Key Insights

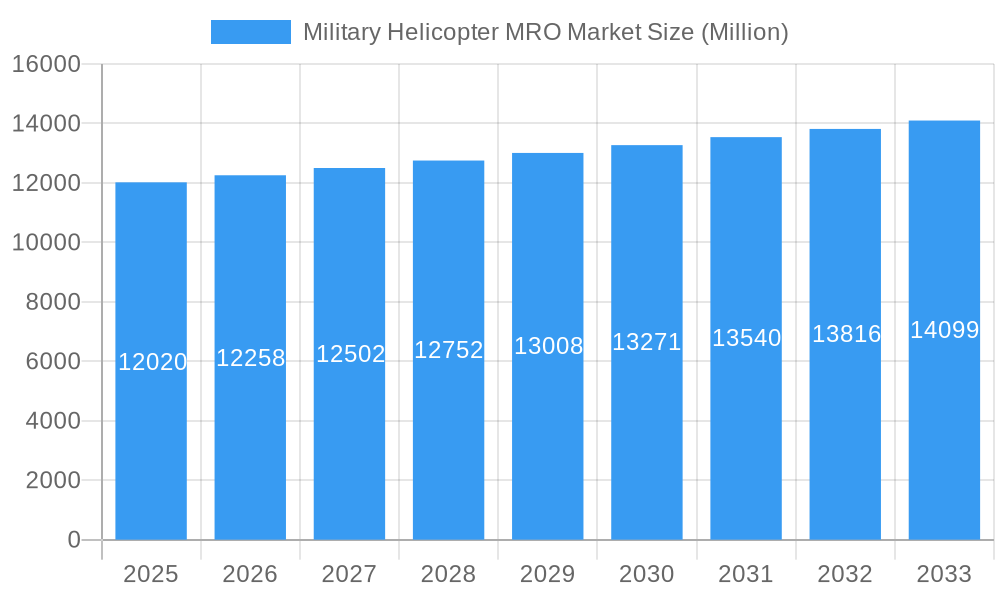

The Military Helicopter Maintenance, Repair, and Overhaul (MRO) market, valued at $12.02 billion in 2025, is projected to experience steady growth, driven by the aging global military helicopter fleet and the increasing operational demands placed on these assets. A Compound Annual Growth Rate (CAGR) of 1.92% from 2025 to 2033 suggests a continuous, albeit moderate, expansion. Key drivers include the need for extending the operational lifespan of existing helicopters, rising defense budgets in several regions, and the adoption of advanced MRO technologies to enhance efficiency and reduce downtime. Technological advancements, such as predictive maintenance using sensor data analytics and the incorporation of digital twins, are transforming the MRO landscape, enabling proactive maintenance and optimizing resource allocation. However, the market faces certain restraints. These include the high cost associated with specialized equipment and skilled labor, geopolitical instability potentially impacting maintenance contracts, and fluctuating defense spending in some countries. The market segmentation is likely diverse, encompassing various helicopter types, service offerings (e.g., component repair, engine overhaul, airframe maintenance), and geographical regions. Major players like Lockheed Martin, Safran, Airbus, and Leonardo compete fiercely, leveraging their expertise and global networks to secure lucrative contracts. Regional market variations are anticipated, with North America and Europe likely dominating due to strong defense budgets and established MRO infrastructure.

Military Helicopter MRO Market Market Size (In Billion)

The forecast period (2025-2033) presents opportunities for MRO providers to capitalize on the growing demand for their services. Strategic partnerships, investments in advanced technologies, and a focus on efficient service delivery are crucial for success. The market's steady growth trajectory presents a stable investment outlook, though careful consideration of regional variations and potential geopolitical risks is essential for informed decision-making. The competitive landscape is intense, necessitating a focus on differentiation through superior technological capabilities, operational efficiency, and strong customer relationships. Growth will likely be driven by increased modernization efforts of older fleets and a continuous emphasis on ensuring mission readiness of military helicopters.

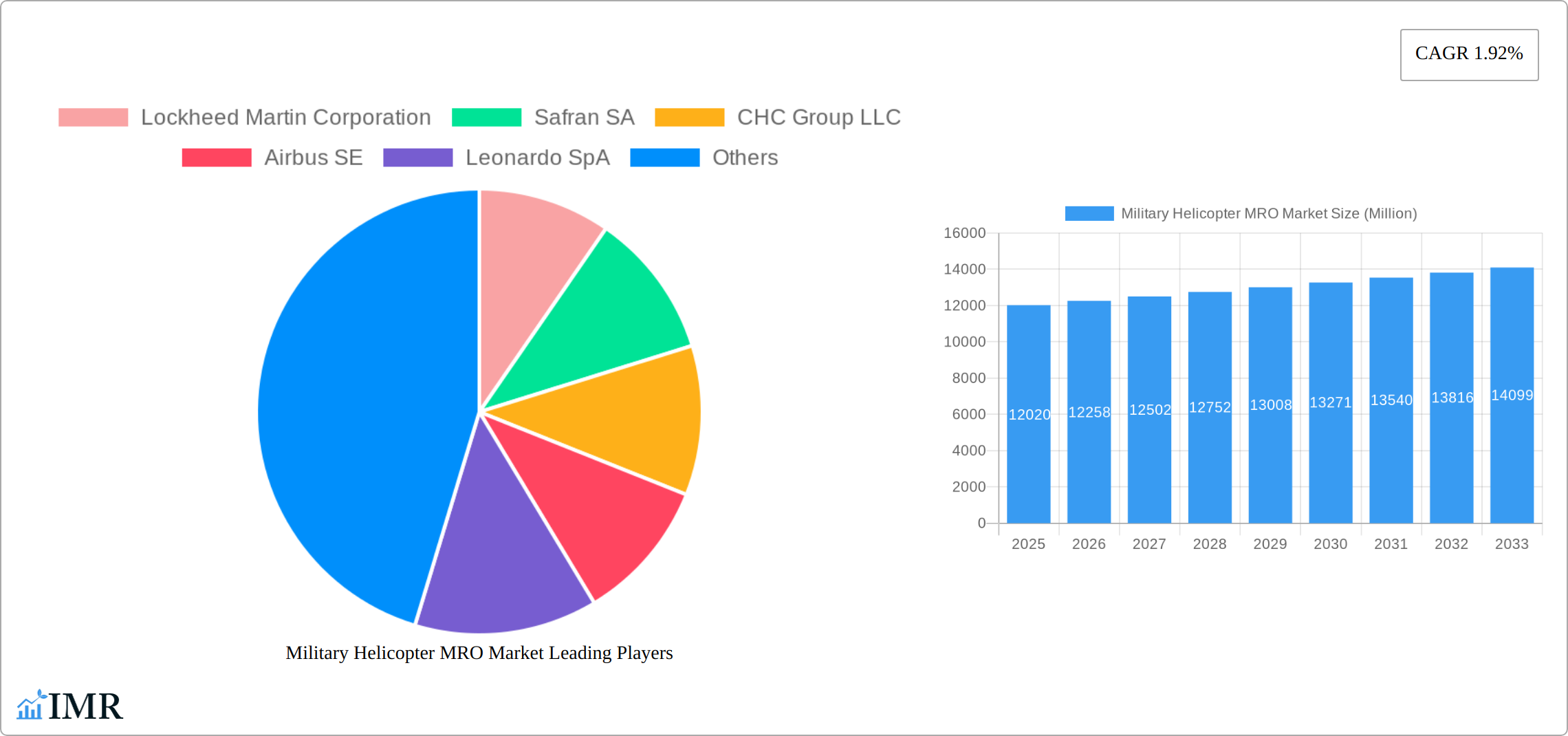

Military Helicopter MRO Market Company Market Share

Military Helicopter MRO Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Military Helicopter Maintenance, Repair, and Overhaul (MRO) market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 (Base Year: 2025, Estimated Year: 2025). The analysis delves into both the parent market (Military Aviation MRO) and the child market (Military Helicopter MRO), providing a granular understanding of this vital sector. The market size is projected to reach xx Million USD by 2033.

Military Helicopter MRO Market Dynamics & Structure

The Military Helicopter MRO market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, particularly in areas like predictive maintenance and digital solutions, is a key driver. Stringent regulatory frameworks and safety standards influence market operations, while the competitive landscape includes both established MRO providers and emerging players offering specialized services. The market also experiences considerable M&A activity, reflecting consolidation and expansion strategies. End-user demographics, primarily encompassing national armed forces and specialized military units, shape demand patterns.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Drivers: Predictive maintenance, AI-powered diagnostics, and digital twin technologies are driving efficiency and reducing downtime.

- Regulatory Landscape: Stringent safety regulations (e.g., FAA, EASA) significantly influence operational standards and compliance costs.

- M&A Activity: Significant M&A activity observed in recent years, with xx major deals recorded between 2019 and 2024, resulting in market consolidation.

- Innovation Barriers: High capital expenditure for advanced technologies, and the need for skilled labor, pose significant barriers to entry.

Military Helicopter MRO Market Growth Trends & Insights

The Military Helicopter MRO market is experiencing robust growth, driven by factors such as the aging global military helicopter fleet, increasing operational hours, and the adoption of advanced maintenance strategies. The market size expanded from xx Million USD in 2019 to xx Million USD in 2024, exhibiting a CAGR of xx%. Technological disruptions, such as the increasing adoption of digital technologies, are further accelerating growth. Shifts in consumer behavior, with greater emphasis on efficiency and cost optimization, also play a vital role. The market is expected to maintain a healthy growth trajectory in the forecast period, driven by sustained demand and technological advancements.

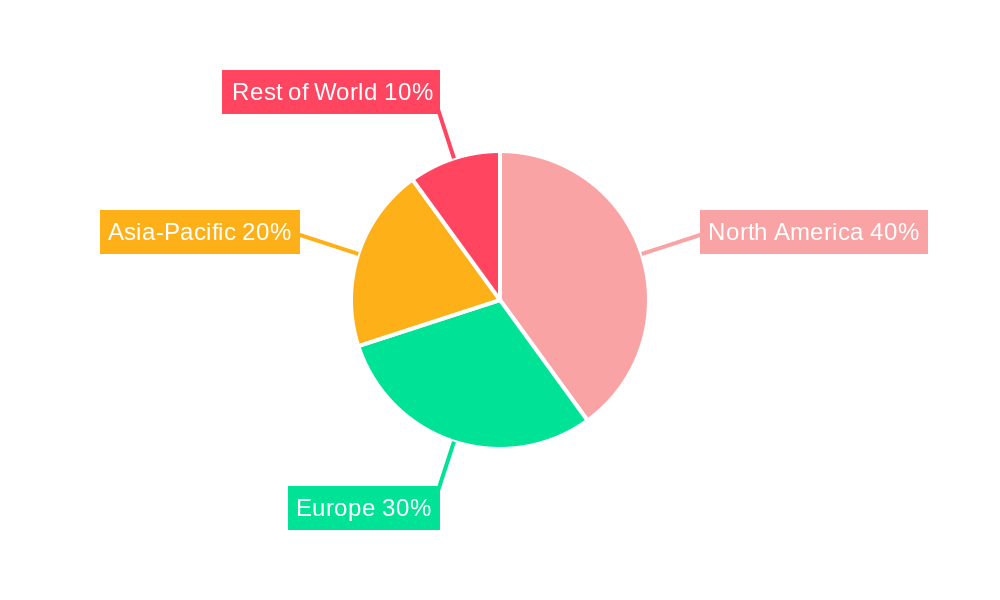

Dominant Regions, Countries, or Segments in Military Helicopter MRO Market

The global Military Helicopter Maintenance, Repair, and Overhaul (MRO) market is characterized by the established dominance of North America and Europe. This leadership is underpinned by their extensive existing fleets of military helicopters, substantial defense budgets allocated for upkeep and modernization, and well-developed, sophisticated MRO infrastructure. Concurrently, the Asia-Pacific region is rapidly ascending as a critical growth engine. This surge is directly attributable to escalating defense expenditures and comprehensive modernization initiatives undertaken by numerous nations within the region, including significant investments in advanced rotary-wing capabilities.

- North America: The region's market preeminence is driven by robust defense spending, continuous technological innovation, and a vast operational fleet demanding ongoing MRO support.

- Europe: With a long-standing foundation of specialized MRO infrastructure and deep-seated expertise, Europe remains a pivotal player in the global market.

- Asia-Pacific: This region is witnessing accelerated growth fueled by burgeoning defense budgets and the strategic modernization of military helicopter fleets, particularly in key countries like India and China, which are investing heavily in expanding and upgrading their rotary-wing assets.

- Middle East & Africa: Market expansion in these regions is primarily propelled by ambitious defense modernization programs and the persistent geopolitical landscape, which necessitates robust and ready helicopter capabilities.

Military Helicopter MRO Market Product Landscape

The Military Helicopter MRO market encompasses a comprehensive spectrum of services designed to ensure the airworthiness, performance, and longevity of these critical assets. This includes routine scheduled maintenance, addressing unforeseen unscheduled repairs, in-depth component overhaul and refurbishment, meticulous engine repair and diagnostics, and specialized structural and avionics modifications to meet evolving operational requirements. Innovation within this sector is sharply focused on enhancing operational efficiency, minimizing aircraft downtime, and extending the overall service life of military helicopters. The integration of cutting-edge technologies such as predictive analytics for proactive maintenance, and augmented reality (AR) for technician assistance and training, is revolutionizing maintenance procedures. Key competitive advantages for MRO providers include achieving faster turnaround times for repairs and overhauls, delivering cost-effective solutions without compromising quality, and ensuring enhanced operational reliability and readiness for demanding military missions.

Key Drivers, Barriers & Challenges in Military Helicopter MRO Market

Key Drivers:

- Increasing operational hours of military helicopters

- Aging helicopter fleets requiring more frequent maintenance

- Technological advancements driving efficiency and reducing downtime

- Rising defense budgets in several regions

Key Challenges:

- High initial investment costs for advanced technologies

- Skill shortages in specialized maintenance expertise

- Stringent regulatory compliance requirements

- Intense competition from established and emerging players, leading to price pressure. This resulted in an estimated xx% decrease in average revenue per MRO contract in 2024 compared to 2019.

Emerging Opportunities in Military Helicopter MRO Market

- Growth in the Asia-Pacific region presents significant expansion opportunities.

- The increasing adoption of digital technologies presents opportunities for developing innovative MRO solutions.

- Specialized services catering to unique needs of emerging military platforms presents new potential avenues for growth.

Growth Accelerators in the Military Helicopter MRO Market Industry

The long-term trajectory of the Military Helicopter MRO market is being significantly propelled by several converging factors. A primary driver is the ongoing global modernization of military helicopter fleets, which necessitates specialized MRO support for newer platforms and upgrades. Strategic collaborations and partnerships between MRO service providers and Original Equipment Manufacturers (OEMs) are crucial for knowledge transfer, technology development, and ensuring seamless support throughout an aircraft's lifecycle. The continuous emergence and adoption of new technologies that enhance operational efficiency and enable sophisticated predictive maintenance capabilities are also key accelerators. Furthermore, the strategic expansion of MRO services into nascent and emerging markets, coupled with the development of highly specialized and niche maintenance services tailored to specific platform requirements, will serve as vital catalysts for sustained market growth.

Key Players Shaping the Military Helicopter MRO Market Market

- Lockheed Martin Corporation

- Safran SA

- CHC Group LLC

- Airbus SE

- Leonardo SpA

- Saudi Rotorcraft Support Company Ltd

- Elbit Systems Ltd

- Honeywell International Ltd

- AAR Corp

- MTU Aero Engines AG

Notable Milestones in Military Helicopter MRO Market Sector

- June 2023: Airbus Helicopters, Kongsberg Defence & Aerospace, and KONGSBERG formalized an MoU for customized maintenance services for the Norwegian Army's new helicopter fleet. This highlights growing demand for specialized MRO services.

- February 2024: Airbus Helicopter secured MRO agreements with PT Garuda Maintenance Facility (GMF) Aero Asia and PT LEN Industri in Indonesia, signifying expansion into the Asia-Pacific market and fostering local MRO capabilities.

In-Depth Military Helicopter MRO Market Market Outlook

The Military Helicopter MRO market is exceptionally well-positioned for robust and sustained growth in the coming years. This positive outlook is underpinned by a confluence of critical factors, including the relentless pace of technological advancements, steadily increasing global defense expenditures, and a substantial and aging helicopter fleet that requires continuous and advanced maintenance, repair, and upgrade services. Strategic alliances between key industry players, aggressive expansion into promising emerging markets, and the proactive adoption of innovative MRO solutions are anticipated to significantly accelerate market expansion and unlock substantial opportunities for both established market leaders and agile new entrants. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, presenting a highly lucrative and attractive investment landscape for all stakeholders involved in this vital sector.

Military Helicopter MRO Market Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component and Modifications MRO

- 1.3. Airframe MRO

- 1.4. Field Maintenance

Military Helicopter MRO Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Military Helicopter MRO Market Regional Market Share

Geographic Coverage of Military Helicopter MRO Market

Military Helicopter MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Engine Maintenance Segment is Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component and Modifications MRO

- 5.1.3. Airframe MRO

- 5.1.4. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component and Modifications MRO

- 6.1.3. Airframe MRO

- 6.1.4. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component and Modifications MRO

- 7.1.3. Airframe MRO

- 7.1.4. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component and Modifications MRO

- 8.1.3. Airframe MRO

- 8.1.4. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component and Modifications MRO

- 9.1.3. Airframe MRO

- 9.1.4. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Military Helicopter MRO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component and Modifications MRO

- 10.1.3. Airframe MRO

- 10.1.4. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lockheed Martin Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Safran SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHC Group LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Rotorcraft Support Company Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elbit Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Honeywell International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AAR Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MTU Aero Engines A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global Military Helicopter MRO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Military Helicopter MRO Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 4: North America Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 5: North America Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 6: North America Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 7: North America Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 12: Europe Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 13: Europe Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 14: Europe Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 15: Europe Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 20: Asia Pacific Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 21: Asia Pacific Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 22: Asia Pacific Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 23: Asia Pacific Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 28: Latin America Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 29: Latin America Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 30: Latin America Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 31: Latin America Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Latin America Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Latin America Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Military Helicopter MRO Market Revenue (Million), by MRO Type 2025 & 2033

- Figure 36: Middle East and Africa Military Helicopter MRO Market Volume (Billion), by MRO Type 2025 & 2033

- Figure 37: Middle East and Africa Military Helicopter MRO Market Revenue Share (%), by MRO Type 2025 & 2033

- Figure 38: Middle East and Africa Military Helicopter MRO Market Volume Share (%), by MRO Type 2025 & 2033

- Figure 39: Middle East and Africa Military Helicopter MRO Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Military Helicopter MRO Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Military Helicopter MRO Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Military Helicopter MRO Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 3: Global Military Helicopter MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Military Helicopter MRO Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 6: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 7: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: US Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: US Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 14: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 15: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: France Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Russia Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 28: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 29: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: China Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: India Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Korea Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 42: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 43: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: Brazil Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Latin America Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Latin America Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Military Helicopter MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 50: Global Military Helicopter MRO Market Volume Billion Forecast, by MRO Type 2020 & 2033

- Table 51: Global Military Helicopter MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Military Helicopter MRO Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Saudi Arabia Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Saudi Arabia Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: United Arab Emirates Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: United Arab Emirates Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Middle East and Africa Military Helicopter MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Middle East and Africa Military Helicopter MRO Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Helicopter MRO Market?

The projected CAGR is approximately 1.92%.

2. Which companies are prominent players in the Military Helicopter MRO Market?

Key companies in the market include Lockheed Martin Corporation, Safran SA, CHC Group LLC, Airbus SE, Leonardo SpA, Saudi Rotorcraft Support Company Ltd, Elbit Systems Ltd, Honeywell International Ltd, AAR Corp, MTU Aero Engines A.

3. What are the main segments of the Military Helicopter MRO Market?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Engine Maintenance Segment is Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: European helicopter manufacturer Airbus Helicopter solidified maintenance, repair, and overhaul (MRO) agreements with two Indonesian aerospace firms. The initial pact was with MRO specialist PT Garuda Maintenance Facility (GMF) Aero Asia. In this collaboration, Airbus committed to lending its expertise and technical support for designing, manufacturing, and retrofitting five AS332 Super Puma helicopters, which were part of the Indonesian Air Force's fleet. Additionally, Airbus signed a memorandum of understanding (MoU) with state-owned defense entity PT LEN Industri (Defend ID), focusing on aerostructure production, bolstering helicopter manufacturing, and enhancing local MRO capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Helicopter MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Helicopter MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Helicopter MRO Market?

To stay informed about further developments, trends, and reports in the Military Helicopter MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence