Key Insights

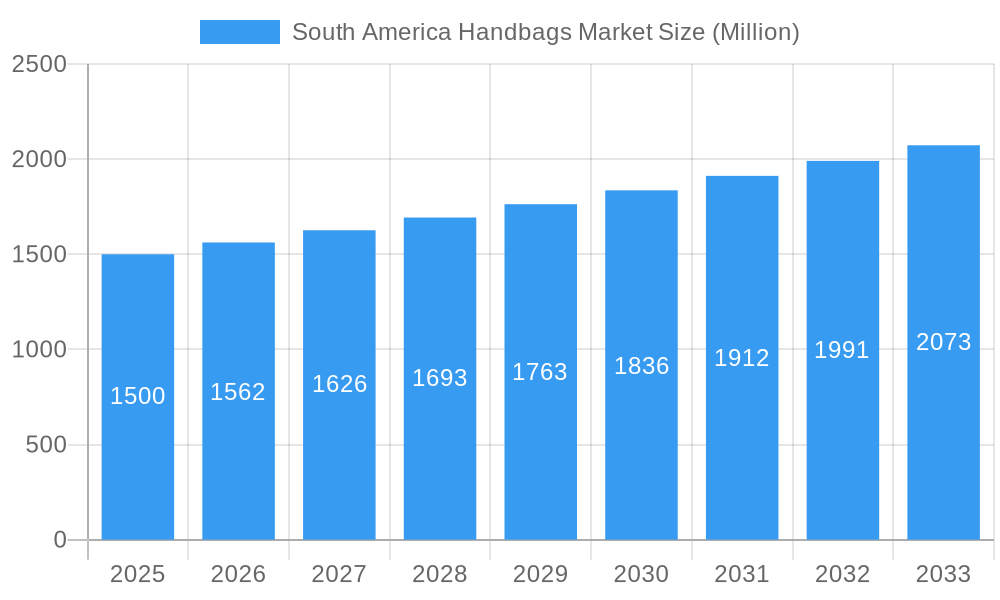

The South America Handbags Market is poised for robust growth, projected to reach an estimated market size of approximately USD 1,500 million by 2025, fueled by a compound annual growth rate (CAGR) of 4.10% over the forecast period of 2025-2033. This upward trajectory is primarily driven by increasing disposable incomes across South America, a growing fashion-conscious population, and the rising influence of global fashion trends penetrating regional markets. The demand for premium and designer handbags is on the rise, particularly in urban centers, as consumers increasingly view handbags as status symbols and essential fashion accessories. E-commerce expansion is significantly contributing to market accessibility, allowing a wider consumer base to explore and purchase diverse handbag styles.

South America Handbags Market Market Size (In Billion)

The market is segmented into various handbag types, with Satchels, Totes, and Sling Bags likely dominating sales due to their versatility and everyday appeal. While Online Stores are experiencing rapid growth, Offline Stores, especially in key metropolitan areas and premium retail locations, continue to hold significant market share, offering tactile experiences and personalized service. Geographically, Brazil is expected to lead the market, followed by Argentina and then the Rest of South America, owing to larger economies and more developed retail infrastructures. Key players like LVMH Moet Hennessy Louis Vuitton, Kering SA, and Michael Kors (USA) Inc. are strategically expanding their presence and product offerings to cater to the evolving preferences of South American consumers, while emerging local brands like Colombian Label Co and Catarina Mina Brand are carving out niches with their unique designs and emphasis on craftsmanship and sustainability.

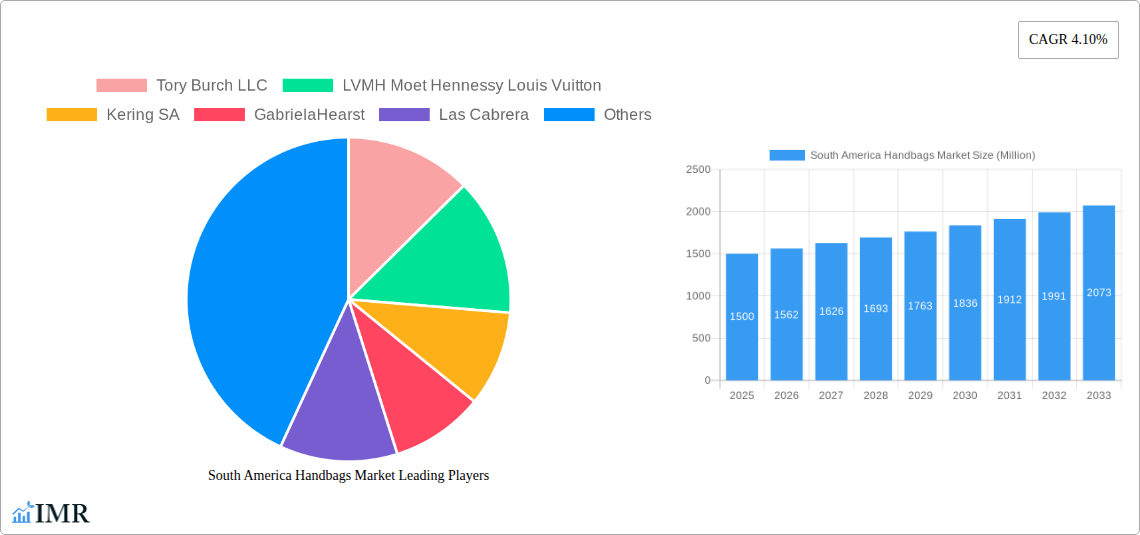

South America Handbags Market Company Market Share

South America Handbags Market Report: Forecast to 2033

Unlock in-depth insights into the dynamic South America handbags market. This comprehensive report offers a granular analysis of market size, growth trends, competitive landscape, and future opportunities. Featuring a robust handbag market analysis for regions including Brazil handbag market and Argentina handbag market, alongside a detailed breakdown of segments like satchel handbags, clutch bags, tote bags, and sling bags. Explore the impact of online and offline distribution channels on South America fashion accessories market. Leverage our expert analysis to navigate the luxury handbag market in South America and the affordable handbag market in South America.

South America Handbags Market Market Dynamics & Structure

The South America handbags market is characterized by a moderate to high concentration, with established global luxury players and a growing number of local designers vying for market share. Technological innovation is primarily driven by advancements in materials science, sustainable production methods, and the integration of smart features, though adoption rates in this region are still evolving. Regulatory frameworks, particularly concerning import duties and local manufacturing incentives, play a significant role in shaping market entry and operational costs. Competitive product substitutes include other fashion accessories like wallets and travel bags, as well as the increasing popularity of fast fashion alternatives. End-user demographics are diverse, spanning from affluent consumers seeking luxury designer handbags in South America to a burgeoning middle class demanding stylish and affordable options. Mergers and acquisitions (M&A) trends are moderately active, often involving strategic partnerships or smaller brands being acquired by larger entities to expand their regional footprint.

- Market Concentration: Dominated by a mix of global luxury houses and emerging regional brands.

- Technological Innovation: Focus on sustainable materials and digital integration for enhanced customer experience.

- Regulatory Impact: Import tariffs and local production policies influence pricing and competitiveness.

- End-User Demographics: A dual market of luxury connoisseurs and value-conscious consumers.

- M&A Activity: Strategic acquisitions and partnerships to gain market access and diversify product portfolios.

South America Handbags Market Growth Trends & Insights

The South America handbags market is poised for significant growth, driven by an expanding middle class, increasing disposable incomes, and a growing appreciation for fashion and personal expression across the continent. The South America fashion market is witnessing a paradigm shift with a rising demand for both premium and accessible handbag collections. Our analysis leverages extensive market data to project a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, indicating a robust expansion trajectory. The adoption rate of both online and offline purchasing channels is steadily increasing, with e-commerce platforms demonstrating particularly strong momentum, especially for online handbag sales in South America. Technological disruptions, such as the integration of AI for personalized recommendations and the use of blockchain for authenticity verification, are beginning to influence consumer behavior. Shifts in consumer preferences towards sustainable and ethically sourced eco-friendly handbags in South America are also becoming more pronounced, influencing brand strategies and product development. The penetration of designer brands is increasing, fueled by targeted marketing campaigns and the growing influence of social media on fashion trends.

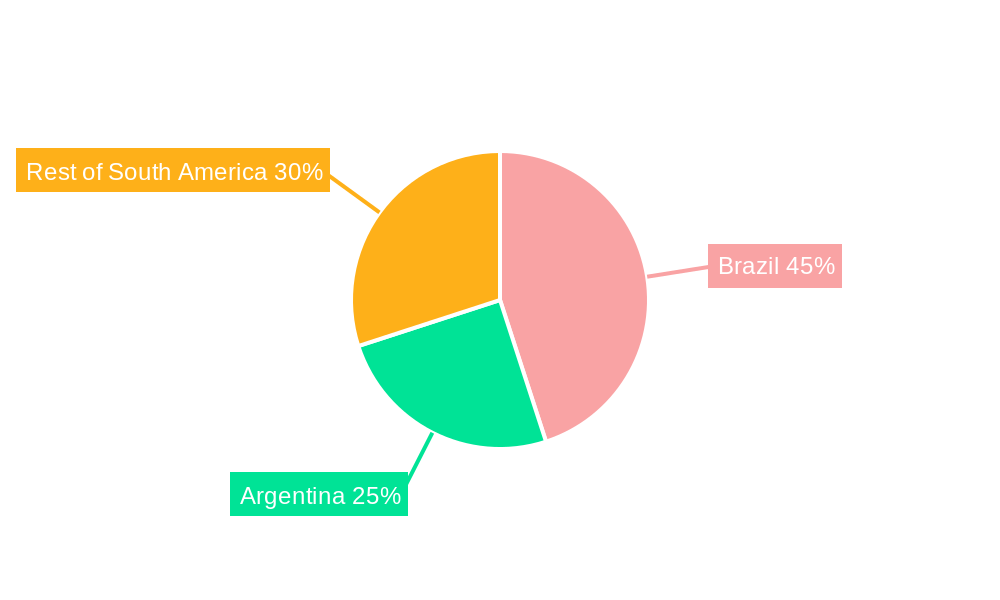

Dominant Regions, Countries, or Segments in South America Handbags Market

Brazil stands out as the dominant region within the South America handbags market, driven by its large population, robust economy, and a sophisticated fashion-conscious consumer base. The Brazil handbags market alone accounts for an estimated 45% of the total regional sales value. Key drivers for this dominance include significant disposable income, a well-developed retail infrastructure comprising both high-end malls and thriving online marketplaces, and a strong cultural inclination towards fashion and luxury goods. Argentina follows as a significant market, contributing an estimated 20% to the regional market share, with its own growing demand for stylish and branded handbags. The "Rest of South America," encompassing countries like Colombia, Chile, and Peru, collectively represents the remaining 35%, exhibiting varied growth potentials influenced by economic stability and evolving consumer trends.

Within segments, the tote bag market in South America is a consistent performer due to its versatility and broad appeal, capturing an estimated 25% of the market. Satchel handbags are also highly sought after, particularly among the professional demographic, holding an estimated 20% market share. Clutch bags and sling bags cater to specific occasions and daily needs, respectively, each accounting for approximately 15% and 18% of the market. The "Others" category, including backpacks and specialty bags, rounds out the remaining share. In terms of distribution channels, while offline handbag stores in South America maintain a strong presence, particularly for luxury purchases and tactile brand experiences, the online handbag stores in South America segment is experiencing accelerated growth, projected to capture over 40% of the market by 2033, driven by convenience and wider product availability.

South America Handbags Market Product Landscape

The product landscape within the South America handbags market is characterized by a vibrant mix of classic designs and contemporary innovations. Manufacturers are increasingly focusing on premium materials, including high-quality leather, exotic skins, and sustainable alternatives. Product applications span daily wear, professional settings, and special occasions. Performance metrics are evaluated based on durability, craftsmanship, brand prestige, and unique design elements. Notable technological advancements include the integration of RFID tags for authenticity and enhanced security features. Unique selling propositions often revolve around artisanal craftsmanship, limited-edition collections, and the fusion of local cultural aesthetics with global fashion trends, appealing to consumers seeking distinctive pieces.

Key Drivers, Barriers & Challenges in South America Handbags Market

Key Drivers:

- Rising Disposable Income: Increasing purchasing power among a growing middle class fuels demand for fashionable handbags.

- Evolving Fashion Trends: A keen interest in personal style and the adoption of global fashion trends.

- E-commerce Growth: Enhanced accessibility and convenience of online shopping platforms.

- Brand Awareness: Increased exposure to global brands through digital media and international travel.

- Economic Development: Growing economies in key South American nations support luxury and premium product markets.

Barriers & Challenges:

- Economic Volatility: Fluctuations in currency exchange rates and economic instability can impact consumer spending on discretionary items like handbags, estimated to cause a 5-10% dip in sales during periods of uncertainty.

- Import Tariffs & Taxes: High duties on imported goods can significantly increase the final retail price of luxury handbags, making them less accessible.

- Counterfeiting: The prevalence of counterfeit products erodes brand value and consumer trust, posing a significant challenge to legitimate market players.

- Supply Chain Disruptions: Geopolitical events and logistical complexities can lead to delays and increased costs in sourcing raw materials and distributing finished products.

- Intense Competition: A crowded market with both global giants and emerging local designers necessitates constant innovation and strategic pricing.

Emerging Opportunities in South America Handbags Market

Emerging opportunities in the South America handbags market lie in the growing demand for sustainable and ethically produced accessories, presenting a chance for brands to differentiate themselves through eco-conscious practices and transparent sourcing. The "Rest of South America" segment, encompassing countries with developing economies, offers untapped potential for affordable luxury and mid-tier brands. Innovative business models, such as subscription services for luxury handbags or personalized customization platforms, are also gaining traction. Furthermore, the increasing influence of Gen Z consumers, who prioritize authenticity and value-driven brands, creates an avenue for unique brand storytelling and community building.

Growth Accelerators in the South America Handbags Market Industry

Long-term growth in the South America handbags market will be significantly accelerated by the sustained expansion of the digital retail ecosystem, coupled with increasingly sophisticated digital marketing strategies that foster brand loyalty. Strategic partnerships between international luxury houses and local South American designers or manufacturers can unlock new markets and leverage regional expertise. The development of robust e-commerce logistics and payment infrastructure across the continent will further simplify transactions and broaden market reach. Moreover, a continued focus on product innovation, particularly in sustainable materials and smart functionalities, will cater to evolving consumer preferences and create new demand drivers.

Key Players Shaping the South America Handbags Market Market

- Tory Burch LLC

- LVMH Moet Hennessy Louis Vuitton

- Kering SA

- Gabriela Hearst

- Las Cabrera

- Colombian Label Co

- Carla Busso

- Catarina Mina Brand

- Michael Kors (USA) Inc

- Prada Holding SpA

Notable Milestones in South America Handbags Market Sector

- January 2022: LVMH opened a second Dior store in Shops Jardins Shopping Center in São Paulo, Brazil. The store features ready-to-wear, handbags, small leather goods, exotic leathers, jewelry, footwear, accessories, and sunglasses, reinforcing the brand's commitment to the premium segment.

- April 2021: Balenciaga, a major luxury brand from the Kering Group, made its debut in South America by opening its first brick-and-mortar store in the region located at the opulent JK Iguatemi mall in So Paulo. Balenciaga offers handbags apart from clothing, signaling a strategic expansion into a key South American luxury market.

In-Depth South America Handbags Market Market Outlook

The future outlook for the South America handbags market is exceptionally promising, underpinned by a confluence of accelerating growth factors. Continued economic development in key nations will drive sustained consumer spending on aspirational goods, while the deepening penetration of e-commerce will democratize access to a wider array of brands and styles. Strategic alliances and collaborations between established global players and emerging regional artisans are expected to foster innovation and cater to unique local tastes. Furthermore, an increasing consumer consciousness towards sustainability and ethical production will shape product development and brand positioning, presenting significant opportunities for market leaders to differentiate themselves and capture a larger share of this evolving market.

South America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distribution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Handbags Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Handbags Market Regional Market Share

Geographic Coverage of South America Handbags Market

South America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Popularity of Leather Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Tory Burch LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 LVMH Moet Hennessy Louis Vuitton

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kering SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GabrielaHearst

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Las Cabrera

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Colombian Label Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Carla Busso*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Catarina Mina Brand

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Michael Kors (USA) Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Prada Holding SpA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Tory Burch LLC

List of Figures

- Figure 1: South America Handbags Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: South America Handbags Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: South America Handbags Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: South America Handbags Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: South America Handbags Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Handbags Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: South America Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: South America Handbags Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: South America Handbags Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Handbags Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the South America Handbags Market?

Key companies in the market include Tory Burch LLC, LVMH Moet Hennessy Louis Vuitton, Kering SA, GabrielaHearst, Las Cabrera, Colombian Label Co, Carla Busso*List Not Exhaustive, Catarina Mina Brand, Michael Kors (USA) Inc, Prada Holding SpA.

3. What are the main segments of the South America Handbags Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Popularity of Leather Handbags.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In January 2022, LVMH opened a second Dior store in Shops Jardins Shopping Center in São Paulo, Brazil. The store features ready-to-wear, handbags, small leather goods, exotic leathers, jewelry, footwear, accessories, and sunglasses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Handbags Market?

To stay informed about further developments, trends, and reports in the South America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence