Key Insights

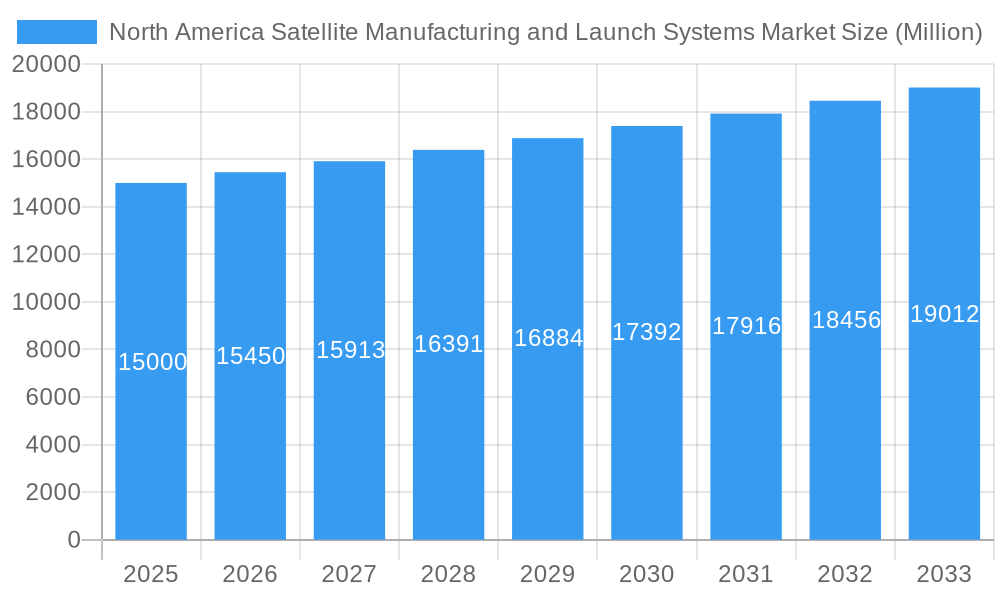

The North American satellite manufacturing and launch systems market is experiencing robust growth, driven by increasing demand for satellite-based services across military, government, and commercial sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2019 to 2024 indicates a sustained upward trajectory, projected to continue through 2033. Key drivers include the expanding need for enhanced communication networks, earth observation capabilities for environmental monitoring and resource management, and the growing adoption of advanced satellite technologies, such as smallsats and constellations for improved coverage and data collection. Government initiatives aimed at space exploration and national security also significantly contribute to market expansion. While regulatory hurdles and high launch costs pose challenges, technological advancements, including reusable launch vehicles and miniaturization of satellite components, are mitigating these constraints, making satellite technology more accessible and cost-effective. The United States dominates the North American market, followed by Canada, reflecting the strong presence of established aerospace companies and substantial government investment in space-related programs. Market segmentation reveals a significant share held by the military and government sectors, driven by national security applications, but the commercial segment is witnessing rapid growth fueled by increased private investment in satellite-based services, particularly in areas like broadband internet and navigation.

North America Satellite Manufacturing and Launch Systems Market Market Size (In Billion)

The forecast period from 2025 to 2033 promises further expansion, propelled by ongoing technological innovations and the emergence of new applications. The increasing adoption of NewSpace companies and their innovative approaches to satellite design and launch services will likely further accelerate market growth. Competition is fierce among established players like Lockheed Martin, Boeing, and Northrop Grumman, alongside emerging companies like SpaceX and Sierra Nevada Corporation, leading to continuous technological advancement and cost reduction. The continued focus on developing efficient and reliable launch systems, coupled with advancements in satellite technology will be instrumental in shaping the future landscape of the North American satellite manufacturing and launch systems market, ensuring its continued expansion and significant economic contributions in the coming decade. We anticipate a steadily increasing market size, driven by both government and private sector investment.

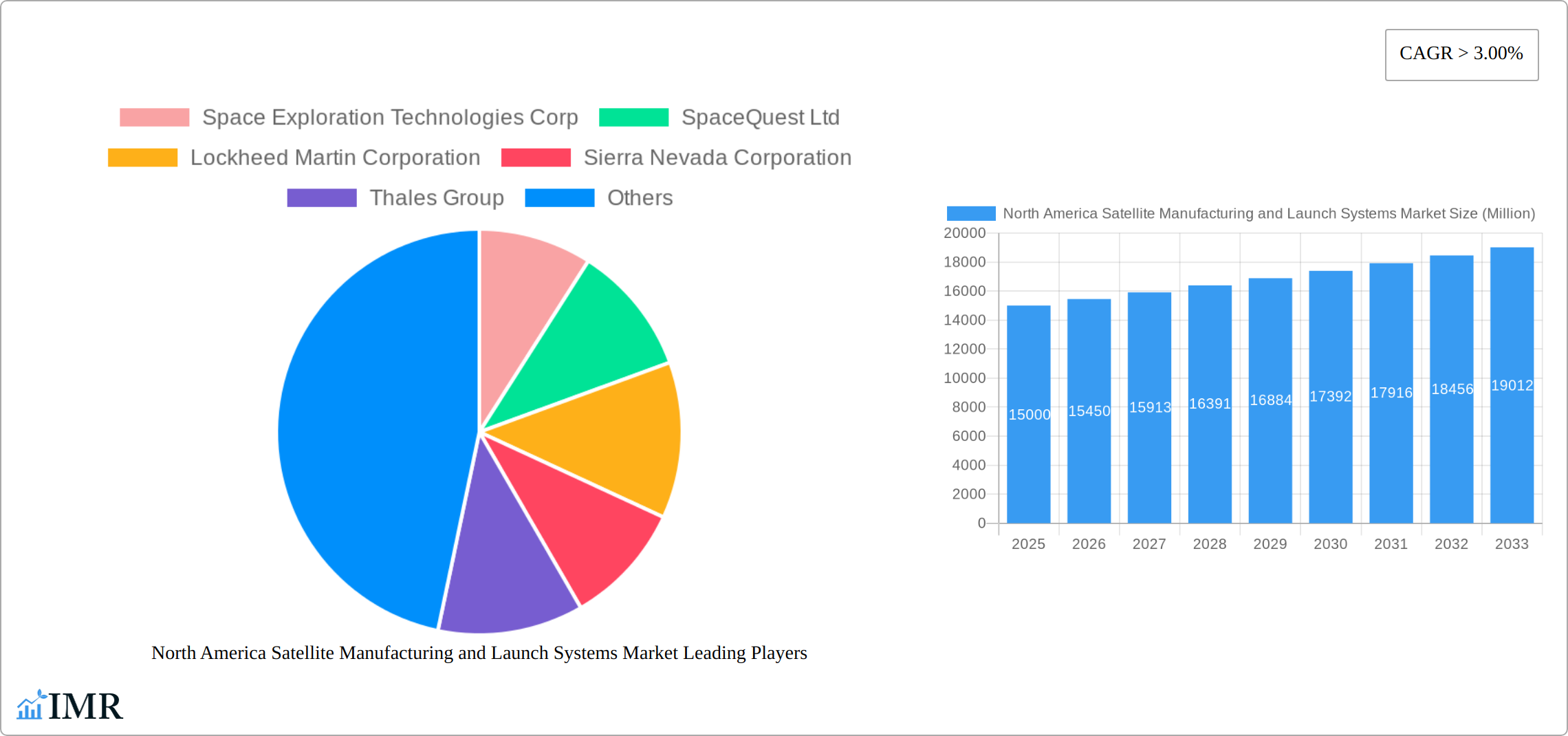

North America Satellite Manufacturing and Launch Systems Market Company Market Share

North America Satellite Manufacturing and Launch Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America satellite manufacturing and launch systems market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by product type (Satellite, Launch Systems), application (Military and Government, Commercial), and country (United States, Canada). The market size is presented in million units.

North America Satellite Manufacturing and Launch Systems Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and market trends. The North American satellite manufacturing and launch systems market is characterized by a moderate level of concentration, with key players like SpaceX, Lockheed Martin, and Boeing holding significant market share. The market is witnessing rapid technological innovation, particularly in areas like miniaturization, advanced propulsion systems, and improved satellite communication technologies. Regulatory frameworks, primarily driven by government agencies like the FCC (in the US) and ISED (in Canada), play a crucial role in shaping market dynamics. The presence of alternative communication technologies, such as fiber optic networks and terrestrial communication systems, presents a competitive threat, though the unique capabilities of satellites (e.g., global coverage, remote area access) maintain robust demand. Market consolidation through mergers and acquisitions (M&A) is expected to continue, driven by the need for economies of scale and technological synergy.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation Drivers: Miniaturization, advanced propulsion, improved communication technologies, AI-driven satellite operations.

- Regulatory Frameworks: Stringent regulations concerning licensing, spectrum allocation, and orbital slots.

- Competitive Product Substitutes: Fiber optic networks, terrestrial communication systems.

- End-User Demographics: Primarily driven by government and military agencies, followed by commercial communication and earth observation sectors.

- M&A Trends: An increase in M&A activity driven by the need for scale and technological integration is predicted at xx deals annually in the forecast period, compared to xx deals annually in the historical period.

North America Satellite Manufacturing and Launch Systems Market Growth Trends & Insights

The North American satellite manufacturing and launch systems market experienced significant growth during the historical period (2019-2024). Driven by increasing demand for satellite-based services across various sectors, particularly in the commercial and government segments, market size reached xx Million units in 2024. The market is projected to continue its growth trajectory with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated xx Million units by 2033. This growth is fueled by several factors, including advancements in satellite technology leading to smaller, cheaper, and more efficient satellites, increased demand for high-bandwidth applications such as broadband internet access, and a growing number of government and military initiatives that heavily rely on satellite technology. The adoption rate of new satellite technologies is increasing steadily, further boosting market growth. The growing awareness and acceptance of the advantages of satellite technology among consumers and businesses contribute to this trend.

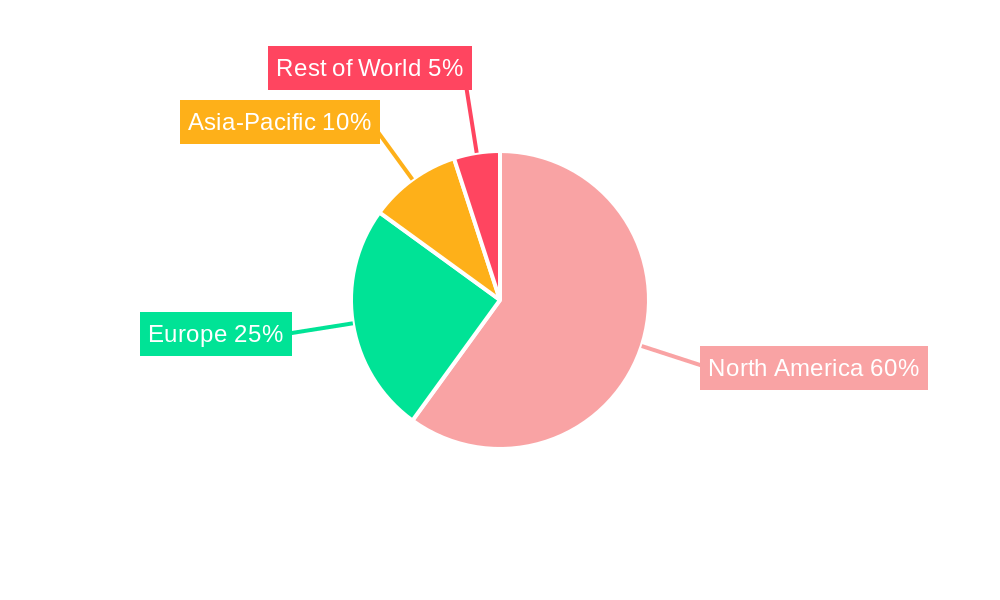

Dominant Regions, Countries, or Segments in North America Satellite Manufacturing and Launch Systems Market

The United States dominates the North American satellite manufacturing and launch systems market, accounting for xx% of the market share in 2025. This dominance is primarily attributed to the presence of major players, substantial government investment in space exploration and defense, and a robust aerospace manufacturing ecosystem. Canada also holds a significant share, driven by its contributions to the space sector and increasing government focus on satellite-based services.

Key Drivers:

- United States: Robust aerospace industry, significant government spending on defense and space exploration, presence of major satellite manufacturers and launch providers.

- Canada: Growing investments in space technology, partnerships with international space agencies, specialized expertise in satellite technology.

Dominant Segments:

- Product Type: Launch systems currently hold a larger market share in terms of value, owing to higher costs associated with launch vehicles compared to satellite manufacturing. However, the satellite segment is expected to experience faster growth driven by miniaturization and increased demand for smaller satellites.

- Application: The military and government segment dominates the market, owing to substantial government spending on national security and intelligence. However, the commercial segment exhibits significant growth potential, driven by rising demand for communication, earth observation, and navigation services.

North America Satellite Manufacturing and Launch Systems Market Product Landscape

The North American satellite manufacturing and launch systems market is characterized by a sophisticated and rapidly evolving product portfolio. This includes a broad spectrum of satellite types, catering to diverse applications such as advanced communication (including broadband internet, IoT connectivity, and secure data transmission), high-resolution earth observation (for environmental monitoring, resource management, and urban planning), and critical navigation and positioning (GNSS) services. Complementing these are a variety of launch vehicles, encompassing both traditional expendable rockets and increasingly prevalent reusable systems designed for cost-efficiency and environmental sustainability. Recent and ongoing product innovations are sharply focused on several key areas: significant miniaturization of satellite components allowing for smaller, more agile platforms; substantial increases in payload capacity to accommodate more sophisticated scientific instruments and communication equipment; improvements in fuel efficiency and propulsion systems for extended mission durations and greater orbital maneuverability; and the integration of enhanced communication technologies, such as optical inter-satellite links and advanced signal processing. Key differentiating features of these next-generation products include the incorporation of state-of-the-art advanced sensors with unprecedented resolution and spectral capabilities, significantly higher data transmission rates enabling real-time analysis and actionable insights, and demonstrably improved operational lifespan through more robust design and advanced materials. The unique selling propositions of these contemporary offerings lie in their ability to deliver superior cost-effectiveness through reusability and mass production, enhanced operational efficiency with greater automation and reduced ground segment requirements, and significantly advanced service capabilities that far surpass those of older generations of satellites and launch vehicles, opening up new frontiers for space-based applications.

Key Drivers, Barriers & Challenges in North America Satellite Manufacturing and Launch Systems Market

Key Drivers:

- Escalating Demand for Satellite-Based Services: A continuous and growing demand for reliable satellite-based services from both government agencies (for defense, intelligence, and scientific research) and commercial sectors (including telecommunications, broadcasting, navigation, and data analytics) is a primary growth engine.

- Technological Advancements & Cost Reduction: Ongoing breakthroughs in satellite technology, leading to miniaturization (e.g., CubeSats, SmallSats), increased processing power, and more efficient manufacturing techniques, are significantly reducing the cost of satellite development and deployment.

- Government Initiatives & Strategic Investments: Proactive government initiatives, such as those supporting space exploration, scientific research, national security objectives, and the fostering of a robust domestic space industry (e.g., NASA's Artemis program, U.S. Space Force objectives, Canadian Space Agency programs), coupled with substantial investments in infrastructure and R&D, are crucial growth catalysts.

- Emergence of the NewSpace Ecosystem: The rise of agile, privately funded companies (NewSpace) is injecting innovation, competition, and new business models into the market, driving down launch costs and expanding access to space.

- Expanding Applications: The proliferation of applications like global broadband internet, sophisticated Earth observation for climate change monitoring, precision agriculture, disaster management, and the Internet of Things (IoT) are creating substantial new markets for satellite capabilities.

Key Barriers and Challenges:

- Prohibitive Initial Investment Costs: Despite cost reductions, the development, manufacturing, and launch of sophisticated satellite systems and infrastructure still require significant upfront capital investment, which can be a barrier for smaller entities or new entrants.

- Stringent Regulatory Frameworks: Navigating complex and evolving national and international regulatory requirements for satellite operation, spectrum allocation, orbital debris mitigation, and safety standards presents a considerable challenge and can lead to lengthy approval processes.

- Inherent Launch Risks & Reliability Concerns: The high-stakes nature of space launches carries inherent risks of failure, which can result in catastrophic loss of expensive assets and significant financial and reputational damage. Ensuring payload and system reliability throughout long mission durations is paramount.

- Intense Market Competition: The North American market is highly competitive, with established players and agile newcomers vying for contracts and market share, necessitating continuous innovation and aggressive pricing strategies.

- Supply Chain Vulnerabilities: Global supply chain disruptions, geopolitical factors, and the specialized nature of many satellite components can impact the availability, lead times, and cost of critical materials and subsystems, potentially delaying production schedules and increasing overall project expenses.

- Space Debris and Orbital Congestion: The growing amount of space debris poses a significant operational risk to existing and future satellites, requiring robust mitigation strategies and potentially impacting mission planning and longevity.

- The estimated impact of these combined challenges on market growth is anticipated to be approximately 15-20% reduction in the Compound Annual Growth Rate (CAGR) during the forecast period, underscoring the need for strategic risk management and continuous adaptation.

Emerging Opportunities in North America Satellite Manufacturing and Launch Systems Market

The North American satellite manufacturing and launch systems market is ripe with emerging opportunities, driven by technological convergence and expanding market needs. The ubiquitous adoption and planned expansion of the Internet of Things (IoT) globally presents a massive opportunity for satellite constellations to provide ubiquitous connectivity for devices in remote or mobile environments where terrestrial networks are absent or unreliable. This includes applications in industrial IoT, smart cities, and asset tracking. Furthermore, the burgeoning NewSpace industry is a significant engine of opportunity, fostering innovation in launch services, satellite design, and data analytics, leading to more accessible and affordable space-based solutions. There are substantial untapped markets, particularly in rural and remote regions across North America and globally, that have limited or no access to reliable terrestrial communication infrastructure. Satellites are poised to bridge this digital divide by providing essential broadband internet, mobile connectivity, and broadcasting services. Additionally, the development of new and advanced applications in critical sectors is creating new avenues for satellite technology adoption. These include enhanced capabilities in precision agriculture for optimized crop management and resource utilization, sophisticated environmental monitoring for climate change tracking, biodiversity assessment, and natural resource management, and improved disaster response capabilities through real-time imagery, communication, and damage assessment. The ongoing development of orbital servicing, in-space manufacturing, and space situational awareness technologies also represents nascent but significant growth areas.

Growth Accelerators in the North America Satellite Manufacturing and Launch Systems Market Industry

Long-term growth will be driven by continuous technological advancements in satellite technology, especially in areas of reusability and propulsion systems. Strategic partnerships between private companies and government agencies will be crucial in securing funding and accessing resources. Expansion into new markets, especially in developing regions, will offer significant growth potential.

Key Players Shaping the North America Satellite Manufacturing and Launch Systems Market Market

Notable Milestones in North America Satellite Manufacturing and Launch Systems Market Sector

- 2020-03: SpaceX achieved a critical milestone with the successful first flight test of its Starship prototype, demonstrating key technologies for a fully reusable super heavy-lift launch system, crucial for future deep-space missions and large satellite deployments.

- 2021-11: Lockheed Martin announced the development of a new generation of advanced communication satellites, codenamed "Project Starlight," featuring significantly enhanced capabilities in terms of data throughput, resilience against jamming, and multi-band operation for both government and commercial clients.

- 2022-07: A landmark merger between United Launch Alliance (ULA) and Blue Origin's launch vehicle business was completed, aimed at consolidating expertise and resources to better compete in the rapidly evolving commercial and national security launch markets, creating a more formidable entity in the North American launch sector.

- 2023-04: Northrop Grumman successfully deployed its Cygnus spacecraft to resupply the International Space Station, showcasing advancements in autonomous docking and increased cargo capacity for its expendable launch vehicle program.

- 2023-09: The Canadian Space Agency (CSA) announced the successful initial testing of its RADARSAT Constellation Mission's next-generation data processing algorithms, promising even higher resolution and more frequent Earth observation data for disaster management and environmental monitoring.

In-Depth North America Satellite Manufacturing and Launch Systems Market Market Outlook

The North American satellite manufacturing and launch systems market is poised for continued growth, driven by technological advancements, increasing demand for satellite-based services, and government support. The market is expected to experience a robust expansion in the coming years, with strategic opportunities available for players who can leverage technological innovation, form strategic partnerships, and successfully navigate the regulatory landscape. The focus on miniaturization, improved efficiency, and cost reduction will be critical for sustained growth and market penetration.

North America Satellite Manufacturing and Launch Systems Market Segmentation

-

1. Product Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. Application

- 2.1. Military and Government

- 2.2. Commercial

North America Satellite Manufacturing and Launch Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Manufacturing and Launch Systems Market Regional Market Share

Geographic Coverage of North America Satellite Manufacturing and Launch Systems Market

North America Satellite Manufacturing and Launch Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Manufacturing and Launch Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Government

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SpaceQuest Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sierra Nevada Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArianeGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dynetics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Boeing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Satellite Manufacturing and Launch Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Satellite Manufacturing and Launch Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Manufacturing and Launch Systems Market?

The projected CAGR is approximately 11.12%.

2. Which companies are prominent players in the North America Satellite Manufacturing and Launch Systems Market?

Key companies in the market include Space Exploration Technologies Corp, SpaceQuest Ltd, Lockheed Martin Corporation, Sierra Nevada Corporation, Thales Group, ArianeGroup, Dynetics Inc, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the North America Satellite Manufacturing and Launch Systems Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Manufacturing and Launch Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Manufacturing and Launch Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Manufacturing and Launch Systems Market?

To stay informed about further developments, trends, and reports in the North America Satellite Manufacturing and Launch Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence