Key Insights

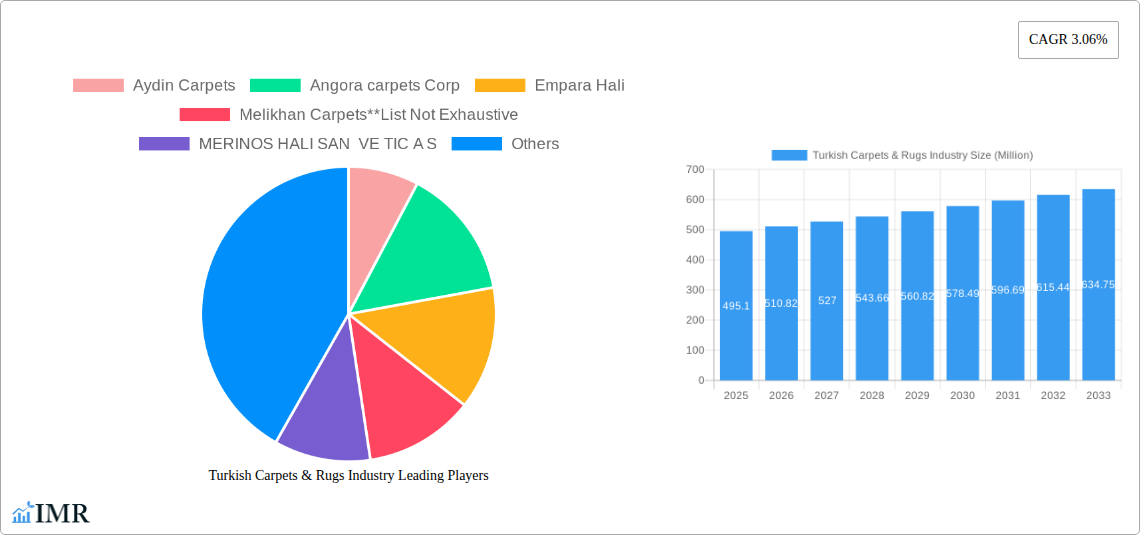

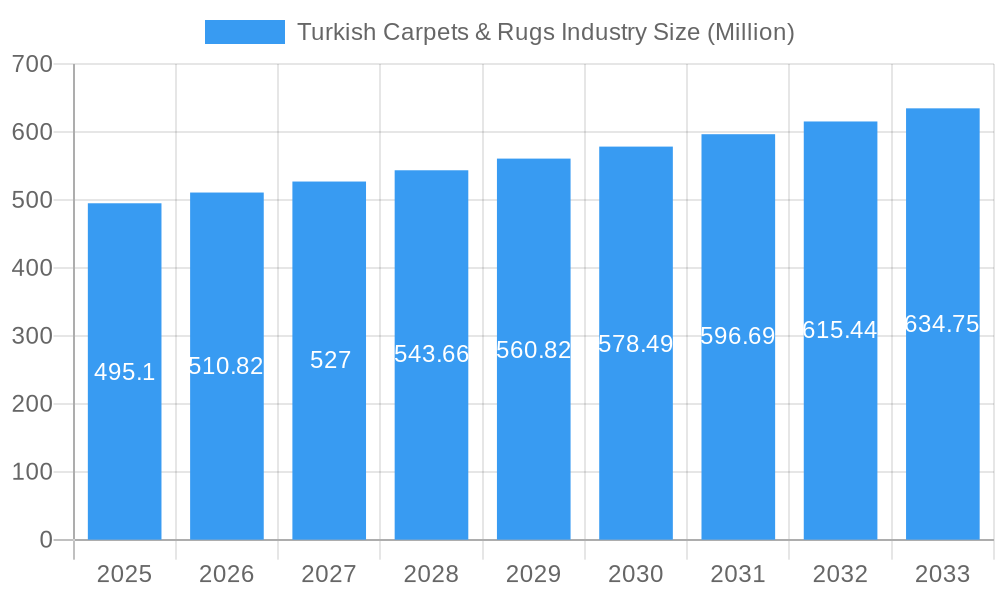

The Turkish carpets and rugs industry, valued at $495.10 million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 3.06% from 2025 to 2033. This growth is fueled by several key factors. The increasing popularity of handcrafted and traditional home décor globally contributes significantly to demand. Furthermore, the rising disposable incomes in developing economies, coupled with a growing preference for luxurious and aesthetically pleasing home furnishings, is boosting sales. The industry benefits from a diverse product portfolio, encompassing tufted, woven, needle-punched, knotted, and other types of carpets and rugs, catering to varied consumer preferences and price points. Strong online sales channels are supplementing traditional offline distribution via contractors and retail outlets, further enhancing market reach. However, challenges exist, including fluctuations in raw material prices (wool, silk, cotton) and increasing competition from synthetic carpet manufacturers offering lower-priced alternatives. The industry’s segmentation also plays a role; the residential application segment is dominant, but the commercial sector shows promise for future expansion, as businesses seek high-quality, durable floor coverings. This segment's growth will depend on construction projects and commercial renovations. Geographic distribution indicates that while data for specific regions is unavailable, the industry's prominence suggests a global footprint. Further expansion is likely to focus on strategic partnerships, branding initiatives, and innovative designs to stay ahead of competitors. The established players listed, including Aydin Carpets, Angora Carpets Corp, and others, are crucial in driving innovation and setting industry standards.

Turkish Carpets & Rugs Industry Market Size (In Million)

The future success of the Turkish carpets and rugs industry hinges on its ability to adapt to evolving consumer preferences, embrace sustainable practices, and leverage technological advancements in production and marketing. Addressing the challenges of fluctuating raw material costs and intensifying competition will be crucial for maintaining the projected growth trajectory. The industry’s ability to highlight its unique heritage and the craftsmanship inherent in its products will be key to sustaining its market position amidst global competition. Investing in digital marketing and building strong e-commerce platforms to reach a broader international customer base will play a significant role. Finally, collaborations between producers and designers will be instrumental in creating innovative and contemporary designs that meet the ever-changing needs of a global consumer market.

Turkish Carpets & Rugs Industry Company Market Share

Turkish Carpets & Rugs Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Turkish carpets and rugs industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector.

Turkish Carpets & Rugs Industry Market Dynamics & Structure

The Turkish carpets and rugs industry is characterized by a moderately concentrated market, with several key players holding significant market share. However, a large number of smaller, regional producers also contribute to the overall market volume. Technological innovation, particularly in materials and manufacturing processes, is a key driver of growth, although barriers to adoption (high initial investment costs, limited access to advanced technology for smaller firms) exist. Regulatory frameworks concerning product safety and environmental standards influence production practices. The industry faces competition from synthetic flooring options and imports, creating pricing pressure. Consumer demographics are shifting, with a growing demand for modern designs and sustainable materials. Mergers and acquisitions (M&A) activity has been moderate in recent years, with larger players seeking to consolidate market share and expand their product portfolios. The total M&A deal volume between 2019-2024 was approximately xx Million USD.

- Market Concentration: Moderately concentrated, with a few major players and numerous smaller firms.

- Technological Innovation: Driven by advancements in materials (e.g., sustainable yarns), manufacturing techniques (automation), and design software.

- Regulatory Framework: Compliance with safety and environmental standards impacts production costs and market access.

- Competitive Substitutes: Synthetic flooring materials and imports from other countries pose a competitive threat.

- End-User Demographics: Shifting towards younger consumers with preferences for modern aesthetics and eco-friendly options.

- M&A Trends: Moderate activity in recent years, with larger firms consolidating market share.

Turkish Carpets & Rugs Industry Growth Trends & Insights

The Turkish carpets and rugs market exhibited robust growth between 2019 and 2024, driven by factors such as increasing disposable incomes, rising urbanization, and growing demand for home improvement and interior decoration. The market size reached xx Million USD in 2024. This positive trajectory is expected to continue, albeit at a moderated pace, during the forecast period (2025-2033). Technological disruptions, such as the introduction of 3D printing and digital design tools, are reshaping the industry landscape. Consumer behavior is evolving, with a growing preference for online purchasing and personalized designs. The industry is adopting e-commerce channels to cater to changing consumer preferences. The CAGR for the period 2025-2033 is projected to be xx%. Market penetration is expected to increase steadily, particularly in emerging segments like online sales and commercial applications.

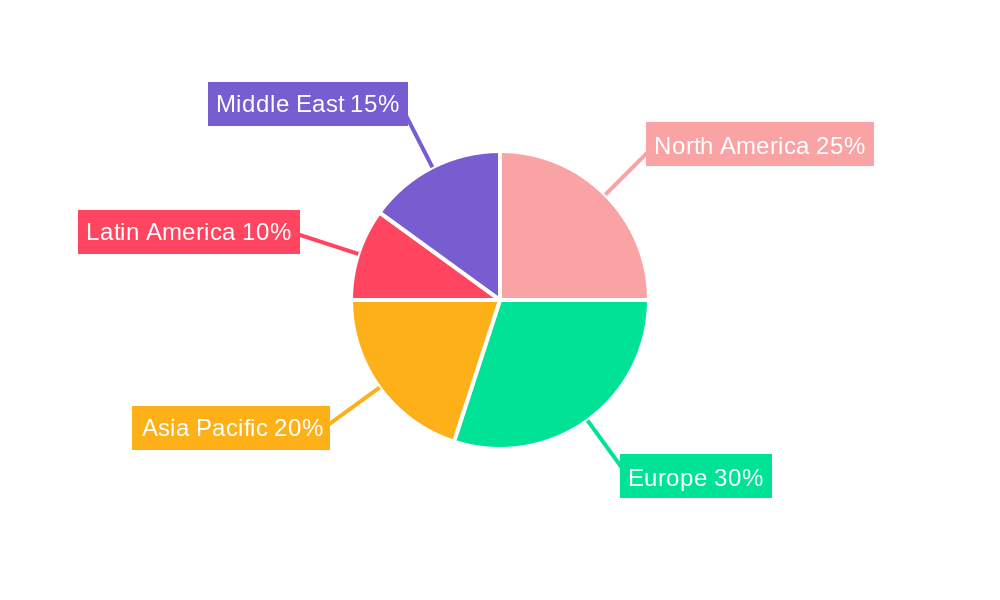

Dominant Regions, Countries, or Segments in Turkish Carpets & Rugs Industry

The largest segment by distribution channel is the offline market via contractors and retailers, accounting for approximately xx% of the market in 2024. This dominance stems from established distribution networks and consumer preference for physical inspection and tactile experience. The knotted segment dominates by type, contributing the largest market share due to its high perceived value and association with traditional Turkish craftsmanship. Residential applications account for the largest segment by application, reflecting a strong demand for carpets and rugs in homes. Istanbul and surrounding regions represent the primary manufacturing and consumption hubs.

- Key Drivers:

- Offline Channel: Established distribution infrastructure, consumer preference for in-person evaluation.

- Knotted Type: High perceived value, association with traditional craftsmanship, strong export demand.

- Residential Application: Strong demand for home improvement and interior decoration, rising disposable incomes.

Turkish Carpets & Rugs Industry Product Landscape

The Turkish carpet and rug industry offers a diverse product range, from traditional hand-knotted pieces to modern machine-made designs. Innovations focus on materials (e.g., sustainable yarns like recycled polyester and organic cotton), manufacturing techniques (e.g., improved weaving technologies resulting in increased production efficiency and reduced costs), and design aesthetics, incorporating contemporary patterns and styles. Unique selling propositions include the heritage of Turkish craftsmanship, superior quality materials, and intricate designs.

Key Drivers, Barriers & Challenges in Turkish Carpets & Rugs Industry

Key Drivers: Growing disposable incomes, increasing urbanization, rising demand for home décor, and technological advancements in materials and manufacturing processes. Government support for the textile industry further fuels market growth.

Challenges & Restraints: Competition from cheaper imports, fluctuations in raw material prices, and rising labor costs. Maintaining traditional craftsmanship while adopting modern manufacturing techniques presents a significant hurdle for some companies. Maintaining supply chains that are sustainable and resilient to global disruptions is paramount. The total estimated impact of these challenges on market growth for 2025 is estimated at xx Million USD.

Emerging Opportunities in Turkish Carpets & Rugs Industry

Emerging opportunities lie in expanding e-commerce channels, catering to younger consumers with modern designs and sustainable materials, and tapping into niche markets such as luxury rugs and bespoke designs. Collaborations with interior designers and architects can broaden product application and drive growth.

Growth Accelerators in the Turkish Carpets & Rugs Industry Industry

Long-term growth will be accelerated by technological advancements such as automation and 3D printing, strategic partnerships with international brands, and expansion into new markets. Investing in sustainable manufacturing processes and promoting the heritage of Turkish craftsmanship will further enhance the industry's competitiveness.

Key Players Shaping the Turkish Carpets & Rugs Industry Market

- Aydin Carpets

- Angora carpets Corp

- Empara Hali

- Melikhan Carpets

- MERINOS HALI SAN VE TIC A S

- Milat Carpet

- Saray Hali

- Festival Carpet

- Padisah Hali

- ipek Mekik Hali

- Kaplan Kardeşler Carpet

- Grand Carpet

- Kartal Hali Tekstil San Tic A S

- Dinarsu T A S

Notable Milestones in Turkish Carpets & Rugs Industry Sector

- April 2022: Dinarsu expanded its yarn production facilities, increasing its monthly capacity.

- January 2023: Milat Carpet launched its new Maxell Collection, utilizing polyester and viscose yarns.

In-Depth Turkish Carpets & Rugs Industry Market Outlook

The Turkish carpets and rugs industry is poised for continued growth, driven by a confluence of factors: increasing consumer demand, technological innovation, and strategic market expansions. The projected CAGR suggests a robust future, presenting significant opportunities for existing players and new entrants. Focusing on sustainability, embracing digitalization, and catering to evolving consumer preferences will be critical for success in this dynamic market.

Turkish Carpets & Rugs Industry Segmentation

-

1. Type

- 1.1. Tufted

- 1.2. Woven

- 1.3. Needle-punched

- 1.4. Knotted

- 1.5. Other Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline (Contractors and Retail)

- 3.2. Online

- 3.3. Other Distribution Channels

Turkish Carpets & Rugs Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Turkish Carpets & Rugs Industry Regional Market Share

Geographic Coverage of Turkish Carpets & Rugs Industry

Turkish Carpets & Rugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased spending in the home improvement projects; The demand for sustainable and eco-friendly bath fittings is on the rise

- 3.3. Market Restrains

- 3.3.1. High cost of installation and maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Turkish Carpets Worldwide is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tufted

- 5.1.2. Woven

- 5.1.3. Needle-punched

- 5.1.4. Knotted

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline (Contractors and Retail)

- 5.3.2. Online

- 5.3.3. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tufted

- 6.1.2. Woven

- 6.1.3. Needle-punched

- 6.1.4. Knotted

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline (Contractors and Retail)

- 6.3.2. Online

- 6.3.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tufted

- 7.1.2. Woven

- 7.1.3. Needle-punched

- 7.1.4. Knotted

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline (Contractors and Retail)

- 7.3.2. Online

- 7.3.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tufted

- 8.1.2. Woven

- 8.1.3. Needle-punched

- 8.1.4. Knotted

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline (Contractors and Retail)

- 8.3.2. Online

- 8.3.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tufted

- 9.1.2. Woven

- 9.1.3. Needle-punched

- 9.1.4. Knotted

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline (Contractors and Retail)

- 9.3.2. Online

- 9.3.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Turkish Carpets & Rugs Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tufted

- 10.1.2. Woven

- 10.1.3. Needle-punched

- 10.1.4. Knotted

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline (Contractors and Retail)

- 10.3.2. Online

- 10.3.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aydin Carpets

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Angora carpets Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Empara Hali

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Melikhan Carpets**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MERINOS HALI SAN VE TIC A S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Milat Carpet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Saray Hali

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Festival Carpet

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Padisah Hali

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ipek Mekik Hali

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kaplan Kardeşler Carpet

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Grand Carpet

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kartal Hali Tekstil San Tic A S

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dinarsu T A S

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Aydin Carpets

List of Figures

- Figure 1: Global Turkish Carpets & Rugs Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Turkish Carpets & Rugs Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Turkish Carpets & Rugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Turkish Carpets & Rugs Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Turkish Carpets & Rugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Turkish Carpets & Rugs Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Turkish Carpets & Rugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Turkish Carpets & Rugs Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Turkish Carpets & Rugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Turkish Carpets & Rugs Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: South America Turkish Carpets & Rugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Turkish Carpets & Rugs Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America Turkish Carpets & Rugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Turkish Carpets & Rugs Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Turkish Carpets & Rugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Turkish Carpets & Rugs Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Turkish Carpets & Rugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Turkish Carpets & Rugs Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Turkish Carpets & Rugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Turkish Carpets & Rugs Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Turkish Carpets & Rugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Turkish Carpets & Rugs Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Turkish Carpets & Rugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Turkish Carpets & Rugs Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Turkish Carpets & Rugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Turkish Carpets & Rugs Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Turkish Carpets & Rugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Turkish Carpets & Rugs Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa Turkish Carpets & Rugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa Turkish Carpets & Rugs Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Turkish Carpets & Rugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Turkish Carpets & Rugs Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Turkish Carpets & Rugs Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Turkish Carpets & Rugs Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Turkish Carpets & Rugs Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Turkish Carpets & Rugs Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific Turkish Carpets & Rugs Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Turkish Carpets & Rugs Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Turkish Carpets & Rugs Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Turkish Carpets & Rugs Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Turkish Carpets & Rugs Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Turkish Carpets & Rugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Turkish Carpets & Rugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkish Carpets & Rugs Industry?

The projected CAGR is approximately 3.06%.

2. Which companies are prominent players in the Turkish Carpets & Rugs Industry?

Key companies in the market include Aydin Carpets, Angora carpets Corp, Empara Hali, Melikhan Carpets**List Not Exhaustive, MERINOS HALI SAN VE TIC A S, Milat Carpet, Saray Hali, Festival Carpet, Padisah Hali, ipek Mekik Hali, Kaplan Kardeşler Carpet, Grand Carpet, Kartal Hali Tekstil San Tic A S, Dinarsu T A S.

3. What are the main segments of the Turkish Carpets & Rugs Industry?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 495.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased spending in the home improvement projects; The demand for sustainable and eco-friendly bath fittings is on the rise.

6. What are the notable trends driving market growth?

Increasing Demand for Turkish Carpets Worldwide is Driving the Market.

7. Are there any restraints impacting market growth?

High cost of installation and maintenance.

8. Can you provide examples of recent developments in the market?

January 2023: Milat introduced a new collection of carpets and rugs, Maxell Collections, produced using polyester and viscose yarn.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkish Carpets & Rugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkish Carpets & Rugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkish Carpets & Rugs Industry?

To stay informed about further developments, trends, and reports in the Turkish Carpets & Rugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence