Key Insights

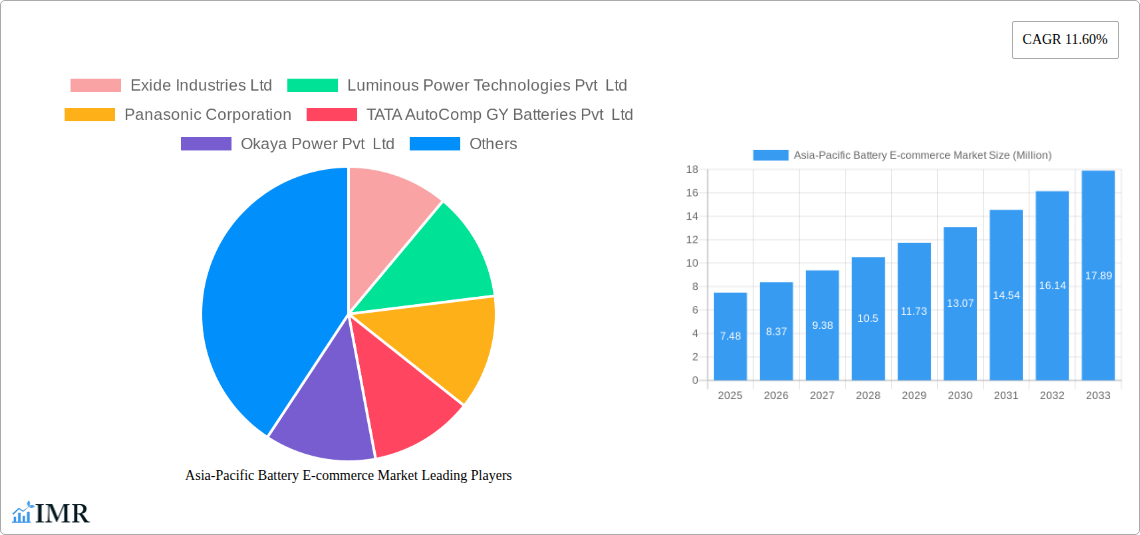

The Asia-Pacific Battery E-commerce Market is poised for substantial growth, with a current market size of approximately USD 7.48 million. Projections indicate a remarkable Compound Annual Growth Rate (CAGR) of 11.60% from 2025 to 2033, signaling a dynamic and expanding sector. This surge is primarily propelled by escalating demand for electric vehicles (EVs) across the region, particularly in India and China, coupled with the increasing adoption of renewable energy storage solutions. Government initiatives supporting green energy and advancements in battery technology, such as the widespread integration of Lithium-ion batteries offering superior performance and lifespan over traditional Lead-Acid variants, are key drivers. The convenience and accessibility offered by e-commerce platforms are further accelerating this trend, allowing consumers and businesses to readily access a diverse range of battery products.

Asia-Pacific Battery E-commerce Market Market Size (In Million)

Several key trends are shaping the Asia-Pacific Battery E-commerce landscape. The burgeoning EV market is a significant contributor, as consumers increasingly opt for online channels to research and purchase batteries for their electric vehicles. Simultaneously, the growing integration of battery storage systems for solar power and other renewable energy sources is fueling demand. While the market is largely driven by technological advancements and consumer preferences, certain restraints exist, such as the complexities of battery disposal and recycling, and the initial higher cost of advanced battery technologies like Lithium-ion. However, the evolving regulatory frameworks and increasing consumer awareness regarding environmental sustainability are likely to mitigate these challenges, paving the way for continued robust growth and innovation in the Asia-Pacific Battery E-commerce Market.

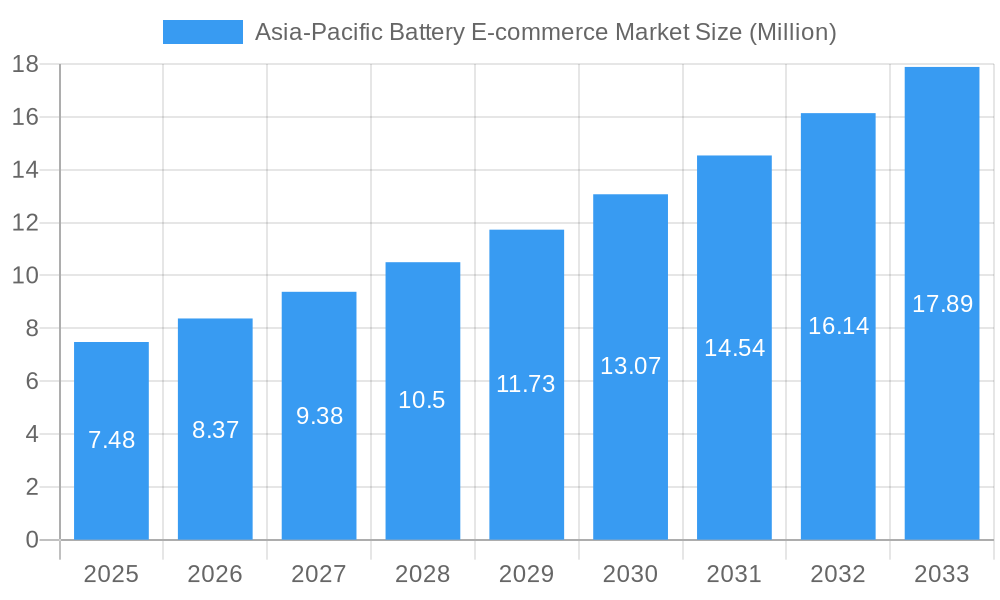

Asia-Pacific Battery E-commerce Market Company Market Share

Asia-Pacific Battery E-commerce Market: Comprehensive Report & Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Battery E-commerce Market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the competitive strategies of major players. Delve into the intricate workings of this rapidly expanding sector, from lead-acid to cutting-edge lithium-ion solutions, and understand the forces shaping its future. Explore market forecasts and actionable insights for strategic decision-making within the battery e-commerce ecosystem. All values are presented in Million units.

Asia-Pacific Battery E-commerce Market Market Dynamics & Structure

The Asia-Pacific battery e-commerce market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demographics. Market concentration varies significantly across different battery types and geographical sub-regions. Lithium-ion batteries, driven by the electric vehicle (EV) revolution and portable electronics, represent a rapidly growing segment, attracting substantial investment and fostering fierce competition. Conversely, the established lead-acid battery market continues to demonstrate resilience, particularly in automotive and industrial backup applications, albeit with slower growth. Technological innovation is a paramount driver, with ongoing advancements in battery chemistry, energy density, charging speeds, and safety features directly influencing consumer purchasing decisions on e-commerce platforms. The proliferation of online marketplaces and direct-to-consumer sales channels has democratized access to a wider range of battery products, intensifying competition and necessitating robust supply chain management. Regulatory frameworks, particularly concerning battery disposal, recycling, and safety standards, play a crucial role in shaping market access and product development. The burgeoning EV sector is a significant end-user demographic, demanding high-performance, reliable, and increasingly cost-effective batteries, creating a substantial pull for e-commerce sales. The competitive product substitute landscape includes not only different battery chemistries but also advancements in alternative energy storage solutions and energy efficiency technologies. Merger and acquisition (M&A) trends are on the rise as established players seek to expand their market reach, acquire innovative technologies, and consolidate their positions in this competitive arena. Key M&A activities often revolve around securing raw material supply chains, gaining access to specialized manufacturing capabilities, or enhancing e-commerce distribution networks.

- Market Concentration: Fragmented in some sub-segments (e.g., lead-acid), consolidating in high-growth areas (e.g., lithium-ion for EVs).

- Technological Innovation Drivers: Advancements in lithium-ion chemistries, solid-state batteries, improved charging infrastructure, and enhanced battery management systems (BMS).

- Regulatory Frameworks: Stringent environmental regulations for battery disposal and recycling, evolving safety standards for lithium-ion batteries, and government incentives for EV adoption are shaping market dynamics.

- Competitive Product Substitutes: Innovations in alternative energy storage, increased adoption of renewable energy sources, and advancements in energy-efficient technologies.

- End-User Demographics: Growing middle class in developing economies, increasing adoption of electric vehicles, expansion of portable electronics, and demand for reliable backup power solutions.

- M&A Trends: Strategic acquisitions to secure supply chains, gain technological expertise, and expand market share in the rapidly growing EV battery segment.

Asia-Pacific Battery E-commerce Market Growth Trends & Insights

The Asia-Pacific battery e-commerce market is experiencing a significant growth trajectory, propelled by a confluence of factors that are reshaping consumer purchasing habits and industrial demand. The market size evolution is particularly striking, with the increasing accessibility and convenience offered by e-commerce platforms facilitating a broader reach for battery manufacturers and distributors. Adoption rates are soaring across diverse segments, from personal electronics and electric vehicles to renewable energy storage and industrial backup systems. This widespread adoption is underpinned by a growing awareness of the benefits of battery-powered technologies and a desire for sustainable energy solutions. Technological disruptions are at the forefront of this growth, with relentless innovation in battery chemistries, such as advancements in lithium-ion technology (e.g., higher energy density, faster charging, improved safety) and emerging technologies like solid-state batteries, driving demand for newer, more efficient products. These innovations are not only enhancing product performance but also reducing costs over the long term, making battery-powered solutions more attractive to a wider consumer base. Consumer behavior shifts are pivotal to understanding the market's expansion. The younger demographic, in particular, is highly comfortable with online purchasing, seeking competitive pricing, product reviews, and convenient delivery options, all of which are readily available through e-commerce channels. The convenience of purchasing batteries online, whether for personal devices, automotive replacements, or industrial applications, has significantly reduced traditional purchasing barriers. Furthermore, the COVID-19 pandemic accelerated the shift towards online shopping for a vast array of products, including batteries, a trend that has largely persisted. Market penetration is deepening across both developed and developing economies within the Asia-Pacific region, driven by increasing disposable incomes, a growing middle class, and government initiatives promoting electrification and renewable energy adoption. The CAGR for the Asia-Pacific battery e-commerce market is projected to remain robust, reflecting sustained demand for battery solutions across various applications. This growth is further amplified by the expansion of online marketplaces that cater specifically to niche battery requirements and offer specialized technical support, thereby enhancing the overall customer experience. The ability of e-commerce platforms to provide detailed product specifications, customer reviews, and competitive pricing allows consumers to make informed purchasing decisions, driving sales volume and market growth.

Dominant Regions, Countries, or Segments in Asia-Pacific Battery E-commerce Market

The Asia-Pacific battery e-commerce market's dominance is intricately linked to specific regions, countries, and battery segments, each contributing uniquely to the overall growth trajectory. Among the battery types, Lithium-Ion batteries are emerging as the most dominant force, propelled by the exponential growth of the electric vehicle (EV) sector and the pervasive demand for portable electronic devices. China, as the world's largest EV market and a manufacturing powerhouse for consumer electronics, spearheads this dominance. Its extensive manufacturing capabilities, coupled with robust government support for new energy vehicles and battery technology development, have created an unparalleled ecosystem for lithium-ion battery production and e-commerce sales. The sheer volume of EV sales, coupled with a growing consumer base for smartphones, laptops, and other battery-powered gadgets, fuels significant demand through online channels.

Within the geographical landscape, China stands out as the single most dominant country. Its vast population, rapidly advancing technological infrastructure, and proactive industrial policies create a fertile ground for battery e-commerce. The country's well-developed logistics networks ensure efficient delivery of battery products across its extensive landmass, making online purchases highly convenient. Furthermore, China's leadership in lithium-ion battery manufacturing and its strong domestic demand for EVs significantly influence the global battery market and its e-commerce segment.

Beyond China, India is rapidly ascending as a key growth driver, particularly in the lead-acid and lithium-ion battery segments. The country's burgeoning automotive sector, coupled with increasing adoption of electric two-wheelers and three-wheelers, is creating substantial demand for batteries. Government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are further incentivizing the transition to EVs, thereby boosting battery sales through e-commerce. The growing consumer demand for home energy storage solutions, driven by unreliable power grids in certain regions, also contributes to the growth of the battery e-commerce market in India.

Australia presents a unique growth profile, primarily driven by its robust renewable energy sector and increasing adoption of electric vehicles. Government incentives for solar power installations and battery storage solutions are creating significant demand for residential and commercial battery systems, which are increasingly being purchased online. The increasing popularity of EVs in Australia, though still nascent compared to China, is also contributing to the growth of the lithium-ion battery e-commerce market.

- Dominant Battery Segment: Lithium-Ion batteries, fueled by the EV revolution and portable electronics.

- Dominant Country: China, due to its massive EV market, consumer electronics manufacturing, and robust e-commerce infrastructure.

- Key Growth Driver: India, driven by electric mobility initiatives and demand for energy storage solutions.

- Emerging Market: Australia, with strong growth in renewable energy storage and increasing EV adoption.

- Other significant markets that contribute to the Asia-Pacific battery e-commerce landscape include Malaysia, Thailand, Indonesia, and Vietnam, each with its own set of drivers such as automotive sector growth, consumer electronics demand, and government policies promoting electrification.

Asia-Pacific Battery E-commerce Market Product Landscape

The Asia-Pacific battery e-commerce market boasts a diverse and evolving product landscape, catering to a wide spectrum of applications. Leading the charge are advanced lithium-ion battery solutions, including various chemistries like Lithium Nickel Manganese Cobalt (NMC), Lithium Iron Phosphate (LFP), and Lithium Cobalt Oxide (LCO), each offering distinct performance metrics such as energy density, cycle life, and safety profiles. These are increasingly available online for electric vehicles, portable power stations, and high-end consumer electronics. Alongside these, high-performance lead-acid batteries, including Absorbed Glass Mat (AGM) and Gel variants, continue to be prominent for automotive starting, lighting, and ignition (SLI) applications and uninterrupted power supply (UPS) systems. Emerging product categories include specialized batteries for drones, medical devices, and industrial robotics, showcasing the expanding reach of battery technology. Unique selling propositions often revolve around enhanced energy storage capacity, faster charging capabilities, extended lifespan, and improved safety features, all meticulously detailed on e-commerce platforms to inform consumer choices and drive sales.

Key Drivers, Barriers & Challenges in Asia-Pacific Battery E-commerce Market

Key Drivers: The Asia-Pacific battery e-commerce market is propelled by several critical forces. The burgeoning electric vehicle (EV) adoption across the region, driven by government incentives and environmental consciousness, is creating immense demand for lithium-ion batteries. Rapid urbanization and rising disposable incomes are fueling the demand for portable electronics and energy storage solutions. Technological advancements in battery chemistries, leading to improved performance, longer lifespan, and reduced costs, are making battery-powered solutions more accessible and appealing. The convenience and competitive pricing offered by e-commerce platforms further accelerate market penetration.

Barriers & Challenges: Despite the robust growth, the market faces significant challenges. Supply chain disruptions and raw material price volatility, particularly for critical minerals like lithium and cobalt, can impact production costs and availability. Stringent regulatory frameworks and safety standards for battery transportation and disposal can create hurdles for e-commerce logistics. Intense competition among numerous players, both established and emerging, exerts pressure on pricing and profit margins. Counterfeit products and quality concerns on online platforms can erode consumer trust. Furthermore, the technical expertise required for battery selection and installation for certain applications can be a barrier for some online consumers.

Emerging Opportunities in Asia-Pacific Battery E-commerce Market

The Asia-Pacific battery e-commerce market presents numerous untapped opportunities. The expansion of battery recycling and second-life applications offers a significant avenue for sustainable growth and circular economy initiatives. The increasing adoption of renewable energy storage systems for residential and commercial use, particularly in regions with grid instability, presents a substantial market. The development of specialized batteries for emerging technologies such as drones, advanced robotics, and the Internet of Things (IoT) devices will open new consumer segments. Furthermore, the rise of "battery-as-a-service" models delivered through e-commerce platforms could revolutionize how consumers access and manage battery power.

Growth Accelerators in the Asia-Pacific Battery E-commerce Market Industry

Several catalysts are accelerating long-term growth in the Asia-Pacific battery e-commerce industry. Continuous innovation in battery technology, focusing on higher energy density, faster charging, and enhanced safety, will remain a primary growth engine. Strategic partnerships between battery manufacturers, e-commerce platforms, and automotive companies are crucial for expanding market reach and streamlining distribution. Government policies promoting electrification and renewable energy adoption, including subsidies and infrastructure development, will create sustained demand. The growth of sophisticated logistics networks across the region will further enhance the efficiency and reach of e-commerce sales, making battery acquisition more convenient for end-users.

Key Players Shaping the Asia-Pacific Battery E-commerce Market Market

- Exide Industries Ltd

- Luminous Power Technologies Pvt Ltd

- Panasonic Corporation

- TATA AutoComp GY Batteries Pvt Ltd

- Okaya Power Pvt Ltd

- LG Chem Ltd

- Samsung SDI Co Ltd

- BYD Co Ltd

- East Penn Manufacturing Company

- Hitachi Ltd

Notable Milestones in Asia-Pacific Battery E-commerce Market Sector

- June 2023: Tata Group signed an outline deal for building a lithium-ion cell factory with an investment of about USD 1.58 billion. The EV battery plant will help the nation create its electric vehicle supply chain rather than rely on imports. The plant will be located in Gujarat and have an initial manufacturing capacity of 20 gigawatt hours (GWh). Similarly, state-owned companies such as BHEL are establishing a lithium-ion battery production facility near Bangalore, Karnataka.

- May 2023: Pan Asia Metals signed a non-binding memorandum of understanding (MoU) with VinES Energy Solutions to explore a standalone lithium conversion project in Vietnam. Under the terms of the agreement, Pan Asia and VinES will collaborate to assess the viability of a standalone lithium conversion facility near VinES' Vietnamese battery plant. The study will consider an initial capacity of 20,000 to 25,000 tonnes of lithium carbonate or hydroxide per year.

In-Depth Asia-Pacific Battery E-commerce Market Market Outlook

The Asia-Pacific battery e-commerce market is poised for sustained, robust growth, driven by accelerating technological advancements and increasing consumer adoption of battery-dependent solutions. The ongoing electrification of transportation, coupled with the pervasive use of portable electronics, ensures a continuous demand for high-performance battery products. Strategic investments in battery manufacturing, particularly for lithium-ion technology, by both private enterprises and governments, will further bolster supply chain capabilities and drive down costs. The expansion of e-commerce logistics and the increasing consumer comfort with online purchases will continue to make batteries more accessible across diverse geographical areas. Future growth will also be significantly influenced by innovations in battery recycling and the development of circular economy models, creating a more sustainable and cost-effective market. Untapped potential in emerging economies and the increasing demand for energy storage solutions for renewable energy integration present substantial avenues for market expansion and strategic opportunities for industry stakeholders.

Asia-Pacific Battery E-commerce Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid

- 1.2. Lithium-Ion

- 1.3. Others

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. India

- 2.1.2. China

- 2.1.3. Australia

- 2.1.4. Malaysia

- 2.1.5. Thailand

- 2.1.6. Indonesia

- 2.1.7. Vietnam

- 2.1.8. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Battery E-commerce Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Australia

- 1.4. Malaysia

- 1.5. Thailand

- 1.6. Indonesia

- 1.7. Vietnam

- 1.8. Rest of Asia Pacific

Asia-Pacific Battery E-commerce Market Regional Market Share

Geographic Coverage of Asia-Pacific Battery E-commerce Market

Asia-Pacific Battery E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.4. Market Trends

- 3.4.1. The Lithium-Ion Battery Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Battery E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid

- 5.1.2. Lithium-Ion

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. India

- 5.2.1.2. China

- 5.2.1.3. Australia

- 5.2.1.4. Malaysia

- 5.2.1.5. Thailand

- 5.2.1.6. Indonesia

- 5.2.1.7. Vietnam

- 5.2.1.8. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exide Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luminous Power Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TATA AutoComp GY Batteries Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okaya Power Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Chem Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung SDI Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East Penn Manufacturing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Exide Industries Ltd

List of Figures

- Figure 1: Global Asia-Pacific Battery E-commerce Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia-Pacific Battery E-commerce Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Battery Type 2025 & 2033

- Figure 4: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Battery Type 2025 & 2033

- Figure 5: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 6: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Battery Type 2025 & 2033

- Figure 7: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Geography 2025 & 2033

- Figure 9: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Asia-Pacific Battery E-commerce Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Asia-Pacific Battery E-commerce Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 11: Global Asia-Pacific Battery E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Asia-Pacific Battery E-commerce Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: India Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: China Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: China Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Australia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Malaysia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Thailand Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Indonesia Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Indonesia Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Vietnam Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Vietnam Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Asia-Pacific Battery E-commerce Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Asia-Pacific Battery E-commerce Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Battery E-commerce Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Asia-Pacific Battery E-commerce Market?

Key companies in the market include Exide Industries Ltd, Luminous Power Technologies Pvt Ltd, Panasonic Corporation, TATA AutoComp GY Batteries Pvt Ltd, Okaya Power Pvt Ltd, LG Chem Ltd, Samsung SDI Co Ltd, BYD Co Ltd, East Penn Manufacturing Company, Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the Asia-Pacific Battery E-commerce Market?

The market segments include Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.48 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

6. What are the notable trends driving market growth?

The Lithium-Ion Battery Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

8. Can you provide examples of recent developments in the market?

June 2023: Tata Group signed an outline deal for building a lithium-ion cell factory with an investment of about USD 1.58 billion. The EV battery plant will help the nation create its electric vehicle supply chain rather than rely on imports. The plant will be located in Gujarat and have an initial manufacturing capacity of 20 gigawatt hours (GWh). Similarly, state-owned companies such as BHEL are establishing a lithium-ion battery production facility near Bangalore, Karnataka.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Battery E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Battery E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Battery E-commerce Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Battery E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence