Key Insights

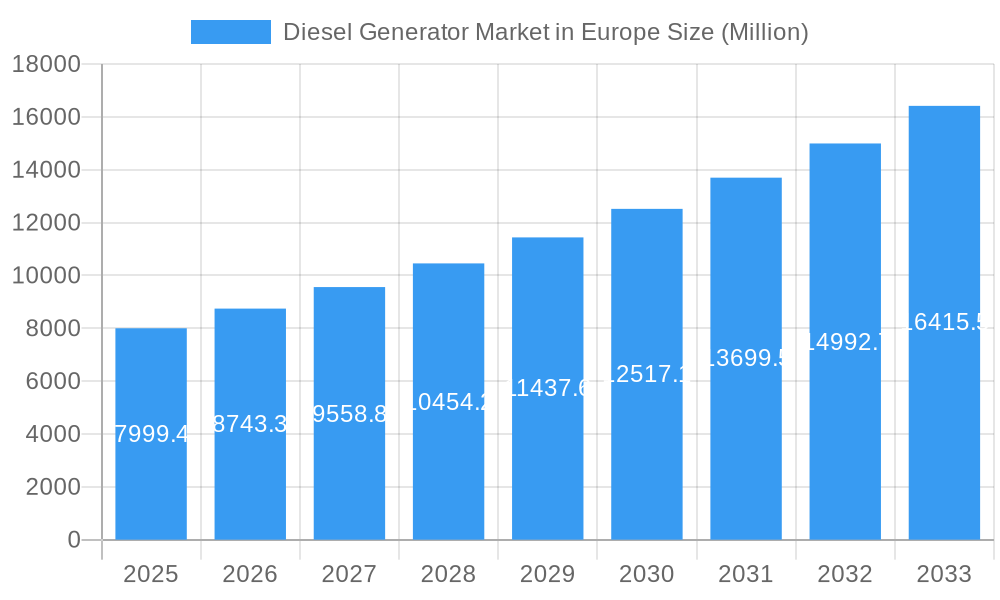

The European Diesel Generator Market is poised for significant expansion, projected to reach a substantial $7,999.4 million in 2025. This growth trajectory is fueled by an estimated Compound Annual Growth Rate (CAGR) of 9.4% throughout the forecast period. A primary driver for this market surge is the increasing demand for reliable backup power solutions across various sectors, particularly in response to an aging grid infrastructure and the growing intermittency of renewable energy sources. Industrial sectors, with their critical continuous operations, are a key segment, alongside the residential sector's rising need for uninterrupted power supply during outages. The commercial segment also contributes significantly, driven by businesses seeking to mitigate financial losses associated with power disruptions. Furthermore, stringent regulations regarding power stability and the need to maintain operational continuity in data centers and healthcare facilities are significant catalysts for market expansion. The market is experiencing a strong trend towards more fuel-efficient and environmentally compliant diesel generator sets, with manufacturers investing in advanced technologies to reduce emissions and noise pollution.

Diesel Generator Market in Europe Market Size (In Billion)

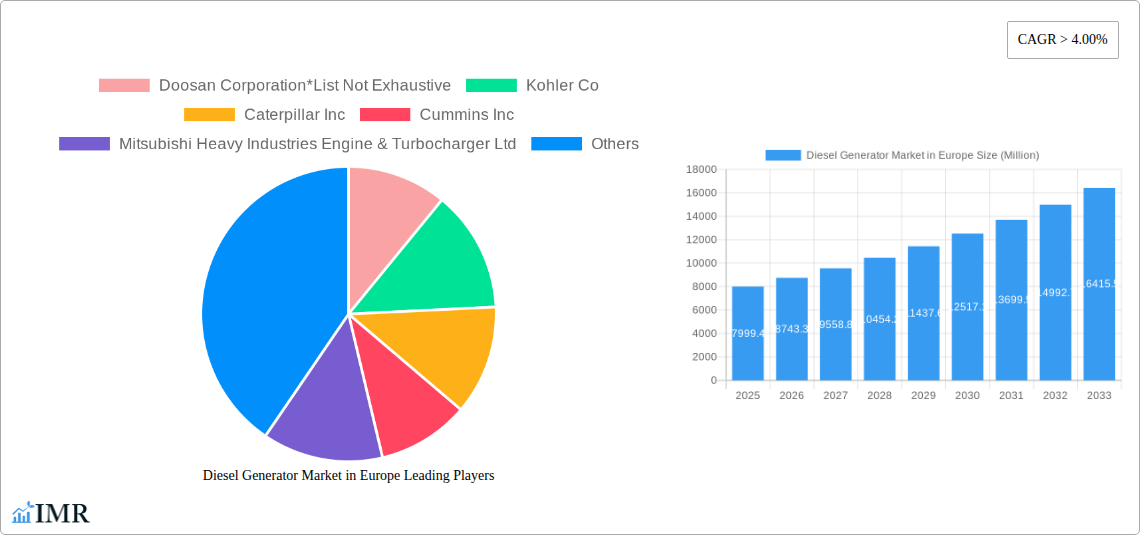

The market segmentation reveals a diverse demand landscape. The 75-350 kVA capacity segment is expected to witness robust growth, catering to a wide array of commercial and small industrial applications. The Above 350 kVA segment will continue to be dominated by large industrial facilities and critical infrastructure. Geographically, Nordic countries are anticipated to exhibit particularly strong growth, driven by their commitment to grid stability and the expanding renewable energy mix. Germany and the United Kingdom remain significant markets due to their mature industrial bases and ongoing infrastructure investments. While the inherent nature of diesel engines presents environmental concerns, ongoing technological advancements in emission control systems and the development of hybrid solutions are mitigating some of the restraint factors. The market is characterized by the presence of well-established global players, including Caterpillar Inc., Cummins Inc., and Mitsubishi Heavy Industries Engine & Turbocharger Ltd., who are continuously innovating to meet evolving market demands and regulatory requirements.

Diesel Generator Market in Europe Company Market Share

Europe Diesel Generator Market: Comprehensive Analysis, Forecast & Opportunities (2019-2033)

Explore the dynamic European diesel generator market with this in-depth report. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights into market size, trends, and future projections. We delve into the intricacies of the market, examining various segments including capacity (Below 75 kVA, 75-350 kVA, Above 350 kVA) and end-user industries (Residential, Commercial, Industrial). Discover key market drivers, challenges, regional dominance, and the strategic moves of major industry players. This report is an essential resource for stakeholders seeking to understand the evolving landscape of diesel power generation in Europe.

Europe Diesel Generator Market: Market Dynamics & Structure

The European diesel generator market exhibits a moderate level of concentration, with a few key players holding significant market share. Technological innovation remains a crucial driver, particularly in areas of fuel efficiency, emission control, and smart grid integration. Regulatory frameworks, such as stringent emission standards set by the European Union, significantly influence product development and market entry. Competitive product substitutes, including natural gas generators and renewable energy solutions with battery storage, present ongoing challenges. End-user demographics are shifting, with increased demand for reliable backup power in data centers, healthcare facilities, and increasingly electrified industrial processes. Mergers and acquisitions (M&A) are prevalent, driven by the pursuit of market expansion, technological acquisition, and economies of scale.

- Market Concentration: Dominated by a mix of global conglomerates and specialized regional manufacturers.

- Technological Innovation Drivers: Focus on reducing carbon footprint, improving operational efficiency, and developing silent generator solutions.

- Regulatory Frameworks: The push for decarbonization and stricter emissions standards (e.g., Euro VI for non-road mobile machinery) mandates continuous technological adaptation.

- Competitive Substitutes: Growth in renewable energy coupled with advanced battery storage systems poses a long-term threat to diesel generator market share in certain applications.

- End-User Demographics: Increasing urbanization and industrialization across Europe drive demand for consistent and reliable power solutions.

- M&A Trends: Strategic acquisitions aimed at consolidating market position and expanding product portfolios in response to evolving demand.

Europe Diesel Generator Market: Growth Trends & Insights

The European diesel generator market is poised for steady growth driven by a confluence of factors including ongoing infrastructure development, the persistent need for reliable backup power solutions, and the increasing electrification of various industries. The market size is projected to witness a notable expansion, fueled by a CAGR of approximately 4.5% during the forecast period. Adoption rates for diesel generators remain high, particularly in sectors where uninterrupted power supply is critical, such as healthcare, telecommunications, and manufacturing. Technological disruptions are continuously shaping the market, with manufacturers focusing on enhancing fuel efficiency, reducing emissions, and integrating advanced control systems for remote monitoring and predictive maintenance. Consumer behavior shifts are also evident, with a growing preference for more sustainable and cost-effective power solutions, compelling manufacturers to innovate. The installed base of diesel generators continues to provide a substantial market for maintenance, repair, and overhaul services, contributing to the overall market value. Furthermore, the increasing complexity of power grids and the sporadic nature of renewable energy sources ensure a continued role for diesel generators as essential ancillary power providers. The industrial segment, in particular, is a significant contributor to market growth due to its high power demands and reliance on stable energy supply for continuous operations. The residential sector's demand is primarily driven by the need for backup power during grid outages, especially in regions prone to extreme weather conditions.

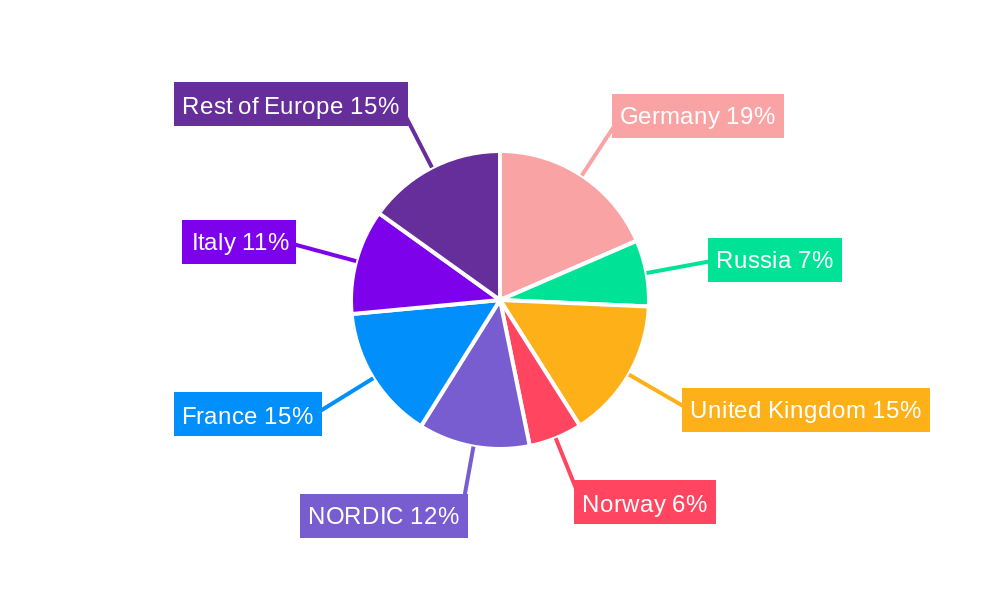

Dominant Regions, Countries, or Segments in Diesel Generator Market in Europe

The European diesel generator market is characterized by significant regional variations in demand and growth drivers. Germany, as Europe's largest economy, consistently emerges as a dominant force, driven by its robust industrial sector and substantial infrastructure projects. The country's advanced manufacturing base, including automotive and chemical industries, necessitates a high degree of power reliability, making diesel generators indispensable for backup power. Furthermore, Germany's proactive stance on energy transition, while pushing for renewables, also highlights the critical role of reliable backup systems during the interim phase and for grid stability. The "Above 350 kVA" capacity segment is particularly dominant in Germany and other industrialized nations like France and the United Kingdom, reflecting the substantial power requirements of large-scale manufacturing plants and critical infrastructure.

In contrast, countries in Southern and Eastern Europe, while also experiencing growth, may see a higher concentration of demand in the "75-350 kVA" and "Below 75 kVA" segments, catering to a growing number of small to medium-sized enterprises (SMEs) and the expanding residential sector. Economic development and infrastructure upgrades in these regions contribute to an increased adoption of diesel generators for both prime and standby power.

The "Commercial" end-user segment, encompassing data centers, hospitals, retail outlets, and office buildings, represents a significant driver across the entire European continent. The increasing digitalization of services and the critical nature of operations in these sectors underscore the non-negotiable requirement for uninterrupted power supply. The continuous expansion of data center infrastructure across Europe, particularly in countries like the Netherlands, Ireland, and the Nordics, fuels substantial demand for high-capacity diesel generators. Economic policies promoting industrial growth and investment in critical infrastructure, such as transportation and telecommunications, further bolster the demand for diesel generators. The market's growth potential is further amplified by the ongoing electrification of various industries, which, despite renewable energy initiatives, still rely on diesel generators for grid resilience and peak load management.

Europe Diesel Generator Market: Product Landscape

Innovations in the European diesel generator market are primarily focused on enhancing sustainability, efficiency, and intelligence. Manufacturers are developing advanced engine technologies that significantly reduce fuel consumption and lower harmful emissions, aligning with stringent EU environmental regulations. The integration of IoT capabilities allows for remote monitoring, diagnostics, and predictive maintenance, enhancing operational uptime and reducing lifecycle costs. Product applications are diversifying, extending beyond traditional backup power to include prime power solutions for off-grid locations and hybrid power systems that integrate diesel generators with renewable energy sources and battery storage. Performance metrics are continually being optimized for noise reduction, vibration control, and improved transient response, catering to sensitive environments and applications. Unique selling propositions now often include advanced digital control platforms, extended service intervals, and customizable configurations to meet specific end-user needs.

Key Drivers, Barriers & Challenges in Diesel Generator Market in Europe

Key Drivers:

- Reliable Backup Power Demand: Critical infrastructure (healthcare, data centers, telecommunications) and industrial operations necessitate uninterrupted power supply.

- Infrastructure Development: Ongoing investments in transportation, utilities, and commercial real estate require robust power solutions.

- Industrial Electrification: The increasing reliance on electricity across various manufacturing sectors drives demand for stable and scalable power sources.

- Grid Instability & Aging Infrastructure: The need for backup power is amplified in regions with less resilient or aging electricity grids.

- Technological Advancements: Improved fuel efficiency, lower emissions, and enhanced control systems make diesel generators more attractive.

Barriers & Challenges:

- Stringent Environmental Regulations: Emission standards and CO2 reduction targets pose a significant challenge for diesel engine manufacturers, requiring substantial investment in R&D.

- Rising Fuel Costs & Price Volatility: Fluctuations in diesel prices directly impact operational expenses, influencing purchasing decisions.

- Competition from Alternatives: Increasing adoption of renewable energy sources, battery storage, and natural gas generators presents a growing competitive threat.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can impact the availability and cost of components, leading to production delays.

- Public Perception & ESG Concerns: Growing emphasis on Environmental, Social, and Governance (ESG) factors may lead some end-users to favor less carbon-intensive power solutions.

Emerging Opportunities in Diesel Generator Market in Europe

Emerging opportunities in the European diesel generator market lie in the development of hybrid power solutions that seamlessly integrate diesel generators with renewable energy sources like solar and wind, coupled with advanced battery energy storage systems (BESS). This offers a more sustainable and cost-effective approach to power generation, especially for off-grid applications and for managing peak loads. The increasing demand for flexible and modular power solutions for temporary or event-based power needs in construction sites and large-scale outdoor events presents another significant opportunity. Furthermore, the growing focus on energy independence and resilience within businesses and critical infrastructure sectors is driving demand for advanced, intelligent diesel generator systems with enhanced remote monitoring and automated switchover capabilities. The retrofitting and upgrading of existing diesel generator fleets with modern emission control technologies and digital management systems also represent a substantial market niche.

Growth Accelerators in the Diesel Generator Market in Europe Industry

Long-term growth in the European diesel generator market is being accelerated by continuous technological breakthroughs in engine design, leading to significant improvements in fuel efficiency and emissions reduction. Strategic partnerships between generator manufacturers and technology providers, particularly in the areas of digital solutions and energy management systems, are creating more integrated and intelligent power offerings. Market expansion strategies focused on emerging economies within Europe, coupled with a growing emphasis on providing comprehensive lifecycle services, including maintenance, repair, and upgrades, are also acting as significant growth catalysts. The increasing need for reliable power to support the expansion of digital infrastructure, such as data centers and 5G networks, provides a consistent demand driver.

Key Players Shaping the Diesel Generator Market in Europe Market

- Doosan Corporation

- Kohler Co

- Caterpillar Inc

- Cummins Inc

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- Yanmar Holdings co Ltd

- Generac Power Systems

- F G Wilson

Notable Milestones in Diesel Generator Market in Europe Sector

- May 2022: For a new 51 MW gas-engine power plant in Frankfurt (Oder), MAN PrimeServ, the after-sales brand of MAN Energy Solutions, has begun a five-year service contract to supply OEM parts, maintenance services, and digital solutions. The five-year contract also includes everything MAN Energy Solutions has to offer, such as engines, generators, and plant accessories.

- August 2022: Cummins Inc. and Grupel announced a partnership to develop and manufacture a range of products up to 700 kVA for the European market.

In-Depth Diesel Generator Market in Europe Market Outlook

The future outlook for the European diesel generator market is characterized by an evolving landscape where sustainability and technological integration are paramount. Growth accelerators will continue to be driven by the persistent demand for reliable backup power in critical sectors and the ongoing need for stable energy supply to support industrial expansion. Strategic opportunities lie in the further development of hybrid power systems, intelligent generator management solutions, and the provision of comprehensive after-sales services. As the market navigates stringent environmental regulations, innovation in cleaner diesel technologies and efficient integration with renewable energy sources will be key to sustained market relevance and future growth.

Diesel Generator Market in Europe Segmentation

-

1. Capacity

- 1.1. Below 75 kVA

- 1.2. 75-350 kVA

- 1.3. Above 350 kVA

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Diesel Generator Market in Europe Segmentation By Geography

- 1. Germany

- 2. Russia

- 3. United Kingdom

- 4. Norway

- 5. NORDIC

- 6. France

- 7. Italy

- 8. Rest of Europe

Diesel Generator Market in Europe Regional Market Share

Geographic Coverage of Diesel Generator Market in Europe

Diesel Generator Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Inclination towards Renewable Sources

- 3.4. Market Trends

- 3.4.1. Industrial Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Below 75 kVA

- 5.1.2. 75-350 kVA

- 5.1.3. Above 350 kVA

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Russia

- 5.3.3. United Kingdom

- 5.3.4. Norway

- 5.3.5. NORDIC

- 5.3.6. France

- 5.3.7. Italy

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Germany Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Below 75 kVA

- 6.1.2. 75-350 kVA

- 6.1.3. Above 350 kVA

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Russia Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Below 75 kVA

- 7.1.2. 75-350 kVA

- 7.1.3. Above 350 kVA

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. United Kingdom Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Below 75 kVA

- 8.1.2. 75-350 kVA

- 8.1.3. Above 350 kVA

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Norway Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Below 75 kVA

- 9.1.2. 75-350 kVA

- 9.1.3. Above 350 kVA

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. NORDIC Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Below 75 kVA

- 10.1.2. 75-350 kVA

- 10.1.3. Above 350 kVA

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. France Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Capacity

- 11.1.1. Below 75 kVA

- 11.1.2. 75-350 kVA

- 11.1.3. Above 350 kVA

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.2.3. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Capacity

- 12. Italy Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Capacity

- 12.1.1. Below 75 kVA

- 12.1.2. 75-350 kVA

- 12.1.3. Above 350 kVA

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.2.3. Industrial

- 12.1. Market Analysis, Insights and Forecast - by Capacity

- 13. Rest of Europe Diesel Generator Market in Europe Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Capacity

- 13.1.1. Below 75 kVA

- 13.1.2. 75-350 kVA

- 13.1.3. Above 350 kVA

- 13.2. Market Analysis, Insights and Forecast - by End User

- 13.2.1. Residential

- 13.2.2. Commercial

- 13.2.3. Industrial

- 13.1. Market Analysis, Insights and Forecast - by Capacity

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Doosan Corporation*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Kohler Co

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Caterpillar Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cummins Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Yanmar Holdings co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Generac Power Systems

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 F G Wilson

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.1 Doosan Corporation*List Not Exhaustive

List of Figures

- Figure 1: Diesel Generator Market in Europe Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Diesel Generator Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 2: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 3: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Diesel Generator Market in Europe Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Diesel Generator Market in Europe Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 8: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 9: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 14: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 15: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 20: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 21: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 26: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 27: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 32: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 33: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 35: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 38: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 39: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 40: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 44: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 45: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 46: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Diesel Generator Market in Europe Revenue undefined Forecast, by Capacity 2020 & 2033

- Table 50: Diesel Generator Market in Europe Volume K Unit Forecast, by Capacity 2020 & 2033

- Table 51: Diesel Generator Market in Europe Revenue undefined Forecast, by End User 2020 & 2033

- Table 52: Diesel Generator Market in Europe Volume K Unit Forecast, by End User 2020 & 2033

- Table 53: Diesel Generator Market in Europe Revenue undefined Forecast, by Country 2020 & 2033

- Table 54: Diesel Generator Market in Europe Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diesel Generator Market in Europe?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Diesel Generator Market in Europe?

Key companies in the market include Doosan Corporation*List Not Exhaustive, Kohler Co, Caterpillar Inc, Cummins Inc, Mitsubishi Heavy Industries Engine & Turbocharger Ltd, Yanmar Holdings co Ltd, Generac Power Systems, F G Wilson.

3. What are the main segments of the Diesel Generator Market in Europe?

The market segments include Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide.

6. What are the notable trends driving market growth?

Industrial Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Inclination towards Renewable Sources.

8. Can you provide examples of recent developments in the market?

May 2022: For a new 51 MW gas-engine power plant in Frankfurt (Oder), MAN PrimeServ, the after-sales brand of MAN Energy Solutions, has begun a five-year service contract to supply OEM parts, maintenance services, and digital solutions. The five-year contract also includes everything MAN Energy Solutions has to offer, such as engines, generators, and plant accessories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diesel Generator Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diesel Generator Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diesel Generator Market in Europe?

To stay informed about further developments, trends, and reports in the Diesel Generator Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence