Key Insights

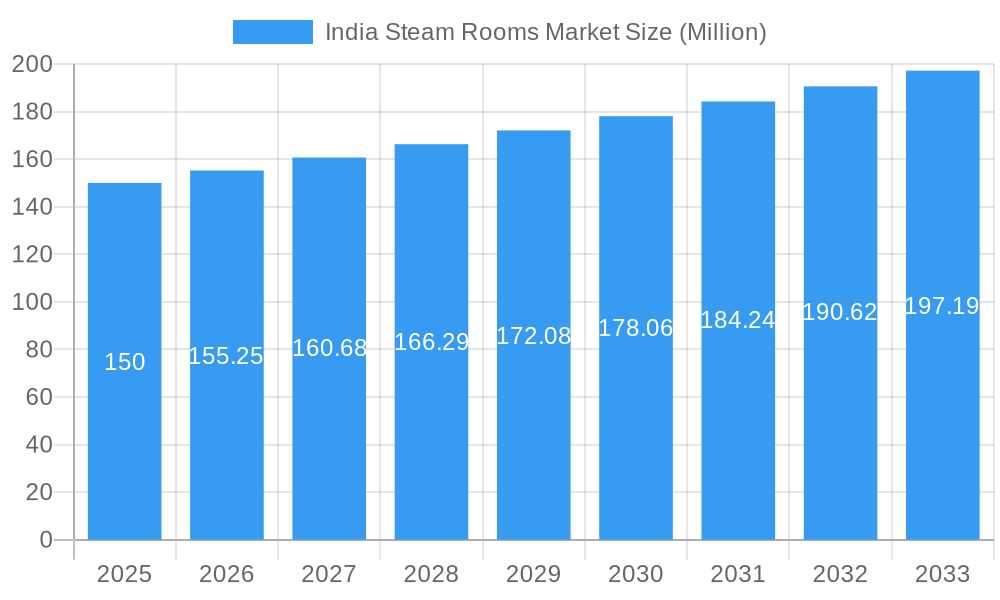

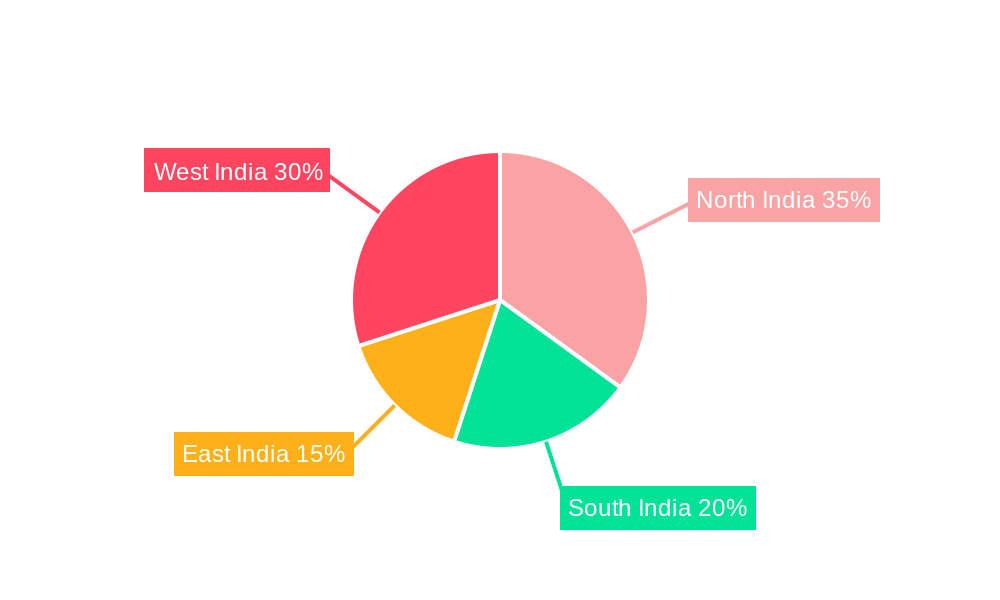

The India steam room market, projected to reach $1.6 billion by 2024, is anticipated to grow at a CAGR of 14.4% between 2025 and 2033. This robust expansion is propelled by escalating disposable incomes and a growing consumer preference for wellness and luxury home amenities among India's burgeoning middle class. Concurrently, the commercial sector, including spas, hotels, and fitness centers, is a significant contributor, driven by the rise of wellness tourism and the integration of steam rooms into comprehensive health and fitness programs. Technological advancements, such as the introduction of infrared steam rooms offering enhanced therapeutic benefits and energy efficiency, further stimulate market growth. However, substantial initial investment costs for installation and maintenance, alongside limited regional awareness regarding health advantages, pose challenges to broader market penetration. The conventional steam room segment currently dominates market share, though the infrared segment is experiencing accelerated growth due to its advanced features. The residential segment is forecasted to outpace the commercial segment in terms of growth. Leading companies, including Kohler and Hi-tech Bath Solutions, are actively contributing through product innovation and strategic expansion. Urban centers in North and West India exhibit higher adoption rates, while South and East India present considerable untapped market potential.

India Steam Rooms Market Market Size (In Billion)

The market's future trajectory indicates sustained growth, fueled by the expanding middle class, heightened health consciousness, and the emergence of new players introducing diverse product portfolios and competitive pricing. While cost and awareness remain pertinent challenges, strategic marketing efforts emphasizing health benefits and flexible financing solutions can mitigate these barriers. The market is expected to witness a transition towards more advanced and energy-efficient steam room technologies, further boosting demand and redefining the competitive landscape. Prioritizing customer experience and post-sales services will be paramount for sustained success in this expanding market.

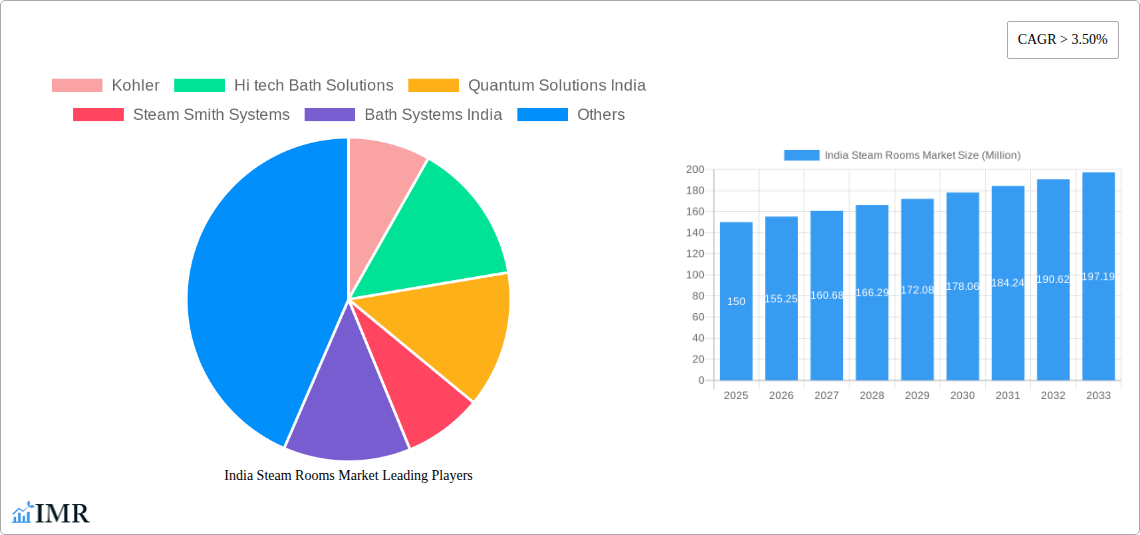

India Steam Rooms Market Company Market Share

India Steam Rooms Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India steam rooms market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. With a focus on both the parent market (wellness and bathroom fixtures) and the child market (steam rooms), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in million units.

India Steam Rooms Market Dynamics & Structure

The Indian steam rooms market is characterized by moderate concentration, with a few key players dominating the landscape alongside numerous smaller regional players. Technological innovation, particularly in energy efficiency and smart home integration, is a significant driver, while regulatory compliance (related to safety and energy consumption) plays a crucial role. The market faces competition from other relaxation methods (e.g., saunas, hot tubs), impacting adoption rates. End-user demographics show increasing demand from the upper-middle and higher-income segments, both residential and commercial. M&A activity remains relatively low, with xx deals recorded in the past five years, representing xx% market share consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on energy-efficient systems, smart controls, and aesthetically pleasing designs.

- Regulatory Framework: Adherence to safety standards and energy efficiency norms is crucial.

- Competitive Substitutes: Saunas, hot tubs, and other relaxation therapies pose competitive pressure.

- End-User Demographics: Growing demand from affluent residential and commercial sectors.

- M&A Trends: Relatively low M&A activity, with xx deals recorded between 2019 and 2024.

India Steam Rooms Market Growth Trends & Insights

The Indian steam rooms market exhibited steady growth during the historical period (2019-2024), with a CAGR of xx%. The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing disposable incomes, a growing awareness of wellness and therapeutic benefits of steam bathing, and the rising adoption of luxurious bathroom fixtures in both residential and commercial settings. Technological advancements, like the introduction of smart steam generators and infrared technology, are further driving market expansion. Consumer behavior is shifting towards premium, energy-efficient, and technologically advanced steam room solutions. Market penetration remains relatively low, with approximately xx% of households owning a steam room in 2024, indicating substantial future growth potential.

Dominant Regions, Countries, or Segments in India Steam Rooms Market

The metropolitan cities of India (Mumbai, Delhi, Bangalore, Chennai, etc.) constitute the dominant market for steam rooms, driven by higher disposable incomes and increased preference for luxury living. Within the segment breakdown, the residential segment currently dominates, accounting for approximately xx% of the market in 2024. However, the commercial segment (hotels, spas, fitness centers) is expected to witness faster growth due to increasing investment in hospitality and wellness infrastructure. In terms of type, conventional steam rooms hold a larger market share than infrared steam rooms, though the infrared segment is demonstrating higher growth.

- Key Drivers for Metropolitan Cities: High disposable incomes, luxury housing growth, and increasing awareness of wellness.

- Residential Segment Dominance: Driven by rising disposable incomes and changing lifestyles.

- Commercial Segment Growth: Fueled by increasing investment in hospitality and wellness infrastructure.

- Conventional Steam Room Market Share: Currently holds the larger share but infrared steam rooms are growing faster.

India Steam Rooms Market Product Landscape

The Indian steam rooms market offers a variety of products, ranging from basic conventional steam generators to advanced infrared units with smart features. Product innovation focuses on enhancing energy efficiency, improving user experience, and incorporating advanced control systems. Many manufacturers emphasize unique selling propositions such as space-saving designs, customizable features, and easy installation. Technological advancements include the integration of aromatherapy features, chromotherapy lighting, and mobile app control.

Key Drivers, Barriers & Challenges in India Steam Rooms Market

Key Drivers: Rising disposable incomes, increasing health consciousness, growing preference for luxurious bathrooms, and technological advancements in steam room technology.

Challenges: High initial investment costs, lack of awareness among a significant portion of the population, limited availability of skilled installers and maintenance personnel, and competition from alternative relaxation methods. These challenges result in a xx% reduction in the projected market growth during the forecast period.

Emerging Opportunities in India Steam Rooms Market

Emerging opportunities include expanding into tier-2 and tier-3 cities, catering to the growing wellness tourism sector, and developing innovative product offerings incorporating AI-powered features and integration with smart home ecosystems. The increasing popularity of wellness retreats and spas presents a significant opportunity for commercial steam room installations. The untapped market in smaller cities offers substantial growth potential as awareness of steam rooms increases.

Growth Accelerators in the India Steam Rooms Market Industry

Strategic partnerships between manufacturers and interior designers, expansion of distribution networks, and focused marketing campaigns targeting specific demographics are key growth catalysts. Technological innovations in energy-efficient steam generation and integrated wellness features can further fuel market growth. Investment in research and development to create compact and affordable steam rooms for smaller homes could accelerate adoption.

Key Players Shaping the India Steam Rooms Market Market

- Kohler

- Hi tech Bath Solutions

- Quantum Solutions India

- Steam Smith Systems

- Bath Systems India

- Orion Bathing Concepts

- Potent Water Care

- Steamers India

- Omega Bath Solutions

- Woven Gold India

Notable Milestones in India Steam Rooms Market Sector

- 2021: Hitech bath solutions launched a new indoor steam room, seating up to five individuals, designed for easy home assembly.

In-Depth India Steam Rooms Market Market Outlook

The Indian steam rooms market is poised for robust growth over the forecast period, driven by favorable demographic trends, rising disposable incomes, and increasing adoption of wellness practices. Strategic investments in product innovation, expansion into untapped markets, and development of effective distribution channels will be crucial for companies seeking to capitalize on the emerging opportunities within this dynamic sector. The focus on energy efficiency and smart features will be a key differentiator in the competitive landscape.

India Steam Rooms Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Steam Rooms Market Segmentation By Geography

- 1. India

India Steam Rooms Market Regional Market Share

Geographic Coverage of India Steam Rooms Market

India Steam Rooms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.144% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Urbanization; Advancements in Kitchen Technology

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Growth in Tourism is Driving the Indian Steam Room Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steam Rooms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kohler

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hi tech Bath Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Quantum Solutions India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Steam Smith Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bath Systems India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orion Bathing Concepts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Potent Water Care**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Steamers India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omega Bath Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Woven Gold India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kohler

List of Figures

- Figure 1: India Steam Rooms Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Steam Rooms Market Share (%) by Company 2025

List of Tables

- Table 1: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Steam Rooms Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: India Steam Rooms Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: India Steam Rooms Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Steam Rooms Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Steam Rooms Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Steam Rooms Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Steam Rooms Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steam Rooms Market?

The projected CAGR is approximately 0.144%.

2. Which companies are prominent players in the India Steam Rooms Market?

Key companies in the market include Kohler, Hi tech Bath Solutions, Quantum Solutions India, Steam Smith Systems, Bath Systems India, Orion Bathing Concepts, Potent Water Care**List Not Exhaustive, Steamers India, Omega Bath Solutions, Woven Gold India.

3. What are the main segments of the India Steam Rooms Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Urbanization; Advancements in Kitchen Technology.

6. What are the notable trends driving market growth?

Growth in Tourism is Driving the Indian Steam Room Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In 2021, Hitech bath solutions launched a new steam room. It is an indoor model that seats up to five individuals. The entire sauna showcases a beautiful blending of vertical and horizontal lines and is designed for corner placement. The panels, backrests, and benches come pre-assembled for an easy, seamless in-home assembly by two individuals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steam Rooms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steam Rooms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steam Rooms Market?

To stay informed about further developments, trends, and reports in the India Steam Rooms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence