Key Insights

The North American e-commerce apparel market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 8.1% from 2025 to 2033. This robust growth is propelled by increasing smartphone adoption and internet penetration, particularly among younger consumers, enhancing online shopping convenience, product variety, and competitive pricing. Social commerce and influencer marketing are emerging as key channels for brand engagement. The market is segmented by product type (formal wear, casual wear, sportswear, nightwear), end-user (men, women, children), and platform (third-party retailers, company websites). The United States leads the market share, followed by Canada and Mexico. Challenges such as product authenticity, fitting issues, and returns are being addressed through technological advancements and improved logistics. Major players like Adidas, Nike, and Inditex are driving innovation in e-commerce technologies and personalized shopping experiences, leveraging data analytics for tailored recommendations and advertising. Growth is anticipated in athleisure and sustainable apparel segments, aligning with evolving consumer preferences.

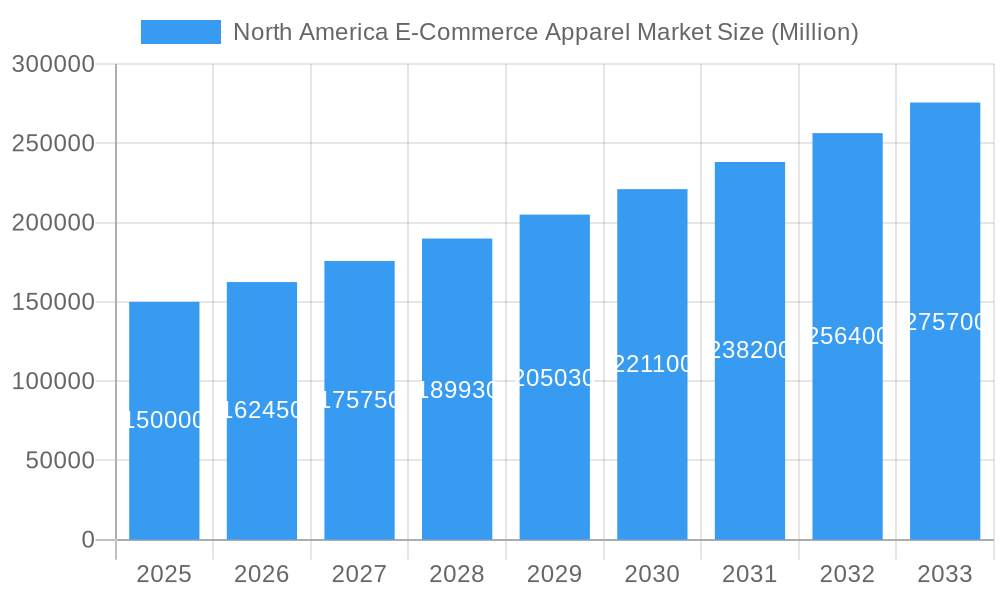

North America E-Commerce Apparel Market Market Size (In Billion)

The competitive landscape features a blend of established global brands and agile direct-to-consumer (DTC) brands. Established brands benefit from brand recognition and supply chain efficiency, while DTC brands often cater to niche markets. Omnichannel strategies, integrating online and offline channels, are a prominent trend, with brands investing in enhanced e-commerce platforms and customer journeys. Technologies like augmented reality (AR) and virtual try-on features are elevating the online shopping experience and mitigating online purchase concerns. Market consolidation is expected, with larger companies acquiring smaller brands to achieve economies of scale and broader market reach.

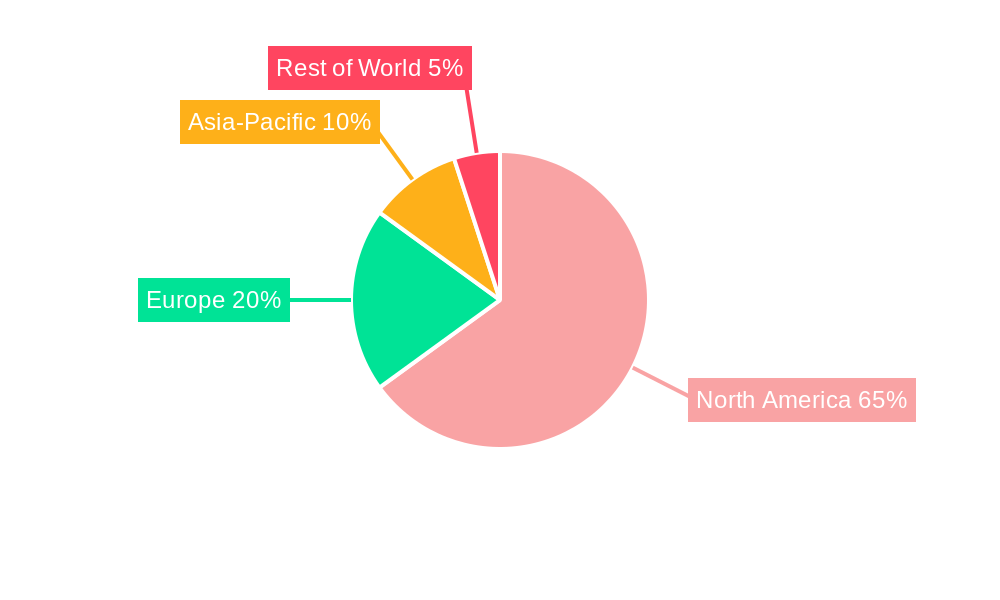

North America E-Commerce Apparel Market Company Market Share

North America E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America e-commerce apparel market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report forecasts a market size of xx Million units by 2033, presenting a detailed breakdown by region (United States, Canada, Mexico, Rest of North America), product type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), end-user (Men, Women, Kids/Children), and platform type (Third Party Retailer, Company's Own Website). The base year for this analysis is 2025, with the forecast period extending from 2025 to 2033. The historical period covered is 2019-2024.

North America E-Commerce Apparel Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory factors shaping the North America e-commerce apparel market. We examine market concentration, exploring the market share held by key players such as Adidas AG, Kering S.A., VF Corporation, Punta Na Holding Sa (MANGO), Industria de Diseño Textil S.A. (Inditex), Chanel Limited, Levi Strauss & Co., PVH Corp, Ralph Lauren Corporation, Hennes & Mauritz AB, LVMH Moët Hennessy Louis Vuitton, and Fast Retailing Co Ltd. The analysis also incorporates M&A activity within the sector, assessing its impact on market structure and competitive dynamics. Quantitative insights, including market share percentages and M&A deal volumes from 2019-2024 will be detailed. Qualitative factors such as innovation barriers and regulatory hurdles affecting market growth will also be discussed. The analysis will also explore the influence of consumer demographics and changing preferences on market trends.

- Market Concentration: Analysis of market share distribution among major players. (e.g., Top 5 players hold xx% of the market in 2024).

- Technological Innovation: Examination of key technological drivers, including advancements in e-commerce platforms, personalized shopping experiences, and supply chain optimization.

- Regulatory Landscape: Assessment of relevant regulations and their influence on market dynamics.

- Competitive Substitutes: Analysis of substitute products and their impact on market competition.

- End-User Demographics: Analysis of consumer demographics and their purchasing behaviors.

- M&A Activity: Review of significant mergers and acquisitions, their impact on market structure, and future predictions.

North America E-Commerce Apparel Market Growth Trends & Insights

This section provides a detailed analysis of the market size evolution from 2019 to 2024, forecasting growth trajectory until 2033. We explore factors driving market growth, including the increasing adoption of online shopping, technological advancements in e-commerce, and shifting consumer preferences. The analysis will incorporate specific metrics such as CAGR (Compound Annual Growth Rate) and market penetration rates across different segments. We will also analyze the influence of technological disruptions, such as the rise of mobile commerce and social media marketing, on market growth. The impact of consumer behavior shifts, including the growing preference for personalized shopping experiences and sustainable fashion, will be examined.

Dominant Regions, Countries, or Segments in North America E-Commerce Apparel Market

This section identifies the leading regions, countries, and segments within the North American e-commerce apparel market, analyzing their dominance factors and growth potential. It will focus on market share, growth rates, and underlying drivers for each dominant segment. Key drivers will be highlighted using bullet points, while dominance factors will be analyzed in paragraphs.

- Leading Region: United States (projected xx Million units in 2025) – reasons for dominance will be elaborated.

- Key Country Growth Drivers: Details on specific factors driving growth in each country (e.g., economic growth, infrastructure development, consumer behavior).

- High-Growth Segments: Analysis of the fastest-growing segments in terms of product type, end-user, and platform.

North America E-Commerce Apparel Market Product Landscape

This section describes the product innovations, applications, and performance metrics within the e-commerce apparel market. It focuses on unique selling propositions (USPs) of different product categories and showcases technological advancements that enhance the online shopping experience. This includes innovations in materials, designs, and functionalities.

Key Drivers, Barriers & Challenges in North America E-Commerce Apparel Market

This section identifies and analyzes the key drivers and challenges impacting market growth. Drivers include technological advancements, economic growth, and supportive government policies. Challenges include supply chain disruptions, regulatory hurdles, and intense competition. Quantifiable impacts of these challenges will be presented.

- Key Drivers: (e.g., Increased smartphone penetration, rising disposable incomes, government initiatives to promote e-commerce).

- Key Challenges: (e.g., Supply chain vulnerabilities leading to xx% increase in costs, increased competition leading to price wars, regulatory complexities related to data privacy).

Emerging Opportunities in North America E-Commerce Apparel Market

This section highlights emerging trends and untapped market opportunities. It will focus on innovative applications, evolving consumer preferences, and potential market expansion in underserved segments.

- Untapped Markets: (e.g., Growth potential in niche apparel categories).

- Innovative Applications: (e.g., Integration of AR/VR for virtual try-ons, personalized recommendations).

- Evolving Consumer Preferences: (e.g., Increased demand for sustainable and ethically sourced apparel).

Growth Accelerators in the North America E-Commerce Apparel Market Industry

This section emphasizes the key catalysts expected to drive long-term market growth. These include technological breakthroughs, strategic partnerships, and market expansion strategies.

Key Players Shaping the North America E-Commerce Apparel Market Market

Notable Milestones in North America E-Commerce Apparel Market Sector

- March 2023: H&M launched its online US resale program in partnership with ThredUp, featuring 30,000 used clothing items.

- February 2023: Adidas announced a new sportswear collection targeted at Gen Z, modeled by Jenna Ortega.

- February 2023: Inditex integrated Massimo Dutti's offerings onto Zara's US website.

In-Depth North America E-Commerce Apparel Market Outlook

This section summarizes the key growth accelerators and strategic opportunities within the North American e-commerce apparel market, projecting future market potential and highlighting key areas for investment and strategic partnerships. The continued growth of online shopping, coupled with technological advancements and evolving consumer preferences, points to a robust and dynamic future for the market. Opportunities lie in personalization, sustainability, and innovative business models.

North America E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

North America E-Commerce Apparel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America E-Commerce Apparel Market Regional Market Share

Geographic Coverage of North America E-Commerce Apparel Market

North America E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion

- 3.3. Market Restrains

- 3.3.1. Robust Offline Retail Channel Penetration

- 3.4. Market Trends

- 3.4.1. Increased Internet Usage and Effortless Shopping Experience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adidas AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kering S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VF Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Punta Na Holding Sa (MANGO)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Industria de Diseño Textil S A (Inditex)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chanel Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Levi Strauss & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PVH Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ralph Lauren Corporatio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hennes & Mauritz AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LVMH Moët Hennessy Louis Vuitton

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fast Retailing Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Adidas AG

List of Figures

- Figure 1: North America E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: North America E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: North America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: North America E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 6: North America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 7: North America E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America E-Commerce Apparel Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: North America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 13: North America E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: North America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 15: North America E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States North America E-Commerce Apparel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States North America E-Commerce Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada North America E-Commerce Apparel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada North America E-Commerce Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America E-Commerce Apparel Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America E-Commerce Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America E-Commerce Apparel Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the North America E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Kering S A, VF Corporation, Punta Na Holding Sa (MANGO), Industria de Diseño Textil S A (Inditex), Chanel Limited, Levi Strauss & Co, PVH Corp, Ralph Lauren Corporatio, Hennes & Mauritz AB, LVMH Moët Hennessy Louis Vuitton, Fast Retailing Co Ltd.

3. What are the main segments of the North America E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 185.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Usage and Effortless Shopping Experience; Growing Consumer Inclination Towards Appearance and Latest Fashion.

6. What are the notable trends driving market growth?

Increased Internet Usage and Effortless Shopping Experience.

7. Are there any restraints impacting market growth?

Robust Offline Retail Channel Penetration.

8. Can you provide examples of recent developments in the market?

March 2023: H&M announced the launch of its online United States resale program; the company introduced the platform in partnership with ThredUp to reduce fashion waste. The company claims that the launch of the platform included 30,000 items of used clothes and accessories in the women's and kids' categories on its website.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the North America E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence