Key Insights

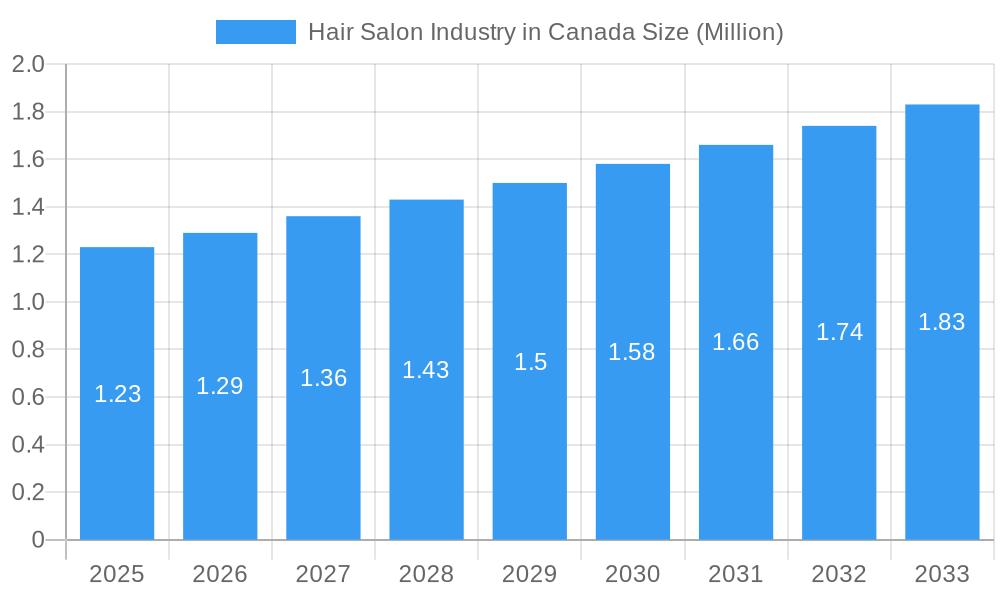

The Canadian hair salon industry is poised for significant expansion, driven by evolving consumer preferences for personalized hair care and styling solutions. With an estimated market size of 1.23 million (value unit: Million) in 2025, the industry is projected to experience a healthy 5.12% CAGR through 2033. This growth is fueled by a rising demand for premium hair treatments, including specialized hair loss solutions and advanced coloring techniques, reflecting a greater emphasis on hair health and aesthetic enhancement among Canadian consumers. The increasing disposable income and a growing social media influence that promotes hair styling trends are key contributors to this upward trajectory. Furthermore, the shift towards professional, salon-exclusive products that offer superior results compared to mass-market alternatives is a notable trend. The integration of digital platforms and online booking services is also enhancing customer accessibility and convenience, further stimulating market engagement.

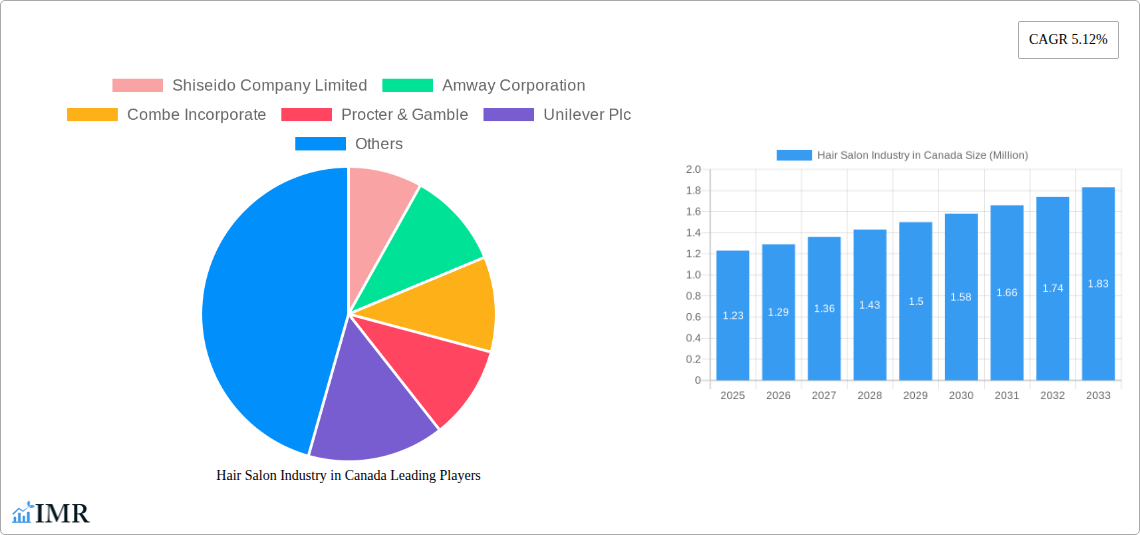

Hair Salon Industry in Canada Market Size (In Million)

The industry's expansion is not without its challenges, however. While drivers such as a strong desire for self-expression through hairstyling and the constant introduction of innovative hair care products are propelling growth, restrains like the increasing cost of raw materials for salon products and a shortage of skilled hairstylists could temper this momentum. Despite these hurdles, the trends towards sustainable and eco-friendly salon practices, along with the growing popularity of DIY hair care coupled with professional salon services, are shaping a dynamic market landscape. The diversification of salon offerings beyond traditional services to include consultations, scalp treatments, and personalized product recommendations further solidifies its appeal. Distribution channels like hypermarkets/supermarkets and online stores are playing an increasingly vital role in product accessibility, catering to a broader consumer base.

Hair Salon Industry in Canada Company Market Share

Here is a comprehensive, SEO-optimized report description for the Hair Salon Industry in Canada, designed for maximum visibility and engagement:

Hair Salon Industry in Canada Market Dynamics & Structure

The Canadian Hair Salon Industry is a dynamic sector characterized by a moderate level of market concentration, with a few large multinational corporations holding significant sway alongside a robust landscape of independent businesses. Technological innovation is a key driver, fueled by advancements in haircare formulations, salon equipment, and digital service platforms. Regulatory frameworks, while generally supportive, focus on consumer safety, professional licensing, and environmental sustainability. Competitive product substitutes range from at-home haircare solutions to emerging DIY salon kits. End-user demographics reveal a growing demand for personalized services, sustainable products, and convenient booking options. Mergers and acquisitions (M&A) trends indicate consolidation among larger players seeking to expand their market share and product portfolios, while smaller independent salons are increasingly exploring strategic alliances to enhance their competitiveness.

- Market Concentration: Dominated by key players such as L'Oreal SA, Procter & Gamble, and Unilever Plc, alongside a fragmented segment of independent salons.

- Technological Innovation: Driven by R&D in ingredients, sustainable packaging, and salon service technologies.

- Regulatory Landscape: Encompasses health and safety standards, ingredient disclosure, and environmental impact regulations.

- Competitive Substitutes: Includes over-the-counter haircare products, DIY kits, and beauty subscription boxes.

- End-User Demographics: Shifting towards younger consumers seeking trend-driven styles and older demographics prioritizing hair health and anti-aging solutions.

- M&A Trends: Steady activity with focus on acquiring niche brands and expanding service offerings, with deal volumes reaching xx Million units annually.

Hair Salon Industry in Canada Growth Trends & Insights

The Canadian Hair Salon Industry is poised for significant expansion over the Study Period (2019–2033), projecting a robust market size evolution. Driven by increasing consumer disposable income and a heightened focus on personal grooming and aesthetic appeal, the industry is witnessing steady adoption rates for premium haircare products and innovative salon services. Technological disruptions, including the widespread integration of online booking platforms, AI-powered consultation tools, and advancements in professional styling and coloring technologies, are fundamentally reshaping how consumers interact with salons and haircare brands. Consumer behavior shifts are evident, with a growing preference for personalized experiences, ethically sourced and sustainable products, and a demand for specialized treatments addressing concerns like hair loss and scalp health. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% from the Base Year of 2025. Market penetration is estimated to reach xx% by the end of the Forecast Period (2025–2033), indicating a strong trajectory for growth. The historical period (2019–2024) has laid a foundation for this anticipated surge, with key market developments and evolving consumer preferences setting the stage for future prosperity. The overall market value in the Estimated Year of 2025 is projected to be xx Million units, with a significant contribution from both the parent market (overall haircare) and the child market (professional salon services).

Dominant Regions, Countries, or Segments in Hair Salon Industry in Canada

Within the Canadian Hair Salon Industry, the Shampoo segment stands out as the dominant force driving market growth, with an estimated market share of xx% in the Estimated Year of 2025. This dominance is underpinned by the fundamental nature of shampoo as a daily essential, with consistent demand across all age demographics and income levels. The widespread availability of this product through diverse distribution channels further bolsters its market leadership.

- Shampoo Segment Dominance: Essential daily product with broad consumer appeal. High purchase frequency ensures consistent revenue streams.

- Key Drivers: Increasing consumer awareness of scalp health, demand for specialized formulations (e.g., anti-dandruff, volumizing, color-safe), and the influence of influencer marketing promoting premium and therapeutic shampoos.

- Market Share: xx% of the total Canadian Hair Salon Industry market in 2025.

- Growth Potential: Significant, driven by product innovation and expansion into niche markets.

The Online Stores distribution channel is experiencing the most rapid growth and is becoming increasingly influential in shaping the market landscape. This channel offers unparalleled convenience, a wider selection of products, and competitive pricing, appealing to a growing segment of tech-savvy consumers.

- Online Stores Distribution Channel Growth: Rapid expansion fueled by e-commerce trends and consumer preference for convenience.

- Key Drivers: Ease of access, price comparison, vast product variety, and direct-to-consumer (DTC) brand strategies. The burgeoning e-commerce infrastructure in Canada supports this growth.

- Market Share: Projected to reach xx% of the total distribution channel market by 2033.

- Growth Potential: Extremely high, with increasing investment from major retailers and independent brands.

In terms of regional dominance, Ontario consistently leads the market due to its large population, high disposable income, and concentration of major urban centers. The province exhibits the highest number of salon establishments and significant consumer spending on haircare products and services.

- Ontario's Regional Dominance: Largest provincial economy and population center in Canada.

- Key Drivers: High consumer spending power, presence of major retailers and salon chains, and a diverse demographic profile.

- Market Share: Accounts for approximately xx% of the national hair salon market.

- Growth Potential: Strong and stable, reflecting its established economic footing.

These segments and regions are interconnected, with the online channel facilitating access to shampoo products across all provinces, and Ontario acting as a key consumer hub for both product and service expenditures. The synergy between these factors underscores the overall health and projected growth trajectory of the Canadian Hair Salon Industry.

Hair Salon Industry in Canada Product Landscape

The Canadian Hair Salon Industry is witnessing a surge in product innovation, with a focus on natural, organic, and sustainable formulations. Shiseido Company Limited, Amway Corporation, and Kao Corporation are leading the charge with advanced ingredient technologies that address specific hair concerns such as frizz control, color protection, and hair loss. Applications are expanding beyond basic cleansing and conditioning to include personalized scalp treatments and styling products infused with beneficial botanicals. Performance metrics emphasize improved hair texture, shine, and overall hair health, with a growing emphasis on eco-friendly packaging and cruelty-free certifications.

Key Drivers, Barriers & Challenges in Hair Salon Industry in Canada

Key Drivers: The Canadian Hair Salon Industry is propelled by several key drivers. Technological advancements in haircare formulations, particularly in anti-hair loss treatments and advanced coloring agents from companies like L'Oreal SA and Procter & Gamble, are creating new market opportunities. A growing consumer emphasis on personal well-being and appearance, coupled with rising disposable incomes, fuels demand for premium salon services and high-quality haircare products. Evolving consumer preferences for natural and sustainable ingredients, championed by brands like Oriflame Cosmetics AG, also act as a significant growth accelerator.

Barriers & Challenges: Despite robust growth prospects, the industry faces several challenges. Supply chain disruptions and the increasing cost of raw materials, as experienced by companies like Revlon Inc and Johnson & Johnson Inc, can impact profitability. Stringent regulatory compliance, particularly concerning product ingredient disclosures and salon operational standards, presents ongoing hurdles. Intense competition, both from established multinational corporations and a burgeoning number of independent and direct-to-consumer brands, exerts downward pressure on pricing and requires continuous innovation. Consumer price sensitivity, especially in economically uncertain times, can also limit the adoption of premium-priced products and services.

Emerging Opportunities in Hair Salon Industry in Canada

Emerging opportunities in the Canadian Hair Salon Industry lie in the growing demand for specialized and personalized services. The rise of the "wellness" trend is creating a niche for holistic hair and scalp treatments, incorporating Ayurvedic principles and advanced dermatological approaches. Untapped markets exist in serving specific demographic groups, such as men seeking sophisticated grooming solutions and a growing aging population requiring hair rejuvenation treatments. Innovative applications of technology, including AI-driven hair analysis for personalized product recommendations and virtual try-on services for hair color, are also presenting significant avenues for growth.

Growth Accelerators in the Hair Salon Industry in Canada Industry

The long-term growth of the Canadian Hair Salon Industry is significantly accelerated by several key factors. Technological breakthroughs in biotechnology and ingredient science are enabling the development of highly effective and targeted haircare solutions, as seen with advancements from Kao Corporation. Strategic partnerships between salon chains, product manufacturers like Unilever Plc, and e-commerce platforms are expanding market reach and enhancing consumer accessibility. Furthermore, aggressive market expansion strategies by both established and emerging brands, focusing on product diversification and entering underserved regional markets, are crucial growth catalysts. The increasing integration of sustainable practices throughout the value chain is also resonating with environmentally conscious consumers, further solidifying market growth.

Key Players Shaping the Hair Salon Industry in Canada Market

- Shiseido Company Limited

- Amway Corporation

- Combe Incorporate

- Procter & Gamble

- Unilever Plc

- L'Oreal SA

- Revlon Inc

- Johnson & Johnson Inc

- Oriflame Cosmetics AG

- Kao Corporation

Notable Milestones in Hair Salon Industry in Canada Sector

- 2019: Increased consumer focus on sustainable haircare products and packaging.

- 2020: Significant shift towards at-home haircare solutions and online retail due to the global pandemic.

- 2021: Resurgence in demand for professional salon services as restrictions eased. Introduction of advanced hair loss treatment formulations by key players.

- 2022: Growing popularity of personalized haircare consultations and custom-blended products.

- 2023: Expansion of e-commerce capabilities and direct-to-consumer (DTC) sales by major brands.

- 2024: Increased investment in AI and digital tools for salon client engagement and personalized service delivery.

In-Depth Hair Salon Industry in Canada Market Outlook

The outlook for the Canadian Hair Salon Industry remains exceptionally positive, driven by a confluence of robust growth accelerators. The persistent demand for personalized and technologically advanced haircare solutions, coupled with a growing consumer consciousness around sustainability and wellness, will continue to shape market trends. Strategic collaborations, further integration of digital technologies for enhanced customer experiences, and a focus on product innovation in areas like hair health and anti-aging treatments are set to drive future market expansion. The industry is well-positioned for sustained growth, offering significant opportunities for stakeholders who can adapt to evolving consumer preferences and leverage technological advancements.

Hair Salon Industry in Canada Segmentation

-

1. Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Loss Treatment Products

- 1.4. Hair Colorants

- 1.5. Hair Styling Products

- 1.6. Perms and Relaxants

- 1.7. Others

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Specialty Store

- 2.3. Online Stores

- 2.4. Pharmacies/ Drug Stores

- 2.5. Convenience Stores

- 2.6. Other Distribution Channels

Hair Salon Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

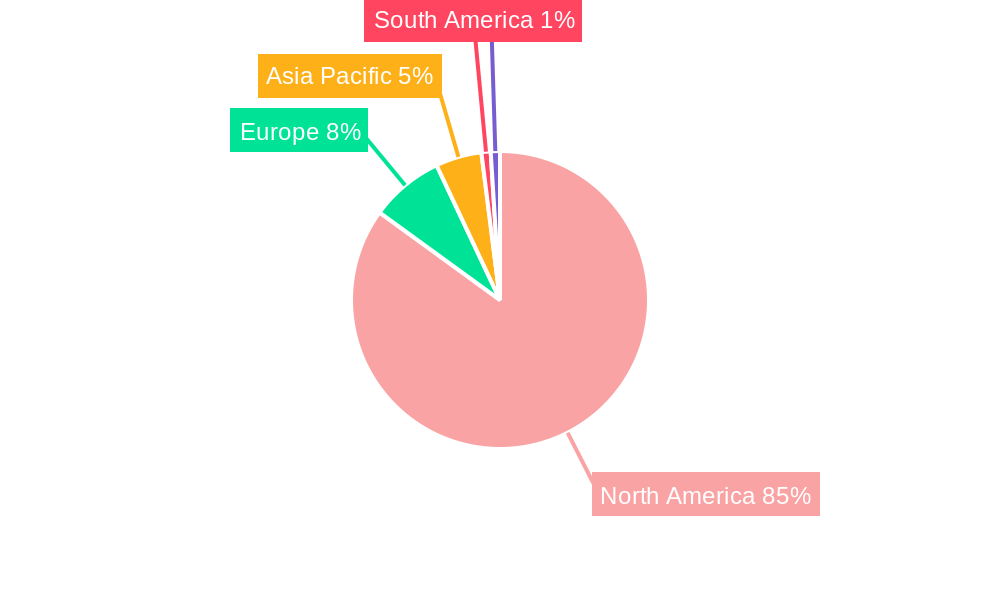

Hair Salon Industry in Canada Regional Market Share

Geographic Coverage of Hair Salon Industry in Canada

Hair Salon Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Growing Demand for Organic Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Loss Treatment Products

- 5.1.4. Hair Colorants

- 5.1.5. Hair Styling Products

- 5.1.6. Perms and Relaxants

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Specialty Store

- 5.2.3. Online Stores

- 5.2.4. Pharmacies/ Drug Stores

- 5.2.5. Convenience Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Loss Treatment Products

- 6.1.4. Hair Colorants

- 6.1.5. Hair Styling Products

- 6.1.6. Perms and Relaxants

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Specialty Store

- 6.2.3. Online Stores

- 6.2.4. Pharmacies/ Drug Stores

- 6.2.5. Convenience Stores

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Loss Treatment Products

- 7.1.4. Hair Colorants

- 7.1.5. Hair Styling Products

- 7.1.6. Perms and Relaxants

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Specialty Store

- 7.2.3. Online Stores

- 7.2.4. Pharmacies/ Drug Stores

- 7.2.5. Convenience Stores

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Loss Treatment Products

- 8.1.4. Hair Colorants

- 8.1.5. Hair Styling Products

- 8.1.6. Perms and Relaxants

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Specialty Store

- 8.2.3. Online Stores

- 8.2.4. Pharmacies/ Drug Stores

- 8.2.5. Convenience Stores

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Loss Treatment Products

- 9.1.4. Hair Colorants

- 9.1.5. Hair Styling Products

- 9.1.6. Perms and Relaxants

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Specialty Store

- 9.2.3. Online Stores

- 9.2.4. Pharmacies/ Drug Stores

- 9.2.5. Convenience Stores

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hair Salon Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Shampoo

- 10.1.2. Conditioner

- 10.1.3. Hair Loss Treatment Products

- 10.1.4. Hair Colorants

- 10.1.5. Hair Styling Products

- 10.1.6. Perms and Relaxants

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarket/Supermarket

- 10.2.2. Specialty Store

- 10.2.3. Online Stores

- 10.2.4. Pharmacies/ Drug Stores

- 10.2.5. Convenience Stores

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shiseido Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amway Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Combe Incorporate

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Procter & Gamble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L'Oreal SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Revlon Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oriflame Cosmetics AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shiseido Company Limited

List of Figures

- Figure 1: Global Hair Salon Industry in Canada Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Hair Salon Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hair Salon Industry in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Hair Salon Industry in Canada Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hair Salon Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hair Salon Industry in Canada Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Hair Salon Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hair Salon Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Salon Industry in Canada?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Hair Salon Industry in Canada?

Key companies in the market include Shiseido Company Limited, Amway Corporation, Combe Incorporate, Procter & Gamble, Unilever Plc, L'Oreal SA, Revlon Inc, Johnson & Johnson Inc, Oriflame Cosmetics AG, Kao Corporation.

3. What are the main segments of the Hair Salon Industry in Canada?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Growing Demand for Organic Hair Care Products.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Salon Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Salon Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Salon Industry in Canada?

To stay informed about further developments, trends, and reports in the Hair Salon Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence