Key Insights

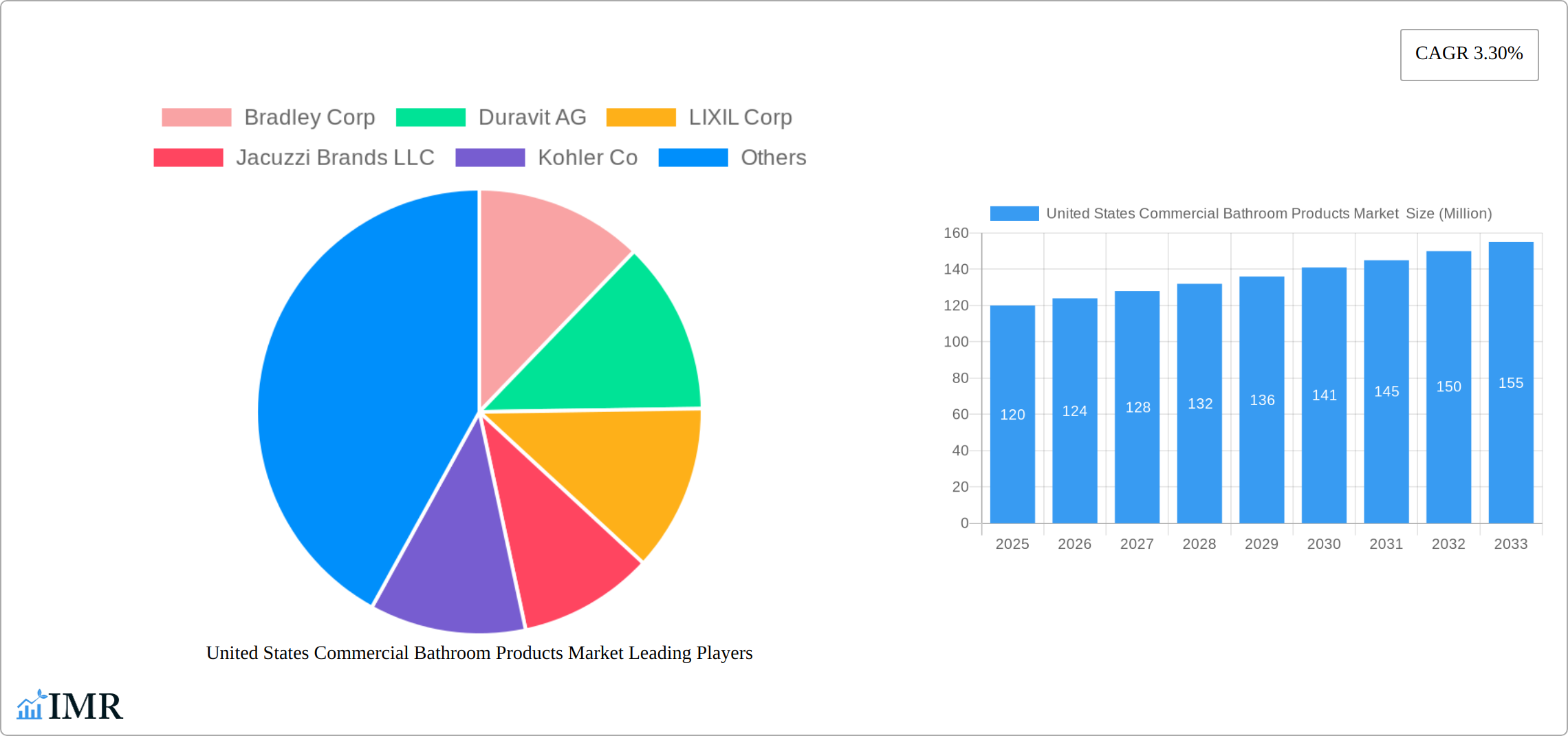

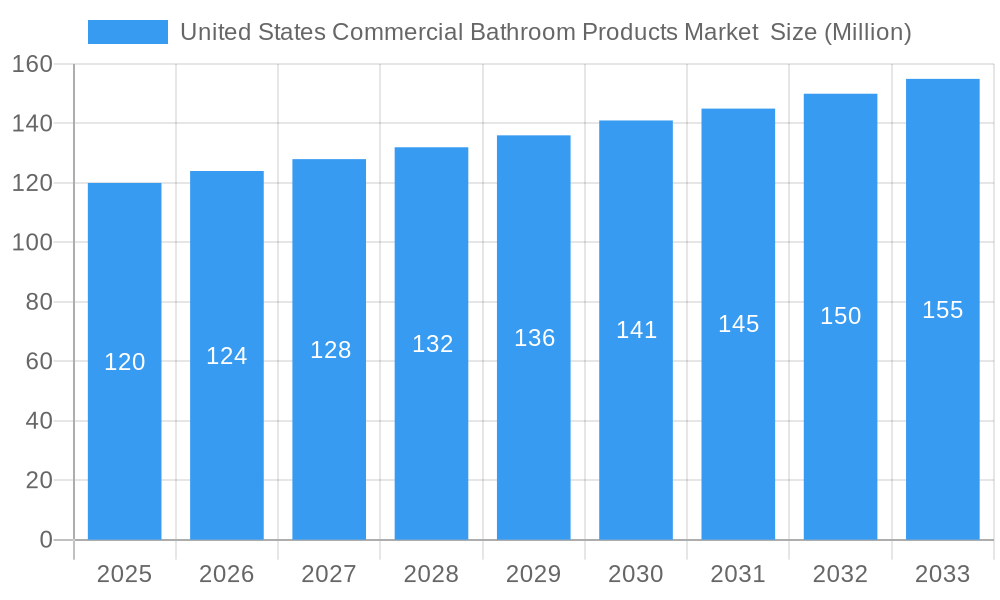

The United States commercial bathroom products market, while data specifically for the US is absent from the provided information, exhibits strong growth potential mirroring global trends. Given the global market size of $358.08 million in 2025 and a Compound Annual Growth Rate (CAGR) of 3.30%, we can infer substantial market value for the US segment. Considering the US's significant economic size and prevalence of commercial buildings, a reasonable estimate for the US market size in 2025 would be between $100 million and $150 million, representing a significant portion of the global market. Key drivers include increasing investments in commercial real estate, a rising focus on hygiene and sanitation in public spaces, and the growing demand for sustainable and water-efficient bathroom fixtures. Trends point toward a shift towards touchless technology, smart bathroom solutions, and customizable designs catering to diverse user needs and accessibility standards. While the market faces restraints such as economic downturns impacting construction activity and fluctuating raw material prices, the long-term outlook remains positive, driven by ongoing urbanization and increasing focus on improving workplace amenities. The market segmentation is diverse with toiletries, soap dispensers, faucets and showers, basins, and bathtubs representing key product types, and price points ranging from standard to premium and luxury options. Distribution occurs through both online and offline channels. Major players include established brands like Kohler Co., Bradley Corp., and LIXIL Corp., along with other significant regional and international manufacturers.

United States Commercial Bathroom Products Market Market Size (In Million)

The market's growth is expected to be fueled by the continued adoption of innovative technologies like sensor-activated faucets and smart toilets in commercial buildings. Furthermore, increasing awareness of water conservation and sustainability initiatives will drive demand for water-efficient fixtures. The premium and luxury segments are expected to witness faster growth due to rising disposable incomes and a preference for high-quality, aesthetically pleasing bathroom solutions in upscale commercial establishments. The online distribution channel is projected to expand significantly, facilitated by the growing adoption of e-commerce platforms and the increasing demand for seamless procurement processes. The competitive landscape is characterized by both established multinational corporations and regional players, resulting in a dynamic market with continuous product innovation and competitive pricing strategies.

United States Commercial Bathroom Products Market Company Market Share

United States Commercial Bathroom Products Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States commercial bathroom products market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is segmented by product type (toileteries, soap dispensers, faucets and showers, basins, bathtubs), price point (standard, premium, luxury), and distribution channel (online, offline). The total market size in 2025 is estimated at XX million units.

United States Commercial Bathroom Products Market Dynamics & Structure

The US commercial bathroom products market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in smart bathroom technology and water conservation, is a major driver. Stringent regulatory frameworks concerning water efficiency and accessibility standards influence product design and manufacturing. The market experiences competition from substitutes like recycled materials and alternative water-saving technologies. End-user demographics, especially the growing demand from commercial construction and renovation projects, significantly impact market growth. Mergers and acquisitions (M&A) activity is relatively moderate, with a yearly average of XX deals between 2019-2024, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on smart toilets, water-saving fixtures, and sustainable materials.

- Regulatory Framework: Compliance with ADA standards and water efficiency regulations (e.g., EPA WaterSense).

- Competitive Substitutes: Recycled materials and alternative water-saving technologies.

- End-User Demographics: Growth driven by commercial construction, hospitality, and healthcare sectors.

- M&A Trends: XX deals annually on average (2019-2024), focusing on portfolio expansion and market penetration.

United States Commercial Bathroom Products Market Growth Trends & Insights

The US commercial bathroom products market is experiencing robust growth, fueled by a confluence of factors. Increased commercial construction activity, particularly in sectors like hospitality and healthcare, is a primary driver. Rising disposable incomes and a growing emphasis on creating sophisticated and hygienic spaces within commercial establishments further contribute to market expansion. The market witnessed a CAGR of [Insert Precise CAGR for 2019-2024]% during the historical period (2019-2024) and is projected to achieve a CAGR of [Insert Precise CAGR for 2025-2033]% during the forecast period (2025-2033). This growth is propelled by several key trends: the increasing integration of smart bathroom technologies, a surge in demand for sustainable and eco-friendly products, the expansion of e-commerce channels, and a notable shift in consumer preferences towards premium and luxury fixtures, especially in high-end commercial developments. The market penetration of smart bathroom products is anticipated to reach [Insert Precise Percentage]% by 2033. Furthermore, technological advancements, such as the proliferation of IoT-enabled fixtures and AI-powered solutions, are poised to significantly accelerate market growth in the coming years.

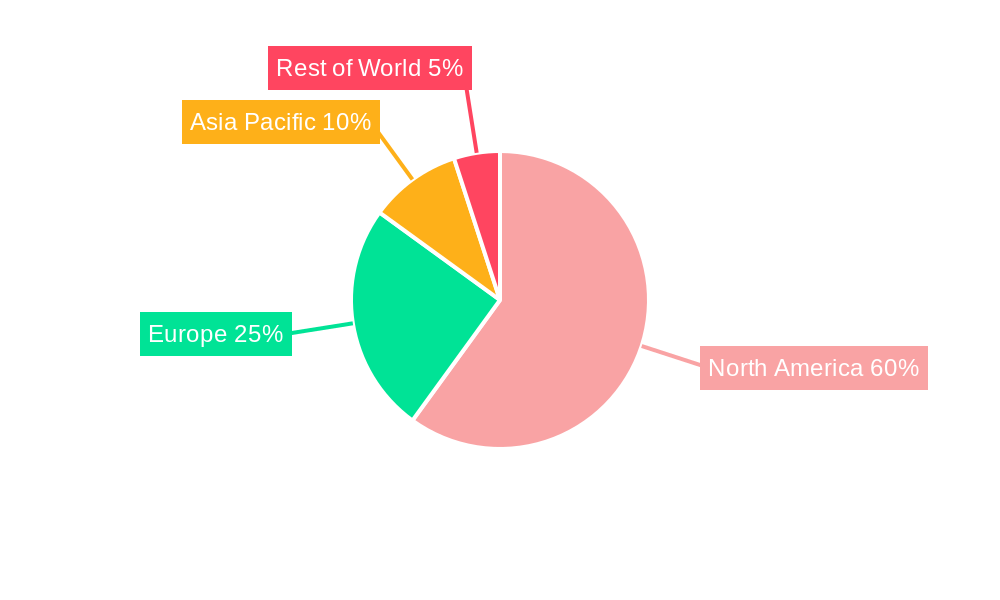

Dominant Regions, Countries, or Segments in United States Commercial Bathroom Products Market

The Northeast and West Coast regions exhibit the strongest growth within the US market, driven by high levels of commercial construction activity and a higher concentration of premium commercial spaces. Within product types, faucets and showers command the largest market share, followed by basins and toilets. The premium and luxury segments are showing faster growth rates than the standard segment, reflecting the increasing demand for high-quality and technologically advanced products. Offline distribution channels currently dominate, but online sales are steadily gaining traction.

- Key Growth Drivers: High commercial construction activity in the Northeast and West Coast regions; increasing disposable incomes; preference for premium and luxury products; expanding online sales channels.

- Dominant Segments: Faucets & Showers (largest market share); Premium and Luxury segments (highest growth rate); Offline channels (dominant but declining).

United States Commercial Bathroom Products Market Product Landscape

The US commercial bathroom products market presents a diverse and dynamic landscape, characterized by continuous innovation in design, functionality, and materials. Smart toilets, incorporating features such as heated seats, automated flushing, and air drying, are rapidly gaining traction. Simultaneously, there's a strong emphasis on water conservation, with low-flow faucets and dual-flush toilets becoming increasingly prevalent to meet both environmental regulations and growing consumer demand for sustainability. Manufacturers are strategically focusing on enhancing product durability, hygiene, and aesthetics to meet the evolving requirements of modern commercial spaces. Key selling points for manufacturers include superior water efficiency, advanced hygiene features, and sophisticated, aesthetically pleasing designs.

Key Drivers, Barriers & Challenges in United States Commercial Bathroom Products Market

Key Drivers: Increased commercial construction, growing demand for sustainable products, technological advancements (smart bathroom technology), and rising disposable incomes.

Challenges: Supply chain disruptions impacting material availability and production costs; stringent regulatory compliance requirements (e.g., water efficiency standards); intense competition from both domestic and international players leading to price pressure; increasing labor costs impacting overall product costs.

Emerging Opportunities in United States Commercial Bathroom Products Market

Significant untapped opportunities exist within the US commercial bathroom products market. The integration of IoT and AI technologies presents a particularly compelling avenue for growth, allowing for personalized and customized solutions tailored to individual commercial needs. Furthermore, there's considerable potential in expanding into niche markets, focusing on sustainable and accessible bathroom fixtures. The increasing demand for touchless and hygienic solutions, driven by concerns about public health and hygiene, will fuel demand for sensor-operated faucets, soap dispensers, and other touchless technologies.

Growth Accelerators in the United States Commercial Bathroom Products Market Industry

Strategic partnerships between manufacturers and technology companies are accelerating the adoption of smart bathroom solutions. Technological breakthroughs in material science and water conservation technologies are driving innovation and product differentiation. Market expansion into new segments, like eco-friendly and accessible bathroom fixtures, is a significant growth catalyst.

Key Players Shaping the United States Commercial Bathroom Products Market Market

- Bradley Corp

- Duravit AG

- LIXIL Corp

- Jacuzzi Brands LLC

- Kohler Co

- Jaquar Group

- Gerber Plumbing Fixtures LLC

- Fujian Xinchang Sanitary Ware Co Ltd

- Hansgrohe SE

- Fortune Brands Innovations Inc

Notable Milestones in United States Commercial Bathroom Products Market Sector

- January 2023: Kohler Co. launched the innovative smart toilet, KOHLER Numi 2.0, showcasing advancements in technology and user experience.

- March 2023: Roca launched the InWash Insignia shower toilet with Roca Connect technology, highlighting the integration of smart features and connectivity in high-end bathroom solutions.

- [Add more recent milestones with details]

In-Depth United States Commercial Bathroom Products Market Market Outlook

The US commercial bathroom products market is poised for continued, substantial growth, driven by a powerful combination of technological innovation, the increasing importance of sustainable practices, and the ongoing expansion of the commercial construction sector. Strategic investments in research and development, particularly focused on smart and sustainable solutions, will be critical for companies aiming to maintain a competitive edge. The market offers compelling opportunities for companies capable of leveraging technological advancements to provide superior value propositions, effectively addressing sustainability concerns, and meeting the evolving needs of commercial establishments across diverse sectors.

United States Commercial Bathroom Products Market Segmentation

-

1. Product Type

- 1.1. Toiletries

- 1.2. Soap Dispensers

- 1.3. Faucets and Showers

- 1.4. Basins

- 1.5. Bathtubs

-

2. Price Point

- 2.1. Standard

- 2.2. Premium

- 2.3. Luxury

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

United States Commercial Bathroom Products Market Segmentation By Geography

- 1. United States

United States Commercial Bathroom Products Market Regional Market Share

Geographic Coverage of United States Commercial Bathroom Products Market

United States Commercial Bathroom Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives; More Expensive than Traditional Fixtures

- 3.4. Market Trends

- 3.4.1. The Increasing Demand of Smart Bathrooms Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Bathroom Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Toiletries

- 5.1.2. Soap Dispensers

- 5.1.3. Faucets and Showers

- 5.1.4. Basins

- 5.1.5. Bathtubs

- 5.2. Market Analysis, Insights and Forecast - by Price Point

- 5.2.1. Standard

- 5.2.2. Premium

- 5.2.3. Luxury

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bradley Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Duravit AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LIXIL Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jacuzzi Brands LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kohler Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaquar Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerber Plumbing Fixtures LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujian Xinchang Sanitary Ware Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hansgrohe SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands Innovations Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bradley Corp

List of Figures

- Figure 1: United States Commercial Bathroom Products Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Commercial Bathroom Products Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Bathroom Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: United States Commercial Bathroom Products Market Revenue Million Forecast, by Price Point 2020 & 2033

- Table 4: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Price Point 2020 & 2033

- Table 5: United States Commercial Bathroom Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Commercial Bathroom Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Commercial Bathroom Products Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: United States Commercial Bathroom Products Market Revenue Million Forecast, by Price Point 2020 & 2033

- Table 12: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Price Point 2020 & 2033

- Table 13: United States Commercial Bathroom Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Commercial Bathroom Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Commercial Bathroom Products Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Bathroom Products Market ?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the United States Commercial Bathroom Products Market ?

Key companies in the market include Bradley Corp, Duravit AG, LIXIL Corp , Jacuzzi Brands LLC, Kohler Co, Jaquar Group, Gerber Plumbing Fixtures LLC, Fujian Xinchang Sanitary Ware Co Ltd, Hansgrohe SE, Fortune Brands Innovations Inc.

3. What are the main segments of the United States Commercial Bathroom Products Market ?

The market segments include Product Type, Price Point , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 358.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market.

6. What are the notable trends driving market growth?

The Increasing Demand of Smart Bathrooms Drives the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives; More Expensive than Traditional Fixtures.

8. Can you provide examples of recent developments in the market?

March 2023 - Roca launched the InWash Insignia shower toilet, which includes advanced technology to achieve maximum comfort and hygiene and is equipped with Roca Connect. The feature would enable users to operate in different modes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Bathroom Products Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Bathroom Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Bathroom Products Market ?

To stay informed about further developments, trends, and reports in the United States Commercial Bathroom Products Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence