Key Insights

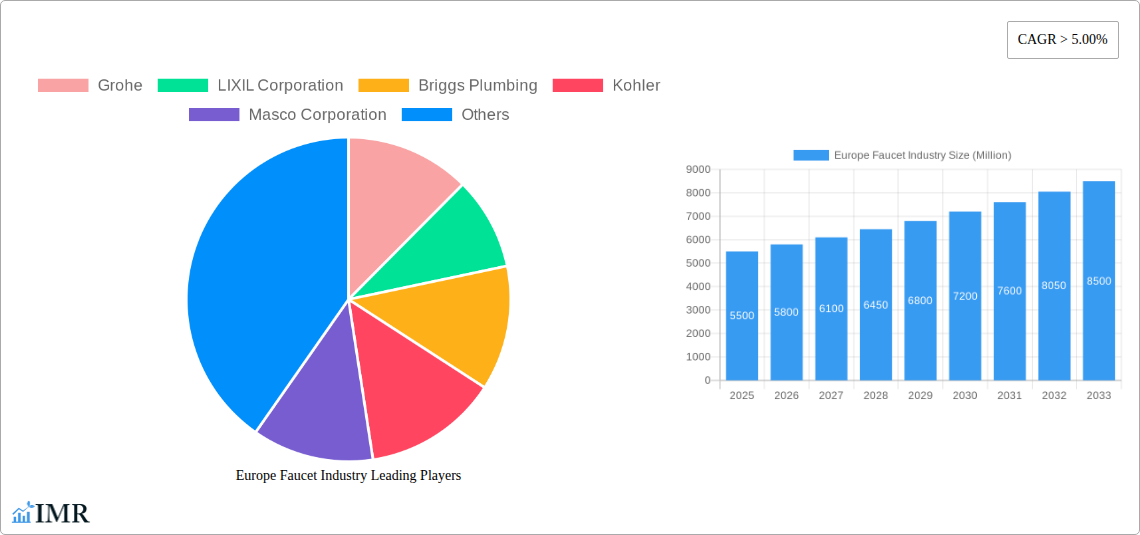

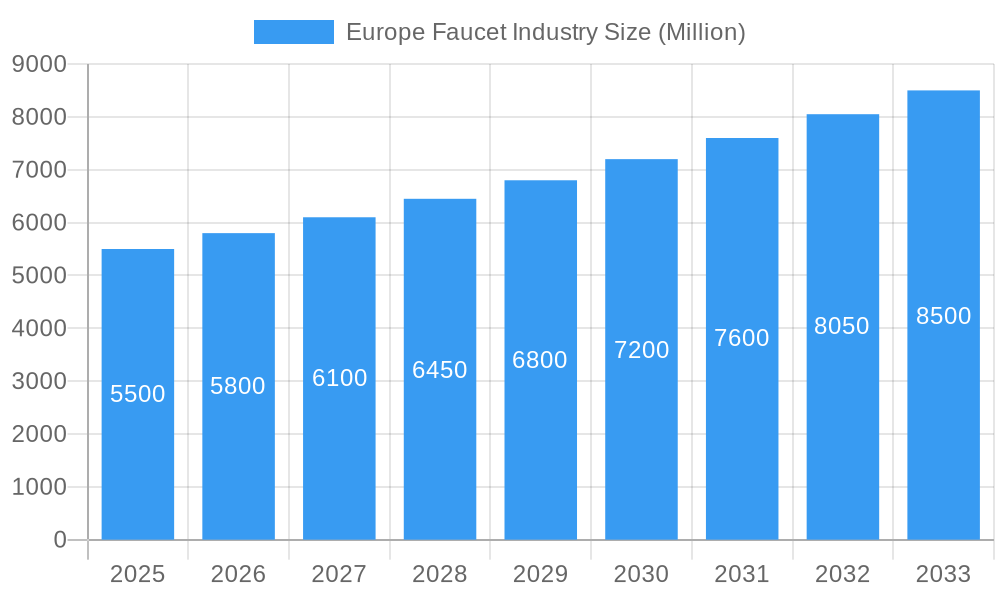

The European faucet market is projected for significant expansion, with a substantial market size and a Compound Annual Growth Rate (CAGR) of 8.3%. This growth is propelled by escalating consumer demand for aesthetically pleasing and technologically advanced plumbing fixtures in both residential and commercial applications. Key growth factors include the sustained renovation and remodeling trend across Europe, an increased emphasis on water conservation and smart home integration, and rising disposable incomes that facilitate investment in premium faucet designs. The growing adoption of automatic and touchless faucets, driven by hygiene and convenience, further accelerates market expansion. Stainless steel and chrome remain the preferred materials due to their durability and aesthetic appeal, while innovative designs cater to evolving interior design preferences. Kitchen and bathroom segments continue to be the primary application areas, exhibiting consistent demand for functional and designer faucets.

Europe Faucet Industry Market Size (In Billion)

The European faucet industry's growth is further influenced by emerging trends such as the integration of smart technology for water usage monitoring and control, and a growing preference for sustainable and eco-friendly materials. While the market presents a positive outlook, potential restraints like fluctuating raw material costs and stringent environmental regulations may pose challenges. However, continuous innovation from leading companies such as Grohe, LIXIL Corporation, Kohler, and Masco Corporation, through their investment in research and development of cutting-edge products, is expected to mitigate these challenges. The regional market is characterized by strong performance in key countries including the UK, Germany, and France, with the "Rest of Europe" also contributing significantly. The forecast period, from a base year of 2025 to 2033, anticipates sustained growth, indicating a dynamic European faucet landscape. The current market size is valued at 21.1 billion.

Europe Faucet Industry Company Market Share

Europe Faucet Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe faucet market, exploring its current dynamics, historical trends, and future trajectory. We delve into key segments, including bathroom faucets, kitchen faucets, and other applications, across residential, commercial, and industrial end-uses. The report examines critical product types such as ball faucets, disc faucets, cartridge faucets, and compression faucets, alongside technological advancements like manual faucets and automatic faucets. Material innovations, including stainless steel faucets, chrome faucets, bronze faucets, plastic faucets, and others, are meticulously analyzed. This report is your definitive guide to understanding market concentration, competitive landscapes, growth drivers, and emerging opportunities within the European faucet industry.

Europe Faucet Industry Market Dynamics & Structure

The Europe faucet market is characterized by a moderate level of concentration, with key players like Grohe, LIXIL Corporation, Kohler, and Masco Corporation holding significant market share. Technological innovation remains a primary driver, fueled by increasing demand for water efficiency, smart functionalities, and sophisticated designs. Regulatory frameworks, particularly those focusing on water conservation and sustainable materials, are shaping product development and market entry strategies. While direct product substitutes are limited, the market faces indirect competition from integrated plumbing solutions and DIY alternatives. End-user demographics, especially the growing middle class and an aging population seeking ease of use, influence product preferences. Mergers and acquisitions (M&A) activity has been steady, with companies aiming to expand their product portfolios and geographical reach. For instance, the LIXIL Corporation has actively pursued strategic acquisitions to strengthen its position in the European market.

- Market Concentration: Moderate, with leading global players dominating.

- Technological Innovation Drivers: Water saving technologies, smart faucets, antimicrobial finishes.

- Regulatory Frameworks: EU Water Efficiency Directives, REACH regulations.

- Competitive Product Substitutes: Integrated smart home systems, less sophisticated plumbing fixtures.

- End-User Demographics: Aging population, increasing demand for accessible and user-friendly designs.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

Europe Faucet Industry Growth Trends & Insights

The Europe faucet industry is poised for robust growth, driven by several key factors. The market size is projected to expand significantly, with a steady Compound Annual Growth Rate (CAGR) expected throughout the forecast period. Increasing consumer awareness regarding water conservation, coupled with rising energy costs, is accelerating the adoption of water-efficient faucets, including those with ECO CAP and SELFPOWER technologies. Technological disruptions, such as the integration of IoT in faucets for remote control and usage monitoring, are gaining traction, particularly in the commercial and residential sectors. Consumer behavior is shifting towards premiumization, with a greater demand for durable, aesthetically pleasing, and feature-rich faucets, especially in bathroom and kitchen applications. The ongoing trend of kitchen and bathroom renovations across Europe, driven by home improvement initiatives and a desire for enhanced living spaces, is a significant market penetration driver.

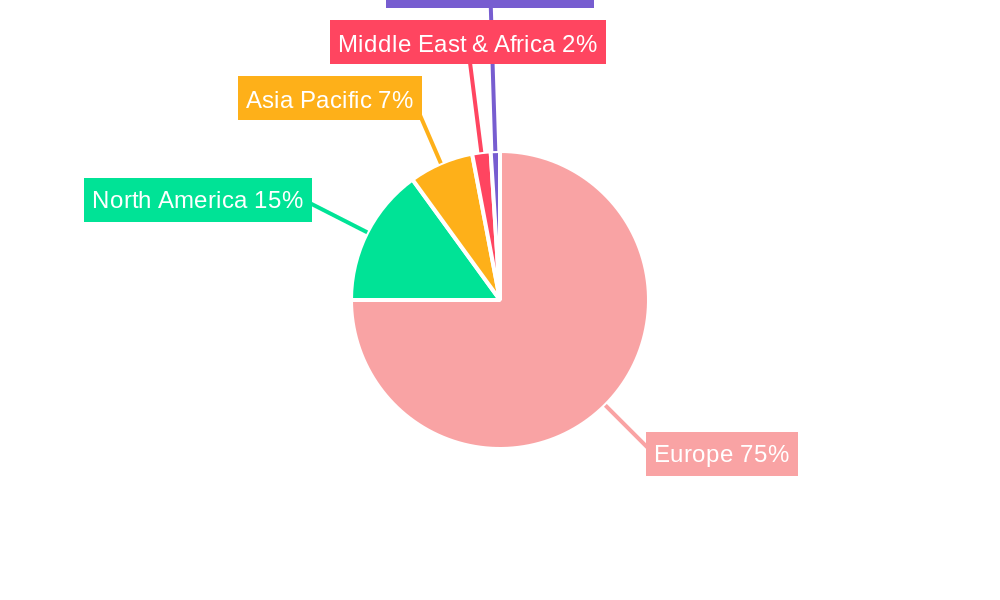

Dominant Regions, Countries, or Segments in Europe Faucet Industry

Within the Europe faucet industry, the bathroom segment, particularly for residential applications, currently demonstrates the strongest growth momentum. Germany, the United Kingdom, and France are identified as dominant countries, propelled by strong economic policies, robust construction sectors, and high disposable incomes that support premium product adoption. The cartridge faucet product type leads due to its superior durability and leak-proof performance, making it a preferred choice for homeowners and builders alike. In terms of technology, automatic faucets are experiencing accelerated growth, driven by hygiene concerns and the demand for touchless solutions in both residential and commercial settings, especially in public restrooms and hospitality. Chrome and stainless steel remain the dominant materials, prized for their aesthetic appeal, durability, and ease of maintenance. Infrastructure development and government incentives for sustainable building practices further bolster the demand for advanced and water-efficient faucet solutions.

- Dominant Product Type: Cartridge faucets, offering advanced sealing and longevity.

- Dominant Technology: Automatic faucets, driven by hygiene and convenience demands.

- Dominant Materials: Chrome and Stainless Steel, valued for durability and aesthetics.

- Dominant Application: Bathroom faucets, a core component of residential and commercial renovations.

- Dominant End-Use: Residential, fueled by home improvement trends and new constructions.

- Key Drivers in Dominant Countries: Strong economies, high consumer spending, advanced building codes.

Europe Faucet Industry Product Landscape

The Europe faucet industry is witnessing continuous product innovation, with a focus on enhanced user experience, water conservation, and hygiene. Innovations include smart faucets with integrated temperature controls and touchless operation, as well as faucets incorporating water-saving technologies like ECO CAP. Performance metrics are increasingly tied to flow rates, durability, and ease of installation. Unique selling propositions often revolve around sophisticated designs, advanced materials like antimicrobial coatings, and seamless integration with other bathroom and kitchen fixtures. The development of diverse forms to suit various washbasin types, from self-rim to vessel sinks, further enriches the product landscape.

Key Drivers, Barriers & Challenges in Europe Faucet Industry

Key Drivers:

- Growing demand for water efficiency: Driven by environmental concerns and rising utility costs.

- Rising disposable incomes and home renovation trends: Encouraging investment in higher-quality faucets.

- Technological advancements: Smart faucets, sensor-activated technologies, and antimicrobial features.

- Government regulations and sustainability initiatives: Promoting water-saving and eco-friendly products.

- Increasing urbanization and new construction projects.

Barriers & Challenges:

- Intense competition and price sensitivity: Especially in the mid-range and economy segments.

- Supply chain disruptions and fluctuating raw material costs: Impacting production and pricing.

- Stringent environmental regulations: Requiring significant R&D investment for compliance.

- Economic downturns and uncertainty: Affecting consumer spending on discretionary home improvement items.

- Counterfeit products: Damaging brand reputation and market integrity.

Emerging Opportunities in Europe Faucet Industry

Emerging opportunities in the Europe faucet industry lie in the burgeoning demand for smart home integration, where faucets become part of connected ecosystems. The increasing focus on health and wellness is driving demand for faucets with advanced hygiene features, such as self-cleaning capabilities and antimicrobial materials. Untapped markets in Eastern Europe, with their growing economies and developing infrastructure, present significant growth potential. Furthermore, the development of aesthetically unique and highly customizable faucet designs catering to niche design trends offers avenues for differentiation and premium market penetration.

Growth Accelerators in the Europe Faucet Industry Industry

Long-term growth in the Europe faucet industry will be significantly accelerated by continued technological breakthroughs, particularly in the realm of smart and connected faucets that offer enhanced convenience and data insights. Strategic partnerships between faucet manufacturers and smart home technology providers will be crucial for seamless integration. Market expansion strategies, including targeting emerging economies and developing innovative product lines for specific demographic groups, such as the elderly or individuals with disabilities, will also act as key growth accelerators.

Key Players Shaping the Europe Faucet Industry Market

- Grohe

- LIXIL Corporation

- Briggs Plumbing

- Kohler

- Masco Corporation

- Lota Corporation

- Elkay

- Roka

- Toto

- Fortune Brands

Notable Milestones in Europe Faucet Industry Sector

- March 2022: TOTO introduces two new automatic faucet sets featuring water-saving ECO CAP and SELFPOWER technologies, winning international Red Dot and Green Design Awards for their exceptional designs, suitable for hotel bathrooms and public restrooms.

- May 2020: TOTO enhances bathroom hygiene and convenience with four new WASHLET models (RW, SW, RX EWATER+, and SX EWATER+) offering advanced comfort and hygiene technologies, with an optional automated flush feature.

In-Depth Europe Faucet Industry Market Outlook

The Europe faucet industry is set for sustained growth, propelled by an increasing consumer appetite for smart, sustainable, and aesthetically superior fixtures. Future market potential will be driven by further integration of IoT capabilities, offering enhanced user control and water management solutions. Strategic opportunities lie in developing ultra-water-efficient models that meet and exceed evolving environmental regulations, and in capitalizing on the rising trend of luxury and wellness-focused bathroom and kitchen designs. The industry is expected to witness continued innovation in materials and functionalities, catering to a discerning European consumer base.

Europe Faucet Industry Segmentation

-

1. product type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. technology

- 2.1. Manual

- 2.2. Automatic

-

3. Material used

- 3.1. Stainless steel

- 3.2. Chrome

- 3.3. Bronze Plastic

- 3.4. Others

-

4. application

- 4.1. Bathroom

- 4.2. Kitchen

- 4.3. Others

-

5. end use

- 5.1. Residential

- 5.2. Commercial

- 5.3. Industrial

Europe Faucet Industry Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. Italy

- 1.3. France

- 1.4. Germany

- 1.5. Rest of Europe

Europe Faucet Industry Regional Market Share

Geographic Coverage of Europe Faucet Industry

Europe Faucet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising New Construction of Residential Apartment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Faucet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Material used

- 5.3.1. Stainless steel

- 5.3.2. Chrome

- 5.3.3. Bronze Plastic

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by application

- 5.4.1. Bathroom

- 5.4.2. Kitchen

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by end use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.5.3. Industrial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LIXIL Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Briggs Plumbing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masco Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lota Corporation**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elkay

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roka

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Europe Faucet Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Faucet Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 2: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 3: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 4: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 5: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 6: Europe Faucet Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 8: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 9: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 10: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 11: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 12: Europe Faucet Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: UK Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Faucet Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Faucet Industry?

Key companies in the market include Grohe, LIXIL Corporation, Briggs Plumbing, Kohler, Masco Corporation, Lota Corporation**List Not Exhaustive, Elkay, Roka, Toto, Fortune Brands.

3. What are the main segments of the Europe Faucet Industry?

The market segments include product type, technology, Material used, application, end use.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising New Construction of Residential Apartment.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

In March 2022, TOTO introduces two new automatic faucet sets that include the water-saving ECO CAP and SELFPOWER technologies. These series, which are ideal for hotel bathrooms and public restrooms, have each won the international Red Dot Award and Green Design Award for their exceptional designs. There is a great faucet for every washbasin, from self-rim and undercounter washbasins to furniture washbasins and vessels, and they are all available in a variety of various forms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Faucet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Faucet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Faucet Industry?

To stay informed about further developments, trends, and reports in the Europe Faucet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence