Key Insights

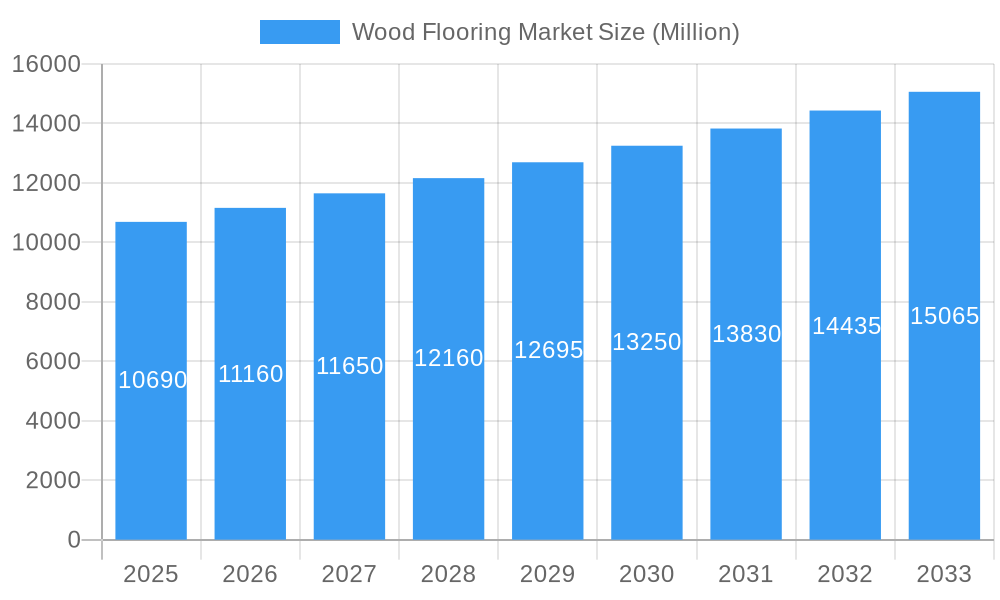

The global wood flooring market is poised for steady growth, projected to reach an estimated USD 10.69 billion in 2025. Driven by a Compound Annual Growth Rate (CAGR) of 4.45% over the study period extending to 2033, this expansion signifies sustained demand for wood as a premium and aesthetically pleasing flooring material. The market's buoyancy is fueled by several key drivers. A growing trend towards home renovation and remodeling, particularly in developed economies, is a significant contributor, as homeowners seek to enhance the value and appeal of their properties. Furthermore, the increasing adoption of sustainable building practices and the rising popularity of eco-friendly materials are propelling the demand for responsibly sourced wood flooring. The commercial sector also plays a crucial role, with hospitality, retail, and office spaces increasingly opting for wood flooring to create sophisticated and inviting environments. The preference for natural materials and the aesthetic versatility of wood, capable of complementing various interior design styles, further bolster its market position.

Wood Flooring Market Market Size (In Billion)

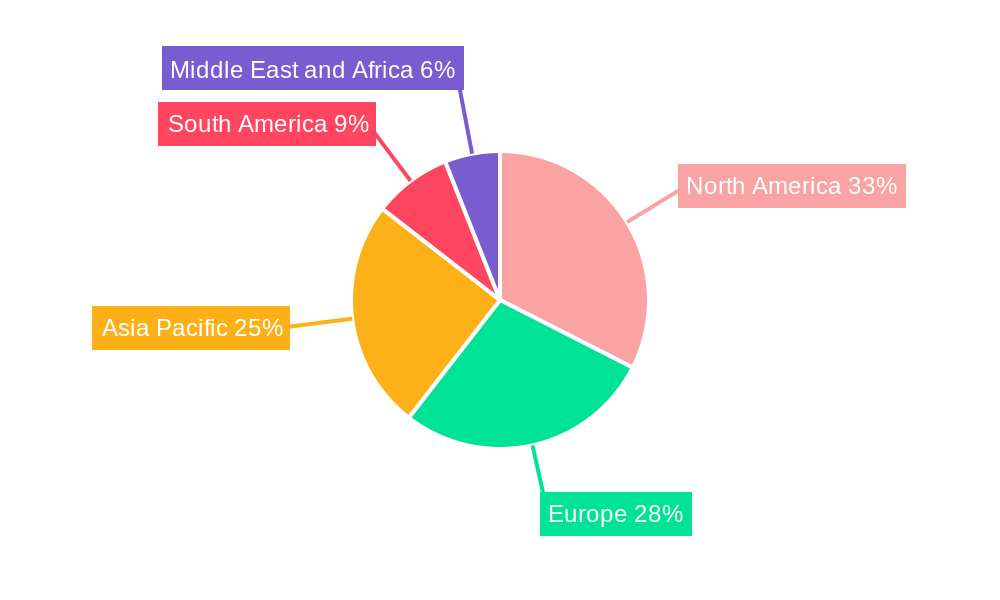

The market segmentation reveals a diverse landscape, with solid wood and engineered wood products catering to different consumer needs and price points. Engineered wood, with its enhanced stability and durability, is gaining traction, especially in regions with fluctuating humidity levels. The distribution channels are evolving, with a notable shift towards online stores alongside traditional channels like home centers and flagship stores, reflecting changing consumer purchasing habits. Geographically, North America and Europe are established markets, but the Asia Pacific region, particularly China and India, is emerging as a significant growth engine due to rapid urbanization and a burgeoning middle class with rising disposable incomes. While the market benefits from these strong drivers, potential restraints such as fluctuating raw material prices, supply chain disruptions, and the increasing competition from alternative flooring materials like luxury vinyl tile (LVT) and laminate need to be carefully managed by market participants.

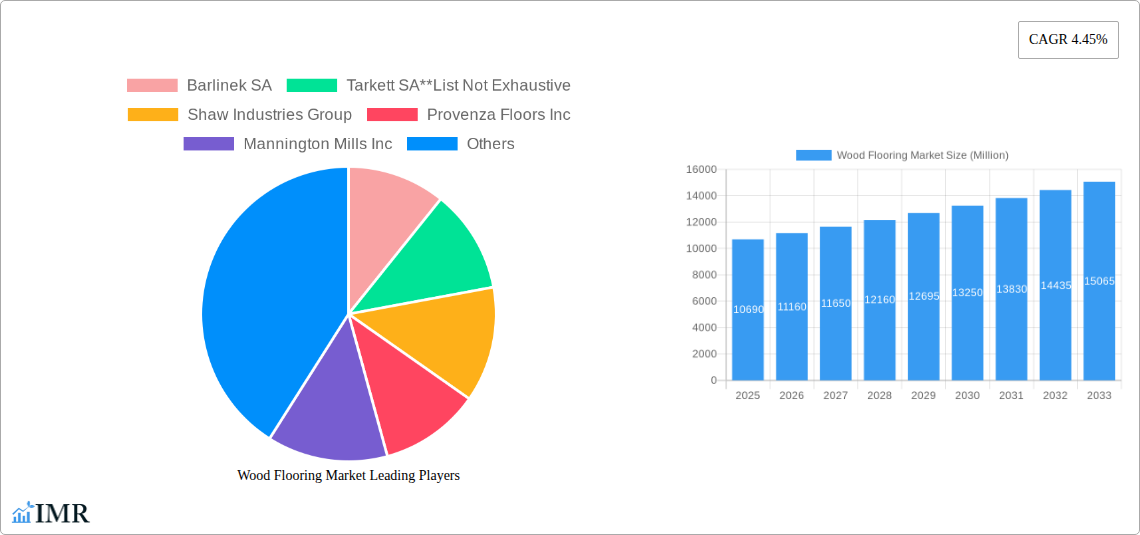

Wood Flooring Market Company Market Share

Wood Flooring Market Analysis Report: Solid Wood, Engineered Wood, Residential, Commercial Growth & Forecast 2019-2033

This comprehensive report offers an in-depth analysis of the global wood flooring market, providing critical insights for stakeholders across the industry. Covering the study period of 2019–2033, with a base year of 2025 and a detailed forecast period from 2025–2033, this report examines market dynamics, growth trends, dominant regions, product landscapes, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the key players shaping the future. Our analysis delves into both solid wood flooring and engineered wood flooring segments, exploring distribution channels like home centers, flagship stores, specialty stores, and online stores, and their impact on residential and commercial end-users. Quantitative data is presented in Million units for clarity and actionable insights.

Wood Flooring Market Market Dynamics & Structure

The wood flooring market exhibits a moderately concentrated structure, with a few dominant players like Mohawk Industries, Shaw Industries Group, and Tarkett SA holding significant market share. However, a growing number of regional and specialized manufacturers contribute to a competitive landscape, especially in niche segments like premium engineered wood flooring. Technological innovation is a primary driver, with advancements in manufacturing processes, material science, and surface treatments enhancing durability, sustainability, and aesthetic appeal. Regulatory frameworks, particularly concerning environmental sustainability and VOC emissions, are increasingly influencing product development and market access, favoring manufacturers with eco-friendly offerings. Competitive product substitutes, such as luxury vinyl tile (LVT) and laminate flooring, present a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics, characterized by a growing demand for natural and sustainable materials in both residential and commercial spaces, are shaping product preferences. Mergers and acquisitions (M&A) trends are notable, with larger companies acquiring smaller innovators to expand their product portfolios and market reach. For instance, the acquisition of specialized engineered wood manufacturers by larger conglomerates reflects this consolidation. The market share of the top five players is estimated to be around 65% in 2025, with significant M&A deal volumes expected to increase in the coming years as companies seek to gain economies of scale and diversify their offerings.

- Market Concentration: Moderately concentrated with dominant players and a growing number of specialized manufacturers.

- Technological Innovation: Focus on durability, sustainability, enhanced surface treatments, and eco-friendly manufacturing.

- Regulatory Frameworks: Increasing emphasis on VOC emission standards and sustainable sourcing.

- Competitive Substitutes: LVT, laminate, and other resilient flooring options pose ongoing competition.

- End-User Demographics: Rising demand for natural, sustainable, and aesthetically pleasing flooring solutions.

- M&A Trends: Consolidation and strategic acquisitions to expand market share and product portfolios.

Wood Flooring Market Growth Trends & Insights

The global wood flooring market is poised for robust growth driven by a confluence of economic, demographic, and lifestyle factors. Over the study period of 2019–2033, the market size is projected to witness a steady expansion, fueled by increasing disposable incomes, a burgeoning construction industry, and a persistent consumer preference for the aesthetic and tactile qualities of natural wood. The base year of 2025 marks a pivotal point, from which the forecast period of 2025–2033 is expected to see a Compound Annual Growth Rate (CAGR) of approximately 4.5%. This growth is underpinned by evolving consumer behavior, with a heightened emphasis on home improvement and renovation projects, particularly in developed economies. The residential segment continues to be the primary demand driver, as homeowners invest in upgrading their living spaces with premium solid wood flooring and versatile engineered wood flooring. Simultaneously, the commercial segment, encompassing offices, retail spaces, hotels, and restaurants, is also contributing significantly, with businesses increasingly opting for wood flooring to enhance their brand image and create inviting environments.

Technological disruptions are playing a crucial role, with advancements in manufacturing techniques for engineered wood flooring offering enhanced stability, moisture resistance, and wider plank formats, making it a more accessible and practical alternative to traditional solid wood flooring. This innovation is expanding the market's reach into areas where solid wood was previously less viable. Furthermore, the growing awareness and demand for sustainable and eco-friendly products are accelerating the adoption of wood flooring sourced from responsibly managed forests, often certified by organizations like the Forest Stewardship Council (FSC). Online retail channels have also emerged as significant growth accelerators, providing consumers with greater access to a wider variety of products and competitive pricing, thereby increasing market penetration. The historical period of 2019–2024 laid the groundwork for this expansion, demonstrating consistent demand and early adoption of new technologies. The market penetration for wood flooring in developed nations is already substantial, but there remains significant untapped potential in emerging economies undergoing rapid urbanization and infrastructure development. Shifts in consumer preferences towards natural materials, coupled with an increasing focus on indoor air quality and non-toxic building materials, further bolster the market's positive trajectory. The overall market size for wood flooring is projected to reach approximately $150,000 Million units by 2033, an increase from an estimated $110,000 Million units in 2025.

Dominant Regions, Countries, or Segments in Wood Flooring Market

The wood flooring market is characterized by distinct regional dominance, with North America and Europe leading in terms of market size and consumption. Within North America, the United States stands out as the most significant market, driven by strong consumer demand for residential and commercial applications, a well-established renovation and remodeling culture, and a thriving construction industry. Factors such as economic stability, high disposable incomes, and a cultural preference for natural materials contribute to the robust sales of both solid wood flooring and engineered wood flooring. Canada also represents a substantial market, exhibiting similar trends in consumer preferences and construction activities.

In Europe, Germany, the United Kingdom, and France are key contributors to market growth. High standards of living, a strong emphasis on interior design and aesthetics, and stringent regulations promoting sustainable building materials favor the adoption of premium wood flooring. The increasing popularity of engineered wood flooring due to its versatility and stability in various climatic conditions is a significant growth driver across these regions.

Segment-wise, engineered wood flooring is increasingly outpacing solid wood flooring in terms of growth rate, particularly in the residential segment. Its adaptability to different subfloors, resistance to moisture fluctuations, and suitability for underfloor heating systems make it a preferred choice for modern construction and renovation projects. While solid wood flooring retains its appeal for its timeless elegance and classic charm, the practical advantages of engineered wood are widening its market penetration.

Distribution channels also play a crucial role in market dominance. Home Centers continue to be a primary channel for residential consumers due to their accessibility and wide product selection. However, the growth of online stores is accelerating, offering consumers convenience and a broader range of choices, impacting the market share of traditional retail formats. Specialty Stores cater to a niche market seeking premium and custom wood flooring solutions, while Flagship Stores of major manufacturers often serve as brand showcases and attract discerning customers. The commercial segment relies more heavily on specialty dealers and direct sales channels, where project-specific requirements and technical expertise are paramount. The market share for engineered wood flooring in 2025 is estimated at 60% of the total wood flooring market, with residential applications accounting for approximately 70% of overall demand.

Wood Flooring Market Product Landscape

The wood flooring market showcases a dynamic product landscape driven by continuous innovation in materials, manufacturing, and finishes. Engineered wood flooring leads product development, offering enhanced stability through its multi-layered construction, making it suitable for a wider range of environmental conditions and installation methods, including over concrete. Advances in veneer technology allow for a variety of premium wood species to be presented in thinner, more resource-efficient formats. Solid wood flooring continues to be favored for its authenticity and potential for refinishing, with manufacturers focusing on sustainable sourcing and traditional craftsmanship. Surface treatments, including advanced UV-cured finishes and matte lacquers, are providing improved scratch resistance, UV protection, and natural aesthetics. The application spectrum spans from elegant residential interiors to high-traffic commercial spaces like boutique hotels and modern offices, where durability and aesthetic appeal are paramount. Unique selling propositions increasingly revolve around sustainability certifications, traceable sourcing, and bespoke design options, catering to a discerning clientele seeking both beauty and environmental responsibility.

Key Drivers, Barriers & Challenges in Wood Flooring Market

Key Drivers:

- Rising Disposable Incomes and Home Improvement Trends: Increased consumer spending power fuels demand for premium home décor, with wood flooring being a prime choice for renovations and new constructions. The global average disposable income is projected to grow by 3% annually between 2025 and 2033, directly impacting home spending.

- Growing Preference for Natural and Sustainable Materials: Consumers are increasingly prioritizing eco-friendly and aesthetically pleasing materials for their living and working spaces, driving the demand for responsibly sourced wood flooring.

- Urbanization and Infrastructure Development: Rapid urbanization in emerging economies leads to increased construction of residential and commercial properties, creating a substantial market for flooring solutions.

- Technological Advancements in Engineered Wood: Innovations in manufacturing techniques enhance the stability, durability, and versatility of engineered wood, making it a more competitive and accessible option.

Barriers & Challenges:

- Competition from Substitute Flooring Materials: Luxury vinyl tile (LVT), laminate, and other resilient flooring options offer competitive price points and performance characteristics, posing a significant challenge to market share. The global LVT market is projected to reach $30,000 Million units by 2028.

- Price Volatility of Raw Materials: Fluctuations in the cost and availability of lumber can impact manufacturing costs and final product prices, affecting consumer purchasing decisions.

- Environmental Regulations and Sustainability Concerns: Stringent regulations regarding sustainable forestry practices and VOC emissions can increase compliance costs for manufacturers.

- Skilled Labor Shortage for Installation: The availability of experienced and skilled installers can be a bottleneck in certain regions, potentially delaying projects and increasing labor costs.

Emerging Opportunities in Wood Flooring Market

Emerging opportunities in the wood flooring market lie in the growing demand for sustainable and smart flooring solutions. The increasing consumer awareness and preference for eco-friendly products are driving innovation in the use of reclaimed wood, bamboo, and cork as viable alternatives to traditional hardwoods. Furthermore, the integration of smart technology within flooring, such as embedded sensors for environmental monitoring or energy efficiency, presents an untapped market segment. The expansion into emerging economies with rapidly growing middle classes and increasing urbanization also offers significant growth potential. Customization and personalization are also key trends, with manufacturers exploring options for bespoke designs, finishes, and plank sizes to cater to individual consumer preferences and unique architectural projects. The increasing trend of hybrid work models is also creating opportunities for home office renovations, where consumers are investing in durable and aesthetically pleasing flooring options.

Growth Accelerators in the Wood Flooring Market Industry

Several key catalysts are propelling long-term growth in the wood flooring market industry. Technological breakthroughs in manufacturing, particularly in the production of highly stable and moisture-resistant engineered wood flooring, are expanding its applicability into diverse environments. Strategic partnerships between flooring manufacturers and smart home technology firms, such as the collaboration between Mohawk Group and Scanalytics, are creating new product avenues and enhancing the functionality of flooring. Market expansion strategies, including increased penetration into developing economies and the development of online sales channels, are broadening the customer base. The growing emphasis on healthy living and indoor air quality also favors wood flooring, which is generally considered a healthier alternative to some synthetic materials. The continuous development of innovative finishes and surface treatments that enhance durability and aesthetics also contributes to sustained demand.

Key Players Shaping the Wood Flooring Market Market

- Barlinek SA

- Tarkett SA

- Shaw Industries Group

- Provenza Floors Inc

- Mannington Mills Inc

- Home Legend LLC

- Armstrong World Industries

- Beaulieu International Group

- Boral Limited

- Mohawk Industries

Notable Milestones in Wood Flooring Market Sector

- December 2023: Mohawk Group and Scanalytics, a smart flooring firm with its headquarters in Milwaukee, Wisconsin, entered a partnership to lower emissions from the built environment.

- August 2023: Johnson Hardwood announced that The R.A. Siegel Company would represent it in the Southeast territories, including Florida, Georgia, Alabama, South Carolina, North Carolina, and the eastern portions of Tennessee. The R.A. Siegel Company offers Johnson’s complete floor coverings, including SPC/rigid core, high-performance laminate, and premium hardwood flooring.

In-Depth Wood Flooring Market Market Outlook

The wood flooring market is set for continued expansion, driven by a strong interplay of evolving consumer preferences, technological advancements, and global economic trends. The increasing demand for sustainable and natural materials in both residential and commercial settings will remain a cornerstone of growth. Innovations in engineered wood flooring, offering enhanced performance and aesthetic versatility, are expected to capture a larger market share. Furthermore, the growing influence of online retail channels will democratize access to a wider array of wood flooring products. Strategic collaborations and the focus on eco-friendly manufacturing practices will shape the competitive landscape, with companies prioritizing sustainability and product innovation poised for significant success. The market's trajectory indicates a positive outlook, with substantial opportunities for stakeholders who can adapt to shifting consumer demands and leverage emerging technologies.

Wood Flooring Market Segmentation

-

1. Product

- 1.1. Solid Wood

- 1.2. Engineered Wood

-

2. Distribution Channel

- 2.1. Home Centers

- 2.2. Flagship Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Wood Flooring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Wood Flooring Market Regional Market Share

Geographic Coverage of Wood Flooring Market

Wood Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Increasing Focus on Sustainable and Eco-friendly Products

- 3.3. Market Restrains

- 3.3.1. Competition from Alternative Flooring Market; High Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Engineered Wood Flooring is Boosting the Market’s Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Solid Wood

- 5.1.2. Engineered Wood

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Home Centers

- 5.2.2. Flagship Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Solid Wood

- 6.1.2. Engineered Wood

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Home Centers

- 6.2.2. Flagship Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Solid Wood

- 7.1.2. Engineered Wood

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Home Centers

- 7.2.2. Flagship Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Solid Wood

- 8.1.2. Engineered Wood

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Home Centers

- 8.2.2. Flagship Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Solid Wood

- 9.1.2. Engineered Wood

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Home Centers

- 9.2.2. Flagship Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Wood Flooring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Solid Wood

- 10.1.2. Engineered Wood

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Home Centers

- 10.2.2. Flagship Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Barlinek SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tarkett SA**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shaw Industries Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Provenza Floors Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mannington Mills Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Home Legend LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Armstrong World Industries

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beaulieu International Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boral Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mohawk Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Barlinek SA

List of Figures

- Figure 1: Global Wood Flooring Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wood Flooring Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Wood Flooring Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Wood Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Wood Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Wood Flooring Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Wood Flooring Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Wood Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Wood Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wood Flooring Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Wood Flooring Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Wood Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: Europe Wood Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Wood Flooring Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Wood Flooring Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Wood Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Wood Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wood Flooring Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Wood Flooring Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Wood Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Wood Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Wood Flooring Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Wood Flooring Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Wood Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Wood Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Wood Flooring Market Revenue (Million), by Product 2025 & 2033

- Figure 27: South America Wood Flooring Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Wood Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: South America Wood Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Wood Flooring Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: South America Wood Flooring Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: South America Wood Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Wood Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Wood Flooring Market Revenue (Million), by Product 2025 & 2033

- Figure 35: Middle East and Africa Wood Flooring Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Middle East and Africa Wood Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Middle East and Africa Wood Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East and Africa Wood Flooring Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East and Africa Wood Flooring Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East and Africa Wood Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Wood Flooring Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Wood Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Wood Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Wood Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 24: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 26: Global Wood Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: India Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: China Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global Wood Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Wood Flooring Market Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Wood Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Wood Flooring Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Wood Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: United Arab Emirates Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Africa Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Wood Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wood Flooring Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Wood Flooring Market?

Key companies in the market include Barlinek SA, Tarkett SA**List Not Exhaustive, Shaw Industries Group, Provenza Floors Inc, Mannington Mills Inc, Home Legend LLC, Armstrong World Industries, Beaulieu International Group, Boral Limited, Mohawk Industries.

3. What are the main segments of the Wood Flooring Market?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Increasing Focus on Sustainable and Eco-friendly Products.

6. What are the notable trends driving market growth?

Engineered Wood Flooring is Boosting the Market’s Growth.

7. Are there any restraints impacting market growth?

Competition from Alternative Flooring Market; High Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2023: Mohawk Group and Scanalytics, a smart flooring firm with its headquarters in Milwaukee, Wisconsin, entered a partnership to lower emissions from the built environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wood Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wood Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wood Flooring Market?

To stay informed about further developments, trends, and reports in the Wood Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence