Key Insights

The Asia Pacific Residential Vacuum Cleaners Market is poised for robust expansion, projected to reach USD 50.56 billion in 2025, driven by an impressive CAGR of 8.6% throughout the forecast period. This significant growth is underpinned by several key factors. Increasing disposable incomes across major economies like China, India, and Southeast Asian nations are fueling consumer demand for sophisticated and convenient home appliances. Furthermore, a growing awareness of hygiene and cleanliness, amplified by recent global health events, is prompting households to invest in advanced cleaning solutions. The burgeoning middle class and rapid urbanization are also contributing to higher adoption rates of residential vacuum cleaners, particularly in emerging markets. Technological advancements are playing a crucial role, with a strong trend towards cordless, robotic, and smart vacuum cleaners offering enhanced convenience and efficiency. The market is witnessing a shift in consumer preference towards premium and feature-rich products, further propelling market value.

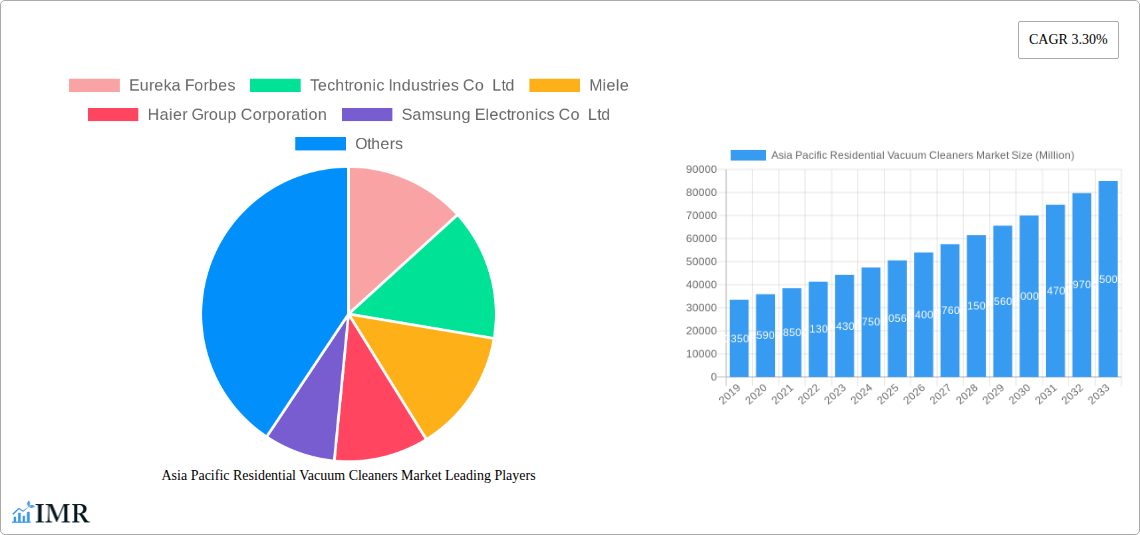

Asia Pacific Residential Vacuum Cleaners Market Market Size (In Billion)

The competitive landscape is dynamic, with leading companies like Dyson, Samsung, and iRobot introducing innovative products that cater to evolving consumer needs. Product segmentation reveals a strong demand for upright and robotic vacuum cleaners, reflecting the desire for both powerful cleaning and automated solutions. Cordless variants are gaining substantial traction due to their portability and ease of use, contributing significantly to the market's upward trajectory. Distribution channels are also diversifying, with online sales channels experiencing exponential growth, offering wider accessibility and competitive pricing. While market growth is strong, potential restraints such as the initial high cost of advanced models and the availability of lower-priced traditional cleaning tools in some segments could present minor challenges. However, the overall outlook for the Asia Pacific Residential Vacuum Cleaners Market remains exceptionally positive, driven by sustained economic development, technological innovation, and a growing emphasis on home well-being.

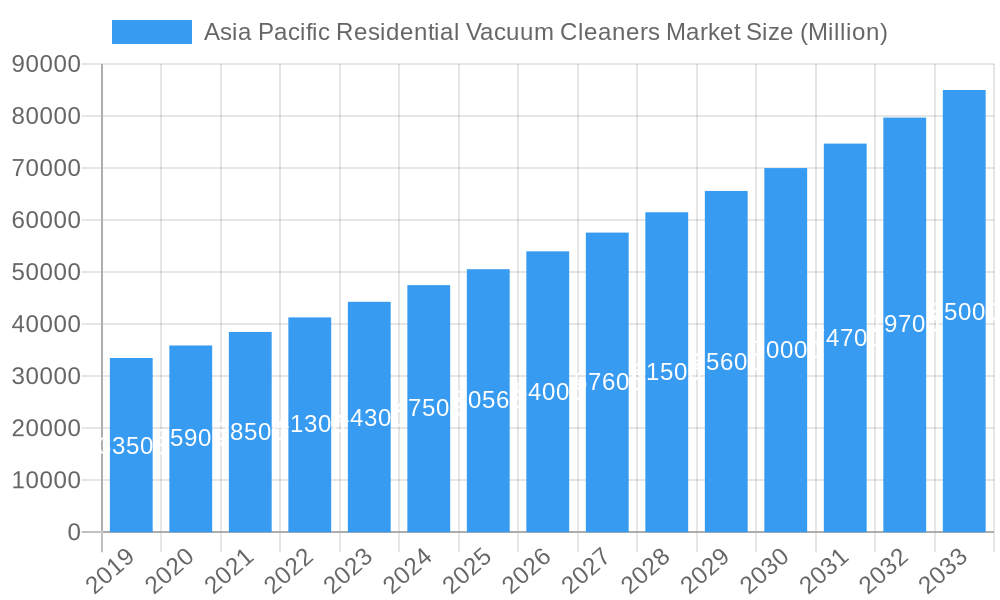

Asia Pacific Residential Vacuum Cleaners Market Company Market Share

This in-depth report provides a detailed analysis of the Asia Pacific Residential Vacuum Cleaners Market, offering crucial insights into market dynamics, growth trends, and competitive landscape for the period 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033. Leveraging extensive historical data from 2019–2024, this research is designed for industry professionals seeking to understand market drivers, challenges, and future opportunities in this rapidly evolving sector. We present all values in billion units for clear quantitative analysis.

Asia Pacific Residential Vacuum Cleaners Market Market Dynamics & Structure

The Asia Pacific Residential Vacuum Cleaners Market exhibits a moderate to high concentration, with key players like Dyson Limited, Samsung Electronics Co Ltd, and Koninklijke Philips NV holding significant shares. Technological innovation is a primary driver, fueled by advancements in cordless vacuum cleaner technology and the burgeoning demand for robotic vacuum cleaners equipped with AI-powered navigation and smart home integration. Regulatory frameworks, primarily focused on energy efficiency and safety standards, are gradually shaping product development. Competitive product substitutes, such as traditional brooms and dustpans, are losing traction as consumer preference shifts towards automated and efficient cleaning solutions. End-user demographics reveal a growing middle class with increasing disposable incomes, particularly in emerging economies, and a rising adoption rate among tech-savvy urban populations. Mergers and Acquisitions (M&A) trends indicate strategic consolidation to enhance market reach and acquire innovative technologies. For instance, M&A deal volumes are projected to increase by approximately 15% over the forecast period, driven by the pursuit of market share and product diversification. Innovation barriers include high research and development costs and the need for localized product adaptations to cater to diverse consumer needs across the region.

Asia Pacific Residential Vacuum Cleaners Market Growth Trends & Insights

The Asia Pacific Residential Vacuum Cleaners Market is poised for significant expansion, driven by a confluence of socioeconomic and technological factors. The market size is estimated to reach $XX.XX billion units by 2033, expanding from $XX.XX billion units in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period. Adoption rates for advanced cleaning solutions are accelerating, particularly in countries like China, Japan, and South Korea, where urbanization and a focus on hygiene are paramount. Technological disruptions, including the integration of smart sensors, advanced filtration systems, and voice-activated controls, are transforming consumer expectations and driving the demand for premium cordless vacuum cleaners and robotic vacuum cleaners. Consumer behavior shifts are evident, with a growing preference for convenience, efficiency, and aesthetically pleasing home appliances. The increasing penetration of online retail channels, coupled with rising awareness campaigns promoting the benefits of modern vacuum cleaners, further bolsters market growth. The market penetration of robotic vacuum cleaners is expected to increase from XX% in 2025 to XX% by 2033, highlighting a significant shift in consumer cleaning habits. The growing popularity of subscription-based models for high-end appliances also presents a novel avenue for market penetration.

Dominant Regions, Countries, or Segments in Asia Pacific Residential Vacuum Cleaners Market

The robotic vacuum cleaner segment, within the Product category, is projected to be a dominant force in the Asia Pacific Residential Vacuum Cleaners Market. Countries like Japan and South Korea are leading this charge due to their technologically advanced consumer base and a strong emphasis on smart home integration. The cordless vacuum cleaner segment, a sub-category of Type, is also experiencing substantial growth across the region, driven by consumer demand for convenience and maneuverability.

- Leading Segment: Robotic Vacuum Cleaners

- Market Share: Expected to capture XX% of the total market revenue by 2033.

- Key Drivers: High disposable incomes, growing acceptance of automation in households, and advancements in AI and mapping technologies.

- Growth Potential: Significant untapped market potential in Southeast Asia, with increasing adoption fueled by smart city initiatives and a desire for time-saving solutions.

- Dominant Type: Cordless Vacuum Cleaners

- Adoption Rate: Surging demand due to portability and ease of use, making them ideal for smaller living spaces common in urban Asia.

- Market Penetration: Expected to surpass corded counterparts in sales volume by 2028.

- Innovation: Continuous development in battery technology and suction power is enhancing their appeal.

- Dominant Distribution Channel: Online

- E-commerce Growth: The robust growth of e-commerce platforms in Asia Pacific, such as Alibaba, JD.com, and Amazon, is a critical factor.

- Consumer Preference: Online channels offer wider product selection, competitive pricing, and convenient home delivery.

- Market Share: Online sales are anticipated to account for over XX% of total sales by 2030.

- Emerging Markets: China, India, and ASEAN countries represent significant growth opportunities due to their large populations and rapidly expanding middle class. Economic policies promoting technological adoption and smart home infrastructure development will further fuel growth in these regions.

Asia Pacific Residential Vacuum Cleaners Market Product Landscape

The product landscape is characterized by rapid innovation, with a focus on enhanced performance, user convenience, and smart capabilities. Robotic vacuum cleaners are increasingly sophisticated, featuring advanced obstacle avoidance, self-emptying stations, and multi-surface cleaning. Cordless vacuum cleaners are witnessing improvements in battery life, suction power, and lightweight designs, making them highly sought-after. Wet/Dry vacuum cleaners are gaining traction for their versatility in handling spills and deep cleaning. Manufacturers are also introducing specialized attachments and features catering to pet owners, such as enhanced allergen filtration and tangle-free brush rolls.

Key Drivers, Barriers & Challenges in Asia Pacific Residential Vacuum Cleaners Market

Key Drivers:

- Technological Advancements: The relentless pursuit of innovation in smart home technology, AI, and robotics is driving demand for advanced robotic vacuum cleaners and smart cordless vacuum cleaners.

- Rising Disposable Incomes: An expanding middle class across Asia Pacific has increased purchasing power for premium home appliances.

- Growing Urbanization: Smaller living spaces in urban areas favor compact and efficient cleaning solutions like cordless and robotic models.

- Increased Health and Hygiene Awareness: Post-pandemic emphasis on a clean living environment is a significant catalyst.

Barriers & Challenges:

- High Initial Cost: Premium robotic vacuum cleaners and advanced cordless models can be prohibitively expensive for a segment of the population.

- Brand Loyalty and Trust: Established brands face the challenge of convincing consumers to switch from traditional cleaning methods or lower-priced alternatives.

- Infrastructure Limitations: In some developing regions, inconsistent power supply and lack of widespread internet connectivity can hinder the adoption of smart devices.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components, affecting production and pricing. The impact of these disruptions is estimated to be a XX% increase in production costs for certain components.

Emerging Opportunities in Asia Pacific Residential Vacuum Cleaners Market

Emerging opportunities lie in the development of more affordable yet feature-rich robotic vacuum cleaners and cordless models to cater to price-sensitive markets. The integration of enhanced AI for personalized cleaning routines and predictive maintenance presents a significant avenue. Furthermore, the growing pet ownership trend creates a niche for specialized vacuum cleaners with superior pet hair removal and allergen filtration capabilities. Untapped markets in Southeast Asia and parts of India offer substantial growth potential with tailored product offerings.

Growth Accelerators in the Asia Pacific Residential Vacuum Cleaners Market Industry

Long-term growth in the Asia Pacific Residential Vacuum Cleaners Market will be accelerated by continuous technological breakthroughs in battery efficiency, motor power, and intelligent navigation for robotic vacuum cleaners. Strategic partnerships between appliance manufacturers and smart home technology providers will foster greater ecosystem integration. Market expansion strategies focused on developing localized product versions that address specific regional cleaning needs and affordability concerns will be crucial. The increasing adoption of direct-to-consumer (DTC) models and subscription services for vacuum cleaners will also fuel sustained growth.

Key Players Shaping the Asia Pacific Residential Vacuum Cleaners Market Market

- Eureka Forbes

- Techtronic Industries Co Ltd

- Miele

- Haier Group Corporation

- Samsung Electronics Co Ltd

- Stanley Black & Decker Inc

- Bissell Inc

- Dyson Limited

- Koninklijke Philips NV

- Groupe SEB

- iRobot Corporation

- Electrolux AB

Notable Milestones in Asia Pacific Residential Vacuum Cleaners Market Sector

- September 2022: iRobot Corporation introduced an advanced 2-in-1 Robot Vacuum and Mop with thoughtful iRobot OS 5.0 updates, enhancing user experience and cleaning efficacy.

- July 2022: British tech firm Dyson Limited launched the V15 Detect, its most powerful and intelligent cord-free vacuum cleaner, in India, setting a new benchmark for premium cordless technology.

- March 2022: iRobot Corporation announced the rollout of its iRobot Genius 4.0 Home Intelligence software update to Wi-Fi-connected Roomba® robot vacuum and Braava jet robot mop customers, improving smart navigation and cleaning customization.

In-Depth Asia Pacific Residential Vacuum Cleaners Market Market Outlook

The future of the Asia Pacific Residential Vacuum Cleaners Market is exceptionally promising, driven by a synergistic blend of technological innovation and evolving consumer demands. Growth accelerators such as the continuous miniaturization and efficiency improvements in cordless vacuum cleaner technology, coupled with the increasingly sophisticated AI capabilities in robotic vacuum cleaners, will redefine home cleaning. Strategic alliances, particularly those integrating vacuum cleaners into broader smart home ecosystems, will unlock new revenue streams and enhance consumer engagement. The market is poised for substantial expansion, with a strong emphasis on sustainability and energy-efficient designs becoming a key differentiator. The increasing adoption of advanced home cleaning solutions across diverse socioeconomic segments will solidify the region's position as a global leader in the residential vacuum cleaner market.

Asia Pacific Residential Vacuum Cleaners Market Segmentation

-

1. Product

- 1.1. Upright

- 1.2. Canister

- 1.3. Central

- 1.4. Drum

- 1.5. Wet/Dry

- 1.6. Robotic

- 1.7. Other Products

-

2. Type

- 2.1. Corded

- 2.2. Cordless

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Others

Asia Pacific Residential Vacuum Cleaners Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Residential Vacuum Cleaners Market Regional Market Share

Geographic Coverage of Asia Pacific Residential Vacuum Cleaners Market

Asia Pacific Residential Vacuum Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Birth Rate Drives The Market; Rise In Disposable Income Of Parents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Lack of Security Issues; Infrastructure and Space Limitations

- 3.4. Market Trends

- 3.4.1. Growing Urbanization Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Residential Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Upright

- 5.1.2. Canister

- 5.1.3. Central

- 5.1.4. Drum

- 5.1.5. Wet/Dry

- 5.1.6. Robotic

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Corded

- 5.2.2. Cordless

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eureka Forbes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Techtronic Industries Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Miele

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stanley Black & Decker Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bissell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dyson Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Groupe SEB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 iRobot Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Electrolux AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Eureka Forbes

List of Figures

- Figure 1: Asia Pacific Residential Vacuum Cleaners Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Residential Vacuum Cleaners Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia Pacific Residential Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Residential Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Pacific Residential Vacuum Cleaners Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Pacific Residential Vacuum Cleaners Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Residential Vacuum Cleaners Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Asia Pacific Residential Vacuum Cleaners Market?

Key companies in the market include Eureka Forbes, Techtronic Industries Co Ltd, Miele, Haier Group Corporation, Samsung Electronics Co Ltd, Stanley Black & Decker Inc, Bissell Inc, Dyson Limited, Koninklijke Philips NV, Groupe SEB, iRobot Corporation, Electrolux AB.

3. What are the main segments of the Asia Pacific Residential Vacuum Cleaners Market?

The market segments include Product, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Birth Rate Drives The Market; Rise In Disposable Income Of Parents Drives The Market.

6. What are the notable trends driving market growth?

Growing Urbanization Across the Region.

7. Are there any restraints impacting market growth?

Lack of Security Issues; Infrastructure and Space Limitations.

8. Can you provide examples of recent developments in the market?

In September 2022, iRobot Corporation introduced an advanced 2-in-1 Robot Vacuum and Mop with thoughtful iRobot OS 5.0 updates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Residential Vacuum Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Residential Vacuum Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Residential Vacuum Cleaners Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Residential Vacuum Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence