Key Insights

The India Thermal Power Plant Market is poised for significant expansion, projected to reach USD 57.74 billion in 2024, demonstrating a robust compound annual growth rate (CAGR) of 6.1%. This growth is underpinned by the nation's escalating energy demands, driven by rapid industrialization, urbanization, and a burgeoning population. Coal continues to be the dominant fuel source, though there's a discernible trend towards diversification with increased investment in gas-based power generation, acknowledging its relatively cleaner emission profile. Nuclear power, while a smaller segment, is also on an upward trajectory, reflecting India's commitment to a diversified and secure energy mix. The "Other Fuel Types" segment, likely encompassing renewables integrated with thermal plants or emerging cleaner technologies, is also expected to contribute to market dynamics, albeit at a nascent stage. Key players like NTPC Limited, Tata Power, and Adani Power are at the forefront, investing in capacity expansion and technological upgrades to meet the country's insatiable appetite for electricity.

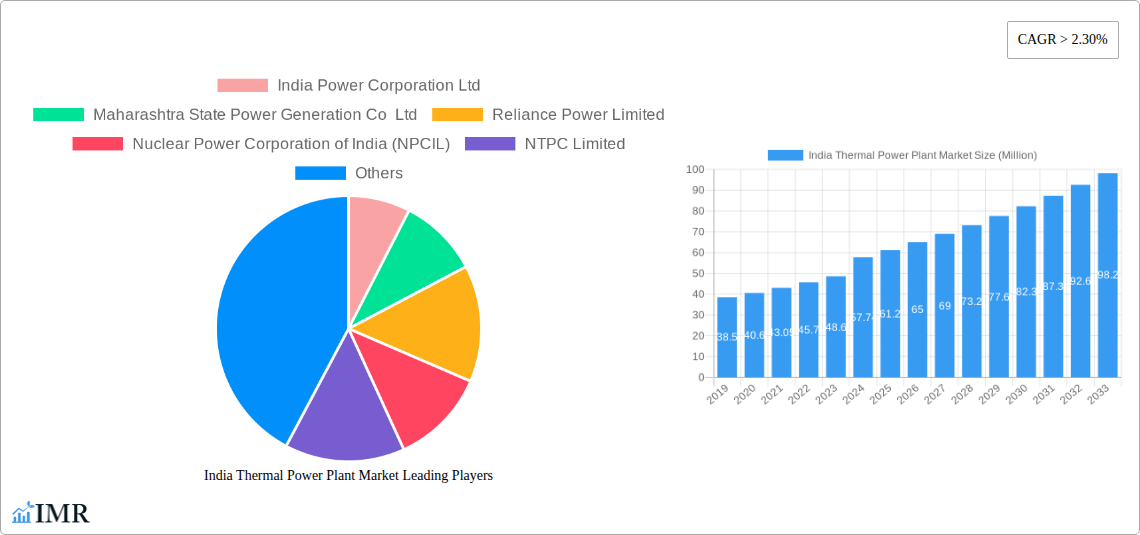

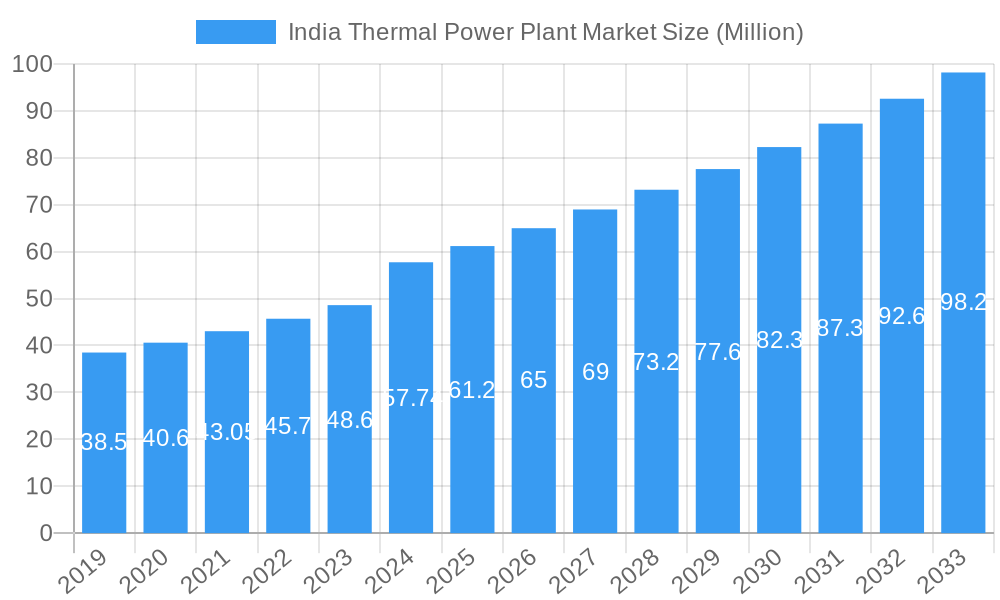

India Thermal Power Plant Market Market Size (In Million)

While the market is driven by the fundamental need for power, several factors influence its trajectory. The increasing emphasis on environmental regulations and the global push towards decarbonization present both opportunities and challenges. Investments in advanced technologies for emission control and efficiency improvements in existing coal-fired plants will be critical. Conversely, the sustained reliance on fossil fuels, particularly coal, faces scrutiny due to its environmental impact. Policy support for cleaner alternatives and the integration of renewable energy sources with thermal power infrastructure are emerging as crucial trends. Restraints may arise from land acquisition challenges, the fluctuating prices of fuel commodities, and the complex regulatory landscape. However, the sheer scale of India's energy deficit and the government's focus on providing 24/7 power access ensure that the thermal power sector will remain a cornerstone of the nation's energy infrastructure for the foreseeable future, adapting and evolving to meet evolving demands and sustainability goals.

India Thermal Power Plant Market Company Market Share

India Thermal Power Plant Market: Comprehensive Growth Analysis and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the India thermal power plant market, encompassing its current state and projected trajectory from 2019 to 2033. With a focus on coal power plants, gas-fired power plants, and nuclear power generation, this study delves into market dynamics, growth trends, regional dominance, product landscapes, and key players shaping India's energy infrastructure. The analysis is structured to offer actionable insights for stakeholders, including power producers, technology providers, investors, and policymakers. The base year for estimation is 2025, with a detailed forecast period from 2025 to 2033 and a historical overview from 2019 to 2024. Gain an unparalleled understanding of the Indian power generation sector, including captive power plants and their contribution to industrial energy needs.

India Thermal Power Plant Market Market Dynamics & Structure

The India thermal power plant market is characterized by a moderately concentrated structure, with a few dominant public and private sector players controlling a significant portion of generation capacity. Technological innovation is primarily driven by the need for enhanced efficiency, reduced emissions, and improved grid stability. Regulatory frameworks, including government policies on fuel sourcing, environmental compliance, and power purchase agreements, play a pivotal role in shaping investment decisions and operational strategies. Competitive product substitutes are limited within the thermal power segment itself, with primary competition arising from renewable energy sources. End-user demographics are diverse, ranging from industrial consumers requiring captive power to residential and commercial sectors reliant on grid supply. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts and strategic expansions, aiming to leverage economies of scale and optimize operational portfolios. For instance, the market size for thermal power in India is projected to reach approximately $XXX billion by 2033, with coal power plants accounting for over 70% of this share in 2025. M&A activities in the past five years have involved deals valued at over $XX billion, focusing on acquiring operational assets and expanding renewable energy portfolios alongside thermal capacities. Barriers to innovation include the substantial capital investment required for new plant construction, the long gestation periods for project approvals, and the fluctuating costs of fuel.

- Market Concentration: Dominated by large integrated power companies with diversified portfolios.

- Technological Innovation: Focus on ultra-supercritical technology for coal, advanced gas turbine technology, and safety enhancements in nuclear power.

- Regulatory Frameworks: Strict environmental norms, fuel import policies, and renewable purchase obligations influence market dynamics.

- End-User Demographics: Industrial sector demand for captive power plants is a key driver, alongside the growing overall energy demand for residential and commercial use.

- M&A Trends: Strategic acquisitions and divestitures to optimize asset portfolios and expand into newer energy technologies.

India Thermal Power Plant Market Growth Trends & Insights

The India thermal power plant market is poised for significant growth, driven by the nation's insatiable demand for electricity. The market size for thermal power in India is estimated to reach $XXX billion in 2025, projected to expand at a compound annual growth rate (CAGR) of approximately X.X% during the forecast period of 2025–2033. This growth is fueled by the increasing industrialization, urbanization, and the need to meet rising per capita electricity consumption. Adoption rates of new technologies, while gradual, are influenced by government incentives and the pursuit of cleaner thermal generation. Technological disruptions, particularly the integration of advanced emission control systems and the exploration of co-firing of biomass in coal plants, are gradually transforming the landscape. Consumer behavior shifts are less pronounced for thermal power directly, but the broader demand for reliable and affordable electricity from all sources underpins the sector's growth. The projected market penetration of advanced thermal technologies is expected to reach XX% by 2033, contributing to enhanced energy security. The market for gas-fired power plants is anticipated to grow at a CAGR of XX.X%, driven by cleaner emission profiles and fuel availability.

Dominant Regions, Countries, or Segments in India Thermal Power Plant Market

Within the India thermal power plant market, the Coal segment stands as the dominant force, primarily due to its historical significance, established infrastructure, and the widespread availability of domestic coal reserves, although increasingly supplemented by imports. This segment accounted for an estimated 70-75% of the total installed thermal capacity in 2024 and is projected to maintain its leading position throughout the forecast period. Key drivers for the dominance of coal include the Indian government's continued reliance on coal for baseload power generation, substantial investments in coal-fired power plants, and the significant employment generated by the coal mining and power sectors. Economic policies strongly favor coal as a cost-effective energy source for large-scale power generation. Infrastructure development in coal-rich states like Jharkhand, Odisha, and Chhattisgarh has further cemented its position.

- Dominant Segment: Coal Fuel Type.

- Market Share (Estimated 2024): 70-75%.

- Key Drivers:

- Government's focus on energy security and affordability.

- Vast domestic coal reserves and established import infrastructure.

- Significant investments in coal power generation.

- Economic policies supporting coal-based energy.

- Infrastructure development in coal-producing regions.

- Growth Potential: While facing environmental scrutiny, coal is expected to remain a crucial component of India's energy mix in the medium term, particularly with the adoption of cleaner technologies.

The Gas segment is emerging as a significant growth area, driven by environmental considerations and fuel diversification efforts. Its market share, though smaller than coal, is expected to increase, with a projected CAGR of XX.X% due to government incentives for gas-based power and the increasing availability of Liquefied Natural Gas (LNG). The Nuclear segment, while providing clean and reliable baseload power, represents a smaller but strategically important portion of the market. Nuclear Power Corporation of India (NPCIL) is the primary entity driving this segment. Other Fuel Types, including biomass and waste-to-energy, are nascent but hold potential for localized applications.

India Thermal Power Plant Market Product Landscape

The product landscape of the India thermal power plant market is evolving with a focus on enhanced efficiency and reduced environmental impact. Modern coal power plants are increasingly adopting ultra-supercritical technology, leading to higher thermal efficiency and lower fuel consumption per unit of electricity generated. Gas-fired power plants are witnessing advancements in combined cycle gas turbine (CCGT) technology, offering faster response times and greater flexibility. Nuclear power plants are characterized by stringent safety protocols and advancements in reactor designs. Innovations in emission control technologies, such as Flue Gas Desulfurization (FGD) and Selective Catalytic Reduction (SCR) for coal plants, are becoming standard. The unique selling proposition of thermal power lies in its ability to provide consistent and dispatchable baseload power, crucial for grid stability.

Key Drivers, Barriers & Challenges in India Thermal Power Plant Market

The India thermal power plant market is propelled by several key drivers including the nation's ever-increasing energy demand, driven by economic growth and population expansion. Government policies supporting energy security and the development of indigenous power generation capabilities also play a crucial role. Technological advancements leading to more efficient and cleaner thermal power generation are further catalysts. The substantial investments required for building large-scale thermal power plants, coupled with long project gestation periods and regulatory hurdles, act as significant barriers. Supply chain disruptions, particularly for imported fuels like coal and LNG, and the global volatility in fuel prices pose persistent challenges. Furthermore, growing environmental concerns and the increasing competitiveness of renewable energy sources present ongoing challenges to the sustained dominance of thermal power.

Key Drivers:

- Surging electricity demand from industrial, commercial, and residential sectors.

- Government focus on energy security and self-reliance.

- Advancements in thermal power generation efficiency and emission control.

- Established infrastructure and skilled workforce.

Key Barriers & Challenges:

- High capital expenditure for new plant construction.

- Long environmental clearance and project approval timelines.

- Volatility in global fuel prices (coal, gas).

- Supply chain vulnerabilities for imported fuels.

- Increasing competitiveness of renewable energy sources.

- Stringent environmental regulations and carbon emission targets.

Emerging Opportunities in India Thermal Power Plant Market

Emerging opportunities within the India thermal power plant market lie in the modernization and retrofitting of existing coal-fired power plants to meet stricter emission standards and improve efficiency. The development of gas-based power infrastructure, leveraging the increasing availability of LNG and the government's focus on a gas-based economy, presents significant growth potential. Furthermore, the integration of advanced technologies for captive power plants in industries seeking reliable and cost-effective energy solutions offers a niche but expanding market. The potential for co-firing biomass with coal also opens avenues for a more sustainable thermal power generation mix, catering to the evolving consumer preference for greener energy solutions.

Growth Accelerators in the India Thermal Power Plant Market Industry

Several catalysts are accelerating the long-term growth of the India thermal power plant market. Technological breakthroughs in carbon capture, utilization, and storage (CCUS) technologies, if economically viable, could significantly extend the life of coal-fired power plants. Strategic partnerships between public sector undertakings and private players are fostering innovation and capital infusion. Government initiatives like the National Thermal Power Corporation (NTPC) driven energy transition plans, aiming for a balanced energy portfolio, also act as growth accelerators. Market expansion strategies, including the development of decentralized power generation solutions and the integration of thermal power with renewable energy sources for a stable grid, are crucial for sustained growth.

Key Players Shaping the India Thermal Power Plant Market Market

- India Power Corporation Ltd

- Maharashtra State Power Generation Co Ltd

- Reliance Power Limited

- Nuclear Power Corporation of India (NPCIL)

- NTPC Limited

- Tata Group

- Jindal Steel & Power Limited

- Adani Power Limited

Notable Milestones in India Thermal Power Plant Market Sector

- February 2023: The Indian government re-imposed the emergency clause of the Electricity Act, 2003, requiring all imported coal-based (ICB) power plants in India to operate and generate power at their full capacity during the ensuing summer months. According to an order issued by the Ministry of Power, peak electricity demand is expected to reach 229 gigawatts (GW) in April 2023, thus requiring the government to take this decision. This move significantly boosted the operational capacity of thermal plants and highlighted their critical role in meeting peak demand.

- November 2022: Under an engineering, procurement, and construction (EPC) contract, Wärtsilä was to construct a 15.5 MW gas-fired captive power plant in Chennai, Tamil Nadu, India, as well as operate and maintain the plant for five years. A manufacturer of linear alkyl benzene (LAB) and heavy chemicals, Tamilnadu Petroproducts Limited (TPL), part of AM International, Singapore, placed the order. This development underscores the growing demand for efficient and dedicated gas-fired captive power plants for industrial energy self-sufficiency.

In-Depth India Thermal Power Plant Market Market Outlook

The future outlook for the India thermal power plant market is one of continued evolution and strategic adaptation. While renewable energy sources are gaining traction, thermal power, particularly coal and gas, will remain indispensable for meeting India's vast and growing energy requirements. Growth will be shaped by the adoption of cleaner technologies, adherence to stringent environmental regulations, and the effective integration of thermal power with renewable energy portfolios. Opportunities in modernizing existing plants, developing advanced gas-fired power stations, and exploring innovative fuel mixes will define the market's trajectory. Strategic investments, policy support, and technological advancements will collectively ensure that thermal power continues to play a pivotal role in powering India's economic development and ensuring energy security in the coming decade.

India Thermal Power Plant Market Segmentation

-

1. Fuel Type

- 1.1. Coal

- 1.2. Gas

- 1.3. Nuclear

- 1.4. Other Fuel Types

India Thermal Power Plant Market Segmentation By Geography

- 1. India

India Thermal Power Plant Market Regional Market Share

Geographic Coverage of India Thermal Power Plant Market

India Thermal Power Plant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Coal Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Thermal Power Plant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Coal

- 5.1.2. Gas

- 5.1.3. Nuclear

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 India Power Corporation Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maharashtra State Power Generation Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Power Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nuclear Power Corporation of India (NPCIL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NTPC Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jindal Steel & Power Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Adani Power Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 India Power Corporation Ltd

List of Figures

- Figure 1: India Thermal Power Plant Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Thermal Power Plant Market Share (%) by Company 2025

List of Tables

- Table 1: India Thermal Power Plant Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 2: India Thermal Power Plant Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 3: India Thermal Power Plant Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Thermal Power Plant Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: India Thermal Power Plant Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 6: India Thermal Power Plant Market Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 7: India Thermal Power Plant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: India Thermal Power Plant Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Thermal Power Plant Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the India Thermal Power Plant Market?

Key companies in the market include India Power Corporation Ltd, Maharashtra State Power Generation Co Ltd, Reliance Power Limited, Nuclear Power Corporation of India (NPCIL), NTPC Limited, Tata Group, Jindal Steel & Power Limited, Adani Power Limited.

3. What are the main segments of the India Thermal Power Plant Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Coal Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023: The Indian government re-imposed the emergency clause of the Electricity Act, 2003, requiring all imported coal-based (ICB) power plants in India to operate and generate power at their full capacity during the ensuing summer months. According to an order issued by the Ministry of Power, peak electricity demand is expected to reach 229 gigawatts (GW) in April 2023, thus requiring the government to take this decision.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Thermal Power Plant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Thermal Power Plant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Thermal Power Plant Market?

To stay informed about further developments, trends, and reports in the India Thermal Power Plant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence