Key Insights

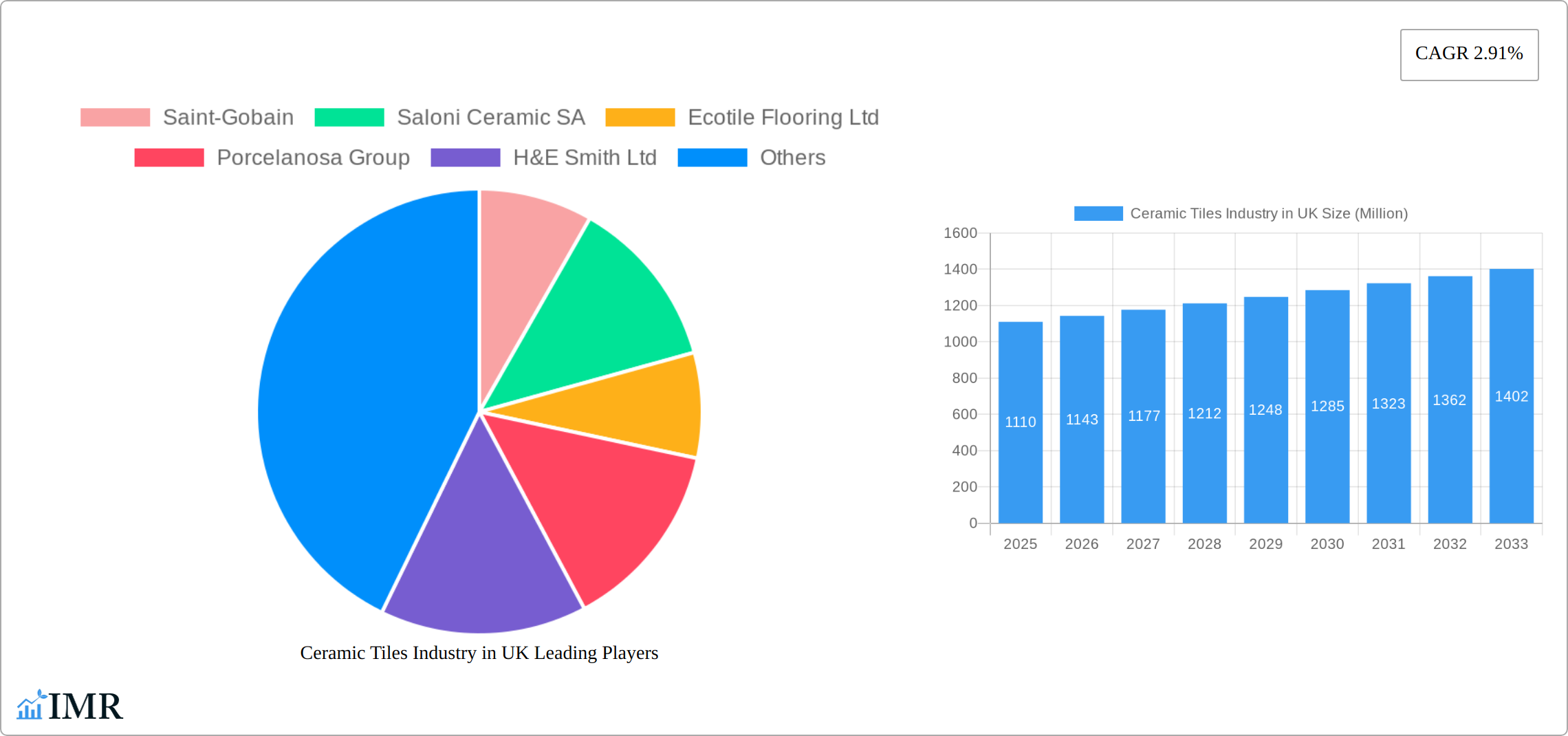

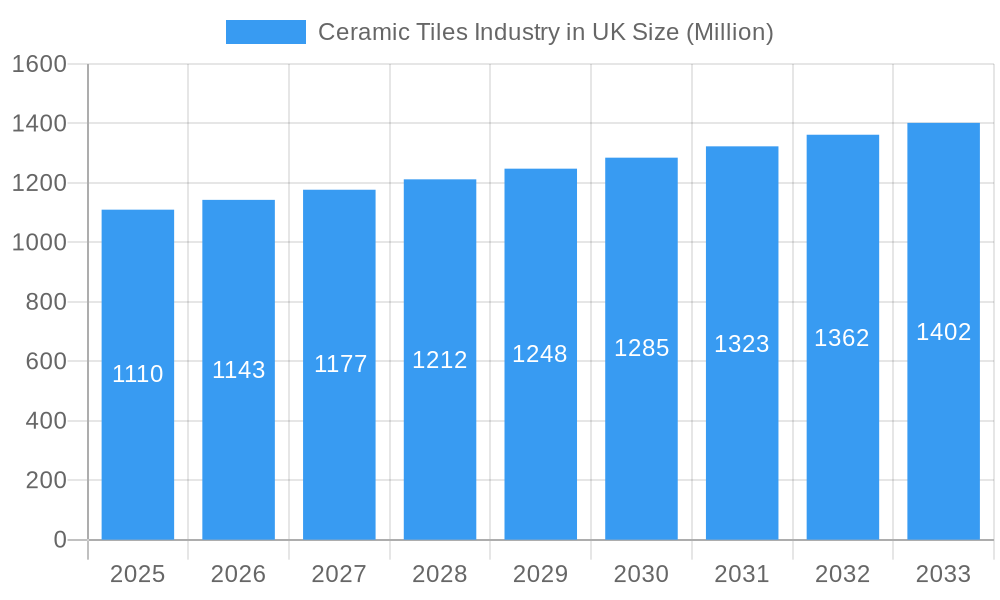

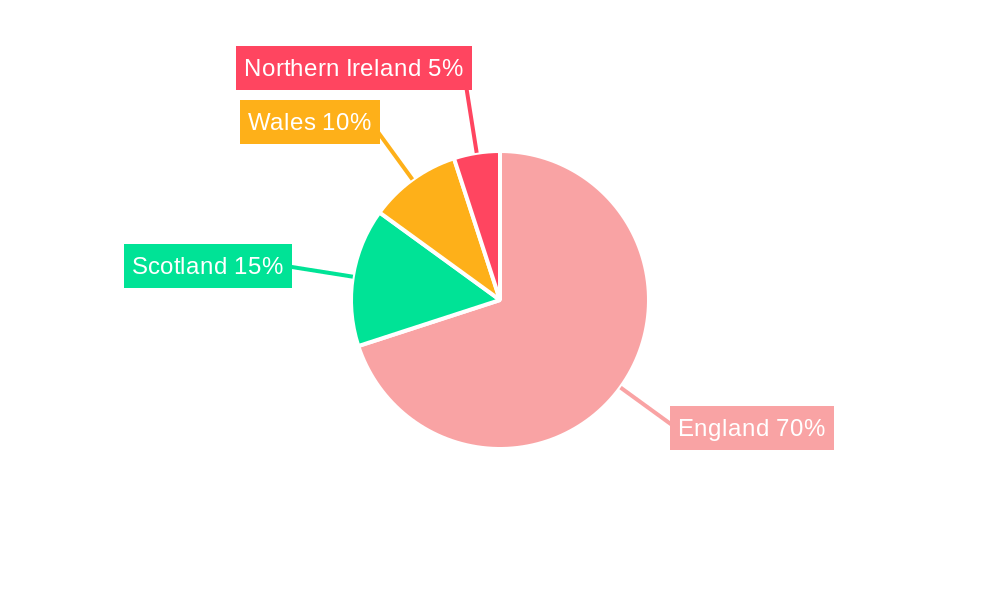

The UK ceramic tile market, valued at £1.11 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 2.91% from 2025 to 2033. This growth is driven by several factors. The ongoing construction boom, particularly in the residential sector, fueled by increasing urbanization and population growth, is a significant contributor. Furthermore, a rising preference for aesthetically pleasing and durable flooring and wall solutions is bolstering demand for ceramic tiles, particularly glazed and porcelain varieties. Renovation and refurbishment projects within both residential and commercial spaces also contribute substantially to market expansion. The increasing adoption of eco-friendly and scratch-resistant tile options reflects growing consumer awareness of sustainability and product longevity. However, fluctuations in raw material prices and potential economic slowdowns could pose challenges to market growth. Competition amongst established players like Saint-Gobain, Saloni Ceramic SA, and Porcelanosa Group, alongside smaller, specialized firms, is fierce, driving innovation and price competitiveness. The market segmentation, encompassing diverse product types (glazed, porcelain, scratch-free, others), applications (floor, wall, other tiles), construction types (new construction, replacement & renovation), and end-users (residential, commercial), offers ample opportunities for targeted marketing and product development. Regional variations exist, with England likely dominating the market share given its larger population and construction activity compared to Wales, Scotland, and Northern Ireland. Future growth will hinge on effective marketing strategies focusing on design trends and technological advancements in tile manufacturing, ensuring the UK ceramic tile market remains a robust and dynamic sector.

Ceramic Tiles Industry in UK Market Size (In Billion)

The UK ceramic tile market’s segmental breakdown reveals significant opportunities. The demand for porcelain tiles is expected to outpace other product types due to their superior durability and water resistance, making them ideal for both residential and commercial applications. Within the application segment, floor tiles command the largest share, driven by their functional and aesthetic importance in homes and businesses. The new construction segment is a key driver of overall market growth, while the replacement and renovation segment provides a stable, albeit slower-growing, component of demand. The residential sector is anticipated to dominate the end-user segment, reflecting the extensive housing stock within the UK. The competitive landscape features both established multinational corporations and smaller, specialized firms. The key to success lies in understanding these segmentation nuances, offering innovative and sustainable products, and adapting to evolving consumer preferences. This involves leveraging digital marketing and focusing on building strong brand recognition and customer loyalty in a competitive market.

Ceramic Tiles Industry in UK Company Market Share

Ceramic Tiles Industry in UK: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK ceramic tiles market, encompassing market dynamics, growth trends, key players, and future prospects. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. The report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic sector. The market is segmented by product (Glazed, Porcelain, Scratch Free, Others), application (Floor Tiles, Wall Tiles, Other Tiles), construction type (New Construction, Replacement & Renovation), and end-user (Residential Replacement, Commercial).

Ceramic Tiles Industry in UK Market Dynamics & Structure

The UK ceramic tile market demonstrates a moderately concentrated structure, with key players such as Saint-Gobain, Porcelanosa Group, and Johnson Tiles commanding substantial market share. Driving market growth is technological innovation, particularly in the development of sustainable and high-performance tiles, catering to the increasing demand for eco-friendly and durable flooring solutions. The market is significantly influenced by stringent building regulations and growing environmental concerns, prompting manufacturers to prioritize sustainable production methods and eco-conscious product design. The competitive landscape is further shaped by the presence of alternative flooring materials like vinyl and engineered wood, forcing ceramic tile manufacturers to constantly innovate and differentiate their offerings. While mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately [Insert Precise Number] deals recorded between 2019 and 2024, it reflects an ongoing process of consolidation within the sector. The residential replacement market segment, fueled by the robust home improvement sector, remains a primary driver of market demand, alongside commercial construction projects.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately [Insert Precise Percentage]% market share in 2024.

- Technological Innovation: Focus on sustainable, large-format, high-performance tiles, incorporating advanced features like antimicrobial properties and improved water resistance.

- Regulatory Framework: Strict adherence to building codes and environmental standards (e.g., [mention specific UK regulations if applicable]) is paramount for market participation.

- Competitive Substitutes: Vinyl flooring, engineered wood flooring, and other alternative materials present ongoing competitive pressure, requiring strategic differentiation.

- End-User Demographics: Residential renovations and refurbishments, alongside commercial construction projects (e.g., hospitality, retail), are key end-user segments.

- M&A Trends: [Insert Precise Number] M&A deals recorded between 2019 and 2024, indicating a degree of consolidation and strategic repositioning within the industry.

Ceramic Tiles Industry in UK Growth Trends & Insights

The UK ceramic tile market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as increasing construction activity and rising disposable incomes. However, the market witnessed some slowdown in 2020-2021 due to the COVID-19 pandemic. The market is projected to recover and maintain a CAGR of xx% during the forecast period (2025-2033), fueled by sustained growth in the construction sector and growing demand for aesthetically pleasing and durable flooring solutions. Consumer preference for eco-friendly and innovative tile designs are also influencing growth. Market penetration of premium tile segments is expected to increase, driven by rising disposable incomes and increasing focus on aesthetics. The market size is expected to reach £xx million by 2033.

Dominant Regions, Countries, or Segments in Ceramic Tiles Industry in UK

The South East of England dominates the UK ceramic tile market, driven by higher construction activity and higher disposable incomes in this region. Within product segments, Porcelain tiles hold the largest market share (approximately xx% in 2024), owing to their durability and versatility. The Floor Tiles application segment is the most dominant (approximately xx%), closely followed by Wall Tiles. The Replacement & Renovation segment is expected to show strong growth in the forecast period. Commercial construction continues to drive steady demand for high-quality ceramic tiles.

- Key Drivers: Strong construction activity, rising disposable incomes, and a preference for durable flooring.

- Dominant Segments: Porcelain tiles, Floor Tiles, Replacement & Renovation, and Commercial sectors.

- Regional Dominance: South East England is leading the market due to higher construction and disposable income.

- Growth Potential: Significant growth potential exists in sustainable tile segments and Northern regions.

Ceramic Tiles Industry in UK Product Landscape

The UK ceramic tile market offers a diverse range of products, including glazed, porcelain, and other specialized tiles designed to meet varied aesthetic and functional requirements. Key product innovations focus on large-format tiles, providing a modern and sleek aesthetic while minimizing grout lines. High-performance finishes, incorporating features like scratch resistance, stain resistance, and antimicrobial properties, are also gaining popularity. Sustainable materials, utilizing recycled content and minimizing environmental impact, are becoming increasingly crucial for manufacturers to remain competitive. Unique selling propositions (USPs) now often emphasize improved durability, enhanced aesthetic appeal, and eco-friendly certifications. Technological advancements, such as digital printing, enable highly customized designs and personalized tile options for consumers and commercial projects.

Key Drivers, Barriers & Challenges in Ceramic Tiles Industry in UK

Key Drivers: The UK ceramic tile market is propelled by increased residential and commercial construction activity, fueled by both new build projects and renovations. Rising consumer spending on home improvements and a growing preference for aesthetically pleasing and durable flooring solutions contribute significantly. Government initiatives supporting sustainable construction practices, including tax incentives or building regulations favoring eco-friendly materials, further stimulate market growth.

Key Challenges: The industry faces challenges including fluctuations in raw material costs (e.g., clay, energy), intense competition from substitute materials, and potential supply chain disruptions, particularly given global economic uncertainties. Stringent environmental regulations mandate investments in sustainable production processes, increasing operational costs and requiring manufacturers to adapt to new technologies and certifications.

Emerging Opportunities in Ceramic Tiles Industry in UK

Emerging trends include increasing demand for sustainable and recycled ceramic tiles, the growth of the large-format tile segment, and personalized design options through digital printing. Untapped markets lie in eco-conscious consumers and specific niches like smart home integration.

Growth Accelerators in the Ceramic Tiles Industry in UK Industry

Long-term growth will be driven by technological advancements leading to more sustainable and durable products. Strategic partnerships between manufacturers and designers will foster innovation and broaden market reach. Government support for sustainable building initiatives will further boost demand.

Key Players Shaping the Ceramic Tiles Industry in UK Market

- Saint-Gobain

- Saloni Ceramic SA

- Ecotile Flooring Ltd

- Porcelanosa Group

- H&E Smith Ltd

- Johnson Tiles

- Dune Ceramica

- Original Style Ltd

- Ceramica Impex Ltd

- Unique Tiles

Notable Milestones in Ceramic Tiles Industry in UK Sector

- March 2022: Porcelanosa launched stylish, ultra-resistant ceramic floor tiles for restaurants.

- February 2022: Porcelanosa renovated its central showroom into a boutique hotel.

- February 2022: Johnson Tiles reintroduced its Surface Design Show, showcasing industry trends.

- November 2021: Johnson Tiles collaborated with Nina+co. on sustainable designs.

- March 2022: Saint-Gobain announced the production of recyclable ceilings.

In-Depth Ceramic Tiles Industry in UK Market Outlook

The UK ceramic tile market presents considerable growth potential, driven by the continuing expansion of the construction industry, rising consumer expenditure on home improvements, and the accelerating focus on sustainable and innovative products. To fully leverage future opportunities, strategic investments in research and development (R&D) to innovate new products and manufacturing processes, adoption of sustainable practices to minimize environmental impact, and expansion into niche markets offering specialized tile solutions, are crucial for manufacturers. The market is projected for continued expansion, with significant growth anticipated over the next [Insert timeframe, e.g., 5 years].

Ceramic Tiles Industry in UK Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Others

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User

- 4.1. Residential Replacement

- 4.2. Commercial

Ceramic Tiles Industry in UK Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ceramic Tiles Industry in UK Regional Market Share

Geographic Coverage of Ceramic Tiles Industry in UK

Ceramic Tiles Industry in UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry

- 3.3. Market Restrains

- 3.3.1. Fluctuating demand in the construction industry

- 3.4. Market Trends

- 3.4.1. Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Residential Replacement

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Residential Replacement

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Residential Replacement

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Residential Replacement

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Residential Replacement

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Ceramic Tiles Industry in UK Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Residential Replacement

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Saint-Gobain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saloni Ceramic SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ecotile Flooring Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Porcelanosa Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 H&E Smith Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johnson Tiles

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dune Ceramica

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Original Style Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ceramica Impex Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unique Tiles**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Saint-Gobain

List of Figures

- Figure 1: Global Ceramic Tiles Industry in UK Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ceramic Tiles Industry in UK Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Ceramic Tiles Industry in UK Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Ceramic Tiles Industry in UK Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Ceramic Tiles Industry in UK Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ceramic Tiles Industry in UK Revenue (Million), by Construction Type 2025 & 2033

- Figure 7: North America Ceramic Tiles Industry in UK Revenue Share (%), by Construction Type 2025 & 2033

- Figure 8: North America Ceramic Tiles Industry in UK Revenue (Million), by End-User 2025 & 2033

- Figure 9: North America Ceramic Tiles Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Ceramic Tiles Industry in UK Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Ceramic Tiles Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Ceramic Tiles Industry in UK Revenue (Million), by Product 2025 & 2033

- Figure 13: South America Ceramic Tiles Industry in UK Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America Ceramic Tiles Industry in UK Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Ceramic Tiles Industry in UK Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Ceramic Tiles Industry in UK Revenue (Million), by Construction Type 2025 & 2033

- Figure 17: South America Ceramic Tiles Industry in UK Revenue Share (%), by Construction Type 2025 & 2033

- Figure 18: South America Ceramic Tiles Industry in UK Revenue (Million), by End-User 2025 & 2033

- Figure 19: South America Ceramic Tiles Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America Ceramic Tiles Industry in UK Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Ceramic Tiles Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Ceramic Tiles Industry in UK Revenue (Million), by Product 2025 & 2033

- Figure 23: Europe Ceramic Tiles Industry in UK Revenue Share (%), by Product 2025 & 2033

- Figure 24: Europe Ceramic Tiles Industry in UK Revenue (Million), by Application 2025 & 2033

- Figure 25: Europe Ceramic Tiles Industry in UK Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Ceramic Tiles Industry in UK Revenue (Million), by Construction Type 2025 & 2033

- Figure 27: Europe Ceramic Tiles Industry in UK Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Europe Ceramic Tiles Industry in UK Revenue (Million), by End-User 2025 & 2033

- Figure 29: Europe Ceramic Tiles Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Ceramic Tiles Industry in UK Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Ceramic Tiles Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million), by Product 2025 & 2033

- Figure 33: Middle East & Africa Ceramic Tiles Industry in UK Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East & Africa Ceramic Tiles Industry in UK Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million), by Construction Type 2025 & 2033

- Figure 37: Middle East & Africa Ceramic Tiles Industry in UK Revenue Share (%), by Construction Type 2025 & 2033

- Figure 38: Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East & Africa Ceramic Tiles Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Ceramic Tiles Industry in UK Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Ceramic Tiles Industry in UK Revenue (Million), by Product 2025 & 2033

- Figure 43: Asia Pacific Ceramic Tiles Industry in UK Revenue Share (%), by Product 2025 & 2033

- Figure 44: Asia Pacific Ceramic Tiles Industry in UK Revenue (Million), by Application 2025 & 2033

- Figure 45: Asia Pacific Ceramic Tiles Industry in UK Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Ceramic Tiles Industry in UK Revenue (Million), by Construction Type 2025 & 2033

- Figure 47: Asia Pacific Ceramic Tiles Industry in UK Revenue Share (%), by Construction Type 2025 & 2033

- Figure 48: Asia Pacific Ceramic Tiles Industry in UK Revenue (Million), by End-User 2025 & 2033

- Figure 49: Asia Pacific Ceramic Tiles Industry in UK Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific Ceramic Tiles Industry in UK Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Ceramic Tiles Industry in UK Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 17: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 25: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 26: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 37: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 40: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Product 2020 & 2033

- Table 48: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Application 2020 & 2033

- Table 49: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 50: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by End-User 2020 & 2033

- Table 51: Global Ceramic Tiles Industry in UK Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Ceramic Tiles Industry in UK Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Tiles Industry in UK?

The projected CAGR is approximately 2.91%.

2. Which companies are prominent players in the Ceramic Tiles Industry in UK?

Key companies in the market include Saint-Gobain, Saloni Ceramic SA, Ecotile Flooring Ltd, Porcelanosa Group, H&E Smith Ltd, Johnson Tiles, Dune Ceramica, Original Style Ltd, Ceramica Impex Ltd, Unique Tiles**List Not Exhaustive.

3. What are the main segments of the Ceramic Tiles Industry in UK?

The market segments include Product, Application, Construction Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry.

6. What are the notable trends driving market growth?

Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuating demand in the construction industry.

8. Can you provide examples of recent developments in the market?

In March 17 2022, Porcelanosa has came up with stylish ultra-resistant floors for resturants. The floors are to be made with infinite ceramic floor tiles featuring warm surfaces inspired by wood or marble. On February 28 2022, with Ramon Esteve's biophilic design Porcelanosa has completely renovated its central showroom and has made it a boutique hotel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ceramic Tiles Industry in UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ceramic Tiles Industry in UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ceramic Tiles Industry in UK?

To stay informed about further developments, trends, and reports in the Ceramic Tiles Industry in UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence