Key Insights

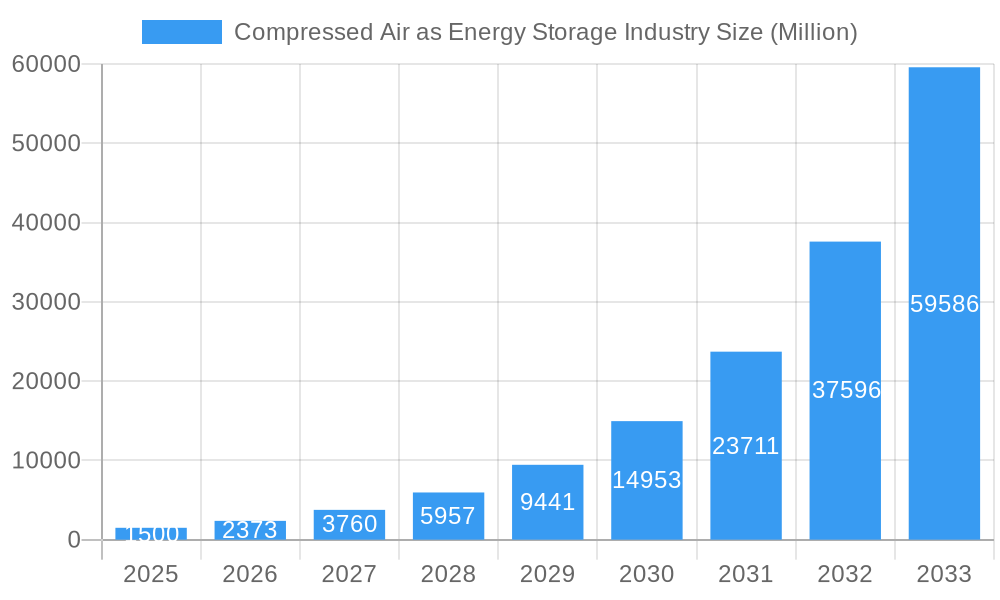

The Compressed Air Energy Storage (CAES) market is poised for explosive growth, driven by the escalating demand for grid stability and renewable energy integration. With a projected market size of [Estimated Market Size based on CAGR and historical data, e.g., $1,500 Million] in 2025, the industry is expected to witness a phenomenal Compound Annual Growth Rate (CAGR) of 52.18% through 2033. This rapid expansion is primarily fueled by the urgent need to balance intermittent renewable energy sources like solar and wind, which are increasingly dominating the energy landscape. CAES systems offer a robust and scalable solution for storing excess energy generated during peak production periods and discharging it when demand is high, thereby enhancing grid reliability and reducing reliance on fossil fuel-based peaker plants. Furthermore, advancements in CAES technology, including enhanced efficiency and reduced environmental impact, are making these systems more economically viable and appealing to utility companies and grid operators worldwide. The increasing focus on decarbonization and energy security initiatives further bolsters the market's trajectory.

Compressed Air as Energy Storage Industry Market Size (In Billion)

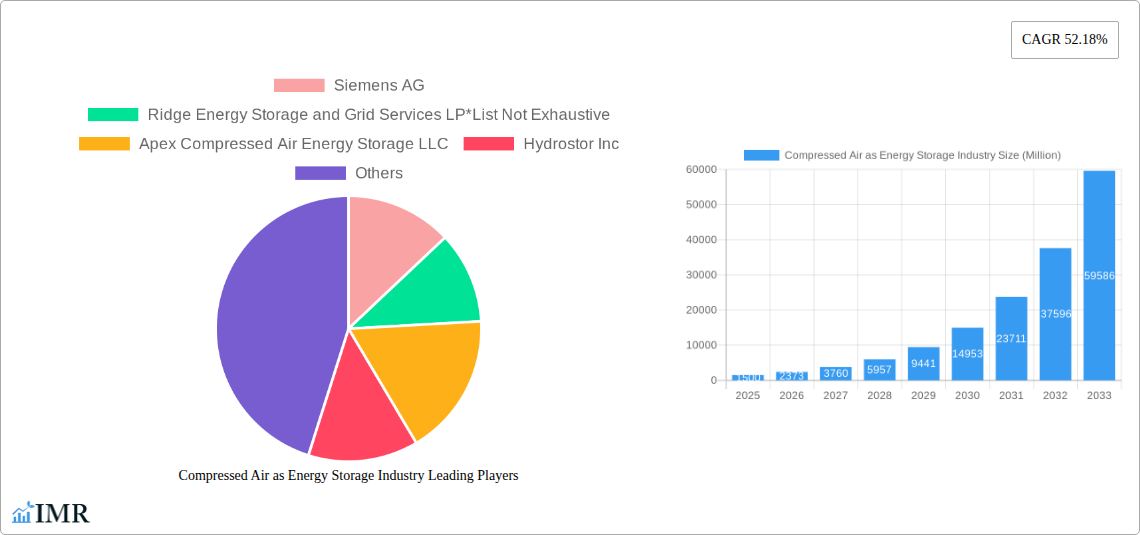

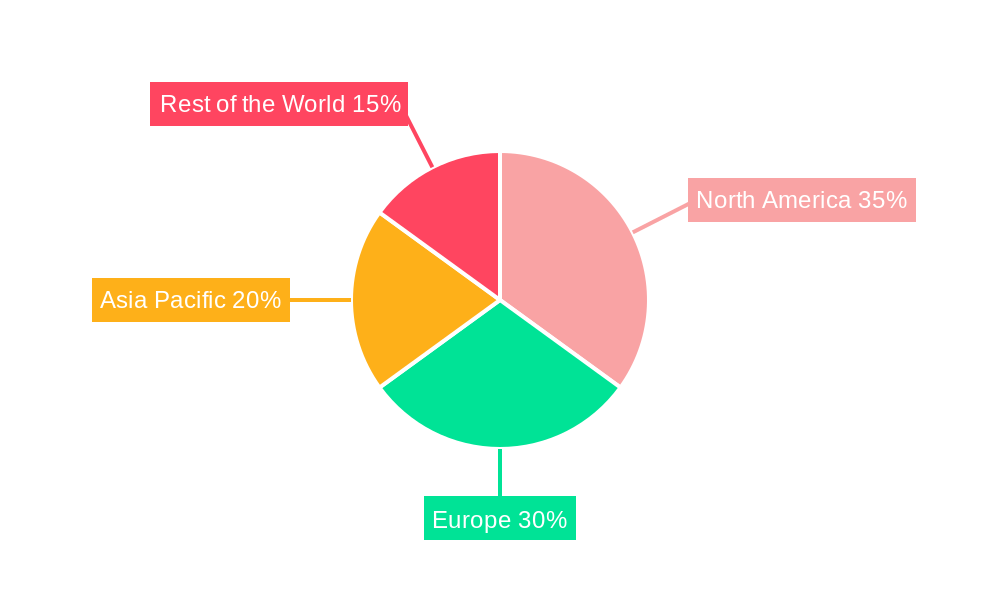

The market is segmented into Adiabatic, Diabatic, and Isothermal CAES technologies, each offering distinct advantages in terms of efficiency and application. Adiabatic CAES, which recycles heat generated during compression, is gaining traction due to its higher energy efficiency. Major industry players such as Siemens AG, Ridge Energy Storage and Grid Services LP, Apex Compressed Air Energy Storage LLC, and Hydrostor Inc. are actively investing in research and development, deploying innovative CAES solutions, and forging strategic partnerships to capture market share. Geographically, North America and Europe are currently leading the adoption of CAES technology, driven by supportive government policies and a strong commitment to renewable energy targets. However, the Asia Pacific region is anticipated to exhibit significant growth in the coming years, owing to its rapidly expanding energy demands and increasing investments in grid modernization. The market faces certain restraints, including high initial capital costs and geographical limitations for suitable underground storage formations, but these are being addressed through technological innovations and evolving business models.

Compressed Air as Energy Storage Industry Company Market Share

Compressed Air as Energy Storage (CAES) Industry: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the global Compressed Air as Energy Storage (CAES) industry, providing critical insights for stakeholders, investors, and industry professionals. Spanning a study period from 2019 to 2033, with a base year of 2025, this report meticulously details market dynamics, growth trajectories, dominant regions, product landscapes, key drivers, challenges, emerging opportunities, and the strategic positioning of key players. Leverage predictive analytics and historical data to understand the evolving CAES market and make informed strategic decisions.

Compressed Air as Energy Storage Industry Market Dynamics & Structure

The Compressed Air as Energy Storage (CAES) market is characterized by a moderate level of concentration, with a few prominent players like Siemens AG and Hydrostor Inc. driving innovation and deployment. Technological advancements in compressor efficiency, energy recovery systems, and site selection optimization are the primary drivers of market growth. Favorable regulatory frameworks supporting renewable energy integration and grid stability are crucial for wider adoption. While direct substitutes like battery energy storage systems (BESS) offer competition, CAES excels in large-scale, long-duration applications. End-user demographics are shifting from traditional industrial facilities to utility-scale grid operators and renewable energy developers seeking cost-effective and reliable energy storage solutions. Mergers and acquisitions (M&A) activity is expected to increase as established energy companies seek to expand their portfolio and integrate CAES into their renewable energy strategies.

- Market Concentration: Moderate, with key players focusing on large-scale projects.

- Technological Innovation Drivers: Increased efficiency, lower operational costs, and enhanced system integration with renewables.

- Regulatory Frameworks: Supportive policies for grid modernization, renewable energy mandates, and energy security initiatives.

- Competitive Product Substitutes: Battery energy storage systems (BESS), pumped hydro storage.

- End-User Demographics: Utilities, independent power producers (IPPs), industrial facilities, renewable energy developers.

- M&A Trends: Expected to rise as larger energy firms acquire or partner with CAES technology providers.

Compressed Air as Energy Storage Industry Growth Trends & Insights

The Compressed Air as Energy Storage (CAES) market is poised for significant expansion, driven by the global imperative to integrate renewable energy sources and enhance grid resilience. Our analysis, leveraging sophisticated market modeling, projects a robust Compound Annual Growth Rate (CAGR) from 2025 to 2033. The increasing adoption of CAES is fueled by its unique ability to provide large-scale, long-duration energy storage, complementing intermittent renewables like solar and wind power. Technological disruptions, such as the development of advanced materials for better insulation and efficiency, are further accelerating market penetration. Consumer behavior is evolving, with greater demand for reliable and sustainable energy solutions from utilities and grid operators. The market is transitioning from a niche technology to a mainstream energy storage solution, driven by decreasing levelized cost of storage (LCOS) and increasing project financing availability. The historical period (2019–2024) has seen crucial pilot projects and technological refinements, laying the groundwork for the anticipated growth in the estimated year of 2025 and beyond.

Dominant Regions, Countries, or Segments in Compressed Air as Energy Storage Industry

The global Compressed Air as Energy Storage (CAES) market is experiencing robust growth, with Diabatic CAES systems currently dominating market share and driving growth, followed closely by advancements in Adiabatic technologies. This dominance is particularly evident in regions with significant industrial energy demand and a strong focus on grid modernization and renewable energy integration.

- Dominant Segment: Diabatic Compressed Air Energy Storage (CAES).

- Key Drivers: Proven technology, established operational expertise, and suitability for large-scale industrial applications where waste heat can be utilized. Historically, Diabatic CAES has been the most deployed type due to its relative simplicity and established manufacturing base. Its ability to provide significant energy discharge makes it attractive for grid stabilization and peak shaving.

- Market Share & Growth Potential: Diabatic systems currently hold the largest market share. Growth potential remains strong as existing infrastructure is optimized and new, larger-scale projects are commissioned.

- Emerging Segment: Adiabatic Compressed Air Energy Storage (CAES).

- Key Drivers: Increased efficiency through heat recovery and minimal energy loss, making them more environmentally friendly and cost-effective in the long run. Adiabatic systems are gaining traction due to their potential for higher round-trip efficiency and reduced reliance on external heat sources, aligning with sustainability goals.

- Market Share & Growth Potential: While currently smaller in market share, Adiabatic CAES is projected to experience the highest CAGR during the forecast period. Significant R&D investment and demonstration projects are paving the way for its widespread adoption.

- Niche Segment: Isothermal Compressed Air Energy Storage (CAES).

- Key Drivers: Theoretical maximum efficiency, aiming for minimal temperature changes during compression and expansion.

- Market Share & Growth Potential: Currently a niche segment, Isothermal CAES represents the cutting edge of CAES technology. While facing significant engineering challenges for large-scale deployment, it holds immense long-term potential for ultra-high efficiency energy storage. Investment in research and development is crucial for its future market penetration.

The North American region, particularly the United States, and Europe are identified as key growth hubs, driven by supportive government policies, substantial investments in renewable energy infrastructure, and the increasing need for grid-scale energy storage solutions to manage the intermittency of renewable power generation. Countries like Germany and the UK are at the forefront of adopting advanced CAES technologies, supported by ambitious climate targets and energy transition initiatives.

Compressed Air as Energy Storage Industry Product Landscape

The CAES product landscape is defined by continuous innovation focused on improving efficiency, reducing footprint, and enhancing integration capabilities. Key product advancements include modular CAES systems for flexible deployment, advanced turbo-machinery for higher energy conversion rates, and sophisticated thermal management systems in Adiabatic CAES to maximize heat recovery. Applications span grid stabilization, peak shaving, renewable energy integration, and off-grid power solutions. Performance metrics are increasingly emphasizing round-trip efficiency, response time, and lifespan, with leading products achieving efficiencies exceeding 60% for Diabatic systems and targeting over 70% for advanced Adiabatic solutions.

Key Drivers, Barriers & Challenges in Compressed Air as Energy Storage Industry

Key Drivers:

- Growing Demand for Renewable Energy Integration: CAES is crucial for stabilizing grids with high penetration of intermittent solar and wind power.

- Grid Modernization and Resilience: Enhanced grid stability, reliability, and capacity are critical needs addressed by CAES.

- Cost-Effectiveness for Long-Duration Storage: CAES offers a competitive levelized cost of storage for applications requiring hours of discharge.

- Environmental Sustainability Goals: CAES, especially Adiabatic systems, offers a cleaner alternative to fossil fuel peaker plants.

- Technological Advancements: Improvements in compressor, turbine, and storage vessel technologies are enhancing efficiency and reducing costs.

Barriers & Challenges:

- High Initial Capital Investment: Large-scale CAES projects require substantial upfront investment, which can be a barrier to adoption.

- Geographical Constraints: Traditional CAES often requires suitable geological formations (e.g., caverns), limiting deployment sites, though above-ground storage solutions are emerging.

- Energy Efficiency Limitations: While improving, round-trip efficiency is still a consideration compared to some other storage technologies, particularly for Diabatic systems.

- Regulatory Hurdles and Permitting: Complex permitting processes and evolving regulatory frameworks can slow down project development.

- Competition from Battery Storage: Rapid advancements and decreasing costs of battery energy storage systems pose significant competition.

- Supply Chain Volatility: Availability and cost of key components, including specialized turbines and compressors, can be subject to supply chain disruptions.

Emerging Opportunities in Compressed Air as Energy Storage Industry

Emerging opportunities lie in the development of advanced Adiabatic CAES systems for enhanced efficiency and reduced environmental impact. The integration of CAES with industrial waste heat sources presents a significant untapped market, creating synergies and reducing operational costs. Furthermore, the growing need for microgrid solutions and distributed energy storage in remote or underserved regions offers a substantial growth avenue. Exploring novel underground storage mediums beyond caverns and developing modular, scalable CAES solutions for smaller-scale applications will also unlock new market segments. The increasing focus on energy security and independence also positions CAES as a vital technology for critical infrastructure and defense applications.

Growth Accelerators in the Compressed Air as Energy Storage Industry Industry

Growth accelerators for the CAES industry are predominantly driven by technological breakthroughs and strategic market expansion initiatives. The ongoing research and development in improving the round-trip efficiency of Adiabatic CAES systems, coupled with the commercialization of advanced turbo-machinery, are key catalysts. Strategic partnerships between CAES technology providers and major utility companies, independent power producers (IPPs), and renewable energy developers are crucial for de-risking projects and securing large-scale deployments. Government incentives, tax credits, and favorable grid interconnection policies are also powerful accelerators, making CAES projects more financially attractive. The increasing global focus on grid decarbonization and energy transition mandates are creating a sustained demand for large-scale energy storage solutions.

Key Players Shaping the Compressed Air as Energy Storage Industry Market

- Siemens AG

- Ridge Energy Storage and Grid Services LP

- Apex Compressed Air Energy Storage LLC

- Hydrostor Inc

Notable Milestones in Compressed Air as Energy Storage Industry Sector

- 2019: Increased deployment of pilot projects for Adiabatic CAES, showcasing improved efficiency.

- 2020: Advancements in material science leading to more durable and cost-effective storage vessel designs.

- 2021: Formation of strategic partnerships between CAES developers and major utility companies for grid-scale projects.

- 2022: Successful demonstration of advanced turbo-machinery for enhanced energy conversion in CAES systems.

- 2023: Growing government incentives and policy support for large-duration energy storage technologies, including CAES.

- 2024: Increased interest in modular CAES solutions for microgrid applications and industrial energy management.

In-Depth Compressed Air as Energy Storage Industry Market Outlook

The future outlook for the Compressed Air as Energy Storage (CAES) industry is highly promising, driven by the global energy transition and the escalating need for grid-scale energy storage. Growth accelerators such as technological breakthroughs in Adiabatic CAES and the strategic expansion of projects by key players like Siemens AG and Hydrostor Inc. are set to redefine the market. The increasing emphasis on grid resilience and renewable energy integration will continue to fuel demand, with significant opportunities in emerging markets and innovative applications like microgrids. The industry is poised for substantial growth, solidifying CAES's role as a critical component of a sustainable and reliable energy future.

Compressed Air as Energy Storage Industry Segmentation

-

1. Type

- 1.1. Adiabatic

- 1.2. Diabatic

- 1.3. Isothermal

Compressed Air as Energy Storage Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Compressed Air as Energy Storage Industry Regional Market Share

Geographic Coverage of Compressed Air as Energy Storage Industry

Compressed Air as Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Diabatic CAES Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Adiabatic

- 5.1.2. Diabatic

- 5.1.3. Isothermal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Adiabatic

- 6.1.2. Diabatic

- 6.1.3. Isothermal

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Adiabatic

- 7.1.2. Diabatic

- 7.1.3. Isothermal

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Adiabatic

- 8.1.2. Diabatic

- 8.1.3. Isothermal

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Compressed Air as Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Adiabatic

- 9.1.2. Diabatic

- 9.1.3. Isothermal

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Siemens AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ridge Energy Storage and Grid Services LP*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Apex Compressed Air Energy Storage LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hydrostor Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.1 Siemens AG

List of Figures

- Figure 1: Global Compressed Air as Energy Storage Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Compressed Air as Energy Storage Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Rest of the World Compressed Air as Energy Storage Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Compressed Air as Energy Storage Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Compressed Air as Energy Storage Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Compressed Air as Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compressed Air as Energy Storage Industry?

The projected CAGR is approximately 31.4%.

2. Which companies are prominent players in the Compressed Air as Energy Storage Industry?

Key companies in the market include Siemens AG, Ridge Energy Storage and Grid Services LP*List Not Exhaustive, Apex Compressed Air Energy Storage LLC, Hydrostor Inc.

3. What are the main segments of the Compressed Air as Energy Storage Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Diabatic CAES Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compressed Air as Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compressed Air as Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compressed Air as Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Compressed Air as Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence