Key Insights

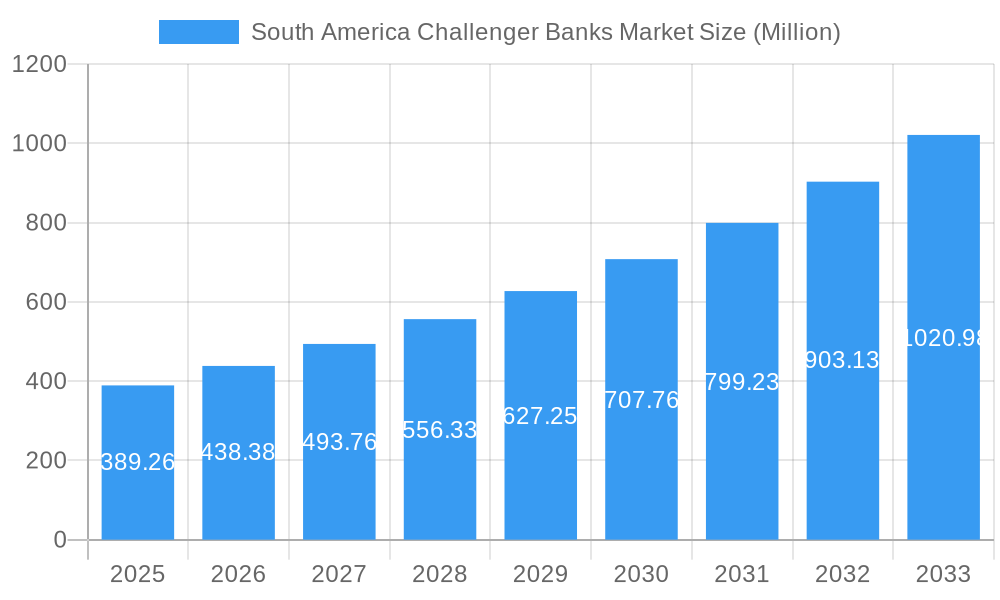

The South American challenger bank market, valued at $389.26 million in 2025, is experiencing robust growth, projected to expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 12.57% indicates a substantial increase in market size driven by several key factors. Rising smartphone penetration and internet access across the region are fueling the adoption of digital banking services, particularly among younger demographics. Furthermore, increasing dissatisfaction with traditional banking institutions, perceived as slow, inefficient, and expensive, is driving consumers towards the innovative and often more user-friendly offerings of challenger banks. These banks leverage technology to provide seamless, cost-effective services, including mobile-first platforms, personalized financial management tools, and competitive fee structures. While regulatory hurdles and infrastructural limitations in certain areas pose challenges, the overall market trajectory remains positive, supported by consistent investment in fintech and a growing preference for digital financial solutions.

South America Challenger Banks Market Market Size (In Million)

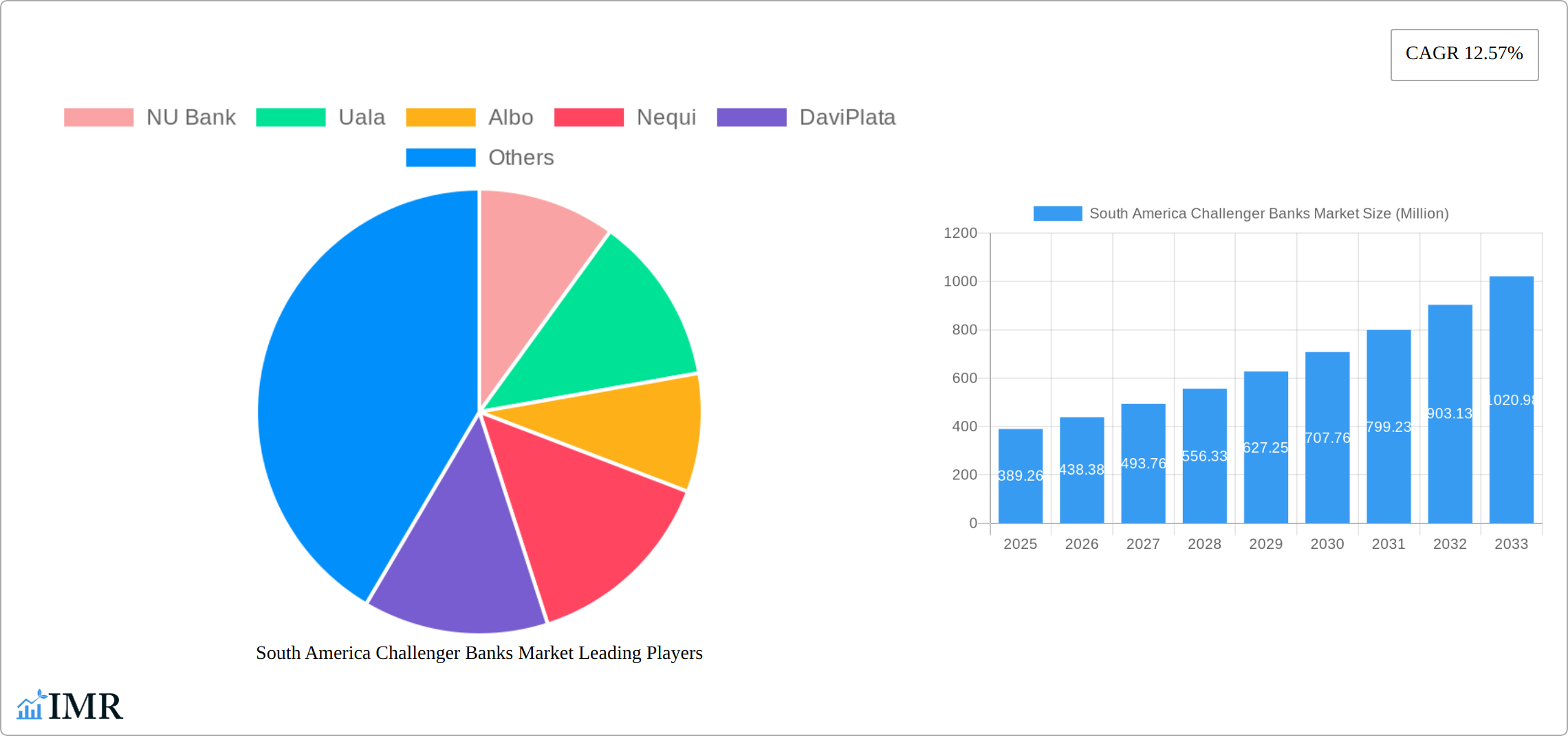

The competitive landscape is dynamic, with prominent players like NU Bank, Uala, Albo, Nequi, DaviPlata, Banco Inter, Neon, C6 Bank, and Burbank leading the charge. These companies are continuously innovating to enhance their services, expand their customer base, and differentiate themselves from both incumbents and emerging competitors. Successful strategies involve strategic partnerships, aggressive marketing campaigns targeting underserved populations, and a focus on building strong brand loyalty through superior customer experience. Market segmentation is likely evolving, with potential divisions based on customer demographics, service offerings (e.g., personal banking, business banking), and geographic location. The continued growth hinges on maintaining technological innovation, effective risk management, and successful navigation of evolving regulatory environments. Expansion into underserved areas and the development of inclusive financial products will be critical for future market dominance.

South America Challenger Banks Market Company Market Share

South America Challenger Banks Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America challenger banks market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The study delves into key segments within the broader Fintech and Financial Services industry, offering valuable insights for investors, industry professionals, and strategic decision-makers. Market values are presented in millions of units.

South America Challenger Banks Market Dynamics & Structure

This section analyzes the South American challenger bank market's structure, identifying key drivers and challenges. We explore market concentration, technological innovations, regulatory landscapes, competitive dynamics, and the influence of mergers and acquisitions (M&A).

Market Concentration: The market exhibits a relatively concentrated landscape, with a few dominant players commanding significant market share. NU Bank, for instance, holds a substantial portion, while others like Uala, Albo, and Nubank compete fiercely for market share. [Insert quantified market share data for each major player if available, otherwise, use xx%]. The overall market concentration ratio (CRx) is estimated at xx% in 2025.

Technological Innovation Drivers: The rapid adoption of mobile technology and digital payments fuels innovation. Challenger banks leverage AI, big data analytics, and open banking APIs to offer personalized services and improved customer experience. This also leads to faster product development and more efficient operations.

Regulatory Frameworks: Regulatory changes and the varying approaches across South American countries significantly impact market growth. Variations in licensing requirements and data privacy regulations present both opportunities and challenges for expansion.

Competitive Product Substitutes: Traditional banks remain significant competitors, although they are adapting to the digital revolution. Other fintech solutions, such as mobile payment apps and peer-to-peer lending platforms, also represent indirect substitutes.

End-User Demographics: The market is largely driven by the growing Millennial and Gen Z population, who are tech-savvy and prefer digital-first financial services. This demographic shift creates a substantial opportunity for challenger banks.

M&A Trends: The industry has witnessed a notable level of M&A activity in recent years. [Insert estimated number or range of M&A deals between 2019-2024, if available, otherwise use xx]. These deals reflect the consolidation of market players and efforts to gain a competitive edge.

- Innovation Barriers: High initial investment costs, talent acquisition challenges, and the need for robust cybersecurity measures create significant barriers to entry.

South America Challenger Banks Market Growth Trends & Insights

The South American challenger banks market is experiencing substantial growth, fueled by rising smartphone penetration, expanding internet access, and increasing financial inclusion. The market size was valued at USD [Insert market size value in Millions for 2019] Million in 2019, and is projected to reach USD [Insert market size value in Millions for 2024] Million by 2024, with an estimated growth to USD [Insert market size value in Millions for 2025] Million by 2025. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be xx%, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration is increasing steadily, with more consumers adopting digital banking services. Technological disruptions, like the emergence of embedded finance and open banking, further contribute to market expansion. Consumer behavior is shifting rapidly toward convenient and personalized digital financial solutions, driving the growth of challenger banks. This trend is further reinforced by decreasing trust in traditional banking institutions among younger demographics, who are actively seeking more agile and customer-centric alternatives.

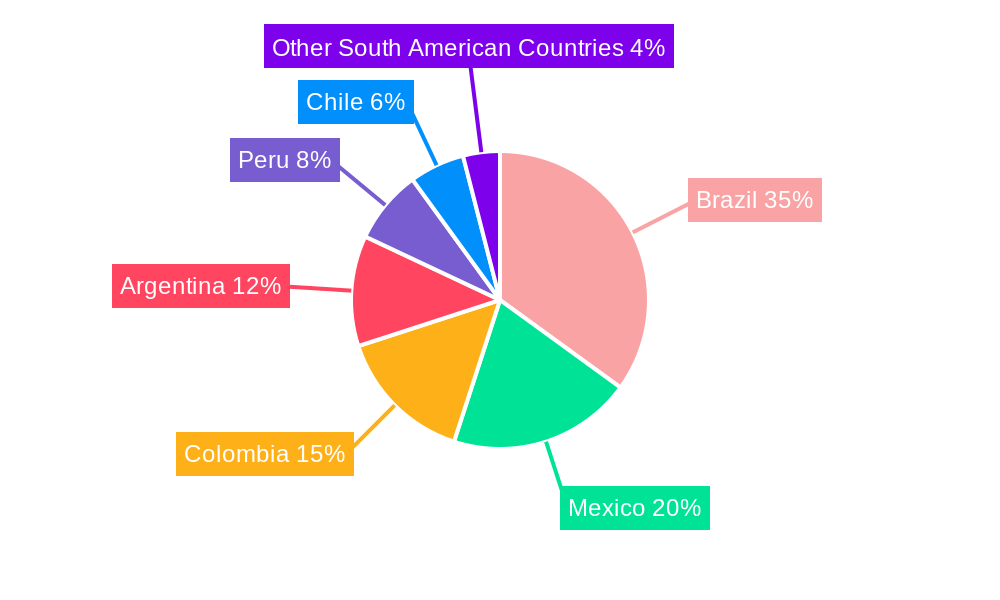

Dominant Regions, Countries, or Segments in South America Challenger Banks Market

Brazil represents the largest market within South America, owing to its large population, high smartphone penetration, and relatively developed fintech ecosystem. [Insert market share and growth projections (in Millions) for Brazil in 2025 and 2033, if available, otherwise use xx]. Mexico and Colombia are also significant markets with considerable growth potential, driven by their burgeoning digital economies and young populations.

Key Drivers in Brazil: A supportive regulatory environment, a large underserved population, and a vibrant startup ecosystem contribute to Brazil's dominance.

Key Drivers in Mexico: Increasing internet and mobile penetration, coupled with government initiatives promoting financial inclusion, are driving market growth.

Key Drivers in Colombia: Similar to Mexico, a growing digital economy and government focus on financial technology are fueling the expansion of the challenger banking sector.

Market dominance is determined by factors such as market share, regulatory conditions, technological advancements, and the intensity of competition. While Brazil currently leads, other countries have the potential to catch up quickly, depending on policy changes, investment, and consumer adoption rates.

South America Challenger Banks Market Product Landscape

Challenger banks in South America offer a comprehensive suite of digital financial products designed for the modern consumer. This includes intuitive mobile-first current accounts, high-yield digital savings accounts, accessible credit cards with competitive rates, streamlined personal loans, and user-friendly investment platforms. These offerings are distinguished by their exceptionally user-friendly interfaces, robust personalized financial management tools that empower users to track spending and set budgets, and notably competitive pricing structures that often undercut traditional banks. Cutting-edge technological advancements such as AI-powered fraud detection systems provide enhanced security, while personalized financial advice helps users make informed decisions. The unwavering focus on delivering seamless digital experiences and pioneering innovative financial tools are the core pillars that attract and retain customers, setting them apart from the legacy offerings of traditional financial institutions.

Key Drivers, Barriers & Challenges in South America Challenger Banks Market

Key Drivers: The rapid adoption of smartphones and widespread internet access across the continent are foundational drivers. This is complemented by a surging demand for convenient and accessible digital financial services, especially among populations previously underserved by traditional banking. Governments are also playing a crucial role through initiatives aimed at promoting fintech innovation and enhancing financial inclusion. The inherent desire for greater financial inclusion among vast segments of the South American population also presents a significant tailwind.

Key Challenges: Navigating the evolving and sometimes uncertain regulatory landscape presents a significant challenge for new entrants. Ensuring robust cybersecurity measures to protect sensitive customer data is paramount and requires continuous investment. The competitive pressure from well-established traditional banks, which are increasingly adopting digital strategies, alongside a crowded fintech ecosystem, intensifies the market. Infrastructure limitations in certain remote or less-developed regions can also pose operational hurdles. Furthermore, effectively educating users on digital financial tools and ensuring widespread financial literacy are crucial for sustained adoption. Managing operational costs in a highly competitive and cost-sensitive market remains a persistent challenge for challenger banks.

Emerging Opportunities in South America Challenger Banks Market

Significant untapped markets exist within South America, particularly in less-developed regions with historically lower rates of financial inclusion. The growing embrace of Open Banking APIs by regulators and financial institutions presents a fertile ground for the development of innovative, interoperable financial products and strategic partnerships. Catering to the increasingly sophisticated and specific needs of various consumer segments, most notably small and medium-sized enterprises (SMEs), which often find traditional banking services cumbersome, holds substantial growth potential. The burgeoning gig economy and the demand for flexible financial solutions also represent lucrative avenues for challenger banks.

Growth Accelerators in the South America Challenger Banks Market Industry

Strategic collaborations with leading technology providers for platform development and enhanced service delivery are crucial growth accelerators. Expanding operations into underserved and emerging markets within the continent will unlock new customer bases. The continuous development and introduction of innovative financial products, such as seamlessly integrated embedded finance solutions and flexible Buy Now, Pay Later (BNPL) options, will significantly boost market traction. Technological breakthroughs, particularly advancements in artificial intelligence (AI) and machine learning (ML), are pivotal for improving personalized customer experiences, streamlining backend operations, and enhancing risk management, thereby driving sustained expansion and market leadership.

Key Players Shaping the South America Challenger Banks Market Market

- NU Bank

- Uala

- Albo

- Nequi

- DaviPlata

- Banco Inter

- Neon

- C6 bank

- Burbank

- List Not Exhaustive

Notable Milestones in South America Challenger Banks Market Sector

- November 2023: N26 exits the Brazilian market.

- October 2023: Nubank launches over 40 new products and features.

In-Depth South America Challenger Banks Market Market Outlook

The South America challenger banks market exhibits robust growth potential, fueled by continued digital adoption, expanding financial inclusion, and supportive regulatory changes. Strategic partnerships, technological innovations, and a focus on underserved segments will define the future market landscape. The increasing demand for personalized financial services and convenient digital solutions will continue driving market expansion throughout the forecast period.

South America Challenger Banks Market Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Account

- 1.4. Consumer Credit

- 1.5. Loans

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

South America Challenger Banks Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Challenger Banks Market Regional Market Share

Geographic Coverage of South America Challenger Banks Market

South America Challenger Banks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Fintech Investments in South America Fueling the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Challenger Banks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Account

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NU Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nequi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DaviPlata

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Banco Inter

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Neon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 C6 bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Burbank**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NU Bank

List of Figures

- Figure 1: South America Challenger Banks Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Challenger Banks Market Share (%) by Company 2025

List of Tables

- Table 1: South America Challenger Banks Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Challenger Banks Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 3: South America Challenger Banks Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 4: South America Challenger Banks Market Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 5: South America Challenger Banks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Challenger Banks Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South America Challenger Banks Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Challenger Banks Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 9: South America Challenger Banks Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: South America Challenger Banks Market Volume Billion Forecast, by End-User Type 2020 & 2033

- Table 11: South America Challenger Banks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Challenger Banks Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Challenger Banks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Challenger Banks Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Challenger Banks Market?

The projected CAGR is approximately 12.57%.

2. Which companies are prominent players in the South America Challenger Banks Market?

Key companies in the market include NU Bank, Uala, Albo, Nequi, DaviPlata, Banco Inter, Neon, C6 bank, Burbank**List Not Exhaustive.

3. What are the main segments of the South America Challenger Banks Market?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 389.26 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Fintech Investments in South America Fueling the Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2023, N26, a German challenger bank, announced its exit from Brazil, marking the end of its two-year stint in the South American market. This move aligns with N26's strategic shift in geographical focus. The bank made its foray into Brazil in 2021, having obtained a Sociedade de Crédito Direto (SCD) license from the Banco Central do Brasil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Challenger Banks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Challenger Banks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Challenger Banks Market?

To stay informed about further developments, trends, and reports in the South America Challenger Banks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence