh Shampoo Market?

Key companies in the market include Unilever, The Lóreal group, Square Toiletries Ltd, Hamdard Laboratories(WAQF) Bangladesh*List Not Exhaustive, The Procter and Gamble Company, Johnson and Johnson, Herbal Essences, The Body Shop, Marico Bangladesh, Kohinoor Chemical Company, Keya Group.

3. What are the main segments of the Bangladesh Shampoo Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Increasing Demand for Herbal and Medicated Shampoo.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

June 2022: Sunsilk, a hair care brand of Unilever Bangladesh Limited, introduced a new range of shampoos with an active blend of natural ingredients. The new Sunsilk shampoo line provides three hair care solutions shiny black hair, thick and long hair, and hair fall prevention.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Shampoo Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Shampoo Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Shampoo Market?

To stay informed about further developments, trends, and reports in the Bangladesh Shampoo Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence