Key Insights

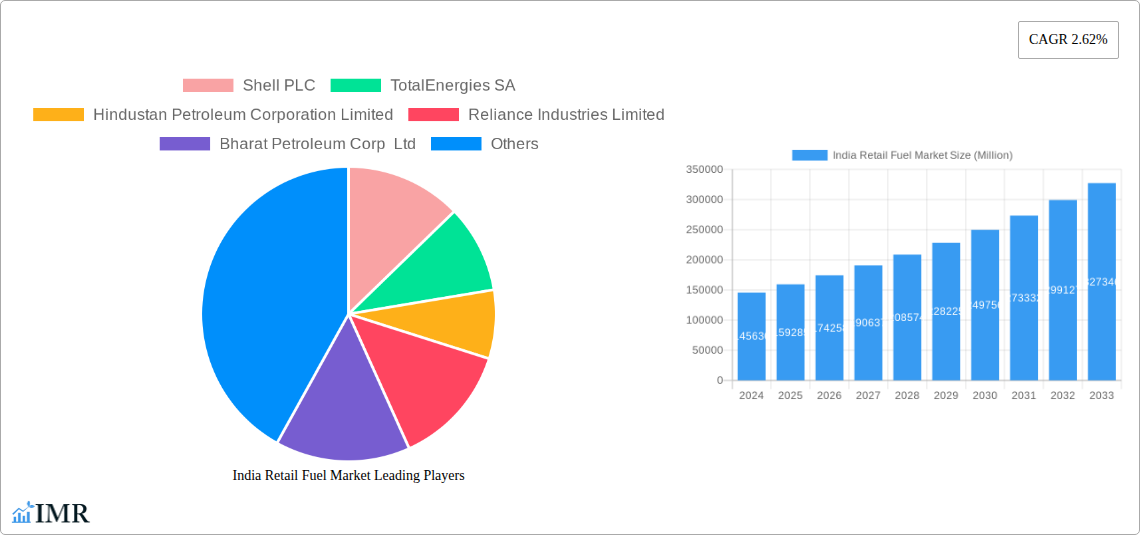

The India Retail Fuel Market is experiencing robust expansion, projected to reach an estimated USD 145.63 billion in 2024, with a significant compound annual growth rate (CAGR) of 9.8% from 2019 to 2033. This growth is primarily fueled by the burgeoning Indian economy, increasing vehicle parc, and rising disposable incomes, which collectively drive demand for transportation fuels. The market is characterized by a dynamic interplay between public sector undertakings and private players, with both segments catering to a diverse end-user base comprising government and private entities. Key drivers for this growth include government initiatives promoting fuel efficiency and alternative energy sources, alongside substantial investments in infrastructure development, including the expansion of retail fuel stations. The increasing adoption of advanced fuel formulations and the growing convenience store offerings at fuel stations are also contributing to market buoyancy.

India Retail Fuel Market Market Size (In Billion)

Despite the strong growth trajectory, the India Retail Fuel Market faces certain restraints. The price volatility of crude oil, a primary input for fuel production, poses a significant challenge, impacting both pricing strategies and consumer spending. Furthermore, the evolving regulatory landscape, particularly concerning environmental norms and the promotion of electric vehicles (EVs), necessitates strategic adaptation from market participants. While the transition towards cleaner energy alternatives is gaining momentum, conventional fuels will continue to dominate the energy mix in the foreseeable future, supported by extensive existing infrastructure. The market's segmentation by ownership and end-user highlights the competitive intensity and the need for players to offer differentiated products and services to capture market share. Major companies like Indian Oil Corporation Ltd., Reliance Industries Limited, and Shell PLC are actively investing in expanding their retail networks and enhancing customer experience to maintain their competitive edge.

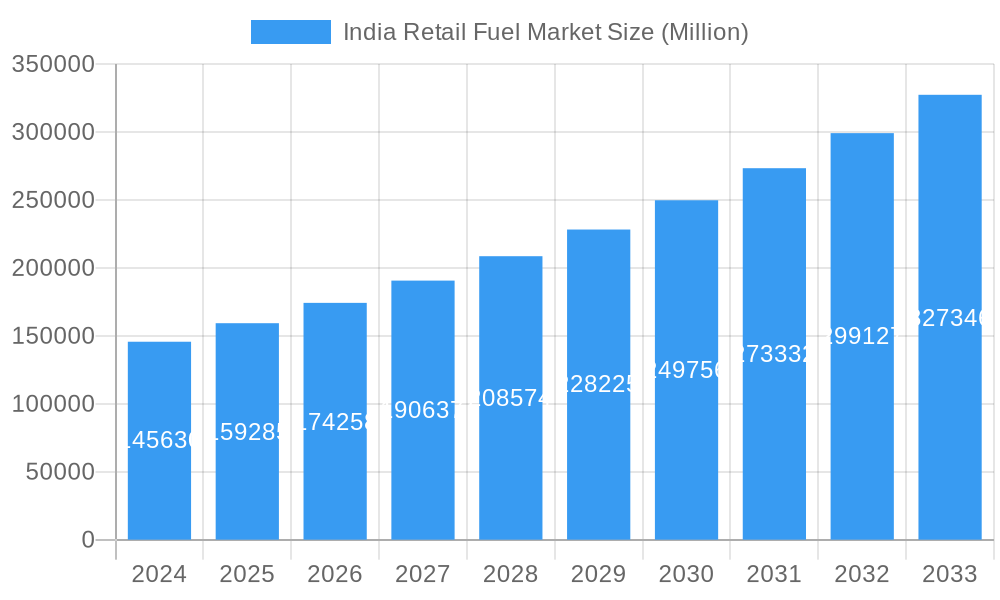

India Retail Fuel Market Company Market Share

India Retail Fuel Market: Comprehensive Market Analysis and Growth Outlook (2019-2033)

This in-depth report provides a definitive analysis of the India Retail Fuel Market, projecting growth and evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study is crucial for industry professionals seeking to understand market dynamics, key players, and future opportunities in the rapidly transforming Indian energy landscape. We meticulously examine parent and child market segments, offering granular insights into market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. The report quantures the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, delivering specific metrics such as CAGR and market penetration. Explore dominant regions, countries, and segments, highlighting key drivers like economic policies and infrastructure. This analysis includes a detailed product landscape, outlining innovations and applications, alongside a thorough examination of key drivers, barriers, challenges, and emerging opportunities. Discover growth accelerators and gain strategic insights into the future potential of India's retail fuel sector, driven by leading companies including Shell PLC, TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, and Indian Oil Corporation Ltd.

India Retail Fuel Market Market Dynamics & Structure

The India Retail Fuel Market is characterized by a dynamic interplay of established Public Sector Undertakings (PSUs) and emerging Private Owned players, shaping a competitive yet evolving landscape. Market concentration is influenced by the significant presence of PSUs like Indian Oil Corporation Ltd. (IOCL), Hindustan Petroleum Corporation Limited (HPCL), and Bharat Petroleum Corporation Ltd (BPCL), which collectively hold a substantial market share. However, private entities such as Reliance Industries Limited and Nayara Energy Limited are aggressively expanding their retail networks, introducing modern infrastructure and customer-centric services. Technological innovation is a key driver, with a growing emphasis on cleaner fuels and digital integration at retail outlets. Regulatory frameworks, driven by government initiatives to promote renewable energy and reduce emissions, are profoundly impacting market strategies. The push towards E20 fuel, as evidenced by recent government announcements, is a prime example. Competitive product substitutes, including the increasing adoption of electric vehicles (EVs) and alternative fuels, present a long-term challenge to conventional petrol and diesel sales. End-user demographics are diverse, with demand from both public sector entities and the burgeoning private sector, including individual vehicle owners and commercial fleets. Merger and Acquisition (M&A) trends are currently nascent but expected to gain traction as companies seek to consolidate market presence and enhance operational efficiencies. While specific M&A deal volumes are still developing, the potential for consolidation remains high. Innovation barriers include the high capital investment required for retail network expansion and the need for robust supply chain management to ensure consistent fuel availability across a vast geographical area.

- Market Concentration: Dominated by a few large Public Sector Undertakings (PSUs) with significant market share, alongside growing competition from private players.

- Technological Innovation Drivers: Focus on cleaner fuels (e.g., E20), digital payment integration, and enhanced customer experience at retail outlets.

- Regulatory Frameworks: Government policies promoting ethanol blending, emission reduction, and infrastructure development are crucial.

- Competitive Product Substitutes: Rise of Electric Vehicles (EVs) and potential for alternative fuel infrastructure pose long-term competitive threats.

- End-User Demographics: Diverse demand from individual consumers, commercial fleets, and public sector organizations.

- M&A Trends: Emerging opportunities for consolidation and strategic partnerships to gain market share and operational synergies.

- Innovation Barriers: High capital expenditure for network expansion, complex supply chain logistics, and fluctuating crude oil prices.

India Retail Fuel Market Growth Trends & Insights

The India Retail Fuel Market is poised for significant growth and transformation over the study period of 2019–2033, with the base year of 2025 serving as a critical point for estimated growth trajectories. The market's expansion is intrinsically linked to India's robust economic growth, rising disposable incomes, and the burgeoning automotive sector. We project the total market size to evolve from approximately XXX billion units in the historical period (2019-2024) to XXX billion units in the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at a strong XX.X%, underscoring the immense potential within the sector. This growth is being fueled by increasing vehicle ownership across all segments, from passenger cars to commercial vehicles and two-wheelers. Furthermore, the government's ambitious infrastructure development plans, including the expansion of national highways and urban transportation networks, directly correlate with higher fuel consumption.

Technological disruptions are playing a pivotal role in reshaping consumer behavior and market dynamics. The accelerating adoption of E20 fuel, with the government aiming for 20% ethanol blending by 2025, signifies a major shift towards greener fuel economies. This initiative, coupled with the increasing availability of E20 compatible vehicles, is expected to drive substantial demand for blended fuels. Oil marketing companies (OMCs) are actively investing in the infrastructure required to meet these blending targets, indicating a proactive response to policy changes.

Consumer behavior is also undergoing a noticeable shift. Beyond just fuel, customers are increasingly seeking convenience and additional services at retail outlets. This includes the proliferation of convenience stores, quick-service restaurants, and digital payment options, transforming fuel stations into integrated service hubs. The integration of digital technologies, such as the SD-WAN network solutions being implemented by Indian Oil Corporation (IOCL) with Reliance Jio, demonstrates a move towards enhanced operational efficiency, real-time monitoring, and improved customer service through seamless connectivity. This digital transformation is expected to improve the overall customer experience, fostering loyalty and driving repeat business. As India continues its trajectory of rapid industrialization and urbanization, the demand for retail fuels, while evolving with the advent of alternative energy sources, will remain a cornerstone of its energy consumption for the foreseeable future. The market penetration of conventional fuels will continue to be high, albeit with a gradual integration of cleaner alternatives.

Dominant Regions, Countries, or Segments in India Retail Fuel Market

Within the India Retail Fuel Market, the dominance is primarily driven by the Public Sector Undertakings (PSUs) segment for ownership, and the Private Sector as a key end-user segment, experiencing rapid growth. This analysis spans across the nation, with particular emphasis on regions experiencing high economic activity and population density, which naturally translate into higher fuel consumption.

Dominance of Public Sector Undertakings (PSUs) in Ownership: Public Sector Undertakings, including Indian Oil Corporation Ltd. (IOCL), Hindustan Petroleum Corporation Limited (HPCL), and Bharat Petroleum Corporation Ltd (BPCL), have historically dominated the Indian retail fuel landscape. Their extensive existing network of retail outlets, established supply chains, and strong brand recognition provide them with a significant market share. These companies benefit from government backing and are crucial in ensuring fuel accessibility across the vast and diverse Indian geography. Their strategic importance in national energy security further solidifies their dominant position.

- Extensive Retail Network: PSUs operate thousands of retail outlets spread across urban, semi-urban, and rural areas, ensuring widespread availability of fuel.

- Government Support and Policy Alignment: Their operations are closely aligned with government energy policies, including initiatives like ethanol blending, which they are instrumental in implementing.

- Brand Trust and Loyalty: Years of consistent service have built strong trust and loyalty among a significant customer base.

- Market Share: Collectively, PSUs command a majority market share in fuel sales, estimated to be around XX% in the historical period.

Dominance of the Private Sector as an End User: The Private Sector, encompassing individual vehicle owners, commercial transportation, and industrial consumers, represents the largest and fastest-growing end-user segment. As India's economy expands, so does the number of vehicles on its roads. Increased urbanization, a growing middle class with higher disposable incomes, and the expansion of logistics and transportation industries are key drivers of this demand. The adoption of new vehicle technologies, while diversifying fuel needs, also signifies increased overall vehicle utilization.

- Growing Vehicle Population: A rising number of passenger cars, two-wheelers, and commercial vehicles directly translates to increased demand for retail fuels.

- Economic Activity and Logistics: The expansion of manufacturing, e-commerce, and the services sector fuels demand for transportation and thus, fuel.

- Consumer Spending Power: Increased disposable income allows for greater mobility and vehicle ownership among a larger segment of the population.

- Fleet Modernization: Commercial fleets are continuously being upgraded, leading to higher mileage and consistent fuel consumption.

While regions like Maharashtra, Gujarat, Uttar Pradesh, and Tamil Nadu consistently show higher fuel consumption due to their industrial and population density, the underlying growth drivers are national. The ongoing expansion of the retail fuel network by both PSUs and private players, including companies like Shell PLC and TotalEnergies SA, indicates a competitive push to capture this ever-growing demand from the private sector. The increasing focus on offering value-added services at retail outlets also caters to the evolving preferences of private sector consumers, further solidifying its importance as a dominant end-user segment.

India Retail Fuel Market Product Landscape

The India Retail Fuel Market's product landscape is evolving beyond traditional petrol and diesel to incorporate more sustainable and technologically advanced offerings. The primary products remain petrol and diesel, crucial for the nation's vast internal combustion engine vehicle fleet. However, a significant development is the increasing availability and promotion of E20 fuel, a blend of 20% ethanol with petrol. This initiative is driven by environmental concerns and the government's push towards a greener fuel economy. Oil marketing companies are investing in facilities to ensure the consistent supply of E20. Furthermore, premium fuel variants are gaining traction, offering enhanced engine performance and efficiency, catering to a segment of consumers willing to pay for superior quality. The digital integration at retail outlets, facilitating cashless transactions and loyalty programs, is also becoming a key feature, enhancing the overall product experience for consumers.

Key Drivers, Barriers & Challenges in India Retail Fuel Market

Key Drivers:

- Robust Economic Growth: India's consistent GDP growth fuels increased industrial activity, transportation, and consumer spending, directly driving fuel demand.

- Expanding Automotive Sector: Rising vehicle ownership, particularly in the passenger car and commercial vehicle segments, is a primary driver.

- Government Initiatives: Policies promoting fuel blending (like E20), infrastructure development (roads, highways), and energy security enhance market growth.

- Urbanization and Infrastructure Development: Expanding urban centers and improved road networks lead to higher vehicle usage and fuel consumption.

- Growing Middle Class: Increased disposable incomes lead to greater mobility and a higher demand for personal transportation.

Barriers & Challenges:

- Volatility of Crude Oil Prices: Fluctuations in global crude oil prices directly impact the cost of imported fuels, affecting pricing and profitability.

- Competition from Electric Vehicles (EVs): The long-term shift towards EVs poses a potential threat to the demand for traditional liquid fuels.

- Infrastructure Development Pace: While improving, the pace of expansion for new retail outlets and distribution networks can be slow in remote areas.

- Regulatory Hurdles and Land Acquisition: Obtaining approvals and acquiring land for new retail stations can be a time-consuming and complex process.

- Supply Chain Disruptions: Geopolitical events or logistical challenges can impact the consistent supply of fuel, leading to potential shortages.

- Environmental Regulations and Emission Norms: Increasingly stringent emission standards necessitate investments in cleaner fuel technologies and infrastructure.

Emerging Opportunities in India Retail Fuel Market

The India Retail Fuel Market presents significant emerging opportunities driven by evolving consumer preferences and technological advancements. The increasing focus on biofuels and ethanol blending, particularly the E20 mandate, opens avenues for enhanced production and distribution infrastructure for ethanol. The development of alternative fuel stations, such as those for compressed natural gas (CNG) and potentially hydrogen in the future, represents a diversification opportunity. The digital transformation of retail outlets is creating opportunities for integrated services, including EV charging points, convenience stores, and advanced payment solutions, transforming fuel stations into mobility hubs. Furthermore, companies can explore partnerships with EV manufacturers and charging infrastructure providers to cater to the evolving mobility landscape. Untapped rural markets and the expansion of retail networks into Tier-2 and Tier-3 cities also offer substantial growth potential.

Growth Accelerators in the India Retail Fuel Market Industry

Several key catalysts are accelerating long-term growth in the India Retail Fuel Market. The government's commitment to energy transition and environmental sustainability, particularly through the aggressive promotion of ethanol blending, is a significant accelerator. Technological breakthroughs in biofuel production and refining processes are making cleaner fuels more economically viable. Strategic partnerships between oil marketing companies (OMCs), technology providers, and automotive manufacturers are crucial for co-developing and integrating new fuel technologies and services. The continuous expansion of road infrastructure and logistics networks across the country directly fuels increased fuel demand. Moreover, the growing adoption of digital technologies for customer engagement, loyalty programs, and operational efficiency is enhancing the overall retail fuel experience and driving repeat business, thereby accelerating market growth.

Key Players Shaping the India Retail Fuel Market Market

- Shell PLC

- TotalEnergies SA

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Bharat Petroleum Corp Ltd

- Nayara Energy Limited

- Indian Oil Corporation Ltd

Notable Milestones in India Retail Fuel Market Sector

- February 2023: The Government of India launched E20 fuel across 11 states and union territories at 84 retail outlets, signaling a major step towards achieving 20% ethanol blending by 2025 and promoting a greener fuel economy. Oil marketing companies (OMCs), including HPCL, have set up plants to accomplish this goal.

- February 2023: Jio-bp, a prominent retail fuel company, commenced the sale of E20 gasoline at select locations, allowing customers with compatible vehicles to choose this blended fuel, with plans for network-wide expansion.

- December 2022: Indian Oil Corporation (IOCL) selected Reliance Jio to implement an SD-WAN (Software Defined Wide Area Network) solution for its 7,200 retail sites for a period of five years, enhancing network connectivity, zero-touch provisioning, and real-time monitoring.

In-Depth India Retail Fuel Market Market Outlook

The India Retail Fuel Market outlook remains highly positive, driven by a confluence of factors that will continue to accelerate growth. The nation's robust economic trajectory, coupled with a rapidly expanding automotive sector, will sustain the demand for conventional fuels. However, the significant push towards ethanol blending, exemplified by the E20 initiative, presents a substantial opportunity for market players to innovate and adapt. The ongoing digitalization of retail operations and the integration of value-added services are transforming fuel stations into comprehensive mobility hubs, enhancing customer convenience and loyalty. Furthermore, strategic investments in infrastructure, both for fuel distribution and road networks, will continue to facilitate market expansion, particularly in emerging economic corridors. The market is set to witness a gradual integration of cleaner fuel alternatives and digital solutions, positioning it for sustained growth and evolution in the coming decade, with companies like Reliance Industries Limited and Indian Oil Corporation Ltd at the forefront of this transformation.

India Retail Fuel Market Segmentation

-

1. Ownership

- 1.1. Public Sector Undertakings

- 1.2. Private Owned

-

2. End User

- 2.1. Public Sector

- 2.2. Private Sector

India Retail Fuel Market Segmentation By Geography

- 1. India

India Retail Fuel Market Regional Market Share

Geographic Coverage of India Retail Fuel Market

India Retail Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Public Sector Undertakings Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Public Sector Undertakings

- 5.1.2. Private Owned

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Public Sector

- 5.2.2. Private Sector

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hindustan Petroleum Corporation Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Reliance Industries Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bharat Petroleum Corp Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nayara Energy Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: India Retail Fuel Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: India Retail Fuel Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2020 & 2033

- Table 3: India Retail Fuel Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2020 & 2033

- Table 5: India Retail Fuel Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: India Retail Fuel Market Volume Metric Tonns Forecast, by Region 2020 & 2033

- Table 7: India Retail Fuel Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 8: India Retail Fuel Market Volume Metric Tonns Forecast, by Ownership 2020 & 2033

- Table 9: India Retail Fuel Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: India Retail Fuel Market Volume Metric Tonns Forecast, by End User 2020 & 2033

- Table 11: India Retail Fuel Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: India Retail Fuel Market Volume Metric Tonns Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail Fuel Market?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the India Retail Fuel Market?

Key companies in the market include Shell PLC, TotalEnergies SA, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Bharat Petroleum Corp Ltd, Nayara Energy Limited, Indian Oil Corporation Ltd.

3. What are the main segments of the India Retail Fuel Market?

The market segments include Ownership, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

The Public Sector Undertakings Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: The Government of India announced the launch of E20 fuel across 11 states and union territories at 84 retail outlets in India. The Indian government aims to achieve 20% blending of ethanol with petrol by 2025 in the country. The step was taken to control the environmental emission from conventional fuels and progress towards a greener fuel economy. Oil marketing companies (OMC), including HPCL, have set up plants to accomplish the goal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail Fuel Market?

To stay informed about further developments, trends, and reports in the India Retail Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence