Key Insights

The European High Voltage Direct Current (HVDC) Cables market is set for significant expansion, with a projected market size of 9.7 billion by 2025. This growth is driven by the increasing demand for efficient power transmission to integrate renewable energy sources, particularly offshore wind farms, into existing grids. Europe's commitment to decarbonization and stringent climate targets necessitates advanced HVDC technology for its lower energy losses over long distances compared to AC systems. Grid modernization and the expansion of cross-border interconnections to bolster grid stability and security are also key factors. The market is segmented into submarine, overhead, and underground HVDC transmission systems, with converter stations and cables as essential components. The submarine segment is anticipated to experience robust growth, fueled by expanding offshore wind capacity in regions like the North Sea, with a CAGR of 24.3%.

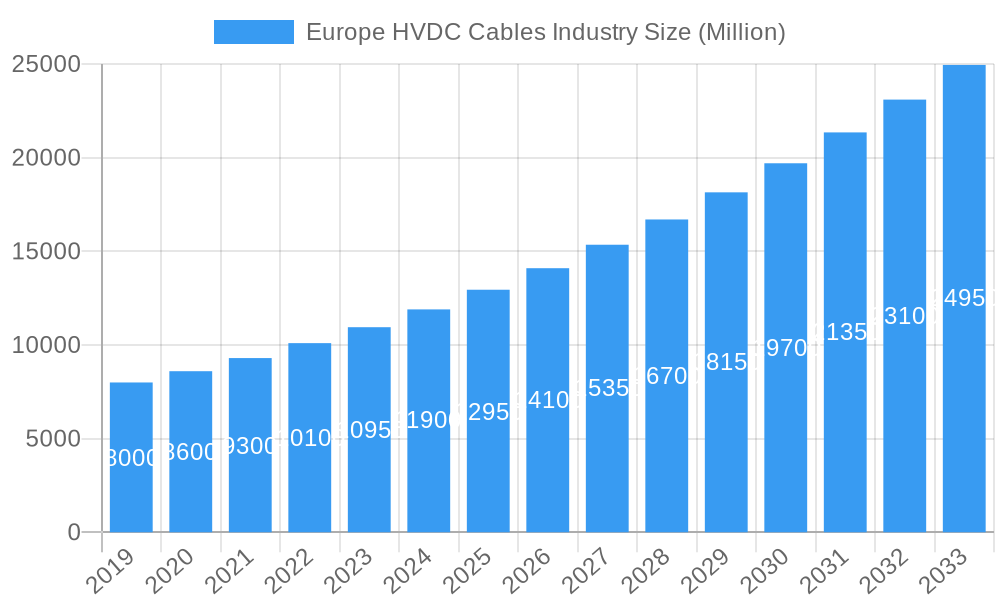

Europe HVDC Cables Industry Market Size (In Billion)

Innovation is a cornerstone of the European HVDC Cables market, with significant investments in enhancing cable performance, reliability, and installation efficiency. Manufacturers are developing advanced insulation materials and manufacturing processes to support higher voltage levels and increased power transfer capabilities. However, market challenges include substantial initial capital investment, installation complexities, particularly for submarine cables, and the need for specialized skilled labor. Regulatory and permitting processes can also present obstacles. Despite these constraints, the long-term outlook is highly favorable. Leading countries such as Germany, the United Kingdom, and the Netherlands are at the forefront of HVDC adoption, driven by ambitious renewable energy goals and grid enhancement projects. Continued emphasis on energy security and the transition to a sustainable energy future will sustain demand for HVDC cable solutions across Europe.

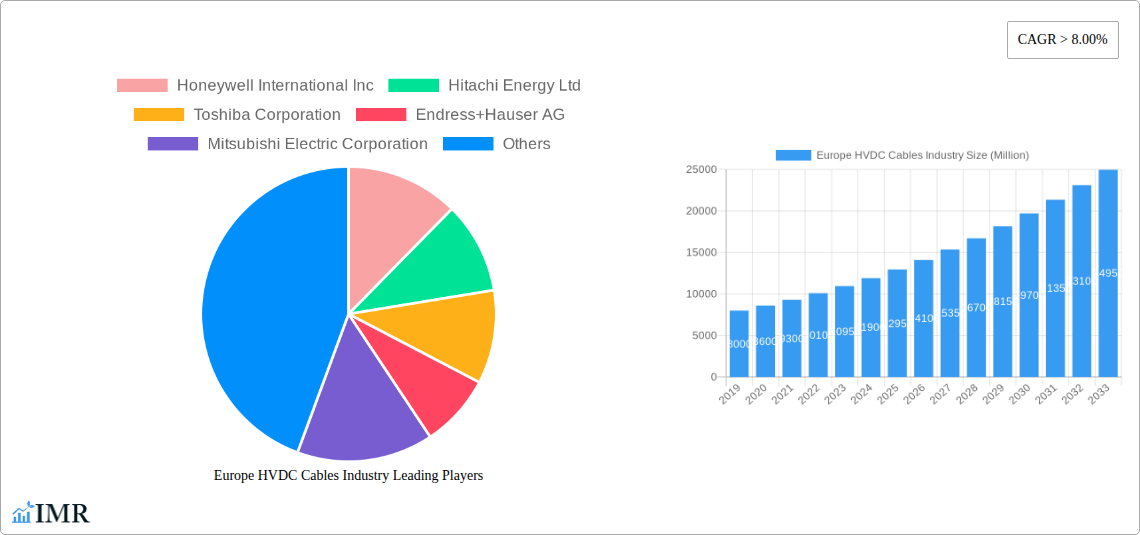

Europe HVDC Cables Industry Company Market Share

Europe HVDC Cables Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a complete analysis of the Europe High Voltage Direct Current (HVDC) Cables Industry, a critical sector driving the continent's energy transition and grid modernization. With a detailed study period from 2019 to 2033, encompassing a base year of 2025, historical data from 2019-2024, and a forecast period from 2025-2033, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, and key strategic elements. We cover parent and child markets, integrating high-traffic keywords such as "HVDC cables Europe," "offshore wind transmission," "grid modernization," "energy infrastructure," and "submarine power cables" to maximize search engine visibility.

Europe HVDC Cables Industry Market Dynamics & Structure

The Europe HVDC Cables Industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and increasing demand for efficient power transmission. Market concentration is moderate, with several key players vying for dominance. Technological innovation is primarily driven by the need for higher voltage capabilities, increased power transfer capacity, and enhanced reliability, particularly for offshore renewable energy integration. Regulatory frameworks, including EU directives promoting renewable energy targets and grid interconnections, significantly shape market growth. Competitive product substitutes, such as High Voltage Alternating Current (HVAC) systems, are gradually being overshadowed by HVDC's advantages for long-distance and bulk power transmission. End-user demographics are shifting towards utilities, grid operators, and renewable energy developers. Merger and Acquisition (M&A) trends are active, indicating consolidation and strategic expansion within the industry, aiming to capture market share and enhance technological portfolios.

- Market Concentration: Moderate, with key players like Siemens Energy AG, Hitachi Energy Ltd, and Prysmian Group holding significant shares.

- Technological Innovation Drivers: Growing offshore wind capacity, intercontinental power transmission needs, and the development of superconducting HVDC technology.

- Regulatory Frameworks: EU Green Deal, renewable energy targets, and cross-border energy infrastructure initiatives.

- Competitive Product Substitutes: HVAC for shorter distances, but HVDC offers superior efficiency for long-haul and subsea applications.

- End-User Demographics: Public and private utilities, transmission system operators (TSOs), renewable energy project developers.

- M&A Trends: Strategic acquisitions to expand technological capabilities and geographical reach; for instance, the acquisition of General Cable by Prysmian Group.

- Innovation Barriers: High capital investment requirements for R&D and manufacturing, complex testing procedures, and long project lead times.

Europe HVDC Cables Industry Growth Trends & Insights

The Europe HVDC Cables Industry is poised for substantial growth, driven by the accelerating transition to renewable energy sources and the urgent need for grid modernization. Market size is projected to expand significantly as countries across Europe invest heavily in upgrading their electricity grids to accommodate intermittent renewable generation and enhance energy security through interconnections. Adoption rates of HVDC technology are surging, particularly for offshore wind farm connections and large-scale interconnector projects, where its efficiency and reduced transmission losses are paramount. Technological disruptions are focusing on advancements in insulation materials, cable design for higher voltage ratings, and improved converter technologies, enabling greater power flow and reduced environmental impact. Consumer behavior shifts, in this context, refer to the growing demand for reliable, sustainable, and increasingly interconnected energy networks, pushing for investments in robust transmission infrastructure. The market penetration of HVDC for new large-scale projects is expected to rise considerably over the forecast period.

- Market Size Evolution: Projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market value of XXX Million USD by 2033.

- Adoption Rates: Increasing rapidly, especially for offshore wind projects and cross-border interconnections, driven by efficiency gains and environmental benefits.

- Technological Disruptions: Innovations in extruded insulation, SF6-free gas-insulated switchgear for converter stations, and advanced cable monitoring systems.

- Consumer Behavior Shifts: Growing demand for grid stability, reliable energy supply from diverse sources, and reduced carbon footprints, fueling investment in HVDC.

- Market Penetration: Expected to increase as HVDC becomes the preferred solution for projects exceeding xx km or involving significant power transfer.

- Key Growth Factors: Government incentives for renewable energy, decommissioning of aging grid infrastructure, and increasing cross-border electricity trade.

- Market Share of HVDC: Expected to grow from xx% in 2025 to over xx% by 2033 for eligible transmission projects.

Dominant Regions, Countries, or Segments in Europe HVDC Cables Industry

Within the Europe HVDC Cables Industry, Submarine HVDC Transmission Systems are emerging as a dominant segment, primarily driven by the expansion of offshore wind farms in the North Sea and the Baltic Sea. Countries like Germany, the UK, the Netherlands, and Denmark are leading the charge, investing heavily in connecting these offshore powerhouses to their onshore grids. This dominance is fueled by a confluence of factors, including vast untapped offshore wind potential, ambitious renewable energy targets set by national governments, and supportive economic policies aimed at fostering a green economy. The inherent advantages of HVDC for transmitting large amounts of power over long subsea distances with minimal losses make it the technology of choice for these monumental projects.

- Leading Transmission Type: Submarine HVDC Transmission System.

- Key Drivers for Submarine Dominance:

- Massive Offshore Wind Capacity: Significant investments in offshore wind farms across the North Sea and Baltic Sea.

- Environmental Policies: Ambitious renewable energy targets and decarbonization goals.

- Economic Incentives: Government subsidies and tax credits for renewable energy projects.

- Technological Superiority: HVDC's efficiency and reliability for long-distance subsea power transmission.

- Dominant Countries in Submarine Segment:

- Germany: Extensive investments in offshore wind connections, exemplified by projects like BorWin6.

- United Kingdom: Continued expansion of offshore wind capacity, requiring robust transmission infrastructure.

- Netherlands: Growing offshore wind sector and strategic interconnections.

- Denmark: Pioneer in offshore wind, with ongoing projects necessitating HVDC solutions.

- Market Share (Submarine): Expected to account for over xx% of the total HVDC cables market in Europe by 2033.

- Growth Potential (Submarine): High, driven by the pipeline of planned offshore wind projects and future interconnection needs.

- Other Significant Segments: While submarine systems lead, HVDC Overhead Transmission Systems are crucial for long-distance land-based transmission and interconnections between countries, and HVDC Underground Transmission Systems are gaining traction in densely populated urban areas and for sensitive environmental zones.

Europe HVDC Cables Industry Product Landscape

The product landscape for Europe's HVDC Cables Industry is defined by continuous innovation aimed at enhancing performance, reliability, and cost-effectiveness. Key products include high-performance extruded HVDC cables designed for voltages ranging from ±320 kV up to ±600 kV and beyond, utilizing advanced insulation materials like cross-linked polyethylene (XLPE) and specialized compounds to manage dielectric stress and thermal performance. Submarine cables, a critical sub-segment, are robustly engineered with enhanced mechanical protection for extreme marine environments, featuring multiple layers of armoring and specialized sheathing. Converter stations, integral to the HVDC system, are evolving with advancements in modular designs, semiconductor technology (e.g., VSC - Voltage Source Converters), and digital control systems for greater efficiency and grid control capabilities.

- Product Innovations: Development of cables with higher voltage ratings (e.g., ±600 kV and above), improved thermal management for increased power throughput, and enhanced resistance to environmental factors.

- Applications: Connecting offshore wind farms, intercontinental power grid interconnections, transmitting power from remote renewable energy sources to demand centers, and upgrading existing AC grids.

- Performance Metrics: Focus on reducing transmission losses (typically <1%), increasing power transfer capacity, enhancing long-term reliability (MTBF), and minimizing installation time and cost.

- Unique Selling Propositions: Superior efficiency for long-distance transmission compared to HVAC, smaller physical footprint for comparable power transfer, and enhanced grid stability control.

- Technological Advancements: Integration of fiber optics for real-time monitoring and diagnostics within the cable, development of more compact and efficient converter station designs, and research into advanced cooling techniques.

Key Drivers, Barriers & Challenges in Europe HVDC Cables Industry

The Europe HVDC Cables Industry is propelled by several powerful drivers, chief among them being the accelerating shift towards renewable energy sources, particularly offshore wind, which necessitates efficient long-distance transmission. This is complemented by government mandates and targets for decarbonization and grid modernization, aiming to create a more resilient and interconnected European energy network. The inherent efficiency and reduced transmission losses of HVDC technology over long distances, especially for subsea applications, further solidify its demand. Furthermore, increasing cross-border electricity trade and the need for enhanced grid stability and flexibility are crucial catalysts.

However, the industry faces significant barriers and challenges. The high upfront capital investment required for HVDC projects, including cables, converter stations, and installation, remains a primary restraint. Complex and lengthy permitting and regulatory processes can cause project delays. Supply chain vulnerabilities and the availability of specialized raw materials can impact production timelines and costs. Competition from established HVAC infrastructure and the perceived risk associated with new HVDC installations in certain regions present ongoing challenges. Furthermore, skilled workforce shortages in specialized areas like HVDC cable manufacturing and installation can hinder expansion.

- Key Drivers:

- Renewable energy integration (especially offshore wind).

- Grid modernization and expansion.

- Energy security and interconnections.

- Environmental regulations and decarbonization goals.

- Technological advancements leading to cost reductions and efficiency gains.

- Key Barriers & Challenges:

- High initial capital expenditure.

- Lengthy and complex regulatory approvals.

- Supply chain constraints for critical components and materials.

- Skilled labor shortages in manufacturing and installation.

- Standardization and interoperability issues across different HVDC systems.

- Geopolitical risks and energy market volatility.

Emerging Opportunities in Europe HVDC Cables Industry

Emerging opportunities within the Europe HVDC Cables Industry are abundant and diverse, driven by evolving energy landscapes and technological advancements. The development of large-scale offshore energy islands and the expansion of multinational HVDC interconnector projects present significant growth avenues. Innovations in modular and standardized HVDC converter station designs are opening doors for faster deployment and cost efficiencies. Furthermore, the increasing adoption of smart grid technologies and the integration of energy storage solutions with HVDC networks offer new application areas. The pursuit of green hydrogen production through renewable energy will also drive demand for efficient power transmission solutions.

- Untapped Markets: Interconnections between the Nordic and Southern European energy markets, and the potential for HVDC connections with North Africa.

- Innovative Applications: Integration of HVDC with large-scale battery storage for grid stabilization, and the use of HVDC for powering offshore industrial facilities.

- Evolving Consumer Preferences: Growing demand for highly reliable and sustainable energy supply, pushing utilities to invest in advanced transmission infrastructure.

- Technological Opportunities: Advancements in superconducting HVDC cables for ultra-high power transmission, and development of digital twins for predictive maintenance of HVDC assets.

Growth Accelerators in the Europe HVDC Cables Industry Industry

Several key factors are poised to accelerate the long-term growth of the Europe HVDC Cables Industry. Continued government support and policy initiatives aimed at achieving ambitious renewable energy targets will remain a primary growth accelerator, driving investment in new transmission infrastructure. Technological breakthroughs in cable insulation materials and converter technologies are expected to further improve efficiency, reduce costs, and enhance the performance of HVDC systems, making them even more attractive. Strategic partnerships and collaborations between cable manufacturers, technology providers, and project developers will streamline project execution and foster innovation. The growing urgency to de-carbonize heavy industries and transportation sectors will also necessitate the development of more robust and efficient electricity grids powered by HVDC.

- Technological Breakthroughs: Development of cables with even higher voltage capabilities and improved thermal management.

- Strategic Partnerships: Joint ventures for R&D, manufacturing, and project development to de-risk investments and accelerate deployment.

- Market Expansion Strategies: Focus on emerging markets within Europe and potential expansion into neighboring regions.

- Infrastructure Investment Cycles: Anticipated large-scale investments in grid upgrades and new renewable energy projects.

Key Players Shaping the Europe HVDC Cables Industry Market

- Honeywell International Inc

- Hitachi Energy Ltd

- Toshiba Corporation

- Endress+Hauser AG

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- Siemens Energy AG

- General Electric Company

- Prysmian Group

- Nexans S.A.

- NKT A/S

- Sumitomo Electric Industries, Ltd.

Notable Milestones in Europe HVDC Cables Industry Sector

- February 2022: McDermott International awarded its largest-ever renewable energy contract from TenneT for the BorWin6 980 MW high-voltage direct current project, involving the design, manufacture, installation, and commissioning of an HVDC offshore converter platform.

- June 2021: PSE SA and Litgrid approved investments in a 700-MW interconnector project between Poland and Lithuania, the Harmony Link, a 330-km undersea cabling system, initiating tender procedures for HVDC cable and converter stations.

- 2020: Siemens Energy AG spun off from Siemens AG, consolidating its focus on energy technologies, including HVDC solutions.

- 2019: Hitachi Energy Ltd (formerly ABB Power Grids) continued to secure major offshore wind grid connection projects, reinforcing its market leadership.

- Ongoing: Continuous advancements in VSC-HVDC technology by key players, enhancing grid flexibility and control capabilities.

In-Depth Europe HVDC Cables Industry Market Outlook

The outlook for the Europe HVDC Cables Industry is exceptionally promising, characterized by sustained growth and transformative potential. The ongoing expansion of renewable energy portfolios, particularly in offshore wind, coupled with the imperative to enhance grid interconnectivity and resilience, will continue to be the primary growth accelerators. Technological advancements in cable design, insulation, and converter technology are expected to drive down costs and improve performance, further stimulating adoption. Strategic investments in grid modernization and the increasing demand for reliable, sustainable energy solutions position HVDC as a cornerstone of Europe's future energy infrastructure. The industry is poised for significant expansion, driven by ambitious climate goals and a commitment to a secure and decarbonized energy future, with projected market growth reaching XXX Million USD by 2033.

Europe HVDC Cables Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Ovehead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

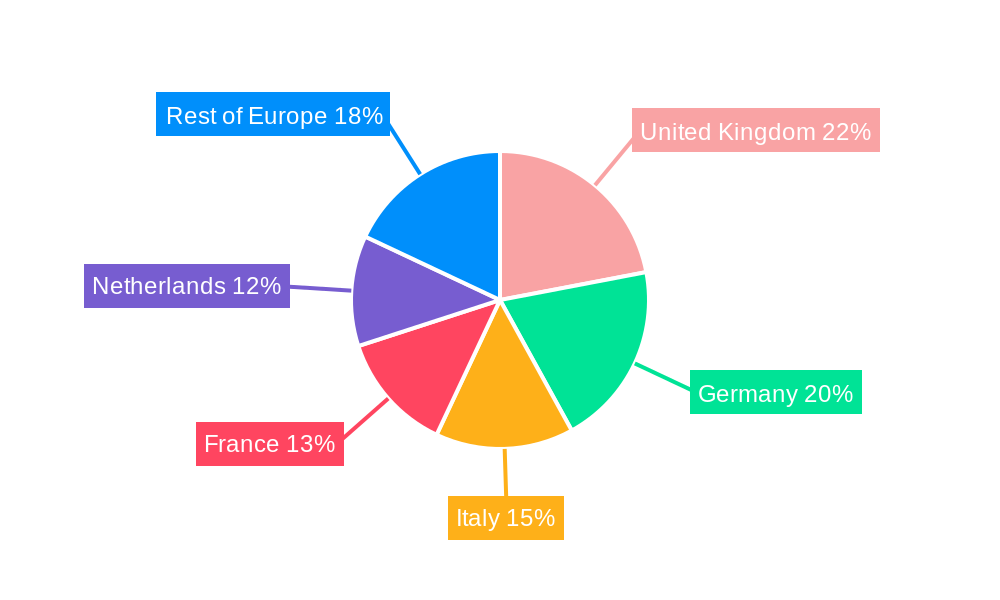

Europe HVDC Cables Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Netherlands

- 6. Rest of Europe

Europe HVDC Cables Industry Regional Market Share

Geographic Coverage of Europe HVDC Cables Industry

Europe HVDC Cables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs Of Power Quality Equipment

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Ovehead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Netherlands

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. United Kingdom Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Submarine HVDC Transmission System

- 6.1.2. HVDC Ovehead Transmission System

- 6.1.3. HVDC Underground Transmission System

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Converter Stations

- 6.2.2. Transmission Medium (Cables)

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Germany Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Submarine HVDC Transmission System

- 7.1.2. HVDC Ovehead Transmission System

- 7.1.3. HVDC Underground Transmission System

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Converter Stations

- 7.2.2. Transmission Medium (Cables)

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Italy Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Submarine HVDC Transmission System

- 8.1.2. HVDC Ovehead Transmission System

- 8.1.3. HVDC Underground Transmission System

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Converter Stations

- 8.2.2. Transmission Medium (Cables)

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. France Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Submarine HVDC Transmission System

- 9.1.2. HVDC Ovehead Transmission System

- 9.1.3. HVDC Underground Transmission System

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Converter Stations

- 9.2.2. Transmission Medium (Cables)

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. Netherlands Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10.1.1. Submarine HVDC Transmission System

- 10.1.2. HVDC Ovehead Transmission System

- 10.1.3. HVDC Underground Transmission System

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Converter Stations

- 10.2.2. Transmission Medium (Cables)

- 10.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11. Rest of Europe Europe HVDC Cables Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 11.1.1. Submarine HVDC Transmission System

- 11.1.2. HVDC Ovehead Transmission System

- 11.1.3. HVDC Underground Transmission System

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Converter Stations

- 11.2.2. Transmission Medium (Cables)

- 11.1. Market Analysis, Insights and Forecast - by Transmission Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Hitachi Energy Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Toshiba Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Endress+Hauser AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mitsubishi Electric Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Eaton Corporation PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Siemens Energy AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 General Electric Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe HVDC Cables Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe HVDC Cables Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 2: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Europe HVDC Cables Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 5: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 8: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 9: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 11: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 12: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 14: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 17: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 18: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe HVDC Cables Industry Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 20: Europe HVDC Cables Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 21: Europe HVDC Cables Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVDC Cables Industry?

The projected CAGR is approximately 24.3%.

2. Which companies are prominent players in the Europe HVDC Cables Industry?

Key companies in the market include Honeywell International Inc, Hitachi Energy Ltd, Toshiba Corporation, Endress+Hauser AG, Mitsubishi Electric Corporation, Eaton Corporation PLC, Siemens Energy AG, General Electric Company.

3. What are the main segments of the Europe HVDC Cables Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Power Quality In Industrial And Manufacturing Sectors4.; Increase In Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Costs Of Power Quality Equipment.

8. Can you provide examples of recent developments in the market?

In February 2022, McDermott International was awarded its largest-ever renewable energy contract from TenneT for the BorWin6 980 MW high-voltage direct current project. The project is for the design, manufacture, installation, and commissioning of an HVDC offshore converter platform located 118 miles offshore Germany on the North Sea Cluster 7 platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVDC Cables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVDC Cables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVDC Cables Industry?

To stay informed about further developments, trends, and reports in the Europe HVDC Cables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence