Key Insights

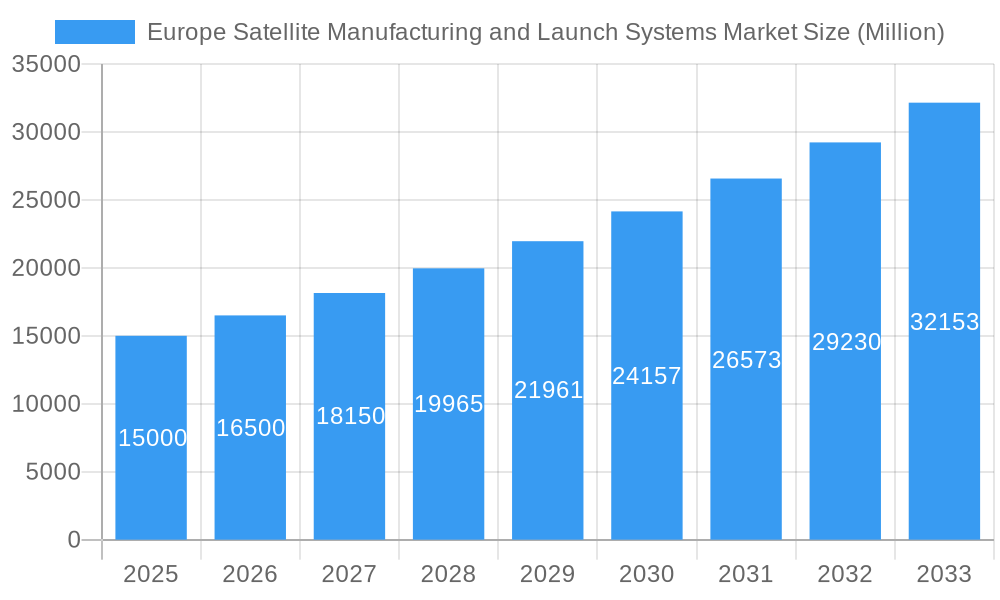

The European satellite manufacturing and launch systems market is experiencing robust growth, driven by increasing demand for satellite-based services across civil, commercial, and military sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024 signifies a strong upward trajectory. This expansion is fueled by several key factors. Firstly, the burgeoning need for improved communication infrastructure, particularly in remote areas and for specialized applications like IoT and Earth observation, is significantly boosting demand. Secondly, advancements in miniaturization and cost-effectiveness of satellite technologies are making them more accessible to a wider range of users, further stimulating market growth. Furthermore, government initiatives promoting space exploration and technological innovation within Europe are providing substantial impetus. Germany, France, the UK, and Italy are major contributors to the market, leveraging their established aerospace industries and research capabilities.

Europe Satellite Manufacturing and Launch Systems Market Market Size (In Billion)

However, the market also faces certain challenges. The high initial investment required for satellite development and launch can act as a significant restraint, particularly for smaller companies. Competition from established international players and the potential for regulatory hurdles also pose risks. Despite these limitations, the long-term outlook remains positive, with continued growth expected throughout the forecast period (2025-2033). Segmentation analysis reveals a strong presence across various satellite types (e.g., communication, Earth observation) and launch systems, with a balanced distribution of demand across civil, commercial, and military end-users. The dominance of major players like Airbus Defence and Space, Thales Alenia Space, and OHB SE highlights the importance of established expertise and technological capabilities in this competitive landscape. The continued investment in research and development, alongside the increasing adoption of new technologies like NewSpace initiatives, is set to further shape the market's evolution.

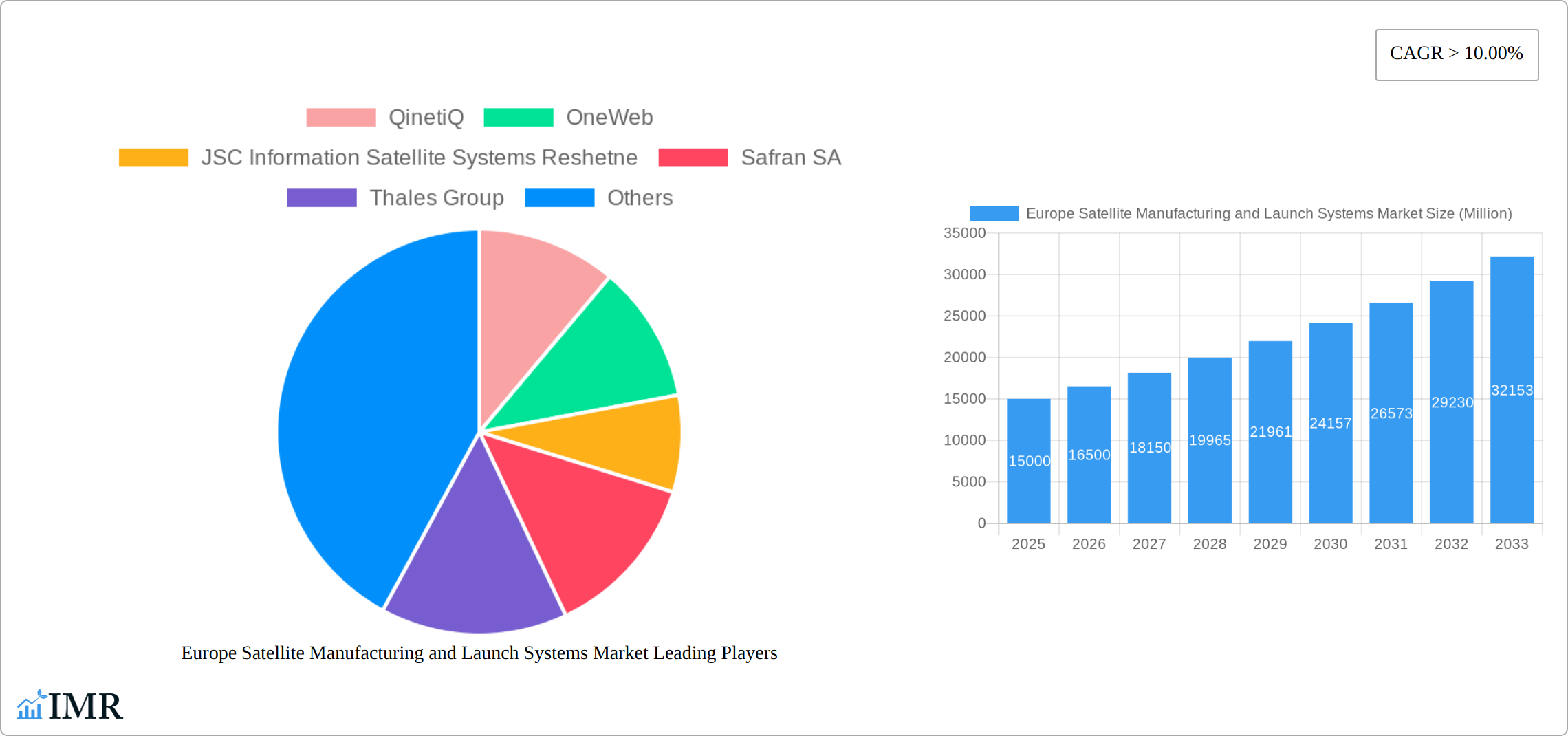

Europe Satellite Manufacturing and Launch Systems Market Company Market Share

This comprehensive report provides an in-depth analysis of the European satellite manufacturing and launch systems market, encompassing market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and policymakers seeking a clear understanding of this rapidly evolving sector. The market is segmented by Type (Satellite, Launch Systems) and End-user (Civil, Commercial, Military). The market size is valued in Million units.

Europe Satellite Manufacturing and Launch Systems Market Market Dynamics & Structure

The European satellite manufacturing and launch systems market is characterized by a dynamic interplay of consolidation and innovation. While a moderate concentration of key players exists, a significant trend towards strategic mergers and acquisitions (M&A) is reshaping the competitive landscape, allowing established entities to bolster their technological prowess and market share. A primary growth catalyst stems from relentless technological innovation, particularly in the realms of satellite miniaturization, the development of advanced propulsion systems, and the burgeoning field of satellite constellation technologies. These advancements are opening new avenues for functionality and efficiency. Simultaneously, the market operates within a stringent regulatory framework that governs all aspects of satellite launches and operations. Evolving strategies for space debris mitigation are also exerting a considerable influence on operational planning and market dynamics. While competitive substitutes such as advanced terrestrial communication networks and sophisticated drone technologies present ongoing challenges, the unparalleled capabilities and unique value proposition of satellite systems continue to ensure robust and sustained market demand. The end-user demographics are notably diverse, encompassing critical government agencies (both military and civil), a broad spectrum of commercial entities (with a strong focus on telecommunications and Earth observation), and vital research institutions.

- Market Concentration: Moderately concentrated, with the top 5 players projected to hold approximately 65-70% of the market share in 2025.

- Technological Innovation Drivers: Miniaturization (CubeSats, smallsats), advanced electric and hybrid propulsion systems, large-scale satellite constellations (e.g., for broadband internet and IoT), enhanced sensor technologies for Earth observation, and reusable launch vehicle technologies.

- Regulatory Framework: Stringent regulations impacting launch permits, orbital slot allocation, spectrum licensing, and increasingly, comprehensive space debris mitigation requirements and international compliance.

- Competitive Substitutes: Advanced terrestrial fiber optics, 5G/6G networks, and highly capable unmanned aerial vehicles (UAVs) for specific data collection and communication tasks.

- End-User Demographics: Government agencies (defense, national security, scientific research, meteorological services), commercial entities (telecommunications, broadcasting, Earth observation and remote sensing, precision agriculture, maritime surveillance, financial services), and academic/research institutions.

- M&A Trends: Significant consolidation activity is evident, with an estimated 10-15 major deals recorded between 2019 and 2024, focused on acquiring technological capabilities or market access. Projections indicate approximately 12-18 further strategic M&A activities anticipated between 2025 and 2033.

- Innovation Barriers: High research and development (R&D) costs, lengthy and complex certification processes, significant technological complexity in developing and manufacturing cutting-edge systems, and the challenges of securing adequate and consistent funding for long-term projects.

Europe Satellite Manufacturing and Launch Systems Market Growth Trends & Insights

The European satellite manufacturing and launch systems market is experiencing substantial growth, fueled by increasing demand for satellite-based services across various sectors. The market size expanded from xx million units in 2019 to xx million units in 2024, demonstrating a CAGR of xx%. This robust growth is projected to continue, with a forecasted CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. Technological disruptions, particularly the rise of NewSpace companies and the adoption of reusable launch vehicles, are reshaping the market landscape. Consumer behavior is shifting towards greater reliance on satellite-based data and services, driving market expansion across diverse applications, including navigation, communication, Earth observation, and defense. Market penetration in specific sectors, such as IoT and broadband internet access, is expected to significantly increase. Furthermore, government initiatives promoting space exploration and commercialization are driving further growth.

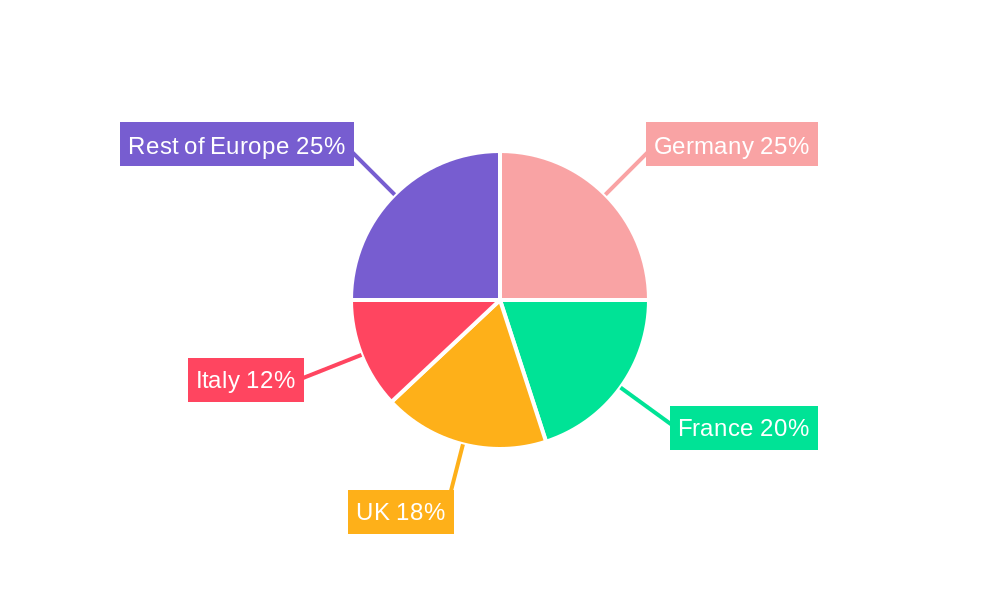

Dominant Regions, Countries, or Segments in Europe Satellite Manufacturing and Launch Systems Market

The United Kingdom, France, and Germany stand out as the leading hubs within the European satellite manufacturing and launch systems market. This prominence is attributable to a confluence of factors, including the deep-rooted presence of established aerospace conglomerates, substantial and consistent government backing for ambitious space programs, and a vibrant ecosystem that fosters groundbreaking innovation. Within the market's segmentation, the Satellite segment commands a larger market share than the Launch Systems segment. This disparity is primarily driven by the escalating and diverse demand for various types of satellites catering to an expanding array of applications. On the end-user front, commercially driven applications, particularly those in the telecommunications and Earth observation sectors, currently dominate the market landscape, reflecting strong private sector investment and service adoption.

- Key Drivers (UK): A world-leading aerospace industry, significant government investment through the UK Space Agency, a highly skilled engineering workforce, and a burgeoning NewSpace sector contributing to innovation.

- Key Drivers (France): The strong strategic role of the Centre National d'Études Spatiales (CNES), ArianeGroup's continued dominance in European launch vehicle development, and robust private sector investment in satellite technology.

- Key Drivers (Germany): OHB SE's significant contributions to satellite platforms and scientific missions, substantial public and private investments in advanced satellite technology development, and a strong emphasis on research and development.

- Dominant Segment (Type): Satellite segment, driven by an ever-increasing demand for communication satellites (including broadband constellations), Earth observation satellites (for climate monitoring, resource management, and urban planning), navigation satellites, and scientific research satellites.

- Dominant Segment (End-user): Commercial segment, fueled by the insatiable demand for high-throughput telecommunications, global broadband internet services, and sophisticated Earth observation data for commercial intelligence and service provision.

- Market Share: Estimated market share for 2025: United Kingdom (approx. 25-30%), France (approx. 22-27%), Germany (approx. 18-23%), and other European countries (approx. 20-30%).

Europe Satellite Manufacturing and Launch Systems Market Product Landscape

The product landscape is characterized by a diverse range of satellites, from small satellites for Earth observation to large geostationary communication satellites. Launch systems encompass both expendable and reusable rockets, each with varying payload capacities and cost-effectiveness. Technological advancements focus on improving satellite performance (e.g., higher resolution imagery, increased bandwidth), reducing launch costs, and enhancing reliability. Unique selling propositions include miniaturization, improved fuel efficiency, and advanced onboard processing capabilities. Recent innovations include the development of smallsat constellations and reusable launch vehicles.

Key Drivers, Barriers & Challenges in Europe Satellite Manufacturing and Launch Systems Market

Key Drivers:

- Growing demand for satellite-based services across various sectors (telecommunications, navigation, Earth observation).

- Government investments in space exploration and technology development.

- Emergence of NewSpace companies, driving innovation and competition.

Challenges:

- High initial investment costs associated with satellite development and launch.

- Stringent regulatory frameworks and licensing requirements.

- Intense competition from international players, particularly from the US and China.

- Supply chain vulnerabilities impacting the availability of critical components. Estimated xx% increase in component costs between 2024 and 2025.

Emerging Opportunities in Europe Satellite Manufacturing and Launch Systems Market

- The burgeoning growth of the small satellite (smallsat) and CubeSat market, offering highly cost-effective and agile solutions for a wide range of applications, including scientific research, Earth observation, and specialized communications.

- A significant and accelerating demand for satellite-based Internet of Things (IoT) connectivity and global broadband internet services, particularly in underserved or remote regions.

- The continuous expansion and sophistication of Earth observation applications, with increasing traction in precision agriculture, detailed environmental monitoring, advanced climate change studies, and efficient disaster management and response systems.

- The development and commercialization of transformative new space-based technologies, such as space-based solar power (SBSP) for clean energy generation, in-space manufacturing and servicing capabilities, and advanced space situational awareness (SSA) systems.

- The growing opportunities in the in-orbit servicing, assembly, and manufacturing (ISAM) sector, enabling satellite life extension, debris removal, and the on-orbit construction of larger structures.

- Increased investment and focus on lunar exploration and resource utilization, creating demand for lunar landers, orbiters, and communication infrastructure.

Growth Accelerators in the Europe Satellite Manufacturing and Launch Systems Market Industry

Technological breakthroughs in propulsion systems, miniaturization, and satellite constellations will be instrumental in driving market expansion. Strategic partnerships between established players and NewSpace companies will accelerate innovation and market penetration. Expansion into new markets, such as developing countries with emerging communication and data needs, presents considerable growth potential.

Key Players Shaping the Europe Satellite Manufacturing and Launch Systems Market Market

- QinetiQ

- OneWeb

- JSC Information Satellite Systems Reshetnev

- Safran SA

- Thales Group

- ArianeGroup

- OHB SE

- Surrey Satellite Technology Ltd

- GomSpace

- Berlin Space Technologies GmbH

- Avio SpA

- EnduroSat

- AAC Clyde Space

Notable Milestones in Europe Satellite Manufacturing and Launch Systems Market Sector

- 2020: Successful initial launches and operational deployment of satellites for the OneWeb constellation, marking a significant step in European global broadband initiatives.

- 2022: ArianeGroup securing a landmark contract for a substantial series of Ariane 6 launches, reinforcing its position in the European launch market and ensuring future launch capability.

- 2023: OHB SE announcing a strategic partnership with a prominent NewSpace company, signaling integration and collaboration between traditional aerospace and innovative startups.

- 2024: Implementation of regulatory changes designed to streamline and expedite the licensing process for small satellite launches, fostering greater agility for commercial operators.

- Early 2025: Successful demonstration of a new reusable rocket component by a European launch provider, signaling progress towards more sustainable and cost-effective launch solutions.

- Mid-2025: Unveiling of a new generation of Earth observation satellites with enhanced resolution and multispectral capabilities by a consortium of European nations.

In-Depth Europe Satellite Manufacturing and Launch Systems Market Market Outlook

The European satellite manufacturing and launch systems market is on a trajectory for robust and sustained growth. This upward momentum is being propelled by a confluence of factors, including rapid technological advancements, a continually escalating demand for innovative satellite-based services, and increasingly supportive governmental policies that champion space exploration and commercialization. Strategic partnerships, proactive expansion into emerging global markets, and the relentless development of groundbreaking satellite technologies are set to be the defining features of future market dynamics. The current market landscape presents significant and compelling opportunities for both investors and companies keen on capitalizing on the rapidly expanding global space economy. The long-term outlook for the European sector is decidedly positive, with projected growth rates anticipated to outpace global averages. This optimistic forecast is underpinned by the region's formidable aerospace industrial base, its commitment to research and development, and its well-established and adaptable regulatory environment, all contributing to a fertile ground for future success and innovation.

Europe Satellite Manufacturing and Launch Systems Market Segmentation

-

1. Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. End-user

- 2.1. Civil

- 2.2. Commercial

- 2.3. Military

Europe Satellite Manufacturing and Launch Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Rest of Europe

Europe Satellite Manufacturing and Launch Systems Market Regional Market Share

Geographic Coverage of Europe Satellite Manufacturing and Launch Systems Market

Europe Satellite Manufacturing and Launch Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Segment Held the Largest Market Share in 2019

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Manufacturing and Launch Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Civil

- 5.2.2. Commercial

- 5.2.3. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 QinetiQ

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OneWeb

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JSC Information Satellite Systems Reshetne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Safran SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArianeGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OHB SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Surrey Satellite Technology Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GomSpace

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berlin Space Technologies GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Avio SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 EnduroSat

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AAC Clyde Space

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 QinetiQ

List of Figures

- Figure 1: Europe Satellite Manufacturing and Launch Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Satellite Manufacturing and Launch Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 3: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 6: Europe Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Manufacturing and Launch Systems Market?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Europe Satellite Manufacturing and Launch Systems Market?

Key companies in the market include QinetiQ, OneWeb, JSC Information Satellite Systems Reshetne, Safran SA, Thales Group, ArianeGroup, OHB SE, Surrey Satellite Technology Ltd, GomSpace, Berlin Space Technologies GmbH, Avio SpA, EnduroSat, AAC Clyde Space.

3. What are the main segments of the Europe Satellite Manufacturing and Launch Systems Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Segment Held the Largest Market Share in 2019.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Manufacturing and Launch Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Manufacturing and Launch Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Manufacturing and Launch Systems Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Manufacturing and Launch Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence