Key Insights

The Asia Pacific Men's Grooming Products Market is projected for robust expansion, anticipated to reach a market size of 72514.1 million by 2025. This growth trajectory is driven by a Compound Annual Growth Rate (CAGR) of 8.89%. Key growth catalysts include rising disposable incomes, heightened awareness of personal grooming and hygiene, and the pervasive influence of social media and celebrity endorsements. Consumers are increasingly opting for premium and specialized products, spanning advanced skincare, targeted haircare, and innovative shaving solutions. The recent emphasis on self-care, accelerated by the pandemic, further bolsters market potential.

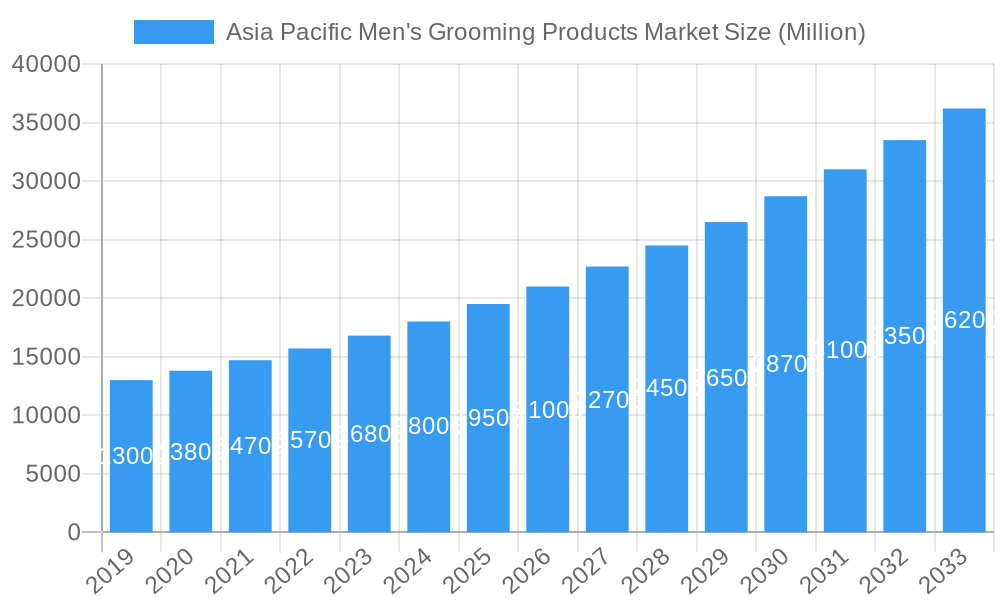

Asia Pacific Men's Grooming Products Market Market Size (In Billion)

The market encompasses a comprehensive product range, with Skincare Products (including facial cleansers, moisturizers, and oil-free creams) leading in demand. Haircare Products (shampoos, conditioners, styling agents) and Shaving Products (pre-shave and post-shave essentials) also constitute significant segments, marked by product innovation and specialized offerings. Online retail channels are emerging as dominant, offering convenience and extensive product selections, complementing traditional channels like supermarkets and specialty stores. Leading global players such as Unilever Plc, L'Oreal SA, and The Procter & Gamble Company, alongside emerging regional brands like Vi-john Group and Bombay Shaving Company, are actively competing through product innovation and strategic marketing. The Asia Pacific region, particularly China, Japan, South Korea, and India, is expected to be a primary driver of this market's growth.

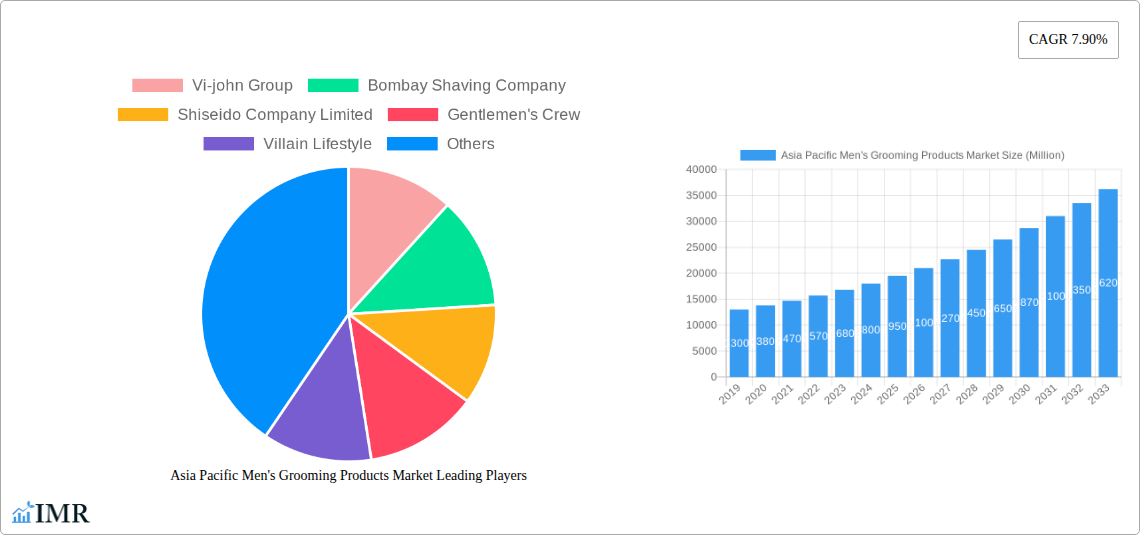

Asia Pacific Men's Grooming Products Market Company Market Share

This comprehensive report provides in-depth analysis of the Asia Pacific Men's Grooming Products Market from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. It covers market size, growth drivers, emerging trends, competitive landscape, and key opportunities. Optimized with high-volume keywords such as "men's skincare," "men's haircare," "shaving products," "APAC grooming," "Asia men's products," and "personal care market," this analysis is designed for industry professionals, manufacturers, distributors, and investors. Explore detailed insights into parent and child markets, with all data presented in Million Units for actionable understanding.

Asia Pacific Men's Grooming Products Market Market Dynamics & Structure

The Asia Pacific men's grooming products market is characterized by a moderately concentrated structure, with a few dominant global players alongside a growing number of agile local and regional brands. Technological innovation is a key driver, fueled by advancements in ingredient formulations, product efficacy, and sustainable packaging solutions. Regulatory frameworks across different countries are evolving, focusing on product safety, ingredient transparency, and environmental impact. Competitive product substitutes are increasing, especially in the skincare and haircare segments, with brands differentiating through unique ingredient stories, specialized benefits, and targeted marketing campaigns. End-user demographics are shifting, with a younger, more digitally-savvy male population increasingly prioritizing personal care and grooming as essential aspects of their lifestyle. Mergers and acquisitions (M&A) trends are present, indicating strategic consolidations and brand acquisitions aimed at expanding market reach and product portfolios. The market is estimated to be valued at approximately USD 35,000 Million Units in the base year 2025.

- Market Concentration: Dominated by global players like Unilever Plc, Procter & Gamble, and L'Oréal SA, but with significant growth from emerging brands.

- Technological Innovation: Focus on natural ingredients, anti-aging formulations, and specialized products for specific skin and hair concerns.

- Regulatory Landscape: Increasing emphasis on clean beauty, sustainable sourcing, and consumer protection regulations across key markets like Japan, South Korea, and Australia.

- Competitive Substitutes: Rise of niche brands offering personalized solutions and subscription-based models.

- End-User Demographics: Growing demand from urban millennials and Gen Z, influenced by social media trends and celebrity endorsements.

- M&A Trends: Strategic acquisitions of smaller, innovative brands by larger corporations to tap into specific market segments and consumer preferences.

Asia Pacific Men's Grooming Products Market Growth Trends & Insights

The Asia Pacific men's grooming products market is poised for robust growth, driven by a confluence of evolving consumer preferences, increasing disposable incomes, and a burgeoning awareness among men regarding personal grooming. The market size is projected to witness a significant expansion, escalating from an estimated USD 28,000 Million Units in the historical year 2019 to a projected USD 50,000 Million Units by 2033. This upward trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the study period. Adoption rates for specialized grooming products, beyond basic hygiene, are on the rise, particularly for skincare and advanced haircare solutions. Technological disruptions, such as the integration of AI in personalized product recommendations and the development of advanced formulations for efficacy and sustainability, are reshaping the market. Consumer behavior shifts are evident, with men actively seeking products that address specific concerns like acne, aging, and hair loss, moving beyond generic offerings. The increasing influence of digital platforms and e-commerce has further democratized access to a wider array of products, fostering greater experimentation and brand loyalty.

- Market Size Evolution: Significant growth from USD 28,000 Million Units (2019) to an estimated USD 35,000 Million Units (2025) and a projected USD 50,000 Million Units (2033).

- Adoption Rates: Increasing uptake of premium skincare, anti-aging products, and specialized hair treatments by a broader male demographic.

- Technological Disruptions: Integration of smart devices for skin analysis, development of bi-functional products, and advancements in sustainable ingredient sourcing.

- Consumer Behavior Shifts: Men are becoming more discerning, seeking efficacy, ingredients, and ethical brand practices, driven by online research and peer recommendations.

- Market Penetration: Expanding into tier 2 and tier 3 cities, with increasing online availability and localized marketing efforts.

Dominant Regions, Countries, or Segments in Asia Pacific Men's Grooming Products Market

The Asia Pacific men's grooming products market demonstrates distinct regional dominance and segment leadership, driven by a complex interplay of economic factors, cultural nuances, and consumer receptiveness. Skincare Products emerge as the dominant segment, accounting for an estimated 40% of the total market share in the base year 2025, with a projected value of USD 14,000 Million Units. Within this segment, Face Wash and Moisturizers are leading categories, driven by increased awareness of skin health and a desire for a refined appearance.

Among the countries, China stands out as the leading market, representing approximately 35% of the total Asia Pacific market in 2025, valued at USD 12,250 Million Units. This dominance is attributed to its large male population, rapidly growing disposable incomes, and a strong influence of social media and e-commerce trends that promote grooming and self-care. South Korea and Japan also exhibit significant market presence due to their established grooming cultures and high adoption rates of innovative beauty and personal care products.

Online Retail Stores are the fastest-growing distribution channel, capturing an estimated 30% of the market share in 2025, with a projected value of USD 10,500 Million Units. This channel's ascendancy is propelled by convenience, wider product availability, competitive pricing, and effective digital marketing strategies.

- Dominant Segment (Product Type): Skincare Products

- Face Wash: Driven by increasing concern over acne, oil control, and pollution effects.

- Moisturizers: Growing demand for hydration and anti-aging benefits.

- Other Skincare Products: Includes serums, masks, and exfoliants, gaining traction among more sophisticated consumers.

- Leading Country: China

- Economic Policies: Favorable trade policies and government support for the beauty and personal care industry.

- Disposable Income: Rising purchasing power of the male population.

- E-commerce Penetration: High adoption of online shopping for convenience and access to global brands.

- Fastest Growing Distribution Channel: Online Retail Stores

- Convenience: 24/7 accessibility and doorstep delivery.

- Product Variety: Access to a wider selection of niche and international brands.

- Digital Marketing: Targeted advertising and influencer collaborations driving online sales.

Asia Pacific Men's Grooming Products Market Product Landscape

The product landscape of the Asia Pacific men's grooming market is increasingly sophisticated and innovation-driven. Brands are focusing on developing multi-functional products that offer enhanced efficacy and cater to specific male grooming needs. Key product innovations include advanced anti-aging serums, targeted acne treatments, natural ingredient-based hair styling products, and specialized post-shave solutions designed to soothe and repair. For instance, the launch of sheet masks exclusively for men, like the one by Uno in September 2022, highlights a growing trend in innovative skincare formats. Performance metrics are now centered around ingredient efficacy, speed of results, and long-term skin and hair health benefits.

Key Drivers, Barriers & Challenges in Asia Pacific Men's Grooming Products Market

Key Drivers: The market is propelled by a significant shift in societal attitudes towards male grooming, with men increasingly viewing personal care as an integral part of their well-being and professional image. Rising disposable incomes, especially in emerging economies, have empowered consumers to invest in premium grooming products. The pervasive influence of social media and celebrity endorsements further fuels demand by normalizing and promoting grooming routines. Technological advancements in product formulation, offering superior efficacy and addressing specific concerns like anti-aging and hair loss, are also critical drivers.

Barriers & Challenges: Despite the positive outlook, the market faces certain challenges. Price sensitivity remains a significant barrier in some sub-regions, particularly for premium products. A lack of awareness about specialized grooming needs among certain segments of the male population can hinder adoption. Supply chain complexities and logistical challenges in some developing markets can impact product availability. Regulatory hurdles and varying import/export policies across different countries can also pose obstacles for market expansion. Intense competition from both global giants and agile local brands necessitates continuous innovation and effective marketing strategies.

Emerging Opportunities in Asia Pacific Men's Grooming Products Market

Emerging opportunities in the Asia Pacific men's grooming products market lie in the untapped potential of natural and organic ingredients, offering a sustainable and ethical choice for environmentally conscious consumers. The increasing demand for personalized grooming solutions, driven by advancements in AI and data analytics for tailored product recommendations, presents a significant avenue for growth. Subscription-based grooming services are gaining traction, offering convenience and consistent product replenishment. Furthermore, the expansion into developing markets within Southeast Asia and Oceania, with their burgeoning middle class, offers substantial untapped consumer bases eager to explore the world of men's grooming.

Growth Accelerators in the Asia Pacific Men's Grooming Products Market Industry

Several catalysts are accelerating the growth of the Asia Pacific men's grooming products industry. The continuous development of innovative product formulations that address specific male concerns, such as sensitivity, oiliness, and hair thinning, is a primary accelerator. Strategic partnerships between beauty tech companies and grooming brands are enabling the creation of smart grooming devices and personalized digital experiences. Market expansion strategies by major players, focusing on localized product offerings and targeted marketing campaigns in diverse Asian markets, are also driving growth. The increasing adoption of subscription models for recurring purchases of grooming essentials is fostering customer loyalty and predictable revenue streams.

Key Players Shaping the Asia Pacific Men's Grooming Products Market Market

- Vi-john Group

- Bombay Shaving Company

- Shiseido Company Limited

- Gentlemen's Crew

- Villain Lifestyle

- Nourish Pvt Ltd

- Unilever Plc

- Colgate-Palmolive Company

- L'Oreal SA

- The Procter & Gamble Company

- Emami Group

- The Man Company

- Beiersdorf AG

- Maaj Holding (Uno)

Notable Milestones in Asia Pacific Men's Grooming Products Market Sector

- April 2023: Villain Lifestyle launched its personal care range, including the Xtreme Foam Choco Mint Face Wash, with a campaign starring actor Yash.

- March 2023: CODE (under Nourish Pvt. Ltd.) expanded its haircare portfolio with a new hair serum specifically designed for Indian men, offering nourishing and revitalizing properties.

- February 2023: Nykaa launched its new brand, Gentlemen's Crew, offering a holistic range of grooming and personal care products including deodorants, beard care, and hair styling ranges.

- September 2022: The Japanese brand Uno launched its first sheet mask exclusively designed for men.

In-Depth Asia Pacific Men's Grooming Products Market Market Outlook

The outlook for the Asia Pacific men's grooming products market remains exceptionally bright, fueled by sustained consumer interest and continuous product innovation. Growth accelerators such as the increasing emphasis on men's wellness, digital transformation of retail channels, and the expanding product portfolios catering to diverse needs will continue to drive market expansion. Strategic investments in research and development, coupled with effective market penetration strategies, will be crucial for players aiming to capture significant market share. The market is poised to become even more dynamic, with emerging brands leveraging niche strategies and established players adapting to evolving consumer preferences for efficacy, sustainability, and personalized experiences.

Asia Pacific Men's Grooming Products Market Segmentation

-

1. Product Type

-

1.1. Skincare Products

- 1.1.1. Face Wash

- 1.1.2. Moisturizers

- 1.1.3. Oil-Free Creams

- 1.1.4. Other Skincare Products

-

1.2. Haircare Products

- 1.2.1. Shampoo

- 1.2.2. Conditioners

- 1.2.3. Styling Products

- 1.2.4. Waxes

- 1.2.5. Other Haircare Products

-

1.3. Shaving Products

-

1.3.1. Pre-Shave

- 1.3.1.1. Shaving Cream

- 1.3.1.2. Pre-Shave Oil

- 1.3.1.3. Shaving Soap

- 1.3.1.4. Other Pre-Shave Products

-

1.3.2. Post-Shave

- 1.3.2.1. After-Shave

- 1.3.2.2. Balms

- 1.3.2.3. Other Post-Shave Products

-

1.3.1. Pre-Shave

-

1.1. Skincare Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

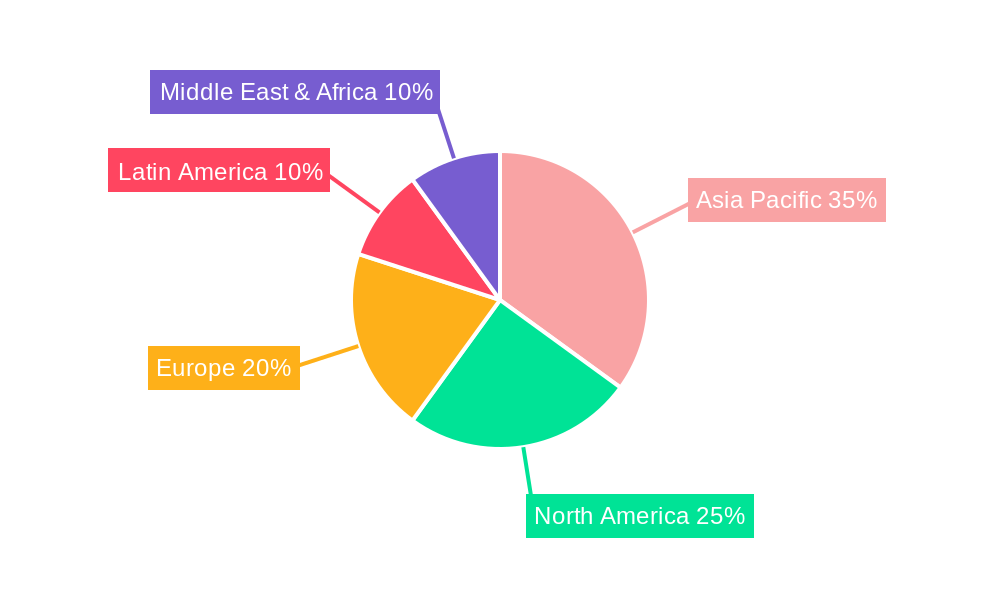

Asia Pacific Men's Grooming Products Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Men's Grooming Products Market Regional Market Share

Geographic Coverage of Asia Pacific Men's Grooming Products Market

Asia Pacific Men's Grooming Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products

- 3.4. Market Trends

- 3.4.1. Growing Skin Concerns Among Men Leading to Purchase of Skincare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Men's Grooming Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skincare Products

- 5.1.1.1. Face Wash

- 5.1.1.2. Moisturizers

- 5.1.1.3. Oil-Free Creams

- 5.1.1.4. Other Skincare Products

- 5.1.2. Haircare Products

- 5.1.2.1. Shampoo

- 5.1.2.2. Conditioners

- 5.1.2.3. Styling Products

- 5.1.2.4. Waxes

- 5.1.2.5. Other Haircare Products

- 5.1.3. Shaving Products

- 5.1.3.1. Pre-Shave

- 5.1.3.1.1. Shaving Cream

- 5.1.3.1.2. Pre-Shave Oil

- 5.1.3.1.3. Shaving Soap

- 5.1.3.1.4. Other Pre-Shave Products

- 5.1.3.2. Post-Shave

- 5.1.3.2.1. After-Shave

- 5.1.3.2.2. Balms

- 5.1.3.2.3. Other Post-Shave Products

- 5.1.3.1. Pre-Shave

- 5.1.1. Skincare Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vi-john Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bombay Shaving Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shiseido Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gentlemen's Crew

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Villain Lifestyle

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nourish Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilever Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Colgate-Palmolive Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 L'Oreal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Procter & Gamble Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Emami Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Man Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Beiersdorf AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Maaj Holding (Uno)*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Vi-john Group

List of Figures

- Figure 1: Asia Pacific Men's Grooming Products Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Men's Grooming Products Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Men's Grooming Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Men's Grooming Products Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Men's Grooming Products Market?

The projected CAGR is approximately 8.89%.

2. Which companies are prominent players in the Asia Pacific Men's Grooming Products Market?

Key companies in the market include Vi-john Group, Bombay Shaving Company, Shiseido Company Limited, Gentlemen's Crew, Villain Lifestyle, Nourish Pvt Ltd, Unilever Plc, Colgate-Palmolive Company, L'Oreal SA, The Procter & Gamble Company, Emami Group, The Man Company, Beiersdorf AG, Maaj Holding (Uno)*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Men's Grooming Products Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 72514.1 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Skin Concerns Among Men Leading to Purchase of Skincare Products; The Taming and Beard Maintenance Market Dominates the Men's Grooming Products Market.

6. What are the notable trends driving market growth?

Growing Skin Concerns Among Men Leading to Purchase of Skincare Products.

7. Are there any restraints impacting market growth?

Increasing Awareness Regarding the Side Effects Associated with Chemical Cosmetic/Skincare Products.

8. Can you provide examples of recent developments in the market?

April 2023: Villain Lifestyle, a men's fragrances, accessories, and grooming brand, announced the launch of its personal care range with a campaign starring actor Yash. The product launch included the launch of its new product, the Xtreme Foam Choco Mint Face Wash.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Men's Grooming Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Men's Grooming Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Men's Grooming Products Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Men's Grooming Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence