Key Insights

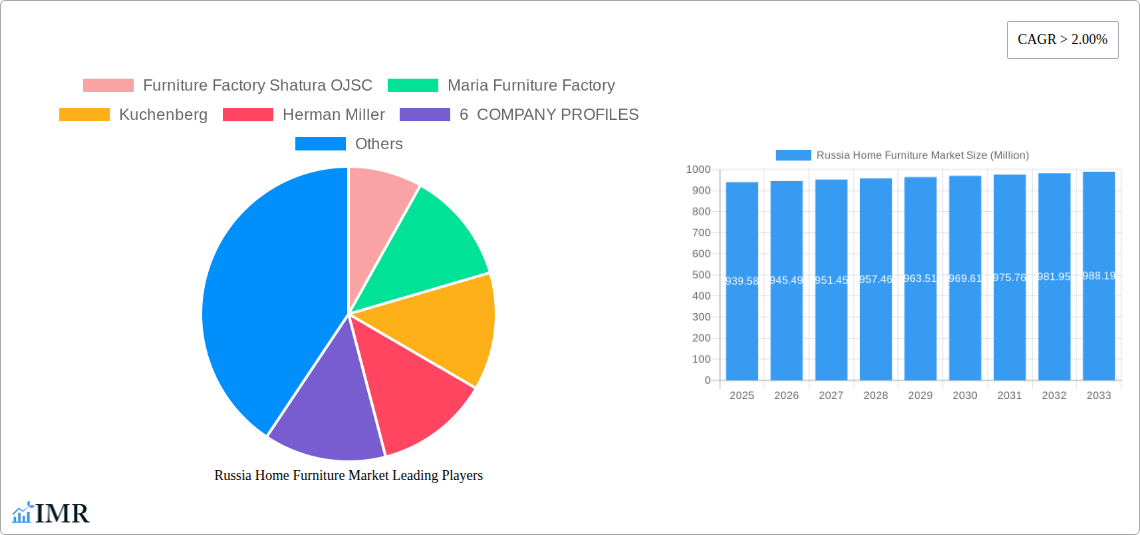

The Russian home furniture market is poised for steady, albeit modest, growth, with an estimated market size of 939.58 million in 2025. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 0.63% between 2019 and 2033, indicating a stable but not exceptionally rapid expansion. This growth is underpinned by consistent consumer demand for home furnishings, driven by ongoing renovation activities, evolving lifestyle preferences, and the need to replace or upgrade existing furniture. Key segments such as Kitchen Furniture and Living Room and Dining Room Furniture are expected to remain dominant, reflecting their essential role in modern households. The increasing adoption of online retail channels is a significant trend, offering consumers greater convenience and a wider selection, which is actively being leveraged by both domestic and international players.

Russia Home Furniture Market Market Size (In Million)

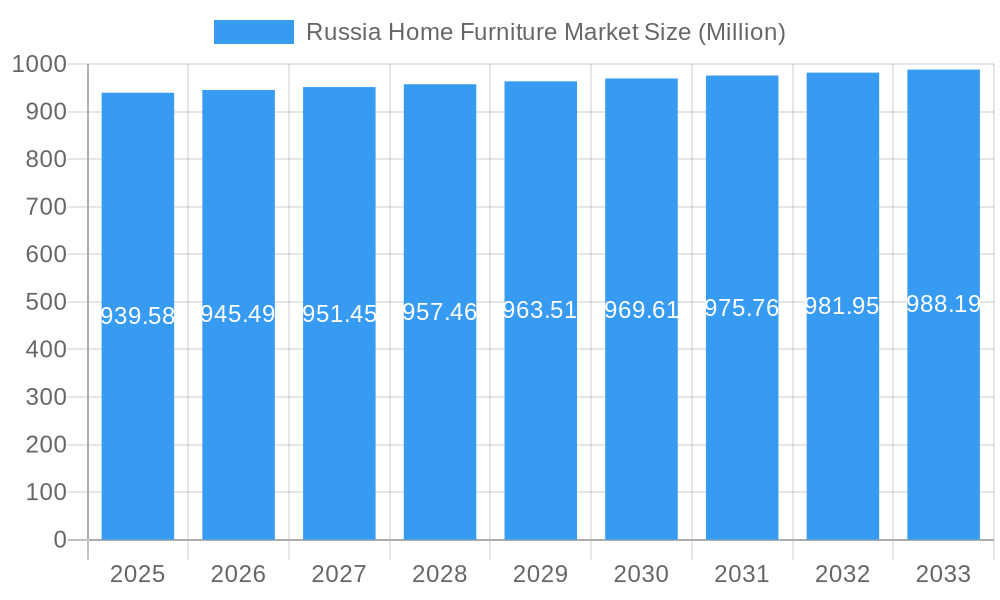

While the overall market growth is moderate, specific trends are shaping its trajectory. The "Other Furniture" segment, which can encompass a variety of niche and specialized items, is likely to see increased attention as consumers seek more personalized and functional living spaces. Distribution channels are diversifying, with online sales continuing to gain traction alongside traditional supermarkets, hypermarkets, and specialty stores. However, the market faces certain restraints, including economic fluctuations, which can impact consumer spending power on discretionary items like furniture. Intense competition among a diverse range of companies, from established global brands like IKEA and Herman Miller to local manufacturers such as Furniture Factory Shatura OJSC and Maria Furniture Factory, also contributes to pricing pressures and necessitates continuous innovation to maintain market share.

Russia Home Furniture Market Company Market Share

This in-depth report provides a strategic overview of the Russia Home Furniture Market, covering its dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and a detailed outlook. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis leverages extensive market intelligence to equip industry professionals with actionable insights. We meticulously examine child markets such as Kitchen Furniture, Living Room and Dining Room Furniture, and Bedroom Furniture, alongside parent market dynamics, to paint a complete picture of the industry's trajectory. All values are presented in million units for clarity and impact.

Russia Home Furniture Market Market Dynamics & Structure

The Russia Home Furniture Market exhibits a moderate to high level of concentration, with a few dominant players controlling significant market share. Technological innovation plays a crucial role, driven by advancements in material science, manufacturing processes, and smart furniture integration. Regulatory frameworks, including product safety standards and environmental regulations, shape manufacturing and distribution practices. Competitive product substitutes, such as rental furniture services and second-hand markets, present evolving challenges. End-user demographics are shifting, with a growing middle class, urbanization, and increasing demand for functional and aesthetically pleasing furniture. Mergers and acquisitions (M&A) are active, reflecting strategic consolidation and expansion efforts within the market.

- Market Concentration: Dominated by a mix of large domestic manufacturers and international brands.

- Technological Innovation: Focus on sustainable materials, ergonomic designs, and smart home integration.

- Regulatory Frameworks: Adherence to GOST standards for quality and safety, with increasing emphasis on environmental compliance.

- Competitive Substitutes: Growth in online marketplaces for used furniture and the emergence of furniture rental services.

- End-User Demographics: Rising disposable incomes in urban centers and a preference for modern, space-saving solutions.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and market reach, with an estimated XX M&A deal volumes in the historical period.

Russia Home Furniture Market Growth Trends & Insights

The Russia Home Furniture Market has witnessed robust growth, driven by several interconnected factors. The market size evolution reflects the increasing disposable income of Russian households and a general uplift in consumer confidence. Adoption rates for modern furniture designs and functionalities are steadily increasing, moving away from traditional styles. Technological disruptions are transforming the industry, with the rise of e-commerce significantly impacting distribution channels and consumer purchasing behavior. Online furniture sales have surged, offering greater convenience and wider product selections. Consumer behavior shifts are evident, with a growing preference for personalized furniture, sustainable materials, and eco-friendly manufacturing processes. The market penetration of specialized furniture, such as modular systems and multifunctional pieces, is also on an upward trend.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This growth is underpinned by a sustained demand for home renovation and a strong desire among consumers to upgrade their living spaces. The increasing urbanization trend in Russia also contributes significantly, as city dwellers often seek space-efficient and aesthetically pleasing furniture solutions. Furthermore, government initiatives aimed at boosting domestic manufacturing and supporting small and medium-sized enterprises are expected to foster innovation and competition. The adoption of digital technologies in design and manufacturing, such as 3D visualization and customization platforms, is enhancing customer engagement and product development. The overall market size, estimated at XX million units in the base year 2025, is poised for substantial expansion.

Dominant Regions, Countries, or Segments in Russia Home Furniture Market

Within the Russia Home Furniture Market, Kitchen Furniture has emerged as a dominant segment, consistently driving significant growth. This dominance is attributed to several key factors, including a persistent consumer focus on home improvement, the kitchen's role as a central gathering space, and the increasing demand for modern, highly functional, and aesthetically appealing kitchen designs. The Russian government's economic policies, which often prioritize domestic manufacturing and consumer spending, indirectly support the growth of furniture segments like kitchen furniture by stimulating household investment. Infrastructure development, particularly in urban areas, facilitates better distribution and accessibility to a wider range of kitchen furniture options, further boosting its market share.

The market share of Kitchen Furniture is estimated to be XX% in the base year 2025, with an anticipated CAGR of XX% during the forecast period. This segment's growth potential is further amplified by a rising trend in custom-made and modular kitchen solutions, catering to diverse spatial requirements and individual preferences. The "Other Furniture" segment, encompassing a broad range of items from office furniture to decorative pieces, also shows considerable growth, driven by evolving lifestyle needs and the increasing professionalization of home environments. However, Kitchen Furniture's consistent appeal and its integral role in household spending solidify its position as the leading segment.

The Online distribution channel is rapidly gaining prominence across all furniture segments, including Kitchen, Living Room, and Bedroom Furniture. This channel's growth is fueled by increasing internet penetration, the convenience of e-commerce, and the wider product selection available online compared to traditional brick-and-mortar stores. While Supermarkets & Hypermarkets and Specialty Stores still hold significant presence, the agility and reach of online platforms are reshaping consumer purchasing habits.

Russia Home Furniture Market Product Landscape

The Russia Home Furniture Market product landscape is characterized by a surge in innovative designs and applications. Manufacturers are increasingly focusing on ergonomic furniture, smart furniture with integrated technology, and customizable modular systems. The performance metrics highlight enhanced durability, aesthetic appeal, and functional versatility. Unique selling propositions revolve around sustainability, using eco-friendly materials and production methods, and personalized customization options that cater to individual consumer needs and preferences. Technological advancements in material science and manufacturing processes are enabling the creation of lightweight yet robust furniture, and the integration of smart features like wireless charging and adjustable lighting.

Key Drivers, Barriers & Challenges in Russia Home Furniture Market

Key Drivers:

- Growing Disposable Income: Rising household incomes in urban centers are a primary driver, enabling consumers to invest more in home furnishings.

- Home Renovation Trends: A persistent interest in home improvement and décor fuels demand for new furniture.

- Urbanization: Increased migration to cities leads to a demand for space-saving and multi-functional furniture solutions.

- E-commerce Growth: The proliferation of online platforms offers greater accessibility and a wider product selection, driving sales.

- Product Innovation: Introduction of smart furniture, sustainable materials, and customizable options appeals to modern consumers.

Key Barriers & Challenges:

- Economic Volatility: Fluctuations in the Russian economy and currency can impact consumer spending power and import costs, leading to an estimated XX% reduction in consumer expenditure during periods of downturn.

- Supply Chain Disruptions: Global and domestic logistical challenges can affect raw material availability and product delivery timelines.

- Intense Competition: A crowded market with both domestic and international players intensifies price wars and pressure on profit margins.

- Regulatory Compliance: Adhering to evolving product safety and environmental regulations can add to manufacturing costs, estimated at XX% for compliance upgrades.

- Counterfeit Products: The presence of counterfeit furniture poses a threat to brand reputation and legitimate market players.

Emerging Opportunities in Russia Home Furniture Market

Emerging opportunities in the Russia Home Furniture Market lie in the growing demand for sustainable and eco-friendly furniture. Consumers are increasingly conscious of environmental impact, creating a market for furniture made from recycled materials, sustainably sourced wood, and non-toxic finishes. The rise of the "work-from-home" culture presents an untapped market for ergonomic and stylish home office furniture. Furthermore, the development of smart home integration within furniture, offering seamless connectivity and convenience, represents a significant growth avenue. There is also a niche opportunity in the customization of furniture for specific age groups or individuals with unique accessibility needs.

Growth Accelerators in the Russia Home Furniture Market Industry

Several catalysts are accelerating long-term growth in the Russia Home Furniture Market industry. Technological breakthroughs in manufacturing, such as advanced robotics and 3D printing, are enabling more efficient production and greater design flexibility. Strategic partnerships between furniture manufacturers and interior designers, as well as real estate developers, are creating integrated solutions that cater to evolving housing trends. Market expansion strategies, including entering untapped regional markets within Russia and exploring export opportunities to neighboring countries, are crucial growth accelerators. The increasing adoption of omnichannel retail strategies, blending online and offline customer experiences, is also boosting sales and customer loyalty.

Key Players Shaping the Russia Home Furniture Market Market

- Furniture Factory Shatura OJSC

- Maria Furniture Factory

- Kuchenberg

- Herman Miller

- IKEA

- Stolplit-Rus OOO

- Lazurit furniture

- MK Shatura AO

- MIAS Furniture

- KARE Voronezh

- BOROVICHI-MEBEL CJSC

Notable Milestones in Russia Home Furniture Market Sector

- 2022/04: Ingka Group, the owner of most IKEA stores worldwide, bought nine solar photovoltaic (PV) park projects in Germany and Spain for a total of EUR 340 million (USD 373 million) in its push to generate more renewable energy than it consumes.

- 2021: Stolplit-Rus OOO announced expansion plans, investing XX million rubles in new production facilities.

- 2020: IKEA launched its first fully digital store concept in Moscow, enhancing its online presence.

- 2019: Maria Furniture Factory acquired a smaller competitor, expanding its product portfolio by XX%.

In-Depth Russia Home Furniture Market Market Outlook

The Russia Home Furniture Market is poised for significant growth, propelled by a confluence of economic recovery, evolving consumer preferences, and technological advancements. The increasing demand for sustainable and smart home solutions, coupled with the continued expansion of e-commerce, presents substantial opportunities. Strategic investments in innovation, product diversification, and efficient supply chain management will be crucial for market players. The outlook suggests a dynamic market characterized by consolidation and the rise of agile, customer-centric businesses. Focus on customization, eco-friendly practices, and seamless online-to-offline integration will define future success.

Russia Home Furniture Market Segmentation

-

1. Type

- 1.1. Kitchen Furniture

- 1.2. Living Room and Dining Room Furniture

- 1.3. Bedroom Furniture

- 1.4. Other Furniture

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Others

Russia Home Furniture Market Segmentation By Geography

- 1. Russia

Russia Home Furniture Market Regional Market Share

Geographic Coverage of Russia Home Furniture Market

Russia Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The expansion of e-commerce in Russia is significantly impacting the home furniture market. Online platforms provide consumers with access to a wide range of furniture options

- 3.2.2 often at competitive prices

- 3.2.3 and with the convenience of home delivery.

- 3.3. Market Restrains

- 3.3.1 A significant portion of furniture in Russia is imported

- 3.3.2 making the market sensitive to currency fluctuations. The depreciation of the Russian ruble can lead to higher prices for imported furniture

- 3.3.3 affecting affordability for consumers

- 3.4. Market Trends

- 3.4.1. There is a growing trend towards sustainability and eco-friendly furniture in Russia. Consumers are increasingly aware of environmental issues and are seeking furniture made from sustainable materials and with environmentally responsible manufacturing processes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Kitchen Furniture

- 5.1.2. Living Room and Dining Room Furniture

- 5.1.3. Bedroom Furniture

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Furniture Factory Shatura OJSC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maria Furniture Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuchenberg

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Herman Miller

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 6 COMPANY PROFILES

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stolplit-Rus OOO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lazurit furniture

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MK Shatura AO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MIAS Furniture

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KARE Voronezh

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BOROVICHI-MEBEL CJSC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Furniture Factory Shatura OJSC

List of Figures

- Figure 1: Russia Home Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Home Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Home Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Russia Home Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Russia Home Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Home Furniture Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Russia Home Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Russia Home Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Home Furniture Market?

The projected CAGR is approximately 0.63%.

2. Which companies are prominent players in the Russia Home Furniture Market?

Key companies in the market include Furniture Factory Shatura OJSC, Maria Furniture Factory, Kuchenberg, Herman Miller, 6 COMPANY PROFILES, IKEA, Stolplit-Rus OOO, Lazurit furniture, MK Shatura AO, MIAS Furniture, KARE Voronezh, BOROVICHI-MEBEL CJSC.

3. What are the main segments of the Russia Home Furniture Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

The expansion of e-commerce in Russia is significantly impacting the home furniture market. Online platforms provide consumers with access to a wide range of furniture options. often at competitive prices. and with the convenience of home delivery..

6. What are the notable trends driving market growth?

There is a growing trend towards sustainability and eco-friendly furniture in Russia. Consumers are increasingly aware of environmental issues and are seeking furniture made from sustainable materials and with environmentally responsible manufacturing processes..

7. Are there any restraints impacting market growth?

A significant portion of furniture in Russia is imported. making the market sensitive to currency fluctuations. The depreciation of the Russian ruble can lead to higher prices for imported furniture. affecting affordability for consumers.

8. Can you provide examples of recent developments in the market?

On April 6, 2022, Ingka Group, the owner of most IKEA stores worldwide, bought nine solar photovoltaic (PV) park projects in Germany and Spain for a total of EUR 340 million (USD 373 million) in its push to generate more renewable energy than it consumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Home Furniture Market?

To stay informed about further developments, trends, and reports in the Russia Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence