Key Insights

The Saudi Arabia Beauty and Personal Care Market is poised for significant growth, reaching an estimated $6.8 billion in 2025. This robust expansion is fueled by a 3.5% CAGR, indicating a healthy and sustained upward trajectory for the foreseeable future. The market's dynamism is driven by several key factors. Rising disposable incomes among Saudi consumers, a growing emphasis on personal grooming and aesthetics, and increasing adoption of premium and niche beauty products are significant contributors. Furthermore, the government's Vision 2030 initiative, which encourages diversification and growth in non-oil sectors, including retail and consumer goods, provides a supportive ecosystem for the beauty and personal care industry. The increasing influence of social media and digital platforms in shaping consumer preferences and driving purchasing decisions also plays a crucial role in market expansion.

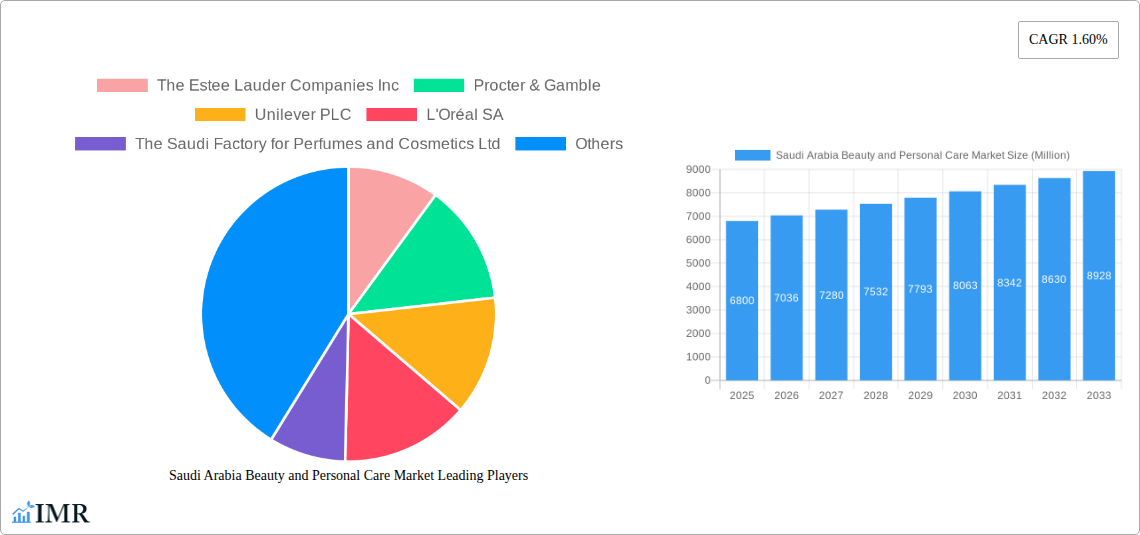

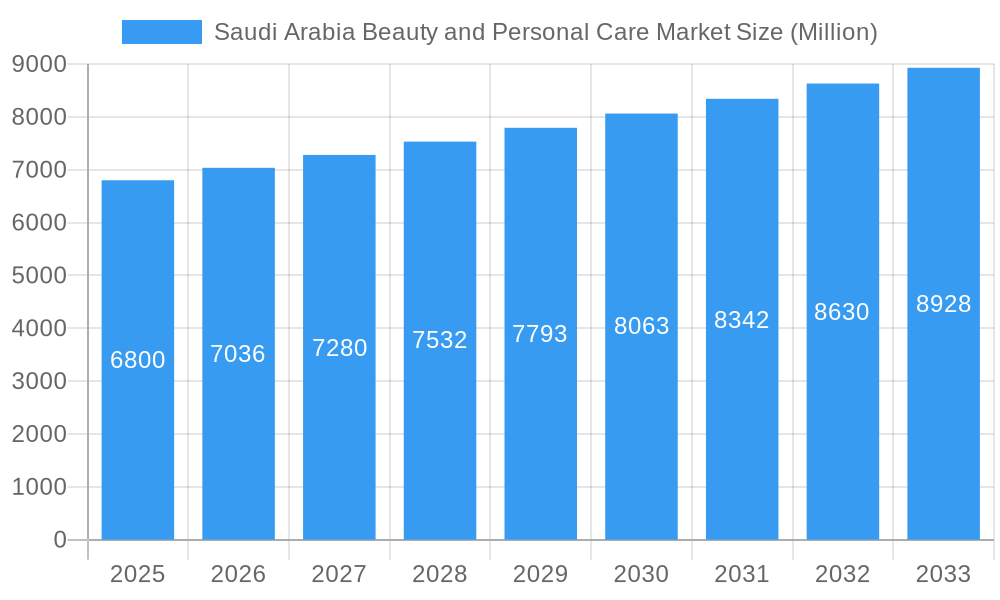

Saudi Arabia Beauty and Personal Care Market Market Size (In Billion)

The market segmentation reveals a diverse landscape, with Color Cosmetics and Hair Styling and Coloring Products leading as key categories. Within Color Cosmetics, facial make-up products, eye make-up products, and lip and nail make-up products are all experiencing strong demand. The Hair Styling and Coloring Products segment, encompassing hair colors and styling products, is also a significant growth area. Distribution channels are evolving, with online retailing showing remarkable growth, complementing traditional channels like specialty stores, hypermarkets/supermarkets, and pharmacies. Key players like The Estee Lauder Companies Inc., Procter & Gamble, Unilever PLC, and L'Oréal SA are actively investing in product innovation, marketing, and expanding their presence in the region, further intensifying competition and driving market development. This strategic focus by major companies, coupled with a discerning consumer base, is set to shape the future of the Saudi beauty and personal care market.

Saudi Arabia Beauty and Personal Care Market Company Market Share

Unlock the immense potential of the Saudi Arabian beauty and personal care market with our in-depth report. Spanning from 2019 to 2033, this analysis provides unparalleled insights into market dynamics, growth trajectories, and strategic opportunities. We delve into the parent and child market segments, examining product types like Color Cosmetics and Hair Styling and Coloring Products, and distribution channels including Specialty Stores, Hypermarkets/supermarkets, Pharmacy and Drug Stores, and Online Retailing. With a base year of 2025 and a robust forecast period of 2025–2033, this report is your definitive guide to navigating this rapidly evolving industry. Discover key players, industry developments, and future outlooks, all presented with clear, concise data and actionable intelligence.

Saudi Arabia Beauty and Personal Care Market Market Dynamics & Structure

The Saudi Arabian beauty and personal care market is characterized by a dynamic interplay of intense competition and evolving consumer preferences, driving a moderately concentrated market structure. Technological innovation, particularly in product formulations and digital engagement, acts as a significant growth driver, with brands increasingly investing in R&D for premium and personalized offerings. Regulatory frameworks, while evolving to support market growth, also present adherence requirements for product safety and marketing claims. Competitive product substitutes are abundant, ranging from mass-market accessible items to high-end luxury goods, forcing brands to differentiate through quality, branding, and unique selling propositions. End-user demographics are shifting, with a burgeoning young population and increasing disposable incomes driving demand for a wider array of beauty products. Mergers and acquisitions (M&A) trends are emerging as key strategies for market consolidation and expansion, allowing established players to acquire innovative startups and broaden their portfolios.

- Market Concentration: Moderate, with a few global giants holding significant share, but a growing number of local and niche brands gaining traction.

- Technological Innovation Drivers: Focus on AI-driven personalization, advanced skincare ingredients, sustainable packaging, and e-commerce integration.

- Regulatory Frameworks: Evolving standards for product safety, ingredient disclosure, and ethical marketing practices.

- Competitive Product Substitutes: Extensive range from affordable mass-market brands to premium luxury and niche artisanal products.

- End-User Demographics: Young, digitally-savvy population with increasing disposable income, driving demand for trend-driven and efficacy-focused products.

- M&A Trends: Strategic acquisitions of niche brands with unique product lines and strong online presence to enhance market share and innovation capabilities. Expected M&A deal volume in the upcoming years is projected to be in the range of 5-10 significant transactions, indicating consolidation efforts.

Saudi Arabia Beauty and Personal Care Market Growth Trends & Insights

The Saudi Arabia beauty and personal care market is poised for substantial growth, projected to reach an estimated $XX billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This upward trajectory is fueled by a confluence of factors including increasing disposable incomes, a rapidly growing young demographic with a keen interest in beauty trends, and a significant surge in digital adoption and e-commerce penetration. The market's evolution is marked by shifting consumer behaviors, with a heightened emphasis on product efficacy, natural and sustainable ingredients, and personalized beauty solutions. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI) for personalized recommendations, augmented reality (AR) for virtual try-ons, and advanced formulations promising enhanced results.

The adoption rates for premium and specialized beauty products are on the rise, as consumers become more educated about ingredients and their benefits. This is particularly evident in the skincare segment, which is experiencing robust growth due to a greater awareness of preventative skincare and anti-aging solutions. The demand for color cosmetics is also robust, driven by social media trends and a desire for self-expression. Online retailing has emerged as a dominant force, offering unparalleled convenience and a wider selection, further accelerating market penetration for both global and emerging brands. The market's expansion is also supported by significant investments in marketing and brand building by both international and local players, creating a vibrant and competitive landscape. Consumer willingness to experiment with new brands and products, coupled with a strong preference for aesthetically pleasing and ethically produced goods, underpins the sustained growth observed. The estimated market size in 2019 was $XX billion, and by 2024, it reached $XX billion, showcasing consistent expansion. The forecast anticipates this momentum to continue, with the market size expected to reach $XX billion by 2033, reflecting its enduring appeal and untapped potential.

Dominant Regions, Countries, or Segments in Saudi Arabia Beauty and Personal Care Market

Within the Saudi Arabian beauty and personal care market, Color Cosmetics stands out as the dominant product type segment, consistently driving market growth. This segment's strength is attributed to its broad appeal across different age groups and its direct correlation with evolving fashion and social media trends. The sub-segments of Facial Make-Up Products and Lip and Nail Make-up Products are particularly influential, witnessing high demand due to their visibility and role in daily self-expression and special occasions. The increasing disposable income and a young, fashion-conscious population are key factors fueling this dominance.

The Online Retailing distribution channel is rapidly emerging as a dominant force, challenging traditional brick-and-mortar establishments. Its growth is propelled by the convenience it offers, the extensive product selection available, and the personalized shopping experiences facilitated by digital platforms. E-commerce penetration in Saudi Arabia has seen exponential growth, making it an indispensable channel for both consumers and brands. This channel allows for direct-to-consumer (DTC) sales, reducing reliance on intermediaries and enabling brands to build direct relationships with their customer base.

Dominant Product Type: Color Cosmetics

- Key Drivers: High adoption rates driven by fashion trends, social media influence, and a young demographic's desire for self-expression.

- Sub-segment Dominance: Facial Make-Up Products and Lip and Nail Make-up Products exhibit particularly strong performance.

- Market Share: Estimated to account for XX% of the total beauty and personal care market in 2025.

- Growth Potential: Continued innovation in formulations, shades, and long-wear technologies will sustain its growth.

Dominant Distribution Channel: Online Retailing

- Key Drivers: Unparalleled convenience, vast product availability, personalized shopping experiences, and increasing internet and smartphone penetration.

- Market Share: Projected to capture XX% of the market by 2025, with significant year-over-year growth.

- Growth Potential: Further expansion of e-commerce platforms, integration of AI-powered recommendations, and efficient last-mile delivery solutions will fuel its dominance.

- Impact on Traditional Channels: Increased pressure on Hypermarkets/supermarkets and Specialty Stores to enhance their online presence and omnichannel strategies.

Saudi Arabia Beauty and Personal Care Market Product Landscape

The Saudi Arabian beauty and personal care product landscape is characterized by a dynamic infusion of innovation and a growing emphasis on efficacy and personalization. Brands are actively launching advanced formulations incorporating potent active ingredients, catering to specific skin concerns and beauty aspirations. From cutting-edge skincare serums with scientifically proven benefits to long-wear, transfer-proof color cosmetics, the focus is on delivering tangible results. Unique selling propositions often revolve around natural and sustainable sourcing, cruelty-free certifications, and the development of products tailored to the unique needs of the region's climate and skin types. Technological advancements are evident in product delivery systems, such as airless pumps for preserving ingredient integrity and microencapsulation for controlled release of active compounds, enhancing both product performance and consumer experience.

Key Drivers, Barriers & Challenges in Saudi Arabia Beauty and Personal Care Market

Key Drivers: The Saudi Arabian beauty and personal care market is propelled by a burgeoning young and affluent population with a strong appetite for trendy and premium products. Increasing disposable incomes, coupled with a growing awareness and adoption of global beauty standards influenced by social media, are significant catalysts. The government's Vision 2030 initiatives, promoting economic diversification and encouraging entrepreneurship, also foster market growth. Technological advancements in product formulation, digital marketing, and e-commerce are further accelerating market penetration and consumer engagement. The rising interest in wellness and self-care also contributes to the demand for a wider range of personal care products.

Barriers & Challenges: Despite the growth, the market faces several challenges. Intense competition from established global brands and a growing number of local players can make it difficult for new entrants to gain market share. Regulatory hurdles, although streamlining, still require careful navigation for product registration and compliance. Supply chain complexities and the need for robust logistics infrastructure to reach diverse consumer bases across the country can pose significant operational challenges. Furthermore, the rapid pace of innovation necessitates continuous investment in R&D and marketing to stay relevant, impacting profit margins. Counterfeiting and intellectual property protection also remain persistent concerns. The market is estimated to lose XX% of its potential revenue annually due to counterfeit products.

Emerging Opportunities in Saudi Arabia Beauty and Personal Care Market

Emerging opportunities within the Saudi Arabian beauty and personal care market lie in the burgeoning demand for halal-certified and ethically sourced products, aligning with the cultural values of a significant portion of the population. The growing awareness of sustainable beauty practices presents a significant opening for eco-friendly packaging and biodegradable ingredients. Furthermore, the expansion of men's grooming products, a segment with considerable untapped potential, offers substantial growth prospects. Personalization, driven by advancements in AI and data analytics, allows for hyper-tailored product recommendations and custom formulations, catering to individual consumer needs and preferences. The development of innovative skincare solutions addressing specific regional concerns, such as hyperpigmentation and sun damage, also represents a promising niche.

Growth Accelerators in the Saudi Arabia Beauty and Personal Care Market Industry

Long-term growth in the Saudi Arabian beauty and personal care market is significantly accelerated by strategic market expansion initiatives and ongoing technological breakthroughs. The increasing adoption of advanced digital marketing strategies, including influencer collaborations and targeted social media campaigns, plays a crucial role in reaching and engaging a wider consumer base. The government's continued support for local manufacturing and innovation through incentives and favorable policies also acts as a powerful growth accelerator. Strategic partnerships between international brands and local distributors are crucial for navigating market nuances and expanding reach. Moreover, the continuous development of e-commerce infrastructure and logistics networks further streamlines product accessibility, enabling brands to cater to a more dispersed customer base effectively.

Key Players Shaping the Saudi Arabia Beauty and Personal Care Market Market

- The Estee Lauder Companies Inc

- Procter & Gamble

- Unilever PLC

- L'Oréal SA

- The Saudi Factory for Perfumes and Cosmetics Ltd

- Madi International

- Oriflame Cosmetics SA

- Shiseido Company Limited

- Beiersdorf AG

- Avon Cosmetics

Notable Milestones in Saudi Arabia Beauty and Personal Care Market Sector

- September 2023: Charlotte Tilbury, the renowned British beauty brand, opened two new stores in Riyadh, Saudi Arabia, aiming to offer its award-winning makeup and skincare products.

- August 2023: Zvezda Beauty, a new beauty brand, was launched in Saudi Arabia, providing cosmetics, skincare, and beauty essentials to local fashion shops, makeup parlors, and beauty businesses.

- January 2023: Happier Skincare, a North Indian brand, expanded its presence in the Middle East, focusing on Saudi Arabia and the UAE by offering its skincare products, including toners, cleansers, sunscreens, and serums, with a strong emphasis on e-commerce expansion.

In-Depth Saudi Arabia Beauty and Personal Care Market Market Outlook

The outlook for the Saudi Arabian beauty and personal care market remains exceptionally bright, driven by sustained consumer demand and an increasing focus on product innovation and diversification. Growth accelerators such as the expansion of e-commerce, coupled with a rising awareness of specialized beauty needs, will continue to fuel market expansion. Strategic opportunities for brands lie in capitalizing on the demand for sustainable and halal-certified products, as well as the untapped potential in the men's grooming segment. The ongoing digital transformation within the sector, from AI-driven personalization to augmented reality experiences, will further enhance consumer engagement and brand loyalty. Continued investment in market research and product development tailored to regional preferences will solidify the market's impressive growth trajectory.

Saudi Arabia Beauty and Personal Care Market Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-Up Products

- 1.1.2. Eye Make-Up Products

- 1.1.3. Lip and Nail Make-up Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Hypermarkets/supermarkets

- 2.3. Pharmacy and Drug Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

Saudi Arabia Beauty and Personal Care Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Beauty and Personal Care Market Regional Market Share

Geographic Coverage of Saudi Arabia Beauty and Personal Care Market

Saudi Arabia Beauty and Personal Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Natural Variants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-Up Products

- 5.1.1.2. Eye Make-Up Products

- 5.1.1.3. Lip and Nail Make-up Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Hypermarkets/supermarkets

- 5.2.3. Pharmacy and Drug Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Procter & Gamble

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 L'Oréal SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Saudi Factory for Perfumes and Cosmetics Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Madi International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oriflame Cosmetics SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiseido Company Limited*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beiersdorf AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avon Cosmetics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: Saudi Arabia Beauty and Personal Care Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Beauty and Personal Care Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Saudi Arabia Beauty and Personal Care Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Beauty and Personal Care Market?

The projected CAGR is approximately 0.78%.

2. Which companies are prominent players in the Saudi Arabia Beauty and Personal Care Market?

Key companies in the market include The Estee Lauder Companies Inc, Procter & Gamble, Unilever PLC, L'Oréal SA, The Saudi Factory for Perfumes and Cosmetics Ltd, Madi International, Oriflame Cosmetics SA, Shiseido Company Limited*List Not Exhaustive, Beiersdorf AG, Avon Cosmetics.

3. What are the main segments of the Saudi Arabia Beauty and Personal Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics.

6. What are the notable trends driving market growth?

Increasing Popularity of Natural Variants.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2023: Charlotte Tilbury, the renowned British beauty brand, opened two new stores in Riyadh, Saudi Arabia. The store claims to include the brand's award-winning makeup and skin care products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Beauty and Personal Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Beauty and Personal Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Beauty and Personal Care Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Beauty and Personal Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence