Key Insights

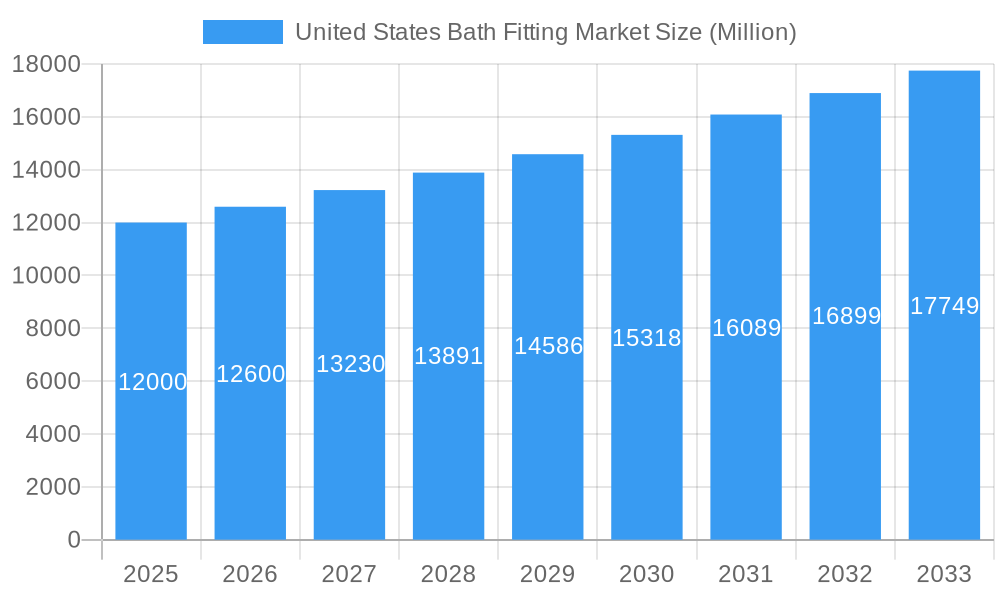

The United States bath fitting market is poised for significant expansion, propelled by escalating home renovation projects, new residential construction, and a burgeoning consumer preference for premium and intelligent bathroom fixtures. This market, valued at $22.53 billion in the 2025 base year, is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. Key growth drivers include an aging demographic increasing demand for accessible bath fittings, the widespread adoption of smart home technology for advanced fixtures, and a growing emphasis on water conservation and sustainability influencing purchasing decisions. The market is segmented by product type (faucets, showerheads, bathtubs), material (brass, stainless steel, ceramic), and distribution channels (online retail, home improvement stores, plumbing suppliers).

United States Bath Fitting Market Market Size (In Billion)

The competitive environment features both established industry leaders and innovative new entrants, with a strong focus on product development, portfolio expansion, and strategic alliances to secure market advantage. Regional dynamics are pronounced, with urban and suburban areas anticipated to lead growth due to higher disposable incomes and increased housing development. Potential challenges such as supply chain volatility and raw material price fluctuations may affect profitability. Nevertheless, the outlook for the US bath fitting market is highly favorable, anticipating substantial growth driven by demographic trends, technological innovation, and evolving consumer demand for sophisticated, eco-friendly bathroom solutions.

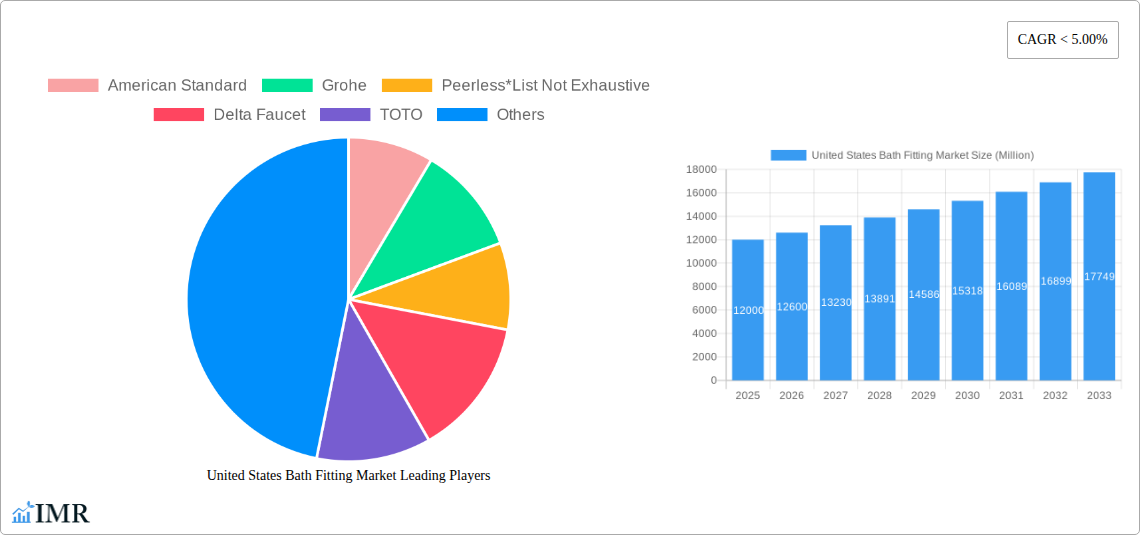

United States Bath Fitting Market Company Market Share

United States Bath Fitting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States bath fitting market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study covers the period from 2019 to 2033, with 2025 serving as the base year and estimated year. The report segments the market by product type (faucets, showers, bathtubs, shower enclosures, other), distribution channel (multi-brand stores, exclusive stores, online stores, other), and end-user (residential, commercial). Key players analyzed include American Standard, Grohe, Peerless, Delta Faucet, TOTO, Kohler, Kraus, and Pfister, though the list is not exhaustive. The total market value is projected to reach xx Million units by 2033.

United States Bath Fitting Market Dynamics & Structure

The US bath fitting market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, particularly in water-saving technologies and smart home integration, is a key driver. Stringent water conservation regulations influence product development and adoption. Competitive pressure from substitute materials and alternative showering solutions exists. The residential sector dominates, reflecting housing construction and renovation trends. Mergers and acquisitions (M&A) activity has been moderate, with strategic partnerships playing a more significant role.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on water-saving technologies (e.g., low-flow faucets), smart features (e.g., voice-activated controls), and sustainable materials.

- Regulatory Framework: EPA's WaterSense program influences product standards and consumer choices.

- Competitive Substitutes: Increased competition from alternative showering solutions (e.g., rain showers, body sprays).

- End-User Demographics: Residential sector accounts for approximately xx% of total market value in 2025, driven by new construction and home renovations.

- M&A Trends: Strategic partnerships are more prevalent than outright acquisitions, focusing on technology transfer and market expansion. xx M&A deals were recorded between 2019 and 2024.

United States Bath Fitting Market Growth Trends & Insights

The US bath fitting market exhibited steady growth during the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and a preference for home improvement projects. Technological advancements, such as the incorporation of smart technology, have influenced consumer preferences and accelerated market expansion. The market is expected to maintain a positive Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Market penetration of water-saving technologies is increasing gradually, with xx% market adoption projected by 2033.

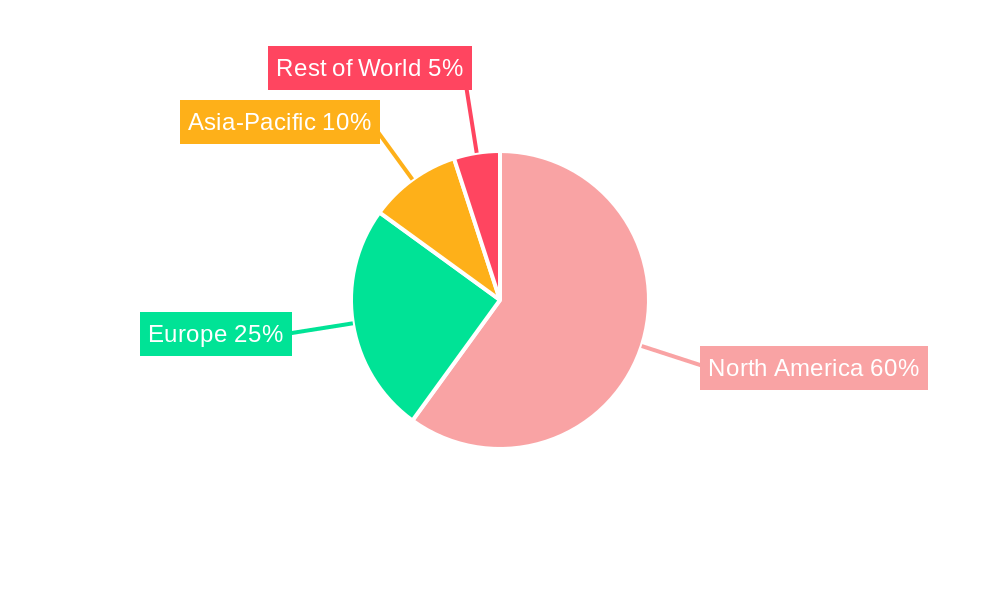

Dominant Regions, Countries, or Segments in United States Bath Fitting Market

The Northeast and West Coast regions are leading the US bath fitting market, driven by higher disposable incomes and a greater focus on home renovations. Within product segments, faucets hold the largest market share in 2025 (xx Million units), followed by showers (xx Million units). Multi-brand stores constitute the largest distribution channel, owing to their widespread presence and accessibility. The residential segment remains the primary end-user, accounting for approximately xx% of total market value.

- Key Regional Drivers: Higher construction activity, increased disposable incomes, and favorable housing market conditions in specific regions.

- Leading Product Segment: Faucets, due to their high frequency of replacement and integration into new construction projects.

- Dominant Distribution Channel: Multi-brand stores due to their extensive reach and customer base.

- Primary End-User: Residential sector due to high demand from new housing construction and renovation projects.

United States Bath Fitting Market Product Landscape

The US bath fitting market showcases ongoing innovation in design, materials, and functionality. Smart features, water-saving technologies, and aesthetically pleasing designs are key selling points. Manufacturers are increasingly focusing on sustainable and eco-friendly materials to appeal to environmentally conscious consumers. Performance metrics, such as water flow rate and durability, are crucial in determining product success.

Key Drivers, Barriers & Challenges in United States Bath Fitting Market

Key Drivers: Rising disposable incomes, increasing housing starts, home renovation activities, and the growing adoption of smart home technologies are key drivers. Government initiatives promoting water conservation further propel market growth.

Key Challenges: Supply chain disruptions, rising raw material costs, and intense competition from both domestic and international players pose significant challenges. Stringent regulatory compliance requirements add to the cost and complexity of product development and distribution.

Emerging Opportunities in United States Bath Fitting Market

Emerging opportunities lie in the expansion of smart home integration, sustainable and eco-friendly product offerings, and customization options. The increasing demand for luxury and high-end bath fittings also presents a significant growth avenue. Untapped markets include affordable housing segments and the growing rental market.

Growth Accelerators in the United States Bath Fitting Market Industry

Technological advancements in water-saving technologies and smart features, strategic partnerships between manufacturers and technology providers, and expansion into untapped market segments are crucial growth accelerators. Increased focus on sustainability and the adoption of circular economy principles will further enhance market expansion.

Key Players Shaping the United States Bath Fitting Market Market

- American Standard

- Grohe

- Peerless

- Delta Faucet

- TOTO

- Kohler

- Kraus

- Pfister

Notable Milestones in United States Bath Fitting Market Sector

- 2020-Q4: Delta Faucet launched its new line of touchless faucets.

- 2022-Q2: Kohler announced a strategic partnership with a smart home technology provider.

- 2023-Q1: American Standard introduced a new line of water-saving showerheads.

- (Further milestones to be added based on available data)

In-Depth United States Bath Fitting Market Market Outlook

The US bath fitting market is poised for continued growth, driven by the factors discussed above. Strategic investments in R&D, focusing on innovation, sustainability, and smart home integration, will be crucial for long-term success. Expansion into emerging markets and tapping into the growing demand for luxury and customized products will further enhance the industry’s growth trajectory.

United States Bath Fitting Market Segmentation

-

1. Product

- 1.1. Faucets

- 1.2. Showers

- 1.3. Bathtubs

- 1.4. Showers Enclosures

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Multi- brand Stores

- 2.2. Exclusive Store

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. End Users

- 3.1. Residential

- 3.2. Commercial

United States Bath Fitting Market Segmentation By Geography

- 1. United States

United States Bath Fitting Market Regional Market Share

Geographic Coverage of United States Bath Fitting Market

United States Bath Fitting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising Urbanization And Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Bath Fitting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Faucets

- 5.1.2. Showers

- 5.1.3. Bathtubs

- 5.1.4. Showers Enclosures

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi- brand Stores

- 5.2.2. Exclusive Store

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Standard

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grohe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Peerless*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Faucet

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kohler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kraus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pfister

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 American Standard

List of Figures

- Figure 1: United States Bath Fitting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Bath Fitting Market Share (%) by Company 2025

List of Tables

- Table 1: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: United States Bath Fitting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: United States Bath Fitting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Bath Fitting Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the United States Bath Fitting Market?

Key companies in the market include American Standard, Grohe, Peerless*List Not Exhaustive, Delta Faucet, TOTO, Kohler, Kraus, Pfister.

3. What are the main segments of the United States Bath Fitting Market?

The market segments include Product, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising Urbanization And Construction Activities.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Bath Fitting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Bath Fitting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Bath Fitting Market?

To stay informed about further developments, trends, and reports in the United States Bath Fitting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence