Key Insights

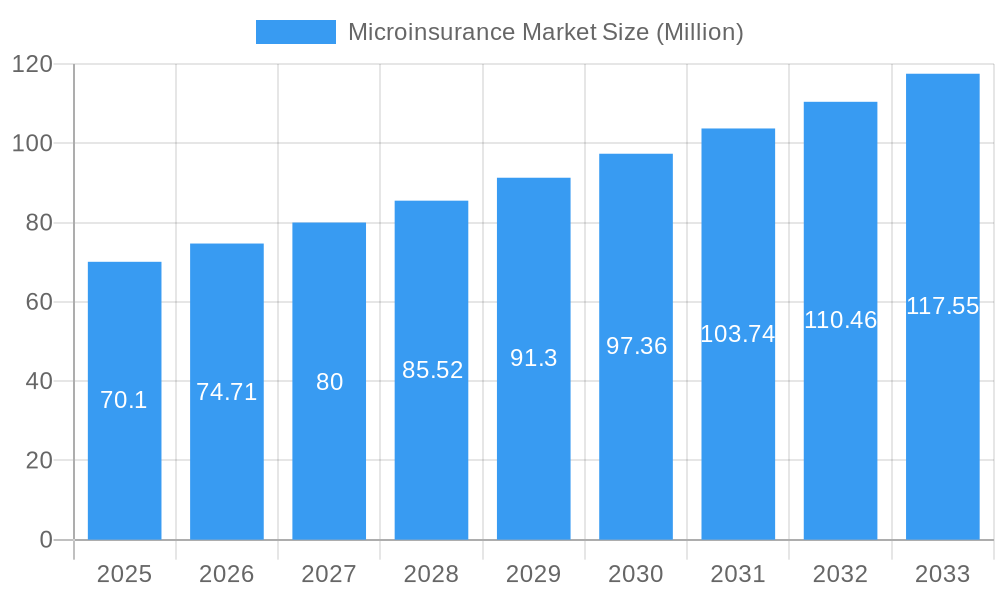

The global Microinsurance market is poised for significant expansion, projected to reach approximately USD 70.10 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.53% through 2033. This growth trajectory is fueled by a confluence of factors, primarily driven by increasing awareness of the need for financial protection among low-income populations and a growing understanding of its role in poverty alleviation and economic stability. Governments and non-governmental organizations are actively promoting microinsurance schemes, recognizing their potential to bridge the insurance gap and provide a safety net against unforeseen events like natural disasters, health crises, and crop failures. Furthermore, technological advancements, particularly in digital channels, are playing a crucial role in expanding reach and reducing operational costs, making microinsurance more accessible and affordable for underserved communities. The development of innovative product types tailored to specific needs, such as customized life and health insurance plans, is also contributing to market penetration.

Microinsurance Market Market Size (In Million)

The market is characterized by a dynamic interplay of distribution channels and provider models. While direct sales and financial institutions remain significant, the burgeoning digital channels are set to revolutionize how microinsurance is accessed and delivered, offering convenience and wider coverage. The competitive landscape includes a mix of commercially viable entities and those supported by aid or government initiatives, each contributing to the market's overall growth and outreach. Key players are focusing on strategic partnerships and product innovation to capture market share. Emerging trends indicate a shift towards more sophisticated and integrated microinsurance solutions, with a greater emphasis on customer education and claims processing efficiency. However, challenges such as low customer literacy, trust deficits, and regulatory hurdles in certain regions may present restraints, necessitating concerted efforts from stakeholders to foster sustained growth and ensure equitable access to financial security for all.

Microinsurance Market Company Market Share

Microinsurance Market Report: Unlocking Financial Inclusion for Underserved Populations (2019–2033)

This comprehensive report offers an in-depth analysis of the global microinsurance market, a vital sector dedicated to providing affordable insurance solutions to low-income individuals and small businesses. Driven by the increasing recognition of its role in poverty alleviation and financial resilience, the microinsurance industry is poised for significant expansion. This study meticulously examines market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and the competitive strategies of leading players. Our analysis covers the historical period from 2019–2024, with a base year of 2025 and a detailed forecast extending to 2033. We provide actionable insights for insurers, policymakers, financial institutions, and technology providers seeking to capitalize on this rapidly evolving market. The report quantifies market evolution in millions of USD.

Microinsurance Market Market Dynamics & Structure

The microinsurance market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration varies significantly by region, with some areas dominated by a few large players while others exhibit a more fragmented landscape. Technological innovation serves as a primary driver, enabling new delivery models and product designs. Regulatory frameworks play a crucial role, often shaping the accessibility and affordability of microinsurance products, with many governments actively promoting initiatives to expand financial inclusion. Competitive product substitutes, such as informal savings groups and government-provided social safety nets, present a constant challenge. End-user demographics, primarily low-income households and vulnerable populations, dictate product design and distribution strategies. Mergers and acquisitions (M&A) are increasingly becoming a strategic tool for market consolidation and expanding reach.

- Market Concentration: Varies by region, with some developed markets showing higher concentration and emerging economies exhibiting a more fragmented landscape.

- Technological Innovation: Mobile technology, digital platforms, and data analytics are key enablers for efficient distribution and claims processing.

- Regulatory Frameworks: Supportive policies and government initiatives are critical for fostering market growth and ensuring consumer protection.

- Competitive Product Substitutes: Informal savings, community-based schemes, and existing government welfare programs pose competition.

- End-User Demographics: Focus on affordability, simplicity, and accessibility for low-income segments.

- M&A Trends: Strategic acquisitions and partnerships are observed to gain market share and expand product portfolios. For instance, in October 2023, the Bharti Group entered an agreement to purchase AXA's 49% stake in Bharti AXA Life Insurance, highlighting consolidation efforts.

Microinsurance Market Growth Trends & Insights

The microinsurance market is experiencing robust growth, driven by a confluence of economic, social, and technological factors. The market size is projected to expand significantly from approximately $15,000 million in the base year 2025 to an estimated $35,000 million by 2033, showcasing a compelling Compound Annual Growth Rate (CAGR) of around 12%. This expansion is fueled by increasing awareness among vulnerable populations about the importance of financial protection against unforeseen events, coupled with government and non-governmental organization (NGO) initiatives aimed at promoting financial inclusion. Adoption rates are steadily rising, particularly in emerging economies in Asia and Africa, where a substantial portion of the population remains underinsured.

Technological disruptions are revolutionizing microinsurance delivery. The proliferation of mobile phones has enabled new distribution channels, allowing insurers to reach remote and underserved communities efficiently. Digital platforms facilitate simplified enrollment processes, premium collection, and claims management, thereby reducing operational costs and enhancing customer experience. Consumer behavior is also shifting, with a growing demand for flexible, tailored insurance products that cater to specific needs and income levels. For example, parametric microinsurance, which pays out based on predefined triggers like weather events, is gaining traction due to its transparency and speed. The penetration of microinsurance is expected to deepen significantly, moving from an estimated 15% in 2025 to over 25% by 2033 in target markets.

The parent market (broader insurance sector) provides a fertile ground for the growth of microinsurance as a specialized segment. Increased investment and innovation within the broader insurance industry often trickle down to create more sophisticated and accessible microinsurance products. The child market of microinsurance, in turn, is diversifying, with an increasing array of specialized products addressing specific risks such as crop failure, health emergencies, and natural disasters. This diversification is crucial for meeting the nuanced needs of low-income populations, thereby accelerating market penetration and deepening its impact. The shift towards digital-first strategies and the increasing use of artificial intelligence in risk assessment and pricing further contribute to the market's expansion and efficiency.

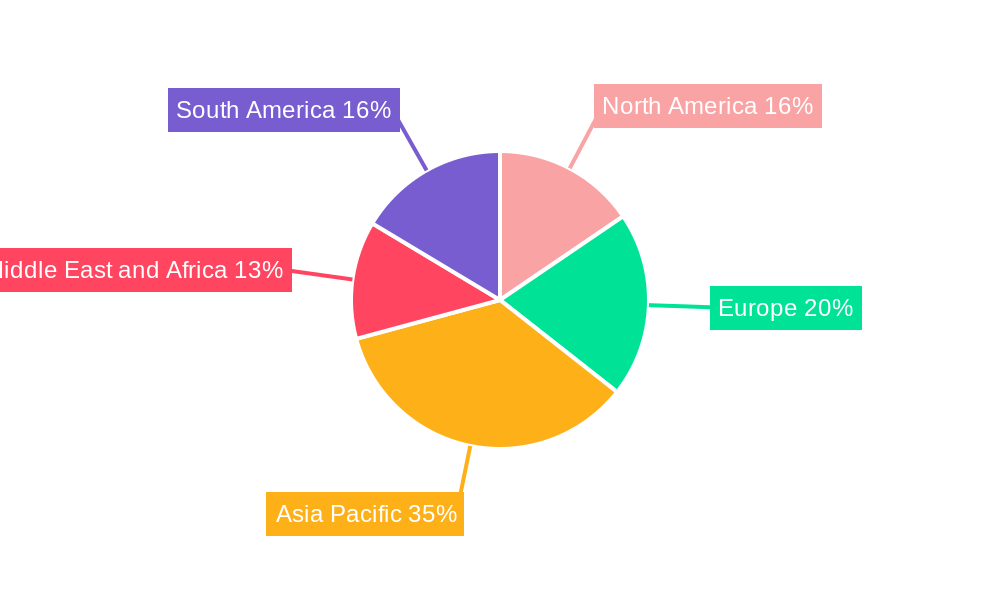

Dominant Regions, Countries, or Segments in Microinsurance Market

The microinsurance market demonstrates distinct regional dominance and segment leadership, driven by a combination of socio-economic conditions, government policies, and infrastructural development. Asia Pacific currently leads the market, propelled by its vast, underinsured population and proactive government initiatives promoting financial inclusion. Countries like India, Indonesia, and the Philippines are at the forefront, exhibiting high adoption rates for various microinsurance products. This dominance is underpinned by a growing middle class, increased mobile penetration, and supportive regulatory frameworks that encourage insurers to cater to the lower-income segments.

Within the product types, Life Insurance and Health Insurance emerge as the dominant segments. Life microinsurance offers a crucial safety net for families facing the loss of a primary breadwinner, while health microinsurance addresses the often-catastrophic financial burden of medical emergencies for low-income households. The demand for these products is consistently high due to their direct impact on household well-being and poverty reduction.

The Partner Agent Model is a particularly effective distribution channel, especially in regions with limited digital infrastructure. Local agents, often community leaders or small business owners, possess invaluable local knowledge and trust, enabling them to effectively reach and educate potential policyholders. This model fosters strong customer relationships and facilitates on-the-ground premium collection and claims support.

- Asia Pacific: Dominant region due to large underserved populations, government support for financial inclusion, and increasing mobile penetration.

- Key countries: India, Indonesia, Philippines, Vietnam.

- Drivers: Poverty reduction programs, government mandates, innovative digital solutions.

- Product Type Dominance:

- Life Insurance: Provides essential financial security for families.

- Health Insurance: Addresses critical healthcare needs and prevents catastrophic health-related debt.

- Distribution Channel Dominance:

- Partner Agent Model: Leverages local networks and trust for effective reach and engagement.

- Enables personalized customer service and on-ground support.

- Facilitates easier premium collection in remote areas.

- Partner Agent Model: Leverages local networks and trust for effective reach and engagement.

- Provider Type: Commercially Viable providers are increasingly shaping the market, demonstrating the sustainability of microinsurance as a business model.

- Focus on profitability through efficient operations and product design.

- Attracts private investment and innovation.

Microinsurance Market Product Landscape

The microinsurance market's product landscape is characterized by innovation aimed at affordability, simplicity, and relevance for low-income populations. Products are typically designed with low premium payments, short waiting periods, and straightforward claim processes. Innovations include index-based insurance, such as crop insurance triggered by rainfall levels or temperature, which significantly reduces administrative costs and speeds up payouts. Mobile-enabled health insurance plans and simple life insurance policies with minimal underwriting are also prominent. The focus remains on providing tangible benefits that address immediate risks, thereby building trust and encouraging broader adoption.

Key Drivers, Barriers & Challenges in Microinsurance Market

Key Drivers:

- Growing Awareness of Financial Inclusion: Increasing recognition by governments and NGOs of microinsurance's role in poverty alleviation and economic stability.

- Technological Advancements: Mobile technology, digital platforms, and data analytics enabling wider reach, lower costs, and improved customer experience.

- Supportive Government Policies & Initiatives: Subsidies, regulatory frameworks, and awareness campaigns promoting microinsurance uptake.

- Increasing Income Levels (in some segments): A growing lower-middle class with disposable income to afford basic insurance protection.

- Natural Disasters & Climate Change: Heightened awareness of vulnerability to shocks, driving demand for risk mitigation products.

Barriers & Challenges:

- Low Income Levels & Affordability: A significant portion of the target market has very limited disposable income, making even low premiums a challenge.

- Low Financial Literacy & Trust Deficit: Lack of understanding of insurance principles and historical mistrust in formal financial institutions.

- High Operational Costs: Reaching and serving dispersed, low-income populations can be expensive for insurers, especially with traditional models.

- Regulatory Hurdles: Inconsistent or inadequate regulatory frameworks in some regions can stifle innovation and market development.

- Product Design & Customization: Developing products that are both affordable and relevant to diverse needs requires significant market research and expertise.

- Distribution Channel Limitations: Establishing efficient and cost-effective distribution networks in remote or underdeveloped areas remains a challenge.

Emerging Opportunities in Microinsurance Market

Emerging opportunities in the microinsurance market are centered on leveraging technology to enhance accessibility and affordability. The expansion of digital payment systems and mobile wallets presents a significant avenue for streamlined premium collection and claims disbursement. Furthermore, the increasing availability of granular data through mobile devices and other sources offers the potential for more accurate risk assessment and personalized product offerings. Growing partnerships between insurers, mobile network operators, and fintech companies are creating innovative ecosystems for microinsurance delivery. There is also a substantial opportunity in developing specialized microinsurance products for emerging sectors such as the gig economy, smallholder agriculture, and small and medium-sized enterprises (SMEs) in underserved regions.

Growth Accelerators in the Microinsurance Market Industry

Several key catalysts are accelerating the long-term growth of the microinsurance market. Technological breakthroughs, particularly in mobile technology and data analytics, are proving transformative. These advancements enable insurers to reduce operational costs, improve customer outreach, and develop more tailored products. Strategic partnerships between insurance companies, microfinance institutions (MFIs), mobile network operators, and NGOs are crucial for expanding distribution networks and building trust among target populations. Market expansion strategies, including the development of simplified product designs and enhanced financial literacy programs, are further driving penetration. The increasing recognition of microinsurance as a vital tool for achieving Sustainable Development Goals is also attracting greater investment and policy support, fostering a more conducive environment for sustained growth.

Key Players Shaping the Microinsurance Market Market

- The Hollard Insurance Company

- afpgen com ph

- American International Group Inc

- Bharti AXA Life Insurance Company Limited

- SBI Life Insurance Company Limited

- ICICI Prudential Life Insurance Co Ltd

- Banco do Nordeste Brasil SA

- Climbs

- Allianz SE

- Bajaj Allianz Life Insurance Co Ltd

Notable Milestones in Microinsurance Market Sector

- October 2023: Bharti Group entered an agreement with its partner AXA to purchase AXA's 49% ownership stake in Bharti AXA Life Insurance. This move signals consolidation and strategic shifts within the life insurance sector.

- April 2023: American International Group (AIG) finalized its arrangement with investment funds managed by Stone Point Capital to establish a standalone managing general agency, Private Client Select Insurance Services. This agency will focus on serving high-net-worth and ultra-high-net-worth markets, indicating a strategic realignment and focus on specialized segments.

In-Depth Microinsurance Market Market Outlook

The future outlook for the microinsurance market is exceptionally positive, driven by persistent growth accelerators and evolving market dynamics. The increasing embrace of digital technologies, from mobile payments to AI-driven risk assessment, will continue to lower operational costs and enhance product accessibility, particularly in remote areas. Strategic alliances between diverse stakeholders—insurers, technology providers, governments, and NGOs—will be paramount in building robust distribution ecosystems and fostering financial literacy. The market's expansion will also be fueled by a growing demand for tailored solutions addressing specific risks faced by vulnerable populations, such as climate-related agricultural losses and health emergencies. As more evidence emerges on the economic and social benefits of microinsurance, it will increasingly attract significant investment and policy support, solidifying its role as a critical enabler of financial inclusion and resilience globally.

Microinsurance Market Segmentation

-

1. Model Type

- 1.1. Partner Agent Model

- 1.2. Full-service Model

-

2. Product Type

- 2.1. Life Insurance

- 2.2. Health Insurance

- 2.3. Property Insurance

- 2.4. Other Product Types

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Financial Institutions

- 3.3. Digital Channels

- 3.4. Other Distribution Channels

-

4. Provider

- 4.1. Commercially Viable

- 4.2. Through Aid/Government Support

Microinsurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Microinsurance Market Regional Market Share

Geographic Coverage of Microinsurance Market

Microinsurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Access to Financial Services; Rise of Digital Platforms and Mobile Technology

- 3.3. Market Restrains

- 3.3.1. Access to Financial Services; Rise of Digital Platforms and Mobile Technology

- 3.4. Market Trends

- 3.4.1. Low- and Middle-income Earners prefer Healthcare Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Model Type

- 5.1.1. Partner Agent Model

- 5.1.2. Full-service Model

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Life Insurance

- 5.2.2. Health Insurance

- 5.2.3. Property Insurance

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Financial Institutions

- 5.3.3. Digital Channels

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Commercially Viable

- 5.4.2. Through Aid/Government Support

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Model Type

- 6. North America Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Model Type

- 6.1.1. Partner Agent Model

- 6.1.2. Full-service Model

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Life Insurance

- 6.2.2. Health Insurance

- 6.2.3. Property Insurance

- 6.2.4. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Financial Institutions

- 6.3.3. Digital Channels

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Provider

- 6.4.1. Commercially Viable

- 6.4.2. Through Aid/Government Support

- 6.1. Market Analysis, Insights and Forecast - by Model Type

- 7. Europe Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Model Type

- 7.1.1. Partner Agent Model

- 7.1.2. Full-service Model

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Life Insurance

- 7.2.2. Health Insurance

- 7.2.3. Property Insurance

- 7.2.4. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Financial Institutions

- 7.3.3. Digital Channels

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Provider

- 7.4.1. Commercially Viable

- 7.4.2. Through Aid/Government Support

- 7.1. Market Analysis, Insights and Forecast - by Model Type

- 8. Asia Pacific Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Model Type

- 8.1.1. Partner Agent Model

- 8.1.2. Full-service Model

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Life Insurance

- 8.2.2. Health Insurance

- 8.2.3. Property Insurance

- 8.2.4. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Financial Institutions

- 8.3.3. Digital Channels

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Provider

- 8.4.1. Commercially Viable

- 8.4.2. Through Aid/Government Support

- 8.1. Market Analysis, Insights and Forecast - by Model Type

- 9. Middle East and Africa Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Model Type

- 9.1.1. Partner Agent Model

- 9.1.2. Full-service Model

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Life Insurance

- 9.2.2. Health Insurance

- 9.2.3. Property Insurance

- 9.2.4. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Financial Institutions

- 9.3.3. Digital Channels

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Provider

- 9.4.1. Commercially Viable

- 9.4.2. Through Aid/Government Support

- 9.1. Market Analysis, Insights and Forecast - by Model Type

- 10. South America Microinsurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Model Type

- 10.1.1. Partner Agent Model

- 10.1.2. Full-service Model

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Life Insurance

- 10.2.2. Health Insurance

- 10.2.3. Property Insurance

- 10.2.4. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Financial Institutions

- 10.3.3. Digital Channels

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Provider

- 10.4.1. Commercially Viable

- 10.4.2. Through Aid/Government Support

- 10.1. Market Analysis, Insights and Forecast - by Model Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Hollard Insurance Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 afpgen com ph

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American International Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bharti AXA Life Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SBI Life Insurance Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ICICI Prudential Life Insurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Banco do Nordeste Brasil SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Climbs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allianz SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bajaj Allianz Life Insurance Co Ltd**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Hollard Insurance Company

List of Figures

- Figure 1: Global Microinsurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Microinsurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Microinsurance Market Revenue (undefined), by Model Type 2025 & 2033

- Figure 4: North America Microinsurance Market Volume (Billion), by Model Type 2025 & 2033

- Figure 5: North America Microinsurance Market Revenue Share (%), by Model Type 2025 & 2033

- Figure 6: North America Microinsurance Market Volume Share (%), by Model Type 2025 & 2033

- Figure 7: North America Microinsurance Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 8: North America Microinsurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 9: North America Microinsurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Microinsurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 11: North America Microinsurance Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 12: North America Microinsurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America Microinsurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Microinsurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Microinsurance Market Revenue (undefined), by Provider 2025 & 2033

- Figure 16: North America Microinsurance Market Volume (Billion), by Provider 2025 & 2033

- Figure 17: North America Microinsurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 18: North America Microinsurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 19: North America Microinsurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 20: North America Microinsurance Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Microinsurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Microinsurance Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Microinsurance Market Revenue (undefined), by Model Type 2025 & 2033

- Figure 24: Europe Microinsurance Market Volume (Billion), by Model Type 2025 & 2033

- Figure 25: Europe Microinsurance Market Revenue Share (%), by Model Type 2025 & 2033

- Figure 26: Europe Microinsurance Market Volume Share (%), by Model Type 2025 & 2033

- Figure 27: Europe Microinsurance Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Europe Microinsurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Europe Microinsurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Microinsurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Microinsurance Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 32: Europe Microinsurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: Europe Microinsurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Microinsurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Microinsurance Market Revenue (undefined), by Provider 2025 & 2033

- Figure 36: Europe Microinsurance Market Volume (Billion), by Provider 2025 & 2033

- Figure 37: Europe Microinsurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 38: Europe Microinsurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 39: Europe Microinsurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: Europe Microinsurance Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Microinsurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Microinsurance Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Microinsurance Market Revenue (undefined), by Model Type 2025 & 2033

- Figure 44: Asia Pacific Microinsurance Market Volume (Billion), by Model Type 2025 & 2033

- Figure 45: Asia Pacific Microinsurance Market Revenue Share (%), by Model Type 2025 & 2033

- Figure 46: Asia Pacific Microinsurance Market Volume Share (%), by Model Type 2025 & 2033

- Figure 47: Asia Pacific Microinsurance Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 48: Asia Pacific Microinsurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 49: Asia Pacific Microinsurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 50: Asia Pacific Microinsurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 51: Asia Pacific Microinsurance Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 52: Asia Pacific Microinsurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 53: Asia Pacific Microinsurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 54: Asia Pacific Microinsurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 55: Asia Pacific Microinsurance Market Revenue (undefined), by Provider 2025 & 2033

- Figure 56: Asia Pacific Microinsurance Market Volume (Billion), by Provider 2025 & 2033

- Figure 57: Asia Pacific Microinsurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 58: Asia Pacific Microinsurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 59: Asia Pacific Microinsurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Microinsurance Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Microinsurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Microinsurance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Microinsurance Market Revenue (undefined), by Model Type 2025 & 2033

- Figure 64: Middle East and Africa Microinsurance Market Volume (Billion), by Model Type 2025 & 2033

- Figure 65: Middle East and Africa Microinsurance Market Revenue Share (%), by Model Type 2025 & 2033

- Figure 66: Middle East and Africa Microinsurance Market Volume Share (%), by Model Type 2025 & 2033

- Figure 67: Middle East and Africa Microinsurance Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 68: Middle East and Africa Microinsurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 69: Middle East and Africa Microinsurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Middle East and Africa Microinsurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Middle East and Africa Microinsurance Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 72: Middle East and Africa Microinsurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 73: Middle East and Africa Microinsurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 74: Middle East and Africa Microinsurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 75: Middle East and Africa Microinsurance Market Revenue (undefined), by Provider 2025 & 2033

- Figure 76: Middle East and Africa Microinsurance Market Volume (Billion), by Provider 2025 & 2033

- Figure 77: Middle East and Africa Microinsurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 78: Middle East and Africa Microinsurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 79: Middle East and Africa Microinsurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Middle East and Africa Microinsurance Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Microinsurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Microinsurance Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Microinsurance Market Revenue (undefined), by Model Type 2025 & 2033

- Figure 84: South America Microinsurance Market Volume (Billion), by Model Type 2025 & 2033

- Figure 85: South America Microinsurance Market Revenue Share (%), by Model Type 2025 & 2033

- Figure 86: South America Microinsurance Market Volume Share (%), by Model Type 2025 & 2033

- Figure 87: South America Microinsurance Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 88: South America Microinsurance Market Volume (Billion), by Product Type 2025 & 2033

- Figure 89: South America Microinsurance Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 90: South America Microinsurance Market Volume Share (%), by Product Type 2025 & 2033

- Figure 91: South America Microinsurance Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 92: South America Microinsurance Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 93: South America Microinsurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 94: South America Microinsurance Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 95: South America Microinsurance Market Revenue (undefined), by Provider 2025 & 2033

- Figure 96: South America Microinsurance Market Volume (Billion), by Provider 2025 & 2033

- Figure 97: South America Microinsurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 98: South America Microinsurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 99: South America Microinsurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 100: South America Microinsurance Market Volume (Billion), by Country 2025 & 2033

- Figure 101: South America Microinsurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Microinsurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 2: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 3: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 8: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 9: Global Microinsurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Global Microinsurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 12: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 13: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 18: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 19: Global Microinsurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global Microinsurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 22: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 23: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 25: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 28: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 29: Global Microinsurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Microinsurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 32: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 33: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 38: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 39: Global Microinsurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Microinsurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 42: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 43: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 45: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 48: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 49: Global Microinsurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Microinsurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Global Microinsurance Market Revenue undefined Forecast, by Model Type 2020 & 2033

- Table 52: Global Microinsurance Market Volume Billion Forecast, by Model Type 2020 & 2033

- Table 53: Global Microinsurance Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 54: Global Microinsurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 55: Global Microinsurance Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 56: Global Microinsurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 57: Global Microinsurance Market Revenue undefined Forecast, by Provider 2020 & 2033

- Table 58: Global Microinsurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 59: Global Microinsurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Microinsurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microinsurance Market?

The projected CAGR is approximately 4.57%.

2. Which companies are prominent players in the Microinsurance Market?

Key companies in the market include The Hollard Insurance Company, afpgen com ph, American International Group Inc, Bharti AXA Life Insurance Company Limited, SBI Life Insurance Company Limited, ICICI Prudential Life Insurance Co Ltd, Banco do Nordeste Brasil SA, Climbs, Allianz SE, Bajaj Allianz Life Insurance Co Ltd**List Not Exhaustive.

3. What are the main segments of the Microinsurance Market?

The market segments include Model Type, Product Type, Distribution Channel, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Access to Financial Services; Rise of Digital Platforms and Mobile Technology.

6. What are the notable trends driving market growth?

Low- and Middle-income Earners prefer Healthcare Insurance.

7. Are there any restraints impacting market growth?

Access to Financial Services; Rise of Digital Platforms and Mobile Technology.

8. Can you provide examples of recent developments in the market?

October 2023: Bharti Group entered an agreement with its partner AXA to purchase AXA's 49% ownership stake in Bharti AXA Life Insurance. The completion of the transaction was anticipated by December 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microinsurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microinsurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microinsurance Market?

To stay informed about further developments, trends, and reports in the Microinsurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence