Key Insights

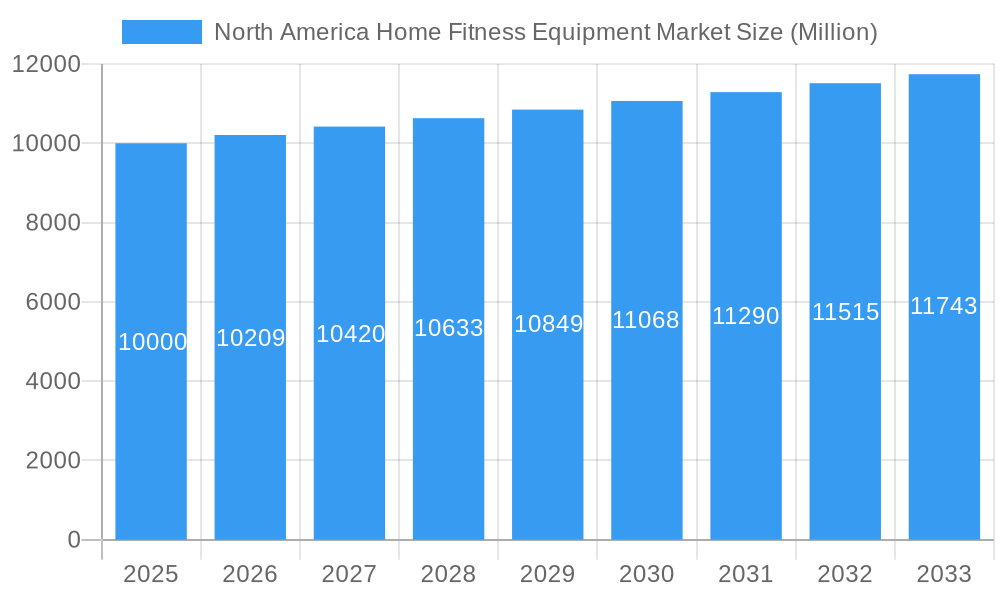

The North American home fitness equipment market, valued at approximately $19.98 billion in 2025, is projected for robust expansion. This growth is primarily fueled by increasing health consciousness, the rising prevalence of sedentary lifestyles, and a greater understanding of the benefits of regular exercise. The inherent convenience and flexibility of home fitness solutions, enabling personalized workout schedules, further drive demand. Innovations in interactive fitness applications and connected equipment are enhancing user engagement and broadening the consumer base. While the market demonstrates sustained growth, economic volatility and competition from alternative fitness options, such as outdoor activities or community fitness centers, may present moderating influences. The connected fitness equipment segment, including smart treadmills and ellipticals, is anticipated to experience the highest growth rate due to escalating consumer preference for personalized and immersive workout experiences. The online retail channel is increasingly dominant, offering convenience and competitive pricing, though offline retail stores remain vital for consumers prioritizing hands-on product evaluation.

North America Home Fitness Equipment Market Market Size (In Billion)

Market segmentation highlights treadmills and stationary cycles as consistently strong performers, owing to their broad appeal. However, the strength training equipment segment is projected for substantial growth, reflecting heightened awareness of strength building's importance for overall health. The "Other Product Types" segment, encompassing accessories like yoga mats and resistance bands, is expected to see moderate growth, aligning with the trend toward holistic fitness practices. Leading market players, including Peloton, NordicTrack, and Life Fitness, are committed to continuous innovation and product portfolio expansion to leverage emerging trends and maintain competitive leadership. The forecast period (2025-2033) indicates continued market expansion, influenced by evolving consumer preferences and technological advancements within the fitness sector.

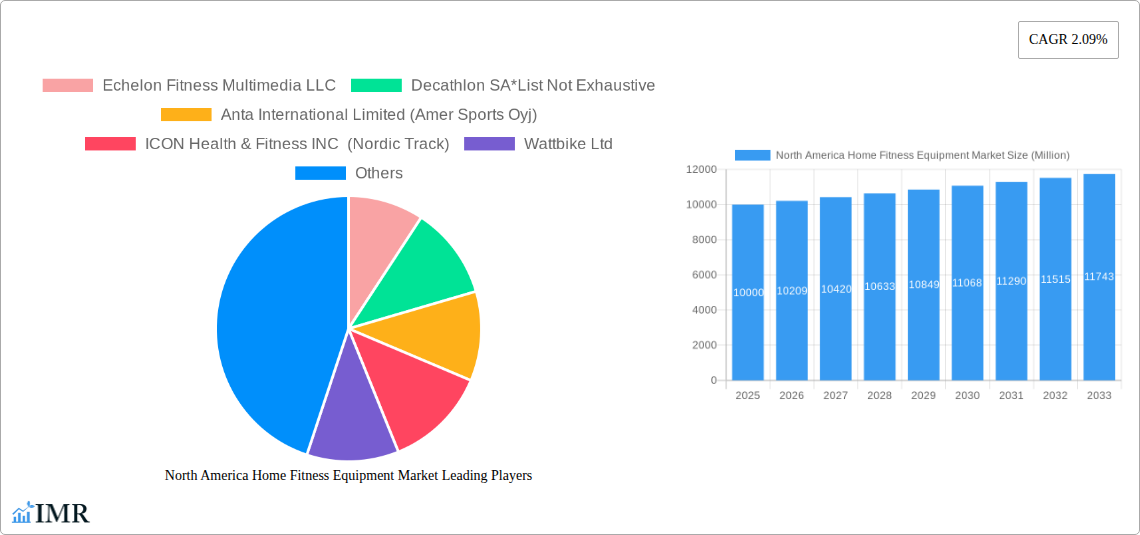

North America Home Fitness Equipment Market Company Market Share

North America Home Fitness Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America home fitness equipment market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market is segmented by product type (treadmills, elliptical machines, stationary cycles, rowing machines, strength training equipment, other product types) and distribution channel (offline retail stores, online retail stores, direct selling). The total market size is expected to reach xx Million units by 2033.

North America Home Fitness Equipment Market Dynamics & Structure

The North America home fitness equipment market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in areas such as connected fitness and AI-powered training programs, is a major driver. Regulatory frameworks concerning product safety and data privacy also play a crucial role. Competitive pressures from substitute products, such as outdoor activities and gym memberships, influence market growth. The end-user demographic is expanding to include diverse age groups and fitness levels. M&A activity has been moderate in recent years, with a focus on expanding product portfolios and enhancing distribution networks.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on connected fitness, AI-powered personal training, and immersive workout experiences.

- Regulatory Framework: Compliance with safety standards and data privacy regulations impacts product development and marketing.

- Competitive Substitutes: Outdoor activities, gym memberships, and other fitness solutions compete for consumer spending.

- End-User Demographics: Growing demand from diverse age groups and fitness levels fuels market expansion.

- M&A Trends: Moderate activity, driven by portfolio diversification and distribution expansion (xx M&A deals in the last 5 years).

North America Home Fitness Equipment Market Growth Trends & Insights

The North America home fitness equipment market experienced significant growth during the historical period (2019-2024), driven by increased health consciousness, the COVID-19 pandemic, and the rising popularity of at-home fitness solutions. This growth is projected to continue throughout the forecast period (2025-2033), albeit at a moderated pace. Technological disruptions, such as the introduction of interactive fitness platforms and smart home integration, are reshaping consumer preferences. The adoption rate of connected fitness equipment is rapidly increasing, creating new opportunities for market players. Consumer behavior is shifting towards personalized fitness experiences and convenient, on-demand workouts.

- Market Size Evolution: Market size grew from xx Million units in 2019 to xx Million units in 2024, with a projected CAGR of xx% during the forecast period.

- Adoption Rates: Increasing adoption of connected fitness equipment and subscription-based fitness services.

- Technological Disruptions: Smart home integration, AI-powered training, and virtual reality fitness experiences are transforming the market.

- Consumer Behavior Shifts: Demand for personalized fitness experiences, convenience, and on-demand workouts.

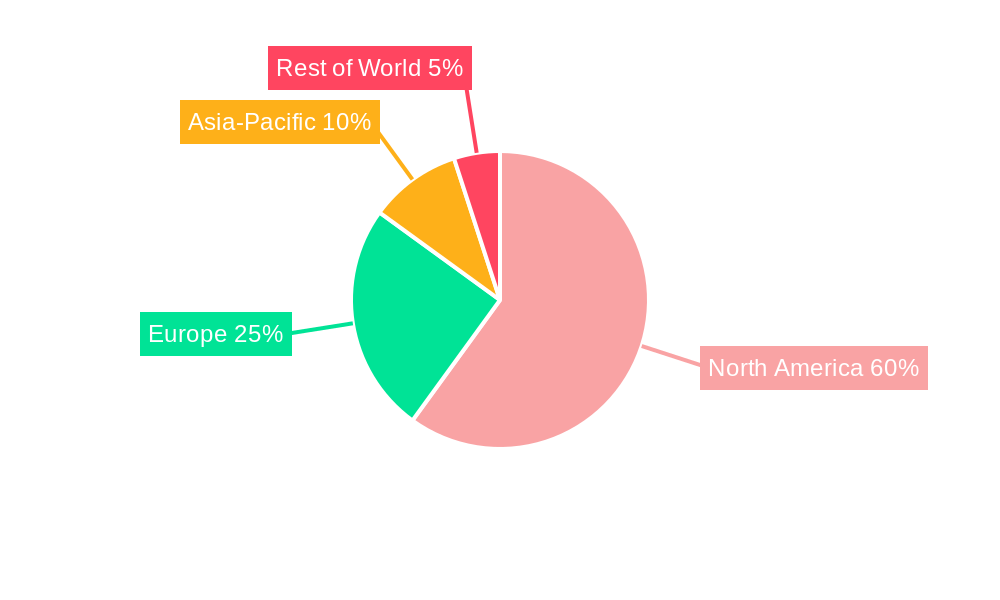

Dominant Regions, Countries, or Segments in North America Home Fitness Equipment Market

The United States remains the dominant market for home fitness equipment in North America, driven by high disposable incomes, strong health consciousness, and a well-established fitness culture. Among product types, treadmills and stationary cycles maintain the largest market share, while strength training equipment is experiencing rapid growth. Online retail stores are witnessing substantial expansion, driven by increased e-commerce penetration.

- Leading Region: United States.

- Dominant Product Type: Treadmills and Stationary Cycles.

- Fastest Growing Segment: Strength Training Equipment and Online Retail.

- Key Growth Drivers (US): High disposable incomes, health consciousness, established fitness culture, and increasing e-commerce penetration.

North America Home Fitness Equipment Market Product Landscape

The home fitness equipment market is characterized by a wide array of products, each with unique selling propositions. Recent innovations focus on improved ergonomics, connectivity, and personalized workout experiences. Advanced features such as integrated screens, heart rate monitoring, and AI-powered coaching are becoming increasingly common. Manufacturers are constantly striving to improve product performance metrics, such as durability, safety, and ease of use.

Key Drivers, Barriers & Challenges in North America Home Fitness Equipment Market

Key Drivers: Increasing health awareness, technological advancements (connected fitness, AI), rising disposable incomes, and the convenience of at-home workouts. The pandemic significantly accelerated adoption rates.

Key Challenges: High initial costs of equipment, competition from gyms and other fitness options, the potential for technological obsolescence, and supply chain disruptions impacting availability and pricing (estimated impact on market growth: xx%).

Emerging Opportunities in North America Home Fitness Equipment Market

Untapped markets exist in underserved demographics, such as older adults and individuals with specific physical limitations. Opportunities lie in developing inclusive and adaptive fitness equipment. The integration of virtual reality and augmented reality technology presents exciting possibilities for creating immersive and engaging workout experiences. Furthermore, the growth of subscription-based fitness content and personalized training programs creates significant opportunities.

Growth Accelerators in the North America Home Fitness Equipment Market Industry

Strategic partnerships between fitness equipment manufacturers and technology companies are driving innovation and expanding market reach. The expansion of subscription-based fitness models enhances revenue streams and fosters customer loyalty. Technological breakthroughs such as AI-powered personalized training and immersive workout experiences are transforming the landscape and attracting a wider range of consumers.

Key Players Shaping the North America Home Fitness Equipment Market Market

- Echelon Fitness Multimedia LLC

- Decathlon SA

- Anta International Limited (Amer Sports Oyj)

- ICON Health & Fitness INC (Nordic Track)

- Wattbike Ltd

- Johnson Health Tech Co Ltd

- Nautilus Inc

- Technogym SpA

- TRUE Fitness

- Peloton Interactive Inc (Precor Incorporated)

- SportsArt

- KPS Capital Partners (Life Fitness)

Notable Milestones in North America Home Fitness Equipment Sector

- November 2022: Nautilus Inc. launched the Bowflex BXT8J Treadmill, expanding its retail presence.

- September 2022: Peloton Interactive Inc. introduced a range of rowing machines and partnered with Amazon.

- June 2022: SportsArt added the G866 Front-Drive Elliptical to its ECO-POWR line, enhancing its product portfolio.

In-Depth North America Home Fitness Equipment Market Market Outlook

The North America home fitness equipment market is poised for continued growth, driven by sustained health consciousness, technological advancements, and the increasing popularity of at-home fitness solutions. Strategic partnerships, expansion into new market segments, and the development of innovative products will shape the future of the market. The market holds significant potential for companies that can successfully leverage technological advancements to offer personalized and engaging fitness experiences.

North America Home Fitness Equipment Market Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

- 2.3. Direct Selling

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Home Fitness Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Home Fitness Equipment Market Regional Market Share

Geographic Coverage of North America Home Fitness Equipment Market

North America Home Fitness Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Counterfeiting In Hair Care Products

- 3.4. Market Trends

- 3.4.1. Consumers’ Interest in Customized Workout Regimes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.2.3. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.2.3. Direct Selling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.2.3. Direct Selling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.2.3. Direct Selling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Home Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.2.3. Direct Selling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Echelon Fitness Multimedia LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Decathlon SA*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Anta International Limited (Amer Sports Oyj)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ICON Health & Fitness INC (Nordic Track)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wattbike Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Johnson Health Tech Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nautilus Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Technogym SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TRUE Fitness

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Peloton Interactive Inc (Precor Incorporated)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SportsArt

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 KPS Capital Partners (Life Fitness)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Echelon Fitness Multimedia LLC

List of Figures

- Figure 1: North America Home Fitness Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Home Fitness Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: North America Home Fitness Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Home Fitness Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 19: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: North America Home Fitness Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: North America Home Fitness Equipment Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 35: North America Home Fitness Equipment Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Home Fitness Equipment Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Home Fitness Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Home Fitness Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Home Fitness Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Home Fitness Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Fitness Equipment Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the North America Home Fitness Equipment Market?

Key companies in the market include Echelon Fitness Multimedia LLC, Decathlon SA*List Not Exhaustive, Anta International Limited (Amer Sports Oyj), ICON Health & Fitness INC (Nordic Track), Wattbike Ltd, Johnson Health Tech Co Ltd, Nautilus Inc, Technogym SpA, TRUE Fitness, Peloton Interactive Inc (Precor Incorporated), SportsArt, KPS Capital Partners (Life Fitness).

3. What are the main segments of the North America Home Fitness Equipment Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Private Label and Indigenous Brands; Internet Penetration Proliferated the eCommerce Sales of Hair Care Products.

6. What are the notable trends driving market growth?

Consumers’ Interest in Customized Workout Regimes.

7. Are there any restraints impacting market growth?

Counterfeiting In Hair Care Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Nautilus Inc. launched the Bowflex BXT8J Treadmill with JRNY adaptive fitness app in limited retail outlets such as Amazon, Dick's Sporting Goods, Academy, Best Buy, and Nebraska Furniture Mart. The product has a wide range of running belts, a Comfort Tech cushioning system, speeds up to 12 mph, and a 15% motorized incline.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Fitness Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Fitness Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Fitness Equipment Market?

To stay informed about further developments, trends, and reports in the North America Home Fitness Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence