Key Insights

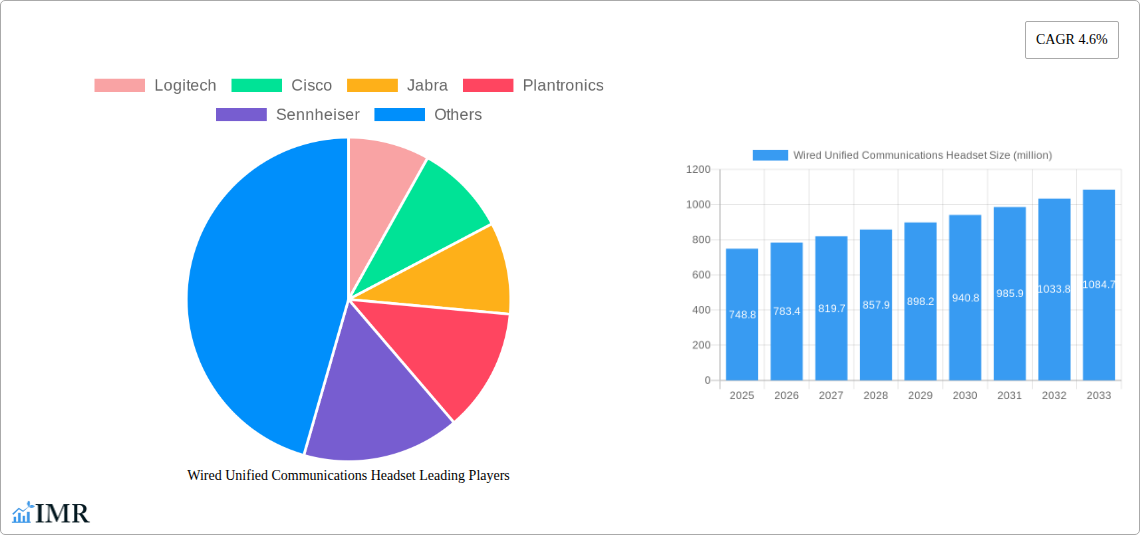

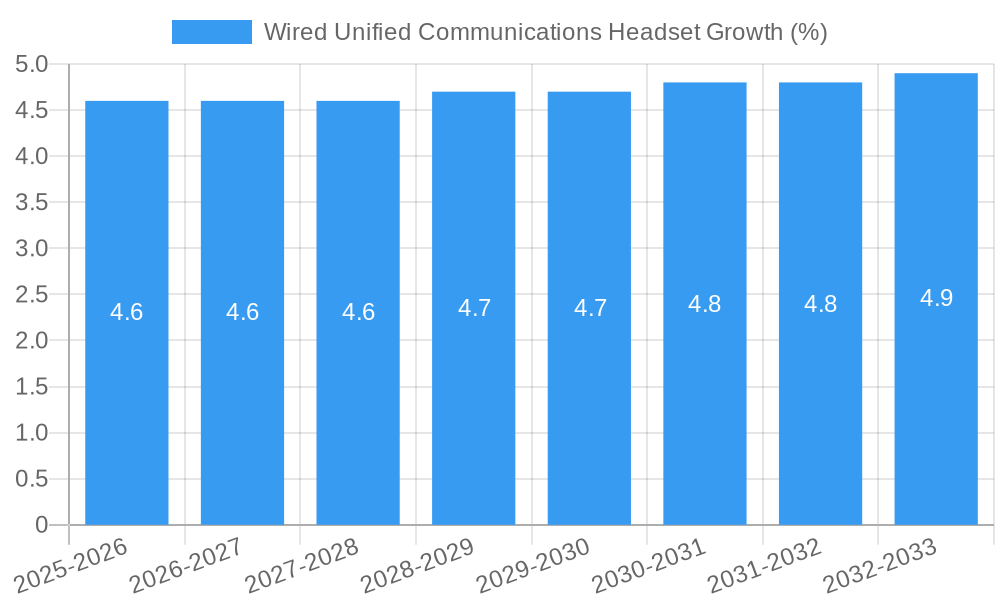

The global Wired Unified Communications Headset market is poised for robust growth, projected to reach a substantial market size of $748.8 million. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 4.6% over the forecast period of 2025-2033. A significant driver for this upward trajectory is the increasing adoption of unified communications (UC) solutions across diverse business environments, from large enterprises to contact centers. As remote and hybrid work models become increasingly prevalent, the demand for reliable, high-quality communication tools like wired headsets escalates. These headsets offer superior audio clarity, reduced latency, and enhanced security compared to wireless alternatives, making them indispensable for seamless collaboration and productivity in professional settings. Furthermore, advancements in audio technology, including noise cancellation and ergonomic designs, are contributing to improved user experience and driving market penetration.

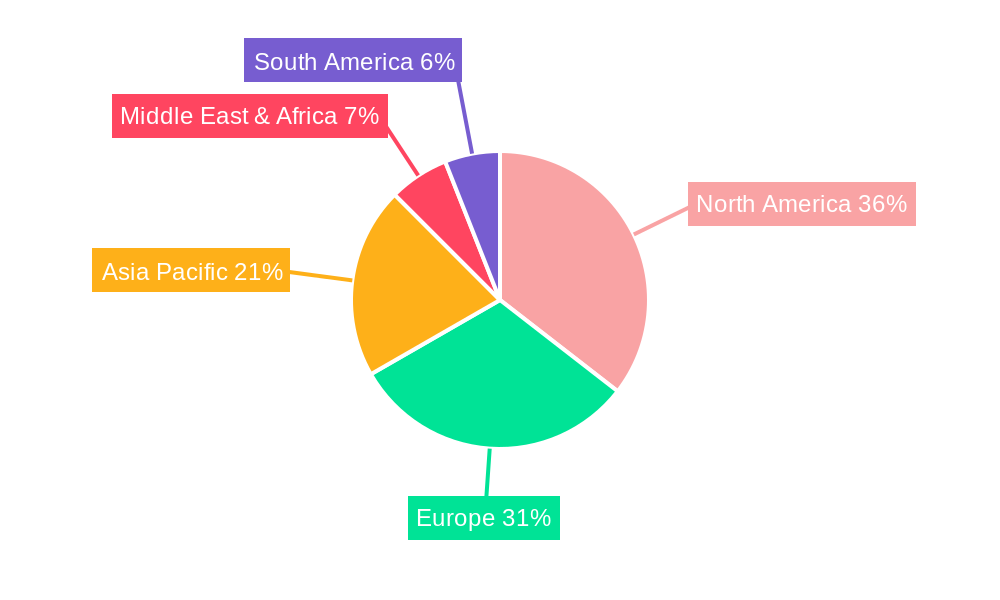

The market is segmented by application into Contact Centers and Business Enterprises, with both segments demonstrating strong growth potential. Contact centers, in particular, are a major consumer, relying heavily on dependable audio equipment for customer interactions. Business enterprises are also increasingly equipping their workforce with UC headsets to facilitate efficient internal and external communication. Price segmentation reveals opportunities across various tiers, from budget-friendly options below $150 to premium models above $300, catering to a wide spectrum of customer needs and budgets. Key players like Logitech, Cisco, Jabra, Plantronics, and Sennheiser are actively innovating and competing to capture market share, further stimulating market dynamism. Geographically, North America and Europe are anticipated to remain dominant markets, driven by early adoption of advanced UC technologies and a strong presence of multinational corporations. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by rapid digital transformation and expanding business landscapes.

Wired Unified Communications Headset Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report offers a panoramic view of the global Wired Unified Communications Headset market, providing critical insights for stakeholders, manufacturers, and investors. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this analysis delves into market dynamics, growth trends, regional dominance, product innovation, and key players shaping the industry.

Wired Unified Communications Headset Market Dynamics & Structure

The wired unified communications headset market is characterized by a moderately concentrated structure, with major players like Logitech, Cisco, Jabra, Plantronics, and Sennheiser commanding significant market share. Technological innovation, particularly in audio clarity, noise cancellation, and ergonomic design, acts as a primary driver. Regulatory frameworks, primarily concerning data privacy and workplace safety, also influence product development and market entry. Competitive product substitutes, including wireless headsets and integrated communication solutions, pose a constant challenge. End-user demographics are shifting, with an increasing demand for feature-rich, comfortable, and reliable headsets from both large enterprises and the growing contact center segment. Merger and acquisition (M&A) trends, though not as rapid as in some tech sectors, continue to consolidate market power and foster innovation. For instance, historical M&A activities have led to the integration of advanced audio technologies into existing product lines.

- Market Concentration: Moderate, dominated by a few key players.

- Technological Innovation Drivers: Enhanced audio quality, advanced noise cancellation, ergonomic comfort, and seamless integration with UC platforms.

- Regulatory Frameworks: Data privacy (e.g., GDPR compliance), workplace safety standards, and electromagnetic compatibility (EMC) certifications.

- Competitive Product Substitutes: Wireless UC headsets, integrated speakerphones, and software-based audio solutions.

- End-User Demographics: Growing demand from remote workers, hybrid workforces, and increasingly sophisticated contact center environments.

- M&A Trends: Strategic acquisitions focused on technology integration and market expansion.

- Estimated M&A Deal Volume (2025-2033): 15-20 significant deals.

Wired Unified Communications Headset Growth Trends & Insights

The wired unified communications headset market is projected to witness steady growth driven by the sustained adoption of unified communications (UC) solutions across businesses of all sizes. The market size is expected to expand from an estimated 155 million units in 2025 to 180 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 1.75%. This growth is fueled by the increasing reliance on remote and hybrid work models, which necessitate reliable and high-quality communication tools. Technological disruptions, such as advancements in AI-powered noise cancellation and the integration of intelligent features, are enhancing user experience and driving adoption. Consumer behavior shifts towards prioritizing productivity, comfort, and seamless integration with existing work ecosystems are further bolstering demand. The penetration of UC solutions in emerging economies also presents significant untapped potential.

- Market Size Evolution: From an estimated 155 million units in 2025 to 180 million units by 2033.

- CAGR (2025-2033): Approximately 1.75%.

- Adoption Rates: Driven by the widespread adoption of UC platforms for remote and hybrid work.

- Technological Disruptions: Advancements in AI-driven noise cancellation, improved microphone arrays, and ergonomic designs.

- Consumer Behavior Shifts: Prioritization of clear audio, comfort for extended use, and integration with popular UC applications (e.g., Microsoft Teams, Zoom).

- Market Penetration: Increasing penetration in both developed and developing economies.

- Projected Market Penetration (2033): 45% of active UC users are expected to utilize wired UC headsets.

Dominant Regions, Countries, or Segments in Wired Unified Communications Headset

The Business Enterprises segment, particularly within North America, is anticipated to remain the dominant force in the wired unified communications headset market. This dominance is attributed to the mature adoption of UC technologies, a robust business infrastructure, and a high concentration of multinational corporations that frequently employ large-scale deployments of communication peripherals. The economic policies in countries like the United States and Canada foster innovation and enterprise spending on advanced IT solutions, including high-performance headsets. Furthermore, the prevalence of hybrid and remote work models in these regions necessitates reliable and cost-effective communication tools. The demand for headsets priced between $150-$300 is particularly strong within this segment, reflecting a balance between advanced features and professional requirements.

- Dominant Application Segment: Business Enterprises, accounting for an estimated 65% of the market share in 2025.

- Dominant Region: North America, projected to hold 35% of the global market share in 2025.

- Key Country Drivers (North America): United States and Canada, driven by strong enterprise adoption and hybrid work trends.

- Dominant Price Segment: Price $150-$300, catering to the premium feature and reliability demands of enterprises.

- Market Share of Dominant Price Segment (2025): Approximately 50% of the total market.

- Growth Potential in Dominant Segments: Continued growth driven by ongoing digital transformation and the need for enhanced remote collaboration tools.

- Contact Center Segment Growth: Expected to witness a CAGR of 2.1% due to increasing outsourcing and demand for specialized UC headsets.

Wired Unified Communications Headset Product Landscape

The wired unified communications headset product landscape is characterized by continuous innovation focused on enhancing audio fidelity, user comfort, and seamless connectivity. Manufacturers are integrating advanced noise-cancellation technologies, including adaptive and AI-powered solutions, to ensure crystal-clear communication in noisy environments. Ergonomic designs with lightweight materials, adjustable headbands, and plush earcups are becoming standard to support extended wear. Performance metrics such as wideband audio support, precise microphone sensitivity, and robust build quality are key differentiators. Unique selling propositions often revolve around specific certifications for major UC platforms like Microsoft Teams and Zoom, ensuring plug-and-play compatibility and optimized performance.

- Key Product Innovations: Advanced active noise cancellation (ANC), AI-driven noise suppression, wideband audio support, and integrated call controls.

- Ergonomic Advancements: Lightweight construction, memory foam earcups, and adjustable headbands for prolonged comfort.

- Performance Metrics: High-fidelity audio, clear microphone pickup, durable build, and reliable connectivity.

- Unique Selling Propositions: Platform certifications (e.g., Microsoft Teams, Zoom), extended warranties, and bundled software solutions.

- Technological Advancements: Integration of voice assistants, advanced DSP for audio processing, and improved microphone beamforming.

Key Drivers, Barriers & Challenges in Wired Unified Communications Headset

The wired unified communications headset market is propelled by several key drivers, including the escalating adoption of remote and hybrid work models, the continuous evolution of unified communications platforms, and the growing emphasis on clear and efficient communication in professional settings. Technological advancements in audio quality and noise cancellation further enhance user experience. The shift towards a more digitally integrated workforce also fuels demand.

- Key Drivers:

- Expansion of remote and hybrid workforces.

- Increased adoption and sophistication of UC platforms.

- Demand for enhanced audio clarity and productivity tools.

- Technological advancements in noise cancellation and audio processing.

Conversely, the market faces significant barriers and challenges. The increasing prevalence and improving quality of wireless UC headsets present a strong competitive pressure. Supply chain disruptions and the rising cost of raw materials can impact manufacturing and pricing. Stringent data privacy regulations and evolving cybersecurity threats also require manufacturers to invest in secure product development. Furthermore, the perceived convenience of wireless options can sometimes outweigh the benefits of wired connections for certain user segments.

- Key Barriers & Challenges:

- Competition from advanced wireless UC headsets.

- Supply chain volatility and rising component costs.

- Stringent data privacy and cybersecurity requirements.

- Price sensitivity in certain market segments.

- Perceived limitations of wired connectivity for mobility.

Emerging Opportunities in Wired Unified Communications Headset

Emerging opportunities in the wired unified communications headset market lie in catering to niche professional needs and integrating advanced functionalities. The demand for specialized headsets optimized for specific industries, such as healthcare or education, with features like enhanced hygiene and specific audio profiles, is growing. The integration of AI-powered features, beyond just noise cancellation, such as real-time transcription assistance or sentiment analysis for contact center agents, presents a significant growth avenue. Furthermore, focusing on eco-friendly materials and sustainable manufacturing practices can attract environmentally conscious businesses. Untapped markets in developing regions with growing digital infrastructure also offer substantial potential.

- Niche Industry Solutions: Development of specialized headsets for healthcare, education, and other specific sectors.

- AI-Powered Functionalities: Integration of real-time transcription, language translation, and intelligent audio analytics.

- Sustainability Focus: Adoption of eco-friendly materials and sustainable production methods.

- Emerging Market Penetration: Targeting developing economies with growing digital infrastructure.

- Enhanced Comfort and Durability: Continued innovation in materials and design for extended professional use.

Growth Accelerators in the Wired Unified Communications Headset Industry

Several factors are expected to accelerate long-term growth in the wired unified communications headset industry. Continued advancements in audio codec technology will deliver higher fidelity sound, improving the overall communication experience. Strategic partnerships between headset manufacturers and leading UC platform providers, such as Microsoft and Cisco, will drive deeper integration and co-marketing efforts, expanding market reach. The increasing realization of cost-effectiveness and reliability of wired connections in enterprise-level deployments, especially for critical communication infrastructure, will continue to solidify their position. Furthermore, the expansion of global businesses and the sustained trend of remote work will create consistent demand for reliable communication peripherals.

- Technological Breakthroughs: Innovations in audio codecs, AI integration for enhanced features, and improved microphone technology.

- Strategic Partnerships: Collaborations with major UC platform providers to ensure seamless integration and bundled offerings.

- Market Expansion Strategies: Targeting emerging economies and specific industry verticals with tailored solutions.

- Focus on Reliability and Cost-Effectiveness: Emphasizing the advantages of wired connections for enterprise-level stability and ROI.

Key Players Shaping the Wired Unified Communications Headset Market

- Logitech

- Cisco

- Jabra

- Plantronics (now Poly)

- Sennheiser

Notable Milestones in Wired Unified Communications Headset Sector

- 2019: Launch of advanced noise-canceling technologies by multiple vendors, improving call clarity in noisy environments.

- 2020: Significant increase in demand for wired UC headsets due to the global shift to remote work.

- 2021: Introduction of AI-powered voice enhancement features in higher-end models.

- 2022: Major UC platform providers (e.g., Microsoft Teams) release enhanced certification programs for peripherals, driving quality standards.

- 2023: Increased focus on sustainable materials and eco-friendly packaging by leading manufacturers.

- 2024: Continued integration of USB-C connectivity as a standard across new product lines.

In-Depth Wired Unified Communications Headset Market Outlook

The wired unified communications headset market is poised for sustained growth, driven by the enduring need for reliable and high-performance communication solutions in the evolving professional landscape. Growth accelerators such as technological advancements in audio quality, AI integration for intelligent features, and strategic partnerships with leading UC platforms will further propel market expansion. The inherent reliability and cost-effectiveness of wired connections continue to make them a preferred choice for enterprise-grade deployments, especially in contact centers and critical business operations. Emerging opportunities in niche industry applications and developing markets present significant potential for innovation and market penetration, ensuring a robust future for this essential segment of the unified communications ecosystem. The market's trajectory is one of steady, quality-driven expansion.

Wired Unified Communications Headset Segmentation

-

1. Application

- 1.1. Contact Center

- 1.2. Business Enterprises

-

2. Types

- 2.1. Price Below $ 150

- 2.2. Price $ 150-$ 300

- 2.3. Price Above $ 300

Wired Unified Communications Headset Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wired Unified Communications Headset REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Contact Center

- 5.1.2. Business Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Price Below $ 150

- 5.2.2. Price $ 150-$ 300

- 5.2.3. Price Above $ 300

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Contact Center

- 6.1.2. Business Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Price Below $ 150

- 6.2.2. Price $ 150-$ 300

- 6.2.3. Price Above $ 300

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Contact Center

- 7.1.2. Business Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Price Below $ 150

- 7.2.2. Price $ 150-$ 300

- 7.2.3. Price Above $ 300

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Contact Center

- 8.1.2. Business Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Price Below $ 150

- 8.2.2. Price $ 150-$ 300

- 8.2.3. Price Above $ 300

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Contact Center

- 9.1.2. Business Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Price Below $ 150

- 9.2.2. Price $ 150-$ 300

- 9.2.3. Price Above $ 300

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wired Unified Communications Headset Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Contact Center

- 10.1.2. Business Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Price Below $ 150

- 10.2.2. Price $ 150-$ 300

- 10.2.3. Price Above $ 300

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Logitech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cisco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jabra

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Plantronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sennheiser

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Logitech

List of Figures

- Figure 1: Global Wired Unified Communications Headset Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Wired Unified Communications Headset Revenue (million), by Application 2024 & 2032

- Figure 3: North America Wired Unified Communications Headset Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Wired Unified Communications Headset Revenue (million), by Types 2024 & 2032

- Figure 5: North America Wired Unified Communications Headset Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Wired Unified Communications Headset Revenue (million), by Country 2024 & 2032

- Figure 7: North America Wired Unified Communications Headset Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wired Unified Communications Headset Revenue (million), by Application 2024 & 2032

- Figure 9: South America Wired Unified Communications Headset Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Wired Unified Communications Headset Revenue (million), by Types 2024 & 2032

- Figure 11: South America Wired Unified Communications Headset Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Wired Unified Communications Headset Revenue (million), by Country 2024 & 2032

- Figure 13: South America Wired Unified Communications Headset Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Wired Unified Communications Headset Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Wired Unified Communications Headset Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Wired Unified Communications Headset Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Wired Unified Communications Headset Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Wired Unified Communications Headset Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Wired Unified Communications Headset Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Wired Unified Communications Headset Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Wired Unified Communications Headset Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Wired Unified Communications Headset Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Wired Unified Communications Headset Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Wired Unified Communications Headset Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Wired Unified Communications Headset Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Wired Unified Communications Headset Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Wired Unified Communications Headset Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Wired Unified Communications Headset Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Wired Unified Communications Headset Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Wired Unified Communications Headset Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Wired Unified Communications Headset Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wired Unified Communications Headset Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Wired Unified Communications Headset Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Wired Unified Communications Headset Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Wired Unified Communications Headset Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Wired Unified Communications Headset Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Wired Unified Communications Headset Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Wired Unified Communications Headset Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Wired Unified Communications Headset Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Wired Unified Communications Headset Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Wired Unified Communications Headset Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wired Unified Communications Headset?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Wired Unified Communications Headset?

Key companies in the market include Logitech, Cisco, Jabra, Plantronics, Sennheiser.

3. What are the main segments of the Wired Unified Communications Headset?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 748.8 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wired Unified Communications Headset," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wired Unified Communications Headset report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wired Unified Communications Headset?

To stay informed about further developments, trends, and reports in the Wired Unified Communications Headset, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence