Key Insights

The United States smart shower market, a segment within the broader global smart home technology sector, is experiencing robust growth, driven by increasing consumer demand for enhanced convenience, water conservation, and personalized showering experiences. The market's expansion is fueled by several key factors. Firstly, rising disposable incomes and a preference for technologically advanced home solutions are propelling adoption. Secondly, the integration of smart showers with home automation systems and voice assistants is enhancing user experience and appeal. Thirdly, manufacturers are continuously innovating, introducing features like precise temperature control, customizable spray patterns, and water usage monitoring, adding value and justifying the premium price point. While the initial investment cost might be a deterrent for some consumers, the long-term benefits of water conservation and energy efficiency contribute to a positive return on investment.

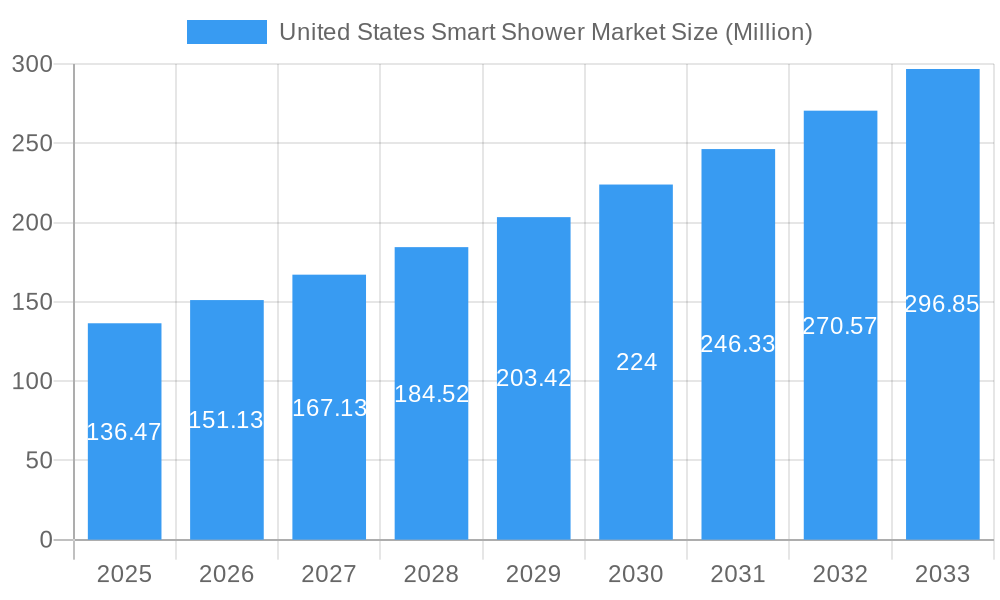

United States Smart Shower Market Market Size (In Million)

Based on the provided global market size of $454.90 million in 2025 with a CAGR of 10.67%, and considering the significant presence of major smart home technology adopters in the US, we can reasonably estimate the US market share to be substantial. Assuming the US market constitutes approximately 30% of the global market (a conservative estimate considering its significant market influence), the US smart shower market size in 2025 would be approximately $136.47 million. With the 10.67% CAGR, we can project continued growth, facing potential restraints like economic downturns or shifts in consumer preferences toward other home automation technologies. However, the ongoing trend of increasing home automation adoption and technological improvements suggest that market growth will likely remain robust in the foreseeable future. Segmentation within the US market mirrors global trends, with residential users dominating, followed by commercial applications in hotels, spas, and wellness centers.

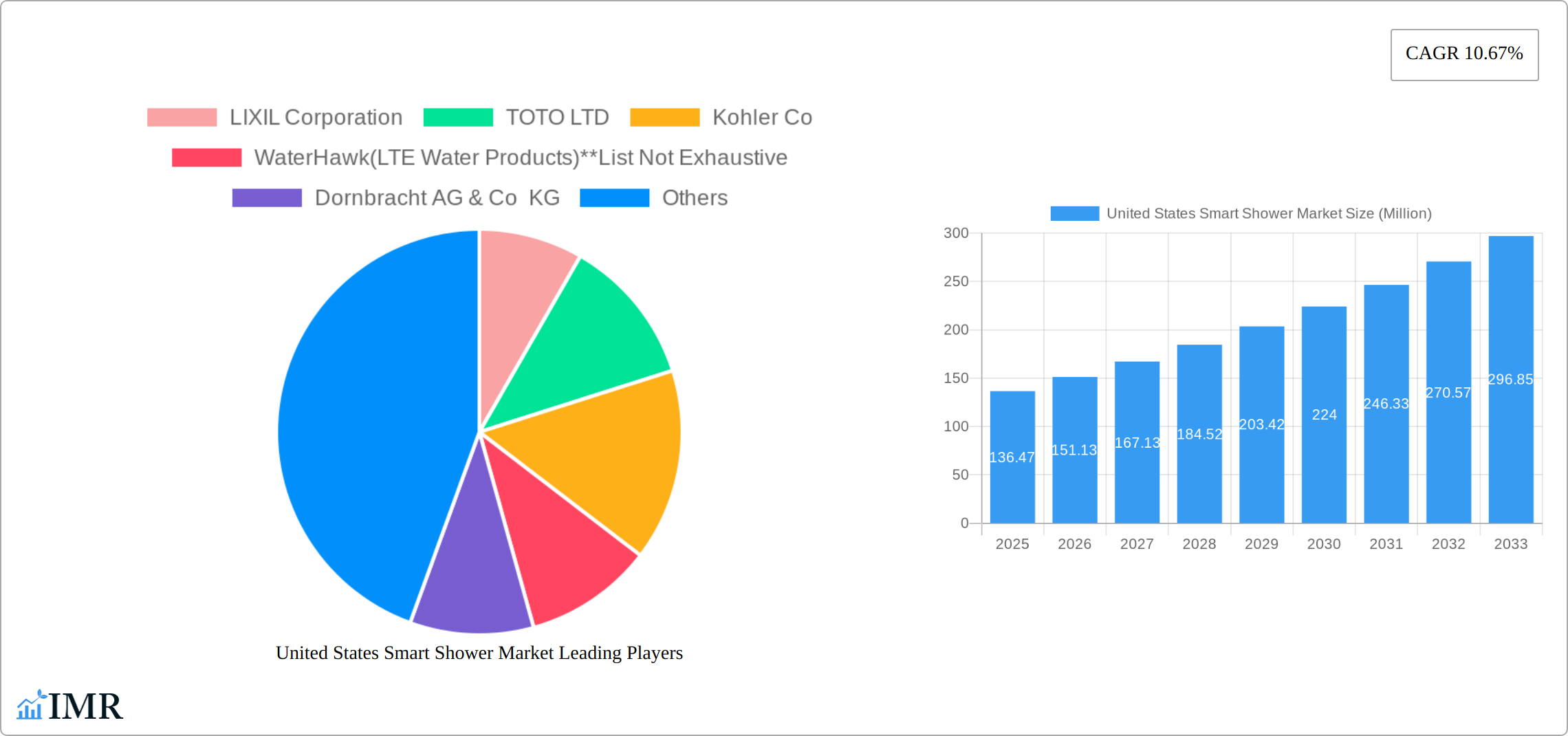

United States Smart Shower Market Company Market Share

United States Smart Shower Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States smart shower market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (Bathroom Fixtures) and child market (Smart Showers), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025-2033, and the historical period covers 2019-2024. The market size is presented in million units.

United States Smart Shower Market Dynamics & Structure

The United States smart shower market is characterized by moderate concentration, with key players like LIXIL Corporation, TOTO LTD, Kohler Co, and WaterHawk (LTE Water Products) holding significant market share (xx%). However, the market is also witnessing the emergence of smaller, innovative players. Technological advancements, particularly in IoT integration and water conservation technologies, are major drivers. Regulatory frameworks focusing on water efficiency influence product design and adoption. Competitive substitutes include traditional showers and less sophisticated smart shower models. End-user demographics show a growing preference for smart home technology among affluent homeowners. M&A activity, as evidenced by Jaquar's acquisition of Artize in 2022, signals consolidation and expansion efforts within the sector.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: IoT integration, water-saving features, voice control, and app connectivity are key drivers.

- Regulatory Framework: Water efficiency standards influence product design and market growth.

- Competitive Substitutes: Traditional showers and basic digital showers pose competition.

- End-User Demographics: High adoption rates among affluent homeowners and environmentally conscious consumers.

- M&A Activity: Moderate level of mergers and acquisitions, indicating market consolidation. (e.g., Jaquar's acquisition of Artize).

United States Smart Shower Market Growth Trends & Insights

The US smart shower market is experiencing robust growth, fueled by a confluence of factors. Rising disposable incomes among consumers, coupled with the increasing popularity of smart home technology and a heightened awareness of water conservation, are key drivers. Market projections for 2025 indicate a market size of [Insert Updated Market Size in Millions of Units], poised for a projected CAGR of [Insert Updated CAGR]% during the forecast period (2025-2033). While current market penetration stands at [Insert Updated Market Penetration Percentage]%, significant expansion is anticipated by 2033. This growth is further accelerated by technological advancements such as AI integration, enabling personalized showering experiences and enhancing user convenience. The shift in consumer preferences towards personalized, sustainable, and convenient solutions is significantly impacting market demand. Furthermore, the availability of diverse financing options and government incentives are playing a crucial role in boosting market adoption.

Dominant Regions, Countries, or Segments in United States Smart Shower Market

The residential sector remains the dominant force in the smart shower market, capturing [Insert Updated Percentage]% of total sales in 2025. States such as California, and other regions with high concentrations of tech-savvy homeowners, exhibit significantly higher adoption rates. Analyzing product types, smart showers with integrated controls maintain the largest market share at [Insert Updated Percentage]%, followed by smart shower controls marketed as upgrades for existing systems. While multi-brand stores currently lead the distribution channel, exclusive retail outlets are experiencing a surge in popularity as premium brands expand their retail presence and focus on targeted customer engagement.

- Leading Segment: Residential ([Insert Updated Percentage]%)

- Key Regions: California, New York, Texas, Florida, and [Add other states with significant growth], showcasing high growth potential due to [mention specific factors like building codes, consumer preferences etc.].

- Dominant Product Type: Smart Showers with Integrated Controls ([Insert Updated Percentage]%)

- Primary Distribution Channel: Multi-brand stores, with increasing prominence of exclusive brand stores.

United States Smart Shower Market Product Landscape

The smart shower technology landscape is characterized by rapid innovation, with a focus on enhancing water efficiency, delivering personalized showering experiences, and ensuring seamless integration with existing smart home ecosystems. Current market offerings boast features such as precise temperature control, customizable spray patterns, voice-activated controls, and smartphone app integration for remote operation and scheduling. Key consumer benefits emphasized by manufacturers include enhanced convenience, energy savings, and responsible water consumption. Leading-edge technological advancements, such as the application of AI for predictive analytics and the creation of truly personalized shower profiles, are shaping the future of the market.

Key Drivers, Barriers & Challenges in United States Smart Shower Market

Key Drivers: Increasing disposable incomes, growing adoption of smart home technology, stringent water conservation regulations, and technological advancements.

Challenges: High initial cost of smart showers compared to traditional units, complexity of installation, and concerns regarding data privacy. Supply chain disruptions and rising material costs also pose significant challenges. The competitive landscape further challenges market entrants with established players holding significant market share. These challenges have resulted in a xx% reduction in the market size for xx% of the product types.

Emerging Opportunities in United States Smart Shower Market

Emerging opportunities include expansion into the commercial sector (hotels, gyms, spas), integrating advanced health monitoring features into smart showers, and development of eco-friendly materials and manufacturing processes.

Growth Accelerators in the United States Smart Shower Market Industry

Strategic partnerships between smart shower manufacturers and smart home technology providers, along with government incentives promoting water conservation, will significantly accelerate market growth. Technological breakthroughs in AI-powered water management and the development of highly customizable and aesthetically pleasing designs will also drive market expansion.

Key Players Shaping the United States Smart Shower Market Market

- LIXIL Corporation

- TOTO LTD

- Kohler Co

- WaterHawk (LTE Water Products)

- Dornbracht AG & Co KG

- Aqualisa

- Moen Incorporated

- Roca Sanitario SA

- GetHai Inc

- Jaquar

Notable Milestones in United States Smart Shower Market Sector

- March 2022: Jaquar's acquisition of Artize and the launch of the Atelier Luxury Bath Gallery marked a significant expansion in the luxury smart shower market segment.

- January 2023: Kohler's introduction of Eir Smart Toilets and Innate smart toilets, showers, faucets, and water monitoring systems demonstrated the company's commitment to comprehensive smart home solutions. [Add other notable milestones with details for greater impact]

- [Insert Date]: [Insert Company] launched [Insert Product] featuring [Key Feature] targeting [Specific Market Segment].

In-Depth United States Smart Shower Market Market Outlook

The US smart shower market is poised for substantial growth in the coming years, driven by strong underlying trends and innovative product development. Strategic partnerships, technological breakthroughs, and increasing consumer awareness of the benefits of smart showers present significant opportunities for market expansion and innovation. The market is expected to reach xx million units by 2033, offering substantial returns for companies that successfully capitalize on these opportunities.

United States Smart Shower Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Smart Shower Market Segmentation By Geography

- 1. United States

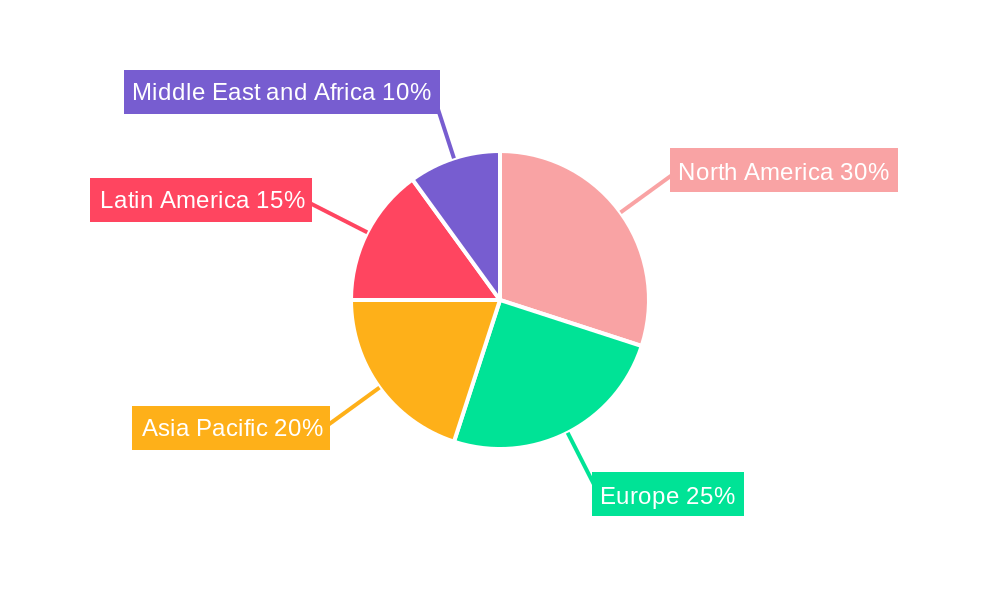

United States Smart Shower Market Regional Market Share

Geographic Coverage of United States Smart Shower Market

United States Smart Shower Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation; Technical Difficulties Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Smart Home Automation Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Smart Shower Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LIXIL Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TOTO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kohler Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WaterHawk(LTE Water Products)**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dornbracht AG & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aqualisa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Moen Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roca Sanitario SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GetHai Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jaquar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LIXIL Corporation

List of Figures

- Figure 1: United States Smart Shower Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Smart Shower Market Share (%) by Company 2025

List of Tables

- Table 1: United States Smart Shower Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Smart Shower Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Smart Shower Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Smart Shower Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Smart Shower Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Smart Shower Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Smart Shower Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Smart Shower Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Smart Shower Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Smart Shower Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Smart Shower Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Smart Shower Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Smart Shower Market?

The projected CAGR is approximately 10.67%.

2. Which companies are prominent players in the United States Smart Shower Market?

Key companies in the market include LIXIL Corporation, TOTO LTD, Kohler Co, WaterHawk(LTE Water Products)**List Not Exhaustive, Dornbracht AG & Co KG, Aqualisa, Moen Incorporated, Roca Sanitario SA, GetHai Inc, Jaquar.

3. What are the main segments of the United States Smart Shower Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 454.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Water Conservation and Sustainability Drives The Market; Smart Integration with Home Systems Drives The Market.

6. What are the notable trends driving market growth?

Increasing Demand for Smart Home Automation Drives the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation; Technical Difficulties Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023: Kohler launched a new smart toilet, Eir Smart Toilets, and Innate smart toilets, showers, faucets, and water monitoring systems to help the world's sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Smart Shower Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Smart Shower Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Smart Shower Market?

To stay informed about further developments, trends, and reports in the United States Smart Shower Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence