Key Insights

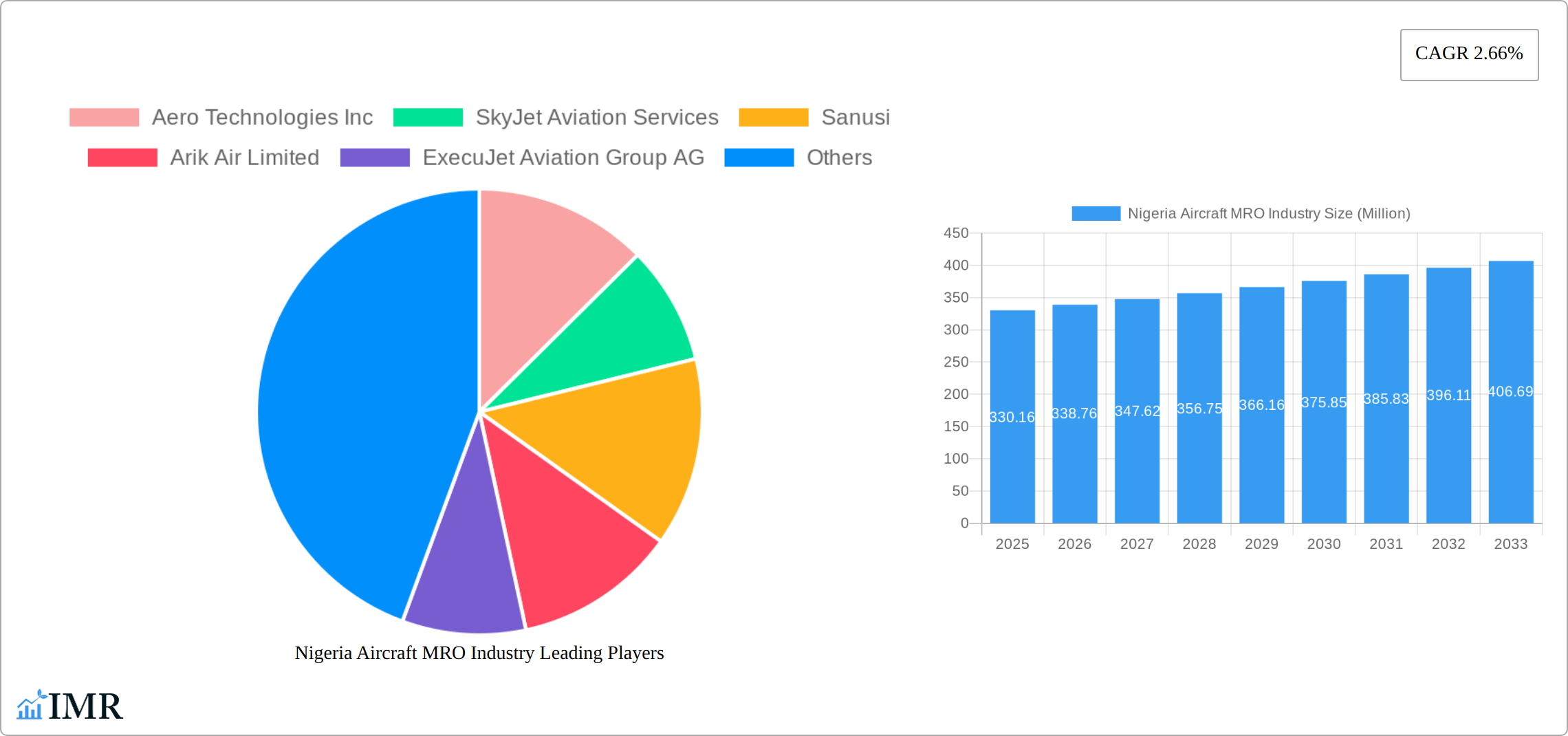

The Nigerian aircraft maintenance, repair, and overhaul (MRO) market, valued at $330.16 million in 2025, is projected to experience steady growth, driven primarily by the increasing number of aircraft in operation within the country and the expanding domestic and regional air travel demand. This growth is further fueled by a rising focus on aircraft safety and regulatory compliance, necessitating regular maintenance and upgrades. Key market segments include engine maintenance, component overhaul, interior refurbishment, airframe repairs, modifications, and field maintenance services. While the current market is dominated by a mix of international and domestic players, including Aero Technologies Inc, SkyJet Aviation Services, and Arik Air Limited, the market presents opportunities for both established players and new entrants to expand their services and capture market share. The steady CAGR of 2.66% suggests a predictable, albeit moderate, growth trajectory over the forecast period (2025-2033). Challenges may include infrastructure limitations and the need for skilled technicians; however, government initiatives aimed at improving aviation infrastructure and training programs could mitigate these constraints.

Nigeria Aircraft MRO Industry Market Size (In Million)

The forecast period (2025-2033) reveals a promising outlook for the Nigerian Aircraft MRO sector. Continued growth in air travel, coupled with the aging aircraft fleet in the region, will inevitably increase the demand for MRO services. The diversification of services offered by MRO providers, incorporating advanced technologies and specialized repair capabilities, will be crucial for competitiveness. The expansion of regional partnerships and collaborations with international MRO companies is anticipated to enhance technological capabilities and expertise within the Nigerian market. While competition remains strong, the long-term growth prospects remain positive, presenting significant investment opportunities for businesses operating in this sector. This growth will be significantly influenced by the continued development of the Nigerian aviation industry and the stability of the regional economy.

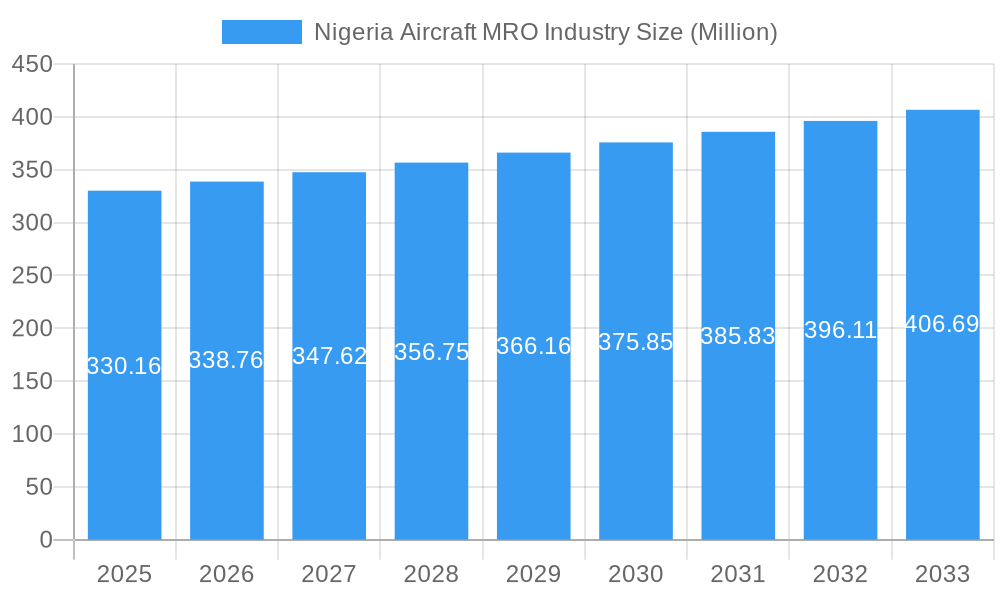

Nigeria Aircraft MRO Industry Company Market Share

This comprehensive report provides a detailed analysis of the Nigeria Aircraft MRO (Maintenance, Repair, and Overhaul) industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within this rapidly evolving sector.

Nigeria Aircraft MRO Industry Market Dynamics & Structure

The Nigerian Aircraft MRO market is characterized by a moderate level of concentration, with a few established players alongside emerging smaller companies. Market size in 2025 is estimated at xx Million. The industry is driven by technological advancements in aircraft maintenance and repair techniques, increasing demand for air travel, and government initiatives to improve aviation infrastructure. However, regulatory hurdles, a shortage of skilled labor, and fluctuating fuel prices present significant challenges. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the market share in 2025. M&A activity within the sector has been relatively low in the historical period (2019-2024), with an estimated xx M&A deals.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Driven by advancements in predictive maintenance and digital technologies.

- Regulatory Framework: A mix of national and international regulations, creating complexities.

- Competitive Substitutes: Limited direct substitutes, but cost pressures from international MRO providers.

- End-User Demographics: Primarily domestic airlines, with increasing participation from international carriers.

- M&A Trends: Relatively low historical activity, but potential for increased consolidation in the forecast period.

Nigeria Aircraft MRO Industry Growth Trends & Insights

The Nigerian Aircraft MRO market has witnessed a steady growth trajectory in recent years, driven by factors such as rising air passenger traffic and the expansion of domestic airlines. The market size experienced a CAGR of xx% during the historical period (2019-2024), reaching xx Million in 2024. The forecast period (2025-2033) projects a CAGR of xx%, with market size reaching xx Million by 2033. This growth is fueled by increased adoption of advanced maintenance technologies and a growing awareness of the importance of safety and reliability in the aviation industry. Technological disruptions, such as the introduction of AI-powered predictive maintenance systems, are significantly impacting market dynamics. Consumer behavior is shifting towards a greater emphasis on efficiency, cost-effectiveness, and faster turnaround times for aircraft maintenance.

Dominant Regions, Countries, or Segments in Nigeria Aircraft MRO Industry

Lagos and Abuja stand as the preeminent hubs for aircraft Maintenance, Repair, and Overhaul (MRO) activities in Nigeria. This dominance is intrinsically linked to their status as major international and domestic airport locations, serving as bases for the majority of airlines operating within the country. Currently, the Engine and Component segments command the largest share of the market due to the inherent complexity and substantial cost associated with their maintenance and overhaul. However, the outlook indicates a significant acceleration in the growth trajectory for the Airframe and Interior segments in the coming years, driven by fleet modernization and increasing passenger expectations.

- Key Drivers of Regional and Segment Dominance:

- Strategic Airport Proximity: The concentration of MRO facilities in close proximity to major airports ensures swift turnaround times and reduced logistical complexities for airlines.

- Availability of Specialized Expertise: The presence of established MRO providers in these regions has fostered a pool of skilled technicians and engineers with specialized knowledge in various aircraft systems.

- Airline Base Operations: Major domestic and international airlines often base their operations and maintenance departments in Lagos and Abuja, naturally concentrating MRO demand.

- Technological Infrastructure: The leading regions tend to have better access to advanced diagnostic tools and repair equipment necessary for complex MRO tasks.

- Dominant Segments Rationale:

- Engine MRO: Engines are the most critical and complex components of an aircraft, requiring highly specialized maintenance and overhaul procedures, often involving substantial capital investment and expertise.

- Component MRO: A wide array of aircraft components, from landing gear to avionics, require regular maintenance and repair, creating a significant and consistent demand.

- Airframe MRO Growth: As the Nigerian airline fleet ages and new aircraft are introduced, the demand for structural checks, repairs, and modifications for airframes is projected to rise considerably.

- Interior MRO Expansion: With increasing competition and a focus on passenger experience, airlines are investing more in cabin refurbishments and interior upgrades, fueling growth in this segment.

Nigeria Aircraft MRO Industry Product Landscape

The Nigerian Aircraft MRO industry offers a range of services, from engine and component maintenance to airframe repairs and interior refurbishment. Technological advancements have led to the adoption of predictive maintenance and digital solutions, improving efficiency and reducing downtime. Unique selling propositions often include specialized expertise in specific aircraft types, competitive pricing, and quick turnaround times.

Key Drivers, Barriers & Challenges in Nigeria Aircraft MRO Industry

The Nigerian Aircraft MRO industry is experiencing a dynamic period, shaped by several influential factors:

Key Drivers:

- Robust Air Travel Demand: The burgeoning population and increasing middle class in Nigeria are fueling a consistent rise in both domestic and international air travel, creating a sustained need for operational aircraft.

- Government Support for Aviation: Initiatives by the Nigerian government to enhance aviation infrastructure, promote local content, and attract investment are providing a fertile ground for MRO sector development. This includes efforts to establish Nigeria as a regional aviation hub.

- Fleet Expansion and Modernization: The ongoing expansion and modernization of fleets by Nigerian airlines necessitate advanced and reliable MRO services to ensure airworthiness and operational efficiency.

- Demand for Cost-Effective Solutions: Airlines are actively seeking MRO providers that can offer efficient, high-quality, and cost-effective solutions to manage their maintenance expenditures.

- Technological Advancements: The adoption of new technologies, such as digital diagnostics and predictive maintenance tools, is becoming a key driver for enhancing MRO capabilities and offering competitive services.

Key Barriers & Challenges:

- Shortage of Skilled Workforce: A significant challenge is the scarcity of highly skilled and certified aviation technicians and engineers. This deficit directly impacts the capacity of MRO providers, prolongs lead times, and can hinder the adoption of advanced maintenance techniques. Addressing this requires robust training programs and talent development initiatives.

- High Cost of Imported Parts and Equipment: The Nigerian MRO industry heavily relies on imported aircraft parts and specialized equipment. Fluctuations in foreign exchange rates and import duties significantly increase operational costs, impacting pricing and competitiveness.

- Regulatory Complexity and Bureaucracy: Navigating the intricate regulatory landscape and administrative processes within Nigeria can be time-consuming and complex. This can lead to delays in approvals, certifications, and overall operational efficiency, potentially impacting project timelines and increasing costs.

- Access to Capital and Financing: Establishing and upgrading MRO facilities requires substantial capital investment. Securing adequate financing and competitive interest rates can be a significant hurdle for local MRO providers.

- Limited Local Manufacturing of Parts: The dependence on imported parts limits local value addition and can contribute to supply chain vulnerabilities.

Emerging Opportunities in Nigeria Aircraft MRO Industry

- Regional MRO Hub Expansion: Leveraging its strategic location, Nigeria has the potential to expand its MRO services to cater to neighboring West African countries, thereby increasing its market share and revenue streams.

- Specialized MRO Services: Developing niche expertise in the maintenance of specific aircraft types, engines, or complex avionics systems can create a competitive advantage and attract a dedicated customer base.

- Sustainable and Eco-Friendly MRO Practices: With a growing global emphasis on environmental responsibility, there is a significant opportunity for MRO providers to adopt and offer sustainable maintenance solutions, including waste reduction, energy efficiency, and the use of environmentally friendly materials.

- Digitalization and Data Analytics: Implementing advanced digital platforms for maintenance planning, execution, and data analysis can enhance efficiency, reduce downtime, and offer value-added services to airlines.

- Component Repair and Overhaul Capabilities: Investing in and developing robust capabilities for the repair and overhaul of critical aircraft components locally can reduce reliance on foreign suppliers and improve cost-effectiveness for airlines.

- Training and Certification Centers: Establishing accredited training and certification centers can address the skills gap and create a sustainable pipeline of qualified MRO professionals, further boosting the industry's capabilities.

Growth Accelerators in the Nigeria Aircraft MRO Industry

Several key factors are poised to significantly propel the growth of the Nigeria Aircraft MRO industry. The integration of technological advancements, particularly in the realm of predictive maintenance and digital solutions, is fundamental. These technologies enable proactive identification of potential issues, minimizing unexpected downtime and optimizing maintenance schedules. Furthermore, the fostering of strategic partnerships between domestic airlines and established international MRO providers is crucial. These collaborations facilitate the transfer of knowledge, technology, and best practices, thereby enhancing the industry's overall capacity and expertise. The establishment of new, state-of-the-art MRO facilities, supported by targeted government incentives and favorable investment policies, will further accelerate market expansion by increasing service availability and competition.

Key Players Shaping the Nigeria Aircraft MRO Industry Market

- Aero Technologies Inc

- SkyJet Aviation Services

- Sanusi

- Arik Air Limited

- ExecuJet Aviation Group AG

- TekniTeed Nigeria Limited

- Onedot AG

- AJW

- Logos Aviation Inc

- JetMS (Avia Solutions Group)

Notable Milestones in Nigeria Aircraft MRO Industry Sector

- September 2023: Dana Air strengthens collaboration with Seven Star Global Hangar, boosting MRO services for Nigerian airlines.

- September 2023: Air Peace partners with Embraer, acquiring 10 new aircraft and establishing a new MRO facility in Nigeria.

In-Depth Nigeria Aircraft MRO Industry Market Outlook

The Nigerian Aircraft MRO market presents a compelling outlook, characterized by robust growth potential and evolving dynamics. The increasing demand for air travel, driven by economic development and population growth, forms a fundamental pillar for sustained MRO activity. Complementing this, proactive government initiatives aimed at transforming Nigeria into a regional aviation hub are creating an environment conducive to investment and expansion. The widespread adoption of technological advancements, from sophisticated diagnostic tools to digital record-keeping, is not only enhancing the efficiency and quality of MRO services but also reducing operational costs for airlines. The strategic cultivation of partnerships and alliances between local and international players is pivotal in bridging the knowledge and technology gap, thereby elevating the industry's capabilities. Furthermore, substantial investment in aviation infrastructure, including the modernization of airports and the development of dedicated MRO facilities, will unlock significant opportunities. This confluence of factors is projected to lead to a substantial increase in the market size, foster greater operational efficiency within the sector, and ultimately propel Nigeria's aviation industry towards a future of enhanced competitiveness and global standing. The market is primed for significant expansion, attracting further investment and solidifying Nigeria's position in the global aviation landscape.

Nigeria Aircraft MRO Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Aircraft MRO Industry Segmentation By Geography

- 1. Niger

Nigeria Aircraft MRO Industry Regional Market Share

Geographic Coverage of Nigeria Aircraft MRO Industry

Nigeria Aircraft MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine Segment to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Aircraft MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aero Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SkyJet Aviation Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanusi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arik Air Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExecuJet Aviation Group AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TekniTeed Nigeria Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Onedot AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJW

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Logos Aviation Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JetMS (Avia Solutions Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aero Technologies Inc

List of Figures

- Figure 1: Nigeria Aircraft MRO Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Aircraft MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Nigeria Aircraft MRO Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Aircraft MRO Industry?

The projected CAGR is approximately 2.66%.

2. Which companies are prominent players in the Nigeria Aircraft MRO Industry?

Key companies in the market include Aero Technologies Inc, SkyJet Aviation Services, Sanusi, Arik Air Limited, ExecuJet Aviation Group AG, TekniTeed Nigeria Limited, Onedot AG, AJW, Logos Aviation Inc, JetMS (Avia Solutions Group).

3. What are the main segments of the Nigeria Aircraft MRO Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 330.16 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine Segment to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2023: Dana Air announced its commitment to fortify its collaboration with Seven Star Global Hangar, demonstrating a steadfast dedication to enhancing Maintenance, Repair, and Overhaul (MRO) services for Nigerian airlines. This strategic move underscores Dana Air's continuous endeavors to foster the expansion of the aviation industry, placing a strong emphasis on capacity building and fostering partnerships with local MRO entities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Aircraft MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Aircraft MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Aircraft MRO Industry?

To stay informed about further developments, trends, and reports in the Nigeria Aircraft MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence