Key Insights

The France steam room market is projected to reach approximately $2.8 billion by 2024, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.1% from 2024 to 2033. This significant growth is propelled by escalating consumer spending on home wellness solutions and luxury amenities. The growing awareness of steam therapy's health benefits, coupled with the integration of steam rooms into hospitality and commercial wellness facilities, are key market drivers. The market is segmented by steam room type, with infrared models expected to gain traction due to superior energy efficiency and faster operation. The commercial sector, including spas, fitness centers, and hotels, is anticipated to be a major revenue contributor, reflecting substantial investments in health and wellness infrastructure. However, substantial upfront installation costs may present a market challenge. Prominent market participants such as Kohler, KLAFS Group, and Harvia are engaged in fierce competition, stimulating innovation and product development.

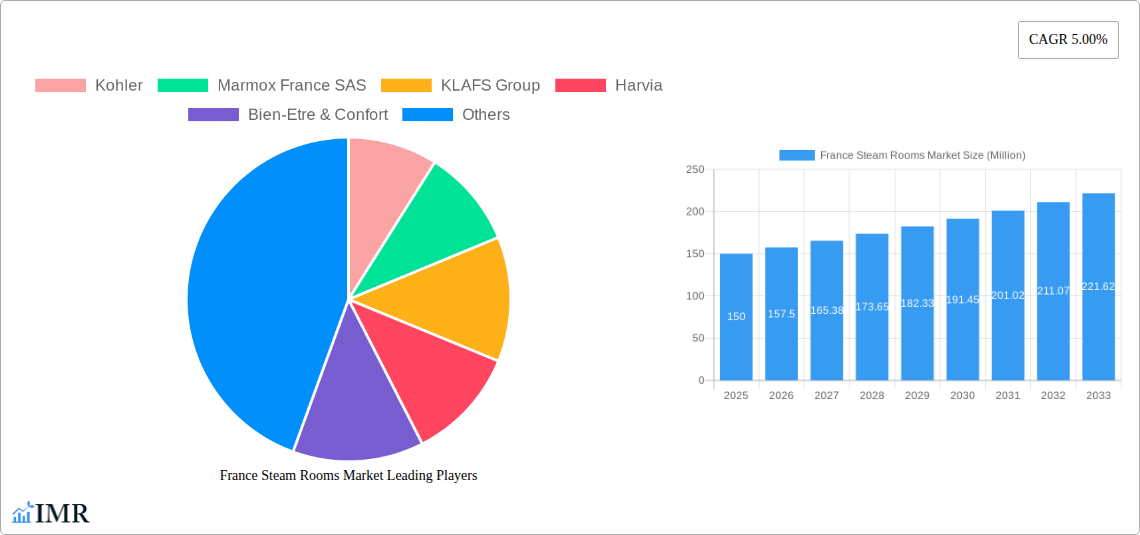

France Steam Rooms Market Market Size (In Billion)

Throughout the forecast period (2024-2033), sustained market expansion is expected. The rising trend of home spa installations, driven by a desire for enhanced residential comfort and relaxation, will fuel the residential segment. Commercial sector growth will largely depend on the performance of the hospitality and wellness industries. The integration of smart technologies and the development of smart home-compatible steam room solutions offer additional avenues for market development. Strategic initiatives for market players will likely revolve around product differentiation, focusing on technological advancements, innovative designs, and sustainable materials to align with evolving consumer demands. Exploring untapped markets and implementing targeted marketing approaches will be critical for achieving sustained success in the competitive French steam room market.

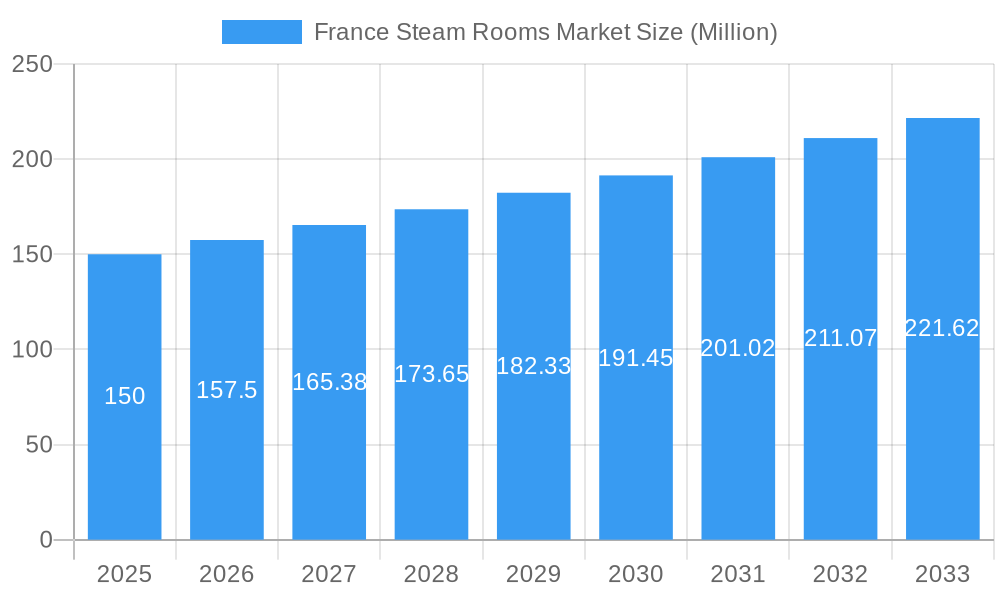

France Steam Rooms Market Company Market Share

France Steam Rooms Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Steam Rooms Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025-2033, while the historical period analyzed is 2019-2024. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The parent market is the broader Wellness & Spa industry, while the child market focuses specifically on steam rooms within France. Market values are presented in Million units.

France Steam Rooms Market Market Dynamics & Structure

The French steam room market exhibits a moderately concentrated structure, with key players like Kohler, Marmox France SAS, KLAFS Group, Harvia, Bien-Etre & Confort, Preti, Duravit, Iber Spa, Thermae, and Oxygen Spa (list not exhaustive) vying for market share. Technological innovation, particularly in energy efficiency and smart home integration, is a significant driver. Stringent safety and environmental regulations influence product design and manufacturing. Competitive substitutes include traditional saunas and other wellness products. The end-user demographic is expanding, encompassing both residential and commercial segments, with growing demand from luxury hotels, spas, and fitness centers. M&A activity within the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, representing a xx% market share consolidation.

- Market Concentration: Moderately Concentrated

- Technological Innovation: High, focused on energy efficiency and smart features.

- Regulatory Framework: Stringent safety and environmental standards.

- Competitive Substitutes: Traditional saunas, other wellness products.

- End-User Demographics: Expanding residential and commercial segments.

- M&A Trends: Moderate activity, xx deals between 2019-2024 resulting in xx% market share consolidation.

France Steam Rooms Market Growth Trends & Insights

The France Steam Rooms Market has experienced a steady growth trajectory over the past few years, driven by rising disposable incomes, increasing health consciousness, and the growing popularity of wellness activities. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period. This growth is fueled by increasing adoption rates, particularly within the commercial segment, and the introduction of innovative, feature-rich products. Consumer behavior shifts towards premiumization and personalized wellness experiences further contribute to market expansion. Technological disruptions, such as smart controls and integrated wellness solutions, are accelerating market growth. Market penetration in the residential segment remains relatively low, presenting significant untapped potential.

Dominant Regions, Countries, or Segments in France Steam Rooms Market

The Ile-de-France region dominates the France Steam Rooms Market, accounting for approximately xx% of total market value in 2025. This dominance is attributed to high population density, a strong economy, and a concentration of luxury hotels and spas. Within the product segmentation, the conventional steam room segment holds a larger market share than the infrared segment due to established consumer preference and price competitiveness. The commercial segment exhibits higher growth potential compared to the residential segment due to the increasing number of wellness facilities and hotels integrating steam rooms into their services.

- Key Drivers (Ile-de-France): High population density, strong economy, concentration of luxury establishments.

- Key Drivers (Conventional Steam Rooms): Established consumer preference, price competitiveness.

- Key Drivers (Commercial Segment): Growing wellness sector, increasing hotel and spa investments.

France Steam Rooms Market Product Landscape

The French steam room market offers a diverse range of products, from basic conventional units to advanced infrared steam showers with smart controls and integrated aromatherapy features. Product innovation focuses on energy efficiency, improved user experience, and customization options. Key features include digital control panels, customizable lighting, and integrated audio systems. Manufacturers leverage unique selling propositions like advanced materials, superior craftsmanship, and innovative designs to attract discerning consumers.

Key Drivers, Barriers & Challenges in France Steam Rooms Market

Key Drivers:

- Increasing health consciousness and wellness spending

- Growing demand for luxury home amenities

- Expansion of the hospitality and wellness sectors

- Technological advancements in steam room technology

Challenges:

- High initial investment costs

- Space constraints in residential settings

- Competition from other wellness products

- Potential regulatory hurdles regarding energy efficiency and safety.

Emerging Opportunities in France Steam Rooms Market

Emerging opportunities lie in the integration of smart home technology, customization options catering to individual preferences, and expansion into untapped market segments like smaller apartments and eco-conscious consumers seeking sustainable steam room solutions. The rising popularity of wellness tourism also presents opportunities for expansion within the commercial sector.

Growth Accelerators in the France Steam Rooms Market Industry

Long-term growth will be driven by technological breakthroughs leading to more efficient and affordable steam rooms, strategic partnerships between manufacturers and wellness facilities, and successful market expansion into under-penetrated segments. Innovative financing solutions could make ownership more accessible, further stimulating market growth.

Key Players Shaping the France Steam Rooms Market Market

- Kohler

- Marmox France SAS

- KLAFS Group

- Harvia

- Bien-Etre & Confort

- Preti

- Duravit

- Iber Spa

- Thermae

- Oxygen Spa

Notable Milestones in France Steam Rooms Market Sector

- June 2022: Harvia launched its high-end Harvia Nova line of steam sauna products, including a stand-alone steam shower column and a steam shower cabin.

- July 2022: Harvia introduced the Harvia Spirit, a sleek, contemporary electric heater designed for saunas.

In-Depth France Steam Rooms Market Market Outlook

The France Steam Rooms Market is poised for continued growth, driven by the factors outlined above. Strategic opportunities exist for companies focusing on innovation, sustainability, and tailored consumer experiences. The market's future potential hinges on addressing challenges related to cost, space, and regulatory compliance, while simultaneously capitalizing on emerging trends in smart technology and wellness tourism.

France Steam Rooms Market Segmentation

-

1. Type

- 1.1. Infrared

- 1.2. Conventional

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

France Steam Rooms Market Segmentation By Geography

- 1. France

France Steam Rooms Market Regional Market Share

Geographic Coverage of France Steam Rooms Market

France Steam Rooms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry

- 3.3. Market Restrains

- 3.3.1. Fluctuating demand in the construction industry

- 3.4. Market Trends

- 3.4.1. The Rising Expenditure Capacities of the Consumers Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Steam Rooms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Infrared

- 5.1.2. Conventional

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kohler

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marmox France SAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KLAFS Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harvia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bien-Etre & Confort

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Preti

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duravit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Iber Spa**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thermae

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oxygen Spa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kohler

List of Figures

- Figure 1: France Steam Rooms Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Steam Rooms Market Share (%) by Company 2025

List of Tables

- Table 1: France Steam Rooms Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: France Steam Rooms Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: France Steam Rooms Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Steam Rooms Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: France Steam Rooms Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: France Steam Rooms Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Steam Rooms Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the France Steam Rooms Market?

Key companies in the market include Kohler, Marmox France SAS, KLAFS Group, Harvia, Bien-Etre & Confort, Preti, Duravit, Iber Spa**List Not Exhaustive, Thermae, Oxygen Spa.

3. What are the main segments of the France Steam Rooms Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry.

6. What are the notable trends driving market growth?

The Rising Expenditure Capacities of the Consumers Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuating demand in the construction industry.

8. Can you provide examples of recent developments in the market?

June 2022 - With the introduction of the Harvia Nova products, Harvia launched a brand-new, high-end line of steam sauna items. Two new products, a stand-alone steam shower column and a steam shower cabin with an integrated steam shower column, are part of the product lineup.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Steam Rooms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Steam Rooms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Steam Rooms Market?

To stay informed about further developments, trends, and reports in the France Steam Rooms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence