Key Insights

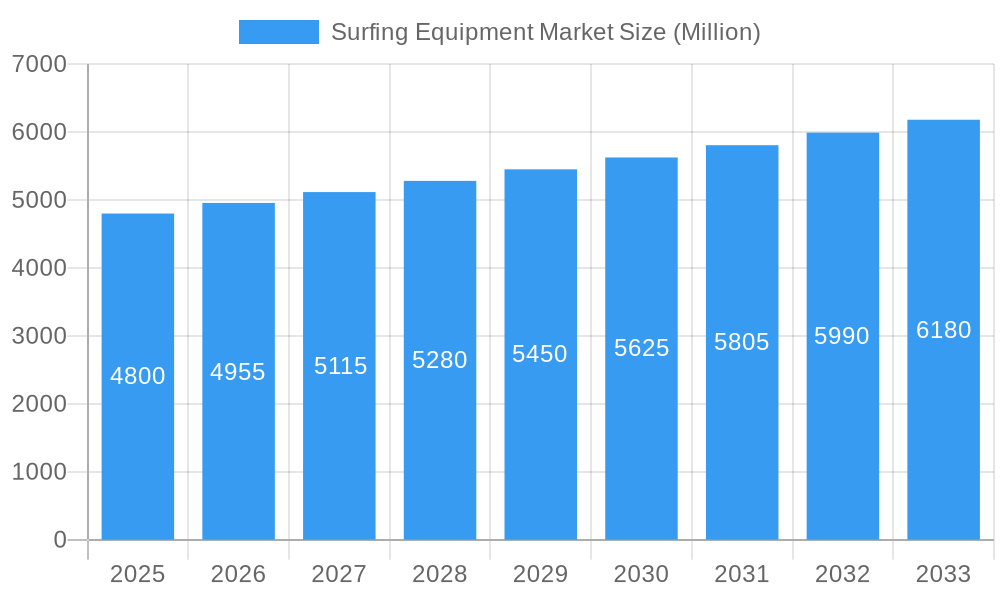

The global Surfing Equipment Market is projected to reach a substantial USD 4.8 billion in 2025, demonstrating robust growth with a projected Compound Annual Growth Rate (CAGR) of 4.4% from 2019 to 2033. This expansion is fueled by several key drivers, including the increasing popularity of surfing as a recreational and competitive sport, a growing awareness of its health benefits, and the rise of surf tourism. Furthermore, technological advancements in surfboard design and materials are leading to lighter, more durable, and higher-performing products, attracting both seasoned surfers and newcomers. The market is also experiencing a significant trend towards sustainable and eco-friendly surfing equipment, driven by environmental consciousness among consumers. This segment is seeing innovation in recycled materials and manufacturing processes, appealing to a growing demographic. The increasing participation across various age groups, from youth to seniors, and the emergence of new surf destinations worldwide are also contributing to market expansion.

Surfing Equipment Market Market Size (In Billion)

Despite the positive growth trajectory, the market faces certain restraints. These include the high cost of specialized surfing equipment, which can be a barrier for entry-level participants, and the dependence on favorable weather and ocean conditions, which can lead to seasonality and unpredictability in demand. Additionally, intense competition among established brands and emerging players, alongside evolving fashion trends in surf apparel and accessories, necessitates continuous product innovation and effective marketing strategies. The market is segmented into Product Types such as surfboards, clothing, footwear, protective guards & accessories, and further categorized by Distribution Channels including online and offline retail. Key players like Billabong International Limited, O'Neill, Boardriders (Quiksilver), and Rip Curl Ltd are actively shaping market dynamics through product development and strategic partnerships.

Surfing Equipment Market Company Market Share

This in-depth report provides a definitive analysis of the global Surfing Equipment Market, offering critical insights into its dynamics, growth trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this research is indispensable for manufacturers, distributors, investors, and industry stakeholders seeking to navigate and capitalize on the evolving surfing industry. We delve into intricate market segmentation, including product types like surfing boards, clothing, footwear, and protective guards & accessories, alongside distribution channels such as online and offline retail. The report meticulously examines parent and child markets, revealing hidden growth avenues and competitive advantages.

This report provides a comprehensive overview of the Surfing Equipment Market, including:

The Surfing Equipment Market is projected to reach $XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033.

- Market Size & Growth: Detailed market size valuations in billion USD for the historical period, base year, estimated year, and forecast period.

- Segmentation Analysis: Granular breakdown by product type and distribution channel.

- Regional Dominance: Identification of key growth regions and countries.

- Competitive Landscape: In-depth analysis of major industry players and their strategies.

- Key Trends & Developments: Examination of technological advancements, industry collaborations, and emerging opportunities.

- Drivers & Restraints: Identification of factors influencing market growth and potential challenges.

Surfing Equipment Market Market Dynamics & Structure

The Surfing Equipment Market exhibits a dynamic interplay of factors shaping its structure and growth. Market concentration varies across product segments, with established brands dominating core categories like surfing boards and apparel, while emerging players carve niches in specialized equipment such as electric surfboards. Technological innovation is a significant driver, propelled by advancements in materials science for lighter and more durable boards, as well as performance-enhancing features in wetsuits and accessories. Regulatory frameworks, primarily concerning environmental sustainability and safety standards for equipment, are increasingly influencing product development and manufacturing processes. Competitive product substitutes, ranging from other water sports equipment to alternative recreational activities, pose a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are shifting, with a growing participation from younger generations and an increasing interest in eco-friendly and sustainable surfing practices. Mergers and acquisitions (M&A) activity, while moderate, plays a role in consolidating market share and expanding product portfolios.

- Market Concentration: Dominance of key brands in surfing boards and apparel, with increasing fragmentation in niche segments.

- Technological Innovation Drivers: Advancements in materials, digital integration in surfboards, and sustainable manufacturing.

- Regulatory Frameworks: Focus on environmental impact, material sourcing, and product safety standards.

- Competitive Product Substitutes: Competition from other water sports, adventure tourism, and active lifestyle products.

- End-User Demographics: Growing youth participation, increasing female surfer demographic, and demand for sustainable products.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

Surfing Equipment Market Growth Trends & Insights

The global Surfing Equipment Market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and increasing participation in water sports. Market size evolution indicates a steady upward trend, fueled by the aspirational appeal of surfing and its associated lifestyle. Adoption rates for surfing equipment are being positively impacted by greater accessibility to information and training resources, both online and through specialized surf schools. Technological disruptions are significantly reshaping the product landscape. The development of lighter, more responsive, and eco-friendly surfboard materials, such as advanced epoxy resins and carbon fiber constructions, is enhancing performance and durability. Furthermore, the integration of smart technology in some surfboards, offering data on wave conditions and rider performance, is a nascent but promising trend. Consumer behavior shifts are particularly noteworthy. There's a discernible move towards sustainable and ethically sourced products, pushing manufacturers to adopt greener practices in materials and production. The rise of e-commerce and direct-to-consumer (DTC) channels has also democratized access to a wider range of equipment and brands, catering to diverse skill levels and preferences. The growing influence of social media and surf culture is further inspiring new entrants into the sport, thereby expanding the overall market. The projected CAGR of XX% underscores the robust expansion anticipated in the coming years, driven by both increased unit sales and a potential rise in average selling prices for premium and technologically advanced equipment. Market penetration is expected to deepen in emerging economies as infrastructure and recreational opportunities for surfing grow.

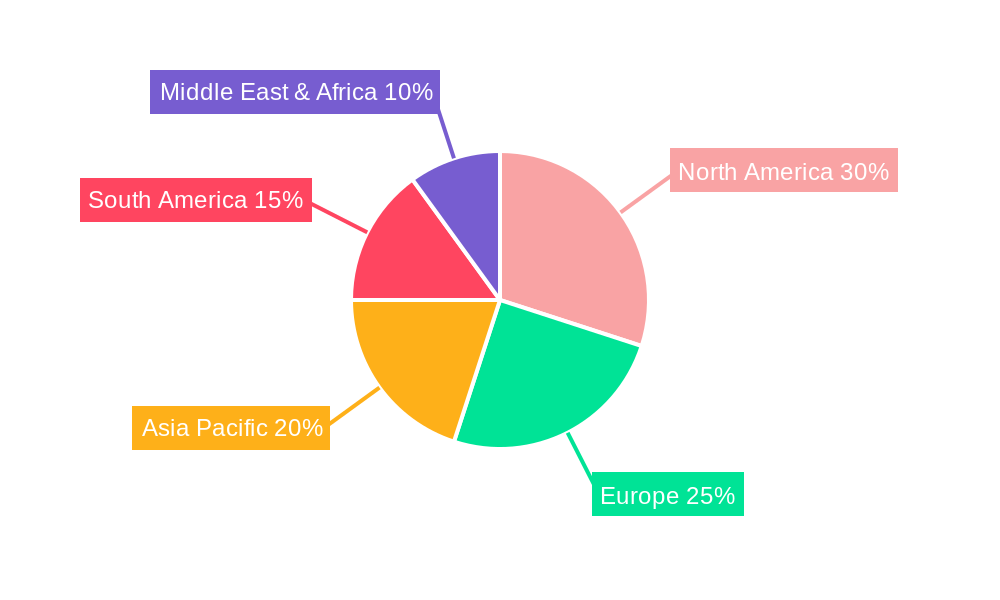

Dominant Regions, Countries, or Segments in Surfing Equipment Market

The global Surfing Equipment Market is experiencing robust growth, with certain regions and product segments exhibiting particularly strong performance. Clothing stands out as a dominant segment within the broader market, driven by its universal appeal and the fashion-forward nature of surf-inspired apparel. This segment benefits from strong brand loyalty and the continuous introduction of new styles and sustainable material innovations. The increasing popularity of surfing as a lifestyle, extending beyond dedicated wave riders to include those who appreciate the aesthetic and ethos, further bolsters clothing sales. Economic policies that support tourism and outdoor recreation, alongside robust infrastructure development in coastal areas, are key drivers in regions with established surf cultures. For instance, countries with extensive coastlines and a long history of surfing, such as Australia and the United States, consistently lead in terms of market share for surfing equipment overall, with clothing being a significant contributor. The Online distribution channel is also a pivotal growth engine, offering unparalleled reach and convenience to consumers worldwide. Its market share is rapidly expanding as consumers increasingly prefer e-commerce for its variety, competitive pricing, and accessibility to niche brands. The COVID-19 pandemic significantly accelerated this shift, and the trend is expected to continue.

- Dominant Segment - Clothing:

- High demand driven by surf culture and lifestyle fashion.

- Continuous innovation in materials, design, and sustainability.

- Strong brand influence and consumer loyalty.

- Dominant Region - North America (especially USA) & Oceania (especially Australia):

- Established surf culture and significant participation rates.

- Strong presence of major surfwear brands and retailers.

- Favorable climate and extensive coastlines for surfing activities.

- Significant investments in surf tourism infrastructure.

- Dominant Distribution Channel - Online:

- Growing consumer preference for e-commerce convenience and selection.

- Increased accessibility to global brands and niche products.

- Impact of digital marketing and social media influence.

- Faster adoption in developed economies, with growing potential in emerging markets.

Surfing Equipment Market Product Landscape

The product landscape of the Surfing Equipment Market is characterized by continuous innovation focused on enhancing performance, durability, and sustainability. Surfing boards are seeing advancements in material science, with the adoption of lightweight and strong composites like EPS foam and epoxy resin, leading to more responsive and maneuverable rides. Innovations also include refined rocker lines, rail designs, and fin systems tailored for specific wave conditions and riding styles. Wetsuits and other surfing apparel are benefiting from improved neoprene technologies and ergonomic designs, offering better thermal insulation, flexibility, and reduced drag. The introduction of eco-friendly and recycled materials is a significant trend, addressing growing consumer demand for sustainable options. Protective guards, such as impact vests and helmets, are becoming more streamlined and offer enhanced safety without compromising mobility. Accessories, including leashes, wax, and board bags, are evolving with improved material resilience and user-friendly features.

Key Drivers, Barriers & Challenges in Surfing Equipment Market

Key Drivers:

- Growing Popularity of Surfing: Increasing global participation driven by media, lifestyle trends, and accessibility.

- Technological Advancements: Innovations in materials and design for enhanced performance and durability.

- Sustainability Initiatives: Growing consumer demand for eco-friendly products and manufacturing practices.

- Rise of Surf Tourism: Expansion of coastal tourism infrastructure and surf camps worldwide.

- Influence of Social Media & Influencers: Increased awareness and aspiration towards surfing.

Barriers & Challenges:

- High Initial Cost of Equipment: Premium surfing boards and gear can be a significant investment for beginners.

- Environmental Concerns: Impact of manufacturing processes and potential pollution from surf wax and equipment.

- Dependence on Favorable Weather and Wave Conditions: Limits consistent participation for some individuals.

- Supply Chain Disruptions: Vulnerability to global shipping delays and raw material availability.

- Competition from Alternative Water Sports: Other activities offering similar recreational benefits.

Emerging Opportunities in Surfing Equipment Market

Emerging opportunities in the Surfing Equipment Market lie in the increasing demand for specialized and personalized equipment catering to a wider range of wave conditions and rider abilities. The growth of electric surfboards presents a significant avenue for innovation and market expansion, offering an alternative for those seeking a consistent surfing experience. Furthermore, the burgeoning market for sustainable and eco-friendly surfing products, from recycled materials in boards and apparel to biodegradable packaging, is a key area for growth. Developing markets in Asia and South America, with their expanding coastlines and increasing disposable incomes, represent untapped potential. The integration of smart technologies, providing performance analytics and wave prediction, also offers opportunities for value-added products.

Growth Accelerators in the Surfing Equipment Market Industry

Catalysts driving long-term growth in the Surfing Equipment Market include ongoing breakthroughs in material science that promise lighter, stronger, and more environmentally friendly surfboard constructions. Strategic partnerships between surf brands and technology companies to develop smart surf gear, such as real-time performance trackers and wave analysis tools, will accelerate innovation and appeal to a tech-savvy demographic. The expansion of surf tourism infrastructure in emerging coastal regions, coupled with government support for water sports, will unlock new markets and increase participation rates globally. Furthermore, the continuous evolution of surf fashion and the integration of surf culture into mainstream lifestyle trends will sustain demand for apparel and accessories, acting as a consistent growth accelerator.

Key Players Shaping the Surfing Equipment Market Market

- Billabong International Limited

- O'Neill

- Boardriders (Quiksilver)

- Cannibal Surfboards

- Rip Curl Ltd

- Rusty Surfboards

- Vans Surf

- Channel Islands Surfboards

- Firewire Surfboards LLC

- Nike Inc

Notable Milestones in Surfing Equipment Market Sector

- Mar 2023: Vans Surf launched Surf VR3 Collection, claiming that it is designed to bring together the relaxed vibes of surfing and Vans' continued commitment to more sustainably-focused clothing and footwear.

- Jan 2023: NASCAR partnered with action-sports brand Hurley in a clothing collaboration, launching men's and women's beach and surf apparel.

- Feb 2022: Swedish electric surfboard manufacturer Awake revealed the latest version of its range-topping model, the Rävik S 22. The board featured a 12-kW brushless motor and a resigned impeller for increased torque and acceleration.

In-Depth Surfing Equipment Market Market Outlook

The Surfing Equipment Market is set for sustained growth, propelled by an increasing global passion for surfing and a continuous wave of innovation. The outlook is particularly bright for companies that can effectively leverage sustainable material technologies and cater to the rising demand for eco-conscious products. The integration of smart technology into surfboards and accessories presents a significant opportunity to enhance user experience and create premium product offerings. Expansion into developing markets, supported by improved coastal infrastructure and a growing middle class, will provide new avenues for market penetration. Strategic collaborations and partnerships, particularly with environmental organizations and tech firms, will further amplify growth and drive forward the evolution of surfing equipment for a more engaged and sustainable future.

Surfing Equipment Market Segmentation

-

1. Product Type

- 1.1. Surfing boards

- 1.2. Clothing

- 1.3. Footwear

- 1.4. Protective guards & Accessories

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

Surfing Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Surfing Equipment Market Regional Market Share

Geographic Coverage of Surfing Equipment Market

Surfing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Growing Interest Of People In Adventure Sports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Surfing boards

- 5.1.2. Clothing

- 5.1.3. Footwear

- 5.1.4. Protective guards & Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Surfing boards

- 6.1.2. Clothing

- 6.1.3. Footwear

- 6.1.4. Protective guards & Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Surfing boards

- 7.1.2. Clothing

- 7.1.3. Footwear

- 7.1.4. Protective guards & Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Surfing boards

- 8.1.2. Clothing

- 8.1.3. Footwear

- 8.1.4. Protective guards & Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Surfing boards

- 9.1.2. Clothing

- 9.1.3. Footwear

- 9.1.4. Protective guards & Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Surfing boards

- 10.1.2. Clothing

- 10.1.3. Footwear

- 10.1.4. Protective guards & Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Surfing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Surfing boards

- 11.1.2. Clothing

- 11.1.3. Footwear

- 11.1.4. Protective guards & Accessories

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Billabong International Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 O'Neill

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Boardriders (Quiksilver)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cannibal Surfboards

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rip Curl Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rusty Surfboards

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Vans Surf*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Channel Islands Surfboards

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Firewire Surfboards LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nike Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Billabong International Limited

List of Figures

- Figure 1: Global Surfing Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Surfing Equipment Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Surfing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Surfing Equipment Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 35: Saudi Arabia Surfing Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 36: Saudi Arabia Surfing Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Surfing Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Surfing Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Spain Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 30: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Surfing Equipment Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 39: Global Surfing Equipment Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Surfing Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: South Africa Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Surfing Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surfing Equipment Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Surfing Equipment Market?

Key companies in the market include Billabong International Limited, O'Neill, Boardriders (Quiksilver), Cannibal Surfboards, Rip Curl Ltd, Rusty Surfboards, Vans Surf*List Not Exhaustive, Channel Islands Surfboards, Firewire Surfboards LLC, Nike Inc.

3. What are the main segments of the Surfing Equipment Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Growing Interest Of People In Adventure Sports.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

Mar 2023: Vans Surf launched Surf VR3 Collection, claiming that it is designed to bring together the relaxed vibes of surfing and Vans' continued commitment to more sustainably-focused clothing and footwear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Surfing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Surfing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Surfing Equipment Market?

To stay informed about further developments, trends, and reports in the Surfing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence