Key Insights

The European carpet and rug market, projected to reach 12.35 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.41% from 2025 to 2033. This expansion is driven by rising disposable incomes, increased home improvement initiatives, and ongoing construction in residential and commercial sectors. A growing consumer preference for sustainable and eco-friendly flooring solutions, utilizing recycled materials, further supports market growth. Key challenges include fluctuating raw material costs and economic uncertainties, alongside intensified competition from both established and new market entrants.

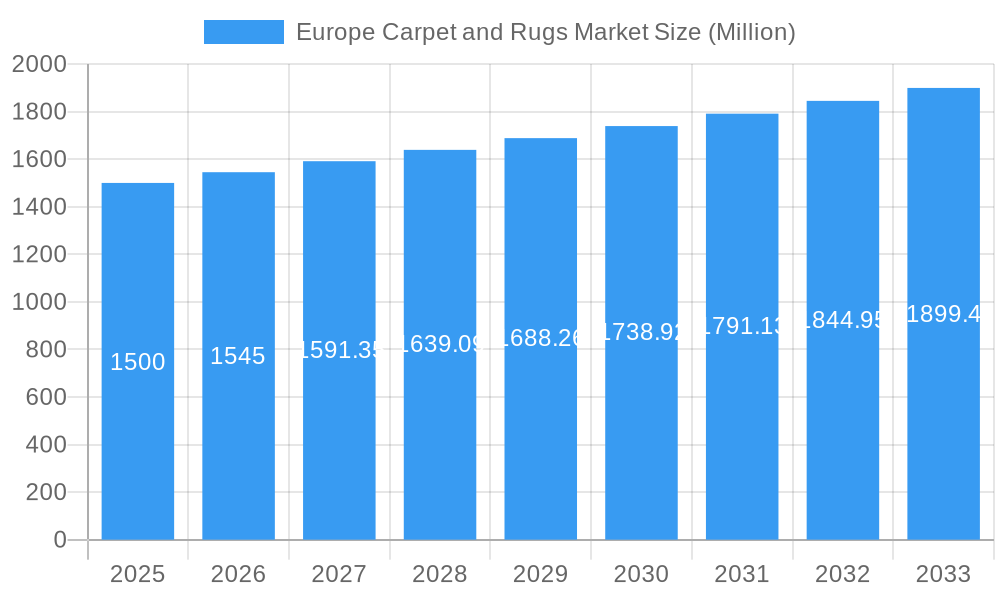

Europe Carpet and Rugs Market Market Size (In Billion)

Market segmentation indicates that while wall-to-wall carpets maintain a strong presence, rugs and runners are gaining traction due to their flexibility. The commercial sector, particularly office renovations, is a significant revenue contributor. Distribution is primarily through retail channels, with contractors playing a vital role in large-scale commercial projects. Germany, the United Kingdom, and France are leading national markets, supported by strong economies and construction activity. Growth in the "Rest of Europe" segment is contingent on economic conditions and infrastructure development. Leading companies are focusing on product innovation, diverse material offerings, and strategic collaborations to meet evolving consumer demands and sustainability goals.

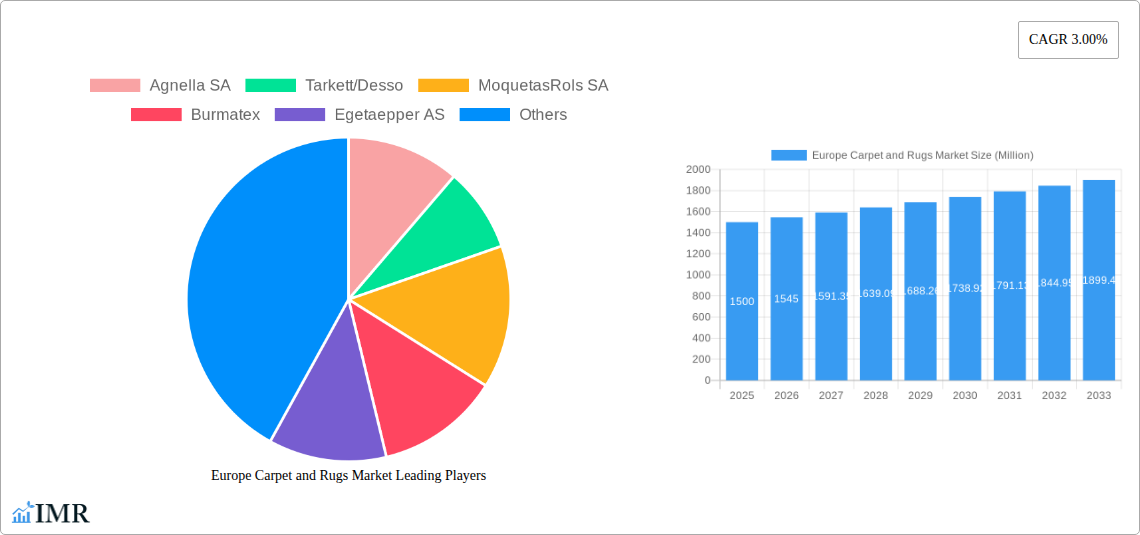

Europe Carpet and Rugs Market Company Market Share

Europe Carpet and Rugs Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe carpet and rugs market, encompassing market dynamics, growth trends, regional performance, product landscape, and key player strategies. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The total market value is predicted to reach xx Million by 2033.

Europe Carpet and Rugs Market Dynamics & Structure

The European carpet and rugs market is characterized by a moderate level of concentration, with several key players holding significant market share. Technological innovation, particularly in sustainable and durable materials, is a key driver. Stringent environmental regulations and consumer demand for eco-friendly products are shaping the industry landscape. The market faces competition from alternative flooring options like hardwood, laminate, and vinyl. M&A activity is relatively frequent, reflecting consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 45% market share in 2024.

- Technological Innovation: Focus on sustainable materials (recycled fibers, bio-based polymers), improved durability, and smart carpet technologies.

- Regulatory Framework: Increasingly stringent environmental regulations impacting material sourcing and manufacturing processes.

- Competitive Substitutes: Hardwood flooring, laminate flooring, vinyl flooring, and tile pose significant competition.

- End-User Demographics: Shifting preferences towards eco-friendly and design-focused products, influenced by generational changes.

- M&A Trends: Significant M&A activity observed in recent years, driven by expansion and market consolidation strategies (e.g., Victoria's acquisition of Balta Group's rugs division).

Europe Carpet and Rugs Market Growth Trends & Insights

The European carpet and rugs market experienced steady growth during the historical period (2019-2024), driven by factors such as increasing disposable incomes, rising construction activity, and growing demand for home improvement. The market is expected to maintain a healthy growth trajectory during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, such as the introduction of innovative materials and designs, are contributing to market expansion. Consumer preferences are shifting towards eco-friendly and customized products, driving demand for sustainable carpet options. Market penetration of smart carpets is still limited but shows significant potential for growth.

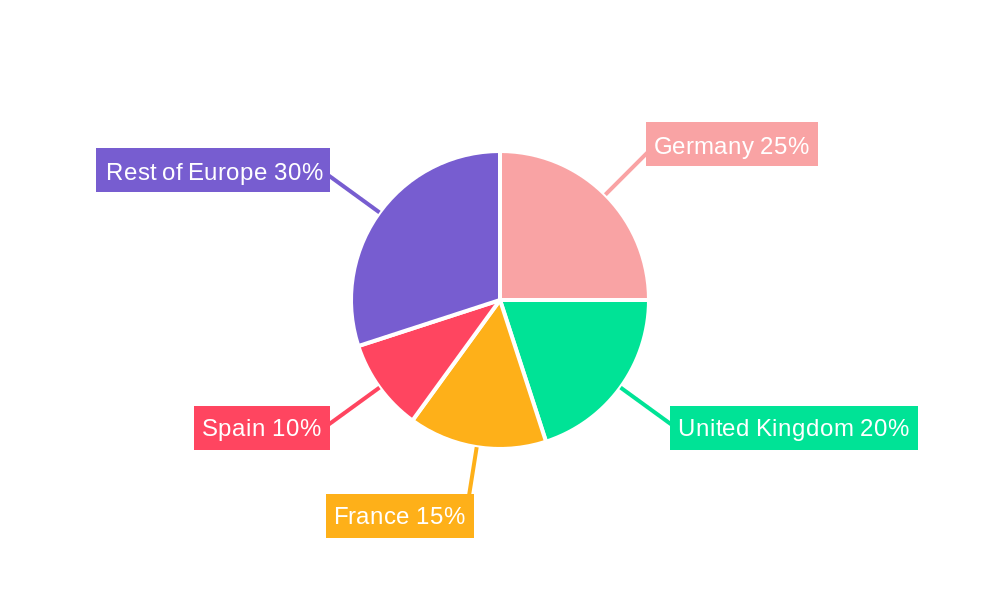

Dominant Regions, Countries, or Segments in Europe Carpet and Rugs Market

Germany, the United Kingdom, and France represent the largest national markets, accounting for a combined xx% of the total market value in 2024. The residential segment dominates the application market, while wall-to-wall tufted carpets hold the largest share in the type segment. Retail channels account for the majority of distribution, followed by contractors. Key growth drivers vary by segment and region:

- Germany: Strong construction sector, high disposable income, and established manufacturing base.

- United Kingdom: Significant renovation activity, diverse consumer preferences, and robust retail infrastructure.

- France: Growing demand for high-end, design-focused carpets and rugs.

- Residential Segment: High demand driven by home improvement trends and population growth.

- Wall-to-Wall Tufted Carpets: Cost-effectiveness and widespread availability.

- Retail Distribution Channel: Established retail networks and direct-to-consumer online sales.

Europe Carpet and Rugs Market Product Landscape

The product landscape is diverse, encompassing a wide range of materials (wool, nylon, polyester, etc.), styles, and designs. Innovations focus on enhanced durability, stain resistance, sound absorption, and sustainable manufacturing processes. Unique selling propositions include hypoallergenic materials, improved comfort, and integrated smart features.

Key Drivers, Barriers & Challenges in Europe Carpet and Rugs Market

Key Drivers:

- Rising disposable incomes and increased spending on home improvement.

- Growing construction activity, particularly in residential and commercial sectors.

- Demand for aesthetically pleasing and functional flooring solutions.

- Technological advancements driving product innovation and improved performance.

Key Barriers & Challenges:

- Competition from alternative flooring materials.

- Fluctuations in raw material prices impacting production costs.

- Stringent environmental regulations increasing manufacturing complexities.

- Economic downturns impacting consumer spending.

Emerging Opportunities in Europe Carpet and Rugs Market

Emerging opportunities include:

- Growing demand for sustainable and eco-friendly carpets.

- Expansion into niche segments, such as smart carpets and customized designs.

- Increased adoption of online sales channels.

- Development of innovative materials and manufacturing processes.

Growth Accelerators in the Europe Carpet and Rugs Market Industry

Long-term growth will be accelerated by strategic partnerships, technological advancements (e.g., improved recycling technologies), and expansion into new markets (e.g., Eastern Europe). Companies focusing on sustainable practices and customization will gain a competitive edge.

Key Players Shaping the Europe Carpet and Rugs Market Market

- Agnella SA

- Tarkett/Desso

- MoquetasRols SA

- Burmatex

- Egetaepper AS

- Balsan

- Milliken

- Fletco Carpets AS

- Creatuft NV

- Associated Weavers

- Brintons Carpets

- Balta Group

- Royal Carpet SA

Notable Milestones in Europe Carpet and Rugs Market Sector

- November 2021: Victoria acquires Balta Group's rugs division for GBP 117 million (USD 141.5 million), significantly impacting market consolidation.

- April 2022: Milliken & Company expands capacity by 60% with the acquisition of Zebra-chem GmbH, enhancing its production capabilities.

In-Depth Europe Carpet and Rugs Market Market Outlook

The Europe carpet and rugs market presents significant long-term growth potential, driven by consistent demand from both residential and commercial sectors. Companies focused on innovation, sustainability, and strategic partnerships are well-positioned to capture market share. The market's evolution will be influenced by technological advancements, economic conditions, and evolving consumer preferences. Strategic investments in research and development, sustainable materials, and digital marketing will be crucial for future success.

Europe Carpet and Rugs Market Segmentation

-

1. Type

- 1.1. Wall to Wall Tufted Carpets

- 1.2. Wall to Wall Woven Carpets

- 1.3. Rugs

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Contractors

- 3.2. Retail

- 3.3. Other Distibution Channels

Europe Carpet and Rugs Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Carpet and Rugs Market Regional Market Share

Geographic Coverage of Europe Carpet and Rugs Market

Europe Carpet and Rugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances

- 3.3. Market Restrains

- 3.3.1. Changing Needs of Customers; Limited Usage of the Product

- 3.4. Market Trends

- 3.4.1. Germany Accounts for a Major Percentage of the Market Share in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Carpet and Rugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall to Wall Tufted Carpets

- 5.1.2. Wall to Wall Woven Carpets

- 5.1.3. Rugs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Contractors

- 5.3.2. Retail

- 5.3.3. Other Distibution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Agnella SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tarkett/Desso

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MoquetasRols SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Burmatex

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Egetaepper AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Balsan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Milliken

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fletco Carpets AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Creatuft NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Associated Weavers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brintons Carpets

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Balta Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Royal Carpet SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Agnella SA

List of Figures

- Figure 1: Europe Carpet and Rugs Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Carpet and Rugs Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Carpet and Rugs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Carpet and Rugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Carpet and Rugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Carpet and Rugs Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Carpet and Rugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Carpet and Rugs Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Carpet and Rugs Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Europe Carpet and Rugs Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Europe Carpet and Rugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Europe Carpet and Rugs Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Carpet and Rugs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Carpet and Rugs Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Carpet and Rugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Carpet and Rugs Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Carpet and Rugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Carpet and Rugs Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the Europe Carpet and Rugs Market?

Key companies in the market include Agnella SA, Tarkett/Desso, MoquetasRols SA, Burmatex, Egetaepper AS, Balsan, Milliken, Fletco Carpets AS, Creatuft NV, Associated Weavers, Brintons Carpets, Balta Group, Royal Carpet SA.

3. What are the main segments of the Europe Carpet and Rugs Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Sales is Driving the Market; Growing Urbanisation is Driving need for Small Appliances.

6. What are the notable trends driving market growth?

Germany Accounts for a Major Percentage of the Market Share in the Region.

7. Are there any restraints impacting market growth?

Changing Needs of Customers; Limited Usage of the Product.

8. Can you provide examples of recent developments in the market?

November 2021: UK-based Victoria, engaged in the manufacturing of carpets and floor coverings, acquired the rugs division of Balta Group for GBP 117 million (around USD 141.5 million). Balta Group is headquartered in Belgium and is the largest manufacturer of carpets in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Carpet and Rugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Carpet and Rugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Carpet and Rugs Market?

To stay informed about further developments, trends, and reports in the Europe Carpet and Rugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence