Key Insights

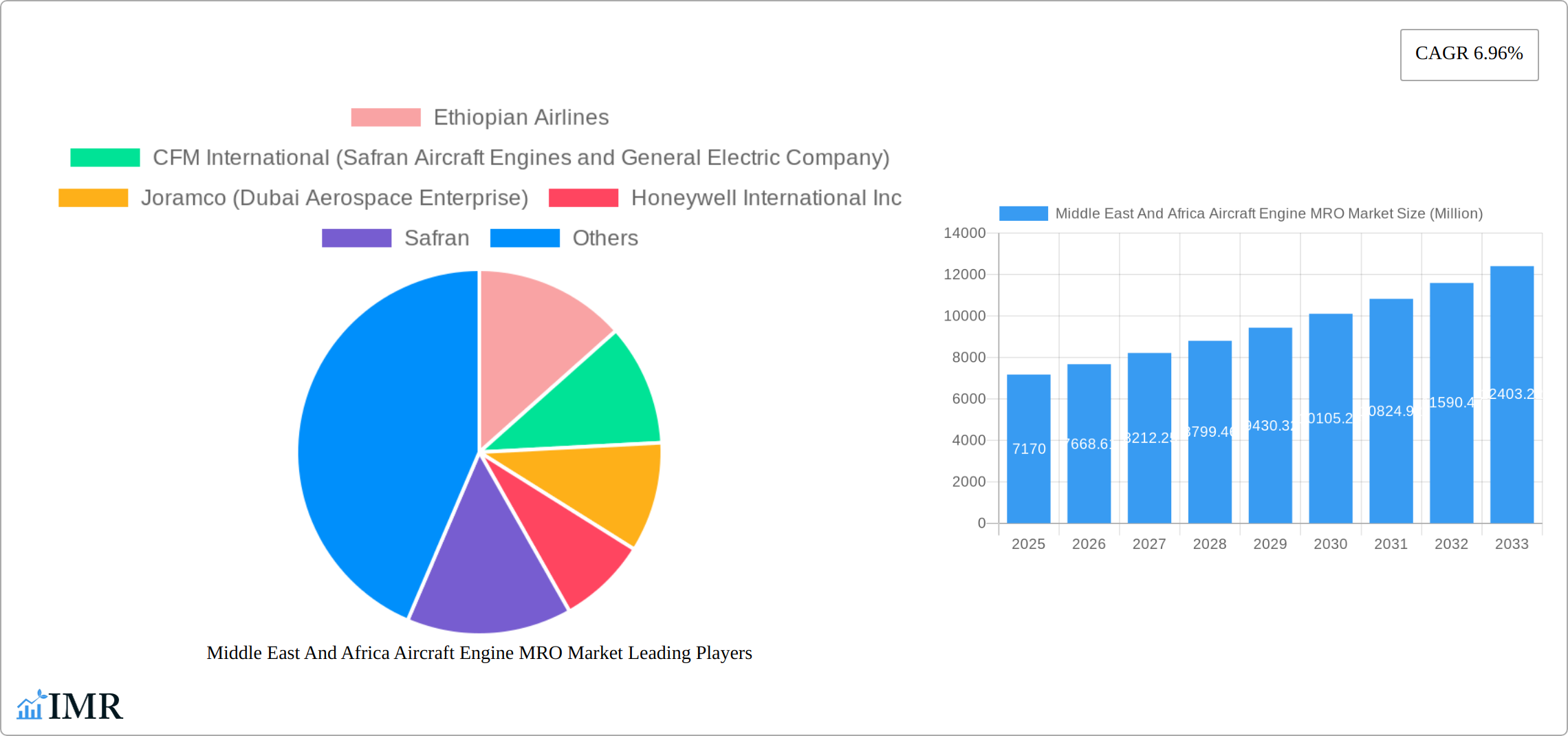

The Middle East and Africa Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market is experiencing robust growth, projected to reach a market size of $7.17 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.96% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning air travel sector across the region, particularly in rapidly developing economies, is driving increased demand for aircraft engine MRO services. Furthermore, the aging aircraft fleet necessitates regular maintenance and upgrades, contributing significantly to market growth. Government initiatives promoting aviation infrastructure development and investments in airline modernization are also playing a crucial role. The increasing adoption of advanced technologies in aircraft engine MRO, such as predictive maintenance and digital solutions, is further enhancing efficiency and reducing operational costs, thus boosting market adoption. Significant players like Ethiopian Airlines, CFM International, and Lufthansa Technik AG are contributing to the market's growth through their extensive service networks and technological advancements. The segment breakdown shows a significant contribution from commercial aviation, with military and general aviation also contributing to the overall growth. The African sub-region, particularly South Africa, is expected to witness substantial growth due to its relatively developed aviation infrastructure and increasing air passenger traffic.

Middle East And Africa Aircraft Engine MRO Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established global players and regional service providers. International companies benefit from established expertise and technological capabilities, while regional companies leverage localized knowledge and proximity to clients. This dynamic competition fosters innovation and ensures diverse service offerings catering to the unique needs of different operators. However, challenges such as infrastructure limitations in some African nations and fluctuating fuel prices pose potential constraints on market growth. Despite these challenges, the long-term outlook remains positive, driven by sustained growth in air travel and increased investment in aviation infrastructure across the Middle East and Africa. The continued focus on technological advancements within the industry will contribute to the market's overall expansion and efficiency gains in the coming years.

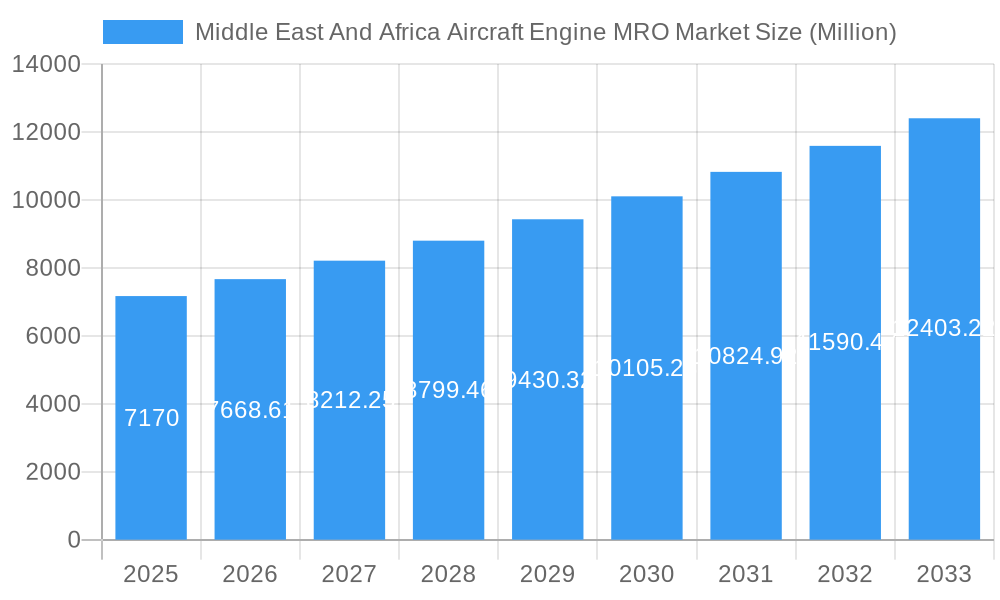

Middle East And Africa Aircraft Engine MRO Market Company Market Share

Middle East & Africa Aircraft Engine MRO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East & Africa Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market, offering invaluable insights for industry professionals, investors, and strategic planners. The study covers the historical period (2019-2024), base year (2025), and forecasts the market's trajectory until 2033. This report analyzes the market across key segments, including Commercial Aviation, Military Aviation, and General Aviation, providing granular data and strategic recommendations for navigating this dynamic landscape. The total market size in 2025 is estimated at xx Million units, with projected growth to xx Million units by 2033.

Middle East And Africa Aircraft Engine MRO Market Market Dynamics & Structure

The Middle East & Africa Aircraft Engine MRO market is characterized by a dynamic and evolving landscape, marked by a moderately concentrated structure. Key players, including established aviation giants like Ethiopian Airlines, the joint venture CFM International (comprising Safran Aircraft Engines and General Electric Company), Joramco (a subsidiary of Dubai Aerospace Enterprise), and innovative technology provider Honeywell International Inc, command significant market share. The primary catalysts for market expansion include relentless technological innovation, particularly in the realms of predictive maintenance, digital twin technology, and the integration of advanced materials for enhanced efficiency and reduced operational downtime. Conversely, navigating complex and varied regulatory hurdles across different nations and the persistent challenge of securing a highly skilled labor force present substantial obstacles.

Mergers and acquisitions (M&A) activity has been a notable feature, contributing to market consolidation and the expansion of service portfolios and geographical reach. The market's trajectory is further shaped by the burgeoning demand for air travel, proactive government initiatives aimed at modernizing national fleets, and the increasing adoption of next-generation engine technologies. Competitive substitution is largely driven by strategic engine type selection and the active choice between alternative MRO providers, profoundly influencing the market's competitive intensity.

- Market Concentration: The market exhibits a moderately concentrated structure, with projections indicating that the top 5 players will collectively hold approximately 55-65% of the market share by 2025.

- Technological Innovation: A strong emphasis is placed on leveraging predictive maintenance, implementing digital twin technology for comprehensive lifecycle management, and utilizing advanced materials to boost efficiency and minimize aircraft downtime.

- Regulatory Framework: Diverse and often differing regulatory frameworks across Middle East and African nations introduce complexities in operational execution and influence market entry strategies.

- Competitive Substitutes: The strategic selection of engine types and the choice among a variety of MRO providers are crucial determinants of competitive advantage.

- End-User Demographics: The primary customer base consists of commercial and military airlines, with growing contributions from general aviation operators and aircraft leasing companies.

- M&A Trends: Moderate M&A activity is observed, driven by strategic imperatives to expand service capabilities, broaden technological expertise, and enhance geographical presence. An estimated 8-12 significant M&A deals took place between 2019 and 2024.

Middle East And Africa Aircraft Engine MRO Market Growth Trends & Insights

The Middle East & Africa Aircraft Engine MRO market has experienced steady growth in recent years, driven by rising air passenger traffic, increased aircraft fleet modernization programs, and the growing demand for efficient maintenance solutions. The market size increased from xx Million units in 2019 to xx Million units in 2024. We forecast a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by a robust increase in commercial aviation and government initiatives for military aircraft modernization. The adoption rate of advanced MRO technologies is also steadily increasing, furthering market expansion. Consumer behavior shifts towards cost-effectiveness and improved maintenance quality significantly influence market dynamics. Factors like investment in infrastructure, airport expansions, and increasing tourism all contribute to the upward trend.

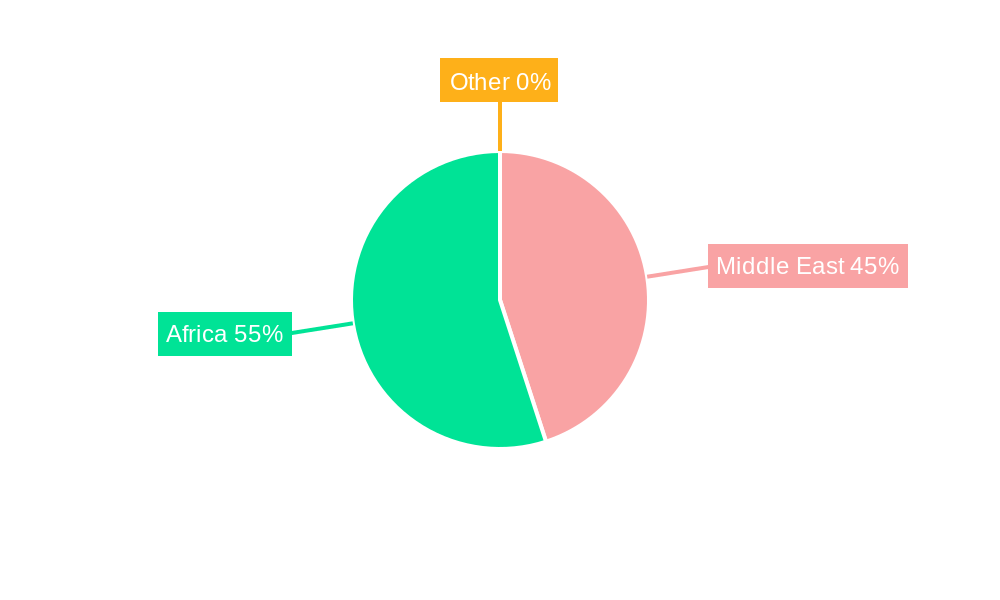

Dominant Regions, Countries, or Segments in Middle East And Africa Aircraft Engine MRO Market

The United Arab Emirates (UAE) and Egypt stand out as leading hubs within the Middle East & Africa Aircraft Engine MRO market. This prominence is attributable to their well-established MRO infrastructure, a substantial presence of major airlines, and supportive government policies designed to foster the growth of the aviation sector. The Commercial Aviation segment unequivocally dominates the market, fueled by the sustained expansion of air travel and the consequent escalating demand for comprehensive aircraft maintenance services.

- UAE: Benefits from a high concentration of airlines, its strategic geographical location as a global aviation nexus, and significant government investments in state-of-the-art aviation infrastructure.

- Egypt: Characterized by a burgeoning airline industry, robust and established MRO capabilities, and its advantageous proximity to key European markets.

- Commercial Aviation: This segment is projected to represent approximately 70-80% of the total market share in 2025, driven by a large aircraft fleet size and continuous maintenance requirements.

- Key Drivers: Economic growth, strong governmental support for the aviation sector, robust tourism expansion, and increasing regional air traffic are pivotal growth enablers.

Middle East And Africa Aircraft Engine MRO Market Product Landscape

The aircraft engine MRO market offers a range of services, including component repair, engine overhaul, and performance restoration. Technological advancements, such as predictive maintenance analytics and digital twin modeling, enhance efficiency and reduce downtime. Unique selling propositions include specialized expertise in specific engine types, quick turnaround times, and cost-effective solutions. The latest advancements prioritize sustainable practices such as reducing waste generation and using eco-friendly materials.

Key Drivers, Barriers & Challenges in Middle East And Africa Aircraft Engine MRO Market

Key Drivers: The unabated surge in air travel demand across the region serves as a primary growth engine. Substantial government investments in aviation infrastructure development and modernization programs, encompassing both commercial and military fleets, provide significant impetus. Furthermore, continuous advancements in predictive maintenance technologies are instrumental in enhancing operational efficiency and reducing overall maintenance costs.

Key Barriers & Challenges: Persistent supply chain disruptions, particularly concerning the availability of critical aircraft parts, represent a significant operational hurdle. The scarcity of highly skilled labor, coupled with inconsistent regulatory frameworks across different countries, poses considerable challenges to market expansion and operational standardization. Intense competition within the market further compresses margins and influences strategic decision-making. Moreover, volatile fuel prices and prevailing geopolitical uncertainties can introduce instability into the market.

- Supply Chain Challenges: Approximately 60-70% of surveyed MRO providers identified supply chain disruptions as a major concern in 2024.

Emerging Opportunities in Middle East And Africa Aircraft Engine MRO Market

Untapped markets in sub-Saharan Africa, growth in low-cost carriers, and a rising demand for specialized MRO services for newer engine technologies present significant opportunities. Focus on developing advanced digital solutions for predictive maintenance and developing a skilled workforce can further propel growth.

Growth Accelerators in the Middle East And Africa Aircraft Engine MRO Market Industry

Strategic partnerships between airlines and MRO providers, coupled with investments in advanced technologies and facility upgrades, will be key growth catalysts. Expanding into new markets in Africa and establishing specialized services for emerging aircraft engine types will also create new avenues for growth. Government initiatives aimed at promoting regional aviation and supporting investments in the MRO sector are crucial for sustained growth.

Key Players Shaping the Middle East And Africa Aircraft Engine MRO Market Market

- Ethiopian Airlines

- CFM International (Safran Aircraft Engines and General Electric Company)

- Joramco (Dubai Aerospace Enterprise)

- Honeywell International Inc

- Safran

- Lockheed Martin Corporation

- Pratt & Whitney (RTX Corporation)

- EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- Sanad (Mubadala Investment Company)

- Other Players: Lufthansa Technik AG (Lufthansa Group), Rolls-Royce plc, Emirates Engineering (Emirates Group), Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd, AMMROC (Edge), General Electric Company, STS Aviation Group, Saudia Aerospace Engineering Industries

Notable Milestones in Middle East And Africa Aircraft Engine MRO Market Sector

- 2020: Joramco significantly expands its MRO facility in Dubai, substantially enhancing its capacity and capabilities for aircraft engine maintenance services.

- 2021: A notable trend emerges as several leading airlines in the region make strategic investments in advanced predictive maintenance software solutions to optimize fleet performance.

- 2022: The market witnesses a significant consolidation with a major M&A deal finalized between two prominent regional MRO providers, redefining the competitive landscape.

- 2023: Governments across key nations announce substantial investments aimed at upgrading and modernizing critical aviation infrastructure, signaling long-term commitment to the sector.

- 2024: A leading MRO provider in the region launches an innovative and comprehensive training program specifically designed to address the growing demand for skilled aviation technicians.

In-Depth Middle East And Africa Aircraft Engine MRO Market Market Outlook

The Middle East & Africa Aircraft Engine MRO market is on an upward trajectory, poised for substantial and sustained growth over the next decade. The continued expansion of the aviation industry, underpinned by significant investments in cutting-edge technologies and the modernization of existing MRO facilities, will be instrumental in shaping future market dynamics. Strategic alliances and further consolidation through acquisitions are expected to continue driving market efficiency and specialization. To thrive in this evolving environment, market participants must proactively focus on cultivating a highly skilled workforce, adeptly navigating and mitigating supply chain vulnerabilities, and demonstrating a strong commitment to addressing environmental sustainability concerns.

The long-term outlook for the market remains decidedly positive, presenting significant opportunities for companies that exhibit agility and a forward-thinking approach to adapt to the ever-changing market landscape and technological advancements.

Middle East And Africa Aircraft Engine MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East And Africa Aircraft Engine MRO Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Aircraft Engine MRO Market Regional Market Share

Geographic Coverage of Middle East And Africa Aircraft Engine MRO Market

Middle East And Africa Aircraft Engine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CFM International (Safran Aircraft Engines and General Electric Company)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Joramco (Dubai Aerospace Enterprise)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Safran

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lockheed Martin Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pratt & Whitney (RTX Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sanad (Mubadala Investment Company)6 2 Other Players

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lufthansa Technik AG (Lufthansa Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rolls-Royce plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Emirates Engineering (Emirates Group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AMMROC (Edge)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 General Electric Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 STS Aviation Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Saudia Aerospace Engineering Industries

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle East And Africa Aircraft Engine MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Aircraft Engine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East And Africa Aircraft Engine MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East And Africa Aircraft Engine MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Aircraft Engine MRO Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Middle East And Africa Aircraft Engine MRO Market?

Key companies in the market include Ethiopian Airlines, CFM International (Safran Aircraft Engines and General Electric Company), Joramco (Dubai Aerospace Enterprise), Honeywell International Inc, Safran, Lockheed Martin Corporation, Pratt & Whitney (RTX Corporation), EGYPTAIR MAINTENANCE & ENGINEERING (EGYPTAIR Group), Sanad (Mubadala Investment Company)6 2 Other Players, Lufthansa Technik AG (Lufthansa Group), Rolls-Royce plc, Emirates Engineering (Emirates Group), Turbine Engine Maintenance Repair and Overhaul (Pty) Ltd, AMMROC (Edge), General Electric Company, STS Aviation Group, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle East And Africa Aircraft Engine MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Aircraft Engine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Aircraft Engine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Aircraft Engine MRO Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Aircraft Engine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence