Key Insights

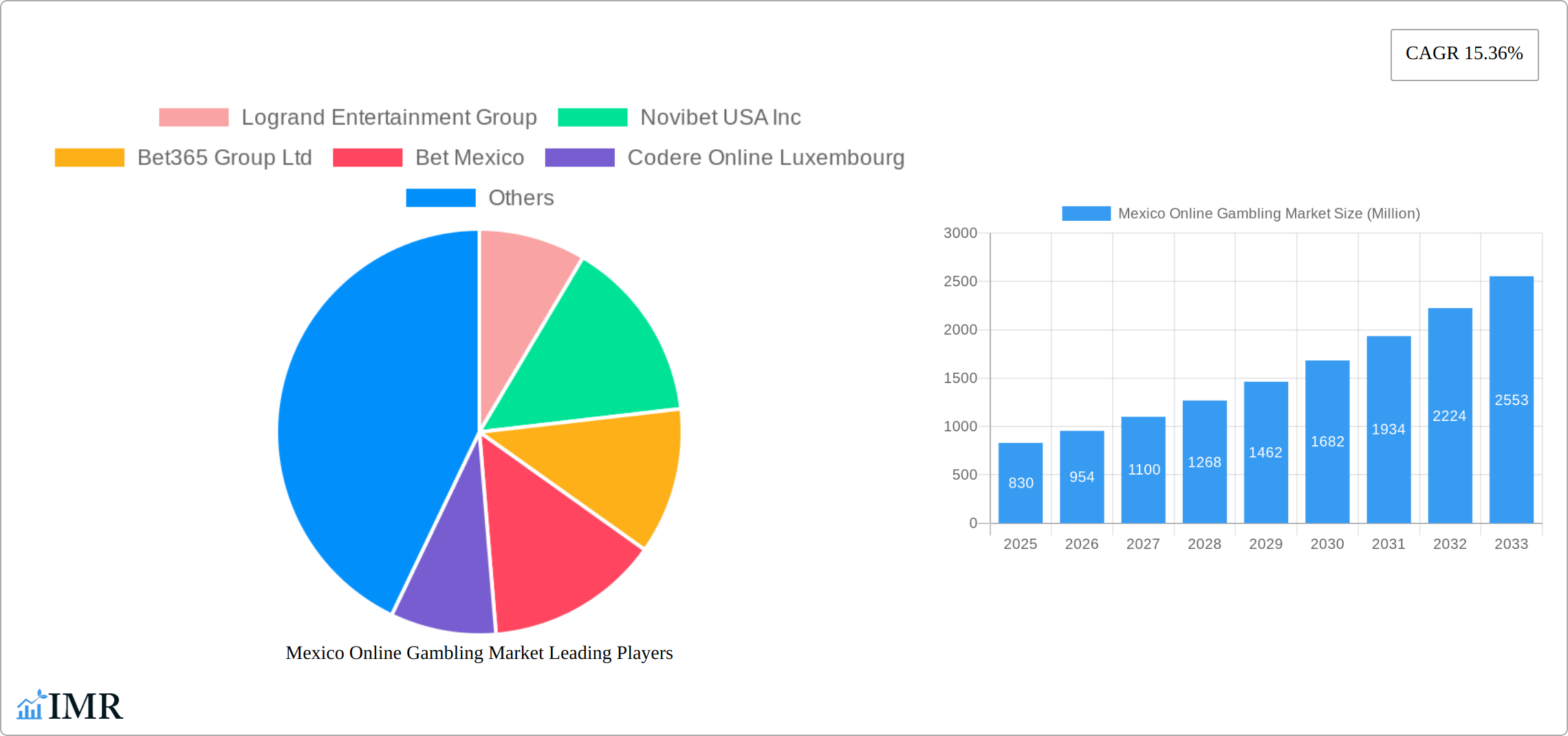

The Mexico online gambling market, currently valued at $830 million (2025), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.36% from 2025 to 2033. This significant expansion is driven by several factors. Increasing internet and smartphone penetration across Mexico is making online gambling more accessible to a wider population. A young, tech-savvy demographic readily embraces digital entertainment options, including online casinos and sports betting. Furthermore, the evolving regulatory landscape, while still developing, is creating a more favorable environment for licensed operators, leading to increased investment and market confidence. The rising popularity of esports and fantasy sports further contributes to the market's growth, attracting a new segment of players. Competition among established players like Logrand Entertainment Group, Novibet USA Inc, and Bet365 Group Ltd., alongside rising local operators like Playdoit and Winnermx, fuels innovation and enhances the overall user experience.

Mexico Online Gambling Market Market Size (In Million)

However, challenges remain. Regulatory uncertainty and the prevalence of unlicensed operators present ongoing concerns. Efforts to combat problem gambling and ensure responsible gaming practices are crucial for sustainable market growth. Addressing concerns about data privacy and security will also be essential in building consumer trust and confidence. Despite these challenges, the long-term outlook for the Mexico online gambling market remains positive, with continued growth expected as the market matures and regulatory clarity improves. The market's segmentation, while currently unspecified, likely includes categories such as sports betting, online casinos, poker, and lottery games, each contributing to the overall market expansion. Future growth will depend on the successful navigation of regulatory hurdles, the implementation of responsible gaming measures, and the continued appeal of online gambling to the Mexican consumer.

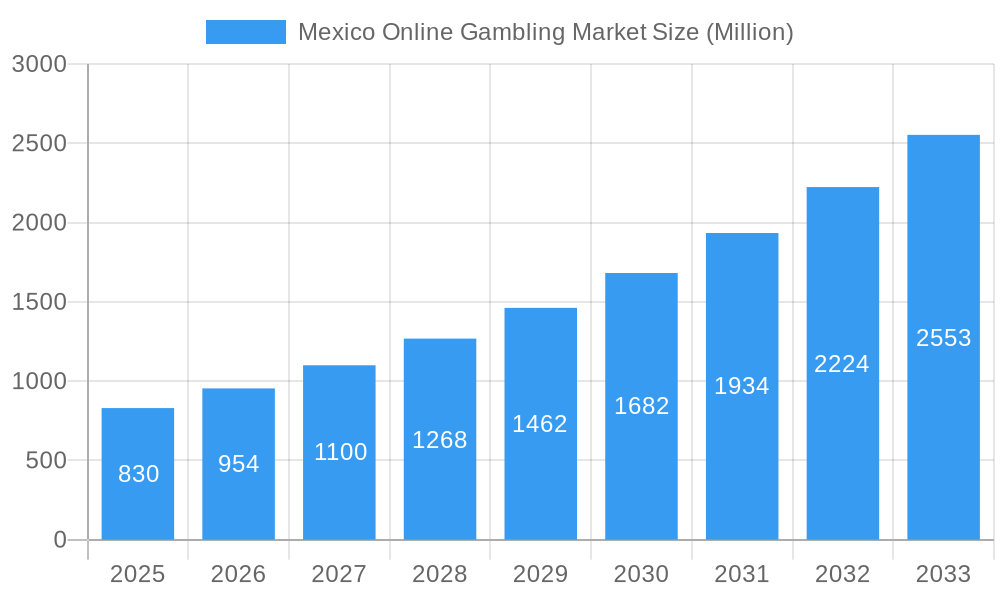

Mexico Online Gambling Market Company Market Share

Mexico Online Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico online gambling market, encompassing market dynamics, growth trends, key players, and future opportunities. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking to understand the complexities and potential of this rapidly evolving market. The parent market is the broader Latin American online gambling market, and the child market focuses specifically on Mexico's unique regulatory landscape and consumer preferences. The market value in 2025 is estimated at XXX Million.

Mexico Online Gambling Market Dynamics & Structure

This section analyzes the structural elements of the Mexican online gambling market, including market concentration, technological drivers, regulatory frameworks, competitive substitutes, end-user demographics, and M&A trends. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, particularly in mobile gaming and virtual reality, is a key driver. However, regulatory uncertainty remains a significant barrier.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Mobile gaming and VR/AR technologies are driving growth, although high internet penetration is still needed in some areas.

- Regulatory Framework: The evolving regulatory landscape presents both opportunities and challenges, with licensing requirements varying across states.

- Competitive Substitutes: Traditional land-based casinos and other forms of entertainment pose competition.

- End-User Demographics: The primary demographic is young adults (18-40 years), with increasing participation from older age groups.

- M&A Trends: The number of M&A deals in the sector between 2019-2024 was xx, indicating a consolidated market.

Mexico Online Gambling Market Growth Trends & Insights

The Mexico online gambling market is experiencing robust growth, driven by increasing internet penetration, smartphone adoption, and a growing preference for online entertainment. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The adoption rate of online gambling platforms is also increasing steadily, fuelled by targeted marketing campaigns and the convenience offered by mobile platforms. Consumer behavior is shifting toward mobile-first experiences, with a preference for user-friendly interfaces and diverse game offerings.

Dominant Regions, Countries, or Segments in Mexico Online Gambling Market

Mexico City and other major urban centers are currently at the forefront of the online gambling market, contributing a substantial share of overall revenue. This dominance is propelled by factors such as higher internet penetration, greater disposable incomes, and a more concentrated existing infrastructure for traditional gambling. As the market matures, these hubs are expected to continue their leadership, setting trends and driving innovation.

- Key Drivers: High urban population density, a robust tourism sector that influences entertainment spending, and government policies that facilitate clear gambling regulation.

- Market Share: Mexico City is projected to account for approximately 35-40% of the total market revenue in 2025, with a steady growth trajectory.

- Growth Potential: Smaller cities and rural areas present significant untapped potential for future market expansion. This growth is contingent upon continued advancements in internet infrastructure, increased digital literacy, and the implementation of targeted marketing campaigns tailored to these demographics.

Mexico Online Gambling Market Product Landscape

The market offers a diverse range of products, including sports betting, casino games (iLottery, Jackpot, etc.), poker, and virtual sports. Technological advancements such as enhanced graphics, immersive gameplay, and personalized experiences are key differentiators. Many operators are incorporating social features and loyalty programs to enhance customer engagement.

Key Drivers, Barriers & Challenges in Mexico Online Gambling Market

Key Drivers:

- Increasing internet and smartphone penetration.

- Growing disposable incomes among the target demographic.

- The rising popularity of online entertainment and esports.

Challenges:

- Regulatory uncertainty and licensing complexities across different states.

- Concerns about responsible gambling and potential social harms.

- Intense competition among established and emerging players.

Emerging Opportunities in Mexico Online Gambling Market

The Mexican online gambling landscape is ripe with emerging opportunities, driven by technological advancements and evolving player preferences. The exponential rise of mobile gaming continues to be a primary growth engine, offering unparalleled accessibility. The integration of cutting-edge technologies like blockchain promises enhanced security and transparency for transactions and gameplay, fostering greater player trust. Furthermore, the burgeoning esports sector presents a fertile ground for specialized betting platforms and unique gaming experiences. Personalization is paramount; offering tailored game recommendations, customized bonuses, and adaptive user interfaces will be key to capturing and retaining player engagement. The expansion into less saturated regions, supported by improved digital access, also represents a significant avenue for growth.

Growth Accelerators in the Mexico Online Gambling Market Industry

Several factors are acting as significant growth accelerators for the Mexico online gambling market. Strategic alliances and partnerships between established gaming operators and innovative technology providers are crucial for developing and launching cutting-edge products and expanding market reach. The continuous development and adoption of advanced, secure, and user-friendly payment gateways are vital for enhancing transaction speed and ensuring consumer confidence. Robust security measures, including data encryption and fraud detection systems, further bolster trust. Crucially, the evolution of regulatory clarity and a supportive legislative environment are indispensable for fostering long-term investment, innovation, and sustainable growth within the industry.

Key Players Shaping the Mexico Online Gambling Market Market

- Logrand Entertainment Group

- Novibet USA Inc

- Bet365 Group Ltd

- Bet Mexico

- Codere Online Luxembourg

- Playdoit (Atracciones America SA de CV)

- Playuzu

- Rush Street Interactive Inc

- Winnermx

- TV Global Enterprises Limited

- List Not Exhaustive

Notable Milestones in Mexico Online Gambling Market Sector

- October 2024: Novibet significantly expanded its North American presence, including Mexico, by launching its iGaming casino games, developed in collaboration with OBBSworks. This move signaled a commitment to the region's burgeoning online casino market.

- July 2024: Further solidifying its strategic growth, Novibet partnered with 7777gaming to enhance its casino game offerings across multiple key markets, including Mexico, Canada, Brazil, Chile, Ecuador, and Ireland, demonstrating a focused expansion strategy.

- April 2024: The collaborative spirit in the industry was highlighted as Playtech and bet365 jointly launched the innovative "Super Mega Ultra" live game show. This engaging entertainment format became available to players in various regions, notably including Mexico, catering to a demand for interactive gaming experiences.

In-Depth Mexico Online Gambling Market Market Outlook

The Mexico online gambling market is poised for significant expansion over the forecast period. Continued technological innovation, strategic partnerships, and regulatory developments will shape the market landscape. The focus on responsible gambling initiatives and the exploration of new gaming technologies will be crucial factors in sustaining long-term growth. Opportunities exist for both established players and new entrants to capitalize on the increasing demand for online gambling entertainment.

Mexico Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

- 1.2. Casino

- 1.3. Other Game Types

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

Mexico Online Gambling Market Segmentation By Geography

- 1. Mexico

Mexico Online Gambling Market Regional Market Share

Geographic Coverage of Mexico Online Gambling Market

Mexico Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.3. Market Restrains

- 3.3.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.4. Market Trends

- 3.4.1. Sports Betting Is The Preferred Game Type Amongst The Majority

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logrand Entertainment Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novibet USA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bet365 Group Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bet Mexico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Codere Online Luxembourg

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Playdoit (Atracciones America SA de CV)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Playuzu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rush Street Interactive Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winnermx

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TV Global Enterprises Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logrand Entertainment Group

List of Figures

- Figure 1: Mexico Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 3: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 5: Mexico Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Online Gambling Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 9: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 11: Mexico Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Online Gambling Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Online Gambling Market?

The projected CAGR is approximately 15.36%.

2. Which companies are prominent players in the Mexico Online Gambling Market?

Key companies in the market include Logrand Entertainment Group, Novibet USA Inc, Bet365 Group Ltd, Bet Mexico, Codere Online Luxembourg, Playdoit (Atracciones America SA de CV), Playuzu, Rush Street Interactive Inc, Winnermx, TV Global Enterprises Limited*List Not Exhaustive.

3. What are the main segments of the Mexico Online Gambling Market?

The market segments include Game Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

6. What are the notable trends driving market growth?

Sports Betting Is The Preferred Game Type Amongst The Majority.

7. Are there any restraints impacting market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

8. Can you provide examples of recent developments in the market?

October 2024: Novibet, in collaboration with OBBSworks, introduced its iGaming casino games on the Novibet platform, extending its reach across North America, including Mexico.July 2024: Novibet Partnered with 7777gaming company to feature its casino games across Mexico, Canada, Brazil, Chile, Ecuador, and Ireland. iLottery, Jackpot, and other casinos were among the major types of casinos available in the market.April 2024: In a collaboration with its long-time operator partner bet365, Playtech unveiled a bespoke live game show named Super Mega Ultra. This new live game show is accessible to bet365 players in various regions, such as the UK, Mexico, and Ontario. The game boasts an innovative three-tier base system across two wheels, presenting three payout levels: Super, Mega, and Ultra. Each round is designed with maximum multipliers: ×300 for Super, ×500 for Mega, and an impressive ×2500 for Ultra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Online Gambling Market?

To stay informed about further developments, trends, and reports in the Mexico Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence