Key Insights

The North America Personal Care Appliances Market is forecast to expand significantly, reaching an estimated market size of $6.5 billion by 2025. Driven by a CAGR of 5.4%, this growth is propelled by rising disposable incomes, a heightened focus on personal grooming, and continuous product innovation. Key segments include "Shaving and Grooming," boosted by advanced shavers and trimmers, and "Styling," influenced by social media trends and at-home beauty solutions. Online retail channels are expanding market access alongside traditional brick-and-mortar stores.

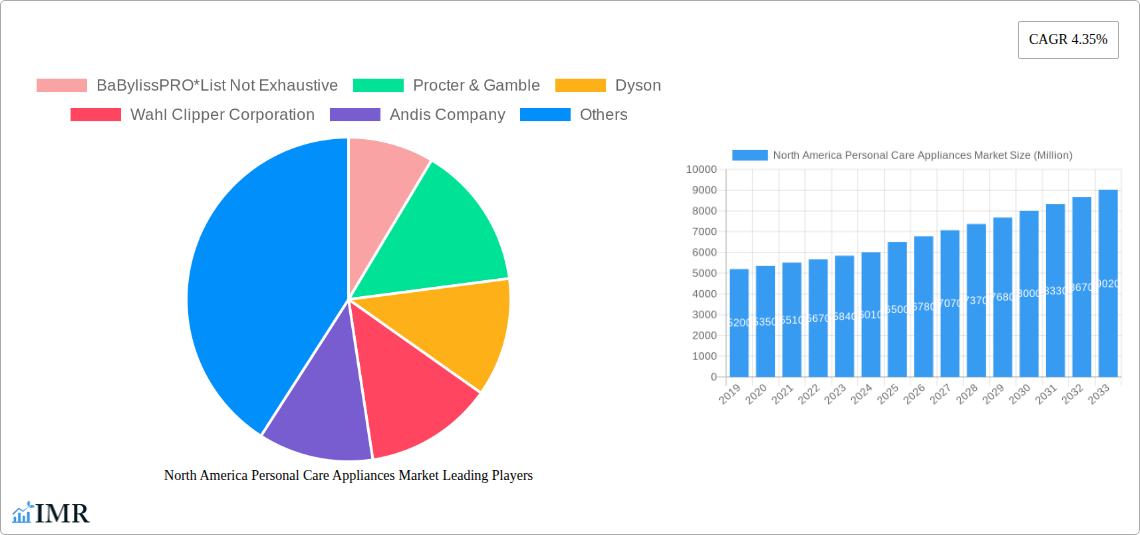

North America Personal Care Appliances Market Market Size (In Billion)

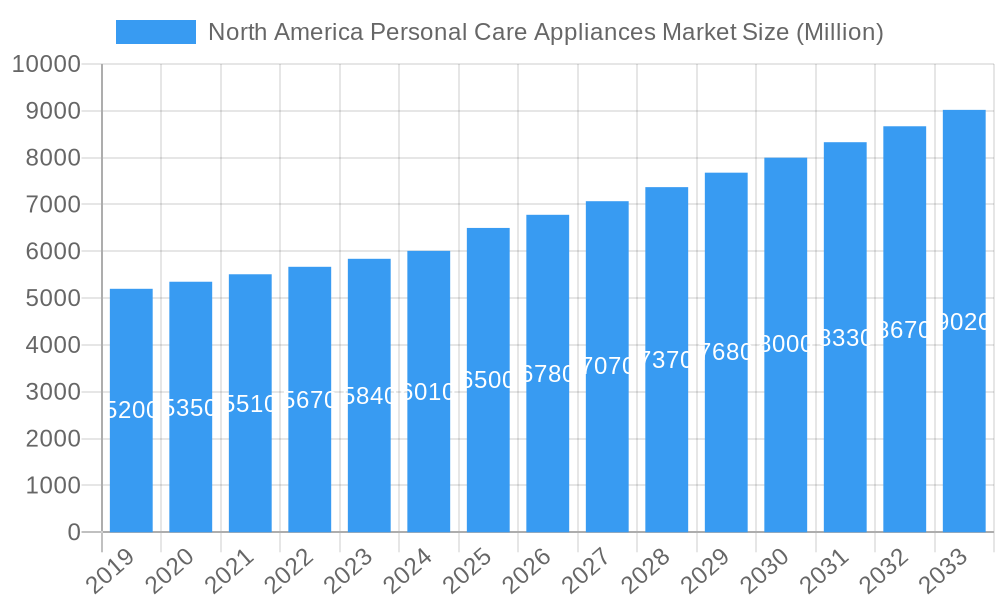

The competitive environment features established global brands and emerging innovators, including Procter & Gamble, Dyson, and Philips, vying for market share through product differentiation and strategic marketing. While high costs for advanced devices and potential saturation pose challenges, the increasing emphasis on self-care and hygiene is expected to maintain positive market momentum. The diverse demographic across North America, catering to men, women, and unisex users, further fuels market potential with specialized product development.

North America Personal Care Appliances Market Company Market Share

This report provides an in-depth analysis of the North America Personal Care Appliances Market, covering market size, trends, and future projections from 2019 to 2033, with a base year of 2025. Discover key insights into personal care devices, grooming tools, hair styling appliances, and beauty tech across the region.

North America Personal Care Appliances Market Market Dynamics & Structure

The North America Personal Care Appliances Market is characterized by moderate to high concentration, with key players like BaBylissPRO, Procter & Gamble, Dyson, and Philips continuously investing in technological innovation to drive demand. Smart beauty appliances and AI-powered grooming devices are emerging as significant disruptors. The regulatory framework, while generally supportive, includes safety and performance standards that influence product development. Competitive product substitutes range from traditional manual tools to advanced electronic devices. End-user demographics are shifting, with a growing interest in personalized care routines and sustainable products. Mergers and Acquisitions (M&A) activity has been a consistent feature, with approximately 10-15 significant deals observed annually in the historical period, aimed at expanding product portfolios and market reach. Barriers to innovation include high R&D costs and the need for extensive consumer testing.

- Market Concentration: Moderate to High, with leading players holding significant market share.

- Technological Innovation Drivers: Growing demand for convenience, effectiveness, and personalized experiences in at-home beauty and grooming.

- Regulatory Frameworks: Focus on product safety, electrical standards, and evolving data privacy for connected devices.

- Competitive Product Substitutes: Manual tools, professional salon services, and a wide array of electronic personal care devices.

- End-User Demographics: Increasing adoption by younger demographics seeking advanced features and by older demographics prioritizing ease of use and health benefits.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and expand geographical presence.

North America Personal Care Appliances Market Growth Trends & Insights

The North America Personal Care Appliances Market is poised for significant expansion, driven by evolving consumer lifestyles, increased disposable income, and a heightened awareness of personal well-being. Leveraging market penetration data and CAGR projections, this analysis reveals a strong upward trajectory. The market size is expected to witness a substantial increase from approximately 60,000 million units in 2024 to an estimated 85,000 million units by 2033. Technological disruptions, such as the integration of IoT in connected personal care devices and advancements in salon-quality hair care at home, are redefining consumer expectations. Shifting consumer behavior, including a growing preference for DIY beauty treatments and the adoption of men's grooming appliances, is a key growth driver. The increasing popularity of online shopping for personal care products and the demand for eco-friendly and sustainable personal care appliances are also shaping market dynamics. Innovations in cordless technology, faster charging capabilities, and intuitive user interfaces are further fueling adoption rates across various segments.

- Market Size Evolution: Projected to grow from approximately 60,000 million units (2024) to 85,000 million units (2033).

- CAGR: An estimated CAGR of 4.5% from 2025-2033.

- Adoption Rates: High adoption for hair styling appliances and shaving/grooming devices, with beauty appliances and oral care showing steady growth.

- Technological Disruptions: Rise of AI-powered devices, smart functionalities, and advancements in materials science for enhanced performance and durability.

- Consumer Behavior Shifts: Increased focus on self-care, demand for convenience and efficiency, and a growing influence of social media trends on purchasing decisions.

- Market Penetration: Steady increase across all product categories, with higher penetration in the United States.

Dominant Regions, Countries, or Segments in North America Personal Care Appliances Market

The United States stands as the dominant country within the North America Personal Care Appliances Market, commanding an estimated market share of 70-75%. This dominance is driven by a combination of factors including a high disposable income, a large and diverse consumer base, and a strong inclination towards adopting new technologies and beauty trends. The Shaving and Grooming segment, particularly trimmers and shavers for both men and women, is a significant contributor, reflecting a strong emphasis on personal hygiene and appearance. Within the Styling segment, hair dryers and hair straighteners exhibit robust sales, catering to the constant demand for sophisticated hairstyles.

Women represent the largest gender demographic influencing the market, followed closely by Men due to the expanding men's grooming sector. Unisex products are also gaining traction. The Online Stores distribution channel is rapidly emerging as a primary driver, facilitated by the convenience and wide selection offered, though Supermarkets/Hypermarkets and Specialty Stores maintain a significant presence. Canada and Mexico are also crucial markets, each contributing to the overall regional growth with their unique consumer preferences and economic conditions. The "Rest of North America" segment, while smaller, presents untapped potential for niche product offerings.

- Dominant Country: United States (Estimated 70-75% market share).

- Key Drivers: High disposable income, strong consumer adoption of technology, significant beauty and grooming industry presence.

- Dominant Segment (Type): Shaving and Grooming (including Shavers, Trimmers) and Styling (including Hair Straighteners, Hair Dryers).

- Growth Factors: Increasing focus on personal grooming, demand for salon-like results at home.

- Dominant Gender: Women, with Men's grooming segment experiencing rapid growth.

- Market Influence: Evolving beauty standards and self-care routines across all genders.

- Dominant Distribution Channel: Online Stores, followed by Supermarkets/Hypermarkets and Specialty Stores.

- Trend: E-commerce's continued rise, offering accessibility and competitive pricing.

- Geographical Influence: United States leading, Canada and Mexico showing steady growth, "Rest of North America" offering niche opportunities.

North America Personal Care Appliances Market Product Landscape

The product landscape for North America Personal Care Appliances is defined by continuous innovation in design, functionality, and user experience. Brands are focusing on developing cordless hair dryers with advanced ionic technology for reduced frizz, smart shavers with skin-sensing capabilities for personalized comfort, and epilators with pain-reducing features. The integration of UV sterilization in oral care appliances and the development of anti-aging beauty devices are also noteworthy. Performance metrics such as motor speed, battery life, heat settings, and ergonomic design are key differentiators, with manufacturers striving for greater efficiency, safety, and portability in their personal care devices. Unique selling propositions often revolve around convenience, speed, effectiveness, and advanced technological integration for a superior at-home grooming and beauty experience.

Key Drivers, Barriers & Challenges in North America Personal Care Appliances Market

Key Drivers: The North America Personal Care Appliances Market is propelled by several key drivers, including the increasing consumer emphasis on personal grooming and hygiene, the growing popularity of DIY beauty treatments, and the continuous influx of technological advancements leading to more sophisticated and user-friendly devices. The rise of influencer marketing and social media trends significantly impacts consumer purchasing decisions, driving demand for the latest beauty and styling tools. Economic factors such as rising disposable incomes also play a crucial role.

Barriers & Challenges: Despite robust growth, the market faces several challenges. High product costs, especially for premium and technologically advanced appliances, can act as a barrier for some consumer segments. Intense competition among numerous brands, including established players and emerging disruptors, puts pressure on pricing and margins. Supply chain disruptions, as experienced in recent years, can impact product availability and lead times. Furthermore, evolving consumer preferences and the rapid pace of technological obsolescence necessitate continuous R&D investment to stay competitive. Regulatory compliance for new technologies, such as smart devices, can also present hurdles.

- Supply Chain Issues: Potential for delays and increased costs due to global logistics challenges.

- Regulatory Hurdles: Need for compliance with evolving safety and data privacy standards for connected devices.

- Competitive Pressures: Intense rivalry leading to price sensitivity and a constant need for differentiation.

- Technological Obsolescence: The rapid advancement of technology requires continuous innovation and product updates.

Emerging Opportunities in North America Personal Care Appliances Market

Emerging opportunities lie in the burgeoning demand for sustainable and eco-friendly personal care appliances, featuring recycled materials and energy-efficient designs. The expansion of the men's grooming segment, with specialized and multi-functional devices, presents significant untapped potential. Furthermore, the development of personalized beauty tech powered by AI and data analytics to offer tailored routines and recommendations is a rapidly growing frontier. Untapped markets within the "Rest of North America" and the increasing adoption of oral care devices beyond basic toothbrushes are also key areas for growth.

Growth Accelerators in the North America Personal Care Appliances Market Industry

Long-term growth in the North America Personal Care Appliances Market will be significantly accelerated by breakthroughs in miniaturization and portability, enabling more convenient and on-the-go grooming solutions. Strategic partnerships between appliance manufacturers and beauty/skincare brands will foster co-branded innovations and bundled offerings, enhancing consumer appeal. Market expansion strategies focusing on emerging demographic segments and geographical regions with growing disposable incomes will drive sustained growth. The continued integration of IoT and smart home ecosystems will create a more connected and personalized user experience, further accelerating adoption.

Key Players Shaping the North America Personal Care Appliances Market Market

- BaBylissPRO

- Procter & Gamble

- Dyson

- Wahl Clipper Corporation

- Andis Company

- Conair Corporation

- Koninklijke Philips NV

- Spectrum Brands Inc

- Panasonic Corporation

Notable Milestones in North America Personal Care Appliances Market Sector

- 2023: Launch of Dyson's advanced hair dryer with intelligent heat control, revolutionizing hair styling.

- 2023: Philips introduces a new line of smart electric toothbrushes with AI-powered coaching for improved oral hygiene.

- 2022: BaBylissPRO unveils its next-generation cordless hair dryers, offering salon-professional performance on the go.

- 2022: Wahl Clipper Corporation expands its professional grooming line with innovative multi-grooming kits.

- 2021: Conair Corporation enhances its styling appliance range with sustainable materials and energy-efficient technologies.

- 2020: Procter & Gamble focuses on smart skincare devices and personalized beauty solutions.

- 2019: Andis Company introduces advanced trimmers and clippers with enhanced battery life and precision.

In-Depth North America Personal Care Appliances Market Market Outlook

The North America Personal Care Appliances Market is set for a future defined by innovation, personalization, and convenience. Growth accelerators such as the increasing demand for smart beauty appliances, the expansion of the men's grooming sector, and the strong consumer drive towards DIY self-care routines will continue to fuel market expansion. Strategic opportunities lie in developing sustainable product lines, leveraging AI for personalized user experiences, and expanding into underserved markets. The future promises a landscape where advanced technology seamlessly integrates into daily grooming and beauty rituals, offering consumers unparalleled control and efficacy in achieving their desired personal care outcomes.

North America Personal Care Appliances Market Segmentation

-

1. Gender

- 1.1. Men

- 1.2. Women

- 1.3. Unisex

-

2. Type

-

2.1. Shaving and Grooming

- 2.1.1. Shavers

- 2.1.2. Trimmers

- 2.1.3. Epilator

-

2.2. Styling

- 2.2.1. Hair Straightener

- 2.2.2. Hair Dryer

- 2.2.3. Hair Curler

- 2.2.4. Others

- 2.3. Beauty Appliances

- 2.4. Oral Care

-

2.1. Shaving and Grooming

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Personal Care Appliances Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Personal Care Appliances Market Regional Market Share

Geographic Coverage of North America Personal Care Appliances Market

North America Personal Care Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Menstrual Hygiene; Advertisement and Promotional Campaigns Raising Awareness

- 3.3. Market Restrains

- 3.3.1. Orthodox and Conventional Approach Towards Menstruation

- 3.4. Market Trends

- 3.4.1. Rising Consumer Inclination Towards Hair Styling Tools

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Personal Care Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Gender

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Unisex

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Shaving and Grooming

- 5.2.1.1. Shavers

- 5.2.1.2. Trimmers

- 5.2.1.3. Epilator

- 5.2.2. Styling

- 5.2.2.1. Hair Straightener

- 5.2.2.2. Hair Dryer

- 5.2.2.3. Hair Curler

- 5.2.2.4. Others

- 5.2.3. Beauty Appliances

- 5.2.4. Oral Care

- 5.2.1. Shaving and Grooming

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Gender

- 6. United States North America Personal Care Appliances Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Gender

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Unisex

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Shaving and Grooming

- 6.2.1.1. Shavers

- 6.2.1.2. Trimmers

- 6.2.1.3. Epilator

- 6.2.2. Styling

- 6.2.2.1. Hair Straightener

- 6.2.2.2. Hair Dryer

- 6.2.2.3. Hair Curler

- 6.2.2.4. Others

- 6.2.3. Beauty Appliances

- 6.2.4. Oral Care

- 6.2.1. Shaving and Grooming

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Gender

- 7. Canada North America Personal Care Appliances Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Gender

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Unisex

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Shaving and Grooming

- 7.2.1.1. Shavers

- 7.2.1.2. Trimmers

- 7.2.1.3. Epilator

- 7.2.2. Styling

- 7.2.2.1. Hair Straightener

- 7.2.2.2. Hair Dryer

- 7.2.2.3. Hair Curler

- 7.2.2.4. Others

- 7.2.3. Beauty Appliances

- 7.2.4. Oral Care

- 7.2.1. Shaving and Grooming

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Gender

- 8. Mexico North America Personal Care Appliances Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Gender

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Unisex

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Shaving and Grooming

- 8.2.1.1. Shavers

- 8.2.1.2. Trimmers

- 8.2.1.3. Epilator

- 8.2.2. Styling

- 8.2.2.1. Hair Straightener

- 8.2.2.2. Hair Dryer

- 8.2.2.3. Hair Curler

- 8.2.2.4. Others

- 8.2.3. Beauty Appliances

- 8.2.4. Oral Care

- 8.2.1. Shaving and Grooming

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Gender

- 9. Rest of North America North America Personal Care Appliances Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Gender

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Unisex

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Shaving and Grooming

- 9.2.1.1. Shavers

- 9.2.1.2. Trimmers

- 9.2.1.3. Epilator

- 9.2.2. Styling

- 9.2.2.1. Hair Straightener

- 9.2.2.2. Hair Dryer

- 9.2.2.3. Hair Curler

- 9.2.2.4. Others

- 9.2.3. Beauty Appliances

- 9.2.4. Oral Care

- 9.2.1. Shaving and Grooming

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Gender

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BaBylissPRO*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Procter & Gamble

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dyson

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Wahl Clipper Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Andis Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Conair Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke Philips NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Spectrum Brands Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Panasonic Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 BaBylissPRO*List Not Exhaustive

List of Figures

- Figure 1: North America Personal Care Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Personal Care Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: North America Personal Care Appliances Market Revenue billion Forecast, by Gender 2020 & 2033

- Table 2: North America Personal Care Appliances Market Volume K Units Forecast, by Gender 2020 & 2033

- Table 3: North America Personal Care Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: North America Personal Care Appliances Market Volume K Units Forecast, by Type 2020 & 2033

- Table 5: North America Personal Care Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Personal Care Appliances Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Personal Care Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Personal Care Appliances Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: North America Personal Care Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Personal Care Appliances Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: North America Personal Care Appliances Market Revenue billion Forecast, by Gender 2020 & 2033

- Table 12: North America Personal Care Appliances Market Volume K Units Forecast, by Gender 2020 & 2033

- Table 13: North America Personal Care Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Personal Care Appliances Market Volume K Units Forecast, by Type 2020 & 2033

- Table 15: North America Personal Care Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: North America Personal Care Appliances Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: North America Personal Care Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Personal Care Appliances Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: North America Personal Care Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Personal Care Appliances Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: North America Personal Care Appliances Market Revenue billion Forecast, by Gender 2020 & 2033

- Table 22: North America Personal Care Appliances Market Volume K Units Forecast, by Gender 2020 & 2033

- Table 23: North America Personal Care Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: North America Personal Care Appliances Market Volume K Units Forecast, by Type 2020 & 2033

- Table 25: North America Personal Care Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 26: North America Personal Care Appliances Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: North America Personal Care Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Personal Care Appliances Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: North America Personal Care Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Personal Care Appliances Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: North America Personal Care Appliances Market Revenue billion Forecast, by Gender 2020 & 2033

- Table 32: North America Personal Care Appliances Market Volume K Units Forecast, by Gender 2020 & 2033

- Table 33: North America Personal Care Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: North America Personal Care Appliances Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: North America Personal Care Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: North America Personal Care Appliances Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: North America Personal Care Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Personal Care Appliances Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Personal Care Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Personal Care Appliances Market Volume K Units Forecast, by Country 2020 & 2033

- Table 41: North America Personal Care Appliances Market Revenue billion Forecast, by Gender 2020 & 2033

- Table 42: North America Personal Care Appliances Market Volume K Units Forecast, by Gender 2020 & 2033

- Table 43: North America Personal Care Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: North America Personal Care Appliances Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: North America Personal Care Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: North America Personal Care Appliances Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: North America Personal Care Appliances Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: North America Personal Care Appliances Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: North America Personal Care Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: North America Personal Care Appliances Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Personal Care Appliances Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the North America Personal Care Appliances Market?

Key companies in the market include BaBylissPRO*List Not Exhaustive, Procter & Gamble, Dyson, Wahl Clipper Corporation, Andis Company, Conair Corporation, Koninklijke Philips NV, Spectrum Brands Inc, Panasonic Corporation.

3. What are the main segments of the North America Personal Care Appliances Market?

The market segments include Gender, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Menstrual Hygiene; Advertisement and Promotional Campaigns Raising Awareness.

6. What are the notable trends driving market growth?

Rising Consumer Inclination Towards Hair Styling Tools.

7. Are there any restraints impacting market growth?

Orthodox and Conventional Approach Towards Menstruation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Personal Care Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Personal Care Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Personal Care Appliances Market?

To stay informed about further developments, trends, and reports in the North America Personal Care Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence