Key Insights

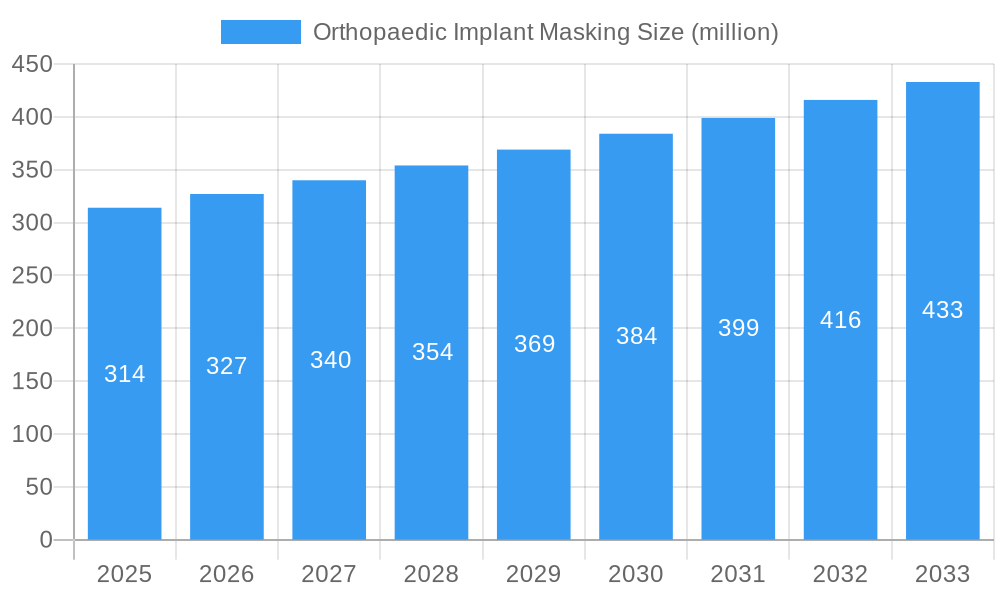

The global Orthopaedic Implant Masking market is poised for significant expansion, with a projected **market size of *314* million** in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.1%, indicating a steady and sustained increase in demand. The primary drivers fueling this market surge are the increasing prevalence of orthopedic conditions such as arthritis, osteoporosis, and sports-related injuries, necessitating a greater number of implant procedures. Advancements in medical technology, leading to the development of more sophisticated and biocompatible implant materials, further propel market growth. The rising global geriatric population, characterized by a higher incidence of degenerative bone diseases, also significantly contributes to the demand for orthopaedic implants and, consequently, the masking solutions required for their protection during manufacturing and sterilization processes.

Orthopaedic Implant Masking Market Size (In Million)

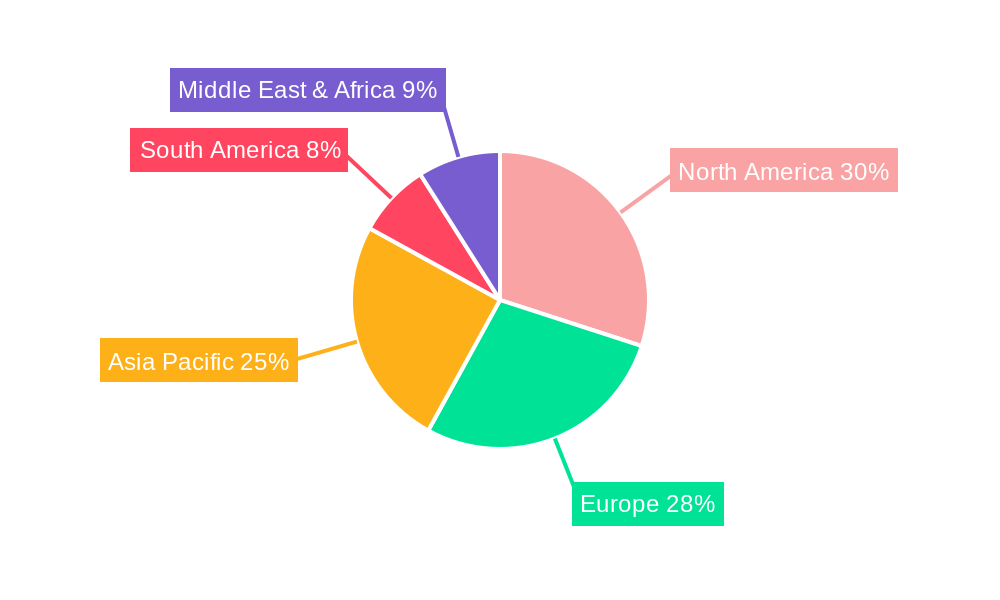

The market is segmented into distinct application areas, with Artificial Joints representing a dominant segment due to the high volume of joint replacement surgeries globally. Spinal Implants also constitute a substantial segment, driven by the increasing incidence of spinal disorders and the growing adoption of minimally invasive surgical techniques. The "Others" category encompasses a range of implants for extremities and trauma. In terms of types, the market is bifurcated into Visible Light Curing Type and UV Curing Type masking solutions. The UV curing type is likely to witness higher adoption owing to its faster curing times and superior performance in various industrial applications. Geographically, North America and Europe are expected to remain the largest markets, owing to well-established healthcare infrastructures and high patient spending. However, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth due to a burgeoning population, increasing healthcare expenditure, and a growing number of orthopedic procedures. Restraints such as the high cost of advanced masking materials and stringent regulatory approvals for medical-grade adhesives may pose challenges, but are likely to be outweighed by the strong market drivers.

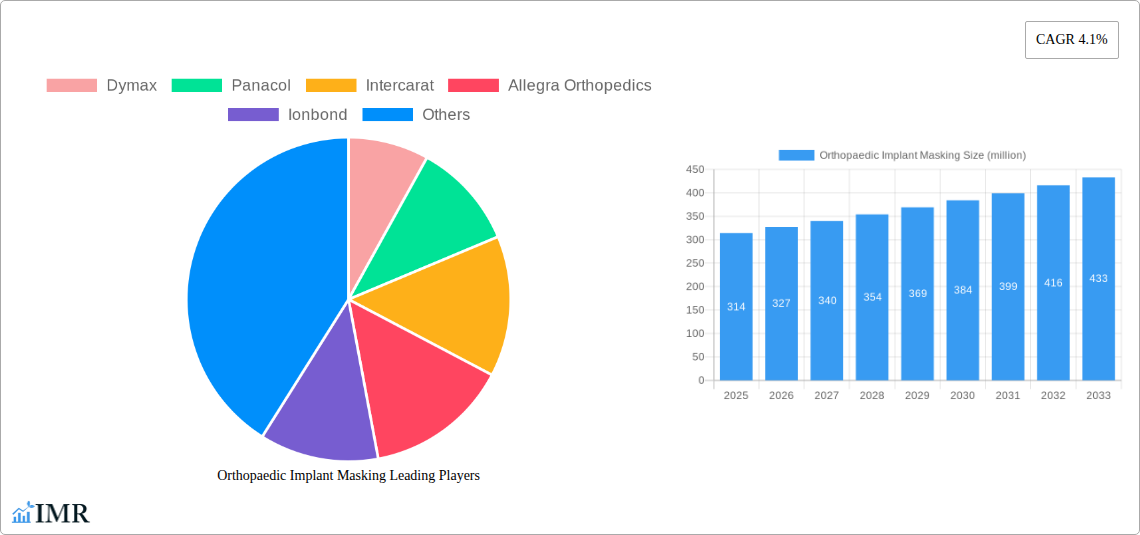

Orthopaedic Implant Masking Company Market Share

Orthopaedic Implant Masking Market Report: Comprehensive Analysis & Future Outlook (2019–2033)

This report offers a deep dive into the global Orthopaedic Implant Masking market, a critical segment within the broader medical device industry. Focusing on innovative solutions for protecting orthopaedic implants during manufacturing and sterilization processes, this analysis integrates high-traffic keywords such as "orthopaedic implant masking," "medical device coatings," "sterilization masks," "UV curing masking," "visible light curing masking," "artificial joint protection," and "spinal implant manufacturing." The report covers a comprehensive study period from 2019 to 2033, with a base year of 2025, providing granular insights into market dynamics, growth trends, regional dominance, product landscapes, and key player strategies across parent and child markets.

Orthopaedic Implant Masking Market Dynamics & Structure

The orthopaedic implant masking market exhibits a moderate to high level of concentration, with a few key players dominating specialized segments. Technological innovation is a primary driver, particularly in the development of advanced masking materials that offer superior adhesion, chemical resistance, and ease of removal without damaging delicate implant surfaces. Regulatory frameworks, though largely standardized for medical device manufacturing, continuously evolve to incorporate enhanced material safety and process validation requirements, influencing product development and adoption. Competitive product substitutes, such as traditional tape or liquid maskants, are gradually being phased out in favour of more efficient and precise masking solutions. End-user demographics in this market are primarily orthopaedic device manufacturers, contract manufacturers, and sterilization service providers. Mergers and acquisitions (M&A) trends are observed as larger chemical and medical device companies seek to integrate specialized masking technologies into their portfolios. For instance, Dymax has been active in acquiring companies with complementary UV curing technologies, while Panacol focuses on specialized adhesives for medical applications. The M&A deal volume in the past five years (2019-2024) is estimated to be between 5-8 significant transactions, with deal values ranging from USD 50 million to USD 200 million. Innovation barriers include the stringent validation processes required for medical device components and the high cost of R&D for novel materials.

- Market Concentration: Moderate to high, with leading players holding significant market share in niche segments.

- Technological Innovation Drivers: Development of advanced UV and visible light-curable maskants with enhanced performance characteristics.

- Regulatory Frameworks: Evolving standards for material safety, biocompatibility, and process validation in medical device manufacturing.

- Competitive Product Substitutes: Traditional masking methods (tape, liquid maskants) are being replaced by advanced curing solutions.

- End-User Demographics: Primarily orthopaedic device manufacturers, contract manufacturers, and sterilization facilities.

- M&A Trends: Strategic acquisitions to integrate specialized masking technologies and expand market reach.

- Innovation Barriers: Stringent validation processes, high R&D costs, and the need for regulatory compliance.

Orthopaedic Implant Masking Growth Trends & Insights

The orthopaedic implant masking market is poised for robust growth, driven by the escalating demand for advanced orthopaedic procedures and the increasing complexity of implant designs. Market size evolution is a critical indicator, with the global orthopaedic implant masking market projected to grow from an estimated USD 350 million in 2019 to a significant USD 800 million by 2033. The compound annual growth rate (CAGR) for the forecast period (2025–2033) is estimated at 8.5%. Adoption rates of UV and visible light curing masking technologies are steadily increasing, fueled by their inherent advantages in precision, speed, and environmental friendliness compared to traditional methods. Technological disruptions are largely centered on the development of new chemistries offering improved adhesion to a wider range of implant materials, including titanium alloys, stainless steel, and advanced polymers, as well as enhanced resistance to sterilization processes like EtO (Ethylene Oxide) and gamma irradiation. Consumer behavior shifts within the industry are characterized by a growing preference for suppliers who can offer integrated solutions, from material science to application engineering support. Market penetration of advanced masking solutions is still evolving, with higher adoption rates anticipated in developed markets where regulatory compliance and quality standards are paramount. The demand for reliable masking solutions for artificial joints, particularly hip and knee replacements, is a significant market segment, accounting for approximately 45% of the total market in 2025. Similarly, spinal implants represent another substantial segment, projected to contribute 30% to the market value by 2025. The remaining 25% is attributed to other orthopaedic applications, including trauma devices and prosthetics.

Dominant Regions, Countries, or Segments in Orthopaedic Implant Masking

The Application: Artificial Joints segment is undeniably the dominant force driving growth in the global orthopaedic implant masking market. This dominance stems from the sheer volume of artificial joint replacement surgeries performed worldwide and the critical need for precise masking during their manufacturing and subsequent sterilization. Within the artificial joints application, knee and hip replacements constitute the largest sub-segments, demanding highly reliable masking solutions to protect intricate surfaces and coatings. The market share for artificial joints in masking applications is estimated to be 45% in 2025.

North America, particularly the United States, is the leading country in this market, attributed to its advanced healthcare infrastructure, high disposable incomes, and a large patient pool undergoing orthopaedic procedures. The country's stringent regulatory environment also mandates the highest standards for medical device manufacturing, including effective masking during production and sterilization, thereby fostering the adoption of premium masking solutions. Economic policies supporting healthcare innovation and robust R&D investments further solidify its leadership position.

The Types: UV Curing Type of masking technology is another significant growth driver. UV curing maskants offer rapid curing times, excellent dimensional stability, and a clean removal process, making them ideal for the high-volume, precision-driven manufacturing environments common in the orthopaedic implant industry. Their ability to form a conformal coating that conforms to complex geometries is particularly beneficial for the intricate designs of artificial joints and spinal implants. The UV curing type segment is projected to hold a market share of approximately 60% in 2025.

- Dominant Application: Artificial Joints (45% market share in 2025), driven by high surgical volumes for hip and knee replacements.

- Leading Country: United States, owing to advanced healthcare, high patient demand, and stringent regulatory standards.

- Key Drivers in North America:

- High prevalence of orthopaedic conditions like osteoarthritis.

- Technological advancements in implant design and materials.

- Government initiatives promoting healthcare access and innovation.

- Presence of major orthopaedic device manufacturers.

- Dominant Type: UV Curing Type (60% market share in 2025), due to its speed, precision, and ease of use in mass production.

- Growth Potential in UV Curing: Increasing adoption due to efficiency, environmental benefits, and compatibility with automated manufacturing processes.

Orthopaedic Implant Masking Product Landscape

The orthopaedic implant masking product landscape is characterized by a focus on high-performance, application-specific solutions. Key innovations include the development of UV and visible light-curable maskants that offer superior adhesion to a wide range of implant materials, including exotic alloys and engineered polymers. These products are designed for rapid curing cycles, ensuring efficient production throughput. Performance metrics emphasize excellent chemical resistance to sterilization agents (EtO, gamma radiation), robust mechanical properties for protection during handling, and residue-free removal without compromising implant integrity or biocompatibility. Unique selling propositions often revolve around tailored formulations for specific implant types (e.g., highly flexible maskants for articulating surfaces, rigid maskants for structural components) and integration with automated dispensing systems. Technological advancements are pushing towards maskants with enhanced thermal stability and reduced curing temperatures, further expanding their applicability across diverse manufacturing processes.

Key Drivers, Barriers & Challenges in Orthopaedic Implant Masking

Key Drivers: The orthopaedic implant masking market is propelled by several critical factors. The increasing global incidence of degenerative joint diseases and age-related conditions fuels the demand for orthopaedic implants, directly impacting the need for effective masking solutions. Advancements in implant design, such as the development of highly complex geometries and surface coatings, necessitate sophisticated masking technologies for their protection during manufacturing and sterilization. Furthermore, stringent regulatory requirements for medical device quality and safety mandate the use of reliable masking processes to prevent contamination and ensure product integrity. Technological innovation, particularly in the realm of UV and visible light-curable maskants, offers faster curing times, higher precision, and improved environmental profiles, driving adoption.

Barriers & Challenges: Despite the growth, the market faces significant barriers and challenges. The high cost of research and development for novel masking materials, coupled with the lengthy and rigorous validation processes required for medical devices, presents a substantial hurdle. Supply chain disruptions, as evidenced by recent global events, can impact the availability of raw materials and affect production timelines. Intense competition from established players and the emergence of new market entrants can lead to price pressures and necessitate continuous innovation to maintain market share. Moreover, the need for specialized application equipment and skilled labor to effectively utilize advanced masking technologies can be a barrier for some manufacturers, particularly smaller ones.

Emerging Opportunities in Orthopaedic Implant Masking

Emerging opportunities in the orthopaedic implant masking market lie in several key areas. The growing adoption of additive manufacturing (3D printing) for orthopaedic implants presents a new frontier for specialized masking solutions capable of protecting intricate lattice structures and porous surfaces. Furthermore, the increasing focus on personalized medicine and patient-specific implants will drive demand for highly adaptable and easily conformable masking materials. Untapped markets in developing economies, where orthopaedic procedures are on the rise, offer significant growth potential as local manufacturers seek to adopt advanced production techniques. The development of bio-compatible maskants that can be safely integrated into the implant's lifecycle, potentially even dissolving after their intended use, represents a highly innovative application area.

Growth Accelerators in the Orthopaedic Implant Masking Industry

Several catalysts are accelerating growth in the orthopaedic implant masking industry. Technological breakthroughs in photopolymer chemistry are enabling the development of maskants with unprecedented performance characteristics, such as enhanced resistance to harsh sterilization environments and superior adhesion to novel biomaterials. Strategic partnerships between masking material manufacturers and orthopaedic device OEMs (Original Equipment Manufacturers) are crucial for co-developing tailored solutions that meet specific product requirements and streamline validation processes. Market expansion strategies, including increased focus on emerging economies and the establishment of localized technical support, will further drive adoption. The continuous drive for process automation in medical device manufacturing also accelerates the adoption of UV and visible light curing masking, which are inherently compatible with automated dispensing and curing systems.

Key Players Shaping the Orthopaedic Implant Masking Market

- Dymax

- Panacol

- Intercarat

- Allegra Orthopedics

- Ionbond

Notable Milestones in Orthopaedic Implant Masking Sector

- 2019: Introduction of advanced UV-curable maskants with enhanced chemical resistance to EtO sterilization by Dymax, improving protection for spinal implants.

- 2020: Panacol launches a new series of medical-grade adhesives and maskants designed for UV curing, specifically targeting the artificial joints market.

- 2021: Intercarat introduces a novel visible light curing masking material with improved tack and removability for complex orthopaedic implant geometries.

- 2022: Allegra Orthopedics announces strategic partnerships with sterilization providers to optimize masking protocols for their advanced implant designs.

- 2023: Ionbond expands its coating services to include integrated masking solutions for titanium alloy orthopaedic implants, offering a comprehensive protection package.

- 2024: Regulatory bodies provide updated guidelines on biocompatibility testing for medical device components, indirectly influencing the development and validation of new masking materials.

In-Depth Orthopaedic Implant Masking Market Outlook

The future outlook for the orthopaedic implant masking market is exceptionally promising, driven by sustained demand for orthopaedic procedures and continuous technological innovation. Growth accelerators, including the development of smart maskants and increased adoption of automation, will shape market dynamics. Strategic opportunities lie in expanding product portfolios to cater to the evolving needs of additive manufacturing and personalized medicine. The market is expected to witness further consolidation as larger entities seek to acquire specialized masking expertise, while smaller, agile companies will focus on niche innovations. The increasing emphasis on sustainability will also drive the development of eco-friendly masking solutions. Overall, the market is poised for significant expansion, offering substantial value creation for stakeholders invested in advanced material science and medical device manufacturing.

Orthopaedic Implant Masking Segmentation

-

1. Application

- 1.1. Artificial Joints

- 1.2. Spinal Implants

- 1.3. Others

-

2. Types

- 2.1. Visible Light Curing Type

- 2.2. UV Curing Type

Orthopaedic Implant Masking Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Orthopaedic Implant Masking Regional Market Share

Geographic Coverage of Orthopaedic Implant Masking

Orthopaedic Implant Masking REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Artificial Joints

- 5.1.2. Spinal Implants

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Visible Light Curing Type

- 5.2.2. UV Curing Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Artificial Joints

- 6.1.2. Spinal Implants

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Visible Light Curing Type

- 6.2.2. UV Curing Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Artificial Joints

- 7.1.2. Spinal Implants

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Visible Light Curing Type

- 7.2.2. UV Curing Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Artificial Joints

- 8.1.2. Spinal Implants

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Visible Light Curing Type

- 8.2.2. UV Curing Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Artificial Joints

- 9.1.2. Spinal Implants

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Visible Light Curing Type

- 9.2.2. UV Curing Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Orthopaedic Implant Masking Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Artificial Joints

- 10.1.2. Spinal Implants

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Visible Light Curing Type

- 10.2.2. UV Curing Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dymax

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Panacol

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intercarat

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allegra Orthopedics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ionbond

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Dymax

List of Figures

- Figure 1: Global Orthopaedic Implant Masking Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Orthopaedic Implant Masking Revenue (million), by Application 2025 & 2033

- Figure 3: North America Orthopaedic Implant Masking Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Orthopaedic Implant Masking Revenue (million), by Types 2025 & 2033

- Figure 5: North America Orthopaedic Implant Masking Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Orthopaedic Implant Masking Revenue (million), by Country 2025 & 2033

- Figure 7: North America Orthopaedic Implant Masking Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Orthopaedic Implant Masking Revenue (million), by Application 2025 & 2033

- Figure 9: South America Orthopaedic Implant Masking Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Orthopaedic Implant Masking Revenue (million), by Types 2025 & 2033

- Figure 11: South America Orthopaedic Implant Masking Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Orthopaedic Implant Masking Revenue (million), by Country 2025 & 2033

- Figure 13: South America Orthopaedic Implant Masking Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Orthopaedic Implant Masking Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Orthopaedic Implant Masking Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Orthopaedic Implant Masking Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Orthopaedic Implant Masking Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Orthopaedic Implant Masking Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Orthopaedic Implant Masking Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Orthopaedic Implant Masking Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Orthopaedic Implant Masking Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Orthopaedic Implant Masking Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Orthopaedic Implant Masking Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Orthopaedic Implant Masking Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Orthopaedic Implant Masking Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Orthopaedic Implant Masking Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Orthopaedic Implant Masking Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Orthopaedic Implant Masking Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Orthopaedic Implant Masking Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Orthopaedic Implant Masking Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Orthopaedic Implant Masking Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Orthopaedic Implant Masking Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Orthopaedic Implant Masking Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Orthopaedic Implant Masking Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Orthopaedic Implant Masking Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Orthopaedic Implant Masking Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Orthopaedic Implant Masking Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Orthopaedic Implant Masking Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Orthopaedic Implant Masking Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Orthopaedic Implant Masking Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthopaedic Implant Masking?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Orthopaedic Implant Masking?

Key companies in the market include Dymax, Panacol, Intercarat, Allegra Orthopedics, Ionbond.

3. What are the main segments of the Orthopaedic Implant Masking?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 314 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Orthopaedic Implant Masking," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Orthopaedic Implant Masking report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Orthopaedic Implant Masking?

To stay informed about further developments, trends, and reports in the Orthopaedic Implant Masking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence