Key Insights

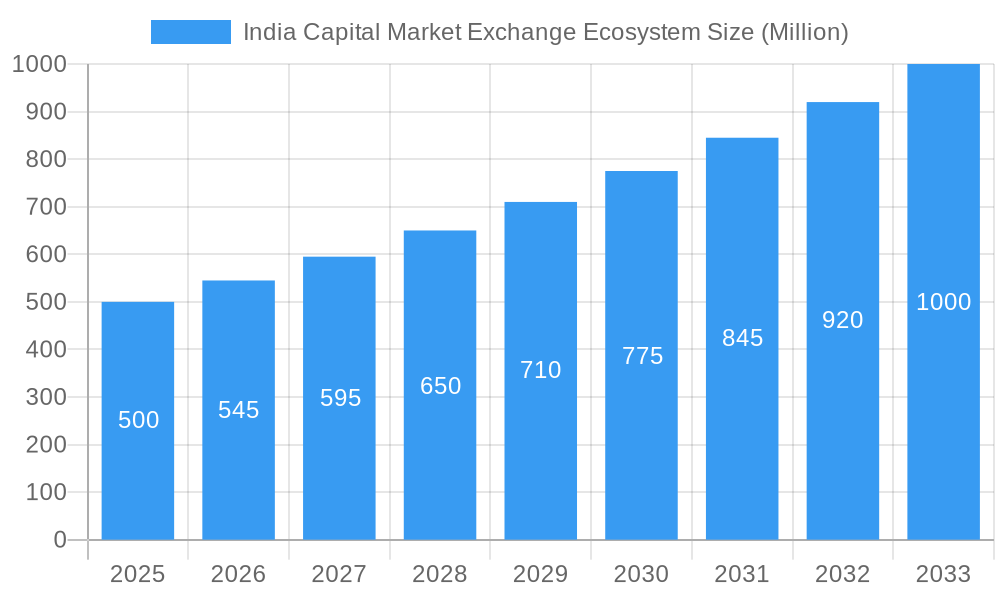

India's Capital Market Exchange Ecosystem is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 9%. This expansion, estimated from a 2025 base year with a market size of ₹124 billion, is driven by escalating financial literacy, a growing middle class, and government-led initiatives fostering financial inclusion and digitalization. The proliferation of online brokerage platforms and mobile trading applications is democratizing investment access. A supportive regulatory framework and product diversification further bolster the ecosystem's development. Key challenges include market volatility, geopolitical risks, and evolving regulatory landscapes.

India Capital Market Exchange Ecosystem Market Size (In Billion)

The competitive arena features established entities and innovative fintech firms. With an anticipated CAGR of 9%, the market size, estimated at ₹124 billion in 2025, is forecast to exceed ₹500 billion by 2033. This growth trajectory offers significant opportunities. Market segments include brokerage, investment advisory, and portfolio management. While major urban centers are expected to lead expansion, granular regional analysis is recommended.

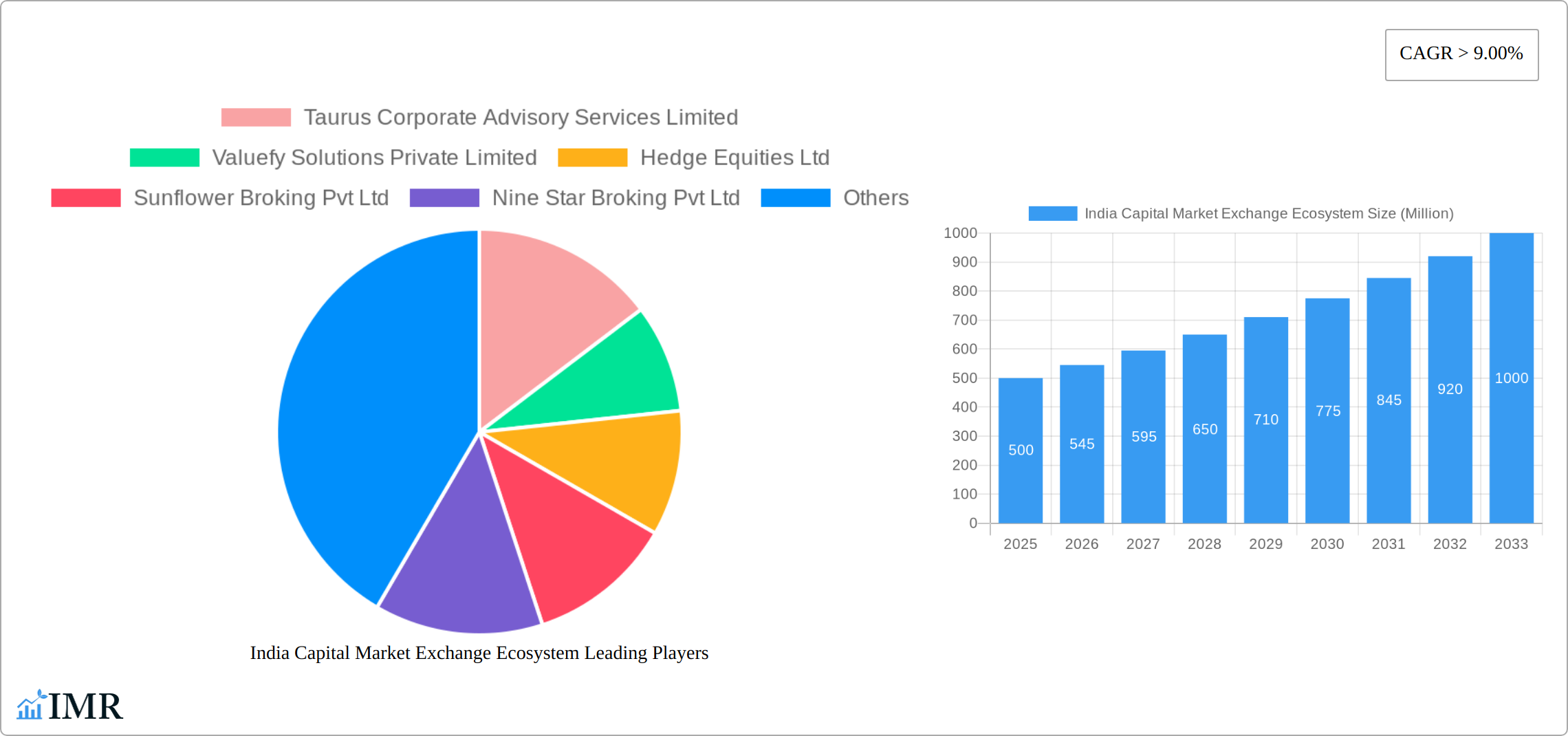

India Capital Market Exchange Ecosystem Company Market Share

India Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Capital Market Exchange Ecosystem, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic planners. The report analyzes the parent market of Financial Services and the child market of Capital Market Exchanges in India. All values are presented in Million units.

India Capital Market Exchange Ecosystem Market Dynamics & Structure

This section delves into the intricate structure and dynamic forces shaping India's capital market exchange ecosystem. We analyze key drivers including market concentration, the pervasive influence of technological innovation, the robust regulatory frameworks, the competitive landscape, and the strategic significance of Mergers & Acquisitions (M&A). The Indian capital market is a vibrant and evolving arena, characterized by a dynamic interplay between well-established financial institutions and a burgeoning wave of agile fintech innovators.

- Market Concentration: The market currently demonstrates moderate concentration, with a select group of dominant players commanding a substantial portion of market share. While their influence is significant, it's estimated that these top players controlled approximately XX% of the market in 2025. However, the rapid emergence and increasing adoption of fintech companies are actively fostering a more competitive environment, challenging established dominance and driving innovation.

- Technological Innovation: The ecosystem is being profoundly reshaped by cutting-edge technological advancements. Artificial Intelligence (AI), sophisticated big data analytics, and the transformative potential of blockchain technology are actively driving enhanced efficiency and fostering novel solutions. Notwithstanding these advancements, the seamless integration of these technologies and their full regulatory acceptance remain critical areas for continued focus and development.

- Regulatory Framework: The Securities and Exchange Board of India (SEBI) stands as a pivotal regulator, exerting considerable influence over the market's trajectory, impacting both innovation and overall growth. Recent regulatory directives have been strategically oriented towards fortifying investor protection measures and elevating market transparency to new heights.

- Competitive Product Substitutes: The proliferation of alternative investment platforms presents a noteworthy competitive challenge to traditional stock exchanges. While these platforms offer diverse avenues for investment, the broader capital market ecosystem continues to exhibit a remarkable degree of cohesion and interconnectedness.

- End-User Demographics: The investor base in India is undergoing a significant expansion, marked by increasing participation from both large-scale institutional investors and a growing cohort of retail investors. A notable trend is the heightened digital literacy across the population, which is directly fueling the widespread adoption of user-friendly online trading platforms.

- M&A Trends: The preceding historical period, spanning from 2019 to 2024, witnessed approximately XX significant M&A transactions. These deals were predominantly driven by strategic imperatives such as market consolidation and the integration of advanced technological capabilities. Projections for the upcoming forecast period anticipate an annual average of XX M&A deals. This anticipated increase is fueled by a strategic drive to expand market share, enhance technological infrastructure, and capitalize on emerging growth opportunities.

India Capital Market Exchange Ecosystem Growth Trends & Insights

The Indian capital market exchange ecosystem is currently experiencing a period of robust and sustained growth. This upward momentum is underpinned by a confluence of factors, including a heightened focus on financial inclusion, the country's strong economic expansion, and the transformative impact of technological advancements. The market size, measured in millions of units, has demonstrated a significant increase, growing from XX in 2019 to XX in 2024, thereby achieving a Compound Annual Growth Rate (CAGR) of XX%. This impressive trajectory is projected to continue its ascent through 2033. Technological disruptions, such as the widespread adoption of algorithmic trading and the ubiquitous presence of mobile-first trading platforms, have played a crucial role in accelerating market adoption rates. The current market penetration rate stands at an estimated XX% in 2025 and is forecasted to reach an impressive XX% by 2033. Furthermore, discernible shifts in consumer behavior, including an increasing reliance on digital platforms for financial transactions and a growing preference for diversified investment products, are significantly contributing to the overall growth narrative. A comprehensive and detailed analysis of historical market size figures, along with future projections and their associated CAGRs, will be meticulously provided.

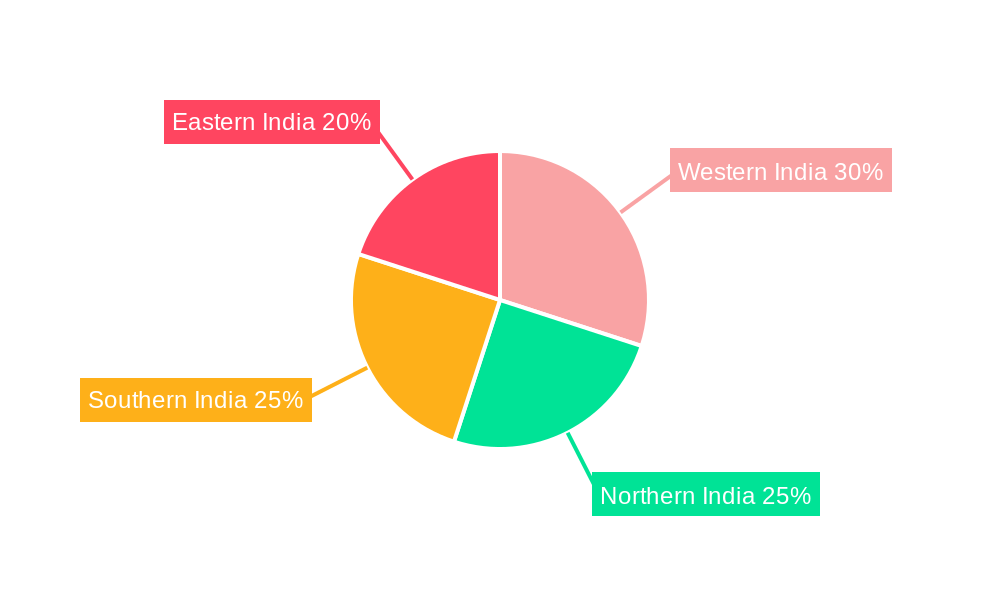

Dominant Regions, Countries, or Segments in India Capital Market Exchange Ecosystem

While the Indian capital market is largely national in scope, certain regions and segments demonstrate more robust growth. Metropolitan areas such as Mumbai, Delhi, and Bangalore exhibit higher trading volumes and investor participation compared to smaller cities. The retail investor segment is exhibiting particularly strong growth, reflecting increased financial inclusion.

- Key Drivers: Government initiatives promoting financial literacy and digitalization are key drivers. Favorable economic policies and robust infrastructure also contribute significantly.

- Dominance Factors: Mumbai's established status as a financial hub, coupled with the presence of major exchanges, contributes to its dominance. The growth of the retail segment is fueled by expanding access to financial services and increasing smartphone penetration.

India Capital Market Exchange Ecosystem Product Landscape

The product landscape within the Indian capital market exchange ecosystem is remarkably diverse and continuously evolving. It encompasses a broad spectrum of offerings, ranging from traditional instruments like equities and derivatives to more specialized and innovative products such as Exchange Traded Funds (ETFs) and various investment funds. The relentless pace of technological advancement is a key catalyst for the introduction of groundbreaking products. These include innovative concepts like fractional ownership, which democratizes access to higher-value assets, and sophisticated algorithmic trading tools designed to enhance trading efficiency and precision. The unique selling propositions that resonate most strongly with market participants often revolve around delivering an exceptional user experience, championing technological innovation, and offering highly competitive pricing structures.

Key Drivers, Barriers & Challenges in India Capital Market Exchange Ecosystem

Key Drivers: Increasing financial inclusion, government initiatives, technological advancements, and a growing middle class are propelling market growth. The rise of fintech companies and their innovative solutions are also major contributors.

Key Barriers & Challenges: Regulatory hurdles, cyber security threats, infrastructure limitations in certain regions, and a lack of financial literacy among some segments of the population pose challenges. Competitive pressures from established players and new entrants impact growth. The estimated cost of regulatory compliance is xx million annually, impacting profitability.

Emerging Opportunities in India Capital Market Exchange Ecosystem

The Indian capital market exchange ecosystem is ripe with emerging opportunities. Significant untapped potential exists within the rural market segments, offering a vast new demographic for financial services. The burgeoning growth of alternative investment products is catering to a more sophisticated investor base seeking diversification beyond traditional asset classes. Furthermore, the increasing adoption of robo-advisors signifies a growing comfort with automated, technology-driven investment management solutions. The pervasive application of Artificial Intelligence (AI) and machine learning in developing advanced investment strategies presents a particularly exciting frontier, paving the way for highly personalized and dynamic investment management services.

Growth Accelerators in the India Capital Market Exchange Ecosystem Industry

Technological breakthroughs such as blockchain technology and the expansion of financial technology are significant growth catalysts. Strategic partnerships between traditional financial institutions and fintech companies will further accelerate growth. Government initiatives aimed at fostering financial inclusion and market development also play a key role.

Key Players Shaping the India Capital Market Exchange Ecosystem Market

- Taurus Corporate Advisory Services Limited

- Valuefy Solutions Private Limited

- Hedge Equities Ltd

- Sunflower Broking Pvt Ltd

- Nine Star Broking Pvt Ltd

- Research Icon

- Agroy Finance and Investment Ltd

- United Stock Exchange of India

- Basan Equity Broking Ltd

- Indira Securities P Ltd

- List Not Exhaustive

Notable Milestones in India Capital Market Exchange Ecosystem Sector

- 2020: Introduction of new regulations impacting algorithmic trading.

- 2021: Launch of several new mobile trading platforms.

- 2022: Significant increase in retail investor participation.

- 2023: Major M&A activity involving fintech companies. (Further milestones will be detailed in the full report)

In-Depth India Capital Market Exchange Ecosystem Market Outlook

The future of the Indian capital market exchange ecosystem looks promising. Continued technological innovation, increasing financial inclusion, and supportive government policies will drive substantial growth. Strategic partnerships and expansion into untapped markets will further enhance the market's potential. The market is expected to reach a size of xx million by 2033, presenting lucrative opportunities for both established players and new entrants.

India Capital Market Exchange Ecosystem Segmentation

-

1. Primary Markets

- 1.1. Equity Market

- 1.2. Debt Market

- 1.3. Corporate Governance and Compliance Monitoring

- 1.4. Corporate Restructuring

- 1.5. Intermediaries Associated

-

2. Secondary Markets

- 2.1. Cash Market

- 2.2. Equity Derivatives Markets

- 2.3. Commodity Derivatives Market

- 2.4. Currency Derivatives Market

- 2.5. Interest Rate Derivatives Market

- 2.6. Market Infrastructure Institutions

- 2.7. Intermediaries Associated

India Capital Market Exchange Ecosystem Segmentation By Geography

- 1. India

India Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of India Capital Market Exchange Ecosystem

India Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Derivatives Occupied with Major Share in the Secondary Capital Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 5.1.1. Equity Market

- 5.1.2. Debt Market

- 5.1.3. Corporate Governance and Compliance Monitoring

- 5.1.4. Corporate Restructuring

- 5.1.5. Intermediaries Associated

- 5.2. Market Analysis, Insights and Forecast - by Secondary Markets

- 5.2.1. Cash Market

- 5.2.2. Equity Derivatives Markets

- 5.2.3. Commodity Derivatives Market

- 5.2.4. Currency Derivatives Market

- 5.2.5. Interest Rate Derivatives Market

- 5.2.6. Market Infrastructure Institutions

- 5.2.7. Intermediaries Associated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taurus Corporate Advisory Services Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valuefy Solutions Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hedge Equities Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunflower Broking Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Star Broking Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Research Icon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agroy Finance and Investment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Stock Exchange of India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Basan Equity Broking Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indira Securities P Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taurus Corporate Advisory Services Limited

List of Figures

- Figure 1: India Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 2: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 3: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 5: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 6: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Capital Market Exchange Ecosystem?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the India Capital Market Exchange Ecosystem?

Key companies in the market include Taurus Corporate Advisory Services Limited, Valuefy Solutions Private Limited, Hedge Equities Ltd, Sunflower Broking Pvt Ltd, Nine Star Broking Pvt Ltd, Research Icon, Agroy Finance and Investment Ltd, United Stock Exchange of India, Basan Equity Broking Ltd, Indira Securities P Ltd **List Not Exhaustive.

3. What are the main segments of the India Capital Market Exchange Ecosystem?

The market segments include Primary Markets, Secondary Markets.

4. Can you provide details about the market size?

The market size is estimated to be USD 124 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Derivatives Occupied with Major Share in the Secondary Capital Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the India Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence