Key Insights

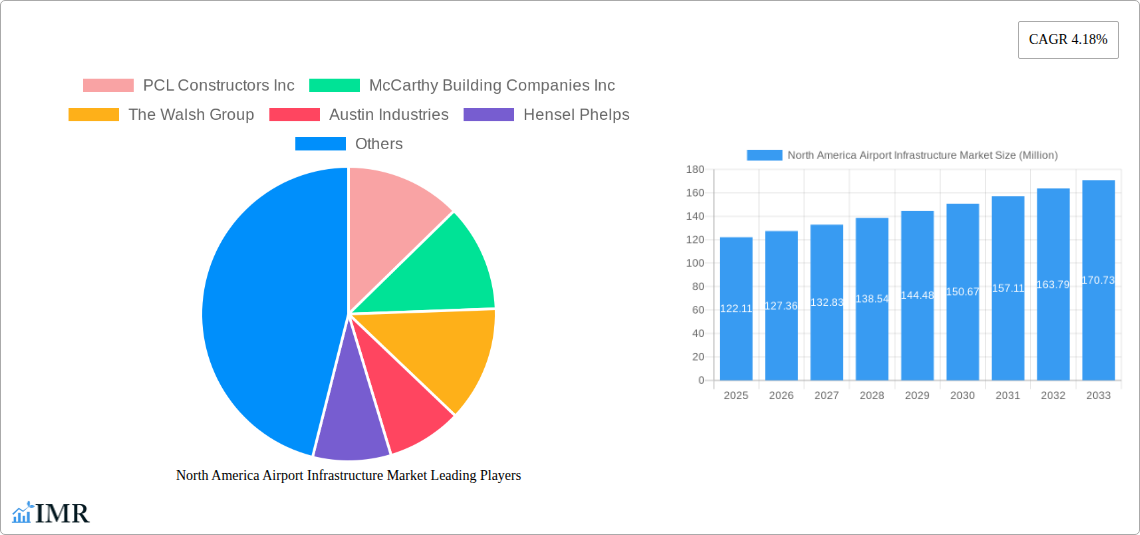

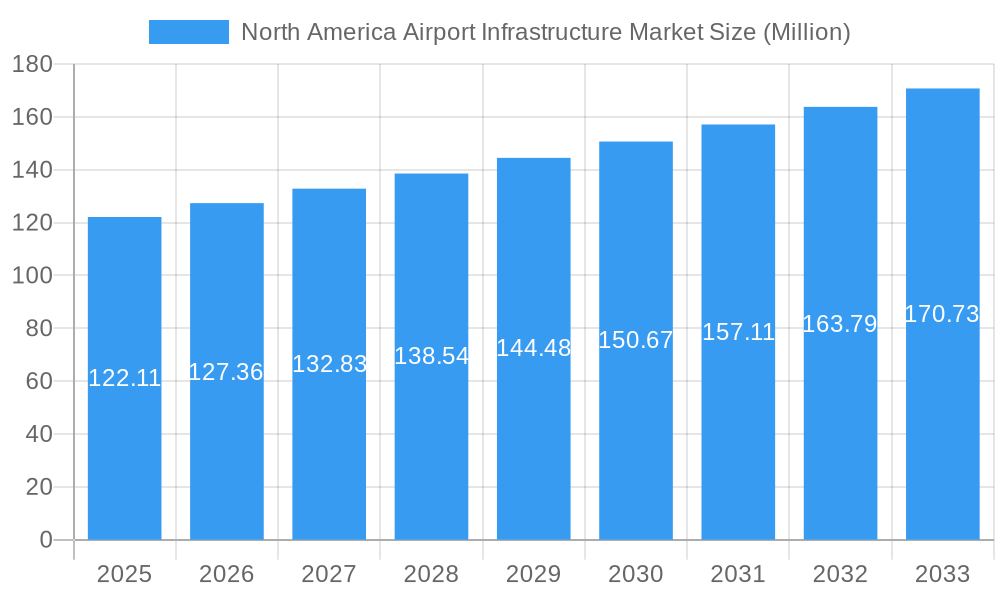

The North America airport infrastructure market, valued at $122.11 million in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, government investments in airport modernization, and the expansion of existing airports to accommodate larger aircraft and growing passenger volumes. Key drivers include the need for improved safety and efficiency, the implementation of advanced technologies like smart airport solutions, and the focus on sustainable infrastructure development. The market is segmented by infrastructure type (terminals, taxiways and runways, aprons, control towers, hangars, and others) and airport type (brownfield and greenfield airports). Brownfield airport projects, focusing on upgrading and expanding existing facilities, are expected to dominate the market share initially, followed by gradual but consistent growth in greenfield airport construction as new airport projects are undertaken to meet rising demand. Major players like PCL Constructors Inc., McCarthy Building Companies Inc., and The Walsh Group are actively shaping the market landscape through their involvement in large-scale projects and strategic partnerships. The United States is expected to hold the largest market share within North America due to its extensive air travel network and ongoing infrastructure investments.

North America Airport Infrastructure Market Market Size (In Million)

Growth within the North American airport infrastructure market is anticipated to be consistent throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of 4.18%. This growth will be influenced by factors such as increasing government regulations focused on improving airport safety and security, the rising adoption of sustainable infrastructure practices, and continued technological advancements within airport operations and management. While potential restraints, such as economic downturns and supply chain disruptions, might temporarily impact growth, the long-term outlook remains positive, driven by the inherent need for expanding and modernizing airport facilities to meet the continuously evolving demands of the aviation industry. The market's segmentation allows for tailored strategies by contractors and developers, focusing on specific infrastructure needs and airport types to maximize market penetration and profitability.

North America Airport Infrastructure Market Company Market Share

North America Airport Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America airport infrastructure market, covering the period 2019-2033, with a focus on market dynamics, growth trends, key players, and future outlook. The report segments the market by infrastructure type (terminals, taxiways and runways, aprons, control towers, hangars, others) and airport type (brownfield and greenfield airports). The total market size is projected to reach xx Million by 2033.

Parent Market: North America Construction Market Child Market: Airport Infrastructure Development

North America Airport Infrastructure Market Dynamics & Structure

The North America airport infrastructure market is characterized by moderate concentration, with a few large players dominating the construction and engineering segments. Market dynamics are shaped by technological innovation, stringent regulatory frameworks, and increasing competition. Mergers and acquisitions (M&A) activity remains significant, driven by the need for expansion and diversification. The historical period (2019-2024) saw a xx% CAGR, while the forecast period (2025-2033) is projected to experience a xx% CAGR.

- Market Concentration: The top 5 contractors account for approximately xx% of the market share in 2025.

- Technological Innovation: Increased adoption of Building Information Modeling (BIM), advanced materials, and automation technologies are driving efficiency gains. However, high initial investment costs present a barrier to wider adoption.

- Regulatory Framework: Stringent safety regulations and environmental compliance standards influence project timelines and costs.

- Competitive Product Substitutes: Limited direct substitutes exist, but alternative construction methods and materials are constantly evolving.

- End-User Demographics: Growth is driven by increasing passenger traffic, government investment in infrastructure modernization, and the need for enhanced safety and security.

- M&A Trends: A total of xx M&A deals were recorded between 2019 and 2024, primarily focused on expanding geographical reach and service offerings.

North America Airport Infrastructure Market Growth Trends & Insights

The North America airport infrastructure market exhibits robust growth, fueled by increasing passenger traffic, government investments in infrastructure upgrades, and the adoption of new technologies. The market size experienced steady growth in the historical period (2019-2024), exceeding xx Million in 2024. This growth trajectory is expected to continue in the forecast period (2025-2033), with the market size predicted to reach xx Million by 2033. This signifies a significant CAGR of xx%. The increasing adoption of sustainable infrastructure solutions and smart airport technologies is further accelerating market expansion. Consumer behavior shifts, such as increased preference for air travel and the demand for a seamless airport experience, are contributing factors. Technological disruptions, including the use of drones for inspection and maintenance, are enhancing efficiency and reducing operational costs.

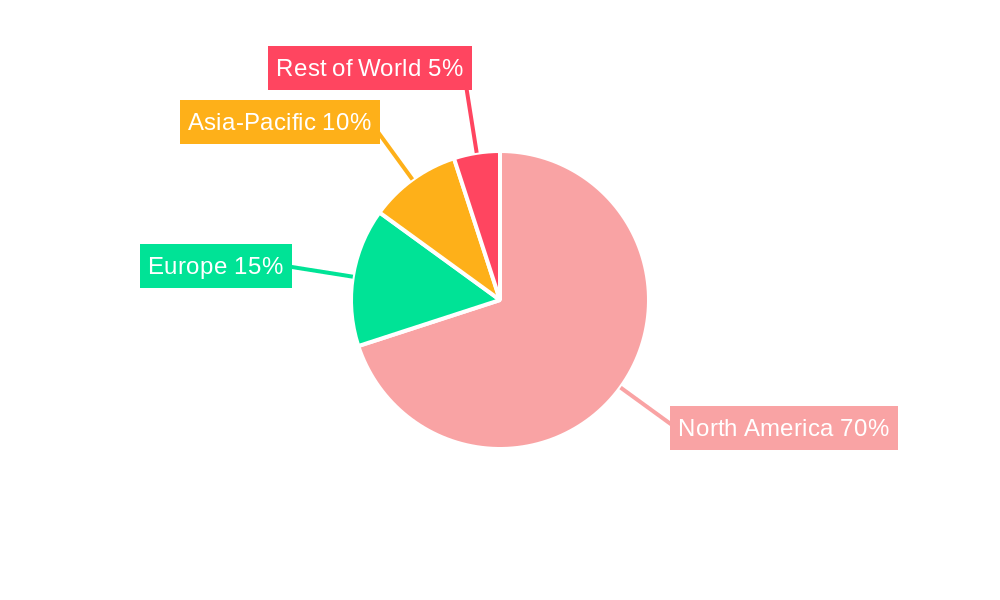

Dominant Regions, Countries, or Segments in North America Airport Infrastructure Market

The Northeastern and Western regions of the United States are currently the most dominant regions in the North American airport infrastructure market, driven by high passenger volumes and significant government investment in airport upgrades. Within infrastructure types, terminals and taxiways and runways represent the largest segments, accounting for approximately xx% and xx% of the market share respectively in 2025. Brownfield airports constitute a larger share of the market compared to greenfield projects due to the existing infrastructure in place.

- Key Drivers in Northeastern US: High passenger traffic at major hubs like JFK and Boston Logan, coupled with significant federal and state funding for airport improvement programs.

- Key Drivers in Western US: Growth in air travel in California and other western states, alongside significant investment in new airport facilities and modernization projects.

- Terminal Segment Dominance: Driven by the need for increased capacity to handle growing passenger numbers, including improved passenger processing facilities and advanced security systems.

- Taxiway and Runway Segment Dominance: The focus on improving safety and efficiency necessitates upgrades to existing runways and taxiways, and the construction of new ones.

North America Airport Infrastructure Market Product Landscape

The market offers a diverse range of products and services, encompassing design, engineering, construction, and maintenance of airport infrastructure. Innovation focuses on sustainable materials, advanced technologies for airport operations, and improving passenger experience. Products and services are tailored to meet specific needs, offering customized solutions that optimize efficiency, safety, and cost-effectiveness. The use of BIM technology allows for enhanced design visualization and optimized construction processes, while the implementation of smart technologies improves operational efficiency and sustainability.

Key Drivers, Barriers & Challenges in North America Airport Infrastructure Market

Key Drivers:

- Increasing passenger traffic and the demand for improved airport facilities.

- Government investments in airport infrastructure modernization and expansion.

- Technological advancements leading to enhanced efficiency and safety.

Challenges:

- High upfront capital costs associated with infrastructure development.

- Complex regulatory approvals and environmental compliance procedures.

- Potential labor shortages and supply chain disruptions, affecting project timelines and costs. These issues contributed to a xx% increase in project delays in 2024.

Emerging Opportunities in North America Airport Infrastructure Market

Emerging opportunities include the development of sustainable airport infrastructure, smart airport technologies, and the integration of advanced data analytics for improved operational efficiency. The rising demand for air travel, particularly in emerging markets, presents significant growth potential. Further opportunities lie in developing innovative solutions to address increasing passenger volumes and enhance the overall passenger experience, such as implementing automated baggage handling systems and utilizing AI for predictive maintenance.

Growth Accelerators in the North America Airport Infrastructure Market Industry

Several factors will accelerate long-term market growth. These include technological breakthroughs such as autonomous vehicles for ground transportation and advanced materials reducing construction time and costs. Strategic partnerships between public and private entities will streamline the development process. The expansion into underserved markets and the adoption of innovative financing models will unlock further growth potential.

Key Players Shaping the North America Airport Infrastructure Market Market

Notable Milestones in North America Airport Infrastructure Market Sector

- 2022 Q3: Increased federal funding announced for airport infrastructure improvements under the Bipartisan Infrastructure Law.

- 2023 Q1: Launch of a new sustainable building material specifically designed for airport construction by a leading materials supplier.

- 2024 Q2: Completion of a major airport expansion project in California, showcasing the successful implementation of advanced construction technologies.

In-Depth North America Airport Infrastructure Market Market Outlook

The North America airport infrastructure market is poised for sustained growth, driven by ongoing modernization efforts, increasing passenger numbers, and the adoption of innovative technologies. Strategic partnerships, sustainable development practices, and investment in emerging technologies will be key to unlocking the market's full potential. The focus on improving passenger experience and operational efficiency will shape future development, presenting opportunities for companies that can deliver innovative and cost-effective solutions.

North America Airport Infrastructure Market Segmentation

-

1. Infrastructure Type

- 1.1. Terminals

- 1.2. Taxiway and Runways

- 1.3. Aprons

- 1.4. Control Towers

- 1.5. Hangars

- 1.6. Others

-

2. Airport Type

- 2.1. Brownfield Airports

- 2.2. Greenfield Airports

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Airport Infrastructure Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Airport Infrastructure Market Regional Market Share

Geographic Coverage of North America Airport Infrastructure Market

North America Airport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.1.1. Terminals

- 5.1.2. Taxiway and Runways

- 5.1.3. Aprons

- 5.1.4. Control Towers

- 5.1.5. Hangars

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Brownfield Airports

- 5.2.2. Greenfield Airports

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6. United States North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.1.1. Terminals

- 6.1.2. Taxiway and Runways

- 6.1.3. Aprons

- 6.1.4. Control Towers

- 6.1.5. Hangars

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Airport Type

- 6.2.1. Brownfield Airports

- 6.2.2. Greenfield Airports

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7. Canada North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.1.1. Terminals

- 7.1.2. Taxiway and Runways

- 7.1.3. Aprons

- 7.1.4. Control Towers

- 7.1.5. Hangars

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Airport Type

- 7.2.1. Brownfield Airports

- 7.2.2. Greenfield Airports

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8. Mexico North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.1.1. Terminals

- 8.1.2. Taxiway and Runways

- 8.1.3. Aprons

- 8.1.4. Control Towers

- 8.1.5. Hangars

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Airport Type

- 8.2.1. Brownfield Airports

- 8.2.2. Greenfield Airports

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Constructors Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 McCarthy Building Companies Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 The Walsh Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Austin Industries

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hensel Phelps

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Turner Construction Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 J E Dunn Construction Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AECOM

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 PCL Constructors Inc

List of Figures

- Figure 1: North America Airport Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Airport Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 2: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Airport Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 10: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 11: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 14: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Airport Infrastructure Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the North America Airport Infrastructure Market?

Key companies in the market include PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, AECOM.

3. What are the main segments of the North America Airport Infrastructure Market?

The market segments include Infrastructure Type, Airport Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Airport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Airport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Airport Infrastructure Market?

To stay informed about further developments, trends, and reports in the North America Airport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence