Key Insights

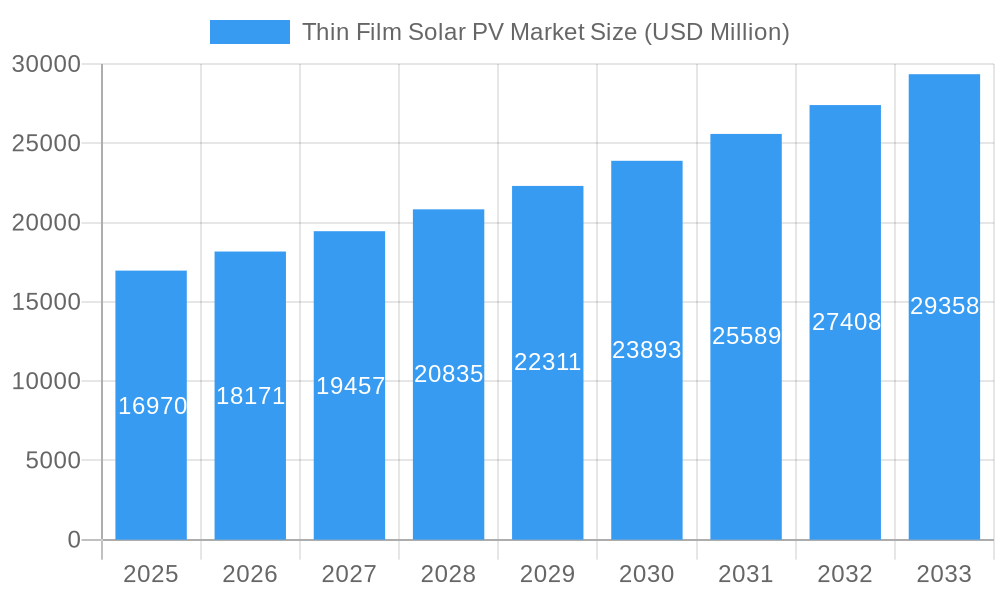

The global Thin Film Solar Photovoltaic (PV) Market is poised for significant expansion, projected to reach $16.97 billion by 2025, driven by a robust CAGR of 7.05% during the forecast period of 2025-2033. This growth is fueled by increasing demand for renewable energy solutions, government incentives for solar adoption, and the inherent advantages of thin-film technology, such as flexibility, lightweight properties, and lower manufacturing costs in certain applications. Cadmium Telluride (CdTe) and Copper Indium Gallium Selenide (CIGS) technologies are expected to be key drivers of this growth, offering competitive performance and cost-effectiveness. The market's expansion will be further supported by advancements in manufacturing processes and a growing awareness of the environmental benefits associated with solar energy.

Thin Film Solar PV Market Market Size (In Billion)

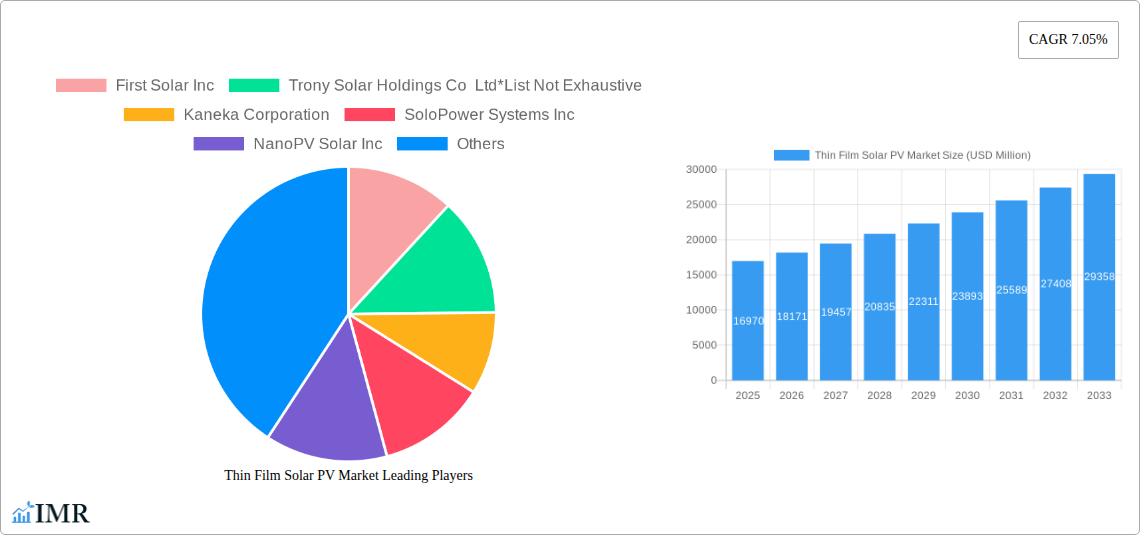

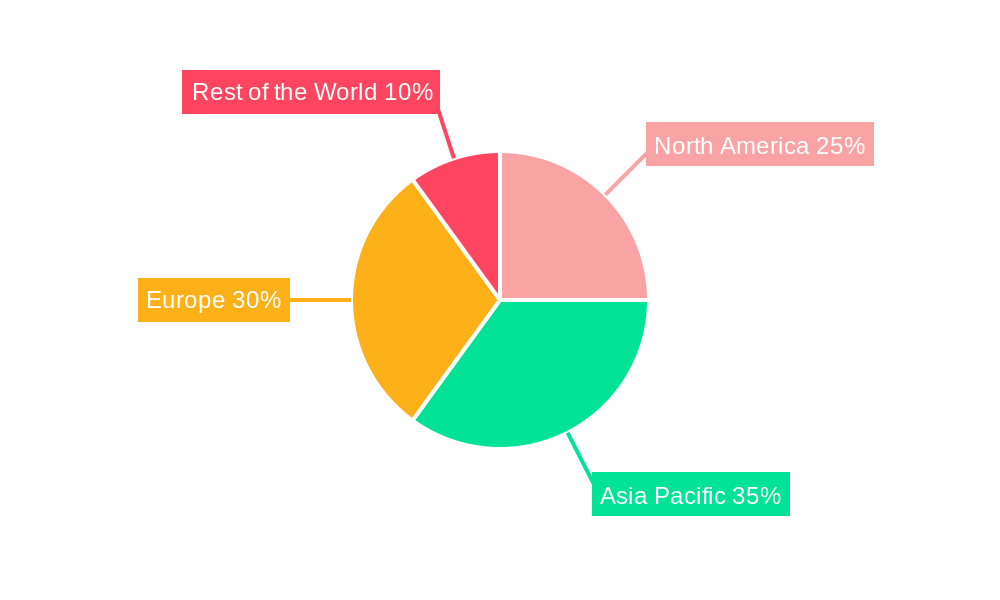

The competitive landscape for thin-film solar PV is characterized by the presence of established players like First Solar Inc. and Hanergy Thin Film Power Group Ltd., alongside emerging companies focusing on innovative solutions. While the market benefits from strong growth drivers, it also faces certain restraints, including the relatively lower efficiency of some thin-film technologies compared to crystalline silicon, as well as initial capital investment requirements for large-scale manufacturing. However, ongoing research and development are continuously improving efficiency and reducing costs, mitigating these challenges. The market's regional distribution is likely to see significant contributions from Asia Pacific, driven by supportive government policies and rapid industrialization, followed by North America and Europe, which are actively pursuing renewable energy targets.

Thin Film Solar PV Market Company Market Share

Unlock the Future of Solar Energy: A Comprehensive Analysis of the Thin Film Solar PV Market

This in-depth report provides an unparalleled look into the global Thin Film Solar PV Market, a rapidly evolving sector poised for significant growth. Explore the intricate dynamics, emerging trends, and future trajectory of thin-film photovoltaic technology, essential for industry leaders, investors, and policymakers navigating the energy transition. With a comprehensive study period spanning 2019–2033, a base year of 2025, and a detailed forecast period of 2025–2033, this report offers critical insights into market size, segmentation, and regional dominance. Dive deep into the competitive landscape, technological advancements, and the key players shaping the future of solar energy.

Thin Film Solar PV Market Market Dynamics & Structure

The Thin Film Solar PV Market is characterized by dynamic market forces and a complex, yet evolving, structure. Technological innovation remains a paramount driver, with ongoing research and development pushing the boundaries of efficiency and cost-effectiveness for various thin-film technologies. Regulatory frameworks, both supportive and restrictive, significantly influence market penetration and investment decisions globally. The competitive landscape features a growing number of established players and emerging innovators, constantly vying for market share through product differentiation and strategic pricing. While crystalline silicon technology remains dominant, thin-film solutions are carving out significant niches due to their unique advantages.

- Market Concentration: The market exhibits moderate concentration, with a few key players holding substantial market share, but a growing number of smaller, specialized companies contributing to innovation and competition.

- Technological Innovation Drivers: Advancements in material science, manufacturing processes, and device architecture are critical for improving efficiency, durability, and reducing the levelized cost of electricity (LCOE) for thin-film solar cells.

- Regulatory Frameworks: Government incentives, feed-in tariffs, tax credits, and renewable energy mandates play a crucial role in stimulating demand and investment. Conversely, trade policies and permitting regulations can pose barriers.

- Competitive Product Substitutes: While crystalline silicon PV is the primary competitor, emerging solar technologies and energy storage solutions also influence market dynamics.

- End-User Demographics: Demand is driven by utility-scale projects, commercial and industrial installations, and increasingly, residential applications where flexibility and aesthetics are valued.

- M&A Trends: The sector has witnessed strategic mergers and acquisitions aimed at consolidating market share, acquiring novel technologies, and expanding global reach. For instance, a notable trend has been the acquisition of smaller R&D-focused firms by larger manufacturers to accelerate innovation cycles, with an estimated 2-3 significant M&A deals annually over the historical period.

Thin Film Solar PV Market Growth Trends & Insights

The Thin Film Solar PV Market is projected to experience robust growth, driven by a confluence of factors including declining manufacturing costs, increasing environmental consciousness, and supportive government policies promoting renewable energy adoption. The market size is estimated to reach $xx billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025–2033). This growth trajectory is underpinned by technological breakthroughs that are steadily improving the performance and cost-competitiveness of thin-film technologies against traditional silicon-based solar panels.

The adoption rates for thin-film solar PV are accelerating, particularly in applications where their unique characteristics offer distinct advantages. For example, their flexibility, lightweight nature, and improved performance in low-light conditions make them ideal for building-integrated photovoltaics (BIPV), portable electronics, and even aerospace applications. Consumer behavior is also shifting, with a growing preference for sustainable energy solutions and a greater understanding of the long-term economic benefits of solar energy. This shift is further amplified by increasing corporate sustainability initiatives and a growing demand for clean energy from businesses.

Technological disruptions are a constant feature of this market. Innovations in material deposition techniques, such as roll-to-roll processing, are paving the way for high-volume, low-cost manufacturing. Furthermore, advancements in tandem solar cell technologies, which combine different photovoltaic materials to capture a wider spectrum of sunlight, hold immense potential for significantly boosting conversion efficiencies. The development of perovskite-based thin-film solar cells, known for their high efficiencies and potential for low-cost production, is another significant disruptive force to watch.

The increasing integration of thin-film solar PV into various end-use applications, from residential rooftops to large-scale power plants and even specialized niche markets, signifies a broadening market penetration. The market penetration of thin-film solar PV, while still lower than crystalline silicon, is steadily increasing as costs decrease and performance improves. The 2025 market is projected to be valued at approximately $xx billion, with a significant expansion anticipated over the next decade. Key metrics such as market penetration and the levelized cost of energy (LCOE) are crucial for understanding the competitive positioning and growth potential of different thin-film technologies. The report analyzes these dynamics, providing detailed forecasts and insights into the future market size evolution and adoption rates.

Dominant Regions, Countries, or Segments in Thin Film Solar PV Market

The Thin Film Solar PV Market is witnessing varied growth patterns across different regions, countries, and technological segments. Among the dominant segments, Cadmium Telluride (CdTe) has emerged as a leading force, driven by its proven track record of high efficiency, durability, and cost-effectiveness in large-scale solar power plants. Its manufacturing scalability and strong supply chain infrastructure have positioned it as a preferred choice for utility-scale projects, contributing significantly to its market share.

Copper Indium Gallium Selenide (CIGS) and Amorphous Silicon (a-Si) also hold significant positions within the market. CIGS offers a compelling balance of efficiency and flexibility, making it suitable for a broader range of applications, including BIPV. Amorphous Silicon, while historically having lower efficiencies, continues to find its place in niche applications due to its low-light performance and cost advantages in specific scenarios.

Asia Pacific, particularly China, continues to be a dominant region in the global solar PV market, including thin-film technologies. Its extensive manufacturing capabilities, supportive government policies, and massive domestic demand fuel the growth of thin-film solar installations. China's commitment to renewable energy targets and its role as a global manufacturing hub for solar components provide a strong foundation for market expansion.

North America is another key region, with the United States leading in the adoption of CdTe technology for utility-scale projects. Favorable economic policies, the declining cost of solar energy, and a growing emphasis on clean energy infrastructure contribute to this dominance. Investments in solar farms and the integration of solar power into the grid are significant growth drivers.

Europe also plays a crucial role, with a strong focus on innovation and the development of BIPV solutions. Germany, for instance, has been at the forefront of promoting renewable energy and advanced solar technologies, including thin-film applications that integrate seamlessly into building designs. The region's commitment to climate goals and its emphasis on sustainable construction practices further propel the market.

Key drivers for dominance in these regions and segments include:

- Economic Policies: Government incentives, tax credits, feed-in tariffs, and renewable energy mandates significantly influence investment decisions and market growth.

- Infrastructure Development: The availability of robust grid infrastructure and the development of large-scale solar projects are critical for the widespread adoption of thin-film PV.

- Technological Advancements: Continuous improvements in efficiency, durability, and manufacturing processes for specific thin-film technologies enhance their competitiveness.

- Market Demand: Growing demand for clean energy from utilities, commercial entities, and residential consumers fuels the expansion of the thin-film solar PV market.

- Manufacturing Capacity: The presence of advanced manufacturing facilities and a well-established supply chain for thin-film components contributes to market leadership.

The Thin Film Solar PV Market is expected to see continued growth in these dominant regions and segments, with ongoing innovation and supportive policies shaping its future landscape.

Thin Film Solar PV Market Product Landscape

The product landscape of the Thin Film Solar PV Market is characterized by continuous innovation aimed at enhancing efficiency, reducing costs, and expanding application versatility. Cadmium Telluride (CdTe) thin-film solar panels, a dominant player, offer high conversion efficiencies in the range of 18-22% and are known for their excellent performance in real-world conditions, including low-light and high-temperature environments. Copper Indium Gallium Selenide (CIGS) thin-film technologies are pushing efficiency boundaries, with laboratory records exceeding 23%, and offer flexibility, making them ideal for Building-Integrated Photovoltaics (BIPV), portable chargers, and curved surfaces. Amorphous Silicon (a-Si) solar cells, while typically offering lower efficiencies (around 6-10%), remain competitive due to their low manufacturing cost and good performance in diffuse sunlight, finding applications in electronic devices and low-power systems. Emerging technologies like perovskite thin-film solar cells are demonstrating rapid efficiency gains, with single-junction cells reaching over 25% and tandem cells exceeding 30% in research settings, promising future breakthroughs in energy generation.

Key Drivers, Barriers & Challenges in Thin Film Solar PV Market

Key Drivers:

- Cost Competitiveness: Declining manufacturing costs and improving efficiency are making thin-film solar PV increasingly competitive with traditional energy sources and silicon-based PV.

- Environmental Mandates & Sustainability Goals: Growing global emphasis on renewable energy and climate change mitigation policies are driving demand.

- Technological Advancements: Continuous R&D is leading to higher efficiencies, improved durability, and novel applications for thin-film technologies.

- Versatility & Niche Applications: The inherent flexibility, lightweight nature, and performance characteristics of thin-film solar PV open doors to unique applications not feasible for rigid silicon panels.

Barriers & Challenges:

- Efficiency Gap with Crystalline Silicon: While narrowing, the average efficiency of many thin-film technologies still trails that of high-performance crystalline silicon, impacting land-use requirements for large-scale projects.

- Material Availability & Toxicity Concerns: The sourcing of certain rare materials (e.g., indium, gallium) and concerns around the toxicity of cadmium in CdTe panels require careful management and regulatory oversight.

- Manufacturing Scalability & Investment: High initial capital investment for establishing large-scale, high-throughput manufacturing facilities can be a barrier for new entrants.

- Market Perception & Awareness: In some segments, a lack of awareness about the advancements and benefits of thin-film solar PV can hinder adoption compared to more established technologies.

- Supply Chain Volatility: Geopolitical factors and disruptions in the supply of critical raw materials can impact production costs and availability, with an estimated 5-10% fluctuation in raw material costs impacting overall module price.

Emerging Opportunities in Thin Film Solar PV Market

Emerging opportunities within the Thin Film Solar PV Market are vast and multifaceted. The burgeoning field of Building-Integrated Photovoltaics (BIPV) presents a significant avenue, allowing thin-film solar cells to be seamlessly integrated into building materials like facades, windows, and roofing, creating aesthetically pleasing and energy-generating structures. Furthermore, the development of flexible and transparent thin-film solar cells is opening up applications in the Internet of Things (IoT) devices, wearable electronics, and the automotive sector for vehicle-integrated power generation. The ongoing advancements in perovskite solar cell technology, with its potential for high efficiency and low-cost manufacturing through printing techniques, represent a major disruptive opportunity for mainstream market penetration in the coming years. The demand for off-grid power solutions in remote areas and developing economies also offers a substantial growth area for cost-effective and easily deployable thin-film PV systems.

Growth Accelerators in the Thin Film Solar PV Market Industry

Growth in the Thin Film Solar PV Market is being significantly accelerated by continuous technological breakthroughs, particularly in increasing conversion efficiencies and improving manufacturing processes. The development of tandem solar cells, combining different thin-film materials, promises to unlock unprecedented levels of energy generation. Strategic partnerships between research institutions, material suppliers, and panel manufacturers are fostering rapid innovation and faster commercialization of new technologies. Furthermore, market expansion strategies, including entering new geographic regions with high renewable energy potential and forging collaborations with utility companies for large-scale project development, are key growth accelerators. The increasing focus on circular economy principles and the development of more sustainable manufacturing methods will also drive long-term adoption and market growth.

Key Players Shaping the Thin Film Solar PV Market Market

- First Solar Inc

- Trony Solar Holdings Co Ltd

- Kaneka Corporation

- SoloPower Systems Inc

- NanoPV Solar Inc

- Hanergy Thin Film Power Group Ltd

- Solar Frontier K K

- Ascent Solar Technologies Inc

Notable Milestones in Thin Film Solar PV Market Sector

- 2019: Hanergy Thin Film Power Group Ltd announces significant advancements in flexible CIGS solar cell technology, achieving record efficiencies for large-area modules.

- 2020: First Solar Inc. inaugurates its new state-of-the-art CdTe manufacturing facility in Ohio, significantly increasing production capacity to meet growing demand.

- 2021: Researchers at the National Renewable Energy Laboratory (NREL) achieve a new world record efficiency for perovskite-silicon tandem solar cells, signaling immense future potential for thin-film technology.

- 2022: Kaneka Corporation launches a new generation of flexible CIGS solar modules designed for enhanced durability and improved performance in diverse environmental conditions.

- 2023: Ascent Solar Technologies Inc. secures a strategic partnership to develop thin-film solar solutions for the aerospace industry, highlighting the expanding application spectrum.

- 2024: Trony Solar Holdings Co Ltd. reports increased production output and cost reductions in its amorphous silicon (a-Si) thin-film module manufacturing, enhancing its competitiveness in niche markets.

In-Depth Thin Film Solar PV Market Market Outlook

The outlook for the Thin Film Solar PV Market is exceptionally promising, fueled by ongoing technological advancements, favorable policy landscapes, and a growing global imperative for clean energy solutions. Key growth accelerators, including breakthroughs in perovskite and tandem cell technologies, will continue to drive efficiency gains and cost reductions, making thin-film solar PV even more competitive. Strategic partnerships and market expansion initiatives will further broaden its reach into new applications and geographies. The increasing integration of thin-film solar into BIPV, portable electronics, and automotive sectors represents significant untapped potential. As the world transitions towards a sustainable energy future, the adaptability, versatility, and improving performance of thin-film solar PV position it as a crucial technology for meeting future energy demands. The market is projected to witness sustained growth, driven by innovation and strategic investments.

Thin Film Solar PV Market Segmentation

-

1. Type

- 1.1. Cadmium Telluride (CdTe)

- 1.2. Copper Indium Gallium Selenide (CIGS)

- 1.3. Amorphous Silicon (a-Si)

Thin Film Solar PV Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Rest of the World

Thin Film Solar PV Market Regional Market Share

Geographic Coverage of Thin Film Solar PV Market

Thin Film Solar PV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Government Policies and Increasing Adoption of Solar PV Systems; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Cadmium-Telluride (CdTe) Thin Film Solar Cells to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cadmium Telluride (CdTe)

- 5.1.2. Copper Indium Gallium Selenide (CIGS)

- 5.1.3. Amorphous Silicon (a-Si)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cadmium Telluride (CdTe)

- 6.1.2. Copper Indium Gallium Selenide (CIGS)

- 6.1.3. Amorphous Silicon (a-Si)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cadmium Telluride (CdTe)

- 7.1.2. Copper Indium Gallium Selenide (CIGS)

- 7.1.3. Amorphous Silicon (a-Si)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cadmium Telluride (CdTe)

- 8.1.2. Copper Indium Gallium Selenide (CIGS)

- 8.1.3. Amorphous Silicon (a-Si)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cadmium Telluride (CdTe)

- 9.1.2. Copper Indium Gallium Selenide (CIGS)

- 9.1.3. Amorphous Silicon (a-Si)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 First Solar Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trony Solar Holdings Co Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kaneka Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SoloPower Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NanoPV Solar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hanergy Thin Film Power Group Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Solar Frontier K K

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ascent Solar Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 First Solar Inc

List of Figures

- Figure 1: Global Thin Film Solar PV Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Thin Film Solar PV Market Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 5: North America Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 9: North America Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Asia Pacific Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 12: Asia Pacific Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 13: Asia Pacific Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Asia Pacific Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Asia Pacific Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: Asia Pacific Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: Asia Pacific Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 20: Europe Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 21: Europe Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Europe Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: Rest of the World Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 29: Rest of the World Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Rest of the World Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Rest of the World Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: Rest of the World Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: Global Thin Film Solar PV Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 7: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 9: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 19: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Solar PV Market?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Thin Film Solar PV Market?

Key companies in the market include First Solar Inc, Trony Solar Holdings Co Ltd*List Not Exhaustive, Kaneka Corporation, SoloPower Systems Inc, NanoPV Solar Inc, Hanergy Thin Film Power Group Ltd, Solar Frontier K K, Ascent Solar Technologies Inc.

3. What are the main segments of the Thin Film Solar PV Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Favorable Government Policies and Increasing Adoption of Solar PV Systems; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Cadmium-Telluride (CdTe) Thin Film Solar Cells to Dominate the Market.

7. Are there any restraints impacting market growth?

The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Solar PV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Solar PV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Solar PV Market?

To stay informed about further developments, trends, and reports in the Thin Film Solar PV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence