Key Insights

The Asia-Pacific Capital Market Exchange Ecosystem is poised for substantial expansion, driven by increasing financial sector depth, a growing affluent population, and proactive government initiatives fostering market development. Projected to grow at a Compound Annual Growth Rate (CAGR) of 5.48% between 2025 and 2033, the market is set to reach a valuation of $1120 billion. Key growth drivers include escalating foreign direct investment (FDI), the widespread adoption of digital trading platforms, and strategic government efforts to enhance capital market infrastructure. Leading exchanges like Shanghai, Tokyo, and Hong Kong are at the forefront of this expansion, supported by robust domestic economies and a progressively sophisticated investor base. Nonetheless, geopolitical volatilities and evolving regulatory frameworks present potential headwinds to sustained expansion. The market is diversified across asset classes including equities, bonds, and derivatives, with dominant exchanges expected to maintain their positions, though regional growth disparities may arise due to differing economic performance and regulatory landscapes.

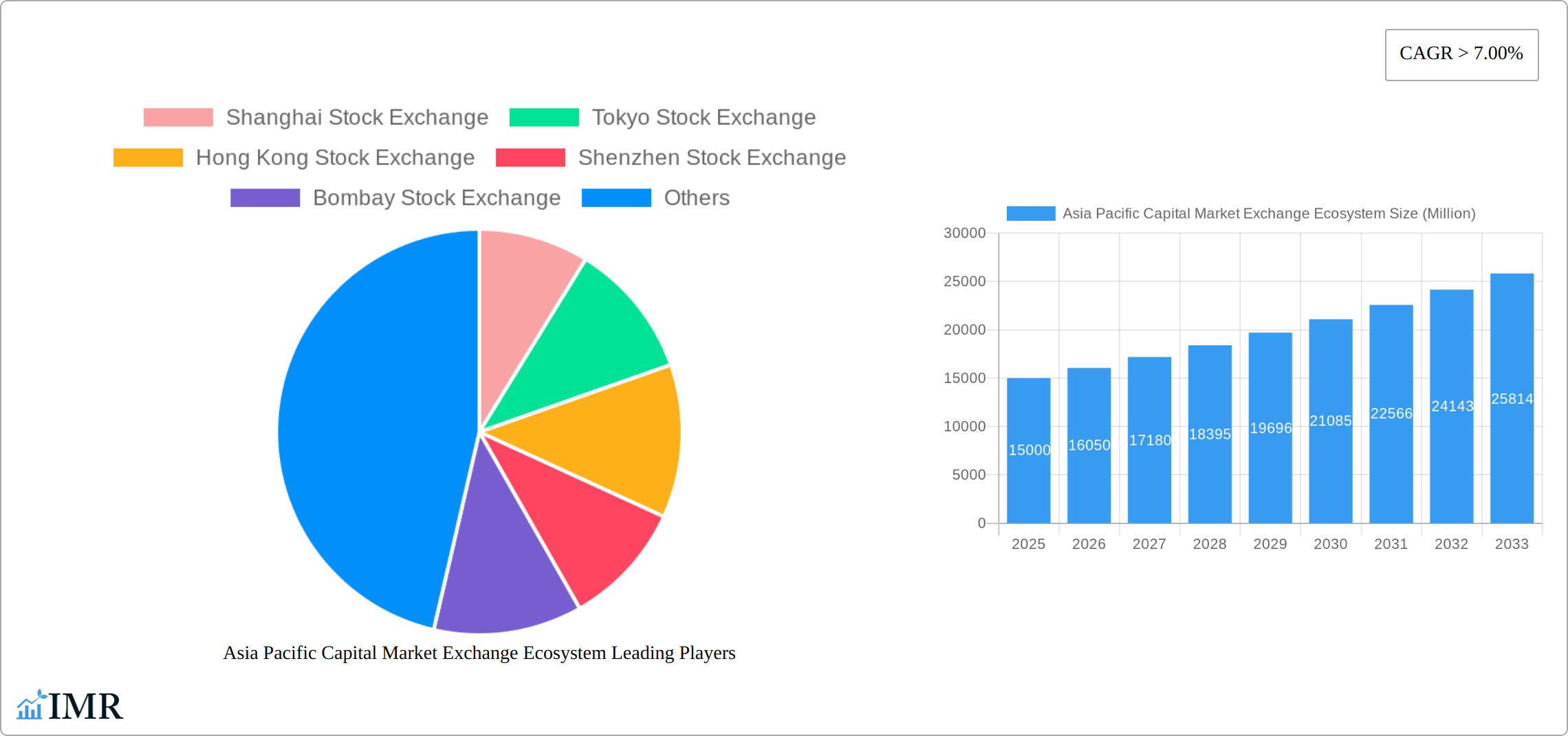

Asia Pacific Capital Market Exchange Ecosystem Market Size (In Million)

The forecast period (2025-2033) anticipates continued market growth, with emerging opportunities in fintech integration and sustainable finance. The market size is estimated at $1120 billion by 2025, expanding at a CAGR of 5.48%. The multifaceted nature of regional markets and diverse regulatory environments will significantly influence the growth trajectory. China's sustained economic expansion is anticipated to be a major contributor, while other nations will experience varied growth patterns influenced by their unique economic and political circumstances.

Asia Pacific Capital Market Exchange Ecosystem Company Market Share

Asia Pacific Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Capital Market Exchange Ecosystem, covering market dynamics, growth trends, dominant players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for investors, industry professionals, and strategic planners. The report analyzes key parent markets (e.g., securities trading, investment banking) and their child markets (e.g., derivatives trading, equity financing), delivering a granular understanding of this dynamic sector. The total market size in 2025 is estimated at XX Million and is projected to reach XX Million by 2033.

Asia Pacific Capital Market Exchange Ecosystem Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory influences, and overall structure. The Asia Pacific capital market exchange ecosystem is characterized by a high level of competition among established exchanges, with varying levels of market concentration across different countries. The market is fragmented, with several major players and many smaller regional exchanges competing for market share.

Market Concentration:

- High concentration in developed markets like Japan and Australia; more fragmented in emerging markets like India and Southeast Asia.

- Market share of top 5 exchanges in 2025 estimated at XX%.

- Mergers and acquisitions (M&A) activity remains relatively high, with a total deal volume of approximately XX Million in 2024.

Technological Innovation:

- Increased adoption of technology driving efficiency and reducing operational costs.

- Focus on high-frequency trading and algorithmic trading capabilities.

- Investment in blockchain technology and other distributed ledger technologies (DLT) for enhanced security and transparency.

Regulatory Frameworks:

- Significant regulatory variations across different jurisdictions.

- Increasing regulatory scrutiny of market integrity and investor protection.

- Harmonization of regulatory frameworks remains a significant challenge.

Competitive Product Substitutes:

- Over-the-counter (OTC) markets present a competitive threat to some exchange-traded products.

- Growth of alternative trading systems (ATS) is impacting traditional exchanges.

End-User Demographics:

- Increasing participation of retail investors in many markets.

- Sophisticated institutional investors dominate trading volumes in major exchanges.

M&A Trends:

- Consolidation is a significant trend, with larger exchanges seeking to acquire smaller players.

- Strategic partnerships and alliances are becoming more prevalent.

Asia Pacific Capital Market Exchange Ecosystem Growth Trends & Insights

The Asia Pacific capital market exchange ecosystem is projected to experience robust growth throughout the forecast period (2025-2033). This growth is propelled by several factors, including increasing economic activity in the region, rising investor participation, technological advancements, and supportive government policies. The market's Compound Annual Growth Rate (CAGR) is estimated at XX% during the forecast period. Market penetration is expected to increase from XX% in 2025 to XX% by 2033.

XXX (Specific data source will be included here) demonstrates a strong correlation between GDP growth and capital market activity in the region, indicating significant growth potential. Furthermore, the increasing adoption of digital technologies, particularly mobile trading platforms and online brokerage services, has broadened investor access and fuelled market expansion. Changes in consumer behavior, including a shift towards long-term investments and a growing interest in sustainable and ethical investing, are also shaping market trends. Technological disruptions, like the rise of fintech companies and the integration of AI in trading algorithms, continue to reshape the competitive landscape.

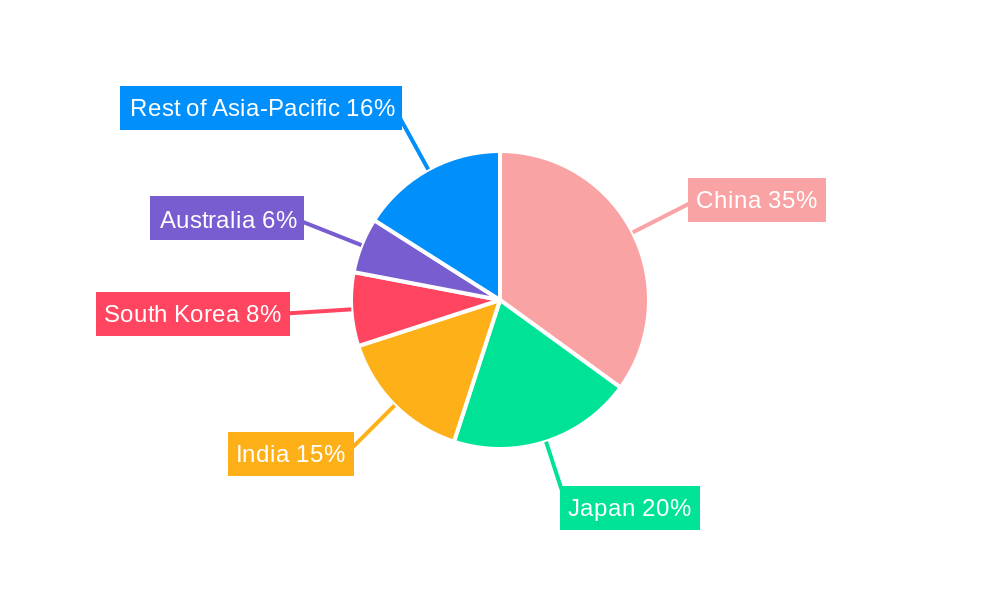

Dominant Regions, Countries, or Segments in Asia Pacific Capital Market Exchange Ecosystem

China and Japan are currently the dominant markets, accounting for a significant share of the overall market volume. Their economic strength, robust regulatory frameworks, and mature financial infrastructure contribute to their dominance. However, other markets, like India and Southeast Asian countries, exhibit high growth potential driven by their burgeoning economies and expanding middle class.

Key Drivers:

- China: Strong economic growth, government support for capital market development, and the presence of major exchanges like the Shanghai Stock Exchange and Shenzhen Stock Exchange.

- Japan: Mature financial markets, technological innovation, and significant institutional investor participation.

- India: Rapid economic expansion, a large and growing investor base, and a relatively young population.

- Southeast Asia: Increasing economic integration, rising middle class, and supportive government policies.

Dominance Factors:

- Market size and trading volume

- Regulatory environment

- Level of technological advancement

- Investor participation

- Economic growth

Growth Potential:

- India and Southeast Asia are expected to experience faster growth than mature markets.

- Focus on smaller and mid-sized enterprises (SMEs) presents lucrative opportunities in many emerging markets.

Asia Pacific Capital Market Exchange Ecosystem Product Landscape

The Asia Pacific capital market exchange ecosystem is a dynamic and evolving landscape, encompassing a comprehensive suite of financial instruments. This includes traditional offerings such as equities, fixed-income securities (bonds), and diverse derivative products, alongside the rapidly growing popularity of exchange-traded funds (ETFs). Recent innovations are keenly focused on elevating trading efficiency through advanced algorithmic trading and high-frequency trading capabilities, fostering greater market transparency via real-time data dissemination and regulatory oversight enhancements, and democratizing investor access through user-friendly digital platforms and fractional ownership opportunities. Product differentiation is further achieved through the integration of sophisticated risk management tools, bespoke investment solutions tailored to niche investor segments (e.g., high-net-worth individuals, family offices), and the strategic development of innovative financial products. A significant and accelerating trend is the burgeoning interest in sustainable investing, leading to the creation and promotion of a wide array of ESG-focused (Environmental, Social, and Governance) financial products and instruments designed to align capital with positive societal and environmental impact.

Key Drivers, Barriers & Challenges in Asia Pacific Capital Market Exchange Ecosystem

Key Drivers:

- Robust and sustained economic expansion across numerous dynamic Asian economies, fueling investment appetite.

- The increasing and sophisticated participation of both retail and institutional investors, driven by rising disposable incomes and a growing understanding of financial markets.

- Pervasive technological advancements, including AI, blockchain, and cloud computing, which are revolutionizing trading infrastructure, enhancing operational efficiency, and significantly reducing transaction costs.

- Proactive and supportive government initiatives and regulatory frameworks designed to foster capital market development, attract foreign investment, and promote financial inclusion.

Key Barriers and Challenges:

- Significant regulatory fragmentation and inconsistencies across diverse national markets, creating complexity and hindering cross-border capital flows.

- Heightened cybersecurity threats, sophisticated data breaches, and the imperative to ensure robust data privacy and integrity in an increasingly digitalized environment.

- Intense competition from an expanding array of alternative trading venues, including dark pools, proprietary trading firms, and decentralized finance (DeFi) platforms.

- Persistent geopolitical uncertainties, regional conflicts, and global economic volatility that can create market instability and deter long-term investment.

Emerging Opportunities in Asia Pacific Capital Market Exchange Ecosystem

- The transformative impact of financial technology (Fintech) in democratizing access, enhancing trading capabilities, and fostering new investment models.

- The escalating global demand for sustainable and responsible investment (SRI) opportunities, creating a significant market for ESG-compliant financial products and services.

- Strategic expansion into underserved and emerging markets within the Asia Pacific region, tapping into untapped investor bases and economic potential.

- The pioneering development of innovative digital assets and novel financial products, including regulated crypto-assets, Non-Fungible Tokens (NFTs) for asset representation, and tokenized securities.

Growth Accelerators in the Asia Pacific Capital Market Exchange Ecosystem Industry

Sustained long-term growth within the Asia Pacific capital market exchange ecosystem will be propelled by a confluence of factors. Continued strong economic expansion and demographic advantages in the region will underpin demand for investment opportunities. Supportive and adaptive government policies, coupled with a commitment to regulatory modernization, will be crucial. Further technological advancements, including the adoption of distributed ledger technology (DLT) and artificial intelligence, will drive efficiency and introduce new product capabilities. An increasingly sophisticated investor base, equipped with greater financial literacy and access to information, will also contribute significantly. Strategic partnerships and collaborations between established exchanges and innovative fintech companies are poised to accelerate the pace of innovation, enhance market liquidity, and facilitate broader market expansion. The rapidly growing emphasis on Environmental, Social, and Governance (ESG) investing represents a pivotal growth area, creating substantial opportunities for exchanges that proactively develop and offer a comprehensive range of related products and services.

Key Players Shaping the Asia Pacific Capital Market Exchange Ecosystem Market

Notable Milestones in Asia Pacific Capital Market Exchange Ecosystem Sector

- July 2022: Eligible companies listed on the Beijing Stock Exchange were allowed to transfer to the Star Market of the Shanghai Stock Exchange, facilitating integration within the Chinese capital market.

- February 2022: The China Securities Regulatory Commission (CSRC) approved the merger of Shenzhen Stock Exchange's main board with the SME board, streamlining the trading structure.

In-Depth Asia Pacific Capital Market Exchange Ecosystem Market Outlook

The Asia Pacific capital market exchange ecosystem is poised for sustained growth driven by technological innovations, increasing investor participation, and the expansion of financial markets in emerging economies. Strategic opportunities lie in leveraging technology to enhance trading efficiency, broaden product offerings, and cater to the evolving needs of a diverse investor base. The integration of ESG principles into investment strategies is expected to drive significant growth in the coming years. The increasing focus on digitalization and the potential of blockchain technology will further transform the industry, paving the way for increased market transparency, reduced operational costs, and enhanced investor protection.

Asia Pacific Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Product

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Asia Pacific Capital Market Exchange Ecosystem Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Asia Pacific Capital Market Exchange Ecosystem

Asia Pacific Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Foreign Direct Investment in Various Developing Economies in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Product

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shanghai Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyo Stock Exchange

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hong Kong Stock Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shenzhen Stock Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bombay Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Korea Exchange

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Taiwan Stock Exchange

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Singapore Exchange

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Stock Exchange of Thailand**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shanghai Stock Exchange

List of Figures

- Figure 1: Asia Pacific Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Financial Product 2020 & 2033

- Table 3: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Investors 2020 & 2033

- Table 4: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 6: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Financial Product 2020 & 2033

- Table 7: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Investors 2020 & 2033

- Table 8: Asia Pacific Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Capital Market Exchange Ecosystem Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Capital Market Exchange Ecosystem?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Asia Pacific Capital Market Exchange Ecosystem?

Key companies in the market include Shanghai Stock Exchange, Tokyo Stock Exchange, Hong Kong Stock Exchange, Shenzhen Stock Exchange, Bombay Stock Exchange, National Stock Exchange, Korea Exchange, Taiwan Stock Exchange, Singapore Exchange, The Stock Exchange of Thailand**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Product, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD 1120 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Foreign Direct Investment in Various Developing Economies in Asia-Pacific.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: The eligible companies listed on Beijing Stock Exchange were allowed to apply for transfer to the Star Market of the Shanghai Stock Exchange. A transfer system is a positive approach for bridge-building efforts between China's multiple layers of the capital market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Asia Pacific Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence