Key Insights

Australia's solar industry is projected for significant expansion, with a projected market size of $9.6 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 15%. This growth is underpinned by supportive government policies promoting renewable energy targets, decreasing solar technology costs, and increasing demand for sustainable energy solutions from both consumers and businesses. The national shift away from fossil fuels and heightened climate change awareness are accelerating solar power adoption. Key drivers include the Renewable Energy Target, solar feed-in tariffs, and state-level incentives enhancing solar investment attractiveness. Advancements in solar panel efficiency and energy storage, particularly battery technology, are improving solar power's reliability for utility-scale and distributed generation.

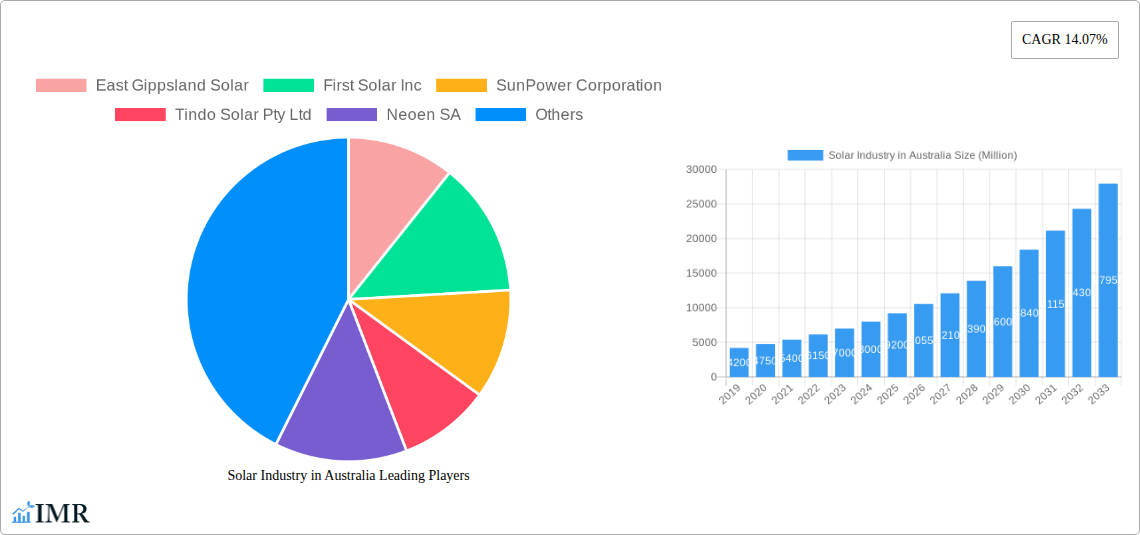

Solar Industry in Australia Market Size (In Billion)

The market is segmented into Solar Photovoltaic (PV) and Concentrated Solar Power (CSP), with PV dominating due to its cost-effectiveness and broad applicability. Utility-scale projects are attracting substantial investment, alongside a thriving non-utility sector including commercial, industrial, and residential installations. Households and the commercial & industrial sectors are key end-users, indicating a strong trend towards distributed solar generation. Leading companies like First Solar Inc., SunPower Corporation, Canadian Solar Inc., and Trina Solar Co. Ltd. are instrumental in market development through innovative solutions and extensive project pipelines. Strategic collaborations, mergers, and a growing focus on integrated energy solutions, including solar plus storage, are also shaping the industry. Potential challenges include grid integration, intermittency due to weather, and the necessity for consistent policy support to sustain investment.

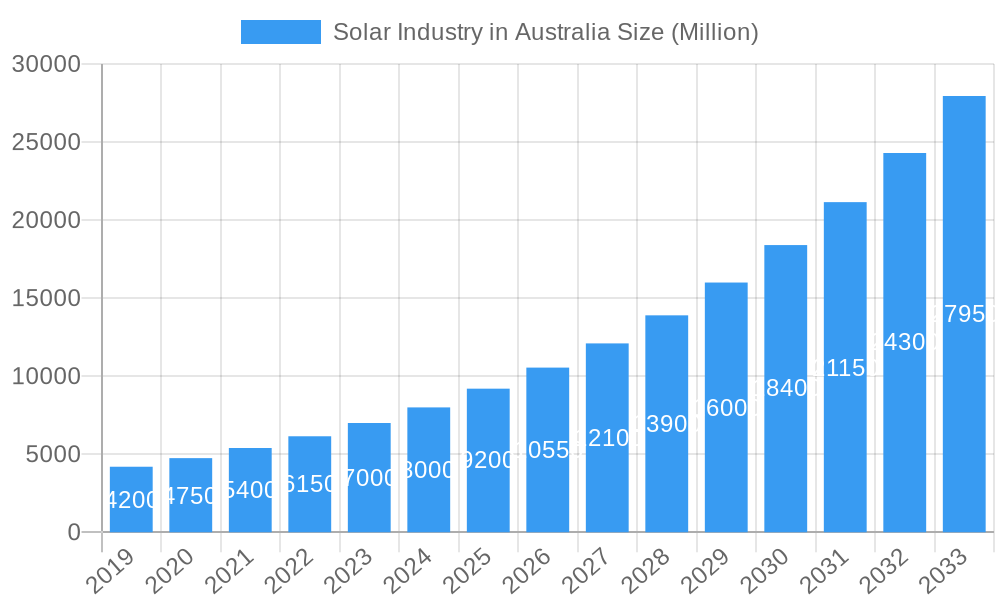

Solar Industry in Australia Company Market Share

This report offers a critical analysis of the Australian solar industry, a vital sector in the nation's energy transition. Spanning 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this research explores market dynamics, growth trends, regional influence, product offerings, key drivers, emerging opportunities, and influential players. Gain comprehensive insights into the Australian solar PV market, residential solar adoption, and the expanding commercial and industrial solar segment.

Solar Industry in Australia Market Dynamics & Structure

The Australian solar industry is characterized by a dynamic interplay of market concentration, rapid technological innovation, and evolving regulatory frameworks. While the market exhibits moderate concentration, with several key players dominating market share, a growing number of new entrants are fostering innovation and driving down costs. Technological advancements in solar photovoltaic (PV) efficiency and battery storage solutions are primary innovation drivers, significantly impacting installation rates and grid integration. Regulatory support, including government incentives and renewable energy targets, plays a crucial role in shaping investment decisions and market expansion. Competitive product substitutes, such as wind energy and traditional fossil fuels, are continuously being challenged by the declining cost and improving performance of solar technology. End-user demographics are diversifying, with significant growth in both household solar installations and large-scale utility and non-utility deployments. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger energy companies and infrastructure funds actively acquiring solar assets to bolster their renewable energy portfolios.

- Market Share: Utility-scale solar PV projects currently hold a dominant market share, driven by government tenders and large-scale renewable energy initiatives.

- Innovation Barriers: While innovation is strong, high upfront capital costs for certain advanced technologies and grid connection complexities can present barriers to widespread adoption.

- M&A Activity: An increasing volume of M&A deals signifies investor confidence and a strategic push for portfolio diversification within the energy sector.

- Regulatory Impact: Favorable government policies, such as the Renewable Energy Target (RET) and state-specific solar schemes, have historically been, and continue to be, significant drivers of market growth.

Solar Industry in Australia Growth Trends & Insights

The Australian solar market is experiencing unprecedented growth, driven by a confluence of economic, environmental, and technological factors. Market size evolution has been consistently upward, with significant increases in installed capacity year-on-year. Adoption rates, particularly for rooftop solar PV in the residential sector, have been among the highest globally. Technological disruptions, including advancements in solar panel efficiency and the integration of smart grid technologies, are further accelerating this growth trajectory. Consumer behavior shifts towards sustainability and energy independence are also playing a pivotal role, with homeowners and businesses increasingly investing in solar solutions. The Australian solar photovoltaic (PV) market is projected to witness a compound annual growth rate (CAGR) of xx% over the forecast period. Market penetration for solar energy, especially within the household solar segment, is expected to reach xx% by 2033. The transition towards decarbonization and the increasing cost-competitiveness of solar power make it an attractive investment for both individuals and corporations.

- Market Size Expansion: The total installed solar capacity in Australia is forecast to grow from xx GW in 2025 to xx GW by 2033, representing a significant expansion of the renewable energy landscape.

- Adoption Rate Acceleration: The exponential growth in rooftop solar installations, driven by attractive feed-in tariffs and falling equipment costs, continues to be a key adoption driver.

- Technological Leapfrogs: Innovations in bifacial solar panels, perovskite solar cells, and advanced inverters are enhancing energy yield and system reliability, pushing the boundaries of solar technology.

- Consumer Sentiment: A heightened awareness of climate change and a desire for energy cost savings are fostering strong consumer demand for solar energy solutions.

Dominant Regions, Countries, or Segments in Solar Industry in Australia

Within the Australian solar landscape, Solar Photovoltaic (PV) technology overwhelmingly dominates, eclipsing Concentrated Solar Power (CSP) in terms of installed capacity and market share. This dominance is primarily driven by the maturity, cost-effectiveness, and widespread applicability of PV technology across various deployment scales. The Utility deployment segment is a significant growth engine, fueled by large-scale solar farms developed to meet national renewable energy targets and provide grid stability. Simultaneously, the Non-utility segment, encompassing commercial and industrial installations, is witnessing substantial expansion as businesses increasingly recognize the financial and environmental benefits of on-site solar generation.

- Solar Photovoltaic (PV) Dominance: PV technology accounts for over xx% of the total installed solar capacity in Australia. Its modular nature, falling costs, and technological advancements have made it the preferred choice for a wide range of applications.

- Utility Deployment as a Growth Driver: Large-scale solar farms, often exceeding 500MW, are critical to Australia's renewable energy transition. Government tenders and attractive Power Purchase Agreements (PPAs) are key drivers for this segment.

- Commercial & Industrial (C&I) Solar Growth: Businesses are increasingly investing in solar to reduce operational costs, enhance their sustainability credentials, and achieve energy independence. This segment offers significant untapped potential.

- Regional Leadership: States like New South Wales (NSW), Queensland, and Victoria are leading the charge in solar deployment due to supportive policies, high solar irradiance, and significant grid infrastructure investment.

Solar Industry in Australia Product Landscape

The Australian solar industry's product landscape is defined by continuous innovation and improved performance metrics. Solar Photovoltaic (PV) panels, the primary product, are seeing advancements in efficiency, durability, and aesthetics. Technologies such as monocrystalline silicon, PERC (Passivated Emitter Rear Cell), and bifacial panels are becoming standard, maximizing energy capture. Inverters, crucial for converting DC to AC power, are evolving with smart functionalities, offering enhanced monitoring, grid support, and energy management capabilities. Battery storage solutions are a rapidly growing component of the product ecosystem, enabling greater energy independence and grid stability for households and businesses.

- High-Efficiency PV Panels: New panel technologies are achieving efficiencies exceeding xx%, translating to more power generation from a smaller footprint.

- Smart Inverter Technologies: Advanced inverters provide real-time performance monitoring, remote diagnostics, and grid-aware functionalities, optimizing system performance.

- Integrated Battery Storage: Seamless integration of battery systems with solar PV installations is becoming a key selling proposition, offering reliable backup power and demand charge management.

Key Drivers, Barriers & Challenges in Solar Industry in Australia

Key Drivers:

- Declining Costs: The continuous reduction in solar panel and inverter prices makes solar energy increasingly competitive against traditional energy sources.

- Government Policies & Incentives: Renewable energy targets, tax credits, and feed-in tariffs significantly incentivize solar adoption.

- Environmental Concerns: Growing public awareness and concern over climate change are driving demand for cleaner energy solutions.

- Technological Advancements: Improved efficiency, reliability, and integration capabilities of solar technology.

- Energy Independence & Cost Savings: Consumers and businesses are seeking to reduce electricity bills and gain greater control over their energy supply.

Barriers & Challenges:

- Grid Integration & Stability: The intermittent nature of solar power requires significant investment in grid modernization and energy storage solutions to ensure reliability.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of solar components.

- Regulatory Hurdles: Complex permitting processes and evolving grid connection standards can create delays and increase project costs.

- Skilled Workforce Shortages: A growing demand for solar installers and maintenance technicians can lead to labor shortages.

- Intermittency & Storage Costs: The inherent intermittency of solar power necessitates costly battery storage solutions for consistent energy supply.

Emerging Opportunities in Solar Industry in Australia

Emerging opportunities within the Australian solar industry are vast, driven by evolving consumer needs and technological breakthroughs. The distributed generation market, encompassing rooftop solar and microgrids, is poised for significant growth, offering enhanced energy resilience and cost savings. Innovative financing models, such as solar leasing and Power Purchase Agreements (PPAs), are making solar more accessible to a wider range of consumers and businesses. The integration of solar with electric vehicles (EVs) presents a unique synergy, enabling charging powered by renewable energy. Furthermore, the development of floating solar farms and agrivoltaics (combining solar power with agriculture) are opening up new avenues for land-use optimization and expanded solar deployment.

- Virtual Power Plants (VPPs): Aggregating rooftop solar and battery systems to create virtual power plants offers grid services and new revenue streams.

- Green Hydrogen Production: Utilizing solar energy to produce green hydrogen is a burgeoning opportunity with significant long-term potential.

- Off-Grid and Remote Area Solutions: Expanding solar and storage solutions to remote communities and off-grid applications remains a key area for development.

Growth Accelerators in the Solar Industry in Australia Industry

Several critical growth accelerators are propelling the Australian solar industry forward. Technological breakthroughs in panel efficiency and energy storage are continuously enhancing the economic viability and performance of solar systems. Strategic partnerships between solar developers, energy retailers, and technology providers are streamlining project development and market access. Furthermore, expansion into new market segments, such as large-scale solar-plus-storage projects and the integration of solar into urban planning, are unlocking further growth potential. The increasing commitment from major corporations to achieve net-zero emissions is a powerful market expansion strategy, driving demand for renewable energy solutions.

- Solar-Plus-Storage Integration: The increasing synergy between solar PV and battery storage is a major accelerator, enabling grid stability and reliable power.

- Corporate Power Purchase Agreements (PPAs): Growing corporate demand for renewable energy through PPAs is a significant driver for large-scale solar projects.

- Policy Certainty and Long-Term Targets: Clear and consistent government policies, including ambitious renewable energy targets, provide the confidence needed for significant investment.

Key Players Shaping the Solar Industry in Australia Market

- East Gippsland Solar

- First Solar Inc

- SunPower Corporation

- Tindo Solar Pty Ltd

- Neoen SA

- Infigen Energy Ltd

- Canadian Solar Inc

- GEM Energy

- Trina Solar Co Ltd

- AGL Energy Limited

Notable Milestones in Solar Industry in Australia Sector

- May 2023: The Australian Energy Market Operator (AEMO) announced the four winners of the tender as part of the NSW Electricity Infrastructure Roadmap. Solar energy projects dominated the given capacity, with 1.12GW awarded between the Stubbo Solar Farm with a capacity of 400MW and the New England Solar Farm with a total capacity of 720MW.

- Jan 2023: ACEN Australia announced that it had awarded the Engineering, Procurement, and Construction (EPC) contract to PCL Construction (PCL) for building the 520 MWdc Stubbo Solar project.

In-Depth Solar Industry in Australia Market Outlook

The future outlook for the Australian solar industry is exceptionally bright, marked by sustained growth and transformative innovation. The continuous decline in solar technology costs, coupled with robust government support and increasing environmental consciousness, will continue to fuel expansion across all market segments. Strategic partnerships and the increasing adoption of advanced technologies like solar-plus-storage and green hydrogen production are set to redefine the energy landscape. The industry is well-positioned to not only meet Australia's decarbonization goals but also to emerge as a global leader in renewable energy deployment and innovation, offering significant strategic opportunities for investors and stakeholders.

Solar Industry in Australia Segmentation

-

1. Type

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

-

2. PV Deployment

- 2.1. Utlility

- 2.2. Non-utility

-

3. End User

- 3.1. Households

- 3.2. Commercial & Industrial

Solar Industry in Australia Segmentation By Geography

- 1. Australia

Solar Industry in Australia Regional Market Share

Geographic Coverage of Solar Industry in Australia

Solar Industry in Australia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solar Industry in Australia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by PV Deployment

- 5.2.1. Utlility

- 5.2.2. Non-utility

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Households

- 5.3.2. Commercial & Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 East Gippsland Solar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SunPower Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tindo Solar Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neoen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Infigen Energy Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian Solar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GEM Energy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trina Solar Co Ltd*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AGL Energy Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 East Gippsland Solar

List of Figures

- Figure 1: Global Solar Industry in Australia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Australia Solar Industry in Australia Revenue (billion), by Type 2025 & 2033

- Figure 3: Australia Solar Industry in Australia Revenue Share (%), by Type 2025 & 2033

- Figure 4: Australia Solar Industry in Australia Revenue (billion), by PV Deployment 2025 & 2033

- Figure 5: Australia Solar Industry in Australia Revenue Share (%), by PV Deployment 2025 & 2033

- Figure 6: Australia Solar Industry in Australia Revenue (billion), by End User 2025 & 2033

- Figure 7: Australia Solar Industry in Australia Revenue Share (%), by End User 2025 & 2033

- Figure 8: Australia Solar Industry in Australia Revenue (billion), by Country 2025 & 2033

- Figure 9: Australia Solar Industry in Australia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solar Industry in Australia Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Solar Industry in Australia Revenue billion Forecast, by PV Deployment 2020 & 2033

- Table 3: Global Solar Industry in Australia Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Solar Industry in Australia Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Solar Industry in Australia Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Solar Industry in Australia Revenue billion Forecast, by PV Deployment 2020 & 2033

- Table 7: Global Solar Industry in Australia Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Solar Industry in Australia Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Industry in Australia?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Solar Industry in Australia?

Key companies in the market include East Gippsland Solar, First Solar Inc, SunPower Corporation, Tindo Solar Pty Ltd, Neoen SA, Infigen Energy Ltd, Canadian Solar Inc, GEM Energy, Trina Solar Co Ltd*List Not Exhaustive, AGL Energy Limited.

3. What are the main segments of the Solar Industry in Australia?

The market segments include Type, PV Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) to Register Significant Growth.

7. Are there any restraints impacting market growth?

Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

May 2023: The Australian Energy Market Operator (AEMO) announced the four winners of the tender as part of the NSW Electricity Infrastructure Roadmap. Solar energy projects dominated the given capacity, with 1.12GW awarded between the Stubbo Solar Farm with a capacity of 400MW and the New England Solar Farm with a total capacity of 720MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solar Industry in Australia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solar Industry in Australia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solar Industry in Australia?

To stay informed about further developments, trends, and reports in the Solar Industry in Australia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence