Key Insights

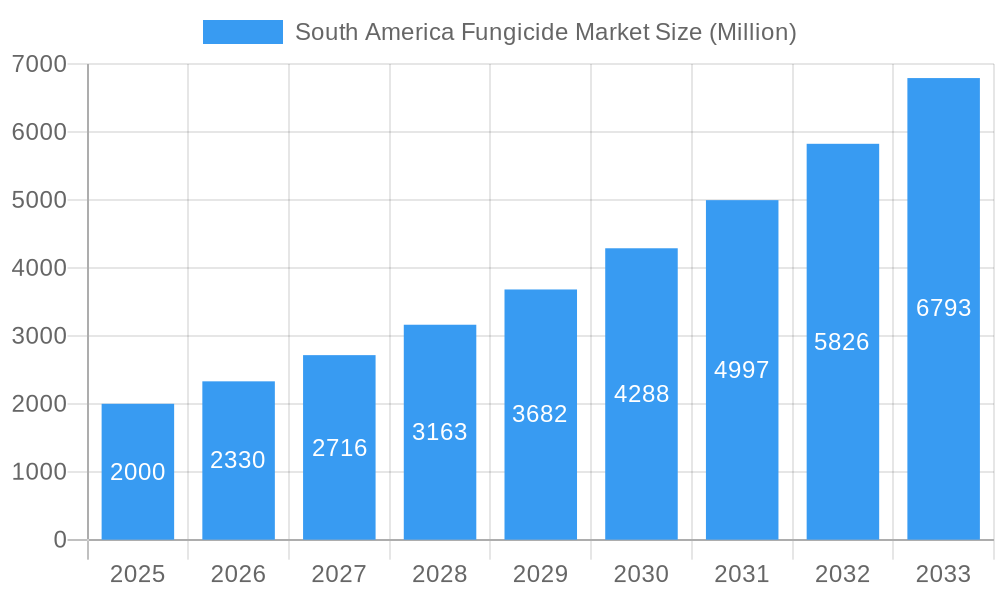

The South American fungicide market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 16.50% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of fungal diseases affecting major crops like grains & cereals, fruits & vegetables, and commercial crops in the region necessitates higher fungicide usage. Secondly, the growing adoption of advanced application methods like chemigation and seed treatment, which improve efficacy and reduce environmental impact, fuels market growth. Furthermore, rising awareness among farmers about the economic benefits of disease management and the increasing availability of high-quality, effective fungicides contribute to market expansion. Brazil and Argentina constitute significant market segments, due to their substantial agricultural output and established pesticide markets. However, factors such as stringent regulatory frameworks regarding pesticide usage and the potential for environmental concerns related to fungicide application represent some market restraints. The market is segmented by application mode (chemigation, foliar, fumigation, seed treatment, soil treatment) and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), providing diverse opportunities for market players. The competitive landscape is shaped by major multinational corporations like Bayer AG, Syngenta Group, BASF SE, and FMC Corporation, alongside regional players, indicating a dynamic market environment.

South America Fungicide Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a significant increase in market size driven by continued investment in agricultural research and development, leading to the introduction of novel, more effective and sustainable fungicides. The growth will also be influenced by government initiatives promoting sustainable agriculture and improved pest management practices across South America. While challenges persist in relation to regulatory compliance and environmental concerns, the overall market outlook remains positive, propelled by the increasing demand for food security and improved crop yields in a region known for its extensive agricultural production. The diverse range of application modes and crop types further ensures market dynamism and opportunities for continued growth. Competition among established players and emerging companies will likely intensify, driving innovation and the development of specialized fungicides targeting specific fungal pathogens and crop types.

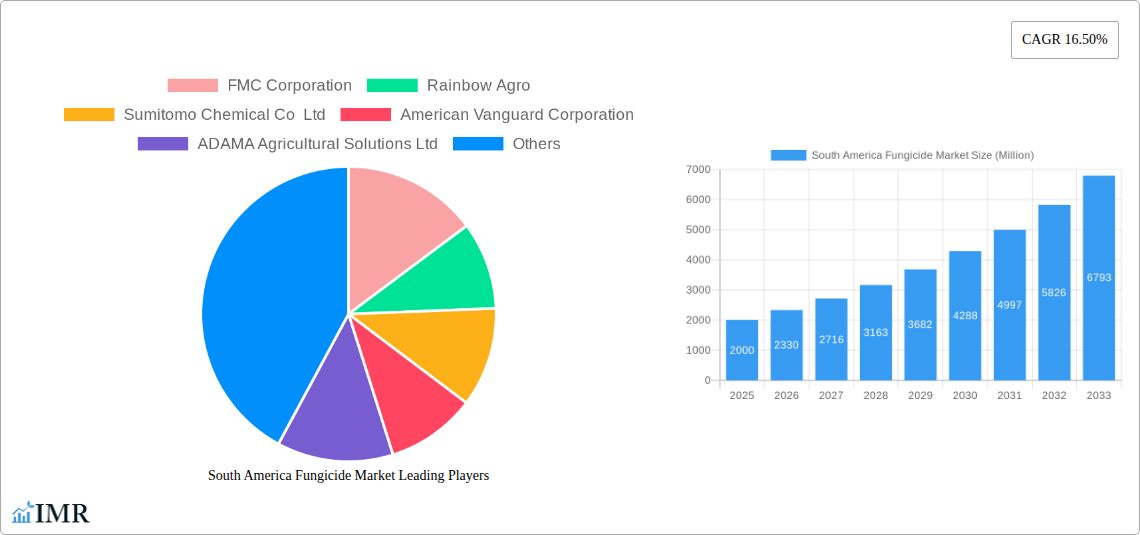

South America Fungicide Market Company Market Share

South America Fungicide Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the South America Fungicide Market, offering valuable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by country (Argentina, Brazil, Chile, Rest of South America), application mode (Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment), and crop type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental). Key players analyzed include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limited, Syngenta Group, Corteva Agriscience, and BASF SE. The total market size is projected to reach xx Million units by 2033.

South America Fungicide Market Dynamics & Structure

The South American fungicide market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, driven by the need for more effective and sustainable solutions, is a key growth driver. Stringent regulatory frameworks regarding pesticide usage influence product development and adoption. The market also faces competition from bio-pesticides and other crop protection methods. M&A activity has been moderate, primarily focused on expanding geographic reach and product portfolios.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on developing environmentally friendly fungicides with improved efficacy and reduced environmental impact.

- Regulatory Framework: Varying regulations across South American countries influence product registration and market access.

- Competitive Substitutes: Bio-pesticides and integrated pest management (IPM) strategies pose a competitive threat.

- M&A Trends: A moderate level of M&A activity is observed, primarily driven by expansion strategies. The total value of M&A deals in the period 2019-2024 was approximately xx Million units.

- Innovation Barriers: High R&D costs and lengthy regulatory approval processes hinder innovation.

South America Fungicide Market Growth Trends & Insights

The South America Fungicide market witnessed significant growth during the historical period (2019-2024), driven by factors such as increasing crop production, growing awareness of crop diseases, and favorable government policies. The market is expected to maintain a steady growth trajectory during the forecast period (2025-2033), exhibiting a CAGR of xx%. This growth is fueled by rising demand for high-yielding crops, expanding agricultural land under cultivation, and increasing adoption of advanced farming techniques. Technological advancements in fungicide formulations, such as the development of more effective and environmentally friendly products, further contribute to market expansion. Consumer behavior is shifting towards sustainable and eco-friendly agricultural practices, pushing the adoption of bio-pesticides and integrated pest management strategies. Market penetration in certain regions and crop types remains relatively low, representing significant untapped potential.

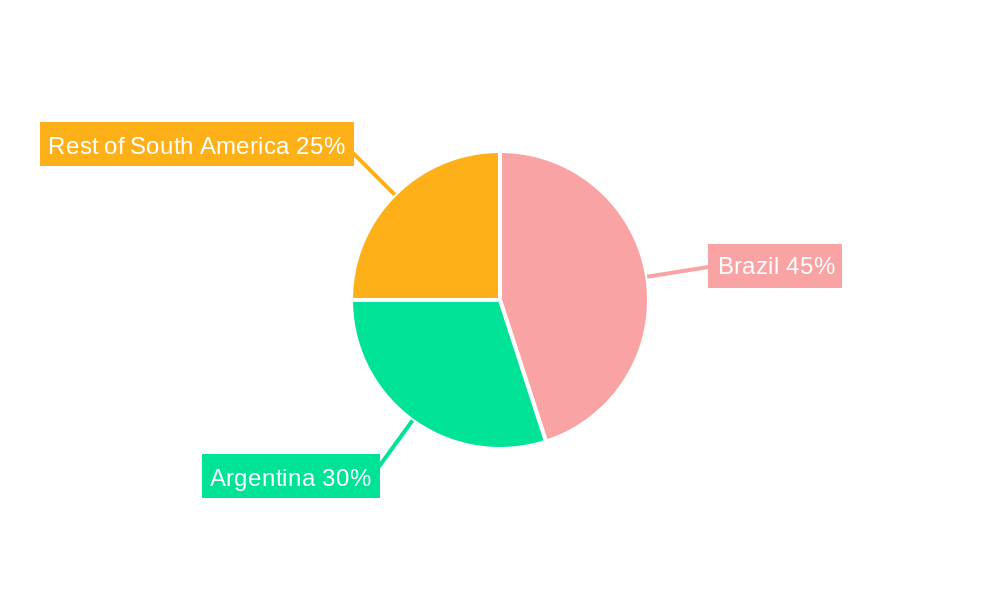

Dominant Regions, Countries, or Segments in South America Fungicide Market

Brazil dominates the South American fungicide market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to its extensive agricultural sector, large arable land, and significant production of major crops such as soybeans, corn, and sugarcane. Argentina and Chile also hold substantial market shares, driven by their robust agricultural economies and diverse cropping patterns. The foliar application mode represents the largest segment, followed by seed treatment and soil treatment. Grains & Cereals and Fruits & Vegetables are the most significant crop segments.

- Key Drivers for Brazil:

- Extensive agricultural land and production of major crops.

- High incidence of fungal diseases.

- Government support for agricultural development.

- Key Drivers for Argentina:

- Significant production of soybeans, corn, and wheat.

- Growing adoption of modern farming techniques.

- Key Drivers for Chile:

- Strong fruit and vegetable production.

- Focus on export-oriented agriculture.

- Growth Potential: Untapped potential exists in the Rest of South America region.

South America Fungicide Market Product Landscape

The South American fungicide market showcases a diverse product landscape, encompassing various chemical classes and formulations. Innovations focus on enhancing efficacy, reducing environmental impact, and improving ease of application. New products often highlight unique selling propositions such as broad-spectrum activity, systemic action, and compatibility with other crop protection products. Technological advancements include nanoformulations, which enhance product delivery and efficacy.

Key Drivers, Barriers & Challenges in South America Fungicide Market

Key Drivers:

- Rising demand for high-yielding crops.

- Increased incidence of fungal diseases due to climate change.

- Growing adoption of modern farming practices.

- Government initiatives promoting agricultural development.

Key Challenges:

- High cost of fungicides.

- Stringent regulations on pesticide use.

- Environmental concerns related to fungicide application.

- Competition from bio-pesticides and other crop protection methods. The market share of bio-pesticides is currently estimated at approximately xx%, with an anticipated increase to xx% by 2033.

Emerging Opportunities in South America Fungicide Market

- Growing demand for bio-pesticides and other sustainable crop protection solutions.

- Untapped potential in the Rest of South America region.

- Increasing adoption of precision agriculture techniques.

- Opportunities for developing fungicides specific to emerging crop diseases.

Growth Accelerators in the South America Fungicide Market Industry

Long-term growth in the South American fungicide market will be driven by several factors. Technological advancements in fungicide formulation and delivery systems will enhance efficacy and reduce environmental impact. Strategic partnerships between fungicide manufacturers and agricultural technology companies will accelerate innovation and market penetration. Expansion into untapped markets within South America and the development of specialized fungicides for specific crops and disease problems will further drive growth.

Key Players Shaping the South America Fungicide Market Market

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co Ltd

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- BASF SE

Notable Milestones in South America Fungicide Market Sector

- October 2022: Corteva Agriscience launched HavizaTM Active, a new fungicide to manage Asian soybean rot.

- January 2023: Bayer partnered with Oerth Bio to develop eco-friendly crop protection solutions.

- February 2023: ADAMA opened a new multi-purpose facility in Brazil, expanding its Prothioconazole-based product offerings.

In-Depth South America Fungicide Market Market Outlook

The South America fungicide market is poised for continued growth, driven by technological innovation, increasing crop production, and growing awareness of crop diseases. Strategic partnerships, expansion into untapped markets, and the development of sustainable solutions will be key to long-term success. The market's future potential is significant, particularly in regions with expanding agricultural sectors and increasing adoption of modern farming practices. Opportunities abound for companies that can develop and deliver effective, sustainable, and cost-efficient fungicide solutions.

South America Fungicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

South America Fungicide Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Fungicide Market Regional Market Share

Geographic Coverage of South America Fungicide Market

South America Fungicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fungicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rainbow Agro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Chemical Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Vanguard Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADAMA Agricultural Solutions Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limite

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Syngenta Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: South America Fungicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Fungicide Market Share (%) by Company 2025

List of Tables

- Table 1: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 2: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 3: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 4: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 5: South America Fungicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 7: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 8: South America Fungicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 9: South America Fungicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 10: South America Fungicide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Brazil South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Argentina South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Chile South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Colombia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Peru South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Venezuela South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Ecuador South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Bolivia South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Paraguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Uruguay South America Fungicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fungicide Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the South America Fungicide Market?

Key companies in the market include FMC Corporation, Rainbow Agro, Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Fungicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Brazil dominated the market as the threat of fungal diseases to crops became increasingly significant.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

February 2023: ADAMA opened a new multi-purpose facility in Brazil. With this factory, the company will be able to deliver all the Prothioconazole-based products in its pipeline to the global market and achieve its objective of introducing a number of innovative items to the Brazilian market in the upcoming years.January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.October 2022: HavizaTM Active was the newest fungicide brand added to Corteva Agriscience's strong innovation pipeline. The product is an alternative for farmers in South America to manage Asian soybean rot. The company broadened its active class of picolinamide through this innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fungicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fungicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fungicide Market?

To stay informed about further developments, trends, and reports in the South America Fungicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence