Key Insights

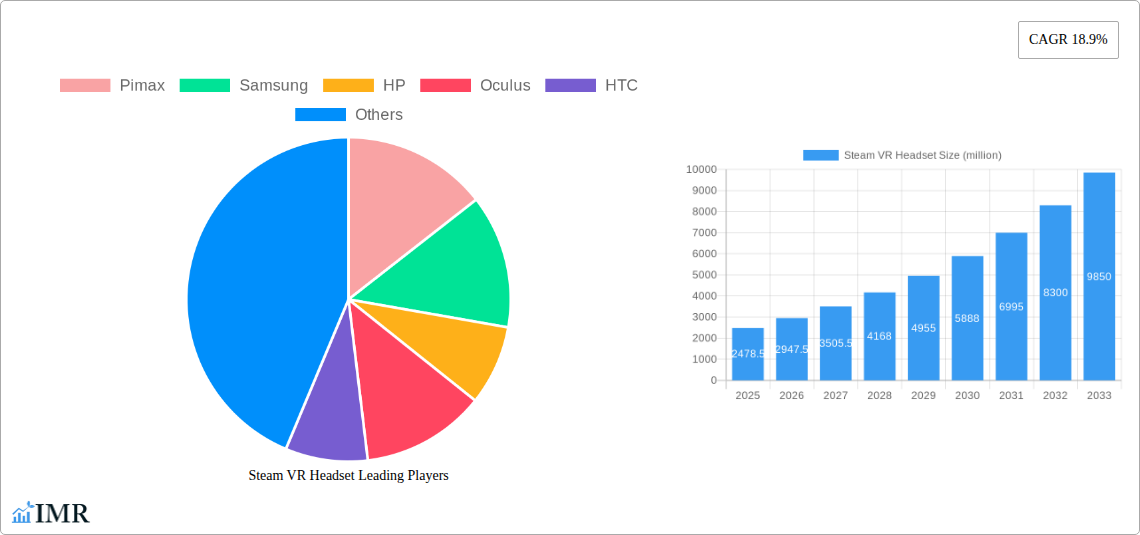

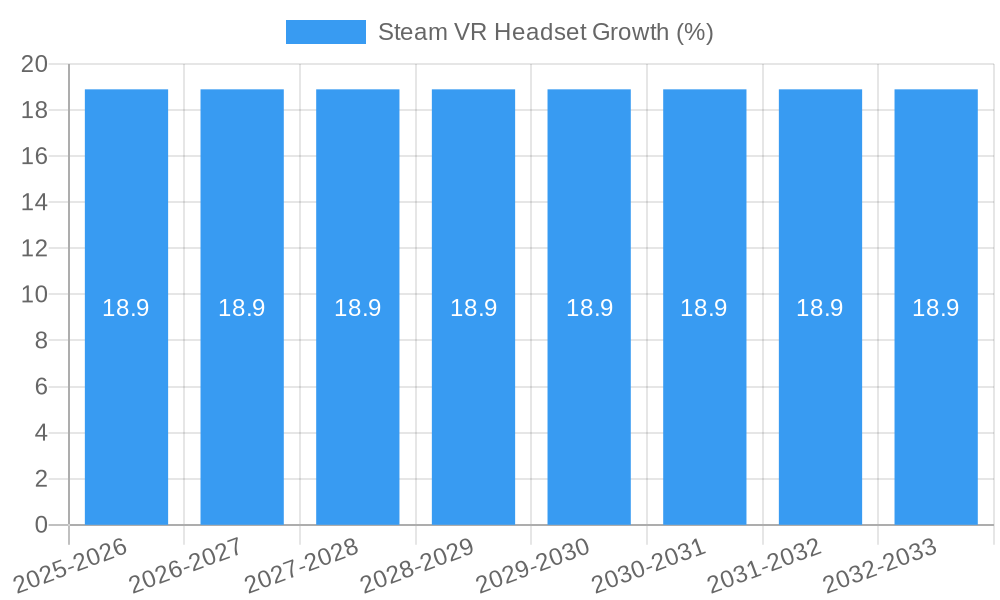

The Steam VR Headset market is poised for remarkable expansion, with an estimated market size of $2478.5 million in 2025, projected to experience a robust Compound Annual Growth Rate (CAGR) of 18.9% through 2033. This significant growth trajectory is fueled by a confluence of compelling drivers, including the increasing adoption of virtual reality technology in gaming, the burgeoning demand for immersive entertainment experiences, and the continuous advancements in VR hardware capabilities such as higher resolution displays, improved tracking, and greater comfort. The expanding ecosystem of VR content, particularly within the Steam platform, further solidifies these growth prospects, attracting both professional and amateur gamers seeking unparalleled virtual adventures.

Key trends shaping the Steam VR Headset market include the proliferation of standalone VR headsets, offering greater accessibility and freedom of movement, alongside advancements in tethered headsets that continue to push the boundaries of visual fidelity and processing power for dedicated PC VR enthusiasts. The market is segmented across professional and amateur player applications, with both tethered and standalone headset types catering to diverse user needs and preferences. Major industry players like Valve, Meta, HTC, and HP are heavily investing in R&D and strategic partnerships to innovate and capture market share. While the market demonstrates immense potential, certain restraints such as the high initial cost of high-end VR setups and the need for more widespread public awareness and understanding of VR technology may temper its pace. Nevertheless, the overarching trend indicates a strong and sustained growth phase for Steam VR headsets.

Steam VR Headset Market Report: Unlocking the Future of Immersive Computing

This comprehensive report delves into the dynamic Steam VR Headset market, providing unparalleled insights for industry professionals, investors, and stakeholders. With a focus on technological advancements, market segmentation, and competitive landscapes, this analysis covers the period from 2019 to 2033, with a detailed examination of the base and forecast years. We offer a deep dive into market size, growth trajectories, regional dominance, and key players shaping the immersive technology revolution.

Steam VR Headset Market Dynamics & Structure

The Steam VR headset market exhibits a moderate to high concentration, with key players like Valve, HTC, and Meta (Oculus) holding significant market share. Technological innovation remains a primary driver, fueled by advancements in display resolution, field of view, inside-out tracking, and haptic feedback. Regulatory frameworks, while still evolving, are beginning to influence data privacy and content distribution within the VR ecosystem. Competitive product substitutes, including advanced AR headsets and immersive gaming PCs, present a nuanced challenge, pushing VR headset manufacturers to differentiate on unique immersive experiences and integrated software ecosystems. End-user demographics are broadening, with a significant shift towards both professional applications and an expanding amateur player base. Mergers and acquisitions (M&A) trends are anticipated to intensify as larger tech conglomerates seek to solidify their positions in the burgeoning metaverse.

- Market Concentration: Top 3 players (Valve, HTC, Meta) estimated to hold ~65% of the market share in 2025.

- Technological Innovation Drivers: Increased demand for higher refresh rates, wider FOV, and reduced motion sickness.

- Regulatory Frameworks: Focus on user safety, data protection, and content moderation.

- Competitive Product Substitutes: High-fidelity gaming PCs, emerging AR devices.

- End-User Demographics: Growing adoption in enterprise training, design, and remote collaboration alongside the core gaming segment.

- M&A Trends: Anticipated consolidation to acquire specialized VR technology or content studios, with an estimated 3-5 significant deals expected between 2025-2027.

Steam VR Headset Growth Trends & Insights

The Steam VR headset market is poised for substantial growth, projected to reach XX million units by 2033, with a Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033. This expansion is underpinned by a significant increase in adoption rates across both consumer and enterprise segments. Technological disruptions, such as the development of lighter, more powerful, and untethered standalone headsets, are democratizing access and enhancing user experience, leading to greater market penetration. Consumer behavior shifts are evident, with a growing appetite for immersive gaming, social VR experiences, and virtual events. The integration of VR into professional workflows for training, design visualization, and remote collaboration further fuels this growth trajectory. The increasing affordability of high-quality VR hardware, coupled with a burgeoning content library across gaming, entertainment, and productivity applications, is creating a powerful flywheel effect, accelerating adoption. Furthermore, advancements in AI and cloud streaming are expected to unlock new possibilities for more complex and engaging VR experiences, pushing the boundaries of what's possible and further solidifying VR's place in the digital landscape. The transition from early adopters to a broader mainstream audience will be a key characteristic of this growth phase.

Dominant Regions, Countries, or Segments in Steam VR Headset

The Amateur Player segment, driven by the expansive and continually growing Steam gaming ecosystem, is anticipated to be the dominant force in the Steam VR headset market. This segment's growth is propelled by several key factors. The sheer volume of PC gamers on Steam, coupled with the increasing appeal of immersive gaming experiences, creates a vast potential user base. The availability of a diverse range of VR-compatible titles, from AAA blockbusters to indie gems, caters to a wide spectrum of player preferences. Furthermore, falling hardware prices for entry-level and mid-range VR headsets make them increasingly accessible to the average consumer. Economic policies in developed nations, such as government initiatives supporting technological adoption and R&D, also play a crucial role. Infrastructure development, including faster internet speeds and wider availability of high-performance gaming PCs, further supports the adoption of VR technology for amateur players.

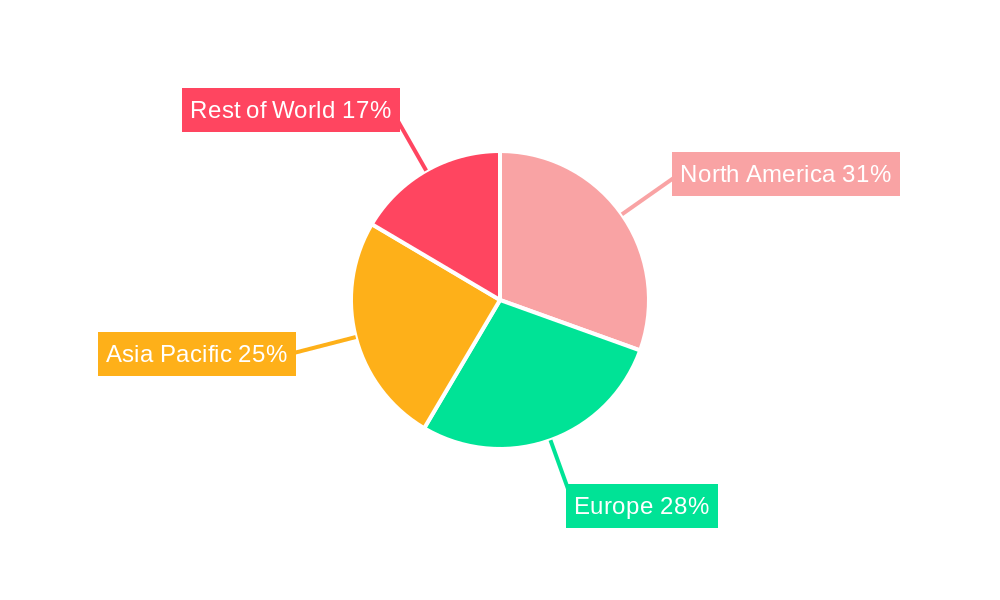

In terms of regions, North America is expected to maintain its dominance due to a strong existing gaming culture, high disposable incomes, and early adoption of new technologies. The United States, in particular, is a powerhouse for both hardware sales and VR content consumption. Europe follows closely, with countries like Germany, the UK, and France showing significant interest and investment in VR technology. Asia-Pacific, while historically lagging, is rapidly emerging as a key growth market, driven by rising disposable incomes in countries like China and South Korea, and a burgeoning PC gaming community. The development of local VR content and the expansion of affordable VR solutions are crucial for continued growth in this region.

- Dominant Segment: Amateur Player, representing an estimated XX% of the total market in 2025.

- Key Drivers (Amateur Player): Extensive Steam game library, increasing affordability of VR headsets, growing popularity of esports and immersive gaming.

- Dominant Region: North America, projected to account for XX% of global sales in 2025.

- Key Drivers (North America): Strong consumer spending, established gaming infrastructure, early technology adoption.

- Emerging Region: Asia-Pacific, exhibiting the highest projected CAGR between 2025-2033.

Steam VR Headset Product Landscape

The Steam VR headset product landscape is characterized by rapid innovation, with manufacturers like Valve, HTC, and Meta continually pushing the boundaries of immersion. Key product developments focus on enhanced visual fidelity through higher resolution displays (e.g., 4K per eye), wider fields of view (e.g., 120 degrees and beyond), and improved refresh rates for smoother motion. Inside-out tracking technology has become standard, eliminating the need for external sensors and simplifying setup. Haptic feedback integration in controllers and even full body suits is creating more realistic sensory experiences. Standalone headsets are gaining traction, offering increased freedom of movement and ease of use, while high-end tethered options continue to appeal to performance-critical users. Varjo Technologies is leading the charge in ultra-high-resolution VR for professional applications, setting new benchmarks for visual clarity.

Key Drivers, Barriers & Challenges in Steam VR Headset

Key Drivers:

- Technological Advancements: Continued improvements in display resolution, tracking accuracy, and form factor ergonomics.

- Growing Content Ecosystem: Expansion of VR-exclusive games, applications, and immersive experiences on Steam.

- Increasing PC Hardware Power: More accessible and powerful gaming PCs capable of running demanding VR titles.

- Enterprise Adoption: Growing use cases in training, design, simulation, and remote collaboration.

- Metaverse Momentum: The broader hype and investment surrounding the metaverse driving interest in VR hardware.

Barriers & Challenges:

- High Cost of Entry: While decreasing, premium VR headsets remain a significant investment for many consumers.

- Motion Sickness & User Comfort: Despite improvements, some users still experience discomfort during prolonged VR use.

- Content Dependency: The market relies heavily on the continuous release of compelling VR content to drive sustained engagement.

- Technical Expertise Required: Setup and troubleshooting can still be a barrier for less tech-savvy users.

- Fragmented Market: A wide array of headsets with varying specifications can confuse potential buyers.

- Supply Chain Disruptions: Potential for component shortages impacting production volumes, estimated to affect XX% of projected Q4 2025 shipments.

Emerging Opportunities in Steam VR Headset

Emerging opportunities lie in the development of more affordable and accessible VR headsets, broadening the consumer base. The integration of eye-tracking technology for foveated rendering and intuitive user interaction presents a significant avenue for performance enhancement and novel control schemes. Expanding VR applications beyond gaming into areas like virtual tourism, educational experiences, and therapeutic interventions offers substantial untapped market potential. The rise of social VR platforms and the continued development of the metaverse will likely drive demand for more sophisticated and personalized VR avatars and environments. Furthermore, the development of lighter, more stylish, and glasses-compatible VR headsets could significantly increase adoption among a wider demographic.

Growth Accelerators in the Steam VR Headset Industry

Several key catalysts are accelerating growth in the Steam VR headset industry. Continued technological breakthroughs in optics, display technology, and wireless connectivity are leading to more immersive and user-friendly devices. Strategic partnerships between hardware manufacturers and leading game developers are crucial for ensuring a steady stream of high-quality, VR-optimized content. Market expansion strategies, including aggressive pricing for entry-level devices and targeted marketing campaigns, are broadening the appeal of VR. The increasing investment in virtual reality by major technology companies signals a long-term commitment to the ecosystem, providing a stable foundation for future innovation and growth. Furthermore, the development of cross-platform VR experiences will unlock new user bases and content sharing opportunities.

Key Players Shaping the Steam VR Headset Market

- Valve

- HTC

- Meta

- HP

- Samsung

- Acer

- Lenovo

- Dell

- Razer

- Sony

- ASUS

- LG

- Microsoft

- DPVR

- PICO

- Pimax

- Varjo Technologies

Notable Milestones in Steam VR Headset Sector

- 2019: Valve releases the Valve Index, setting a new standard for high-fidelity PC VR.

- 2020: Oculus Quest 2 (Meta) launches, significantly driving standalone VR adoption with its affordability and performance.

- 2021: HTC continues to innovate with enterprise-focused headsets and advancements in wireless streaming solutions.

- 2022: The growing interest in the metaverse spurs further development and investment in VR hardware and software.

- 2023: PICO gains significant market traction, particularly in emerging markets, with its competitive standalone VR offerings.

- 2024: Varjo Technologies expands its professional VR solutions, catering to industries requiring unparalleled visual fidelity.

In-Depth Steam VR Headset Market Outlook

The Steam VR headset market is poised for sustained and robust growth, driven by the synergistic forces of technological advancement, expanding content libraries, and increasing consumer and enterprise adoption. Growth accelerators such as the development of more intuitive user interfaces, enhanced wireless capabilities, and the integration of advanced AI for more responsive and personalized experiences will be critical. Strategic partnerships between major tech players and content creators will ensure a vibrant ecosystem that keeps users engaged. The anticipated mainstream adoption of the metaverse will further solidify VR headsets as the primary gateway to immersive digital worlds. The ongoing evolution of standalone VR technology, coupled with the continued innovation in high-end PC VR, ensures a diversified market catering to a wide spectrum of user needs and preferences, presenting significant strategic opportunities for market leaders and new entrants alike.

Steam VR Headset Segmentation

-

1. Application

- 1.1. Professional Player

- 1.2. Amateur Player

-

2. Types

- 2.1. Tethered Headset

- 2.2. Standalone Headset

Steam VR Headset Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Steam VR Headset REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Professional Player

- 5.1.2. Amateur Player

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tethered Headset

- 5.2.2. Standalone Headset

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Professional Player

- 6.1.2. Amateur Player

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tethered Headset

- 6.2.2. Standalone Headset

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Professional Player

- 7.1.2. Amateur Player

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tethered Headset

- 7.2.2. Standalone Headset

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Professional Player

- 8.1.2. Amateur Player

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tethered Headset

- 8.2.2. Standalone Headset

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Professional Player

- 9.1.2. Amateur Player

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tethered Headset

- 9.2.2. Standalone Headset

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Steam VR Headset Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Professional Player

- 10.1.2. Amateur Player

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tethered Headset

- 10.2.2. Standalone Headset

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pimax

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oculus

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HTC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Razer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Valve

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dell

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lenovo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Varjo Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sony

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ASUS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Meta

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Microsoft

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 DPVR

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 PICO

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Pimax

List of Figures

- Figure 1: Global Steam VR Headset Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Steam VR Headset Revenue (million), by Application 2024 & 2032

- Figure 3: North America Steam VR Headset Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Steam VR Headset Revenue (million), by Types 2024 & 2032

- Figure 5: North America Steam VR Headset Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Steam VR Headset Revenue (million), by Country 2024 & 2032

- Figure 7: North America Steam VR Headset Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Steam VR Headset Revenue (million), by Application 2024 & 2032

- Figure 9: South America Steam VR Headset Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Steam VR Headset Revenue (million), by Types 2024 & 2032

- Figure 11: South America Steam VR Headset Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Steam VR Headset Revenue (million), by Country 2024 & 2032

- Figure 13: South America Steam VR Headset Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Steam VR Headset Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Steam VR Headset Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Steam VR Headset Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Steam VR Headset Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Steam VR Headset Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Steam VR Headset Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Steam VR Headset Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Steam VR Headset Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Steam VR Headset Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Steam VR Headset Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Steam VR Headset Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Steam VR Headset Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Steam VR Headset Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Steam VR Headset Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Steam VR Headset Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Steam VR Headset Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Steam VR Headset Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Steam VR Headset Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Steam VR Headset Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Steam VR Headset Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Steam VR Headset Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Steam VR Headset Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Steam VR Headset Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Steam VR Headset Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Steam VR Headset Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Steam VR Headset Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Steam VR Headset Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Steam VR Headset Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steam VR Headset?

The projected CAGR is approximately 18.9%.

2. Which companies are prominent players in the Steam VR Headset?

Key companies in the market include Pimax, Samsung, HP, Oculus, HTC, Razer, Valve, Dell, Acer, Lenovo, Varjo Technologies, Sony, ASUS, LG, Meta, Microsoft, DPVR, PICO.

3. What are the main segments of the Steam VR Headset?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2478.5 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steam VR Headset," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steam VR Headset report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steam VR Headset?

To stay informed about further developments, trends, and reports in the Steam VR Headset, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence