Key Insights

The French insurance market, covering life and non-life segments, is projected for robust expansion. With a base year of 2025, the market is estimated to reach 291.04 billion, driven by evolving consumer demands and a stable economy. Key growth catalysts include rising disposable incomes, heightened financial planning awareness, and a strong regulatory environment fostering industry trust. Digital channel adoption for policy sales and claims processing enhances customer accessibility and convenience. The life insurance sector anticipates sustained demand for retirement and wealth accumulation solutions, while the non-life sector will grow due to mandatory motor insurance and increased focus on home and health protection. Strategic product innovation and distribution network optimization by key players further support this upward market trajectory.

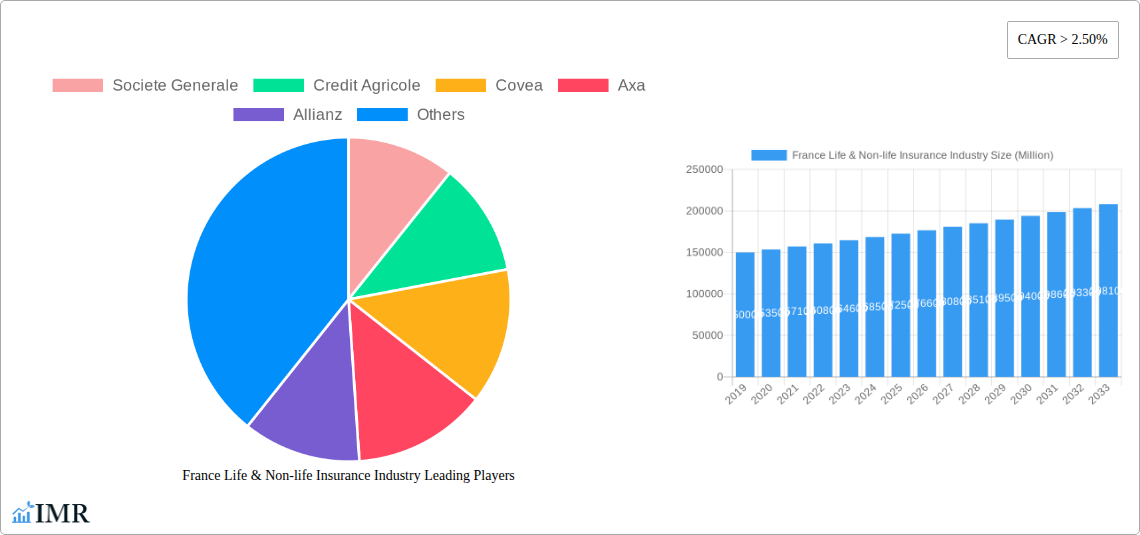

France Life & Non-life Insurance Industry Market Size (In Billion)

The French insurance industry's growth is influenced by a key trend: the increasing demand for personalized and flexible insurance products, moving beyond generic offerings. This is observed in tailored life insurance policies and customized motor insurance. The rise of InsurTech is transforming the market with innovative technologies, improved customer experiences, and streamlined operations, particularly through online distribution. Banks remain vital distribution partners, utilizing their extensive customer bases. However, the market faces restraints such as intense price competition, which can impact insurer profitability, and evolving regulatory landscapes that may introduce compliance complexities. Despite these challenges, the French life and non-life insurance industry shows a positive outlook, with an anticipated Compound Annual Growth Rate (CAGR) of 34.51, indicating a mature yet dynamic market.

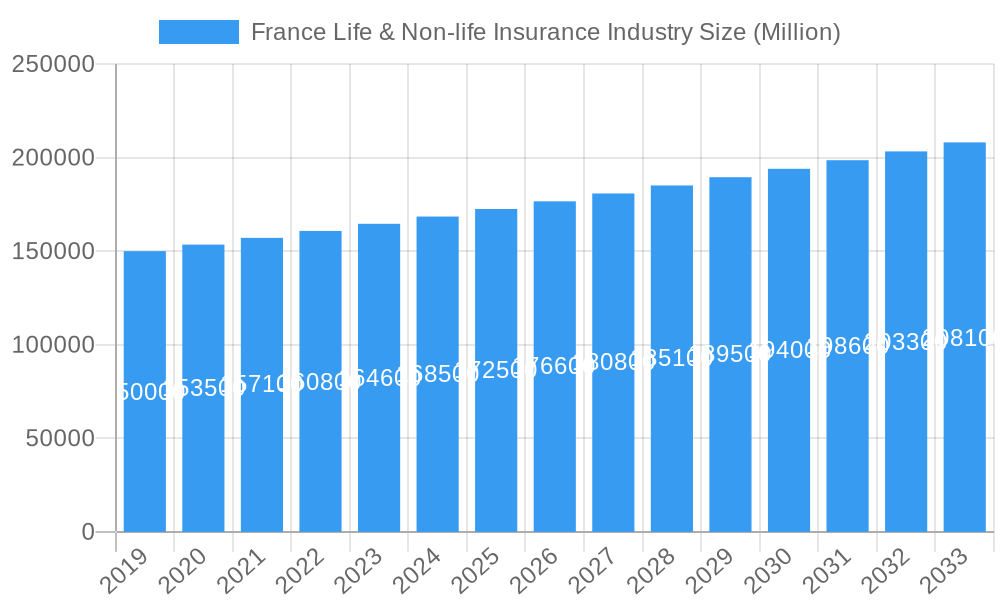

France Life & Non-life Insurance Industry Company Market Share

France Life & Non-life Insurance Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the France life and non-life insurance industry, providing critical insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study delves into market structure, growth trajectories, dominant segments, product innovations, key drivers, barriers, and emerging opportunities. We analyze the interplay between parent and child markets, utilizing high-traffic keywords to ensure maximum visibility for industry professionals and investors. All monetary values are presented in millions of units.

France Life & Non-life Insurance Industry Market Dynamics & Structure

The French insurance market is characterized by a mature yet evolving landscape, with a moderate level of market concentration dominated by established players such as Axa, Allianz, and Credit Agricole. Technological innovation, particularly in InsurTech, is a significant driver, pushing for enhanced customer experience and streamlined operations through AI, big data analytics, and blockchain. Regulatory frameworks, primarily governed by the European Union's Solvency II directive and French national regulations, ensure financial stability and consumer protection. Competitive product substitutes exist, ranging from traditional savings products to alternative investment vehicles, but core insurance products remain resilient. End-user demographics reveal an aging population driving demand for health and life insurance, while younger demographics are increasingly leveraging online channels for motor and home insurance. Mergers and Acquisitions (M&A) trends indicate strategic consolidations aimed at expanding market share and enhancing product portfolios. For instance, Societe Generale's insurance arm and Credit Agricole Assurances are key examples of banking groups deeply integrated into the insurance value chain.

- Market Concentration: Dominated by top players, with a strong presence of bancassurance models.

- Technological Innovation Drivers: InsurTech adoption, AI for underwriting and claims processing, and digital customer engagement platforms.

- Regulatory Frameworks: Solvency II, GDPR, and stringent French financial regulations.

- Competitive Product Substitutes: Investment-linked products, P2P lending, and self-insurance initiatives.

- End-User Demographics: Aging population, increasing digital adoption, and growing demand for personalized coverage.

- M&A Trends: Strategic acquisitions and partnerships to gain market share and diversify offerings.

France Life & Non-life Insurance Industry Growth Trends & Insights

The France insurance market size is projected to witness steady growth, driven by a confluence of economic, demographic, and technological factors. The adoption rate of digital insurance solutions is accelerating, transforming how consumers interact with insurance providers. Technological disruptions, including the rise of telematics in motor insurance and the application of AI in health risk assessment, are reshaping product development and service delivery. Consumer behavior shifts are evident, with a growing preference for personalized policies, seamless digital onboarding, and proactive risk management services. The French insurance sector's CAGR is expected to reflect this sustained expansion. Market penetration for life insurance remains robust, while non-life segments, particularly health and motor, continue to see consistent demand. The increasing awareness of financial planning and retirement solutions is a key growth propeller for the life insurance segment. Conversely, the non-life sector is influenced by economic activity, regulatory changes, and the prevalence of specific risks like natural disasters.

Dominant Regions, Countries, or Segments in France Life & Non-life Insurance Industry

Within the French insurance landscape, Life Insurance stands out as a dominant segment, particularly Individual Life Insurance, driven by its dual role in savings and protection. The Banks channel of distribution continues to be a significant driver, leveraging established customer relationships to cross-sell insurance products. Paris and its surrounding Île-de-France region are the leading economic hubs, contributing significantly to premium volumes across both life and non-life sectors due to higher population density and economic activity. The Motor Insurance segment within Non-Life Insurance also holds substantial market share, influenced by France's extensive road network and high vehicle ownership. Growth in Health Insurance is fueled by an aging population and increasing healthcare costs, making it a critical area for insurers. The Online distribution channel is rapidly gaining traction, particularly among younger demographics for non-life products, indicating a future shift in consumer preferences.

- Dominant Insurance Type: Life Insurance (Individual) and Non-Life Insurance (Motor, Health).

- Dominant Distribution Channel: Banks and Online channels are increasingly influential.

- Key Regional Dominance: Île-de-France region due to its economic and demographic concentration.

- Growth Drivers for Life Insurance: Retirement planning, wealth accumulation, and legacy planning.

- Growth Drivers for Non-Life Insurance: Compulsory third-party liability (motor), property protection (home), and healthcare expenditure.

- Emerging Channel Growth: Significant uptake of online platforms for policy acquisition and management.

France Life & Non-life Insurance Industry Product Landscape

The French insurance market is witnessing a wave of product innovations aimed at enhancing customer value and addressing evolving risk profiles. In the life insurance segment, there's a discernible trend towards unit-linked products offering greater investment flexibility and potential for higher returns, alongside traditional endowment and term life policies. For non-life insurance, telematics-based motor insurance is gaining traction, rewarding safe driving behavior with premium discounts. Parametric insurance solutions, triggered by pre-defined events like natural disasters, are emerging as innovative risk transfer mechanisms. We are also observing the integration of value-added services, such as preventative health programs linked to health insurance or cybersecurity support bundled with home insurance. The focus is increasingly on customizable policies and digital-first product offerings, with insurers like Covea and MACIF actively investing in digital transformation to deliver these advanced solutions.

Key Drivers, Barriers & Challenges in France Life & Non-life Insurance Industry

The France life and non-life insurance industry is propelled by several key drivers. Technological advancements, particularly InsurTech, are crucial for enhancing operational efficiency and customer engagement. Favorable demographic trends, including an aging population, are boosting demand for health and life insurance products. Government initiatives promoting financial inclusion and savings further support market growth.

Key barriers and challenges include intense competition from established players and new entrants, leading to price pressures and the need for continuous innovation. The complex regulatory environment, while ensuring stability, can also increase compliance costs. Economic uncertainties and low-interest-rate environments pose challenges for profitability, particularly in the life insurance sector. Supply chain issues are less of a direct concern for insurance itself, but disruptions affecting client businesses can indirectly impact demand for commercial insurance.

Emerging Opportunities in France Life & Non-life Insurance Industry

Emerging opportunities in the France insurance industry are abundant, particularly in the realm of digital transformation and personalized insurance. The growing demand for cyber insurance is a significant opportunity, driven by increasing digitalization and the rising threat of cyberattacks on businesses and individuals. Insurers can also tap into the burgeoning gig economy by offering tailored insurance solutions for freelancers and independent contractors. The development of embedded insurance models, where insurance is seamlessly integrated into the purchase of other goods and services (e.g., travel insurance with flight bookings), presents a substantial growth avenue. Furthermore, climate change-related insurance products, addressing risks from extreme weather events, are gaining importance and offer a new frontier for innovation.

Growth Accelerators in the France Life & Non-life Insurance Industry Industry

Long-term growth in the France insurance market will be significantly accelerated by continued advancements in InsurTech, enabling more sophisticated data analytics, personalized pricing, and efficient claims processing. Strategic partnerships between traditional insurers and technology startups will foster innovation and expand service offerings. The increasing adoption of Big Data and AI will allow for more accurate risk assessment and the development of proactive risk management solutions. Furthermore, expanding into underserved markets and developing innovative products tailored to specific niche segments, such as sustainable investing-linked life insurance or specialized commercial lines for emerging industries, will act as crucial growth accelerators.

Key Players Shaping the France Life & Non-life Insurance Industry Market

- Societe Generale

- Credit Agricole

- Covea

- Axa

- Allianz

- La banque postale

- MACIF

- Credit mutuel

- MAIF

- ACM

- Caisse D'Epargne

- Groupama

Notable Milestones in France Life & Non-life Insurance Industry Sector

- June 2022: Berkshire Hathaway Specialty Insurance launched a Directors and Officers Liability policy in France, enhancing its capacity to serve multinational companies with global exposure. This move signifies a growing demand for specialized liability coverage and expands the international reach of insurance solutions.

- December 2021: Allianz Partners and Uber partnered to provide benefits and protection insurance for independent drivers and couriers across Europe, including France. This partnership addresses the unique insurance needs of the gig economy, offering on-trip and off-trip benefits, and highlights the industry's adaptation to new work models.

In-Depth France Life & Non-life Insurance Industry Market Outlook

The France life and non-life insurance industry outlook is highly positive, driven by sustained innovation and evolving consumer needs. Future market potential lies in leveraging advanced analytics for hyper-personalization of insurance products, making them more relevant and affordable for consumers. Strategic opportunities include the further integration of digital platforms to enhance customer experience and streamline operations. The growing awareness of ESG (Environmental, Social, and Governance) factors presents a significant avenue for insurers to develop sustainable products and practices, aligning with both regulatory expectations and growing consumer demand for ethical and responsible financial solutions. The continuous evolution of the regulatory landscape will also necessitate agility and adaptability from market players.

France Life & Non-life Insurance Industry Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other distribution channels

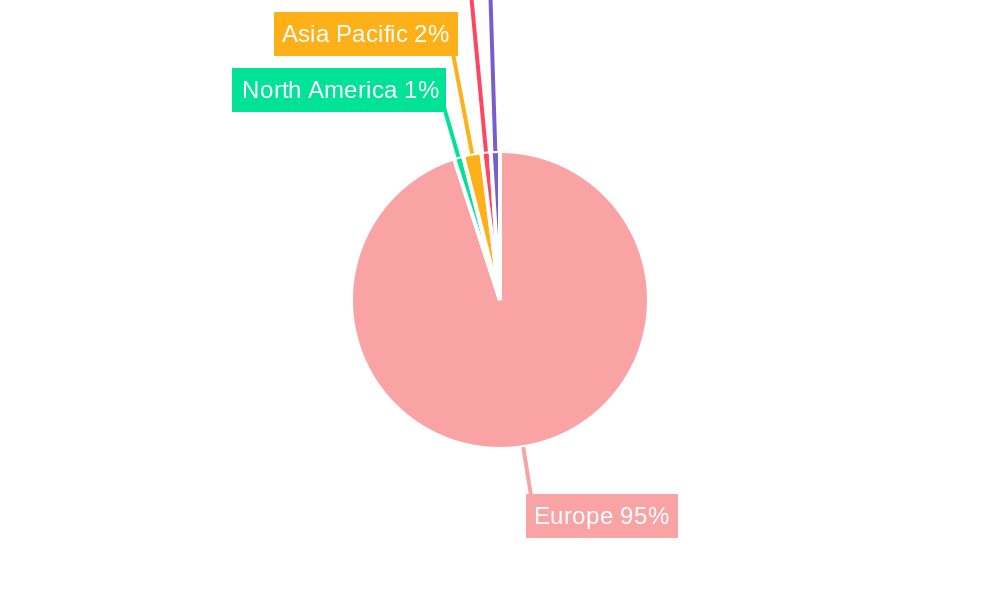

France Life & Non-life Insurance Industry Segmentation By Geography

- 1. France

France Life & Non-life Insurance Industry Regional Market Share

Geographic Coverage of France Life & Non-life Insurance Industry

France Life & Non-life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significant Growth Contributed by the Non-Life Insurance Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Life & Non-life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Societe Generale

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Credit Agricole

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covea

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allianz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 La banque postale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MACIF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Credit mutuel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAIF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ACM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Caisse D'Epargne

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Groupama**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Societe Generale

List of Figures

- Figure 1: France Life & Non-life Insurance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Life & Non-life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: France Life & Non-life Insurance Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: France Life & Non-life Insurance Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 3: France Life & Non-life Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Life & Non-life Insurance Industry Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: France Life & Non-life Insurance Industry Revenue billion Forecast, by Channel of Distribution 2020 & 2033

- Table 6: France Life & Non-life Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Life & Non-life Insurance Industry?

The projected CAGR is approximately 34.51%.

2. Which companies are prominent players in the France Life & Non-life Insurance Industry?

Key companies in the market include Societe Generale, Credit Agricole, Covea, Axa, Allianz, La banque postale, MACIF, Credit mutuel, MAIF, ACM, Caisse D'Epargne, Groupama**List Not Exhaustive.

3. What are the main segments of the France Life & Non-life Insurance Industry?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 291.04 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significant Growth Contributed by the Non-Life Insurance Sector.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On June 15, 2022, Berkshire Hathaway Specialty Insurance launched a Directors and Officers Liability policy insurance in France to serve local and multinational companies. This new coverage enhances BHSI's ability to provide multinational programs and services to companies with exposure in France and throughout the company's global network, which spans 170 countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Life & Non-life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Life & Non-life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Life & Non-life Insurance Industry?

To stay informed about further developments, trends, and reports in the France Life & Non-life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence