Key Insights

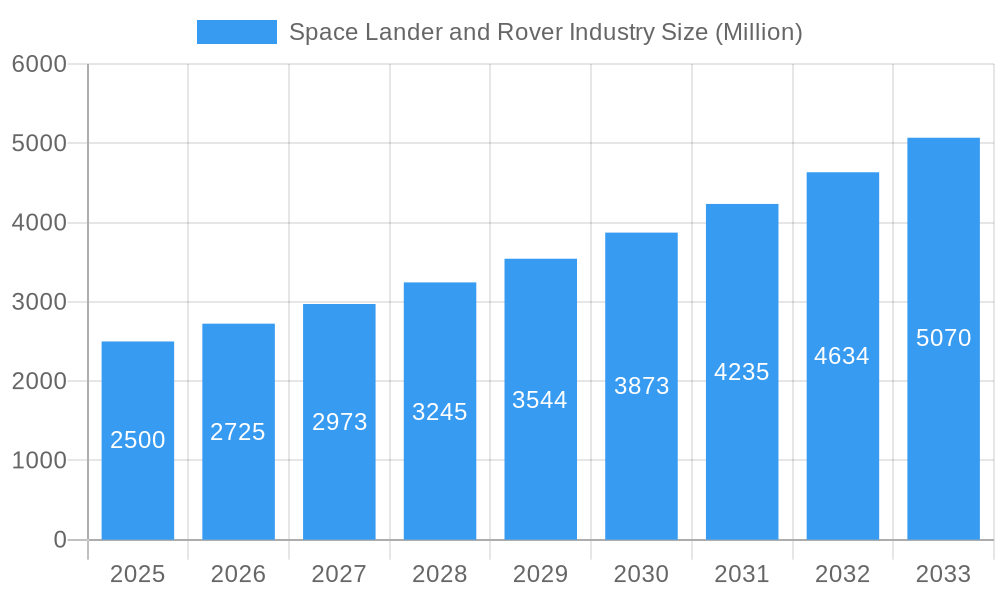

The global space lander and rover market is experiencing robust growth, driven by increased investments in space exploration by both government agencies and private companies. A compound annual growth rate (CAGR) exceeding 9% from 2019 to 2033 projects significant expansion. This surge is fueled by several key factors: the renewed focus on lunar exploration, including Artemis missions and commercial lunar payload delivery services; ambitious Mars exploration plans involving sample return missions and the search for life; and the burgeoning interest in asteroid mining and resource utilization. Technological advancements in robotics, autonomous navigation, and miniaturization are further contributing to market expansion, enabling the development of more sophisticated and cost-effective landers and rovers. The market is segmented by exploration target (Lunar, Mars, Asteroids), reflecting the diverse applications of this technology. While the North American market currently holds a significant share, the Asia-Pacific region is anticipated to exhibit strong growth, driven by increased investments from space agencies like ISRO and JAXA. Competitive forces are shaping the market, with established aerospace giants like Lockheed Martin and Airbus competing with innovative new space companies like Astrobotic and SpaceX, fostering innovation and driving down costs.

Space Lander and Rover Industry Market Size (In Billion)

Challenges remain, including the high cost of space missions, technological complexities associated with extraterrestrial operations, and regulatory hurdles surrounding space resource utilization. However, the long-term prospects for the space lander and rover market appear exceptionally promising, fueled by the pursuit of scientific discovery, resource acquisition, and the expansion of human presence beyond Earth. The market's trajectory suggests considerable opportunities for both established and emerging players in the coming decade, particularly those focusing on enhancing technological capabilities, reducing mission costs, and adapting to the evolving needs of various space exploration programs. The increasing involvement of private companies signifies a shift towards a more commercially viable and sustainable space exploration ecosystem.

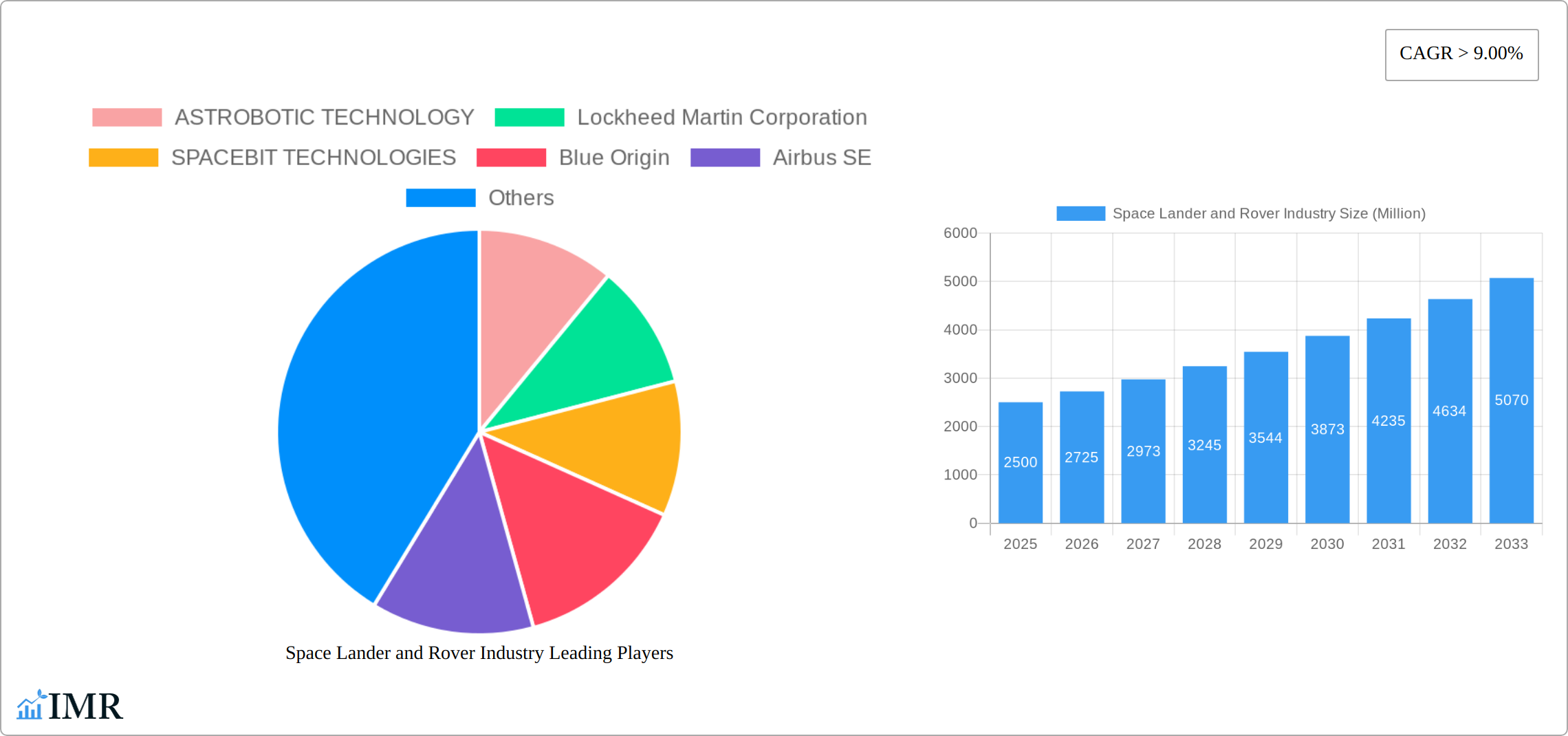

Space Lander and Rover Industry Company Market Share

Space Lander and Rover Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Space Lander and Rover industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of space exploration and the child market of surface exploration vehicles, offering valuable insights for industry professionals, investors, and researchers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

Space Lander and Rover Industry Market Dynamics & Structure

The Space Lander and Rover industry is characterized by a moderately concentrated market structure, with key players like Lockheed Martin Corporation, Northrop Grumman Corporation, and Airbus SE holding significant market share (estimated at xx% combined in 2025). Technological innovation, particularly in areas like autonomous navigation, AI-powered decision-making, and advanced propulsion systems, is a major driver. Stringent safety and reliability regulations, coupled with high initial investment costs, present significant barriers to entry. The industry witnesses consistent M&A activity, with xx deals recorded between 2019 and 2024, primarily driven by the consolidation of technology and expertise. Substitute technologies are limited, though advancements in drone technology could potentially impact niche segments in the future. The end-user demographics consist primarily of government space agencies (e.g., NASA, ESA, JAXA) and increasingly, private companies engaged in space exploration and resource extraction.

- Market Concentration: Moderately concentrated, with top 3 players holding xx% market share (2025).

- Technological Innovation: Autonomous navigation, AI, advanced propulsion systems are key drivers.

- Regulatory Framework: Stringent safety and reliability standards, high entry barriers.

- Competitive Substitutes: Limited, potential impact from advanced drone technology.

- M&A Trends: xx deals (2019-2024), driven by technology consolidation.

- End-User Demographics: Government agencies and private space exploration companies.

Space Lander and Rover Industry Growth Trends & Insights

The global Space Lander and Rover market is projected to experience significant growth during the forecast period (2025-2033). Driven by increased government spending on space exploration, the rise of private space companies, and the growing interest in extraterrestrial resource utilization, the market size is estimated at $xx million in 2025 and is expected to reach $xx million by 2033, exhibiting a CAGR of xx%. Increased adoption of advanced technologies like AI and machine learning for autonomous operations is further accelerating growth. The market penetration for lunar exploration rovers is estimated at xx% in 2025, expected to rise to xx% by 2033. Consumer behavior shifts are minimal, as the market is predominantly B2G (business-to-government) but increasing private sector investment and activity are introducing a more B2B dynamic.

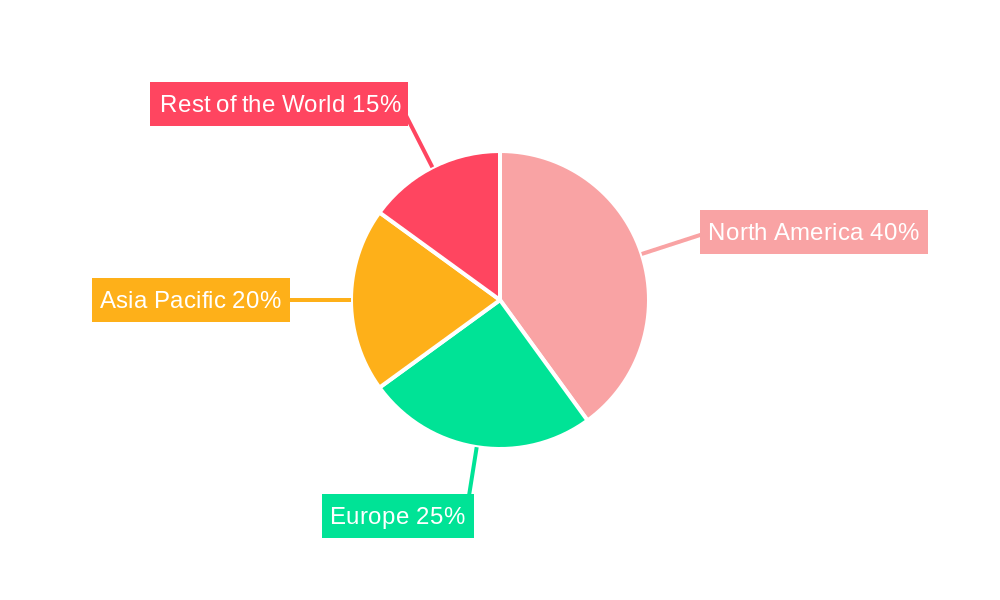

Dominant Regions, Countries, or Segments in Space Lander and Rover Industry

The United States currently dominates the Space Lander and Rover market, driven by substantial government funding (NASA) and a robust private space industry. However, China and other nations are rapidly investing in their space programs, accelerating their market share. In terms of segments, Lunar Surface Exploration currently holds the largest market share, largely due to the renewed focus on lunar missions and the potential for resource extraction.

- Key Drivers (US): Substantial NASA funding, thriving private space sector, advanced technological capabilities.

- Key Drivers (China): Increasing government investment in space exploration, ambitious lunar and Martian programs.

- Lunar Surface Exploration: Largest market segment due to renewed lunar missions and resource extraction potential.

- Mars Surface Exploration: Significant growth potential driven by international collaboration and scientific interest.

- Asteroids Surface Exploration: Emerging segment with significant long-term potential for resource extraction.

Space Lander and Rover Industry Product Landscape

Space landers and rovers are evolving rapidly, incorporating advanced features like autonomous navigation, enhanced scientific instrumentation, and improved durability for harsh environments. Unique selling propositions include increased payload capacity, extended operational lifespan, and advanced communication systems. Technological advancements include AI-powered path planning, advanced robotics, and radiation-hardened electronics.

Key Drivers, Barriers & Challenges in Space Lander and Rover Industry

Key Drivers:

- Escalating Government and Private Investment: A significant surge in funding from both national space agencies and private enterprises is fueling ambitious exploration missions and commercial ventures.

- Rapid Technological Advancements: Breakthroughs in AI-powered autonomy, sophisticated robotics, next-generation propulsion systems, and miniaturization are making complex missions more feasible and cost-effective.

- Growing Interest in Extraterrestrial Resource Utilization (ISRU): The potential to discover and utilize resources on the Moon, Mars, and asteroids for in-situ support and commercial purposes is a powerful motivator for lander and rover development.

- Scientific Discovery and Planetary Science: The enduring human curiosity to understand our solar system and search for signs of life continues to drive demand for specialized scientific landers and rovers.

- Commercialization of Space: The expanding private space sector is creating new opportunities for lunar and Martian payload delivery services, further stimulating the market.

Key Barriers & Challenges:

- Prohibitive Development and Operational Costs: The immense financial investment required for design, manufacturing, testing, launch, and ongoing operations remains a significant hurdle.

- Stringent Safety and Reliability Requirements: Missions to other celestial bodies demand unparalleled levels of reliability and redundancy due to the inability to perform in-flight repairs.

- Extremely Harsh Environmental Conditions: Extreme temperatures, radiation, abrasive dust, and challenging terrain on extraterrestrial surfaces pose significant design and operational challenges.

- Complex Supply Chains and Potential Disruptions: The global nature of space component manufacturing and the reliance on specialized suppliers create vulnerabilities to disruptions.

- International Competition and Evolving Regulatory Frameworks: The race for lunar and Martian resources and influence necessitates careful navigation of international space law, spectrum allocation, and potential geopolitical tensions. (Estimated impact: Potential for xx% reduction in market growth if not proactively addressed through robust international cooperation and clear regulatory guidelines).

- Talent Acquisition and Retention: The specialized skillset required for space mission development can lead to competition for highly skilled engineers and scientists.

Emerging Opportunities in Space Lander and Rover Industry

- Expanding into Commercial Space Tourism and Resource Extraction: Development of landers and rovers capable of supporting tourist expeditions and enabling systematic resource prospecting and extraction on the Moon and Mars.

- Development of Smaller, More Cost-Effective Landers and Rovers: A growing trend towards CubeSat-inspired, modular, and highly specialized smaller robotic systems to reduce mission costs and increase launch frequency.

- Integration of Advanced AI and Machine Learning Capabilities: Harnessing AI for autonomous navigation, intelligent data analysis, on-board decision-making, and adaptive mission planning to enhance efficiency and scientific return.

- Exploration of Icy Moons and Asteroids for Resource Extraction: Designing and deploying specialized landers and rovers equipped to explore and potentially extract water ice, minerals, and other valuable resources from diverse celestial bodies.

- In-Situ Manufacturing and Construction: Developing robotic capabilities for 3D printing and constructing infrastructure on other planets using local resources, paving the way for sustained human presence.

- Lunar and Martian Surface Mobility Solutions: Innovations in rover locomotion, power generation, and environmental adaptation to enable more extensive and complex surface exploration.

Growth Accelerators in the Space Lander and Rover Industry

Technological breakthroughs in areas such as advanced electric and nuclear propulsion systems for faster transit, miniaturization of sophisticated scientific instruments, and development of highly efficient and durable power sources (e.g., advanced solar arrays, radioisotope thermoelectric generators) will significantly accelerate market growth. Strategic partnerships between government agencies, burgeoning private companies, and international collaborations will foster innovation, share development risks, and accelerate the pace of technological maturation. Market expansion strategies targeting new, high-priority space exploration destinations and the establishment of sustainable off-world infrastructure will create unprecedented demand and drive substantial growth.

Key Players Shaping the Space Lander and Rover Industry Market

- ASTROBOTIC TECHNOLOGY

- Lockheed Martin Corporation

- SPACEBIT TECHNOLOGIES

- Blue Origin

- Airbus SE

- Canadian Space Agency

- ISRO (Indian Space Research Organisation)

- National Aeronautics and Space Administration (NASA)

- Roscosmos (State Space Corporation Roscosmos)

- ispace inc.

- Japanese Aerospace Exploration Agency (JAXA)

- Northrop Grumman Corporation

- China Academy of Space Technology (CAST)

- Maxar Technologies

- Honeybee Robotics

Notable Milestones in Space Lander and Rover Industry Sector

- May 2021: Lockheed Martin partners with General Motors to design next-generation lunar rovers.

- March 2021: NASA awards Northrop Grumman a contract (USD 60.2-84.5 million) for Mars Ascent Vehicle (MAV) and Sample Fetch Rover.

In-Depth Space Lander and Rover Industry Market Outlook

The Space Lander and Rover industry is poised for a period of sustained and robust growth, significantly propelled by a confluence of factors including unwavering government investment in ambitious exploration agendas, continuous technological innovation, and the dynamic expansion of the private space sector. Strategic alliances and crucial international collaborations will act as pivotal catalysts in accelerating the development of groundbreaking technologies and unlocking novel market opportunities. The increasing focus on In-Situ Resource Utilization (ISRU) from celestial bodies presents a profound and enduring long-term growth trajectory. While the industry must diligently address persistent challenges related to cost optimization, ensuring paramount safety and reliability, and the ongoing development of cutting-edge technologies, the overarching long-term market outlook remains exceptionally positive and promising, indicating a vibrant and expanding future.

Space Lander and Rover Industry Segmentation

-

1. Type

- 1.1. Lunar Surface Exploration

- 1.2. Mars Surface Exploration

- 1.3. Asteroids Surface Exploration

Space Lander and Rover Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Space Lander and Rover Industry Regional Market Share

Geographic Coverage of Space Lander and Rover Industry

Space Lander and Rover Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Focus On Space Exploration Driving the Demand for Landers and Rovers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lunar Surface Exploration

- 5.1.2. Mars Surface Exploration

- 5.1.3. Asteroids Surface Exploration

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lunar Surface Exploration

- 6.1.2. Mars Surface Exploration

- 6.1.3. Asteroids Surface Exploration

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lunar Surface Exploration

- 7.1.2. Mars Surface Exploration

- 7.1.3. Asteroids Surface Exploration

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lunar Surface Exploration

- 8.1.2. Mars Surface Exploration

- 8.1.3. Asteroids Surface Exploration

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lunar Surface Exploration

- 9.1.2. Mars Surface Exploration

- 9.1.3. Asteroids Surface Exploration

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ASTROBOTIC TECHNOLOGY

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPACEBIT TECHNOLOGIES

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Blue Origin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Canadian Space Agency

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ISRO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National Aeronautics and Space Administration

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roscosmos

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ispace inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Japanese Aerospace Exploration Agency (JAXA)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Northrop Grumman Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 China Academy of Space Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 ASTROBOTIC TECHNOLOGY

List of Figures

- Figure 1: Global Space Lander and Rover Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Space Lander and Rover Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Lander and Rover Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Space Lander and Rover Industry?

Key companies in the market include ASTROBOTIC TECHNOLOGY, Lockheed Martin Corporation, SPACEBIT TECHNOLOGIES, Blue Origin, Airbus SE, Canadian Space Agency, ISRO, National Aeronautics and Space Administration, Roscosmos, ispace inc, Japanese Aerospace Exploration Agency (JAXA), Northrop Grumman Corporation, China Academy of Space Technology.

3. What are the main segments of the Space Lander and Rover Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Focus On Space Exploration Driving the Demand for Landers and Rovers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2021, Lockheed Martin announced that it has teamed up with General Motors to design the next generation of lunar rovers, capable of transporting astronauts across farther distances on the lunar surface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Lander and Rover Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Lander and Rover Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Lander and Rover Industry?

To stay informed about further developments, trends, and reports in the Space Lander and Rover Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence