Key Insights

The United States Hydrogen Generation Market is projected to experience robust expansion, reaching an estimated $204.86 billion by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 8.6%, driven by escalating demand across critical industries such as oil refining, chemical processing, and iron & steel production. These sectors are prioritizing cleaner energy solutions to meet decarbonization targets. Significant investments in both blue and green hydrogen technologies are further propelling market momentum. Blue hydrogen, leveraging established infrastructure and cost-effectiveness through carbon capture, is anticipated to lead in the short to medium term. Concurrently, green hydrogen, produced via renewable-powered electrolysis, is gaining considerable traction due to stringent environmental regulations and declining renewable energy costs. This strategic dual approach is vital for achieving national decarbonization objectives and bolstering energy security.

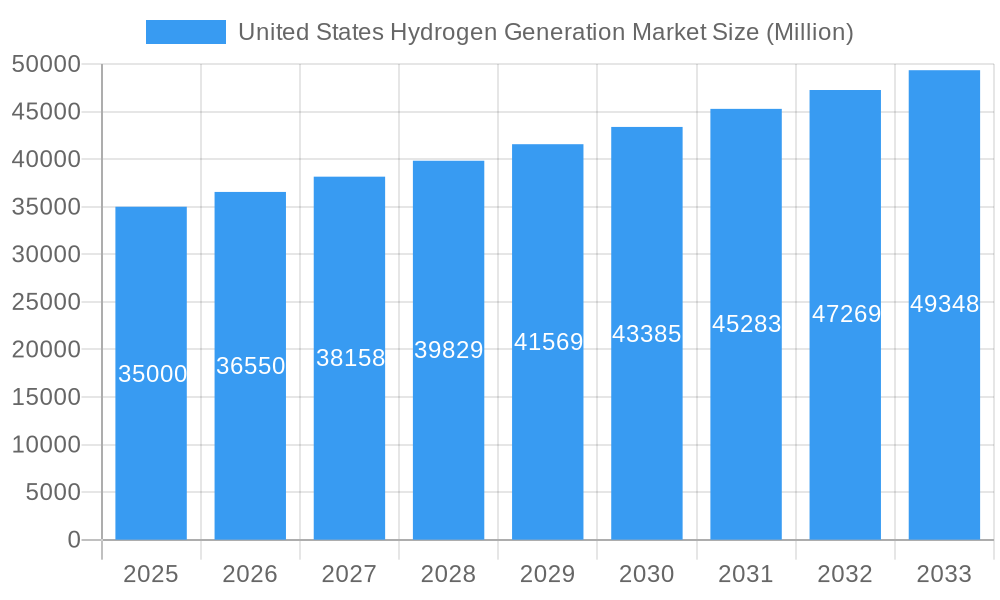

United States Hydrogen Generation Market Market Size (In Billion)

Key market dynamics include technological advancements in Steam Methane Reforming (SMR) and electrolysis, enhancing efficiency and cost-competitiveness. The growing adoption of hydrogen in fuel cell applications, particularly within the transportation and power generation sectors, presents a significant growth opportunity. However, challenges persist, including the substantial initial capital investment required for green hydrogen infrastructure and the necessity for developing a comprehensive hydrogen transportation and storage network. Government support, in the form of tax incentives and research and development funding, will be instrumental in overcoming these obstacles and accelerating the adoption of diverse hydrogen generation methods. Industry leaders such as Air Products and Chemicals Inc., Linde Plc, and Air Liquide SA are actively investing in R&D and expanding capacity to capitalize on these emerging opportunities and shape the future of hydrogen generation in the U.S.

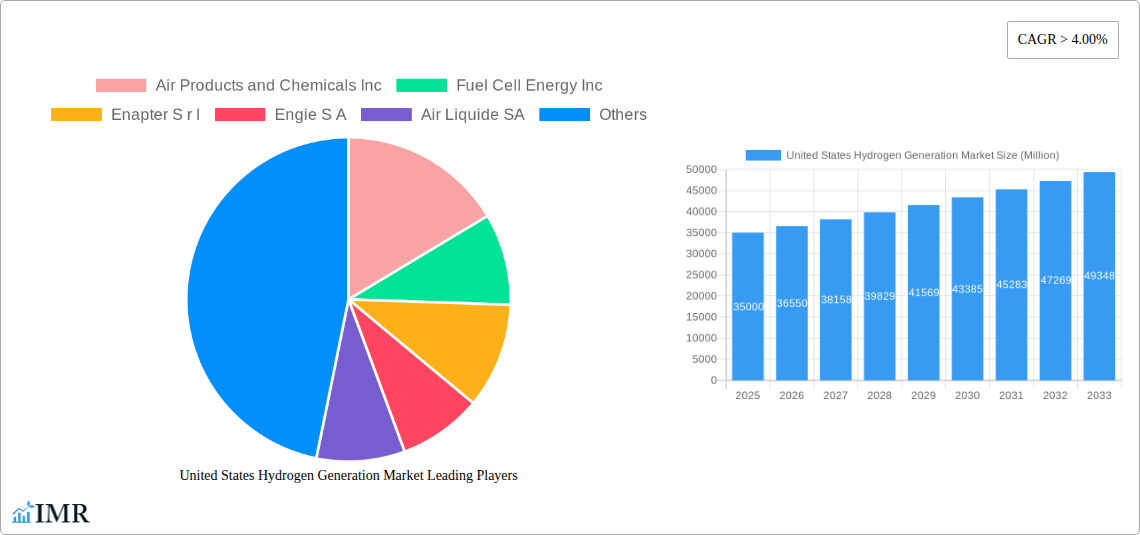

United States Hydrogen Generation Market Company Market Share

United States Hydrogen Generation Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a definitive analysis of the United States Hydrogen Generation Market, covering its dynamics, growth trajectory, competitive landscape, and future potential. Spanning from 2019 to 2033, with a base year of 2025, this study provides crucial insights for stakeholders seeking to understand and capitalize on the burgeoning hydrogen economy. The report delves into parent and child market segments, utilizing high-traffic keywords to ensure maximum search engine visibility and engagement for industry professionals. All values are presented in million units.

United States Hydrogen Generation Market Market Dynamics & Structure

The United States hydrogen generation market is characterized by a moderate level of concentration, with major players like Linde Plc and Air Products and Chemicals Inc. holding significant market shares. Technological innovation is a primary driver, fueled by increasing investments in renewable energy sources for green hydrogen production and advancements in steam methane reforming (SMR) for blue hydrogen. Regulatory frameworks, including federal and state-level incentives and mandates, are increasingly shaping the market, encouraging cleaner hydrogen production methods.

- Market Concentration: Dominated by a few key players, but with growing participation from emerging technology providers.

- Technological Innovation Drivers: Advancements in PEM electrolysis, solid oxide electrolysis, and enhanced SMR efficiency are critical.

- Regulatory Frameworks: The Inflation Reduction Act (IRA) and state-specific clean energy policies are pivotal in driving demand for low-carbon hydrogen.

- Competitive Product Substitutes: While hydrogen is a crucial feedstock, alternative energy carriers and decarbonization technologies pose indirect competition in certain applications.

- End-User Demographics: The industrial sector (oil refining, chemical processing, iron & steel) remains the largest consumer, with growing interest from the transportation and power generation sectors.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies seek to secure supply chains, enhance technological capabilities, and expand market reach. For instance, ITM Power Plc's collaborations are a testament to this trend.

United States Hydrogen Generation Market Growth Trends & Insights

The United States hydrogen generation market is poised for substantial expansion, driven by a confluence of economic, environmental, and technological factors. The total market size is projected to reach an estimated \$52,500 million by 2025 and surge to \$98,750 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth is underpinned by the increasing decarbonization efforts across various industries, a strong push for energy independence, and significant government support.

Adoption rates of cleaner hydrogen production methods, particularly green hydrogen produced via electrolysis powered by renewable energy, are accelerating. This shift is directly influenced by falling renewable energy costs and the development of more efficient and cost-effective electrolyzer technologies. Technological disruptions, such as the evolution of proton exchange membrane (PEM) and solid oxide electrolyzer cells, are making hydrogen production more accessible and economically viable. Consumer behavior shifts are also evident, with industries increasingly prioritizing sustainability and seeking low-carbon solutions to meet their operational and environmental goals. The transition towards hydrogen as a clean energy carrier is not merely an industrial shift but also a societal movement towards a sustainable future. The market penetration of hydrogen fuel cells in heavy-duty transportation and grid-scale energy storage is expected to witness a significant uptick, further catalyzing market growth.

Dominant Regions, Countries, or Segments in United States Hydrogen Generation Market

The United States hydrogen generation market's dominance is multifaceted, influenced by regional industrial concentrations, specific source types, and prevalent technologies.

Source Dominance:

- Blue Hydrogen: Currently holds a substantial market share due to the established infrastructure and cost-effectiveness of Steam Methane Reforming (SMR) processes, particularly in regions with abundant natural gas reserves. States with significant oil and gas production are key contributors to blue hydrogen output.

- Green Hydrogen: Emerging as the fastest-growing segment, driven by federal and state incentives promoting renewable energy integration. Regions with high renewable energy capacity, such as Texas (wind and solar) and the Northeast (offshore wind potential), are rapidly increasing their green hydrogen production capabilities. The declining cost of electrolyzers, particularly PEM technology, further fuels this segment's growth.

- Grey Hydrogen: While still a significant contributor, its dominance is expected to wane as environmental regulations tighten and cleaner alternatives become more economically competitive.

Technology Dominance:

- Steam Methane Reforming (SMR): Remains the dominant technology for hydrogen production due to its established infrastructure and cost-efficiency. This technology is prevalent in established industrial hubs.

- Coal Gasification: Historically important, its share is declining due to environmental concerns and the availability of more efficient and cleaner alternatives.

- Others (Electrolysis): This category, encompassing PEM and alkaline electrolysis, is experiencing exponential growth, particularly for green hydrogen production. The development of large-scale electrolyzer projects is a key indicator of this trend.

Application Dominance:

- Oil Refining & Chemical Processing: These sectors have historically been the largest consumers of hydrogen, utilizing it extensively as a feedstock and in refining processes. Established industrial regions with a strong presence of these industries are leading in demand.

- Iron & Steel Production: Growing adoption of hydrogen in direct reduced iron (DRI) processes and as a fuel for furnaces presents a significant growth opportunity, particularly in regions with established steel manufacturing bases.

- Others: This expanding category includes emerging applications in transportation (fuel cells for vehicles), power generation (grid stabilization and energy storage), and building heating.

Regional Dominance:

- Texas: Leads in hydrogen production and consumption due to its vast oil and gas reserves, established refining and petrochemical industries, and significant investments in renewable energy for green hydrogen.

- Gulf Coast Region (Louisiana, Texas): A major hub for chemical processing and petrochemicals, driving substantial demand for hydrogen.

- Northeast Region (New York, Pennsylvania, New Jersey): Driven by ambitious clean energy goals and increasing investments in green hydrogen projects, including significant electrolyzer installations.

United States Hydrogen Generation Market Product Landscape

The United States hydrogen generation market is characterized by a dynamic product landscape focused on efficiency, cost-effectiveness, and environmental sustainability. Innovations in electrolyzer technologies, such as advanced Proton Exchange Membrane (PEM) and Solid Oxide Electrolyzer Cells (SOEC), are offering higher conversion efficiencies and reduced operational costs. Companies are also developing modular and scalable hydrogen production units, catering to a range of industrial needs and decentralized applications. Furthermore, advancements in carbon capture, utilization, and storage (CCUS) technologies are enhancing the environmental profile of blue hydrogen. The focus remains on producing high-purity hydrogen suitable for diverse applications, from industrial feedstock to clean fuel.

Key Drivers, Barriers & Challenges in United States Hydrogen Generation Market

Key Drivers:

- Decarbonization Mandates: Growing pressure to reduce greenhouse gas emissions across industries and achieve net-zero targets.

- Government Incentives: Federal (e.g., Inflation Reduction Act) and state-level tax credits, grants, and subsidies for hydrogen production and infrastructure.

- Technological Advancements: Improved efficiency and reduced costs of electrolysis technologies and CCUS.

- Energy Security & Independence: Desire to diversify energy sources and reduce reliance on fossil fuels.

- Growing Demand in Emerging Applications: Increasing adoption in transportation, power generation, and industrial decarbonization.

Barriers & Challenges:

- High Production Costs: Green hydrogen production, while improving, can still be more expensive than fossil fuel-based hydrogen.

- Infrastructure Development: The need for a robust hydrogen transportation and storage network is critical and requires significant investment.

- Safety Concerns: Public perception and rigorous safety protocols for handling and transporting hydrogen.

- Intermittency of Renewables: The reliance on renewable energy for green hydrogen production presents challenges related to grid integration and consistent supply.

- Regulatory Harmonization: Inconsistent regulations across different states can hinder large-scale deployment.

- Supply Chain Constraints: Securing raw materials and manufacturing capacity for electrolyzers and related equipment.

Emerging Opportunities in United States Hydrogen Generation Market

Emerging opportunities in the United States hydrogen generation market are abundant, particularly in scaling up green hydrogen production through advanced electrolysis powered by abundant renewable energy sources like wind and solar. The development of a comprehensive hydrogen refueling infrastructure for heavy-duty transportation, including trucks and buses, presents a significant avenue for growth. Furthermore, the utilization of hydrogen in industrial decarbonization, such as in the steel and cement industries through direct reduction and hydrogen-based fuel, offers substantial market potential. The integration of hydrogen fuel cells for grid-scale energy storage and backup power solutions also represents a burgeoning segment. Finally, exploring hydrogen for residential and commercial heating applications, especially in new construction, is an untapped market.

Growth Accelerators in the United States Hydrogen Generation Market Industry

Several catalysts are accelerating the growth of the United States hydrogen generation market. Technological breakthroughs in electrolyzer efficiency and cost reduction are making green hydrogen increasingly competitive. Strategic partnerships between energy companies, industrial consumers, and technology providers are crucial for de-risking investments and facilitating project development. Significant government support through policies like the Inflation Reduction Act is providing financial incentives that drastically improve the economic viability of hydrogen projects. Market expansion strategies, including the development of regional hydrogen hubs and the establishment of clear standards and certifications for low-carbon hydrogen, are also crucial growth accelerators.

Key Players Shaping the United States Hydrogen Generation Market Market

- Air Products and Chemicals Inc

- Fuel Cell Energy Inc

- Enapter S r l

- Engie S A

- Air Liquide SA

- McPhy Energy S A

- Messer Group GmbH

- Cummins Inc

- Linde Plc

- ITM Power Plc

- Taiyo Nippon Sanso Holding Corporation

Notable Milestones in United States Hydrogen Generation Market Sector

- September 2022: Linde announced plans to build a 35-megawatt PEM electrolyzer to produce green hydrogen in Niagara Falls, New York. This plant, the largest electrolyzer installed by Linde globally, will more than double Linde's green liquid hydrogen production capacity in the United States.

- August 2022: National Renewable Energy Laboratory (NREL) announced a collaboration with Toyota Motor North America (Toyota) through a cooperative research and development agreement to build, install, and evaluate a one-megawatt (MW) PEM fuel cell power generation system at NREL's Flatirons Campus in Colorado. New research demonstrates large-scale power production using hydrogen fuel cells in an integrated energy system.

In-Depth United States Hydrogen Generation Market Market Outlook

The outlook for the United States hydrogen generation market is exceptionally strong, driven by a clear policy direction and substantial private sector investment. Growth accelerators such as declining electrolyzer costs, increasing renewable energy capacity, and the development of dedicated hydrogen infrastructure will further propel market expansion. Strategic opportunities lie in leveraging the nation's abundant renewable resources to establish leadership in green hydrogen production, thereby supporting industrial decarbonization and the transition to a hydrogen-powered transportation sector. The continued focus on R&D for next-generation hydrogen technologies and carbon capture will be critical in unlocking the full potential of this vital clean energy vector.

United States Hydrogen Generation Market Segmentation

-

1. Source

- 1.1. Blue hydrogen

- 1.2. Green hydrogen

- 1.3. Grey Hydrogen

-

2. Technology

- 2.1. Steam Methane Reforming (SMR)

- 2.2. Coal Gasification

- 2.3. Others

-

3. Application

- 3.1. Oil Refining

- 3.2. Chemical Processing

- 3.3. Iron & Steel Production

- 3.4. Others

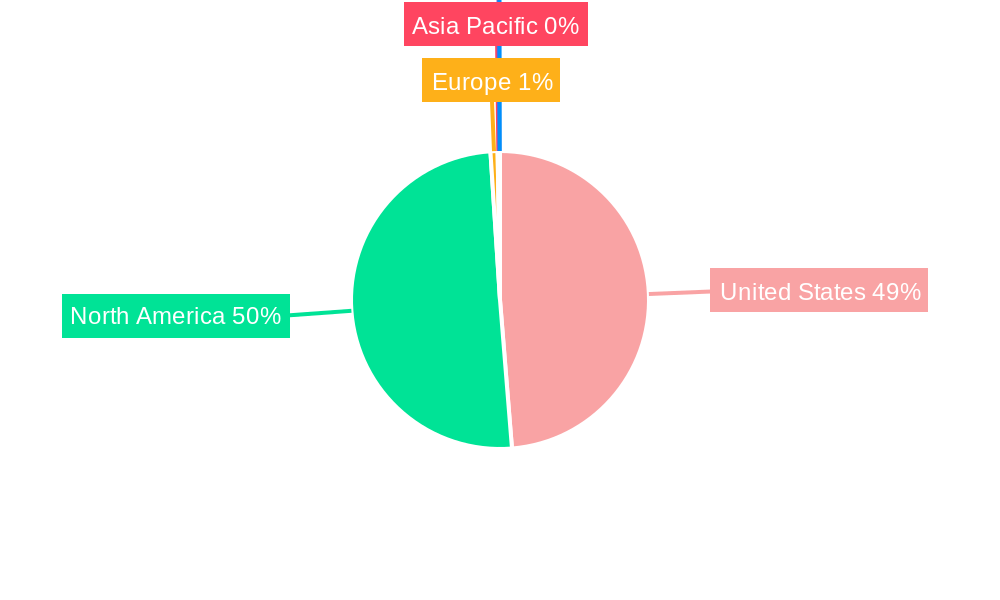

United States Hydrogen Generation Market Segmentation By Geography

- 1. United States

United States Hydrogen Generation Market Regional Market Share

Geographic Coverage of United States Hydrogen Generation Market

United States Hydrogen Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Costs For Hydrogen Energy Storage

- 3.4. Market Trends

- 3.4.1. Grey to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hydrogen Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Blue hydrogen

- 5.1.2. Green hydrogen

- 5.1.3. Grey Hydrogen

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Methane Reforming (SMR)

- 5.2.2. Coal Gasification

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil Refining

- 5.3.2. Chemical Processing

- 5.3.3. Iron & Steel Production

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Air Products and Chemicals Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fuel Cell Energy Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enapter S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engie S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Air Liquide SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 McPhy Energy S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Messer Group GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cummins Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linde Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ITM Power Plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Taiyo Nippon Sanso Holding Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Air Products and Chemicals Inc

List of Figures

- Figure 1: United States Hydrogen Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Hydrogen Generation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Hydrogen Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Hydrogen Generation Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: United States Hydrogen Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: United States Hydrogen Generation Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: United States Hydrogen Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hydrogen Generation Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the United States Hydrogen Generation Market?

Key companies in the market include Air Products and Chemicals Inc, Fuel Cell Energy Inc, Enapter S r l, Engie S A, Air Liquide SA, McPhy Energy S A, Messer Group GmbH, Cummins Inc, Linde Plc, ITM Power Plc, Taiyo Nippon Sanso Holding Corporation.

3. What are the main segments of the United States Hydrogen Generation Market?

The market segments include Source, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.86 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand From Refining And Industrial Sector4.; Favourable Government Policies.

6. What are the notable trends driving market growth?

Grey to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Costs For Hydrogen Energy Storage.

8. Can you provide examples of recent developments in the market?

In September 2022, Linde announced plans to build a 35-megawatt PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in Niagara Falls, New York. The new plant will be the largest electrolyzer installed by Linde globally and will more than double Linde's green liquid hydrogen production capacity in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hydrogen Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hydrogen Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hydrogen Generation Market?

To stay informed about further developments, trends, and reports in the United States Hydrogen Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence