Key Insights

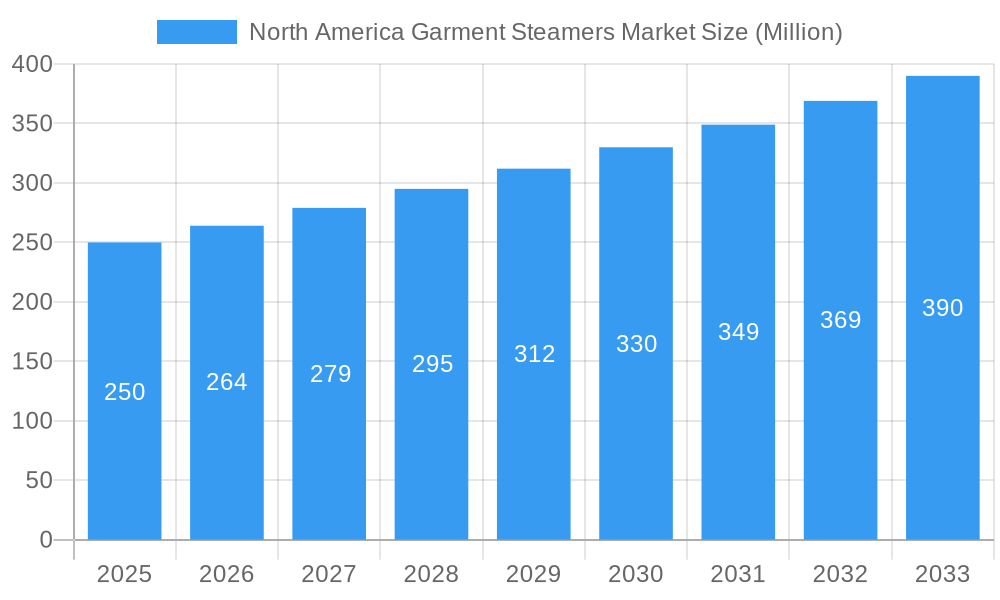

The North American garment steamer market, valued at approximately $XXX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.67% from 2025 to 2033. This expansion is driven by several key factors. The increasing popularity of fast fashion and a growing preference for wrinkle-free clothing among consumers are significant contributors. Furthermore, the convenience and ease of use of garment steamers compared to traditional ironing methods are attracting a wider customer base, particularly among younger demographics. The market is segmented by product type (handheld, upright, tank), tank type (fixed, removable), and distribution channel (multi-brand stores, specialty stores, online, others). The prevalence of e-commerce platforms is further fueling market growth, offering consumers wider product choices and convenient purchasing options. While the market faces restraints such as the higher initial cost of some steamer models compared to irons and potential concerns about water usage, these are being offset by the rising demand for efficient and convenient clothing care solutions. The dominance of key players like Panasonic, Groupe SEB SA, and Philips indicates a competitive landscape, but the market's growth trajectory suggests ample opportunities for both established and emerging brands.

North America Garment Steamers Market Market Size (In Million)

The United States currently represents the largest segment within the North American market, followed by Canada, driven by higher disposable incomes and greater adoption of technologically advanced garment care products. The increasing popularity of travel-friendly handheld steamers is fueling segment growth. The removable tank segment is gaining popularity due to its convenience and ease of refilling, while online distribution channels are experiencing the fastest growth rate within the distribution channels, fueled by consumer preference for online shopping and targeted marketing campaigns by leading brands. The forecast period (2025-2033) suggests a continued upward trend, driven by a sustained focus on convenient and effective laundry solutions and the incorporation of advanced features such as steam level adjustments and safety features. This positive outlook indicates a lucrative market with continued expansion potential across all segments.

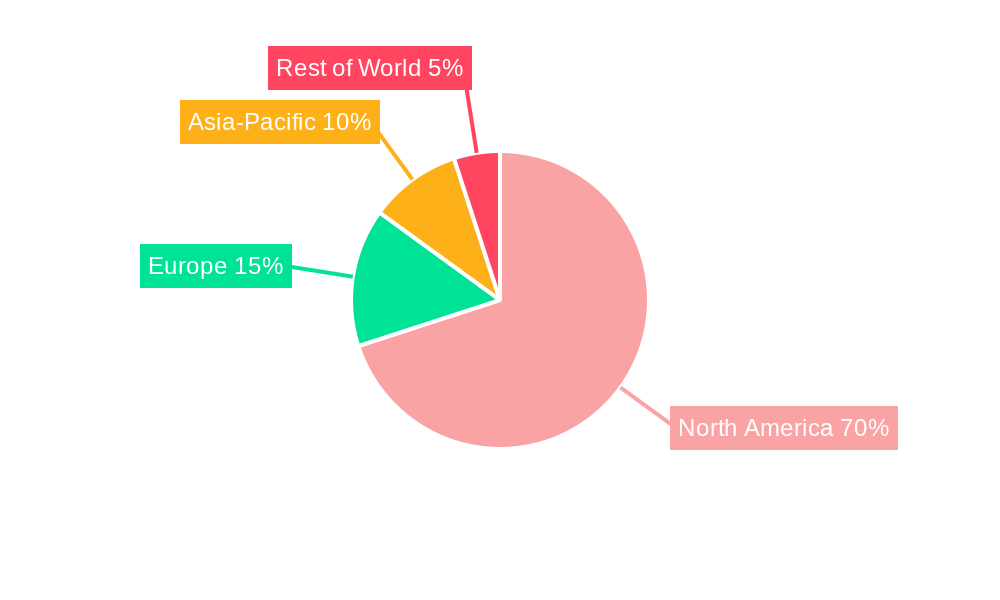

North America Garment Steamers Market Company Market Share

North America Garment Steamers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Garment Steamers Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report uses Million units as the unit of measurement for all market values.

North America Garment Steamers Market Dynamics & Structure

The North America garment steamers market is characterized by moderate concentration, with key players like Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, and Jiffy Steamer Company holding significant market share. The market is driven by technological innovations focusing on enhanced steam output, portability, and ease of use. Regulatory frameworks concerning energy efficiency and product safety play a significant role. Competitive substitutes include irons and dry cleaning services, though the convenience and effectiveness of garment steamers are steadily gaining popularity. The end-user demographics comprise a broad range, from households to commercial laundries, with a growing segment of fashion-conscious individuals and professionals. M&A activity has been relatively moderate in recent years, exemplified by Hillhouse Capital's acquisition of Philips' home appliance business in April 2022, signaling potential for future consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on improved steam technology, energy efficiency, and smart features.

- Regulatory Framework: Compliance with safety and energy efficiency standards influences product design and manufacturing.

- Competitive Substitutes: Irons, dry cleaning services.

- End-User Demographics: Households, commercial laundries, fashion-conscious individuals, professionals.

- M&A Activity: Moderate, with recent acquisitions highlighting industry consolidation potential (e.g., Philips home appliances acquisition).

North America Garment Steamers Market Growth Trends & Insights

The North American garment steamers market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. The market is projected to continue its growth trajectory, with a forecasted CAGR of xx% during the forecast period (2025-2033), driven by increasing disposable incomes, growing demand for convenient and efficient clothing care solutions, and the rising popularity of online retail channels. Technological advancements, such as cordless models and improved steam technology, are further fueling market expansion. Consumer behavior is shifting towards premium, feature-rich steamers, particularly among younger demographics prioritizing convenience and efficiency. Market penetration remains relatively low, presenting significant growth opportunities in the coming years. Adoption rates are increasing steadily, particularly in urban areas.

Dominant Regions, Countries, or Segments in North America Garment Steamers Market

The North American garment steamers market is significantly driven by the United States, representing the largest market share, followed by Canada and the remaining North American regions. Within the product landscape, handheld garment steamers dominate due to their affordability, portability, and ease of use. The preference for removable tank models over fixed tank models continues to increase, offering greater flexibility to users. The online sales channel is experiencing remarkable growth, outpacing both specialty and multi-brand stores, reflecting the increasing prevalence of e-commerce and consumer preference for online shopping. Several key factors contribute to this market's robust growth:

- United States: A substantial population base coupled with high disposable incomes and a well-developed online retail infrastructure fuels significant demand for convenient home appliances like garment steamers.

- Canada: The Canadian market exhibits a rising trend in the adoption of convenient and time-saving home appliances, driving growth in the garment steamer segment.

- Handheld Segment Dominance: The portability and affordability of handheld models make them particularly appealing to a broad consumer base.

- Removable Tank Preference: The flexibility and convenience associated with removable water tanks are key factors influencing consumer purchasing decisions.

- Online Channel Growth: The expanding reach of e-commerce and the preference for online purchasing are major contributors to the market's significant online sales growth.

North America Garment Steamers Market Product Landscape

Continuous innovation within the garment steamer market is characterized by advancements in steam technology leading to faster wrinkle removal. Manufacturers are focusing on improving durability, incorporating ergonomic designs for enhanced user comfort, and integrating smart features, including app connectivity for personalized steam settings. Lightweight designs and compact storage solutions are also key design considerations. Key performance indicators for consumers include steam output, heating-up time, water tank capacity, and overall ease of use. Competitive differentiation is achieved through features such as automatic shut-off, adjustable steam settings, and specialized attachments designed for delicate fabrics. The market is witnessing the introduction of steamers with enhanced features, like improved pressure systems for deeper wrinkle penetration and advanced fabric sensors for automatic steam level adjustments.

Key Drivers, Barriers & Challenges in North America Garment Steamers Market

Key Drivers:

- Rising disposable incomes and increased consumer spending on home appliances.

- Growing awareness of the convenience and effectiveness of garment steamers compared to traditional ironing.

- Expanding online retail channels and e-commerce platforms.

- Technological advancements leading to improved product features and performance.

Key Challenges & Restraints:

- High initial investment costs compared to traditional ironing methods could hinder market penetration.

- Potential concerns regarding the environmental impact of energy consumption and water usage.

- Competition from other apparel care solutions such as dry cleaning and laundry services.

Emerging Opportunities in North America Garment Steamers Market

Untapped markets exist in rural areas with limited access to professional laundry services. Opportunities exist for specialized garment steamers catering to niche needs, like delicate fabrics or large-volume commercial use. Evolving consumer preferences toward sustainable and eco-friendly products present opportunities for manufacturers to offer steamers with reduced energy consumption and recyclable materials.

Growth Accelerators in the North America Garment Steamers Market Industry

Technological breakthroughs in steam generation and energy efficiency will significantly boost market growth. Strategic partnerships between manufacturers and retailers can optimize distribution and marketing efforts. Aggressive expansion strategies into untapped markets, especially in rural areas and through targeted online campaigns, will unlock new growth opportunities.

Key Players Shaping the North America Garment Steamers Market Market

- Panasonic

- Groupe SEB SA

- Philips

- Haier Group Corporation

- Reliable Corporation

- Pursteam

- Salav

- Maryant

- Jiffy Steamer Company

- Midea

Notable Milestones in North America Garment Steamers Market Sector

- April 2022: Hillhouse Capital's acquisition of Philips' home appliances business signifies a potential shift in the market's competitive dynamics, impacting the garment steamer segment.

- February 2023: Haier Group Corporation's launch of 83 new smart home products suggests a potential expansion of their garment steamer offerings with enhanced smart features, although specific details regarding garment steamers remain limited.

- Ongoing Trends: Increased focus on sustainability with eco-friendly materials and energy-efficient designs is shaping the industry. Moreover, the rise of subscription models for steamer rentals and repairs presents a new business model in the market.

In-Depth North America Garment Steamers Market Market Outlook

The North America garment steamers market is poised for significant growth in the coming years, driven by technological advancements, increasing consumer demand, and strategic market expansion initiatives. Opportunities abound in leveraging e-commerce, developing sustainable products, and targeting niche market segments. The market's future success hinges on innovation, strategic partnerships, and effectively addressing consumer needs for efficient and convenient apparel care solutions.

North America Garment Steamers Market Segmentation

-

1. Product Type

- 1.1. Handheld

- 1.2. Upright

-

2. Tank Type

- 2.1. Fixed

- 2.2. Removable

-

3. Distribution Channel

- 3.1. Multi brands store

- 3.2. Speciality Store

- 3.3. Online

- 3.4. Other Distribution Channel

North America Garment Steamers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Garment Steamers Market Regional Market Share

Geographic Coverage of North America Garment Steamers Market

North America Garment Steamers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gentle and Safe on Fabrics

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. United States Leading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Garment Steamers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Handheld

- 5.1.2. Upright

- 5.2. Market Analysis, Insights and Forecast - by Tank Type

- 5.2.1. Fixed

- 5.2.2. Removable

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi brands store

- 5.3.2. Speciality Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe SEB SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reliable Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pursteam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salav

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maryant

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jiffy Steamer Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: North America Garment Steamers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Garment Steamers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 4: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 5: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Garment Steamers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Garment Steamers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 12: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 13: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Garment Steamers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Garment Steamers Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Garment Steamers Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the North America Garment Steamers Market?

Key companies in the market include Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company, Midea.

3. What are the main segments of the North America Garment Steamers Market?

The market segments include Product Type, Tank Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Gentle and Safe on Fabrics.

6. What are the notable trends driving market growth?

United States Leading the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

February 2023: Haier Group Corporation expanded its product portfolio with the launch of 83 new-age products of smart home solutions. Among the products, it includes Android and Google-certified Smart LED TVs, Wi-Fi-enabled Washing Machines, the new Clean Cool Range of ACs with the largest indoor unit in the industry, and Smart Refrigerators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Garment Steamers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Garment Steamers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Garment Steamers Market?

To stay informed about further developments, trends, and reports in the North America Garment Steamers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence