Key Insights

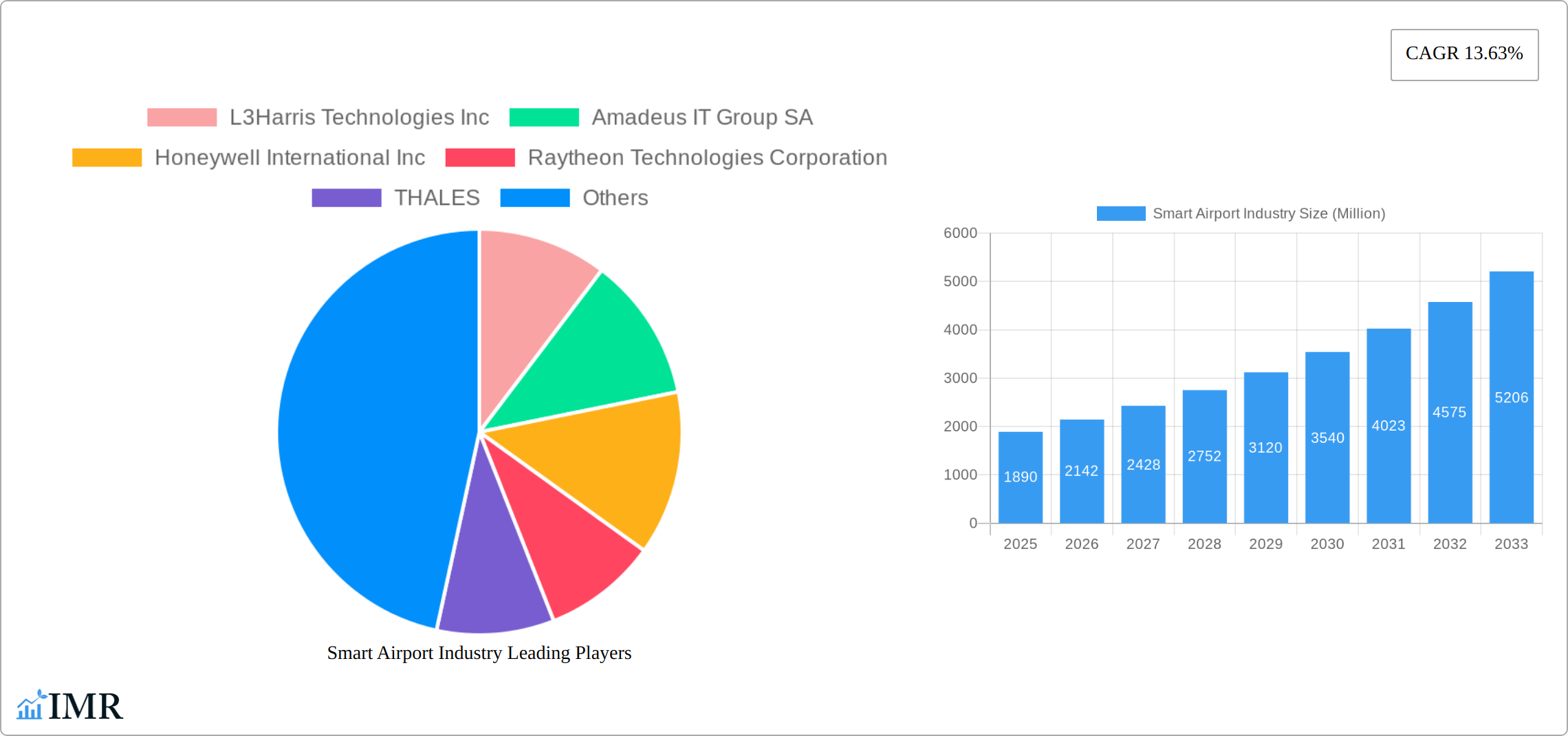

The smart airport market is experiencing robust growth, projected to reach $1.89 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 13.63% from 2025 to 2033. This expansion is driven by several factors. Increasing passenger traffic globally necessitates efficient airport operations, leading to significant investments in technologies that enhance passenger experience, optimize resource allocation, and improve security. The integration of advanced technologies like AI, IoT, and cloud computing is transforming airport management, enabling predictive maintenance, real-time passenger flow monitoring, and personalized services. Furthermore, stringent security regulations and rising concerns about cybersecurity are fueling demand for sophisticated security systems within smart airports. The market is segmented by technology (security, communication, air/ground traffic control, passenger/cargo handling) and by airport operation (landside, airside, terminal side), reflecting the diverse applications of smart airport solutions. North America and Europe currently hold significant market share, driven by early adoption and technological advancements. However, the Asia-Pacific region is poised for rapid growth due to burgeoning air travel and significant infrastructure development.

Smart Airport Industry Market Size (In Billion)

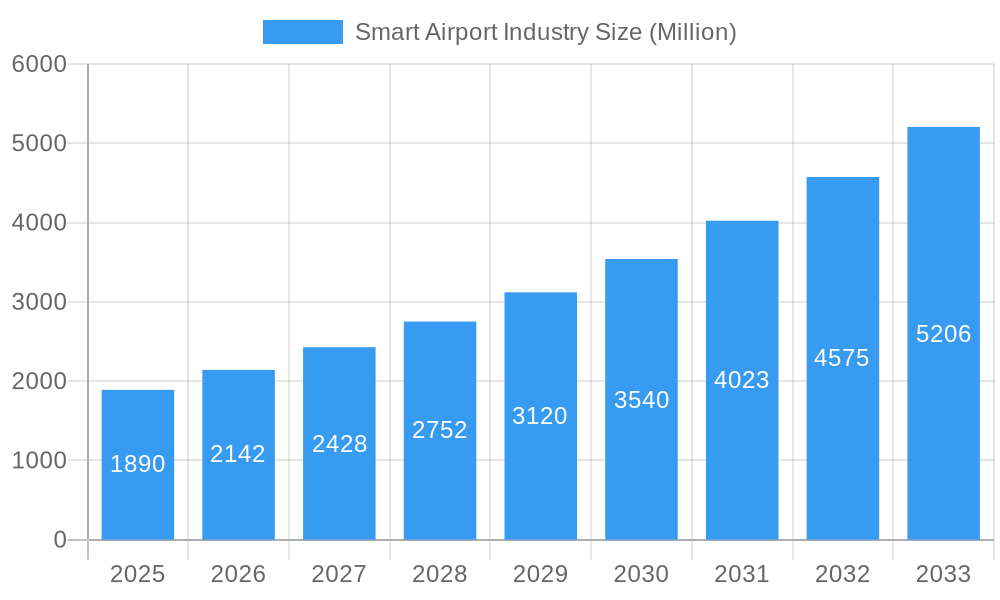

The competitive landscape comprises major players such as L3Harris Technologies, Amadeus IT Group, Honeywell International, Raytheon Technologies, Thales, Sabre, IBM, Cisco, Siemens, NATS Holdings, SITA, and T-Systems. These companies are actively involved in developing and deploying cutting-edge solutions across the various segments of the smart airport market. Continuous innovation in areas such as biometric security, automated baggage handling, and intelligent traffic management systems will further shape market dynamics. While challenges remain, such as high initial investment costs and the need for robust cybersecurity measures, the long-term growth prospects for the smart airport market remain exceptionally positive, driven by sustained demand for improved efficiency and enhanced passenger experience. The market is expected to see considerable expansion in emerging markets as well, driven by investments in infrastructure and improving technology access.

Smart Airport Industry Company Market Share

Smart Airport Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Smart Airport industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking insights into this rapidly evolving sector. The market is segmented by technology (Security Systems, Communication Systems, Air and Ground Traffic Control, Passenger, Cargo & Baggage Ground Handling) and airport operation (Landside, Airside, Terminal Side).

Smart Airport Industry Market Dynamics & Structure

The global smart airport market is experiencing robust and sustained growth, propelled by escalating passenger volumes, rapid technological advancements, and a critical need for enhanced operational efficiency and uncompromising security. The market exhibits a moderate concentration, with a cadre of leading players commanding a significant portion of the market share. Technological innovation, particularly in cutting-edge domains such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced Big Data Analytics, stands as a pivotal catalyst. Evolving regulatory frameworks, encompassing stringent security mandates and comprehensive data privacy laws, exert a considerable influence on the market's developmental trajectory. Direct competitive product substitutes are relatively scarce, given that smart airport solutions are inherently integrated systems. The primary end-user demographic comprises airport operators, airlines, and governmental agencies. Mergers and Acquisitions (M&A) activity is on an upward trend, as established companies strategically pursue market expansion and the acquisition of pioneering technologies.

- Market Concentration: The market is moderately concentrated, with the top 5 players estimated to hold approximately 60-65% of the market share in 2025.

- Technological Innovation: AI, IoT, and Big Data Analytics are the cornerstones of innovation, driving significant improvements in passenger experience and operational efficiency through intelligent automation and data-driven insights.

- Regulatory Framework: Stringent security regulations and robust data privacy laws are shaping market dynamics, pushing for greater compliance and secure data handling practices.

- M&A Activity: An estimated 25-30 M&A deals occurred in the smart airport sector between 2019 and 2024, indicating a growing trend of consolidation and strategic acquisitions.

- Innovation Barriers: Significant hurdles to innovation include high initial investment costs for advanced infrastructure and the inherent complexities associated with integrating diverse technological systems.

Smart Airport Industry Growth Trends & Insights

The smart airport market is poised for substantial expansion, with projections indicating a reach of approximately USD 150-170 billion units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of **15-18% during the forecast period (2025-2033)**. The historical period (2019-2024) witnessed a CAGR of around 12-14%. The escalating adoption of smart technologies is primarily fueled by the persistent demand for enhanced operational efficiency, superior security measures, and an elevated passenger experience. Disruptive technological advancements, such as the seamless integration of 5G connectivity and sophisticated AI-powered solutions, are further accelerating market growth. Shifting consumer behavior, characterized by passengers increasingly expecting seamless, personalized, and intuitive airport journeys, is creating a powerful demand for comprehensive smart airport solutions. Market penetration is anticipated to reach **40-45% by 2033**. This considerable growth is underpinned by escalating global investments in airport infrastructure modernization and technological upgrades.

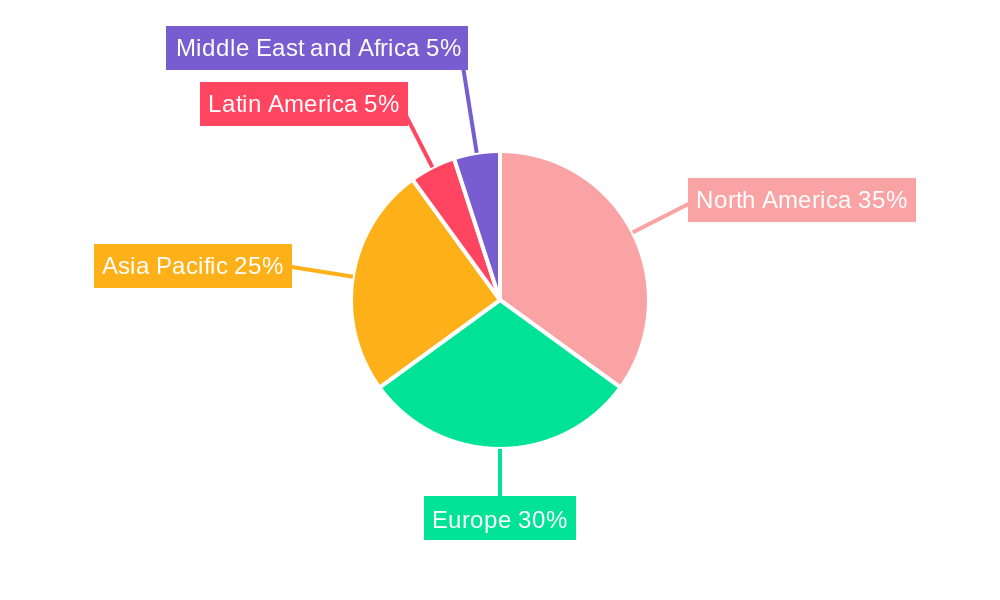

Dominant Regions, Countries, or Segments in Smart Airport Industry

North America currently commands the largest market share, closely followed by Europe and the Asia-Pacific region. The significant growth observed in these regions is attributable to high passenger traffic volumes, advanced infrastructure development, and the early adoption of cutting-edge smart technologies. Within the technological segmentation, Security Systems and Communication Systems presently dominate the market. However, the Air and Ground Traffic Control segment is demonstrating a particularly high growth potential, driven by the need for optimized airspace management. By airport operation, the Airside and Terminal Side segments are currently the largest contributors, reflecting the extensive implementation of smart technologies in these critical areas.

- Key Drivers (North America): Substantial investments in airport infrastructure modernization, robust technological capabilities, and supportive government policies fostering innovation.

- Key Drivers (Europe): A strong emphasis on enhancing passenger experience, widespread adoption of digitalization initiatives, and a continuous pipeline of airport modernization projects.

- Key Drivers (Asia-Pacific): Rapid airport infrastructure development, a significant surge in air travel, and proactive government support for technological upgrades and smart city integration.

- Segment Dominance: Security Systems are currently dominant, holding an estimated market share of 25-28% in 2025, followed by Communication Systems, with a market share of approximately 20-23% in 2025.

Smart Airport Industry Product Landscape

The smart airport product landscape is characterized by a wide range of solutions, including intelligent security systems, advanced communication networks, automated baggage handling systems, and passenger information systems. These systems integrate various technologies, such as AI, IoT, and big data analytics, to enhance efficiency, security, and passenger experience. Key innovations include biometric technologies for faster passenger processing, predictive analytics for optimizing resource allocation, and advanced passenger services like mobile check-in and real-time flight updates. These solutions offer unique selling propositions such as improved operational efficiency, enhanced security, and a better passenger experience, ultimately contributing to the overall success of smart airports.

Key Drivers, Barriers & Challenges in Smart Airport Industry

Key Drivers: Increasing air passenger traffic, the need for enhanced security, rising demand for improved passenger experience, technological advancements (AI, IoT, Big Data), government initiatives promoting airport modernization, and significant investments in airport infrastructure upgrades.

Challenges: High initial investment costs, cybersecurity risks, integration complexities of different systems, lack of interoperability between systems from different vendors, regulatory compliance issues, data privacy concerns, and skilled workforce shortages. These challenges can potentially delay market growth and increase operational costs by approximately xx million units annually.

Emerging Opportunities in Smart Airport Industry

Emerging opportunities include the expanding adoption of AI-powered solutions for predictive maintenance and passenger flow optimization, the integration of 5G technology for enhanced connectivity, and the growth of biometric technologies for seamless passenger processing. Untapped markets exist in developing countries with rapidly growing air travel sectors. Further opportunities lie in developing innovative applications such as personalized airport experiences leveraging data analytics and improving sustainability initiatives within airport operations.

Growth Accelerators in the Smart Airport Industry Industry

Long-term growth will be accelerated by technological breakthroughs in areas such as AI, machine learning, and blockchain technology, fostering further automation and improved security features. Strategic partnerships between airport operators, technology providers, and airlines will also drive market expansion. Market expansion strategies focusing on emerging economies and developing regions, particularly in Asia-Pacific, will contribute to significant future growth.

Key Players Shaping the Smart Airport Industry Market

Notable Milestones in Smart Airport Industry Sector

- February 2023: Smiths Detection secured a significant contract to deploy advanced checkpoint security technology across five major airports in New Zealand, enhancing passenger screening capabilities.

- June 2022: Fiumicino Airport successfully implemented a 100% X-ray baggage control system, significantly improving security efficiency and passenger throughput.

- June 2022: SITA and Alstef Group jointly launched their innovative Swift Drop self-bag drop solution, with Mexico City's Felipe Ángeles International Airport being an early adopter, installing 20 units to streamline the check-in process.

In-Depth Smart Airport Industry Market Outlook

The smart airport market is exceptionally well-positioned for continued, significant growth, primarily driven by relentless technological advancements, ever-increasing passenger traffic, and the non-negotiable imperative for enhanced operational efficiency and robust security. Strategic opportunities abound for companies capable of developing and deploying innovative solutions that effectively address critical challenges such as advanced cybersecurity, sophisticated data privacy management, and seamless system interoperability. Focusing on emerging markets and cultivating strategic partnerships will be paramount for achieving success in this dynamic and rapidly evolving sector. The future outlook for the smart airport industry is unequivocally positive, with substantial market expansion anticipated over the next decade, propelled by a powerful confluence of groundbreaking technological innovations and the evolving, sophisticated needs of the global aviation industry.

Smart Airport Industry Segmentation

-

1. Technology

- 1.1. Security Systems

- 1.2. Communication Systems

- 1.3. Air and Ground Traffic Control

- 1.4. Passenger, Cargo, and Baggage Ground Handling

-

2. Airport Operation

- 2.1. Landside

- 2.2. Airside

- 2.3. Terminal Side

Smart Airport Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Smart Airport Industry Regional Market Share

Geographic Coverage of Smart Airport Industry

Smart Airport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 The Passenger

- 3.4.2 Cargo & Baggage Ground Handling Segment to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Security Systems

- 5.1.2. Communication Systems

- 5.1.3. Air and Ground Traffic Control

- 5.1.4. Passenger, Cargo, and Baggage Ground Handling

- 5.2. Market Analysis, Insights and Forecast - by Airport Operation

- 5.2.1. Landside

- 5.2.2. Airside

- 5.2.3. Terminal Side

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Security Systems

- 6.1.2. Communication Systems

- 6.1.3. Air and Ground Traffic Control

- 6.1.4. Passenger, Cargo, and Baggage Ground Handling

- 6.2. Market Analysis, Insights and Forecast - by Airport Operation

- 6.2.1. Landside

- 6.2.2. Airside

- 6.2.3. Terminal Side

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Security Systems

- 7.1.2. Communication Systems

- 7.1.3. Air and Ground Traffic Control

- 7.1.4. Passenger, Cargo, and Baggage Ground Handling

- 7.2. Market Analysis, Insights and Forecast - by Airport Operation

- 7.2.1. Landside

- 7.2.2. Airside

- 7.2.3. Terminal Side

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Security Systems

- 8.1.2. Communication Systems

- 8.1.3. Air and Ground Traffic Control

- 8.1.4. Passenger, Cargo, and Baggage Ground Handling

- 8.2. Market Analysis, Insights and Forecast - by Airport Operation

- 8.2.1. Landside

- 8.2.2. Airside

- 8.2.3. Terminal Side

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Security Systems

- 9.1.2. Communication Systems

- 9.1.3. Air and Ground Traffic Control

- 9.1.4. Passenger, Cargo, and Baggage Ground Handling

- 9.2. Market Analysis, Insights and Forecast - by Airport Operation

- 9.2.1. Landside

- 9.2.2. Airside

- 9.2.3. Terminal Side

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Security Systems

- 10.1.2. Communication Systems

- 10.1.3. Air and Ground Traffic Control

- 10.1.4. Passenger, Cargo, and Baggage Ground Handling

- 10.2. Market Analysis, Insights and Forecast - by Airport Operation

- 10.2.1. Landside

- 10.2.2. Airside

- 10.2.3. Terminal Side

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amadeus IT Group SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Raytheon Technologies Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 THALES

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sabre GLBL Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBM Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cisco Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NATS Holdings Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SITA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 T-Systems International GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Smart Airport Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 5: North America Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 6: North America Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 11: Europe Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 12: Europe Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 17: Asia Pacific Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 18: Asia Pacific Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Latin America Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 23: Latin America Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 24: Latin America Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Smart Airport Industry Revenue (Million), by Airport Operation 2025 & 2033

- Figure 29: Middle East and Africa Smart Airport Industry Revenue Share (%), by Airport Operation 2025 & 2033

- Figure 30: Middle East and Africa Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 3: Global Smart Airport Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 6: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 11: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 19: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 27: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Smart Airport Industry Revenue Million Forecast, by Airport Operation 2020 & 2033

- Table 32: Global Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Airport Industry?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the Smart Airport Industry?

Key companies in the market include L3Harris Technologies Inc, Amadeus IT Group SA, Honeywell International Inc, Raytheon Technologies Corporation, THALES, Sabre GLBL Inc, IBM Corporation, Cisco Systems Inc, Siemens AG, NATS Holdings Limited, SITA, T-Systems International GmbH.

3. What are the main segments of the Smart Airport Industry?

The market segments include Technology, Airport Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Passenger. Cargo & Baggage Ground Handling Segment to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2023, the Aviation Security Service (AvSec) of New Zealand awarded a contract to Smiths Detection, a leader in threat detection and security inspection technologies, to provide cutting-edge checkpoint security technology for its five main international airports: Auckland, Christchurch, Dunedin, Queenstown, and Wellington.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Airport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Airport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Airport Industry?

To stay informed about further developments, trends, and reports in the Smart Airport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence